alephium crypto Explained: A Deep Dive into the Technology and Toke…

An Investor’s Introduction to alephium crypto

Alephium (ALPH) is an innovative cryptocurrency that has emerged as a significant player in the blockchain landscape, distinguished by its unique approach to scalability, security, and energy efficiency. As a sharded Layer 1 blockchain, Alephium integrates advanced technologies such as a custom virtual machine, Alphred, and a novel consensus mechanism known as Proof of Less Work (PoLW). This combination allows Alephium to facilitate decentralized applications (dApps) and smart contracts while maintaining robust security and minimizing energy consumption. As the demand for efficient blockchain solutions grows, Alephium positions itself as a viable alternative to more established platforms like Ethereum, particularly in the decentralized finance (DeFi) sector.

The significance of Alephium in the crypto market lies in its ability to address several critical challenges faced by traditional blockchains. By utilizing sharding and a stateful Unspent Transaction Output (UTXO) model, Alephium enhances transaction throughput and scalability, enabling it to handle thousands of transactions per second. This capacity is essential for supporting the growing number of dApps and DeFi projects that require high-speed and secure processing. Moreover, Alephium’s focus on sustainability, with its energy-efficient PoLW mechanism, aligns with the increasing scrutiny surrounding the environmental impact of blockchain technologies.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors looking to understand Alephium and its potential as an investment opportunity. Throughout this guide, we will explore various aspects of Alephium, including:

Technology

We will delve into the underlying technology that powers Alephium, explaining how its sharding, virtual machine, and consensus mechanism work together to create a scalable and secure blockchain environment.

Tokenomics

An overview of Alephium’s tokenomics will be provided, detailing the supply, distribution, and economic model of its native token, ALPH.

Investment Potential

This section will analyze Alephium’s market performance, growth potential, and the factors influencing its price.

Risks

Investing in cryptocurrencies comes with inherent risks. We will outline the specific risks associated with Alephium, including market volatility, regulatory challenges, and technological vulnerabilities.

How to Buy

Finally, we will guide you through the process of purchasing Alephium, covering various exchanges and wallets that support ALPH.

By the end of this guide, readers will have a well-rounded understanding of Alephium, equipping them to make informed decisions regarding their investments in this promising cryptocurrency.

What is alephium crypto? A Deep Dive into its Purpose

The Core Problem It Solves

In the rapidly evolving world of blockchain technology, scalability, security, and sustainability remain pressing challenges. Traditional blockchain platforms often struggle with network congestion and slow transaction speeds, particularly during peak usage periods. For instance, Bitcoin and Ethereum, the two most established cryptocurrencies, face significant scalability issues that can lead to high transaction fees and slow confirmation times. This is primarily due to their linear blockchain structures, which limit the number of transactions that can be processed simultaneously.

Alephium addresses these challenges by employing an innovative sharded Layer 1 blockchain architecture. This architecture divides the blockchain into smaller, more manageable segments called shards, allowing for parallel processing of transactions. By implementing sharding, Alephium can process over 20,000 transactions per second (TPS), significantly enhancing its scalability compared to traditional blockchains. This high throughput is crucial for supporting decentralized finance (DeFi) applications, which often require fast and efficient transaction processing.

Moreover, Alephium introduces a unique consensus mechanism called Proof of Less Work (PoLW). This mechanism not only retains the security benefits of traditional Proof of Work (PoW) systems but does so with dramatically reduced energy consumption—up to 87% less than Bitcoin. As concerns about the environmental impact of blockchain technology grow, Alephium’s PoLW offers a more sustainable alternative, making it an appealing option for environmentally-conscious developers and users.

Its Unique Selling Proposition

Alephium’s unique selling proposition lies in its ability to combine several key features into a single platform, setting it apart from other blockchain solutions:

-

Scalability Through Sharding: Alephium’s sharding mechanism allows the network to process transactions in parallel, effectively eliminating bottlenecks and congestion. Each shard can operate independently, which means that the overall network can maintain high throughput even during peak usage.

-

Energy Efficiency: With its Proof of Less Work consensus mechanism, Alephium drastically reduces the energy required to secure the network. This not only makes the platform more sustainable but also democratizes mining by lowering the entry barrier for participants.

-

Enhanced Security: Alephium employs a stateful Unspent Transaction Output (UTXO) model, akin to Bitcoin’s, which enhances security by ensuring that transaction outputs can only be spent once. Coupled with the sharded architecture and PoLW, this creates a robust environment resistant to common vulnerabilities such as double-spending and reentrancy attacks.

