cybro crypto Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to cybro crypto

Introduction to CYBRO Crypto

In the rapidly evolving world of cryptocurrencies, CYBRO stands out as a notable player, characterized as an AI-powered multichain earn marketplace. Launched in April 2024, CYBRO aims to simplify the investment process for both novice and experienced crypto investors by offering a platform that integrates advanced artificial intelligence with multiple blockchain networks. The primary focus of CYBRO is to provide secure access to a variety of Web3 investment opportunities, making it a significant addition to the crypto market, particularly for those interested in yield farming and portfolio management.

Significance in the Crypto Market

As the cryptocurrency landscape matures, there is a growing need for platforms that can effectively bridge the gap between complex financial products and user-friendly interfaces. CYBRO addresses this demand by offering investment tools tailored to individual risk levels and desired returns. Its unique selling proposition lies in its AI Broker, which recommends optimal investment strategies based on user preferences. With over 25 Vaults and 6 One-Click strategies deployed across multiple chains—including Ethereum, BNB Chain, and Blast—CYBRO is positioned to cater to a diverse range of investors. This multichain capability not only enhances accessibility but also increases potential yield opportunities, making CYBRO an attractive option in the competitive crypto marketplace.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for anyone looking to understand CYBRO crypto, whether you’re a beginner just starting your crypto journey or an intermediate investor looking to refine your strategies. We will cover various aspects of CYBRO, including its underlying technology, tokenomics, and potential investment opportunities. Additionally, we will discuss the risks associated with investing in this cryptocurrency and provide a step-by-step guide on how to buy CYBRO tokens.

By exploring these facets, our objective is to equip you with the knowledge necessary to make informed decisions regarding your investment in CYBRO. Understanding the intricacies of this digital asset will empower you to navigate the dynamic cryptocurrency landscape with confidence, maximizing your potential for success. Whether you’re interested in participating in yield farming or simply looking to diversify your portfolio, CYBRO offers a unique avenue worth exploring.

What is cybro crypto? A Deep Dive into its Purpose

Understanding CYBRO Crypto

CYBRO is a multichain cryptocurrency that serves as a powerful tool for users looking to engage in yield farming and investment strategies within the decentralized finance (DeFi) ecosystem. Launched in April 2024, CYBRO aims to simplify the investment process by providing a user-friendly platform equipped with AI-powered tools and diverse strategies for yield generation. Operating on various blockchain networks, including Ethereum, BNB Chain, and Blast, CYBRO addresses the complexities of the DeFi landscape while making it accessible to both novice and experienced investors.

The Core Problem It Solves

The cryptocurrency market, particularly in the DeFi sector, is often characterized by its complexity and the steep learning curve required for effective participation. Many potential investors find themselves overwhelmed by the multitude of options and strategies available for yield farming, staking, and portfolio management. This complexity can lead to missed opportunities and, in some cases, significant financial losses due to poor investment decisions.

CYBRO addresses these issues by providing a structured and intuitive platform that offers a range of investment tools tailored to different risk profiles and desired returns. The platform features a set of investment vaults that allow users to engage in yield farming with minimal effort. These vaults can either pool assets from other protocols or utilize more complex strategies wrapped in easy-to-use interfaces. The AI Broker, a standout feature of CYBRO, recommends optimal investment options based on individual user preferences, thereby streamlining the investment decision-making process.

Its Unique Selling Proposition

What sets CYBRO apart from other DeFi platforms is its commitment to making investment opportunities accessible and straightforward for all users. Here are some of the key elements that define its unique selling proposition:

-

AI-Powered Portfolio Management: The integration of artificial intelligence allows CYBRO to analyze market conditions and user preferences, providing personalized investment strategies. This feature empowers users to make informed decisions without needing extensive market knowledge.

-

Diverse Strategy Portfolio: CYBRO boasts over 25 investment vaults and six one-click strategies that are deployed across multiple chains. This diversity enables users to select strategies that best align with their investment goals and risk tolerance.

-

User-Friendly Interface: The platform is designed with simplicity in mind, making it easy for users to navigate and engage with various investment options. The intuitive design reduces the friction often associated with DeFi platforms, encouraging broader participation.

-

Smart Notifications and Management Tools: CYBRO provides users with smart notifications that keep them informed of market changes and investment opportunities, allowing for timely decision-making.

-

Decentralized Governance: Token holders are given a voice in the platform’s future development, promoting a community-driven approach to governance. This feature ensures that the platform evolves in alignment with the needs and preferences of its users.

