aergo coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to aergo coin

Aergo Coin, often abbreviated as AERGO, stands out as a significant player in the cryptocurrency landscape, primarily known for its innovative approach to enterprise blockchain solutions. As an open-source platform, Aergo facilitates the development and deployment of decentralized applications (DApps) while supporting both permissioned and permissionless blockchain architectures. This hybrid model enables organizations to maintain control over private networks while also leveraging the benefits of public blockchain technology. With its unique features, Aergo Coin has garnered attention from enterprises looking to streamline operations, enhance security, and reduce costs through blockchain integration.

The Importance of Aergo Coin in the Crypto Market

Aergo Coin is not just another digital asset; it serves as the native utility token of the Aergo platform. It plays a crucial role in enabling various functionalities within the ecosystem, including the execution of smart contracts, accessing enterprise-grade services, and rewarding network participants. Its backing by Blocko, a South Korean blockchain technology company supported by Samsung, further enhances its credibility and potential for widespread adoption in various industries such as finance, manufacturing, and more. The platform’s emphasis on SQL support and familiar programming languages makes it accessible to a broader range of developers, thus promoting innovation and growth in the blockchain sector.

Purpose of This Guide

This guide aims to be a comprehensive resource for both beginners and intermediate investors interested in Aergo Coin. It will cover several essential aspects, including:

- Technology: An overview of Aergo’s blockchain architecture, consensus mechanisms, and smart contract capabilities.

- Tokenomics: Insights into the supply dynamics, utility, and economic model of AERGO tokens within the ecosystem.

- Investment Potential: Analysis of market trends, historical performance, and future prospects for Aergo Coin.

- Risks: A balanced discussion on potential risks and challenges investors may face when considering Aergo Coin.

- How to Buy: Step-by-step instructions on purchasing Aergo Coin through various exchanges.

By providing this information, we aim to equip you with the knowledge needed to make informed decisions regarding investing in Aergo Coin. Whether you are looking to delve into the specifics of its technology or evaluate its market potential, this guide will serve as a valuable resource in your cryptocurrency journey.

What is aergo coin? A Deep Dive into its Purpose

Introduction to Aergo Coin

Aergo Coin (AERGO) is the native cryptocurrency of the Aergo blockchain platform, which is designed to facilitate the development and deployment of decentralized applications (DApps) and enterprise solutions. As an open-source enterprise blockchain platform, Aergo aims to bridge the gap between traditional centralized systems and decentralized technologies, providing a robust infrastructure for both permissioned and permissionless blockchain applications.

The Core Problem It Solves

The primary challenges that Aergo addresses are the complexities associated with blockchain implementation in enterprise environments and the need for a flexible, scalable, and cost-effective solution for businesses. Traditional blockchain solutions often present hurdles, including high operational costs, technical barriers, and limited scalability, which can deter enterprises from adopting this transformative technology.

Aergo’s architecture is specifically designed to overcome these issues. By offering a hybrid model that supports both permissioned and permissionless deployments, Aergo allows businesses to maintain control over sensitive data while still reaping the benefits of decentralized technology. This is particularly valuable for organizations that require privacy and security in their operations.

Additionally, Aergo’s integration of SQL support simplifies data management for developers, enabling them to build applications using familiar programming languages. This approach not only reduces the learning curve for developers but also enhances the platform’s accessibility, making it easier for enterprises to transition to blockchain technology.

Its Unique Selling Proposition

Aergo’s unique selling proposition lies in its combination of advanced technological features and its focus on enterprise-level applications. Here are some key aspects that set Aergo apart:

-

Hybrid Blockchain Architecture: Aergo supports both public and private blockchains, allowing enterprises to choose the level of transparency and control that suits their needs. This hybrid approach enables businesses to create private blockchains for sensitive operations while leveraging the public Aergo mainnet for broader applications.

-

High Transaction Throughput and Low Costs: The platform is capable of handling over 10,000 transactions per second at a minimal cost of approximately $0.001 per transaction. This high throughput and low transaction fees make Aergo an attractive solution for businesses looking to scale their blockchain applications without incurring prohibitive costs.

-

Developer-Friendly Environment: By allowing smart contracts to be written in Lua and SQL, Aergo provides a familiar environment for developers. This accessibility encourages innovation and reduces the barriers to entry for companies seeking to build DApps.

-

On-Chain Governance: Aergo incorporates a democratic governance system known as AERGO Agora, which allows token holders to participate in decision-making processes regarding the platform’s future developments. This feature fosters a sense of community and ensures that the platform evolves in alignment with the interests of its users.