-

Developer-Friendly Environment: Alephium provides a custom virtual machine, known as Alphred, specifically designed for decentralized applications (dApps). This VM enhances the development experience by simplifying the creation of smart contracts while maintaining high security. Additionally, Alephium’s proprietary programming language, RALPH, is tailored for building efficient DeFi applications, making it easier for developers to contribute to the ecosystem.

-

Real-World Applications: The versatility of Alephium’s technology allows for various applications, including decentralized finance platforms, digital gift card systems, and decentralized exchanges (DEXs). These practical use cases demonstrate Alephium’s potential to address real-world problems while fostering innovation within the blockchain space.

The Team and Backers

Behind Alephium is a team of experienced professionals with a strong background in blockchain technology, computer science, and finance. The founders include experts who have previously worked on significant projects within the cryptocurrency ecosystem, providing them with the knowledge and skills necessary to tackle the challenges faced by existing blockchain platforms.

The team emphasizes transparency and community engagement, actively seeking feedback from users and developers to refine their technology and ensure it meets the needs of its ecosystem. This collaborative approach has fostered a vibrant developer community that contributes to the ongoing improvement and expansion of the Alephium platform.

In addition to its internal team, Alephium has garnered support from various investors and backers within the blockchain industry. These partnerships not only provide financial backing but also help to raise awareness of the project and facilitate collaborations with other innovative blockchain projects. This network of support enhances Alephium’s credibility and positions it as a serious contender in the competitive blockchain landscape.

Fundamental Purpose in the Crypto Ecosystem

Alephium’s fundamental purpose is to provide a scalable, secure, and sustainable blockchain solution that addresses the limitations of existing platforms. By focusing on these core areas, Alephium aims to facilitate the widespread adoption of decentralized applications and services, particularly in the rapidly growing DeFi sector.

The platform’s innovative technology allows developers to build robust, high-performance dApps that can handle a significant volume of transactions without sacrificing security or efficiency. This capability is essential for fostering a vibrant ecosystem of decentralized applications that can compete with traditional centralized services.

Moreover, Alephium’s commitment to energy efficiency aligns with the increasing demand for sustainable blockchain solutions. As the world grapples with climate change and environmental degradation, Alephium’s PoLW mechanism represents a step towards more responsible blockchain practices.

In conclusion, Alephium serves as a promising solution to the challenges faced by the cryptocurrency ecosystem. By combining scalability, security, and sustainability, it not only enhances the user experience but also paves the way for the future of decentralized applications and services. As the platform continues to evolve and grow, it has the potential to play a pivotal role in shaping the next generation of blockchain technology.

The Technology Behind the Coin: How It Works

Understanding Alephium’s Blockchain Architecture

Alephium employs a sharded Layer 1 (L1) blockchain architecture, which is designed to enhance scalability and efficiency in processing transactions. This architecture divides the blockchain into smaller segments known as shards. Each shard operates independently and can process transactions simultaneously, enabling Alephium to achieve a high throughput of over 20,000 transactions per second (TPS).

This sharding mechanism allows the network to handle a larger volume of transactions without the congestion often experienced by traditional blockchains. By utilizing parallel processing, Alephium ensures that transactions are not bottlenecked as they are in some older blockchain models. This innovative approach results in a more efficient and user-friendly experience, especially for decentralized applications (dApps) and decentralized finance (DeFi) platforms that require quick transaction confirmations.

Consensus Mechanism: Proof of Less Work (PoLW)

One of the standout features of Alephium is its unique consensus mechanism known as Proof of Less Work (PoLW). Traditional blockchain networks like Bitcoin use Proof of Work (PoW), which relies on miners solving complex mathematical problems to validate transactions and create new blocks. This process is energy-intensive and requires significant computational power.

In contrast, PoLW dynamically adjusts the mining difficulty based on real-time network conditions. This means that the amount of computational work required to mine new blocks is reduced, resulting in energy consumption that is approximately 87% lower than Bitcoin’s under similar conditions. PoLW not only enhances the sustainability of the network but also maintains a high level of security.

This consensus mechanism ensures that the network remains decentralized while being more environmentally friendly. By minimizing the energy needed for mining, Alephium aligns with the growing demand for sustainable blockchain solutions, making it an attractive option for environmentally conscious investors and developers.

Key Technological Innovations

Sharding and Parallel Processing

Sharding is a critical innovation that allows Alephium to achieve high throughput and scalability. By breaking the blockchain into smaller, manageable pieces, each shard can operate independently. This parallel processing capability means that multiple transactions can be processed simultaneously, significantly reducing the time it takes to confirm transactions.

