A B2B Buyer’s Guide to Vats Warehouse: Price, Quality, and Suppliers

Introduction: Navigating the Global Market for vats warehouse

Navigating the complexities of international trade can be a daunting task for B2B buyers, especially when it comes to leveraging VAT warehouses effectively. A VAT warehouse, or fiscal warehouse, provides a unique solution for businesses looking to optimize their supply chain while deferring customs duties and taxes. This guide aims to equip international buyers from regions such as Africa, South America, the Middle East, and Europe—particularly in Brazil and Nigeria—with the essential knowledge needed to navigate this advantageous customs regime.

In this comprehensive resource, we will delve into the various types of VAT warehouses, their applications in both import and export scenarios, and the significant tax advantages they offer. Additionally, we will discuss critical aspects such as supplier vetting processes, associated costs, and best practices for operational efficiency. By understanding how to utilize VAT warehouses strategically, businesses can enhance their cash flow, streamline logistics, and ultimately make informed purchasing decisions that align with their operational goals.

Empowering buyers with actionable insights, this guide not only clarifies the intricacies of VAT warehouses but also positions your business to seize opportunities in the global market. Whether you are new to international trade or seeking to optimize your existing operations, the knowledge provided here will serve as a valuable asset in your procurement strategy.

Understanding vats warehouse Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Import VAT Warehouse | Goods stored without customs duties until removal; allows value-added services | Importing goods for resale | Pros: Cash flow management, tax deferral. Cons: Regulatory complexities may require expert guidance. |

| Export VAT Warehouse | Stores goods destined for export without VAT until departure; supports logistics flexibility | Exporting goods to international markets | Pros: VAT exemption, operational flexibility. Cons: Requires compliance with specific export regulations. |

| Fiscal Warehouse | Similar to VAT warehouse but may include additional customs benefits; varies by country | General storage for international trade | Pros: Potential for reduced duties, tax benefits. Cons: May have limited operational flexibility compared to other types. |

| Bonded VAT Warehouse | Combines features of bonded and VAT warehouses; allows for customs duties deferral | Managing both imports and exports | Pros: Flexibility in handling goods, tax deferral. Cons: More complex regulations to navigate. |

| Temporary VAT Warehouse | Short-term storage for goods; often used for seasonal stock | Seasonal inventory management | Pros: Cost-effective for short-term needs. Cons: Limited duration may not suit all business models. |

What are the Characteristics and Suitability of Import VAT Warehouses?

Import VAT warehouses enable businesses to store goods without incurring customs duties until they are removed from the facility. This arrangement is particularly beneficial for companies importing goods for resale, as it improves cash flow by deferring tax payments. Buyers should consider the regulatory requirements and the potential need for logistical support, as the complexities of customs compliance can vary significantly by country.

How Do Export VAT Warehouses Enhance Logistics for International Trade?

Export VAT warehouses allow businesses to store goods intended for export without the burden of VAT until the goods leave the country. This setup is advantageous for companies looking to streamline their export processes, as it provides the opportunity to perform value-added services like packaging and labeling. Buyers should evaluate the specific export regulations in their target markets to ensure compliance and maximize the benefits of this arrangement.

What Unique Benefits Does a Fiscal Warehouse Offer?

A fiscal warehouse functions similarly to a VAT warehouse but may offer additional customs benefits depending on the jurisdiction. This type of warehouse is ideal for businesses engaged in international trade, providing a space for goods to be stored while awaiting final customs clearance. Companies should assess the specific advantages offered in their country, as these can lead to significant savings in duties and taxes.

Why Choose a Bonded VAT Warehouse for Import and Export Management?

Bonded VAT warehouses combine the features of bonded warehouses and VAT warehouses, allowing for the deferral of customs duties while providing flexibility in handling goods. This type of warehouse is suitable for businesses that manage both imports and exports, as it simplifies logistics and compliance. However, buyers must navigate more complex regulations, which may necessitate expert guidance to ensure all requirements are met.

What is the Role of Temporary VAT Warehouses in Inventory Management?

Temporary VAT warehouses are designed for short-term storage solutions, often used by businesses managing seasonal stock. These facilities allow companies to hold inventory without immediate tax implications, making them cost-effective for businesses with fluctuating demand. However, the limited duration of storage may not suit all business models, so buyers should carefully assess their inventory needs before opting for this type of warehouse.

Key Industrial Applications of vats warehouse

| Industry/Sector | Specific Application of vats warehouse | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Pharmaceuticals | Storing raw materials and finished products before distribution | Tax deferral on high-value goods, optimizing cash flow | Compliance with local regulations, temperature control, security |

| Automotive | Managing parts inventory for assembly lines | Streamlined production processes, reduced holding costs | Proximity to production facilities, handling capabilities |

| Textiles and Apparel | Consolidating various suppliers’ goods for export | Improved logistics efficiency, reduced shipping costs | Supplier reliability, quality control, export documentation |

| Electronics | Pre-export processing and assembly of electronic components | Flexibility in meeting customer specifications, tax savings | Technical expertise in handling, compliance with export laws |

| Food and Beverage | Storing imported ingredients before processing | Cash flow management, ability to adapt to market demands | Quality assurance, shelf-life considerations, regulatory compliance |

How Is ‘Vats Warehouse’ Utilized in the Pharmaceutical Industry?

In the pharmaceutical sector, VAT warehouses are essential for storing both raw materials and finished products prior to distribution. This application allows companies to defer VAT and customs duties, significantly optimizing cash flow, especially given the high value of pharmaceutical goods. International buyers must ensure compliance with local regulations and maintain stringent temperature controls and security measures to protect sensitive products.

What Role Does ‘Vats Warehouse’ Play in the Automotive Sector?

