aptos coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to aptos coin

Aptos Coin (APT) has emerged as a significant player in the cryptocurrency market, particularly recognized as a leading Layer 1 smart contract platform. Developed by a team of former Meta (Facebook) engineers, Aptos aims to bring mainstream adoption to Web3 by offering a blockchain network that is both scalable and secure. With its unique architecture and innovative technology, Aptos is designed to support decentralized applications (DApps) that address real-world user needs, making it a compelling option for developers and investors alike.

The Aptos blockchain is built on a novel programming language called Move, which enhances the efficiency and security of smart contracts. This technology allows Aptos to achieve a theoretical transaction throughput of over 150,000 transactions per second (TPS), vastly outpacing many of its competitors, such as Ethereum, which typically processes around 12 to 15 TPS. Such scalability is crucial for the growing demand for DApps and the evolving landscape of decentralized finance (DeFi) and non-fungible tokens (NFTs).

This guide serves as a comprehensive resource for anyone interested in understanding Aptos Coin, whether you are a beginner or an intermediate investor. Throughout this guide, we will delve into various aspects of Aptos, including its technological foundations, tokenomics, investment potential, and associated risks. Additionally, we will provide detailed instructions on how to purchase Aptos Coin, ensuring that readers are well-equipped to make informed decisions.

Understanding the Technology Behind Aptos

Aptos employs a Proof-of-Stake (PoS) consensus mechanism, coupled with a Byzantine Fault-Tolerant (BFT) algorithm, to secure its network. This combination enhances the reliability and performance of the blockchain, allowing it to process multiple transactions simultaneously while maintaining integrity and security.

Tokenomics of Aptos

The native currency of the Aptos network is APT, which plays a crucial role in the ecosystem. Understanding its tokenomics—including supply distribution, use cases, and potential for appreciation—will help investors gauge the long-term viability of their investments.

Investment Potential and Risks

As with any cryptocurrency, investing in Aptos comes with its own set of risks and rewards. While the high transaction throughput and robust technology position Aptos favorably in the market, potential investors should also be aware of market volatility and regulatory challenges that may impact the asset’s performance.

How to Buy Aptos Coin

Finally, this guide will outline the steps needed to purchase Aptos Coin, covering the various exchanges where it is listed and the necessary precautions to take when investing in cryptocurrencies.

By the end of this guide, readers will have a solid understanding of Aptos Coin and be better prepared to navigate the dynamic world of cryptocurrency investment.

What is aptos coin? A Deep Dive into its Purpose

Understanding Aptos Coin

Aptos Coin (APT) is the native cryptocurrency of the Aptos blockchain, a Layer 1 blockchain that leverages a unique consensus mechanism and innovative technology to offer high scalability and security. Developed by a team of engineers with roots in Meta’s Diem project, Aptos aims to facilitate the mainstream adoption of decentralized applications (dApps) and enhance user experiences in the Web3 ecosystem.

The Core Problem It Solves

In the current landscape of blockchain technology, scalability, security, and user experience remain significant challenges. Many existing blockchains struggle with transaction throughput, often processing only a handful of transactions per second (TPS). For example, Ethereum, one of the most widely used blockchains, averages around 12 to 15 TPS. This limitation can lead to network congestion, increased transaction fees, and slow confirmation times, particularly during peak usage periods.

Aptos addresses these issues through its innovative design and technology. The blockchain’s architecture allows for a theoretical throughput of over 150,000 TPS, achieved through a parallel execution engine known as Block-STM. This capability enables multiple transactions to be processed simultaneously, as opposed to the traditional sequential processing approach. By doing so, Aptos can handle a high volume of transactions without compromising speed or security, thereby providing a more efficient platform for developers and users alike.

Additionally, Aptos employs a Byzantine Fault-Tolerant (BFT) Proof-of-Stake (PoS) consensus mechanism, which ensures that the network can continue functioning even in the presence of faulty or malicious nodes. This combination of high throughput and robust security makes Aptos particularly well-suited for various applications, including decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming.

Its Unique Selling Proposition

Aptos’s unique selling proposition lies in its ability to combine high performance with developer-friendly features. The blockchain is built using Move, a programming language originally created for the Diem blockchain. Move is designed to be safe, flexible, and easy to use, offering advantages over traditional smart contract languages like Solidity. This programming language allows developers to write secure code with less effort, facilitating the rapid development of dApps.