Alephium’s sharding architecture simplifies the development of dApps by providing a single-chain experience, which is often easier for developers to navigate than multi-chain systems. This design choice eliminates the complexities associated with cross-chain interactions, making it easier to build and maintain applications.

Stateful UTXO Model

Alephium utilizes a stateful Unspent Transaction Output (UTXO) model, which is similar to the model used by Bitcoin. In the UTXO model, each transaction output can only be spent once, ensuring a robust mechanism for preventing double-spending. However, Alephium enhances this model by introducing statefulness, which combines the benefits of UTXO with the programmability typically associated with account-based models like Ethereum’s.

This hybrid approach allows developers to create complex smart contracts while maintaining a high level of security. The stateful UTXO model empowers developers to build applications that can manage their own states, offering greater flexibility and functionality in the development of decentralized applications.

Alphred: Alephium’s Custom Virtual Machine

Alphred is Alephium’s custom virtual machine designed to support the execution of smart contracts. One of the primary goals of Alphred is to enhance security and usability for developers building decentralized applications. By providing a dedicated virtual machine, Alephium can optimize the execution of smart contracts while addressing common vulnerabilities found in other platforms.

Alphred is designed with developer-friendliness in mind. It offers an intuitive Software Development Kit (SDK) and a high-performance programming language called RALPH. This language is specifically tailored for creating efficient and secure decentralized finance applications, making it more accessible for developers compared to traditional languages like Solidity used in Ethereum.

BlockFlow Algorithm

The BlockFlow algorithm is another innovative component of Alephium’s technology. This algorithm governs how transactions are processed within the network, ensuring that they are handled in an orderly and efficient manner. By implementing BlockFlow alongside sharding and the UTXO model, Alephium can reduce the likelihood of network congestion and enhance overall performance.

The combination of these technologies creates a robust framework for transaction processing, allowing Alephium to maintain high throughput while ensuring the security and integrity of the network. This makes it an attractive choice for developers looking to build applications that require quick transaction confirmations and low latency.

Energy Efficiency and Sustainability

Alephium’s focus on energy efficiency sets it apart in the blockchain space. With its Proof of Less Work consensus mechanism, the network is able to significantly reduce its energy consumption compared to traditional Proof of Work systems. This is particularly important as the environmental impact of blockchain technology comes under scrutiny.

By using only 1/8 of the energy required by Bitcoin, Alephium positions itself as a sustainable blockchain solution. This commitment to sustainability not only appeals to environmentally conscious developers and investors but also aligns with global efforts to reduce carbon footprints in technology.

Security Features

Security is paramount in the blockchain space, and Alephium incorporates multiple layers of protection to safeguard its network. The PoLW consensus mechanism inherently makes it economically unfeasible for attackers to gain control of the network, as they would need to invest significant resources to manipulate block creation.

Moreover, the sharded architecture of Alephium ensures that even if one shard is compromised, the integrity of the rest of the network remains intact. The use of the UTXO model further enhances security by making it difficult for attackers to alter transaction histories.

In addition, Alephium’s virtual machine is designed to be MEV-aware (Miner Extractable Value), which means it includes native safeguards against common vulnerabilities like reentrancy attacks, unlimited approvals, and flash loan exploits. These built-in protections contribute to a more secure environment for developers and users alike.

Conclusion

In summary, Alephium represents a significant advancement in blockchain technology through its innovative use of sharding, a unique consensus mechanism, and a developer-friendly environment. By combining the best aspects of scalability, security, and energy efficiency, Alephium is well-positioned to support the growing demand for decentralized applications and finance solutions. Its commitment to sustainability and robust security measures further enhances its appeal in an increasingly competitive cryptocurrency landscape. For both developers and investors, understanding the technology behind Alephium is essential to appreciating its potential in the evolving world of blockchain.

Understanding alephium crypto Tokenomics

Alephium Tokenomics Overview

Alephium (ALPH) operates within a structured tokenomics framework that supports its innovative blockchain technology. Understanding its tokenomics is crucial for investors and enthusiasts to comprehend how the ALPH token functions within the Alephium ecosystem, its utility, distribution, and overall economic model.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 214.55 million ALPH |

| Max Supply | ∞ (Infinity) |

| Circulating Supply | 120.57 million ALPH |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The ALPH token serves multiple purposes within the Alephium ecosystem, enhancing its utility and value proposition:

-

Transaction Fees: ALPH is used to pay for transaction fees on the Alephium network. Every transaction that occurs on the platform requires a small fee in ALPH, incentivizing miners and validators to process and confirm transactions efficiently.

-

Staking and Governance: Holders of ALPH can participate in the network’s governance by staking their tokens. This allows them to vote on important protocol decisions, upgrades, and other governance-related issues. As Alephium continues to develop, stakeholder involvement through governance will be essential for shaping its future.