For the automotive industry, VAT warehouses facilitate the management of parts inventory needed for assembly lines. By utilizing these warehouses, companies can streamline production processes and reduce holding costs, as they only incur VAT when parts are withdrawn for use. Buyers should consider the location of the VAT warehouse in relation to their production facilities and ensure the warehouse has the necessary handling capabilities for automotive components.

How Does ‘Vats Warehouse’ Benefit the Textiles and Apparel Sector?

In the textiles and apparel industry, VAT warehouses are utilized to consolidate goods from various suppliers before export. This application enhances logistics efficiency and reduces shipping costs by allowing companies to manage inventory more effectively. International buyers need to focus on supplier reliability and quality control, as well as ensure all export documentation is in order to avoid delays.

Why Is ‘Vats Warehouse’ Important for the Electronics Industry?

The electronics sector benefits from VAT warehouses by enabling pre-export processing and assembly of components. This flexibility allows companies to adapt products to meet specific customer requirements while deferring VAT until the goods are exported. For international buyers, it’s crucial to have technical expertise in handling electronic goods and to comply with export laws to ensure a smooth transaction.

How Does ‘Vats Warehouse’ Support the Food and Beverage Industry?

In the food and beverage sector, VAT warehouses provide a solution for storing imported ingredients before processing. This application allows companies to manage cash flow efficiently while being able to adapt to market demands. Buyers should pay attention to quality assurance measures, shelf-life considerations, and regulatory compliance to ensure that products meet safety standards before they reach the market.

3 Common User Pain Points for ‘vats warehouse’ & Their Solutions

Scenario 1: Navigating Complex Customs Regulations

The Problem: Many B2B buyers face significant challenges when it comes to understanding and complying with the intricate customs regulations associated with VAT warehouses. This complexity can lead to costly mistakes, delays in shipments, and even legal penalties. For example, a company importing goods into Brazil may not be aware of specific documentation requirements or the precise steps needed to utilize a VAT warehouse effectively. This lack of understanding can result in unexpected tax liabilities and hinder the smooth operation of their supply chain.

The Solution: To navigate these complex regulations, it is essential to engage with customs experts who specialize in VAT warehouse operations. Buyers should conduct thorough research to identify logistics providers with proven experience in the target market’s customs regulations. Collaborating with a knowledgeable customs broker can help ensure that all necessary documentation is prepared accurately and submitted on time. Additionally, companies should invest in training for their staff on the specific customs processes relevant to VAT warehouses. This proactive approach not only minimizes the risk of non-compliance but also streamlines operations, allowing businesses to take full advantage of the VAT warehouse benefits.

Scenario 2: Managing Cash Flow Effectively

The Problem: Importers and exporters often struggle with cash flow management due to the upfront costs associated with customs duties and VAT payments. For instance, a South African electronics distributor might find itself in a tight spot when it needs to pay VAT before its goods are sold, impacting its liquidity and ability to reinvest in inventory. Such financial strain can limit growth opportunities and affect overall business sustainability.

The Solution: Utilizing a VAT warehouse allows businesses to defer VAT payments until the goods are sold or removed from the warehouse, thus improving cash flow. To optimize this solution, buyers should carefully select VAT warehouses that provide flexible terms and conditions. They should also analyze their inventory turnover rates and align their procurement strategies accordingly. Establishing a strong relationship with warehouse operators can lead to better terms and potentially lower storage costs. By strategically managing their inventory and cash flow through VAT warehouses, companies can enhance their financial flexibility and focus on growth initiatives.

Scenario 3: Overcoming Logistical Challenges in Global Trade

The Problem: B2B buyers often encounter logistical hurdles when importing or exporting goods through VAT warehouses, especially when dealing with multiple suppliers or complex supply chains. For instance, a Brazilian exporter may struggle to consolidate shipments from various manufacturers before exporting to Europe, leading to inefficiencies and increased costs. These logistical challenges can derail timelines and create frustration for both suppliers and customers.