-

Real-World Applications: Aergo has demonstrated its value through successful implementations in various industries. Notably, its partnership with Lotte Card for fingerprint credit card verification showcases how Aergo’s technology can streamline operations and significantly reduce costs. Such real-world use cases validate Aergo’s capabilities and enhance its appeal to potential investors and enterprises.

The Team and Backers

Aergo was developed by Blocko, a South Korean blockchain technology company that has established itself as a leader in the enterprise blockchain sector. Blocko has collaborated with major corporations, including Lotte Card, Shinhan Bank, and Hyundai Motors, to implement blockchain solutions that address specific business needs. The backing of Blocko, which is supported by Samsung, lends significant credibility to Aergo and enhances its prospects for adoption in the competitive blockchain landscape.

The founder of Aergo, Won-Beom Kim, has played a pivotal role in shaping the platform’s vision and direction. His leadership has focused on creating a blockchain solution that is not only technologically advanced but also tailored to the requirements of enterprises. The team’s expertise in blockchain technology, combined with their commitment to innovation, positions Aergo as a formidable player in the blockchain ecosystem.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Aergo Coin is to serve as the utility token within the Aergo ecosystem. AERGO tokens are integral to various functions, including:

-

Transaction Fees: Users pay transaction fees in AERGO tokens when deploying and executing smart contracts on the Aergo platform. This ensures that network participants contribute to the maintenance and security of the blockchain.

-

Governance Participation: Holders of AERGO tokens can participate in the governance of the Aergo ecosystem through voting mechanisms. This democratic approach empowers users to influence the platform’s development and direction.

-

Access to Services: AERGO tokens are used to access additional products and services within the Aergo ecosystem, further integrating the token into the platform’s economic activities.

-

Incentives for Network Participants: AERGO tokens can be distributed as rewards for users who contribute to the network, such as block producers and validators. This incentivization model encourages active participation and enhances the overall security and efficiency of the platform.

In conclusion, Aergo Coin represents a significant advancement in the realm of enterprise blockchain solutions, addressing key challenges while offering a versatile and accessible platform for developers and businesses alike. With its unique features, strong backing, and real-world applications, Aergo is poised to play an essential role in the evolving landscape of blockchain technology.

The Technology Behind the Coin: How It Works

Overview of Aergo Coin Technology

Aergo Coin (AERGO) is an innovative digital asset that operates on a sophisticated blockchain platform tailored for enterprise applications. Its architecture and technology are designed to facilitate both permissioned and permissionless use cases, making it a versatile solution for various industries. This guide will delve into the key components of Aergo’s technology, including its blockchain architecture, consensus mechanism, and notable technological innovations.

Blockchain Architecture

Aergo’s blockchain architecture is a hybrid model that integrates the best features of both public and private blockchains. This design allows enterprises to customize their blockchain solutions based on their specific needs.

Hybrid Model

-

Permissioned Blockchains: Aergo supports the creation of permissioned blockchains, which are ideal for businesses that require a controlled environment. These blockchains are particularly useful in scenarios where sensitive data is involved, as they provide restricted access to authorized users. The architecture utilizes a Proof-of-Authority (PoA) consensus mechanism powered by the RAFT algorithm, ensuring fast and efficient transactions while maintaining security and privacy.

-

Permissionless Blockchains: The Aergo mainnet operates as a public blockchain, allowing anyone to participate. This aspect fosters transparency and inclusivity, making it suitable for applications that benefit from decentralized validation. The public blockchain can handle a high volume of transactions and enables users to interact freely without the need for intermediaries.

SQL Support

One of the standout features of Aergo’s architecture is its integration of SQL (Structured Query Language) support. SQL is a widely used language for managing and manipulating databases, making it familiar to many developers. By allowing smart contracts to utilize SQL, Aergo simplifies data handling and enhances the development process. This feature opens the door for traditional database developers to transition into blockchain development without extensive retraining.

Consensus Mechanism

Aergo employs a two-fold consensus mechanism tailored to its hybrid architecture, ensuring both security and efficiency.

Proof-of-Authority (PoA)

In the context of permissioned blockchains, Aergo utilizes the Proof-of-Authority consensus model. This mechanism is characterized by:

-

Authority Nodes: Only a select number of nodes, known as authority nodes, are permitted to validate transactions and create new blocks. This controlled access enhances security and speeds up the transaction process, making it suitable for enterprise applications where trust and reliability are paramount.

-

RAFT Algorithm: The RAFT algorithm is a consensus protocol that facilitates efficient leader election and log replication among nodes. This ensures that transactions are processed quickly and consistently, reducing the risk of forks and enhancing overall network reliability.