-

Access to Decentralized Applications (dApps): The ALPH token is integral for interacting with decentralized applications built on the Alephium blockchain. Users may need ALPH to access various services, participate in decentralized finance (DeFi) activities, or engage with other dApps.

-

Incentives for Developers: Developers can earn ALPH by creating and deploying applications on the Alephium platform. This not only encourages innovation but also helps expand the ecosystem, attracting more users and investors.

-

Reward Mechanism: Miners who validate transactions and secure the network are rewarded with ALPH tokens. This incentivizes network participation and ensures the blockchain’s security and integrity.

Token Distribution

Token distribution is a critical aspect of Alephium’s tokenomics, as it influences the overall health and sustainability of the ecosystem. The distribution model ensures that tokens are allocated fairly while incentivizing participation and development. Here are the main components of Alephium’s token distribution:

-

Initial Allocation: Upon the launch of the Alephium mainnet, a significant portion of the ALPH tokens was allocated to early investors, developers, and the founding team. This initial allocation is vital for securing the necessary funding to develop the platform and incentivizing the team’s ongoing efforts.

-

Mining Rewards: The Proof of Less Work (PoLW) consensus mechanism allows miners to earn ALPH tokens as rewards for their contributions to securing the network. This mechanism ensures that the distribution of tokens is tied to active participation, aligning the interests of miners with the health of the network.

-

Community Incentives: Alephium has plans to allocate a portion of its tokens to community incentives, which may include rewards for contributors, developers, and users who actively engage with the platform. This strategy encourages the growth of a vibrant community around Alephium.

-

Ecosystem Development: A dedicated fund may be established to support ecosystem development initiatives, including hackathons, grants, and partnerships. This fund aims to foster innovation and ensure that Alephium remains competitive in the rapidly evolving blockchain landscape.

-

Deflationary Mechanism: As part of its tokenomics, Alephium employs a deflationary model. This may involve mechanisms such as token burns or reducing the rewards over time, leading to a decrease in the circulating supply. Such a model can potentially enhance the value of the remaining tokens as demand increases while supply decreases.

-

Long-term Vision: Alephium’s tokenomics is designed with a long-term vision in mind. The focus on sustainability, community engagement, and developer incentives ensures that the ecosystem continues to thrive, attracting new users and participants over time.

Conclusion

Understanding the tokenomics of Alephium provides valuable insights into its operational framework, utility, and long-term sustainability. The ALPH token plays a critical role in facilitating transactions, incentivizing network participation, and fostering community governance. With a robust distribution model and a deflationary approach, Alephium is positioned to adapt and grow in the competitive blockchain ecosystem, making it an attractive option for both beginners and intermediate investors. By comprehensively grasping these tokenomics, investors can make informed decisions regarding their involvement with Alephium and its potential in the ever-evolving cryptocurrency landscape.

Price History and Market Performance

Key Historical Price Milestones

Alephium (ALPH) has had a dynamic price history since its inception, marked by significant milestones that reflect the broader trends in the cryptocurrency market and the project’s own developments.

Initial Launch and Early Trading

Alephium began its journey in 2018 with the release of its white paper, but the token did not see active trading until its public testnet launch in March 2021. The mainnet launch in November 2021 marked a pivotal moment for Alephium, allowing users to transact and deploy decentralized applications on its platform. This milestone contributed to an initial surge in interest and trading volume, with prices starting to gain traction.

All-Time High and Subsequent Corrections

The price of Alephium reached an all-time high of approximately $3.86 on February 27, 2024. This peak can be attributed to a combination of factors, including heightened investor interest in decentralized finance (DeFi) projects, the growing adoption of blockchain technologies, and Alephium’s unique selling propositions, such as its sharding capabilities and energy-efficient consensus mechanism.

However, following this peak, the price experienced a significant correction, dropping to lower levels. As of the latest data, Alephium is trading around $0.2172, indicating a decline of about 94.37% from its all-time high. This price adjustment is not uncommon in the cryptocurrency market, which is characterized by volatility and speculative trading.

Recent Performance Trends

In the past few months leading up to October 2023, Alephium has shown fluctuations within a range, with a 24-hour trading volume of approximately $260,330 and a market cap of around $26.19 million. The price has varied between a low of $0.04655 and a high of $0.2173 in recent months, demonstrating a recovery trend from its all-time low of $0.04655 recorded on January 10, 2023. This represents a remarkable increase of approximately 366.65%, indicating a potential resurgence in interest and investment in Alephium.