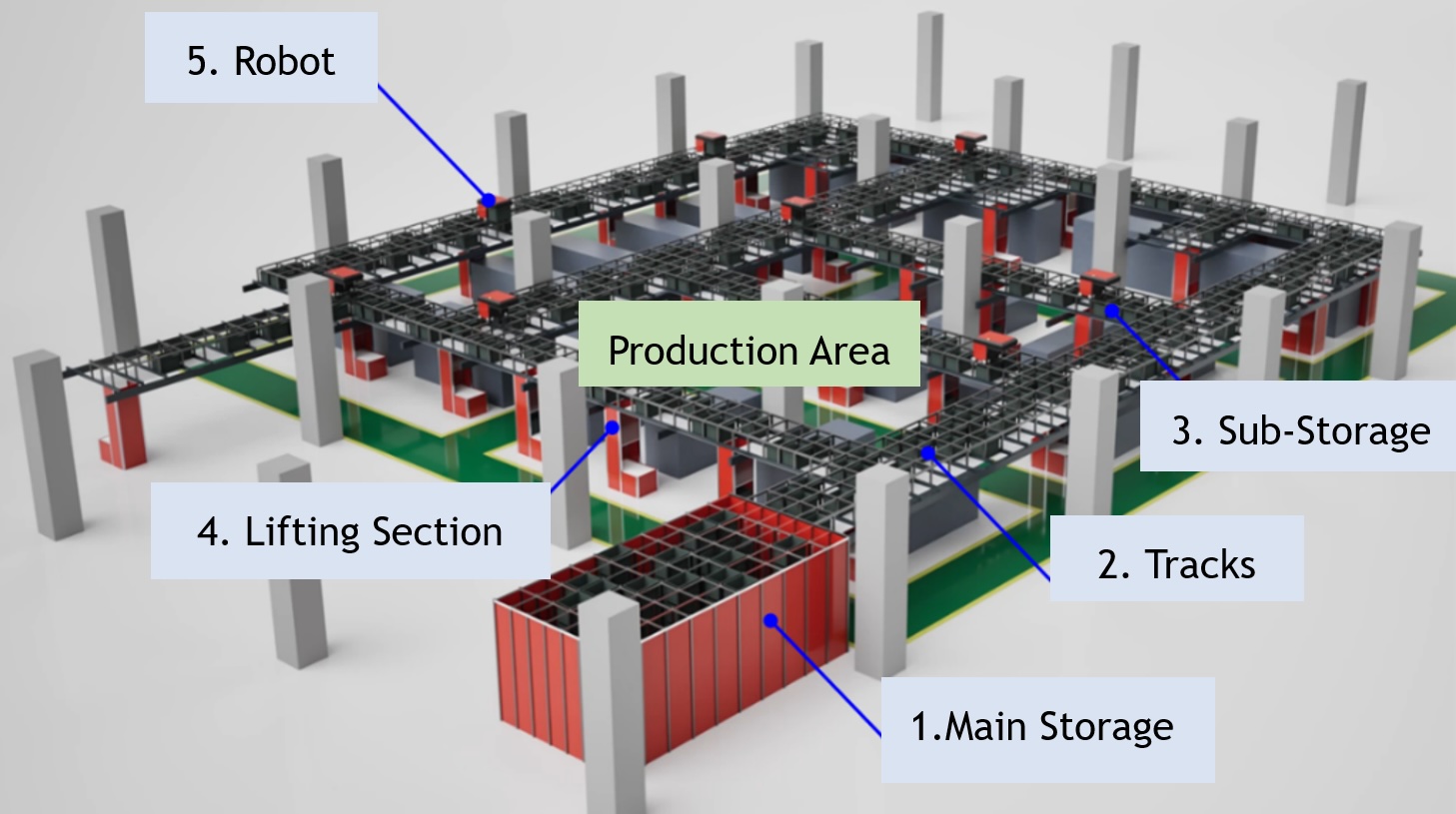

Illustrative image related to vats warehouse

The Solution: To effectively overcome these logistical challenges, businesses should leverage the operational flexibility that VAT warehouses offer. They should seek out VAT warehouse facilities that allow for value-added services such as cargo consolidation, relabeling, and repackaging. When selecting a VAT warehouse, it is crucial to inquire about the specific services offered and how they align with the company’s logistics needs. Additionally, investing in technology solutions, such as inventory management systems, can help streamline operations and improve visibility across the supply chain. By optimizing logistics processes through VAT warehouses, companies can enhance operational efficiency and better meet customer demands in the global marketplace.

Strategic Material Selection Guide for vats warehouse

What Are the Key Materials Used in VAT Warehousing?

When considering the construction and operation of VAT warehouses, selecting the right materials is critical for ensuring durability, compliance, and operational efficiency. Here, we analyze four common materials used in VAT warehouse applications, focusing on their properties, advantages, disadvantages, and implications for international B2B buyers.

How Does Steel Perform in VAT Warehouse Applications?

Steel is a widely used material in VAT warehouse construction due to its strength and durability. It has excellent temperature and pressure ratings, making it suitable for various storage conditions. Steel is also resistant to many chemicals, which is essential for warehouses storing diverse goods.

Pros: Steel structures offer high durability and strength, making them capable of withstanding heavy loads. They are relatively easy to fabricate and can be customized to meet specific design requirements.

Cons: The primary drawback of steel is its susceptibility to corrosion if not properly treated. Additionally, the initial cost can be higher than other materials, which may impact budget considerations for international buyers.

Impact on Application: Steel’s compatibility with various media makes it ideal for storing both liquid and solid goods. However, it is crucial to consider protective coatings to enhance corrosion resistance, especially in humid climates prevalent in regions like Africa and South America.

What Role Does Concrete Play in VAT Warehousing?

Concrete is another common material used in VAT warehouses, particularly for flooring and structural elements. It offers excellent compressive strength and is highly durable, making it suitable for heavy-duty applications.

Pros: Concrete is cost-effective and provides excellent thermal mass, which can help regulate temperature fluctuations within the warehouse. It is also fire-resistant, adding an extra layer of safety for stored goods.

Cons: One limitation of concrete is its weight, which can complicate transportation and installation. Additionally, it may require additional treatment or reinforcement to resist cracking under certain conditions.

Impact on Application: Concrete is particularly well-suited for warehouses that handle bulk materials or heavy goods. International buyers should consider local standards for concrete strength, such as ASTM or DIN, to ensure compliance with regional regulations.

Why Is Polyethylene Important for VAT Warehousing?

Polyethylene is a versatile plastic material often used for packaging and lining within VAT warehouses. It is known for its excellent chemical resistance and flexibility.

Pros: Polyethylene is lightweight, making it easy to handle and transport. It is also resistant to moisture, which is beneficial for protecting stored goods from environmental factors.

Cons: However, polyethylene is less durable than metals or concrete and may not withstand extreme temperatures or heavy loads. Its lifespan can be shorter in demanding environments.

Impact on Application: This material is ideal for packaging goods that require moisture protection. B2B buyers should assess the specific chemical compatibility of polyethylene with the products being stored, especially in regions with varying climate conditions.

How Does Aluminum Compare in VAT Warehouse Applications?

Aluminum is increasingly used in VAT warehouse applications for its lightweight and corrosion-resistant properties. It is often utilized in shelving, racking systems, and other structural components.

Illustrative image related to vats warehouse

Pros: Aluminum is highly resistant to corrosion, making it suitable for warehouses in humid or coastal areas. Its lightweight nature allows for easier installation and modification.

Cons: The main disadvantage is that aluminum can be more expensive than other materials, which may impact budget considerations for some businesses. Its strength-to-weight ratio is lower than steel, which may limit its use in heavy-duty applications.

Impact on Application: Aluminum’s compatibility with various goods makes it a suitable choice for dynamic storage solutions. International buyers should consider the specific load requirements and local pricing when selecting aluminum components.