The Team and Backers

While the founders of CYBRO are not publicly disclosed, the project has garnered attention and support from a community of over 18,000 token holders. This large user base reflects the platform’s appeal and the trust it has built within the crypto community.

CYBRO has successfully completed multiple technical audits and KYC checks, demonstrating its commitment to security and compliance. These audits are conducted by reputable firms, ensuring that the platform meets industry standards and safeguards user assets. Additionally, CYBRO raised $7 million in its public presale, indicating strong interest and backing from the investment community.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of CYBRO is to democratize access to DeFi investment opportunities, making them available to a wider audience. By leveraging AI technology and offering a user-friendly interface, CYBRO aims to lower the barriers to entry for everyday investors who may not have the expertise or resources to navigate the complexities of the cryptocurrency market.

As the DeFi sector continues to grow, platforms like CYBRO play a crucial role in fostering wider adoption and participation. By providing tools that simplify investment processes and enhance user experience, CYBRO contributes to the overall maturation of the crypto ecosystem. Its focus on security, transparency, and community governance aligns with the core principles of decentralized finance, reinforcing the notion that financial empowerment should be accessible to all.

In summary, CYBRO is not just another cryptocurrency; it is a comprehensive solution designed to address the challenges faced by investors in the DeFi landscape. With its innovative features, diverse strategies, and commitment to user empowerment, CYBRO is well-positioned to make a significant impact on the future of decentralized finance. Whether you are a beginner looking to dip your toes into the world of crypto or an experienced investor seeking advanced strategies, CYBRO offers the tools and resources necessary to navigate this dynamic environment successfully.

The Technology Behind the Coin: How It Works

Introduction to CYBRO’s Technology

CYBRO is a multichain AI-powered earn marketplace designed to simplify and enhance the investment experience in the cryptocurrency space. By leveraging advanced technologies, CYBRO aims to provide users with a secure, efficient, and user-friendly platform for yield farming and investment management. This guide will explore the underlying technology that powers CYBRO, focusing on its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

At the core of CYBRO’s operations is its multichain architecture, which allows the platform to interact with multiple blockchain networks. Currently, CYBRO operates on Ethereum, BNB Chain, and Blast, providing users with flexibility and access to various decentralized finance (DeFi) services.

Multichain Interaction

-

Cross-Chain Compatibility: CYBRO’s architecture enables users to transact across different blockchain networks seamlessly. This compatibility expands the range of investment opportunities and enhances liquidity. For example, a user can invest in a yield farming opportunity on the BNB Chain while holding assets on Ethereum.

-

Smart Contracts: The use of smart contracts is a fundamental aspect of CYBRO’s architecture. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate transactions, ensuring transparency and reducing the need for intermediaries. CYBRO utilizes smart contracts for various functions, including staking, yield farming, and portfolio management.

-

User-Friendly Interface: CYBRO’s platform is designed with the user experience in mind. The interface is intuitive, making it easy for both beginners and experienced investors to navigate and engage with the various investment options available.

Consensus Mechanism

CYBRO operates on multiple blockchain networks, each with its own consensus mechanism. Understanding these mechanisms is essential for grasping how transactions are validated and how security is maintained within the CYBRO ecosystem.

Ethereum: Proof-of-Stake (PoS)

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism with the Ethereum 2.0 upgrade. Here’s how PoS works in the context of CYBRO:

-

Validation Process: In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This process reduces the energy consumption associated with traditional mining.

-

Security and Rewards: Validators earn rewards for confirming transactions and maintaining the network’s integrity. This incentivizes participants to act honestly, as malicious actions could lead to the loss of their staked coins.

-

Impact on CYBRO: The PoS mechanism allows CYBRO users to stake their tokens, earning rewards while contributing to the network’s security. This feature aligns with CYBRO’s focus on yield generation.

BNB Chain: Delegated Proof-of-Stake (DPoS)

BNB Chain employs a Delegated Proof-of-Stake (DPoS) mechanism, which enhances transaction speed and scalability:

-

Delegation of Power: In DPoS, token holders vote for a small number of delegates who validate transactions and create new blocks. This system increases efficiency by reducing the number of nodes required for consensus.

-

Faster Transactions: The DPoS mechanism allows for quicker transaction confirmations, making it ideal for high-frequency trading and time-sensitive investments.