Factors Influencing the Price

Historically, the price of Alephium has been influenced by several key factors that are common across the cryptocurrency landscape, as well as those specific to the Alephium project.

Market Sentiment and Overall Cryptocurrency Trends

One of the most significant factors affecting Alephium’s price is the overall sentiment in the cryptocurrency market. Bullish trends in major cryptocurrencies, such as Bitcoin and Ethereum, often lead to increased investment in altcoins, including Alephium. Conversely, bearish market conditions can lead to significant sell-offs, impacting the price negatively. As part of a broader market, Alephium’s price is sensitive to shifts in investor sentiment and market trends.

Technological Developments and Upgrades

Alephium’s technological advancements play a crucial role in its price performance. Developments such as the introduction of new features, improvements in network scalability, and enhancements to the Alephium Virtual Machine (Alphred) have historically led to price increases. For instance, the launch of the mainnet in November 2021 was a significant event that catalyzed interest and investment, contributing to an initial price surge.

Adoption and Use Cases

The real-world applications of Alephium’s technology, particularly in the DeFi space and digital gift card market, also influence its price. Increased adoption of the Alephium platform for decentralized applications (dApps) and partnerships with other blockchain projects can drive demand for the ALPH token, positively impacting its market value. As more developers and users engage with Alephium’s ecosystem, the token’s utility may enhance, leading to potential price appreciation.

Regulatory Developments and Market Conditions

Regulatory news and changes in the legal landscape for cryptocurrencies can significantly affect Alephium’s price. Positive regulatory developments often lead to increased confidence among investors, while negative news can result in fear and uncertainty, prompting sell-offs. Alephium’s price has also been affected by broader economic conditions, including inflation rates, interest rates, and geopolitical events that influence market stability.

Community Engagement and Ecosystem Growth

Alephium has cultivated a vibrant community of developers and users, which is essential for the project’s long-term success. Community-driven initiatives, such as hackathons and developer engagement programs, help to foster innovation and attract new users to the platform. A strong community can lead to increased interest and investment in Alephium, positively impacting its price.

Conclusion

Alephium’s price history reflects a journey marked by significant milestones and influenced by a variety of factors. Understanding these historical price movements and the elements that have impacted them provides valuable insights for both new and experienced investors. The cryptocurrency market remains volatile, and Alephium, like many other digital assets, continues to navigate the complexities of technological advancements, market sentiment, and broader economic conditions.

Where to Buy alephium crypto: Top Exchanges Reviewed

5. Alephium (ALPH) – A Rising Star in Exchange Listings!

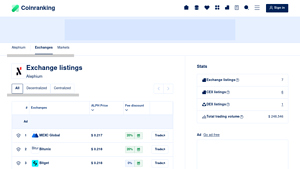

The article on “Exchange Listings of Alephium (ALPH)” from Coinranking provides a comprehensive overview of where Alephium can be traded, highlighting key factors such as price comparisons, trading volumes, and available discounts. What sets this exchange review apart is its user-friendly approach, enabling traders to easily identify the most advantageous platforms for their transactions, ensuring they make informed decisions based on up-to-date market data.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Alephium (ALPH) – Your Ultimate Guide to Smart Investing!

The article “How to Buy Alephium (ALPH): A Step-by-Step Guide” on Bitcompare provides a thorough overview of selecting the right cryptocurrency exchange for purchasing Alephium. It emphasizes the importance of researching exchanges that not only operate in your country but also offer robust support for Alephium trading. This focus on localized options and user-friendly processes sets this guide apart, making it a valuable resource for both novice and experienced investors looking to navigate the Alephium market.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

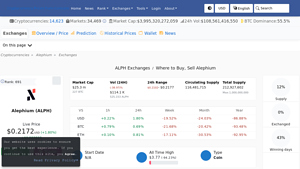

5. Alephium (ALPH) – Your Gateway to Seamless Trading!

Alephium (ALPH) is gaining traction in the cryptocurrency market, available for trading on over eight exchanges, with Gate, Bitget, and Coinex leading the pack. These platforms stand out due to their user-friendly interfaces, robust security measures, and diverse trading options, making it easy for both beginners and seasoned traders to buy, sell, and trade Alephium efficiently.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. SimpleSwap – Best for Seamless Alephium Exchanges!

SimpleSwap stands out as a premier platform for exchanging Alephium (ALPH) due to its extensive selection of over 1,000 cryptocurrencies, ensuring users can find competitive rates and a wide variety of trading options. The platform prioritizes speed and convenience, making it an ideal choice for both novice and seasoned investors looking to efficiently manage their digital asset portfolios while enjoying a seamless user experience.