Summary Table of Material Selection for VAT Warehousing

| Material | Typical Use Case for VAT Warehouse | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Structural framework and shelving | High durability and strength | Susceptible to corrosion | High |

| Concrete | Flooring and heavy-duty structures | Cost-effective and fire-resistant | Heavy and may crack | Medium |

| Polyethylene | Packaging and lining | Lightweight and moisture-resistant | Less durable under extreme conditions | Low |

| Aluminum | Shelving and racking systems | Corrosion-resistant and lightweight | Higher cost and lower strength | High |

This guide provides a comprehensive overview of the materials commonly used in VAT warehouses, helping international B2B buyers make informed decisions that align with their operational needs and compliance requirements.

Illustrative image related to vats warehouse

In-depth Look: Manufacturing Processes and Quality Assurance for vats warehouse

What Are the Main Stages of Manufacturing Processes for VAT Warehousing?

The manufacturing processes for VAT warehouses primarily involve the handling and preparation of goods for storage and eventual distribution. The main stages of these processes include material preparation, forming, assembly, and finishing. Each stage plays a critical role in ensuring that goods are ready for storage and subsequent movement, whether for import or export.

Material Preparation

In the initial stage, raw materials or imported goods arrive at the VAT warehouse. Proper material handling is crucial, as it involves inspecting the goods for any damage, verifying quantities, and ensuring compliance with relevant import regulations. This stage may also include the categorization of materials based on their intended use, which aids in efficient storage and retrieval.

Forming

Forming refers to the modification of goods to prepare them for further processing or sale. This may involve breaking down bulk shipments into smaller, manageable lots. For B2B buyers, this stage is essential as it allows for customization according to specific market demands, such as adapting packaging or adjusting quantities to meet client orders.

Assembly

The assembly stage may include combining various components of a product to create a finished good. In VAT warehouses, this could involve assembling parts sourced from different suppliers before final distribution. This flexibility is particularly advantageous for businesses that require bespoke solutions tailored to their clients in different regions.

Finishing

Finishing processes include labeling, packaging, and quality assurance checks before goods are dispatched. This stage ensures that products meet both regulatory standards and customer expectations. For international B2B buyers, adherence to finishing standards is vital as it can affect customs clearance and market acceptance.

What Key Techniques Are Used in VAT Warehouse Manufacturing Processes?

Several key techniques are employed throughout the VAT warehousing manufacturing processes to enhance efficiency and ensure quality. These techniques include inventory management systems, automation technologies, and lean manufacturing principles.

Inventory Management Systems

Effective inventory management is crucial in VAT warehouses. Technologies such as barcode scanning and RFID tracking allow for real-time monitoring of stock levels, facilitating better decision-making regarding procurement and logistics. For B2B buyers, robust inventory management translates into reduced lead times and improved service levels.

Automation Technologies

Automation plays an increasingly important role in VAT warehousing operations. Automated systems can streamline material handling, reduce human error, and enhance productivity. For international buyers, this means faster turnaround times and improved accuracy in order fulfillment.

Illustrative image related to vats warehouse

Lean Manufacturing Principles

Lean principles focus on minimizing waste while maximizing productivity. Implementing these principles in VAT warehouses can lead to more efficient processes, resulting in cost savings that can be passed on to B2B buyers. Adopting a lean mindset fosters a culture of continuous improvement, which is beneficial for all stakeholders involved.

How Is Quality Control (QC) Managed in VAT Warehousing?

Quality control in VAT warehousing is essential to ensure that goods meet both internal specifications and international standards. A robust QC process involves several checkpoints and methodologies to ensure product integrity and compliance.

International Standards and Industry-Specific Regulations

Adherence to international standards such as ISO 9001 is critical for maintaining quality management systems in VAT warehouses. Additionally, industry-specific certifications like CE (for products sold in Europe) or API (for the oil and gas sector) may apply, depending on the nature of the goods. B2B buyers should ensure that their suppliers are compliant with relevant certifications, as this can greatly impact the reliability of the products they source.

Quality Control Checkpoints

Quality control checkpoints typically include Incoming Quality Control (IQC), In-Process Quality Control (IPQC), and Final Quality Control (FQC).

- Incoming Quality Control (IQC): This step involves inspecting goods upon arrival to verify that they meet specifications and are free from defects.

- In-Process Quality Control (IPQC): Continuous monitoring during the manufacturing process ensures that any deviations are addressed promptly.

- Final Quality Control (FQC): Before dispatch, a final inspection is conducted to ensure that all goods comply with quality standards.

What Common Testing Methods Are Used for Quality Assurance?

A variety of testing methods are employed to ensure that goods stored in VAT warehouses meet quality standards. These methods may include:

Illustrative image related to vats warehouse

- Visual Inspections: Basic but effective, visual inspections can identify obvious defects in packaging or labeling.

- Dimensional Testing: Ensures that products meet specified dimensions and tolerances, which is crucial for components that must fit together.

- Performance Testing: For some goods, performance tests may be necessary to verify functionality under expected conditions.

- Chemical Testing: Particularly for food and pharmaceutical products, chemical tests can confirm that goods meet safety and regulatory standards.

How Can B2B Buyers Verify Supplier Quality Control?

B2B buyers must take proactive steps to verify the quality control practices of their suppliers to ensure that they meet international standards. This can be achieved through several methods:

Conducting Audits

Regular audits of suppliers can provide insights into their QC processes and adherence to standards. These audits can be scheduled or random and should assess all stages of the manufacturing process.

Requesting Quality Reports

Buyers can request quality assurance reports from suppliers, which detail the results of inspections and tests conducted during the manufacturing process. These reports should align with international standards and regulations.

Utilizing Third-Party Inspections

Engaging third-party inspection services can provide an unbiased assessment of a supplier’s quality control processes. These inspections can be particularly valuable when sourcing from regions with less stringent regulations.