One of the standout features of Aptos is its horizontal scalability, made possible by its natively-implemented sharding mechanism. This allows the network to dynamically allocate resources based on demand, ensuring that the blockchain remains responsive even as user activity fluctuates. Furthermore, Aptos is built for upgradeability and configurability, enabling developers to implement new features and improvements without significant disruptions.

The blockchain’s architecture also supports seamless cross-chain interoperability. For instance, the Aptos Bridge allows users to transfer assets from other major blockchains, such as Ethereum and BNB Chain, to the Aptos network. This feature enhances the liquidity and usability of the Aptos ecosystem, making it easier for users to engage with various applications and services.

The Team and Backers

The development of Aptos is spearheaded by co-founders Mo Shaikh and Avery Ching, both of whom have extensive experience in the blockchain space, particularly from their time at Meta. Mo Shaikh, the CEO of Aptos, has a background in scaling products and has worked in financial services and venture capital. Avery Ching, the CTO, is a seasoned software engineer who was one of the principal engineers behind the Diem project. Together, they lead a talented team of researchers, designers, and engineers, many of whom also contributed to the Diem project.

Aptos has garnered significant interest and investment from prominent venture capital firms. In March 2022, the project raised $200 million in a seed funding round led by Andreessen Horowitz (a16z), with participation from other notable investors like Tiger Global and Multicoin Capital. The project continued to attract investment, raising another $200 million in a Series A round later that year. In addition, Binance Labs made a strategic investment in Aptos, further validating the project’s potential within the crypto ecosystem.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Aptos Coin and its underlying blockchain is to create a platform that facilitates the development and deployment of scalable, secure, and user-friendly dApps. By solving the critical issues of scalability and security, Aptos aims to empower developers and users alike, fostering innovation and growth within the Web3 space.

Aptos positions itself as a production-ready blockchain, capable of supporting a diverse range of applications, from DeFi protocols to NFT marketplaces and gaming platforms. Its high transaction throughput and low latency make it an attractive choice for developers looking to build applications that require real-time interactions and high user engagement.

In summary, Aptos Coin serves as a vital component of the Aptos blockchain ecosystem, enabling users to interact with a scalable and secure network. Its innovative technology, strong backing, and focus on developer experience position it as a significant player in the evolving landscape of blockchain technology. As Aptos continues to develop and expand its ecosystem, it has the potential to drive the mainstream adoption of decentralized applications and contribute to the broader vision of a decentralized internet.

The Technology Behind the Coin: How It Works

Introduction to Aptos Technology

Aptos is a Layer 1 blockchain that aims to bring mainstream adoption to decentralized applications (DApps) and empower a new ecosystem for Web3. It utilizes a unique programming language called Move, developed by engineers from Meta’s Diem project, and implements advanced technological features that set it apart from other blockchain networks. This guide will delve into the core technologies that underpin Aptos, including its architecture, consensus mechanisms, and key innovations.

Blockchain Architecture

Aptos is built on a modern blockchain architecture designed to optimize speed, scalability, and security. Its architecture is structured to enable high transaction throughput and parallel processing of transactions, which is a significant improvement over traditional blockchain systems that process transactions sequentially.

1. Layer 1 Design

Being a Layer 1 blockchain means that Aptos operates its own independent network, handling all transactions and smart contracts directly on its own blockchain. This design allows for more control over the network’s performance and security compared to Layer 2 solutions, which rely on existing blockchains like Ethereum.

2. Move Programming Language

Aptos employs Move, a Rust-based programming language, to write smart contracts. Move was specifically designed to enhance the safety and security of smart contracts by making it easier to verify their correctness. It incorporates several advanced features:

- Resource-oriented Programming: Move treats digital assets as first-class citizens, allowing developers to create more secure and efficient smart contracts.

- Static Typing and Custom Types: This feature helps catch errors during the compilation phase rather than at runtime, reducing potential vulnerabilities in smart contracts.

- Modular Design: Move’s modular architecture allows developers to build reusable components, enhancing the efficiency of DApp development.