-

Benefits for CYBRO: By utilizing BNB Chain, CYBRO can offer users faster transaction speeds and lower fees, improving the overall investment experience.

Blast Network: Custom Consensus Mechanism

The Blast Network features a unique consensus mechanism designed to optimize performance for specific applications:

-

Tailored to DeFi: The Blast Network’s consensus mechanism is optimized for decentralized finance applications, providing fast and efficient transaction processing.

-

Scalability and Low Latency: This mechanism allows CYBRO to handle a high volume of transactions with minimal delays, making it suitable for users engaging in yield farming and other time-sensitive activities.

-

Integration with CYBRO: The Blast Network enhances CYBRO’s capabilities, allowing for innovative investment strategies and improved user experience.

Key Technological Innovations

In addition to its blockchain architecture and consensus mechanisms, CYBRO incorporates several technological innovations that set it apart in the cryptocurrency landscape.

AI-Powered Portfolio Management

-

Personalized Investment Strategies: CYBRO utilizes artificial intelligence to analyze user preferences and market conditions. This enables the platform to recommend tailored investment strategies, optimizing returns based on individual risk tolerance and investment goals.

-

Automated Decision-Making: The AI system automates portfolio management, continuously adjusting strategies based on real-time data. This ensures that users can take advantage of market fluctuations without constant monitoring.

-

Enhanced User Experience: By simplifying investment decision-making, CYBRO makes it accessible for beginners while providing advanced tools for seasoned investors.

Yield Farming Vaults

-

Diverse Investment Options: CYBRO offers over 25 Vaults, which are pools of assets from various protocols. Users can select from a range of yield farming strategies, allowing them to optimize returns based on their risk appetite.

-

One-Click Strategies: The platform features easy-to-use “One-Click” strategies, making it simple for users to engage in complex yield farming opportunities without needing deep technical knowledge.

-

Risk Mitigation: CYBRO’s Vaults are designed with risk management in mind, utilizing advanced algorithms to minimize potential losses while maximizing yield.

Smart Notifications and Portfolio Management Tools

-

Real-Time Alerts: CYBRO provides smart notifications that keep users informed about market trends, price changes, and potential investment opportunities. This feature helps users make timely decisions in a fast-paced market.

-

Portfolio Tracking: The platform includes tools for tracking portfolio performance, enabling users to assess their investments and adjust strategies accordingly.

-

User-Centric Design: These tools are designed to enhance user engagement and improve the overall investment experience, catering to both novices and experienced traders.

Security Measures

Security is a critical aspect of any cryptocurrency platform, and CYBRO takes this seriously:

-

Technical Audits: CYBRO has undergone multiple technical audits to ensure the integrity of its smart contracts and overall platform security. These audits help identify vulnerabilities and enhance user trust.

-

KYC Compliance: The platform adheres to Know Your Customer (KYC) regulations, ensuring that users are verified and reducing the risk of fraud and malicious activities.

-

Decentralized Governance: Token holders have a say in the platform’s development, promoting transparency and community involvement in decision-making processes.

Conclusion

The technology behind CYBRO is designed to provide a secure, efficient, and user-friendly investment experience in the cryptocurrency market. By utilizing a multichain architecture, innovative consensus mechanisms, and advanced technological features like AI-powered portfolio management, CYBRO is well-positioned to cater to both new and experienced investors. As the platform continues to evolve, it aims to enhance the way users engage with decentralized finance, making it accessible and rewarding for everyone.

Understanding cybro crypto Tokenomics

Key Metrics of CYBRO Tokenomics

To understand the tokenomics of CYBRO, it is essential to look at the key metrics that define its economic model. Below is a summary of critical token metrics:

| Metric | Value |

|---|---|

| Total Supply | 499.99 million CYBRO |

| Max Supply | 1 billion CYBRO |

| Circulating Supply | 132.39 million CYBRO |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The CYBRO token serves multiple purposes within the CYBRO ecosystem, which is designed to be an AI-powered multichain earn marketplace. Here are the primary utilities of the CYBRO token:

-

Investment in Vaults: Users can utilize CYBRO tokens to invest in various Vaults, which are investment strategies for yield farming. These Vaults are designed to optimize returns based on user preferences and risk levels.

-

Staking and Yield Farming: Token holders can stake their CYBRO tokens to earn additional rewards. This process not only allows users to earn passive income but also helps maintain liquidity within the ecosystem.