Byzantine Fault-Tolerant Delegated Proof-of-Stake (BFT-DPoS)

For its public blockchain, Aergo employs a Byzantine Fault-Tolerant Delegated Proof-of-Stake (BFT-DPoS) mechanism. This system operates as follows:

-

Token Holder Participation: AERGO token holders can vote for block producers, who are responsible for validating transactions and maintaining the blockchain. This democratic approach empowers users and encourages active participation in the network’s governance.

-

High Throughput: The BFT-DPoS mechanism is designed to support over 10,000 transactions per second at a minimal cost of approximately $0.001 per transaction. This high throughput makes Aergo an attractive option for applications requiring quick and cost-effective transaction processing.

Key Technological Innovations

Aergo’s technology is marked by several innovations that distinguish it from other blockchain platforms. These advancements cater to the needs of enterprise clients and developers alike.

Smart Contract Engine

Aergo features a robust smart contract engine that supports the Lua programming language alongside SQL. This dual-language support allows developers to create complex smart contracts efficiently. Key benefits include:

-

Developer Accessibility: By leveraging Lua, a lightweight scripting language, Aergo makes it easier for developers to write and deploy smart contracts. This lowers the barrier to entry for those transitioning from traditional programming environments.

-

Integration with SQL: The ability to use SQL within smart contracts simplifies data management and enhances the functionality of decentralized applications (DApps). Developers can interact with databases seamlessly, making Aergo a powerful tool for data-driven applications.

On-Chain Governance: AERGO Agora

Aergo incorporates an on-chain governance system called AERGO Agora. This feature allows token holders to participate in the decision-making processes regarding the platform’s future development. Key aspects include:

-

Voting Mechanism: Token holders can vote on proposals related to upgrades, changes in governance, and other critical decisions affecting the ecosystem. This creates a sense of ownership and community involvement.

-

Decentralized Control: AERGO Agora emphasizes decentralization, ensuring that no single entity has unilateral control over the platform. This aligns with the core principles of blockchain technology, fostering trust among users.

Enterprise Solutions and Use Cases

Aergo is particularly focused on providing blockchain solutions for enterprises. Its technology has been successfully applied in various real-world scenarios, including:

-

Fingerprint Credit Card Verification: Aergo’s technology was used by Lotte Card to develop a fingerprint credit card verification system, significantly reducing operational costs related to security. This deployment showcases Aergo’s potential to streamline processes in the financial sector.

-

Partnerships and Collaborations: Aergo has partnered with prominent companies across various industries, including finance and manufacturing. These collaborations facilitate the adoption of Aergo’s technology, demonstrating its versatility and effectiveness in meeting diverse business needs.

Security Features

Aergo’s security framework is designed to protect the integrity of its network while ensuring user data remains secure. Key security features include:

-

Cryptographic Techniques: Aergo employs advanced cryptographic methods to safeguard transactions and sensitive information. This includes data encryption and secure access controls, which prevent unauthorized access and ensure the authenticity of transactions.

-

Hardware Wallet Support: To further enhance security, Aergo supports hardware wallets, providing users with an additional layer of protection for their digital assets. This feature is crucial for safeguarding tokens against cyber threats.

Conclusion

Aergo Coin stands out in the blockchain landscape due to its innovative technology tailored for enterprise applications. With a hybrid blockchain architecture, robust consensus mechanisms, and a strong focus on security and developer accessibility, Aergo is well-positioned to facilitate a wide range of use cases. As the platform continues to evolve, it remains a compelling option for businesses and developers seeking to leverage blockchain technology for efficiency, security, and innovation. Understanding the underlying technology of Aergo Coin is essential for both investors and users looking to navigate this dynamic ecosystem effectively.

Understanding aergo coin Tokenomics

Tokenomics Overview of Aergo Coin

Aergo Coin (AERGO) is the native utility token of the Aergo blockchain platform, which is designed to facilitate various operations within its ecosystem. Understanding the tokenomics of AERGO is crucial for investors and users as it provides insights into its supply, utility, distribution, and overall economic model. The following table summarizes key metrics related to AERGO:

| Metric | Value |

|---|---|

| Total Supply | 500,000,000 AERGO |

| Max Supply | 500,000,000 AERGO |

| Circulating Supply | 484,990,000 AERGO |

| Inflation/Deflation Model | Deflationary (fixed supply) |

Token Utility (What is the coin used for?)

The AERGO token plays a vital role within the Aergo ecosystem, serving multiple functions that enhance its utility for both developers and enterprises. Here are the primary uses of AERGO tokens:

-

Transaction Fees: AERGO tokens are used to pay transaction fees for executing smart contracts and processing transactions on the Aergo blockchain. This is a standard function for most blockchain platforms, where users must pay a fee to incentivize miners or validators to include their transactions in the blockchain.