Consensus Mechanism

Aptos utilizes a unique consensus mechanism that combines Proof-of-Stake (PoS) with its custom AptosBFT (Byzantine Fault Tolerance) protocol.

1. Proof-of-Stake (PoS)

In a PoS system, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. This method is more energy-efficient than Proof-of-Work (PoW), as it does not require extensive computational power to solve complex mathematical problems. Validators in the Aptos network are incentivized to act honestly, as malicious actions can lead to losing their staked coins.

2. AptosBFT Consensus

AptosBFT is a custom consensus algorithm derived from the HotStuff protocol, designed to improve transaction finality and network security. The key features of AptosBFT include:

- Leader Rotation: The protocol automatically rotates the leader node (the node responsible for proposing new blocks) to ensure decentralization and avoid single points of failure.

- Byzantine Fault Tolerance: AptosBFT can tolerate a certain number of nodes acting maliciously or going offline without affecting the network’s overall functionality. This is crucial for maintaining trust and reliability in a decentralized system.

- Optimized Transaction Processing: AptosBFT allows for fast transaction finality, meaning transactions can be confirmed almost instantly, which is vital for applications requiring real-time interactions.

Key Technological Innovations

Aptos incorporates several innovative technologies that enhance its performance and usability, setting it apart in the competitive blockchain landscape.

1. Parallel Execution Engine

One of Aptos’s standout features is its parallel execution engine, known as Block-STM (Software Transactional Memory). This technology enables the network to process multiple transactions simultaneously rather than sequentially. Here’s how it works:

- Conflict Management: Block-STM identifies and manages transaction conflicts, ensuring that only non-conflicting transactions are processed in parallel. If a conflict arises, the conflicting transactions are either re-executed or aborted, which keeps the network running smoothly.

- High Throughput: This parallel processing capability allows Aptos to achieve a theoretical transaction throughput of over 150,000 transactions per second (tps). In contrast, Ethereum’s mainnet typically handles around 12 to 15 tps.

2. Natively Implemented Sharding

Sharding is a technique used to enhance scalability by splitting the blockchain into smaller, manageable pieces called shards. Each shard can process transactions independently, which significantly increases the overall capacity of the network. Aptos implements sharding natively, allowing for horizontal throughput scalability, which can adapt to increased demand without compromising performance.

3. Upgradability and Configurability

Aptos is designed with upgradability in mind, meaning that it can evolve and incorporate new features over time without requiring a complete network overhaul. This adaptability is crucial for maintaining relevance and competitiveness in the rapidly changing blockchain ecosystem. Key aspects include:

- Modular Upgrades: Developers can deploy upgrades to the network without disrupting existing applications, ensuring continuous improvement and innovation.

- Configurable Parameters: Network parameters can be adjusted based on real-time performance metrics, allowing the Aptos network to optimize itself for various use cases.

Security Measures

Security is paramount in the blockchain space, and Aptos employs several measures to protect its network and users.

1. Multi-layer Security Protocols

Aptos integrates multiple layers of security protocols to safeguard against attacks and ensure the integrity of transactions. This includes:

- Validator Security: Validators undergo rigorous checks to ensure they are trustworthy and capable of maintaining the network’s security.

- Regular Audits: Continuous auditing of smart contracts and network performance helps identify and rectify vulnerabilities proactively.

2. Transaction Privacy

While Aptos is a public blockchain, it incorporates privacy features that allow users to conduct transactions confidentially. This is achieved through cryptographic techniques that obscure transaction details while still ensuring they are verifiable on the blockchain.

Conclusion

Aptos represents a significant advancement in blockchain technology, combining a high-performance architecture with innovative features designed to promote scalability, security, and usability. Its unique programming language, consensus mechanism, and ability to process transactions in parallel position it as a strong contender in the evolving landscape of decentralized technologies. As Aptos continues to grow and evolve, it has the potential to drive mainstream adoption of blockchain and decentralized applications, making it an exciting project for both developers and investors alike.