What Are the QC and Certification Nuances for International B2B Buyers?

For international B2B buyers, understanding the nuances of quality control and certification is essential. Compliance with local regulations and international standards can vary significantly across regions such as Africa, South America, the Middle East, and Europe.

- Regional Regulations: Buyers should familiarize themselves with the specific regulatory requirements of their target markets. For instance, certain products may require additional certifications in countries like Brazil or Nigeria.

- Cultural Considerations: Different regions may have varying expectations regarding quality and compliance. Engaging local experts can help navigate these nuances effectively.

- Documentation: Ensuring that all necessary documentation is in place is crucial for customs clearance and market entry. This includes certificates of conformity, quality assurance reports, and any required import/export permits.

By understanding and leveraging the manufacturing processes and quality assurance standards associated with VAT warehousing, international B2B buyers can optimize their supply chains and ensure that they receive high-quality products that meet their specific needs.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘vats warehouse’

This guide aims to provide international B2B buyers with a clear and actionable checklist for sourcing VAT warehouse services. Understanding the complexities of VAT warehouses is essential for optimizing logistics and cash flow in international trade, especially for companies operating in regions such as Africa, South America, the Middle East, and Europe.

Step 1: Assess Your Business Needs

Before sourcing a VAT warehouse, clearly define your operational requirements. Consider factors such as the types of goods you handle, expected storage duration, and specific logistical needs. This assessment will help you identify the most suitable VAT warehouse options that align with your business strategy.

Illustrative image related to vats warehouse

Step 2: Research Regulatory Compliance

Ensure that any VAT warehouse you consider complies with local customs regulations and international trade laws. Research the specific VAT regulations in your target country, as these can vary significantly. Look for warehouses that demonstrate a clear understanding of customs processes and have the necessary licenses to operate.

Step 3: Evaluate Potential Suppliers

Thoroughly vet potential VAT warehouse providers before making a commitment. Request detailed company profiles, case studies, and references from businesses in similar sectors or regions. This evaluation should include:

– Facility Certifications: Confirm that the warehouse meets international standards for storage and handling.

– Experience with Your Goods: Ensure they have experience with the specific types of goods you intend to store, as this can influence both compliance and operational efficiency.

Step 4: Examine Tax Benefits and Financial Implications

Understand the tax advantages offered by different VAT warehouse options. Assess how deferring VAT and customs duties can impact your cash flow and overall financial strategy. Engage with a tax advisor to analyze potential savings and ensure you are making informed decisions regarding VAT obligations.

Step 5: Inspect Operational Capabilities

Visit potential VAT warehouses to evaluate their operational capabilities firsthand. Check for:

– Handling and Value-Added Services: Confirm that the warehouse can perform necessary operations like relabeling, packaging, and cargo consolidation.

– Technology and Inventory Management Systems: A robust inventory management system can significantly enhance your logistics efficiency and tracking capabilities.

Illustrative image related to vats warehouse

Step 6: Understand Logistics and Transportation Links

Evaluate the warehouse’s logistics network and its proximity to major transportation hubs. A VAT warehouse that is well-connected can streamline your import and export processes, reducing transportation costs and lead times. Look for facilities that offer flexible shipping options to accommodate your needs.

Step 7: Establish Clear Communication Channels

Ensure that the VAT warehouse provider has established clear communication protocols. Effective communication is vital for managing operations smoothly and addressing any issues that may arise. Confirm that they provide dedicated points of contact and support services to assist you throughout the warehousing process.

By following this checklist, B2B buyers can make informed decisions when sourcing VAT warehouse services, ultimately enhancing their operational efficiency and financial management in international trade.

Comprehensive Cost and Pricing Analysis for vats warehouse Sourcing

Understanding the cost structure and pricing dynamics of VAT warehouse sourcing is crucial for international B2B buyers, especially those from regions like Africa, South America, the Middle East, and Europe. This analysis will break down the cost components involved, identify price influencers, and provide actionable tips for buyers.

What Are the Key Cost Components in VAT Warehouse Sourcing?

-

Materials: The primary material costs are associated with the goods being stored. Buyers must consider the type of products, their market prices, and potential fluctuations based on supply chain disruptions or regional economic conditions.

-

Labor: Labor costs encompass wages for warehouse staff involved in handling, storing, and preparing goods for import or export. This includes salaries, benefits, and any overtime payments, which can vary based on local labor laws and market conditions.

-

Manufacturing Overhead: While VAT warehouses focus on storage rather than manufacturing, any value-added services like packaging or labeling performed within the warehouse contribute to overhead costs. This can include utilities, maintenance, and administrative expenses.

-

Tooling: For operations requiring specialized equipment (like palletizers or sorting machines), tooling costs can be significant. The necessity and complexity of these tools will depend on the specific operations performed in the VAT warehouse.

-

Quality Control (QC): Ensuring compliance with international standards necessitates investment in quality control processes. This can involve testing, inspections, and certifications that may add to the overall cost of using a VAT warehouse.

-

Logistics: Transportation costs for moving goods to and from the VAT warehouse can be substantial. This includes freight charges, insurance, and any additional handling fees. Efficient logistics planning is essential to minimize these costs.

-

Margin: Suppliers will include a profit margin in their pricing structure, which can vary widely based on market competition, perceived value, and buyer negotiation power.

What Influences Pricing for VAT Warehouse Services?

-

Volume/MOQ: Pricing often benefits from economies of scale. Higher volumes or meeting minimum order quantities (MOQs) can lead to discounted rates.

-

Specifications and Customization: Customized services, such as specific handling or storage requirements, can increase costs. Clear communication of specifications is vital to avoid unexpected charges.

-

Materials and Quality Certifications: Products requiring specific certifications or high-quality standards may incur additional costs. Buyers should assess whether these certifications are necessary for their target markets.