-

Smart Contract Deployment: Developers need AERGO tokens to deploy smart contracts on the Aergo platform. The use of the token for this purpose ensures that developers have a stake in the network, thereby promoting responsible usage of resources.

-

Access to Services: Businesses and enterprises can utilize AERGO tokens to access various services offered within the Aergo ecosystem, including enterprise-grade cloud solutions and hybrid blockchain deployments. This makes AERGO a fundamental part of the operational framework for companies leveraging Aergo’s technology.

-

Staking and Governance: AERGO tokens can be staked to participate in the platform’s governance model. Token holders can vote on crucial decisions, including protocol upgrades and the selection of block producers. This decentralization fosters a community-driven approach to governance, ensuring that users have a say in the platform’s direction.

-

Incentives for Participants: The Aergo ecosystem employs AERGO tokens to incentivize various participants, including developers and node operators. This can include rewards for contributing to the network’s security and performance, further promoting engagement and participation.

-

Partnership and Collaboration Payments: AERGO tokens may be used for transactions between enterprises and service providers within the Aergo ecosystem. This includes payments for collaborative projects and integrations, enhancing the token’s utility in real-world applications.

Token Distribution

The distribution of AERGO tokens is crucial for understanding the economic model of the Aergo platform and its long-term sustainability. The distribution process influences liquidity, market participation, and the overall stability of the token. Here are key aspects of the token distribution model:

-

Initial Distribution: AERGO tokens were distributed during the initial coin offering (ICO) and through private sales. This initial distribution aimed to raise funds for the development of the Aergo platform and its ecosystem.

-

Team and Advisors: A portion of the total supply is allocated to the founding team, advisors, and early investors. These allocations are typically subject to vesting periods to ensure that the team remains committed to the project’s long-term success.

-

Ecosystem Development: A significant share of AERGO tokens is reserved for ecosystem development, which includes partnerships, collaborations, and incentivizing developers. This allocation is essential for fostering growth and adoption of the Aergo platform.

-

Community Incentives: Tokens are also allocated for community-driven initiatives, such as rewards for users who stake their tokens or participate in governance. This encourages community involvement and creates a sense of ownership among token holders.

-

Reserve and Treasury: A portion of the total supply is held in reserve for future developments and unforeseen expenses. This ensures that the Aergo team has resources available to adapt to market conditions and technological advancements.

-

Market Dynamics: The circulating supply of AERGO tokens is closely monitored as it impacts the token’s market value. A fixed total supply of 500 million tokens creates a deflationary model, meaning that as demand increases and tokens are utilized within the ecosystem, the value may appreciate over time.

In summary, the tokenomics of Aergo Coin is built around a fixed supply model, with clear utility and distribution strategies that support its role in facilitating blockchain operations. By understanding these dynamics, potential investors and users can make informed decisions regarding their engagement with the Aergo ecosystem.

Price History and Market Performance

Overview of Aergo Coin’s Price History

Aergo Coin (AERGO) has experienced notable fluctuations since its inception, reflecting the dynamic nature of the cryptocurrency market. Launched in 2020, Aergo has established itself as an enterprise-focused blockchain platform, attracting interest from both institutional and retail investors. Understanding the price history of Aergo Coin can provide valuable insights into its market performance and the factors that have influenced its valuation.

Key Historical Price Milestones

Initial Launch and Early Days

Aergo Coin was launched in March 2020, with an initial price of approximately $0.0161. This marked the all-time low for the cryptocurrency, as it struggled to gain traction amid the broader market’s volatility. The early price movements were heavily influenced by the overall sentiment in the cryptocurrency market, which was still recovering from the significant downturn experienced in 2018 and 2019.

Price Surge in 2021

In 2021, Aergo Coin began to gain momentum, coinciding with a resurgence in interest in blockchain technology and cryptocurrencies. By April 2021, the price reached approximately $0.50, driven by increasing adoption of its enterprise solutions and strategic partnerships, particularly with notable companies in South Korea. This period marked a significant recovery from its earlier lows, showcasing a growth of over 3,000% from its initial price.

All-Time High

The peak for Aergo Coin occurred in April 2025, when it reached an all-time high of approximately $0.6971. This surge can be attributed to several factors, including heightened interest in decentralized finance (DeFi) applications, further developments in its technological capabilities, and the broader bullish trend in the cryptocurrency market. During this time, Aergo’s unique selling propositions, such as its hybrid blockchain architecture and SQL support, resonated well with enterprises looking to leverage blockchain technology.