-

Governance Participation: CYBRO token holders have the opportunity to participate in the governance of the platform. They can vote on key decisions affecting the future development of CYBRO, including proposals for new features or changes to existing mechanisms.

-

Access to AI Tools: The CYBRO token is essential for accessing various AI-powered tools within the marketplace. These tools help users make informed investment decisions by analyzing market trends and optimizing portfolio management.

-

Transaction Fees: CYBRO tokens may also be used to pay for transaction fees associated with trading and other activities within the platform. This utility helps create a demand for the token, contributing to its overall value.

-

Rewards and Incentives: The token can be used for rewarding users who contribute to the ecosystem, whether through providing liquidity, participating in governance, or engaging in community activities.

Token Distribution

Understanding how the CYBRO tokens are distributed is crucial for assessing the long-term sustainability and fairness of the project. The distribution model for CYBRO is designed to ensure a balanced approach that fosters community growth while providing necessary incentives for early investors and developers. Below is an overview of the distribution strategy:

-

Public Presale: A significant portion of the total supply was allocated to the public presale, which successfully raised $7 million from April to December 2024. This fundraising effort was aimed at building an initial community of token holders and ensuring liquidity in the market.

-

Team and Development: A percentage of the total supply is reserved for the development team and advisors. This allocation is typically subject to a vesting period to ensure that the team remains incentivized to contribute to the project’s growth over time.

-

Community Incentives: Tokens are allocated for community-building initiatives, including rewards for early adopters, liquidity providers, and participants in governance. This approach encourages active participation in the ecosystem and helps grow the user base.

-

Marketing and Partnerships: A portion of the tokens is earmarked for marketing efforts and strategic partnerships. This funding is crucial for promoting the platform and expanding its reach within the cryptocurrency community.

-

Reserve Fund: A reserve fund may also be established to manage unforeseen circumstances or to support future development initiatives. This fund can be crucial for maintaining the stability of the project in the long run.

Conclusion

The tokenomics of CYBRO is designed to create a sustainable and rewarding ecosystem for users. With a well-defined utility for the CYBRO token and a balanced distribution strategy, the project aims to attract a diverse range of participants, from casual investors to professional traders. The focus on AI-powered tools and yield farming strategies positions CYBRO as a competitive player in the rapidly evolving cryptocurrency landscape.

Understanding these aspects of CYBRO’s tokenomics can help investors make informed decisions about their participation in the ecosystem. As always, potential investors should conduct thorough research and consider their risk tolerance before engaging with any cryptocurrency.

Price History and Market Performance

Overview of CYBRO Price History

CYBRO, a multichain AI-powered earn marketplace, was launched in April 2024. Since its inception, the cryptocurrency has experienced a volatile price trajectory, characterized by significant fluctuations influenced by various market dynamics. As of October 2023, CYBRO’s price stands at approximately $0.0061, with a market capitalization of around $806,000.

Key Historical Price Milestones

-

Launch and Initial Performance: CYBRO was launched in April 2024, coinciding with a broader bullish trend in the cryptocurrency market. In its early days, the token saw a surge in demand, leading to an initial price rise. The project successfully raised $7 million during its public presale, which contributed to positive market sentiment around the token.

-

All-Time High: CYBRO reached its all-time high of $0.6988 on December 14, 2024. This peak can be attributed to several factors, including the growing interest in decentralized finance (DeFi) and the unique features offered by CYBRO, such as AI-driven investment strategies and a user-friendly interface.

-

Subsequent Decline: Following its all-time high, CYBRO experienced a significant decline, dropping approximately 94.97% in value over the following year. This downturn was reflective of broader market trends affecting many cryptocurrencies during this period, including regulatory challenges and changing investor sentiment.

-

Recent Price Fluctuations: As of October 2023, CYBRO has seen recent price movements ranging between $0.0036 and $0.0063. The token recorded a low of $0.003632 on June 27, 2025, before gradually recovering. This recovery phase has been marked by increased trading volumes and renewed interest in the project, with a 24-hour trading volume fluctuating around $37,000.

Factors Influencing the Price

Historically, the price of CYBRO has been influenced by a combination of market trends, technological developments, and external economic factors:

-

Market Sentiment: Like many cryptocurrencies, CYBRO’s price has been heavily influenced by the overall sentiment in the cryptocurrency market. Bullish trends often lead to price surges, while bearish trends can cause rapid declines. The market sentiment surrounding major cryptocurrencies like Bitcoin and Ethereum often spills over into altcoins, including CYBRO.