Understanding aptos coin Tokenomics

Aptos Coin (APT) is the native cryptocurrency of the Aptos blockchain, a Layer 1 Proof-of-Stake (PoS) network that emphasizes speed and scalability. Understanding its tokenomics is crucial for investors and users alike, as it provides insight into the supply dynamics, utility, and distribution of APT. Below, we will explore key metrics, the utility of the token, and its distribution model.

| Metric | Value |

|---|---|

| Total Supply | 1.17 billion APT |

| Max Supply | Unlimited |

| Circulating Supply | 688.35 million APT |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

APT serves multiple purposes within the Aptos ecosystem, which is designed to facilitate decentralized applications (DApps) and smart contracts. Here are some of the primary uses of the Aptos coin:

-

Transaction Fees: APT is used to pay for transaction fees on the Aptos network. This includes fees for sending APT, executing smart contracts, and performing other operations on the blockchain. The fee structure is designed to incentivize validators and maintain network integrity.

-

Staking: Being a PoS blockchain, Aptos allows APT holders to participate in staking. Users can stake their APT tokens to earn rewards while contributing to the network’s security and consensus. Stakers can also help validate transactions and maintain the network’s overall health.

-

Governance: APT holders may have a say in governance decisions affecting the Aptos network. This includes voting on proposals related to network upgrades, changes in fee structures, or other critical aspects of the ecosystem. Governance mechanisms empower the community and help ensure that the network evolves in alignment with user needs.

-

Incentives for Developers: The Aptos network aims to attract developers by providing a robust environment for building DApps. APT can be used in incentive programs designed to reward developers who create innovative applications that enhance the ecosystem.

-

Interoperability: APT facilitates cross-chain transactions, allowing users to transfer assets between different blockchain networks. This interoperability can enhance the utility of APT in various financial applications and decentralized finance (DeFi) projects.

Token Distribution

The distribution of APT tokens is crucial for understanding the potential market dynamics and community engagement. The total supply of APT is allocated as follows:

-

Community (51.02%): A significant portion of the total supply is dedicated to community initiatives. This allocation is intended to foster growth within the Aptos ecosystem and support the Aptos Foundation’s initiatives. Approximately 80% of the community allocation is held by the Aptos Foundation, while the remaining 20% is managed by Aptos Labs.

-

Core Contributors (19.00%): This allocation is reserved for the team and key contributors who played a vital role in developing the Aptos network. It includes founders, engineers, and other essential personnel who are integral to the project’s success.

-

Foundation (16.50%): The Aptos Foundation is responsible for overseeing the development, marketing, and governance of the Aptos ecosystem. This allocation ensures that the Foundation has the necessary resources to promote the network and support community initiatives.

-

Investors (13.48%): A portion of the tokens is allocated to early investors and venture capital firms that participated in funding rounds for Aptos. These tokens are subject to a four-year vesting schedule to prevent immediate sell-offs and promote long-term commitment to the project’s success.

Conclusion

Understanding the tokenomics of Aptos Coin (APT) is essential for anyone interested in engaging with the Aptos blockchain. With a total supply of 1.17 billion APT and a focus on community-driven development, Aptos aims to create a sustainable and dynamic ecosystem for decentralized applications. The utility of APT extends beyond mere transactions; it encompasses governance, staking, and incentives for developers, ensuring that the token remains integral to the network’s growth.

As the Aptos network continues to evolve, the careful management of its tokenomics will play a significant role in its adoption and success. Investors and users alike should keep these dynamics in mind as they navigate the rapidly changing landscape of blockchain technology and decentralized finance.

Price History and Market Performance

Key Historical Price Milestones

Aptos (APT) has had a notable journey since its inception, characterized by significant price milestones that reflect both market conditions and the underlying developments within the Aptos ecosystem. The token was launched in October 2022, following a successful testnet phase, which generated considerable interest from investors and developers alike.

-

Launch and Initial Trading: Upon its mainnet launch on October 18, 2022, APT began trading on various cryptocurrency exchanges. The initial price was relatively modest, given that it was a new entrant in the competitive blockchain landscape.

-

All-Time Low: The price of Aptos reached its all-time low of approximately $3.09 on December 29, 2022. This period marked a time of market uncertainty and volatility, as many cryptocurrencies were affected by broader economic conditions, including regulatory concerns and macroeconomic factors.