Recent Performance and Current Price

As of October 2023, Aergo Coin is priced at approximately $0.1075, representing a decrease of about 84.57% from its all-time high. The market cap stands at around $52.15 million, with a 24-hour trading volume of approximately $4.02 million. This decline from its peak highlights the inherent volatility in the cryptocurrency market, influenced by both internal and external factors.

Factors Influencing the Price

Market Sentiment

Historically, the price of Aergo Coin has been significantly influenced by overall market sentiment within the cryptocurrency space. Bullish trends in Bitcoin and Ethereum often lead to increased investment across altcoins, including Aergo. Conversely, bearish market conditions can result in rapid declines in price as investors seek to mitigate losses.

Technological Developments

Aergo’s price movements have also been closely tied to its technological advancements and updates. Major upgrades, such as the introduction of Aergo 2.0 and the launch of AERGO Connect, have generated positive sentiment among investors and developers, contributing to price increases. The implementation of the AERGO Agora governance system further demonstrated the platform’s commitment to decentralization, which can attract long-term investors.

Adoption and Partnerships

The establishment of partnerships with major enterprises has played a crucial role in Aergo’s valuation. Collaborations with notable companies like Lotte Card, Shinhan Bank, and others have enhanced the platform’s credibility and market presence. Successful case studies showcasing Aergo’s capabilities in real-world applications have positively impacted investor confidence and, consequently, the price.

Regulatory Developments

Regulatory news and developments have historically impacted the cryptocurrency market, including Aergo. Positive regulatory advancements can lead to increased institutional interest and investment, while negative news can trigger sell-offs. Aergo’s performance has been no exception, as global regulatory trends can create ripple effects across all cryptocurrencies.

Market Competition

As a platform focused on enterprise blockchain solutions, Aergo faces competition from other established and emerging blockchain projects. The performance of rival platforms can influence Aergo’s market positioning and pricing. Investors often compare the features, use cases, and adoption rates of various platforms, which can lead to price fluctuations based on relative performance.

Economic Conditions

Broader economic conditions, including inflation rates, interest rates, and global economic stability, also play a role in the performance of cryptocurrencies. During times of economic uncertainty, investors may flock to digital assets like Aergo as a hedge against traditional market downturns, while favorable economic conditions can lead to increased investment in riskier assets.

Conclusion

Understanding the price history and market performance of Aergo Coin requires a comprehensive examination of its key milestones and the various factors that have influenced its valuation over time. While Aergo has shown resilience and potential for growth, it is essential for investors to remain aware of the volatility inherent in the cryptocurrency market and the multitude of factors that can impact prices. As Aergo continues to evolve and adapt to the changing landscape of blockchain technology, its historical performance provides a framework for analyzing its future potential within the market.

Where to Buy aergo coin: Top Exchanges Reviewed

3. Changelly – Lowest Fees for Aergo (AERGO) Exchange!

Changelly stands out as an exceptional platform for exchanging Aergo (AERGO) due to its competitive rates and low transaction fees, making it an attractive option for both novice and experienced traders. With a user-friendly interface available on both web and iOS, users can seamlessly exchange AERGO among over 700 cryptocurrencies. Additionally, Changelly offers 24/7 live support, ensuring a smooth trading experience at any time.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. AERGO – Unlock the Best Prices for Your Crypto Journey!

ChangeNOW stands out as a premier platform for trading AERGO tokens, boasting an impressive rating of 4.8 from over 2,165 users. The exchange offers competitive rates for AERGO, ensuring users benefit from the best prices available. With a user-friendly interface and no hidden fees, ChangeNOW simplifies the buying and selling process while providing real-time price updates, making it an ideal choice for both novice and experienced traders in the cryptocurrency market.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Aergo Exchanges – Your Gateway to Effortless AERGO Trading!

Aergo can be traded on several prominent exchanges, with HTX (Huobi), KuCoin, OKX, and Gate emerging as the most popular options. These platforms stand out for their user-friendly interfaces, robust security measures, and high liquidity, making it easy for both novice and experienced traders to buy, sell, and trade Aergo efficiently. Each exchange offers unique features, catering to diverse trading preferences and enhancing the overall trading experience for Aergo enthusiasts.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

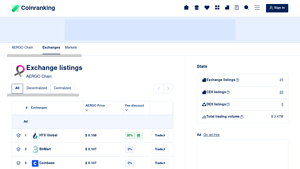

3. AERGO Chain – Unlocking Potential with Diverse Exchange Listings!

The AERGO Chain offers a compelling selection of exchange listings that enable users to compare prices, trading volumes, and available discounts effectively. This user-friendly approach empowers traders to make informed decisions by highlighting the most favorable trading conditions across various platforms. With its focus on transparency and accessibility, AERGO Chain stands out as a valuable resource for both novice and experienced cryptocurrency investors seeking optimal trading opportunities.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy aergo coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Aergo Coin (AERGO) is to select a cryptocurrency exchange that supports it. Not all exchanges list every cryptocurrency, so it’s crucial to ensure that the platform you choose allows you to buy AERGO. Some popular exchanges where you can find AERGO include:

- Binance

- KuCoin

- Bittrex

- Gate.io

When selecting an exchange, consider factors such as:

- User Experience: Is the interface easy to navigate?