-

Supplier Factors: The reputation, location, and capabilities of the VAT warehouse provider can significantly impact pricing. Established suppliers may charge more due to their reliability and service quality.

-

Incoterms: The choice of Incoterms affects the allocation of costs and responsibilities between buyers and sellers. Understanding these terms can help buyers negotiate better pricing structures and avoid hidden costs.

How Can Buyers Optimize Costs in VAT Warehouse Sourcing?

-

Negotiation Strategies: Engage in discussions about pricing structures, especially focusing on volume discounts and long-term contracts. Being informed about market rates can empower buyers during negotiations.

-

Total Cost of Ownership (TCO): Assess the full cost of using a VAT warehouse, including hidden fees, logistics, and potential delays. A low upfront cost might result in higher long-term expenses.

-

Pricing Nuances for International Buyers: Buyers from regions such as Africa and South America should be aware of currency fluctuations, import tariffs, and local regulations that can impact overall costs.

-

Leveraging Technology: Utilize digital tools for inventory management and logistics optimization to reduce waste and improve efficiency, ultimately lowering costs.

-

Regular Supplier Reviews: Conduct periodic assessments of supplier performance and pricing. This helps ensure that the terms remain competitive and that service quality aligns with expectations.

Disclaimer for Indicative Prices

Pricing for VAT warehouse services is highly variable and influenced by multiple factors, including market conditions, regional regulations, and specific operational requirements. Buyers should conduct their own due diligence and seek tailored quotes to obtain accurate and relevant pricing information.

Illustrative image related to vats warehouse

Alternatives Analysis: Comparing vats warehouse With Other Solutions

When evaluating the VAT Warehouse as a logistics and customs management solution, it’s essential to consider alternative methods that can also facilitate the storage, handling, and distribution of goods. Different solutions may offer varying benefits depending on specific business needs, regulatory environments, and operational goals. Below, we compare the VAT Warehouse with two viable alternatives: Bonded Warehousing and Duty Drawback Programs.

Comparison Table

| Comparison Aspect | Vats Warehouse | Bonded Warehousing | Duty Drawback Programs |

|---|---|---|---|

| Performance | High flexibility for value-added operations; defers VAT and customs duties. | Efficient for goods already imported; limited operational flexibility. | Refunds customs duties paid on imported goods; best for high-volume transactions. |

| Cost | Cost-effective due to deferred payments; potential for significant savings. | May incur storage fees; costs can be higher if goods are held for extended periods. | Requires meticulous record-keeping; potential upfront costs before refunds. |

| Ease of Implementation | Moderate; requires compliance with customs regulations and selection of authorized warehouses. | Relatively straightforward; established processes for bonded goods. | Complex; involves detailed documentation and compliance with regulations. |

| Maintenance | Ongoing compliance with customs regulations; operational management of goods. | Requires monitoring of goods; customs compliance necessary. | Administrative burden for tracking and claiming refunds. |

| Best Use Case | Ideal for companies needing flexibility in import/export processes and VAT management. | Suitable for businesses that import goods and wish to defer duties until sold. | Best for companies with consistent import/export activities that can leverage duty refunds. |

Detailed Breakdown of Alternatives

Bonded Warehousing

Bonded Warehousing is a customs-controlled facility where imported goods can be stored without immediate payment of customs duties. This alternative is beneficial for businesses that want to defer costs until the goods are sold or released into the local market. However, it offers limited flexibility in operations since value-added services like repackaging or relabeling are typically restricted. While it provides an efficient solution for managing imported goods, companies may incur storage fees if goods remain in the warehouse for extended periods, which can affect overall cost-effectiveness.

Duty Drawback Programs

Duty Drawback Programs allow businesses to reclaim customs duties paid on imported goods that are subsequently exported. This method can be highly advantageous for companies engaged in international trade, particularly those with high-volume import/export transactions. The primary advantage lies in the potential for significant cost savings through refunds. However, this option requires meticulous record-keeping and compliance with complex regulations, which can pose challenges, especially for smaller businesses without dedicated compliance resources.

Illustrative image related to vats warehouse

Conclusion

Choosing the right solution between the VAT Warehouse, Bonded Warehousing, and Duty Drawback Programs depends on various factors, including a company’s specific operational needs, financial strategies, and regulatory environments. The VAT Warehouse offers superior flexibility for managing both imports and exports without immediate tax implications, making it ideal for businesses looking to optimize logistics and cash flow. Conversely, Bonded Warehousing is more straightforward for companies focused on deferring duties on imported goods, while Duty Drawback Programs are best suited for high-volume traders who can navigate the complexities of duty refunds. B2B buyers should carefully assess their unique circumstances and operational goals to select the most appropriate solution.

Essential Technical Properties and Trade Terminology for vats warehouse

What Are the Key Technical Properties of a VAT Warehouse?

When considering a VAT warehouse for international trade, it is crucial to understand several technical properties that define its functionality and advantages. These specifications not only influence operational efficiency but also impact financial management for businesses.

-

Customs Control Compliance

– Definition: VAT warehouses operate under strict customs regulations, ensuring that goods stored within are monitored by customs authorities.

– Importance: Compliance with customs control is vital for avoiding penalties and ensuring smooth operations. It provides assurance to international buyers that their goods are stored legally, which is particularly important in regions with stringent trade regulations. -

Tax Deferral Mechanism

– Definition: This feature allows businesses to postpone payment of VAT and customs duties until goods are removed from the warehouse.

– Importance: By deferring taxes, companies can improve cash flow management, allowing for better allocation of resources and investment in growth opportunities. This is especially beneficial for businesses operating in capital-intensive industries. -

Flexibility in Operations

– Definition: VAT warehouses allow for various value-added services such as relabeling, packaging, and cargo consolidation.