- Website: simpleswap.io

- Platform Age: Approx. 7 years (domain registered in 2018)

7. KuCoin – Your Gateway to Alephium (ALPH) Trading!

In the review article titled “How to Buy Alephium (ALPH) – KuCoin,” readers will discover a comprehensive step-by-step guide to purchasing Alephium, despite KuCoin’s current lack of direct support for the asset. KuCoin stands out for its user-friendly interface, extensive selection of cryptocurrencies, and robust trading features, making it an ideal platform for both novice and experienced investors looking to navigate the digital asset landscape.

- Website: kucoin.com

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy alephium crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Alephium (ALPH) is to select a cryptocurrency exchange that supports the trading of this specific asset. Some popular exchanges where you can buy ALPH include:

- Binance: One of the largest and most reputable exchanges in the world, known for a wide range of available cryptocurrencies.

- KuCoin: A user-friendly platform that offers a variety of altcoins, including Alephium.

- Gate.io: A well-established exchange that frequently lists new and emerging cryptocurrencies.

When choosing an exchange, consider the following factors:

- Security: Look for exchanges with strong security measures, such as two-factor authentication (2FA) and cold storage for funds.

- Fees: Review the trading and withdrawal fees associated with the platform.

- User Experience: Choose an exchange that you find easy to navigate, especially if you’re a beginner.

- Liquidity: Ensure that the exchange has sufficient trading volume for Alephium to facilitate your purchase without major price fluctuations.

2. Create and Verify Your Account

Once you’ve selected an exchange, the next step is to create an account. This typically involves the following:

- Sign Up: Visit the exchange’s website and click on the ‘Sign Up’ or ‘Register’ button. You’ll need to provide your email address and create a secure password.

- Email Verification: After signing up, you’ll receive a verification email. Click the link in the email to confirm your account.

- Complete KYC (Know Your Customer): Most exchanges require users to complete a KYC process. This usually involves submitting identification documents (like a passport or driver’s license) and possibly proof of address. This step is crucial for security and compliance with regulations.

3. Deposit Funds

After your account is verified, you can deposit funds to trade for Alephium. Here’s how to do it:

- Choose a Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or other cryptocurrencies. Choose the method that best suits you.

- Follow Instructions: If depositing via bank transfer or card, follow the instructions provided by the exchange to complete the transaction. If you are transferring cryptocurrency, make sure to send it to the correct wallet address provided by the exchange.

- Confirm Deposit: After making the deposit, check your account balance to ensure the funds have been credited. This may take some time, especially for bank transfers.

4. Place an Order to Buy Alephium Crypto

With funds in your account, you can now purchase Alephium. Here’s how to place an order:

- Navigate to the Trading Section: Go to the exchange’s trading interface and search for the ALPH trading pair (e.g., ALPH/USD or ALPH/BTC).

- Select Order Type: Most exchanges offer different order types:

- Market Order: Buy immediately at the current market price.

- Limit Order: Set a specific price at which you want to buy ALPH. Your order will execute only if the market reaches that price.

- Enter the Amount: Specify how much Alephium you want to purchase. Make sure to review the total cost, including any fees.

- Confirm the Order: Review all details and confirm the order. Once executed, your ALPH tokens will appear in your exchange wallet.

5. Secure Your Coins in a Wallet

After buying Alephium, it’s crucial to secure your investment. While you can leave your coins on the exchange, it’s generally safer to transfer them to a personal wallet. Here’s how to do it:

- Choose a Wallet: There are different types of wallets:

- Hardware Wallets: Physical devices (like Ledger or Trezor) that store your coins offline, providing high security.

- Software Wallets: Applications (like Exodus or Atomic Wallet) that can be installed on your computer or mobile device. They are more convenient but less secure than hardware wallets.

- Transfer ALPH: To move your Alephium from the exchange to your wallet:

- Go to your wallet and find your Alephium address.

- Return to the exchange, navigate to the withdrawal section, and enter your wallet address and the amount of ALPH you want to transfer.

- Confirm the Transfer: Double-check the address before confirming the transfer. Once the transaction is complete, your ALPH will be securely stored in your wallet.

Conclusion

Buying Alephium can be a straightforward process if you follow these steps carefully. Always remember to conduct your own research and ensure that you’re taking the necessary precautions to secure your investment. Happy trading!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Alephium (ALPH) presents a compelling case for investment through its innovative technology and growing ecosystem. Here are several strengths that may attract investors:

1. Scalability and Performance

One of Alephium’s standout features is its sharding technology, which allows the blockchain to process transactions in parallel across multiple shards. This can lead to significantly higher throughput, reportedly over 20,000 transactions per second (TPS), which is crucial for the growing demand for decentralized applications (dApps) and decentralized finance (DeFi) solutions. This scalability positions Alephium favorably against traditional blockchain networks that face congestion issues during peak usage.