- Fees: Check the trading and withdrawal fees.

- Security: Look for exchanges with strong security measures.

- Liquidity: Higher liquidity means you can buy or sell your coins more easily.

- Support: Customer service can be crucial if you run into issues.

2. Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account. Follow these steps:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will typically need to provide an email address and create a password.

-

Email Verification: After signing up, check your email for a verification link. Click it to verify your email address.

-

Identity Verification: Most reputable exchanges require you to complete a Know Your Customer (KYC) process. This may involve submitting identification documents (like a passport or driver’s license) and proof of address (like a utility bill). This step helps to ensure the security of your account and comply with regulatory requirements.

3. Deposit Funds

With your account verified, you can now deposit funds to buy Aergo Coin. Here’s how:

-

Choose a Deposit Method: Most exchanges offer multiple deposit methods, including bank transfers, credit/debit cards, and sometimes even PayPal. Choose one that works best for you.

-

Deposit Currency: Depending on the exchange, you may need to deposit a fiat currency (like USD, EUR, etc.) or another cryptocurrency (like Bitcoin or Ethereum). If you choose to deposit fiat, ensure that your method of payment is accepted by the exchange.

-

Follow Instructions: Each exchange will have specific instructions for depositing funds. Follow these steps carefully, and ensure that you keep any transaction IDs or confirmations for your records.

4. Place an Order to Buy Aergo Coin

After your funds have been successfully deposited, it’s time to buy Aergo Coin:

-

Navigate to the Trading Section: Go to the trading area of the exchange and locate the AERGO trading pair (for example, AERGO/USD or AERGO/BTC).

-

Select Order Type: You will typically have a few options for order types:

- Market Order: Buys AERGO at the current market price.

-

Limit Order: Sets a specific price at which you want to buy AERGO.

-

Enter the Amount: Specify how much AERGO you want to buy. If you are using a market order, it will execute immediately at the current price. If you are using a limit order, it will execute only when the price reaches your specified amount.

-

Review Your Order: Double-check the details of your order before confirming. Make sure that everything is accurate.

-

Confirm Purchase: Click the button to place your order. Once completed, you will see your AERGO balance in your account.

5. Secure Your Coins in a Wallet

After purchasing Aergo Coin, it’s crucial to secure your investment. While exchanges offer wallets, they are not the safest option for long-term storage. Here’s how to secure your coins:

- Choose a Wallet Type: There are several types of wallets:

- Software Wallets: These are applications or software programs that you can install on your computer or mobile device.

- Hardware Wallets: Physical devices like Ledger or Trezor that store your coins offline, providing enhanced security.

-

Paper Wallets: A physical printout of your public and private keys.

-

Transfer Your AERGO: If you choose to use a software or hardware wallet, you will need to transfer your AERGO from the exchange to your wallet. Go to your wallet, find the option to receive funds, and copy your wallet address. Then, go back to the exchange and initiate a withdrawal to that address.

-

Confirm the Transfer: Once you’ve initiated the transfer, monitor both your wallet and the exchange to confirm that the transaction has been completed successfully.

Conclusion

Buying Aergo Coin is a straightforward process if you follow these steps carefully. Always remember to conduct thorough research and ensure that you are using secure practices when handling your digital assets. Happy investing!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Strong Enterprise Backing

Aergo is developed by Blocko, a prominent blockchain technology company backed by Samsung. This affiliation provides Aergo with significant credibility and resources, which can facilitate widespread adoption and deployment of its technology across various industries. Blocko’s existing partnerships with major corporations such as Lotte Card, Shinhan Bank, and Hyundai Motors demonstrate Aergo’s capability to address real-world business needs effectively.

Versatile Hybrid Architecture

One of Aergo’s standout features is its hybrid blockchain architecture, which supports both permissioned and permissionless deployments. This versatility allows enterprises to choose the level of privacy and control they require while still benefiting from the advantages of blockchain technology. Organizations can implement private blockchains for sensitive operations while having the option to interact with the public Aergo mainnet for broader functionality.