-

Technological Advancements: CYBRO’s unique selling proposition lies in its AI-powered investment tools and multichain capabilities. The introduction of new features or enhancements to the platform has historically led to positive price movements. For instance, the launch of additional investment vaults and strategies attracted more users, which in turn bolstered the token’s value.

-

Regulatory Environment: The cryptocurrency landscape is heavily impacted by regulatory news and developments. Announcements regarding regulations, compliance, or government scrutiny can lead to significant price fluctuations. CYBRO has not been immune to these influences, with regulatory news often correlating with sharp price movements.

-

Community Engagement and Adoption: The growth of CYBRO’s user base and community engagement has played a crucial role in its price dynamics. An increase in the number of holders, currently reported to be around 5,870, reflects growing interest and trust in the project, positively impacting price. Conversely, a lack of community engagement or negative feedback can lead to price declines.

-

Market Liquidity and Trading Volume: The liquidity of CYBRO in various exchanges contributes to its price stability. Higher trading volumes generally indicate better liquidity, allowing for smoother price movements. As of October 2023, CYBRO has maintained a moderate trading volume, which has helped it avoid extreme volatility seen in other cryptocurrencies.

-

Competition and Market Positioning: The competitive landscape of cryptocurrencies, particularly in the DeFi space, also impacts CYBRO’s price. The emergence of new projects offering similar or improved functionalities can affect investor interest and lead to price adjustments.

Conclusion

In summary, CYBRO’s price history reflects the inherent volatility of the cryptocurrency market, influenced by a range of factors including market sentiment, technological developments, regulatory changes, and community engagement. Understanding these elements can provide valuable insights for investors and enthusiasts looking to navigate the complexities of CYBRO and the broader cryptocurrency ecosystem.

Where to Buy cybro crypto: Top Exchanges Reviewed

5 Steps to Seamlessly Buy Cybro (CYBRO) Today!

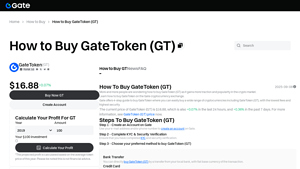

The article “How to Buy Cybro (CYBRO) Step-by-Step Guide – CoinCodex” provides a comprehensive overview of purchasing Cybro through reputable exchanges like Gate and MEXC. Both platforms stand out for their user-friendly interfaces, robust security measures, and a wide selection of trading pairs. The guide emphasizes the ease of registration and the seamless transaction process, making it accessible for both newcomers and experienced investors looking to acquire CYBRO.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. CYBRO – Your Gateway to Innovative Trading!

CYBRO (CYBRO) stands out in the cryptocurrency market due to its limited availability on just two exchanges: Gate and Bitmart. This exclusivity can enhance trading opportunities for investors, as it may lead to increased demand and potentially higher price volatility. The choice of reputable platforms also ensures a secure environment for buying, selling, and trading CYBRO, appealing to both new and experienced traders seeking to diversify their portfolios.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. CYBRO – Your Next Investment Gem!

Gate.com stands out as a user-friendly exchange that simplifies the process of purchasing CYBRO (CYBRO) through its concise four-step guide. Known for its competitive fee structure, Gate.com allows users to buy a diverse selection of cryptocurrencies, making it an attractive option for both beginners and experienced investors. The platform’s commitment to low transaction costs enhances its appeal for those looking to maximize their investment in digital assets.

- Website: gate.com

- Platform Age: Approx. 29 years (domain registered in 1996)

5. CYBRO – Revolutionizing Earnings with AI-Powered Multichain Solutions!

CYBRO distinguishes itself as an innovative AI-powered multichain earn marketplace, offering users a tailored investment experience. By leveraging advanced algorithms, it allows individuals to select from various investment tools—such as staking, farming, and lending—based on their preferred risk and return profiles. This personalized approach not only enhances user engagement but also simplifies the process of maximizing earnings across multiple blockchain networks.

- Website: cybro.io

- Platform Age: Approx. 1 years (domain registered in 2024)

3. BitMart – Instant Trading Made Easy!

BitMart stands out as a trusted cryptocurrency trading platform that offers users the ability to buy and sell major digital assets like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) instantly. With its user-friendly interface and real-time trading services, BitMart caters to both beginners and experienced investors, making it an appealing choice for those looking to navigate the cryptocurrency market efficiently and securely.