2. Energy Efficiency

Alephium employs a unique Proof of Less Work (PoLW) consensus mechanism, which drastically reduces energy consumption—by up to 87% compared to traditional Proof of Work (PoW) systems like Bitcoin. As environmental sustainability becomes increasingly important to investors and users, Alephium’s energy-efficient approach could enhance its appeal in a market that is scrutinizing the carbon footprints of blockchain technologies.

3. Robust Security Features

The platform’s architecture integrates a stateful Unspent Transaction Output (UTXO) model, which enhances security by preventing double-spending. Additionally, the built-in protections against common vulnerabilities—such as reentrancy attacks and flash loan exploits—add another layer of security, making Alephium a more secure choice for developers looking to build DeFi applications.

4. Developer-Friendly Environment

Alephium’s custom virtual machine (Alphred) and its programming language (RALPH) are designed to facilitate efficient development of smart contracts and decentralized applications. This accessibility can encourage more developers to build on the platform, potentially leading to a robust ecosystem of dApps that can drive demand for the ALPH token.

5. Diverse Real-World Applications

Alephium’s technology is not limited to DeFi; it also finds applications in areas like digital gift cards and decentralized exchanges (DEXs). The versatility of its blockchain could provide multiple avenues for growth, diversifying its use cases and attracting different segments of users.

6. Community Engagement and Ecosystem Growth

Alephium has demonstrated a commitment to fostering a vibrant developer community through initiatives like hackathons and active participation in blockchain conferences. This community-driven approach can lead to innovation, collaboration, and continuous improvement of the platform, which is essential for long-term sustainability.

Potential Risks and Challenges (The Bear Case)

While Alephium presents several attractive features, potential investors should also be aware of the risks and challenges associated with this cryptocurrency:

1. Market Volatility

The cryptocurrency market is notoriously volatile, and Alephium is no exception. As of now, its price has experienced significant fluctuations, including a notable drop of over 94% from its all-time high. Such volatility can deter potential investors and may lead to rapid changes in market sentiment that could impact the price of ALPH drastically.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and can vary significantly by jurisdiction. Changes in regulations or increased scrutiny from governments could impact Alephium’s operations and its adoption rate. For instance, if regulations impose stringent requirements on decentralized platforms, it could hinder Alephium’s growth and its ability to attract developers and users.

3. Intense Competition

Alephium operates in a highly competitive environment with numerous established blockchain networks and emerging projects vying for market share in the DeFi and dApp space. Competitors such as Ethereum, Binance Smart Chain, and newer Layer 1 solutions present significant challenges. If Alephium cannot differentiate itself effectively or keep pace with technological advancements from its competitors, it may struggle to gain traction.

4. Technological Risks

While Alephium’s innovative technology is a strength, it also poses inherent risks. For instance, the complexity of its sharding mechanism and the PoLW consensus could lead to unforeseen technical issues or vulnerabilities. If these issues are not addressed promptly, they could undermine user confidence and result in negative market sentiment.

5. Adoption Challenges

The success of any blockchain project hinges on user adoption. Despite its robust features, Alephium may face challenges in attracting a critical mass of users and developers. If the platform does not achieve widespread adoption, the potential for growth may be limited, affecting the long-term value of ALPH.

6. Dependency on the Developer Community

Alephium’s growth is closely tied to its developer community’s engagement. If the community does not actively contribute to the ecosystem or if developers choose to build on competing platforms, Alephium may not realize its full potential. This dependency on community involvement can introduce an element of unpredictability.

Conclusion

In summary, Alephium presents an intriguing investment opportunity with its focus on scalability, energy efficiency, and security. However, potential investors should carefully weigh these strengths against the risks posed by market volatility, regulatory uncertainty, intense competition, and technological challenges. As with any investment in cryptocurrency, thorough research and a clear understanding of both the potential and the risks are crucial for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Alephium crypto?

Alephium is a sharded Layer 1 blockchain designed to enhance scalability, security, and energy efficiency. It utilizes a unique Proof of Less Work (PoLW) consensus mechanism, which reduces energy consumption by over 87% compared to traditional Proof of Work (PoW) systems like Bitcoin. Alephium supports smart contracts and decentralized applications (dApps), making it a suitable platform for decentralized finance (DeFi) and other blockchain-based solutions.