Developer-Friendly Environment

Aergo supports smart contracts written in familiar programming languages such as Lua and SQL, which lowers the barrier to entry for developers. By making it easier for developers to create decentralized applications (DApps), Aergo is likely to attract a broader developer community, fostering innovation and expanding its ecosystem. This accessibility can be a significant advantage over other blockchain platforms that require knowledge of less common programming languages.

High Transaction Throughput

Aergo’s public blockchain network utilizes a Byzantine Fault-Tolerant Delegated Proof-of-Stake mechanism, enabling it to support over 10,000 transactions per second at a minimal cost of approximately $0.001 per transaction. This high transaction throughput and low cost position Aergo as a scalable solution suitable for enterprise applications that demand efficiency and speed.

Real-World Use Cases

Aergo has already demonstrated its value through successful implementations in various sectors, particularly in enterprise solutions. For instance, the fingerprint credit card verification system developed for Lotte Card showcases how Aergo can significantly reduce operational costs while enhancing security. Such real-world applications not only validate the platform’s capabilities but also highlight its potential for future growth and adoption.

On-Chain Governance and Community Engagement

Aergo incorporates an on-chain governance system called AERGO Agora, which allows token holders to participate in decision-making processes regarding the platform’s development. This democratic approach can foster a sense of community and engagement among users, aligning the interests of stakeholders and enhancing the platform’s sustainability.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Like most cryptocurrencies, Aergo is subject to market volatility, which can lead to significant fluctuations in its price. The cryptocurrency market is known for its speculative nature, and prices can be influenced by various factors, including market sentiment, macroeconomic trends, and developments in the broader blockchain ecosystem. Investors should be aware that these price swings can result in substantial gains but also significant losses.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and varies significantly across different jurisdictions. Changes in regulations can impact Aergo’s operations and its ability to attract enterprise customers. For example, stricter regulations on cryptocurrencies could limit the use of Aergo’s technology or affect its market dynamics. Investors should closely monitor regulatory developments in their respective regions and globally, as these could pose risks to Aergo’s growth and adoption.

Competition

Aergo operates in a highly competitive environment, facing challenges from other blockchain platforms such as Ethereum, Hyperledger, and newer entrants that may offer similar or superior features. The rapid pace of technological advancement in the blockchain space means that competitors can quickly innovate, potentially diminishing Aergo’s market share. As enterprises evaluate their blockchain options, the presence of strong competitors could limit Aergo’s growth opportunities.

Technological Risks

While Aergo’s hybrid architecture provides flexibility, it also introduces complexity that could pose technological risks. Any bugs or vulnerabilities in the platform’s code could lead to security breaches or failures in smart contract execution, undermining user confidence and potentially resulting in financial losses. Furthermore, as the platform evolves, maintaining compatibility with existing applications and services may present challenges, particularly as developers adopt new features or updates.

Dependence on Key Partnerships

Aergo’s growth is significantly influenced by its partnerships with enterprise clients and other stakeholders. If key partners were to withdraw their support or shift their focus to competing solutions, Aergo could face challenges in maintaining its user base and expanding its ecosystem. The platform’s reliance on Blocko and its enterprise relationships means that any changes in these dynamics could have a substantial impact on Aergo’s future.

Network Security Concerns

While Aergo employs a Byzantine Fault-Tolerant Delegated Proof-of-Stake consensus mechanism, no blockchain is entirely immune to security threats. Potential attacks, such as Distributed Denial of Service (DDoS) attacks or attempts to manipulate network consensus, could jeopardize the integrity of the Aergo platform. Additionally, the security of user funds is paramount; any breaches or vulnerabilities could lead to significant financial losses for investors and users alike.

Conclusion

Aergo presents a compelling case for investment, particularly for those interested in enterprise blockchain solutions. Its strong backing, versatile architecture, and real-world use cases offer significant potential for growth. However, investors must remain vigilant regarding the inherent risks associated with market volatility, regulatory uncertainty, competition, technological challenges, and security concerns. Conducting thorough research and staying informed about developments in the Aergo ecosystem and the broader cryptocurrency landscape will be essential for anyone considering an investment in Aergo coin.

Frequently Asked Questions (FAQs)

1. What is Aergo Coin (AERGO)?

Aergo Coin (AERGO) is the native cryptocurrency of the Aergo blockchain platform, which is an open-source, enterprise-level blockchain designed for hybrid deployments that incorporate both permissioned and permissionless architectures. Aergo facilitates the development and hosting of decentralized applications (DApps) and smart contracts, utilizing familiar programming languages like SQL and Lua to enhance accessibility for developers. The platform’s dual-structure enables efficient data management and robust application development, making it suitable for various enterprise use cases.