- Website: bitmart.com

- Platform Age: Approx. 24 years (domain registered in 2001)

How to Buy cybro crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying CYBRO crypto is selecting a cryptocurrency exchange that lists the token. Popular exchanges where you can buy CYBRO include:

-

Centralized Exchanges (CEX): Platforms like Binance, Kraken, or Crypto.com typically offer a wide range of cryptocurrencies, including CYBRO. These exchanges are user-friendly and provide various trading features.

-

Decentralized Exchanges (DEX): If you prefer a more decentralized approach, consider using platforms like Uniswap or PancakeSwap. These allow you to trade directly from your wallet without needing to create an account.

Make sure to check the exchange’s trading fees, security features, and user reviews to ensure it meets your needs.

2. Create and Verify Your Account

Once you’ve selected an exchange, the next step is to create an account. Follow these steps:

-

Sign Up: Visit the exchange’s website and click on the sign-up button. You will need to provide your email address and create a secure password.

-

Verification: Most exchanges require identity verification to comply with regulations. You may need to submit documents such as a government-issued ID and proof of address. This process can take anywhere from a few minutes to a few days, depending on the exchange.

-

Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This typically involves linking your account to an authentication app like Google Authenticator.

3. Deposit Funds

After your account is verified, you’ll need to deposit funds to buy CYBRO. Here’s how to do it:

-

Choose Deposit Method: Most exchanges allow you to deposit funds via bank transfer, credit/debit card, or other cryptocurrencies. Select the method that works best for you.

-

Follow Instructions: The exchange will provide specific instructions for your chosen deposit method. For bank transfers, you may need to provide bank account details. For credit/debit cards, you will enter your card information directly on the platform.

-

Wait for Confirmation: Deposits can take some time to process. Bank transfers may take a few days, while card deposits are usually instant. Ensure that the funds have appeared in your exchange account before proceeding.

4. Place an Order to Buy CYBRO Crypto

Now that your account is funded, you can place an order to buy CYBRO. Here’s how:

-

Navigate to the CYBRO Trading Pair: Search for CYBRO on the exchange’s trading platform. You may find it paired with popular cryptocurrencies like USDT, BTC, or ETH.

-

Select Order Type: Decide whether you want to place a market order (buy at the current market price) or a limit order (set a specific price at which you want to buy). Market orders are executed immediately, while limit orders may take time to fulfill.

-

Enter Order Details: If you’re placing a market order, simply enter the amount of CYBRO you want to buy. For a limit order, specify the price and quantity.

-

Confirm the Purchase: Review your order details carefully and confirm the transaction. You should see a confirmation message indicating that your order has been executed.

5. Secure Your Coins in a Wallet

After purchasing CYBRO, it’s essential to store your coins securely. Here are your options:

-

Exchange Wallet: While convenient, storing your CYBRO on the exchange can expose you to risks. If the exchange is hacked, you may lose your funds.

-

Software Wallet: Consider using a software wallet like MetaMask or Trust Wallet. These are user-friendly and allow you to control your private keys.

-

Hardware Wallet: For maximum security, store your CYBRO in a hardware wallet like Ledger or Trezor. These devices are offline and provide a high level of protection against hacks.

-

Transfer Your Coins: If you choose a software or hardware wallet, transfer your CYBRO from the exchange to your wallet by entering your wallet address and confirming the transaction.

Conclusion

Buying CYBRO crypto is a straightforward process that involves selecting an exchange, creating an account, depositing funds, placing an order, and securing your coins. By following these steps, you can confidently navigate the world of cryptocurrency investment. Always remember to conduct thorough research and consider your risk tolerance before investing.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Innovative AI-Powered Features

CYBRO stands out in the crowded cryptocurrency market due to its unique AI-powered investment tools. These tools are designed to recommend optimal investment options based on individual user preferences and risk tolerance. This personalization can attract both novice and experienced investors seeking tailored investment strategies, enhancing user engagement and retention.

2. Multichain Compatibility

The CYBRO token operates across multiple blockchain ecosystems, including Ethereum, BNB Chain, and Blast. This multichain compatibility not only increases the token’s accessibility but also positions CYBRO to tap into diverse user bases across different platforms. The ability to leverage multiple chains can enhance liquidity and trading volume, which are critical for the token’s stability and growth.

3. Diverse Investment Strategies

CYBRO offers over 25 vaults and 6 one-click strategies for yield farming, catering to various risk appetites and investment goals. This diversity allows users to choose strategies that align with their financial objectives, potentially improving their returns. Such a comprehensive strategy portfolio can attract a wider audience and foster a sense of community among investors.