-

Rapid Growth: Following its launch, APT experienced a significant price surge, reaching an all-time high of $19.90 on January 30, 2023. This growth can be attributed to increased media attention, the successful execution of its technology, and heightened investor interest in layer-1 blockchains that aim to enhance scalability and performance.

-

Price Correction: After hitting its all-time high, Aptos experienced a correction, with its price declining substantially. As of the latest data, Aptos is trading around $4.27, representing a decline of approximately 78.56% from its peak. The fluctuations in price can be seen as a reflection of the overall market dynamics, investor sentiment, and the performance of competing projects.

-

Current Market Position: As of now, Aptos holds a market capitalization of approximately $2.93 billion and is ranked #38 among cryptocurrencies. The circulating supply of APT stands at around 688.35 million, contributing to its market dynamics and liquidity.

Factors Influencing the Price

Historically, the price of Aptos has been influenced by a variety of factors, ranging from technological advancements to broader market trends. Understanding these influences can provide insight into the cryptocurrency’s price movements.

-

Market Sentiment and Investor Interest: Like many cryptocurrencies, Aptos has been significantly affected by overall market sentiment. Bullish trends in the cryptocurrency market often lead to increased buying pressure, while bearish trends can result in sell-offs. The enthusiasm surrounding Aptos’s unique features, such as its high transaction throughput capabilities and the Move programming language, has drawn investor interest, particularly during periods of optimism in the crypto space.

-

Technological Developments: The underlying technology of Aptos is a critical factor influencing its price. The blockchain’s ability to process over 150,000 transactions per second (tps) through parallel execution has positioned it as a strong competitor to established blockchains like Ethereum. Innovations and updates to the Aptos network, including enhancements to its consensus mechanisms and smart contract capabilities, can lead to increased investor confidence and, consequently, price increases.

-

Regulatory Environment: The cryptocurrency market is highly sensitive to regulatory changes and government policies. Announcements related to regulations can lead to price volatility, as investors react to potential impacts on market accessibility and the legitimacy of projects. Aptos, being a relatively new player, has had to navigate these challenges while establishing itself in a crowded market.

-

Adoption and Use Cases: The real-world adoption of Aptos’s technology and the development of decentralized applications (DApps) on its platform play a significant role in influencing its price. As more projects are built on Aptos and its ecosystem expands, the demand for APT tokens is likely to increase, potentially driving up the price. Initiatives that showcase the practical use of Aptos’s capabilities can enhance its appeal to developers and investors alike.

-

Market Comparisons and Competition: Aptos operates in a competitive environment alongside other layer-1 blockchains. Price movements of competitors such as Solana and Avalanche can influence investor decisions regarding Aptos. When rival projects achieve notable milestones or price surges, Aptos may experience correlated price movements as investors reassess their portfolios.

-

Tokenomics and Supply Dynamics: The distribution and unlock schedule of Aptos tokens also play a role in its price dynamics. With an initial total supply of 1.17 billion APT, the circulating supply impacts market liquidity and price stability. Events such as token unlocks for early investors and team members can lead to fluctuations in price as new tokens enter circulation.

Conclusion

In summary, the price history of Aptos is marked by significant milestones and influenced by a myriad of factors, including market sentiment, technological advancements, regulatory developments, and competitive dynamics. Understanding these historical trends and influences can help investors make more informed decisions regarding their engagement with Aptos as a digital asset.

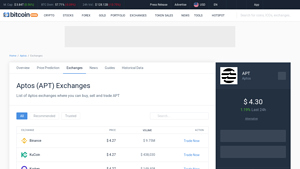

Where to Buy aptos coin: Top Exchanges Reviewed

5. Aptos Exchanges – Your Gateway to Easy APT Trading!

The review article on “Aptos Exchanges” highlights leading platforms like HTX (Huobi), Binance, KuCoin, and Kraken, which facilitate the buying, selling, and trading of Aptos (APT). What sets these exchanges apart is their robust security measures, user-friendly interfaces, and extensive liquidity, making them ideal choices for both novice and experienced traders looking to engage with the Aptos ecosystem effectively.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy aptos coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Aptos (APT) is selecting a cryptocurrency exchange. A cryptocurrency exchange is a platform where you can buy, sell, and trade digital assets. Some popular exchanges that support Aptos include:

- Binance

- Coinbase

- KuCoin

- Huobi

When choosing an exchange, consider factors such as:

- User Interface: Look for an exchange that is user-friendly and easy to navigate, especially if you are a beginner.