2. How is Aergo Coin secured?

Aergo Coin’s security is ensured through a combination of a Byzantine Fault-Tolerant Delegated Proof-of-Stake (DPoS) consensus mechanism for its public blockchain and a Proof-of-Authority (PoA) mechanism for private blockchains. This architecture allows for high transaction throughput (over 10,000 transactions per second) while maintaining low transaction costs. The platform also employs advanced cryptographic techniques and supports hardware wallets, enhancing the security of users’ assets and transactions.

3. What makes Aergo Coin different from Bitcoin?

Aergo Coin differs from Bitcoin in several key aspects. While Bitcoin primarily serves as a digital currency and a store of value, Aergo is designed as a comprehensive blockchain platform aimed at enterprise applications, focusing on smart contracts and DApps. Aergo supports hybrid blockchain models, allowing for both public and private deployments, which is not a feature of Bitcoin. Additionally, Aergo employs a different consensus mechanism that emphasizes speed and scalability, making it more suitable for business-oriented use cases.

4. Is Aergo Coin a good investment?

Determining whether Aergo Coin is a good investment depends on various factors, including market conditions, technological advancements, and the overall growth of the Aergo platform. As with any cryptocurrency investment, potential investors should conduct thorough research, considering Aergo’s use cases, partnerships, and community support. Investors should also assess their risk tolerance and investment goals, as the cryptocurrency market can be highly volatile.

5. Who created Aergo Coin?

Aergo Coin was created by Blocko, a South Korean blockchain technology company, with Won-Beom Kim as one of the key figures behind its development. Blocko has a strong reputation for implementing blockchain solutions for major corporations, and its backing has significantly contributed to Aergo’s credibility and adoption in the enterprise sector.

6. What are the primary use cases for Aergo Coin?

Aergo Coin is utilized within the Aergo ecosystem to facilitate various operations, such as deploying and running smart contracts, accessing enterprise-grade services, and rewarding network participants. Its primary use cases include supporting decentralized applications (DApps), enabling secure transactions in enterprise solutions, and serving as a payment method for services offered on the Aergo platform. Notable implementations include applications in finance, manufacturing, and identity verification.

7. How can I buy Aergo Coin?

Aergo Coin can be purchased on various cryptocurrency exchanges. To buy Aergo, investors typically need to create an account on a supported exchange, complete the necessary verification processes, and deposit funds. Once the account is funded, users can trade their fiat currency or other cryptocurrencies for AERGO tokens. It is advisable to use reputable exchanges and to follow best practices for securing digital assets.

8. What is the future outlook for Aergo Coin?

The future outlook for Aergo Coin depends on several factors, including ongoing technological developments, the growth of the Aergo ecosystem, and its adoption by enterprises. With the increasing interest in blockchain technology across various industries and Aergo’s unique hybrid model, the platform has significant potential for growth. Continued partnerships and successful implementations of real-world applications will also play a crucial role in determining the long-term viability and success of Aergo Coin in the cryptocurrency market.

Final Verdict on aergo coin

Summary of Aergo Coin

Aergo Coin (AERGO) serves as the native utility token of the Aergo blockchain platform, which is designed to facilitate the development and deployment of decentralized applications (DApps) and enterprise solutions. Its architecture supports both permissioned and permissionless blockchain models, making it a versatile option for businesses seeking to leverage blockchain technology. Aergo’s integration of SQL support simplifies data management, allowing developers to utilize familiar programming languages like Lua for smart contract development. This unique approach positions Aergo as an attractive solution for enterprises looking to streamline operations and improve security, as evidenced by successful deployments in various sectors such as finance and manufacturing.

Technology and Potential

Aergo employs a hybrid blockchain structure that combines a Byzantine Fault-Tolerant Delegated Proof-of-Stake consensus mechanism for its public network with a Proof-of-Authority model for private blockchains. This configuration not only enhances transaction throughput but also ensures robust security and governance through its democratic voting system. The platform’s ability to support high transaction volumes at minimal costs further cements its potential as a scalable solution for enterprises. The backing of Blocko, a company with strong ties to major corporations like Samsung, enhances Aergo’s credibility and market reach.

Investment Considerations

However, it is essential to recognize that investing in Aergo Coin, like many cryptocurrencies, comes with inherent risks. The digital asset market is notoriously volatile, and while Aergo has promising technology and real-world applications, potential investors should approach it with caution. As a high-risk, high-reward asset class, Aergo Coin may offer significant upside, but it is crucial to conduct thorough research and understand the market dynamics before committing any funds. Always remember to do your own research (DYOR) to make informed investment decisions that align with your risk tolerance and financial goals.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.