– Importance: The ability to perform these operations means businesses can adapt their products to meet market demands without incurring extra costs upfront. This flexibility can significantly enhance a company’s responsiveness to customer needs and market changes. -

Location Versatility

– Definition: Businesses can select a VAT warehouse location based on proximity to their operations or strategic distribution points.

– Importance: Choosing the right location can reduce transportation costs and improve delivery times. For international buyers, this is crucial to maintaining competitive advantage in their respective markets. -

Regulatory Framework

– Definition: VAT warehouses are governed by specific local and international trade laws which dictate their operation.

– Importance: Understanding these regulations is essential for compliance and strategic planning. Non-compliance can lead to severe financial penalties and disruptions in supply chains, making it vital for businesses to stay informed.

What Are Common Trade Terms Associated with VAT Warehousing?

Familiarity with trade terminology is essential for effective communication and negotiation in international logistics. Here are several key terms relevant to VAT warehousing:

Illustrative image related to vats warehouse

-

Bonded Warehouse

– Definition: A facility where goods are stored under customs control, typically for items that have already been imported but not yet cleared for sale.

– Importance: Understanding the difference between bonded and VAT warehouses can help businesses optimize their storage solutions and tax strategies. -

Customs Declaration

– Definition: A formal statement submitted to customs authorities detailing the nature, value, and origin of goods being imported or exported.

– Importance: Accurate customs declarations are crucial for compliance and for ensuring that the appropriate duties and taxes are applied, minimizing the risk of fines. -

Incoterms

– Definition: International commercial terms that define the responsibilities of buyers and sellers in international transactions, including costs, risks, and logistics.

– Importance: Familiarity with Incoterms helps businesses clarify their obligations and reduce disputes related to shipping and delivery. -

Minimum Order Quantity (MOQ)

– Definition: The smallest quantity of goods that a supplier is willing to sell.

– Importance: Understanding MOQs is crucial for inventory management and cost control, especially for companies looking to optimize their supply chain. -

Request for Quotation (RFQ)

– Definition: A document issued by a buyer to solicit price bids from suppliers for specific products or services.

– Importance: An RFQ is an essential tool for procurement, enabling businesses to compare offers and negotiate better terms. -

Value Added Tax (VAT)

– Definition: A consumption tax added to the value of goods and services at each stage of production or distribution.

– Importance: Awareness of VAT implications is critical for cost calculations and financial planning, especially in regions where VAT rates can vary significantly.

Understanding these technical properties and trade terms will empower businesses to make informed decisions when utilizing VAT warehouses, ultimately leading to improved operational efficiency and financial performance in the global marketplace.

Navigating Market Dynamics and Sourcing Trends in the vats warehouse Sector

What Are the Current Market Dynamics Influencing VAT Warehousing?

The VAT warehouse sector is experiencing significant transformations, driven by globalization, technological advancements, and evolving regulatory landscapes. As international trade continues to expand, especially among regions such as Africa, South America, the Middle East, and Europe, businesses are increasingly leveraging VAT warehousing to optimize their supply chains. This customs regime allows goods to be stored under customs control without incurring immediate tax liabilities, which is particularly advantageous for importers and exporters looking to enhance cash flow management.

One of the key trends is the integration of digital technologies into VAT warehousing operations. The adoption of advanced logistics software and inventory management systems enables businesses to track goods in real-time, streamline operations, and ensure compliance with various customs regulations. Moreover, emerging technologies like blockchain are enhancing transparency and traceability in supply chains, which is crucial for meeting the demands of international buyers.

Another notable trend is the increasing focus on customization and value-added services within VAT warehouses. Companies are not only storing goods but also engaging in activities such as packaging, labeling, and cargo consolidation. This flexibility allows them to adapt quickly to market demands and customer preferences, thus improving their competitive edge.

How Do Sustainability and Ethical Sourcing Impact VAT Warehousing?

Sustainability is becoming a critical consideration for B2B buyers in the VAT warehouse sector. The environmental impact of warehousing operations, including energy consumption and waste generation, is under scrutiny. Companies are increasingly expected to adopt sustainable practices, such as using energy-efficient facilities and reducing carbon footprints.

Ethical sourcing is also gaining traction, with buyers demanding transparency in supply chains. This has led to the rise of certifications that signify adherence to environmental standards and fair labor practices. For VAT warehouses, obtaining ‘green’ certifications can enhance credibility and appeal to socially conscious customers. By ensuring that their sourcing practices are ethical and sustainable, businesses not only comply with regulations but also strengthen their brand reputation in a competitive market.

Illustrative image related to vats warehouse

What Is the Historical Context of VAT Warehousing in B2B Trade?

The concept of VAT warehousing emerged in response to the complexities of international trade and the need for efficient customs management. Initially developed to facilitate the movement of goods across borders without immediate tax implications, VAT warehousing has evolved into a strategic tool for businesses.

Historically, the introduction of VAT warehouses provided a mechanism for importers and exporters to manage their cash flows more effectively by deferring tax payments until goods are sold or shipped. This flexibility has been crucial for businesses looking to optimize their operations and reduce financial burdens. As global trade dynamics continue to shift, VAT warehousing remains an integral part of the logistics landscape, adapting to meet the needs of modern B2B buyers.

Conclusion

The VAT warehouse sector presents a wealth of opportunities for international B2B buyers, particularly in emerging markets. By understanding the current market dynamics, embracing sustainability, and recognizing the historical significance of VAT warehousing, companies can position themselves for success in a rapidly changing global economy.

Frequently Asked Questions (FAQs) for B2B Buyers of vats warehouse

-

How do I solve cash flow issues when importing goods?

To mitigate cash flow challenges during imports, consider using a VAT Warehouse. This customs regime allows you to defer payment of customs duties and VAT until the goods are removed from the warehouse. By storing goods in a VAT Warehouse, you can manage your cash flow more effectively, as it provides time to sell the products before incurring significant costs. Additionally, various operations such as relabeling and packaging can be performed in the warehouse to optimize your logistics and enhance the readiness of your goods for sale. -

What are the tax advantages of using a VAT Warehouse for my business?