- Fees: Be aware of transaction fees and withdrawal fees, as these can vary between exchanges.

- Security: Ensure the exchange has robust security measures in place, such as two-factor authentication (2FA) and cold storage for funds.

- Supported Payment Methods: Check if the exchange supports your preferred payment method (e.g., bank transfer, credit card, PayPal).

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will be prompted to provide your email address and create a password.

- Email Verification: After signing up, you will receive a verification email. Click the link in the email to verify your account.

- Complete KYC (Know Your Customer): Most exchanges require you to complete a KYC process to comply with regulations. This may involve uploading identification documents (e.g., a passport or driver’s license) and providing personal information like your address and date of birth.

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This typically involves linking your account to an authentication app like Google Authenticator.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy Aptos:

- Navigate to the Deposit Section: Log into your account and find the “Deposit” or “Funds” section.

- Select Deposit Method: Choose your preferred payment method. Most exchanges offer options like bank transfer, credit card, or cryptocurrency transfer.

- Follow Instructions: If using a bank transfer, follow the instructions provided by the exchange to complete the transaction. If using a credit card, you may need to enter your card details directly on the platform.

- Confirm Deposit: Once you have submitted the deposit, it may take some time for the funds to reflect in your account, depending on the payment method used.

4. Place an Order to Buy Aptos Coin

Now that your account is funded, you can place an order to buy Aptos:

- Go to the Trading Section: Navigate to the trading or markets section of the exchange.

- Select Aptos (APT): Search for the Aptos trading pair (e.g., APT/USD, APT/BTC) and select it.

- Choose Order Type: Decide on the type of order you want to place:

– Market Order: This order buys Aptos at the current market price.

– Limit Order: This order allows you to set a specific price at which you want to buy Aptos. The order will only execute if the market reaches your desired price. - Enter Amount: Specify how much Aptos you wish to buy.

- Review and Confirm: Double-check the details of your order and confirm the transaction. Your purchased Aptos will now be reflected in your exchange account.

5. Secure Your Coins in a Wallet

After purchasing Aptos, it is essential to secure your coins:

- Choose a Wallet: There are several types of wallets available:

– Software Wallets: These are applications you can download on your computer or smartphone (e.g., Exodus, Atomic Wallet).

– Hardware Wallets: These are physical devices that store your cryptocurrencies offline, providing enhanced security (e.g., Ledger, Trezor).

– Paper Wallets: These are physical printouts of your public and private keys, but they require careful handling to avoid loss or theft. - Transfer Your Aptos: Go to your exchange account and navigate to the withdrawal section. Enter your wallet address and specify the amount of Aptos you want to transfer.

- Confirm the Transfer: Review the transaction details carefully and confirm the withdrawal. Ensure that you are sending your Aptos to the correct wallet address.

- Backup Your Wallet: If using a software or hardware wallet, make sure to backup your wallet and keep your recovery phrase secure. This will allow you to recover your funds in case you lose access to your wallet.

By following these steps, you can successfully buy and securely store Aptos (APT). Always remember to stay informed about market trends and security practices to protect your investment.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Aptos (APT) has emerged as a noteworthy contender in the blockchain space since its mainnet launch in October 2022. Several factors contribute to its potential strengths and appeal to investors.

1. High Transaction Throughput

One of Aptos’s most significant advantages is its potential to process over 150,000 transactions per second (TPS) using a parallel execution model. This capability far exceeds that of many existing blockchains, including Ethereum, which typically processes 12 to 15 TPS. This high throughput can facilitate a wide range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs), making Aptos a versatile platform for developers.

2. Innovative Programming Language

Aptos utilizes Move, a new smart contract programming language developed by former Meta engineers. Move is designed to enhance security and efficiency in smart contract execution, offering advantages over more widely used languages like Solidity. The modular design and ability to easily verify blockchain commands can result in a more robust ecosystem, potentially attracting developers looking for a reliable platform.