2. Who created Alephium crypto?

Alephium was founded by a team of blockchain experts and researchers, including co-founders David Yang, Denny Xu, and Yi Wang. The team has a strong background in computer science and blockchain technology, which has contributed to the development of Alephium’s innovative features and infrastructure.

3. What makes Alephium crypto different from Bitcoin?

Alephium differs from Bitcoin in several key ways:

- Consensus Mechanism: Alephium uses Proof of Less Work (PoLW), which is more energy-efficient than Bitcoin’s Proof of Work (PoW).

- Scalability: Alephium employs sharding to enhance transaction throughput, allowing it to process over 20,000 transactions per second, whereas Bitcoin’s network can handle far fewer transactions per second.

- Smart Contracts: Alephium supports smart contracts and decentralized applications, while Bitcoin primarily focuses on peer-to-peer transactions.

- Transaction Model: Alephium uses a stateful Unspent Transaction Output (UTXO) model, similar to Bitcoin, but adds programmability features that enhance security and efficiency.

4. Is Alephium crypto a good investment?

As with any cryptocurrency investment, the potential for profit comes with risks. Alephium has shown promising technology with its unique features and a growing ecosystem. However, it is essential to conduct thorough research, consider market conditions, and assess your risk tolerance before investing. Always remember that cryptocurrency markets can be highly volatile.

5. What are the real-world applications of Alephium?

Alephium has various real-world applications, including:

- Decentralized Finance (DeFi): The platform supports the development of dApps and smart contracts, enabling a wide range of financial services.

- Digital Gift Cards: Alephium can be used to create secure and verifiable digital gift cards.

- Decentralized Exchanges (DEXs): Its efficient consensus mechanism makes it a suitable option for building DEXs that require high throughput and low latency.

- Developer Ecosystem: Alephium provides a robust environment for developers to create secure and efficient decentralized applications.

6. How does Alephium ensure security?

Alephium employs several security measures, including:

- Proof of Less Work (PoLW): This consensus mechanism reduces the likelihood of attacks by making it economically unfeasible for bad actors to control the network.

- Stateful UTXO Model: This model prevents double-spending and enhances transaction security.

- Built-in Protections: Alephium’s architecture includes safeguards against common vulnerabilities, such as reentrancy attacks and flash loan exploits.

7. What is the current price of Alephium crypto?

As of the latest data, Alephium (ALPH) is priced at approximately $0.2172, with a market capitalization of around $26.19 million. Prices can fluctuate frequently, so it is advisable to check a reliable cryptocurrency market tracking website for the most current price.

8. How can I buy Alephium crypto?

You can purchase Alephium through various cryptocurrency exchanges. To buy ALPH, you typically need to:

- Create an Account: Sign up on a cryptocurrency exchange that lists Alephium, such as Binance or KuCoin.

- Verify Your Identity: Complete any necessary identity verification processes required by the exchange.

- Deposit Funds: Fund your account with fiat currency or another cryptocurrency.

- Place an Order: Search for Alephium (ALPH) on the exchange and place a buy order at your desired price.

Make sure to store your ALPH in a secure wallet after purchasing.

Final Verdict on alephium crypto

Overview of Alephium Crypto

Alephium (ALPH) presents a compelling opportunity in the cryptocurrency space, particularly for those interested in decentralized finance (DeFi) and scalable blockchain solutions. Designed as a sharded Layer 1 blockchain, Alephium effectively combines the security of the Proof-of-Work model with the efficiency of modern smart contract platforms. Its unique Proof of Less Work (PoLW) consensus mechanism significantly reduces energy consumption while maintaining high security levels, making it an environmentally sustainable option in the blockchain ecosystem.

Key Technological Features

The platform’s standout features include a custom virtual machine, Alphred, which enhances the development experience for decentralized applications (dApps) and introduces a stateful Unspent Transaction Output (UTXO) model. This combination allows developers to create complex smart contracts while ensuring robust security against common vulnerabilities. With a throughput capacity exceeding 20,000 transactions per second (tps), Alephium addresses scalability challenges that often plague traditional blockchains.

Investment Potential and Risks

Despite its innovative technology and practical applications in DeFi, digital gift cards, and decentralized exchanges, investing in Alephium remains a high-risk, high-reward endeavor. The cryptocurrency market is notoriously volatile, and while Alephium has shown promise, potential investors should be cautious and well-informed.

Final Thoughts

Before investing in Alephium or any cryptocurrency, it is crucial to conduct thorough research (DYOR). Understanding the technology, use cases, market dynamics, and risks involved will empower you to make informed decisions. Alephium has the potential to reshape aspects of the blockchain landscape, but like any investment in the crypto sector, it requires careful consideration and due diligence.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.