A VAT Warehouse offers significant tax benefits, including the deferral of customs duties and VAT payments until goods are actually imported or exported. This means you can manage your liquidity better by holding off on these expenses until the goods are ready for distribution. Furthermore, depending on the country’s customs regulations, you may also benefit from suspensive customs regimes or tariff exemptions, which can lead to substantial savings for your business operations. -

What is the difference between a VAT Warehouse and a bonded warehouse?

The primary distinction lies in the treatment of goods: a VAT Warehouse is for goods not yet considered imported or exported, allowing for deferred tax payments. In contrast, a bonded warehouse is for goods already imported but held under customs control. Moreover, VAT Warehouses permit value-added operations like sorting and packaging, while bonded warehouses typically do not allow such activities. Understanding these differences is crucial for optimizing your storage and logistics strategies. -

How can I ensure compliance when using a VAT Warehouse?

To ensure compliance while utilizing a VAT Warehouse, partner with customs management experts who can guide you through the regulatory requirements specific to your industry and location. It is essential to maintain accurate records of all transactions and operations conducted within the warehouse. Regular audits and consultations with tax advisors can also help ensure that you remain compliant with local customs regulations and avoid any potential penalties. -

What should I consider when selecting a VAT Warehouse location?

When choosing a VAT Warehouse, consider factors such as proximity to your business operations, transportation infrastructure, and the specific customs regulations of the country. A location near key logistics hubs can reduce transportation costs and lead times. Additionally, evaluate the warehouse’s capacity to accommodate your goods and whether it offers the necessary facilities for any value-added operations you may need to perform. -

Are there minimum order quantities (MOQs) for using VAT Warehouses?

Typically, VAT Warehouses do not impose strict minimum order quantities; however, specific requirements may vary by facility and country. It is advisable to discuss your needs with the warehouse operator to understand any potential MOQs or storage fees. Knowing these details will help you plan your inventory management strategy effectively and avoid unnecessary costs. -

What payment terms should I negotiate with VAT Warehouse providers?

When negotiating with VAT Warehouse providers, consider flexible payment terms that align with your cash flow needs. Look for options that allow you to defer payments until goods are sold or removed from the warehouse. Additionally, discuss potential discounts for bulk storage or long-term contracts, as these can provide financial advantages. A clear agreement on payment schedules and terms will help avoid disputes and ensure smooth operations. -

How can I assess the quality assurance (QA) processes of a VAT Warehouse?

To evaluate the quality assurance processes of a VAT Warehouse, inquire about their compliance with international standards and certifications. Request details on their operational procedures for handling goods, including storage conditions, inventory management, and any value-added services. Additionally, consider visiting the facility or seeking testimonials from other clients to gauge their reliability and commitment to maintaining high-quality standards in warehousing operations.

Top 5 Vats Warehouse Manufacturers & Suppliers List

1. EY – VAT Warehouse License Benefits

Domain: ey.com

Registered: 1994 (31 years)

Introduction: This company, EY – VAT Warehouse License Benefits, is a notable entity in the market. For specific product details, it is recommended to visit their website directly.

2. KR Group – VAT Warehouse Solutions

Domain: krgroup.eu

Introduction: VAT warehouse is a new investment incentive for entrepreneurs in Poland, allowing for the application of a 0% VAT rate for goods entering a VAT warehouse. The procedure simplifies VAT collection and settlement, particularly for international trade. Conditions for applying the 0% rate include issuing an invoice via the National e-Invoice System, indicating the legal basis for the 0% rate, entering …

3. Cicatiello Group – VAT Tax Warehouse Solutions

Domain: cicatiellogroup.com

Registered: 2004 (21 years)

Introduction: VAT Tax Warehouse is an authorized facility for producing, processing, holding, receiving, or shipping goods subject to excise duty under suspension of excise duty. Goods must originate from a Community country or a non-EU country with duties paid. Goods eligible for VAT tax warehouse include: 1. National and Community goods not intended for retail sale, entered via administrative or commercial do…

4. Xalution – Microsoft Dynamics 365 Finance & Supply Chain Solutions

Domain: xalution.com

Registered: 2016 (9 years)

Introduction: Microsoft Dynamics 365 Finance & Supply Chain: 1. One-Stop-Shop (OSS) Integration: Centralized management of tax obligations reduces administrative effort. 2. Automated tax calculation: New reverse charge regulations can be mapped directly in the system. 3. Enhanced reporting features: Automated reports help maintain visibility and control over tax obligations.

5. Reddit – 80s/90s Music Video Search

Domain: reddit.com

Registered: 2005 (20 years)

Introduction: Music video or movie from the 80s or 90s featuring two women running through an industrial warehouse or dungeon with people in vats.

Strategic Sourcing Conclusion and Outlook for vats warehouse

Why Should International B2B Buyers Consider VAT Warehousing?

In conclusion, the VAT Warehouse regime presents significant advantages for international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe. By allowing goods to be stored under customs control without immediate tax implications, businesses can optimize cash flow and enhance liquidity. This strategic sourcing tool not only defers customs duties and VAT but also enables value-added operations, such as relabeling and packaging, that can streamline logistics and improve efficiency.

Illustrative image related to vats warehouse

Moreover, the flexibility offered by VAT Warehousing allows companies to adapt their inventory management to meet fluctuating market demands without incurring unnecessary costs. As global trade continues to evolve, leveraging such customs regimes will be critical for maintaining a competitive edge.

To maximize the benefits of VAT Warehousing, it is essential for businesses to partner with knowledgeable logistics and customs management experts. As you explore your sourcing strategies, consider how VAT Warehousing can be integrated into your operations to enhance profitability and operational efficiency. Embrace this opportunity to transform your supply chain and position your business for future growth in the international market.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.