3. Strong Backing and Funding

Aptos has garnered significant financial support from reputable venture capital firms, including Andreessen Horowitz and Binance Labs. This backing not only provides the necessary capital for growth and development but also adds credibility to the project. The financial stability allows Aptos to invest in marketing, partnerships, and technological advancements that could foster adoption.

4. Focus on Real-World Applications

The Aptos team emphasizes real-world use cases, aiming to make blockchain technology more accessible to mainstream users. By targeting sectors such as finance, gaming, and social applications, Aptos is positioned to solve actual problems faced by users, enhancing its adoption potential. The focus on practical applications can lead to higher user engagement and network activity.

5. Community and Ecosystem Development

Aptos has actively worked on building a community around its blockchain, fostering developer engagement through incentives and support programs. A healthy community can drive innovation, adoption, and long-term sustainability of the platform. As more developers build on Aptos, the ecosystem may expand, attracting users and investors alike.

Potential Risks and Challenges (The Bear Case)

While Aptos presents several strengths, it is essential to consider the potential risks and challenges that could impact its growth and adoption.

1. Market Volatility

Cryptocurrencies are known for their price volatility, and Aptos is no exception. As of now, APT has experienced significant price fluctuations, with an all-time high of $19.90 in January 2023 and a current price of approximately $4.27, indicating a decline of over 78%. Such volatility can deter potential investors and create uncertainty for long-term holders, impacting Aptos’s ability to establish a stable user base.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continually evolving. Governments around the world are implementing various frameworks to manage and regulate digital assets, which could pose challenges for Aptos. Regulatory actions can affect the legality of trading, taxation, and operational compliance for platforms built on Aptos. Any unfavorable regulatory developments could lead to decreased confidence among investors and users.

3. Intense Competition

The blockchain space is highly competitive, with numerous established players like Ethereum, Solana, and newer entrants constantly emerging. Aptos must differentiate itself to capture market share, which can be challenging in a crowded ecosystem. Competing platforms may have established user bases, extensive developer support, and advanced technology, making it difficult for Aptos to gain traction.

4. Technological Risks

Although Aptos boasts advanced technology, it is still a relatively new blockchain. As with any emerging technology, there may be unforeseen bugs, vulnerabilities, or scalability issues that could arise. The complexity of the Move programming language, while offering benefits, may also pose challenges for developers unfamiliar with it. Any technical failures or security breaches could severely impact user trust and the overall reputation of the network.

5. Dependence on Ecosystem Growth

Aptos’s success largely depends on the growth and adoption of its ecosystem. If developers do not build applications or if user engagement fails to materialize, the value of APT may stagnate or decline. Additionally, the success of the Aptos Foundation and its initiatives to support community growth will play a crucial role in determining the platform’s long-term viability. Without a vibrant ecosystem, Aptos may struggle to maintain relevance in the rapidly evolving blockchain landscape.

Conclusion

Investing in Aptos (APT) presents both opportunities and challenges. Its innovative technology, strong backing, and focus on real-world applications position it as a promising player in the blockchain space. However, potential investors should remain cautious of the inherent risks, including market volatility, regulatory uncertainties, and intense competition. A well-informed approach, coupled with an understanding of the potential strengths and risks, will be crucial for anyone considering an investment in Aptos. As always, it is essential to conduct thorough research and consider personal financial circumstances before making any investment decisions.

Frequently Asked Questions (FAQs)

1. What is Aptos Coin (APT)?

Aptos Coin (APT) is the native cryptocurrency of the Aptos blockchain, a Layer 1 Proof-of-Stake (PoS) blockchain designed to facilitate high-throughput and low-latency transactions. Aptos aims to bring mainstream adoption to Web3 by providing a platform for decentralized applications (DApps) that solve real-world problems. The network utilizes a unique smart contract programming language called Move, which was developed by engineers from Meta (formerly Facebook) who previously worked on the Diem blockchain project.

2. Who created Aptos Coin?

Aptos Coin was created by Mo Shaikh and Avery Ching, both former employees of Meta. Mo Shaikh serves as the CEO of Aptos, while Avery Ching is the CTO. The duo collaborated on the Diem project before founding Aptos Labs in early 2022, aiming to leverage their experience to build a more efficient blockchain infrastructure.

3. What makes Aptos Coin different from Bitcoin?

Aptos Coin differs from Bitcoin in several key ways:

– Consensus Mechanism: Aptos uses a Proof-of-Stake consensus mechanism combined with AptosBFT, allowing for faster transaction processing and higher throughput compared to Bitcoin’s Proof-of-Work system.

– Transaction Speed: Aptos can theoretically process over 150,000 transactions per second (tps), while Bitcoin typically handles around 7 tps.

– Smart Contracts: Aptos employs the Move programming language, which is designed for secure and efficient smart contract development, offering advantages over Bitcoin’s scripting language.

4. Is Aptos Coin a good investment?

The suitability of Aptos Coin as an investment depends on various factors, including market conditions, the project’s development progress, and individual investment goals. As of now, Aptos has a market capitalization of approximately $2.93 billion and has shown notable growth since its mainnet launch in October 2022. However, like all cryptocurrencies, it carries risks and volatility. Potential investors should conduct thorough research and consider consulting with financial advisors before investing.

5. Where can I buy Aptos Coin?

Aptos Coin (APT) can be purchased on several major cryptocurrency exchanges, including Binance, Coinbase, Huobi, and KuCoin. Users can trade APT for various cryptocurrencies or fiat currencies, depending on the exchange’s offerings.

6. How does the Aptos network ensure security?

The Aptos network utilizes a combination of Proof-of-Stake and a custom Byzantine Fault Tolerant (BFT) consensus algorithm called AptosBFT. This design helps ensure the network remains operational even if some validators go offline or act maliciously. The AptosBFT algorithm is based on the HotStuff protocol, which facilitates automatic leader rotations and updates to enhance network resilience.

7. What are the use cases for Aptos Coin?

Aptos Coin can be used in various applications within the Aptos ecosystem, including:

– Transaction Fees: APT is used to pay for transaction fees on the Aptos blockchain.

– Staking: Users can stake APT tokens to help secure the network and earn rewards.

– DApps: Developers can build decentralized applications (DApps) on the Aptos platform, utilizing APT for in-app transactions and governance.

8. What is the future outlook for Aptos Coin?

The future outlook for Aptos Coin will largely depend on the project’s ability to attract developers and users to its ecosystem, as well as the overall market conditions for cryptocurrencies. With its focus on high transaction speeds, scalability, and innovative features like the Move programming language, Aptos aims to establish itself as a leading blockchain platform. Continuous development, partnerships, and community engagement will be crucial in determining its success in the competitive blockchain landscape.

Final Verdict on aptos coin

Summary of Aptos Coin

Aptos Coin (APT) serves as the native currency of the Aptos blockchain, a Layer 1 Proof-of-Stake network designed to enhance mainstream adoption of decentralized applications (DApps). Developed by a team of former Meta (Facebook) engineers, Aptos utilizes the innovative Move programming language, which offers unique advantages over traditional smart contract languages like Solidity. The blockchain’s architecture allows for an impressive theoretical transaction throughput of over 150,000 transactions per second (TPS), achieved through its parallel execution engine, Block-STM. This capability positions Aptos as a strong contender in the blockchain space, particularly for applications requiring high-speed transactions and scalability.

Technology and Use Cases

Aptos is built on a robust consensus mechanism known as AptosBFT, ensuring reliability and security even in adverse conditions. The blockchain’s unique features, such as horizontal scalability and modular design, open doors for various use cases, from DeFi applications to NFTs and gaming. Additionally, the Aptos Bridge facilitates seamless cross-chain transfers, enhancing interoperability with other blockchain networks.

Investment Considerations

While Aptos presents exciting technological advancements and potential use cases, it is essential to recognize that investing in cryptocurrencies, including Aptos Coin, involves significant risks. The market is highly volatile, and APT’s price has experienced notable fluctuations since its launch, making it a high-risk, high-reward asset. As of now, Aptos is ranked #38 in market capitalization, indicating a growing interest among investors.

Final Thoughts

Before considering an investment in Aptos Coin, it is crucial to conduct your own thorough research (DYOR). Understanding the underlying technology, market dynamics, and potential risks will equip you with the knowledge necessary to make informed decisions. Always remember that the cryptocurrency landscape is continuously evolving, and staying informed is key to navigating this complex environment effectively.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.