4. Growing Market Demand for DeFi Solutions

The decentralized finance (DeFi) sector is experiencing rapid growth as more investors seek alternatives to traditional financial systems. CYBRO’s focus on yield farming and staking positions it well to capitalize on this trend. As more users become familiar with DeFi concepts, the demand for platforms like CYBRO may increase, driving up token adoption and usage.

5. Strong Community Support

With a reported community of over 18,000 token holders and a successful fundraising effort of $7 million in its public presale, CYBRO has garnered significant interest from investors. A strong community can provide the necessary support for the project’s development and marketing efforts, creating a robust ecosystem that fosters user loyalty and long-term growth.

6. Security and Compliance Measures

CYBRO has undergone multiple technical audits and KYC checks, which enhance its credibility and trustworthiness in the eyes of potential investors. Strong security measures can mitigate concerns regarding hacks or fraud, which are prevalent issues in the cryptocurrency space. This commitment to security can be a significant selling point for users wary of entering the market.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is notoriously volatile, characterized by rapid price fluctuations that can lead to significant financial losses. CYBRO’s current price of approximately $0.0061, down from its all-time high of $0.6988, highlights the inherent risks associated with investing in cryptocurrencies. Such volatility can deter conservative investors and may result in rapid sell-offs during market downturns, impacting the token’s stability and market cap.

2. Regulatory Uncertainty

The evolving regulatory landscape for cryptocurrencies presents a significant challenge for projects like CYBRO. Governments worldwide are increasingly scrutinizing digital assets, which could lead to potential restrictions or unfavorable regulations. Regulatory actions can impact the operational capabilities of CYBRO, affect investor sentiment, and ultimately influence the token’s price and adoption.

3. Competition in the DeFi Space

The DeFi sector is highly competitive, with numerous platforms offering similar services. Established players and new entrants alike continuously innovate, which could dilute CYBRO’s market share. If CYBRO fails to differentiate itself effectively or keep pace with technological advancements, it may struggle to attract and retain users, impacting its growth potential.

4. Technological Risks

As a multichain platform, CYBRO is subject to various technological risks, including potential bugs in smart contracts or vulnerabilities in its AI algorithms. If security breaches occur or if the platform faces technical issues, it could lead to loss of user funds or damage to the project’s reputation. Furthermore, the reliance on multiple blockchains introduces additional complexities that could complicate operations and user experience.

5. Lack of Transparency

While the CYBRO project has successfully raised funds and gained a community following, the anonymity of its founding team may raise concerns among potential investors. A lack of transparency regarding the project’s leadership and decision-making processes can deter investment, as many investors prefer to understand the backgrounds and track records of the teams behind the projects they support.

6. Economic Conditions

The broader economic environment can significantly influence the cryptocurrency market. Economic downturns, inflation, or changes in monetary policy can lead to reduced investor appetite for high-risk assets like cryptocurrencies. In such scenarios, projects like CYBRO may struggle to maintain user engagement and investment inflow, affecting their long-term viability.

Conclusion

Investing in CYBRO presents both opportunities and risks that potential investors should carefully consider. The innovative features, multichain compatibility, and growing market demand for DeFi solutions position CYBRO as a promising project. However, the inherent volatility of the cryptocurrency market, regulatory uncertainties, and competitive pressures pose significant challenges.

As with any investment, a thorough understanding of the asset, its market dynamics, and potential risks is crucial. Investors should conduct their own research and consider their risk tolerance before engaging with CYBRO or any other cryptocurrency.

Frequently Asked Questions (FAQs)

1. What is CYBRO crypto?

CYBRO is a multichain cryptocurrency designed as an earn marketplace that leverages artificial intelligence (AI) to optimize investment strategies. Launched in April 2024, CYBRO operates on multiple blockchain networks, including Ethereum, BNB Chain, and Blast. Its primary purpose is to provide users with secure and easy access to top Web3 investment options through AI-powered portfolio management, yield farming strategies, and diversified investment vaults.

2. Who created CYBRO crypto?

The founders of CYBRO have not been publicly disclosed. The project was launched as a decentralized initiative aimed at providing a multi-chain earn marketplace. Despite the anonymity of its founding team, CYBRO successfully raised $7 million during its public presale from April to December 2024, establishing a strong community of over 18,000 token holders.

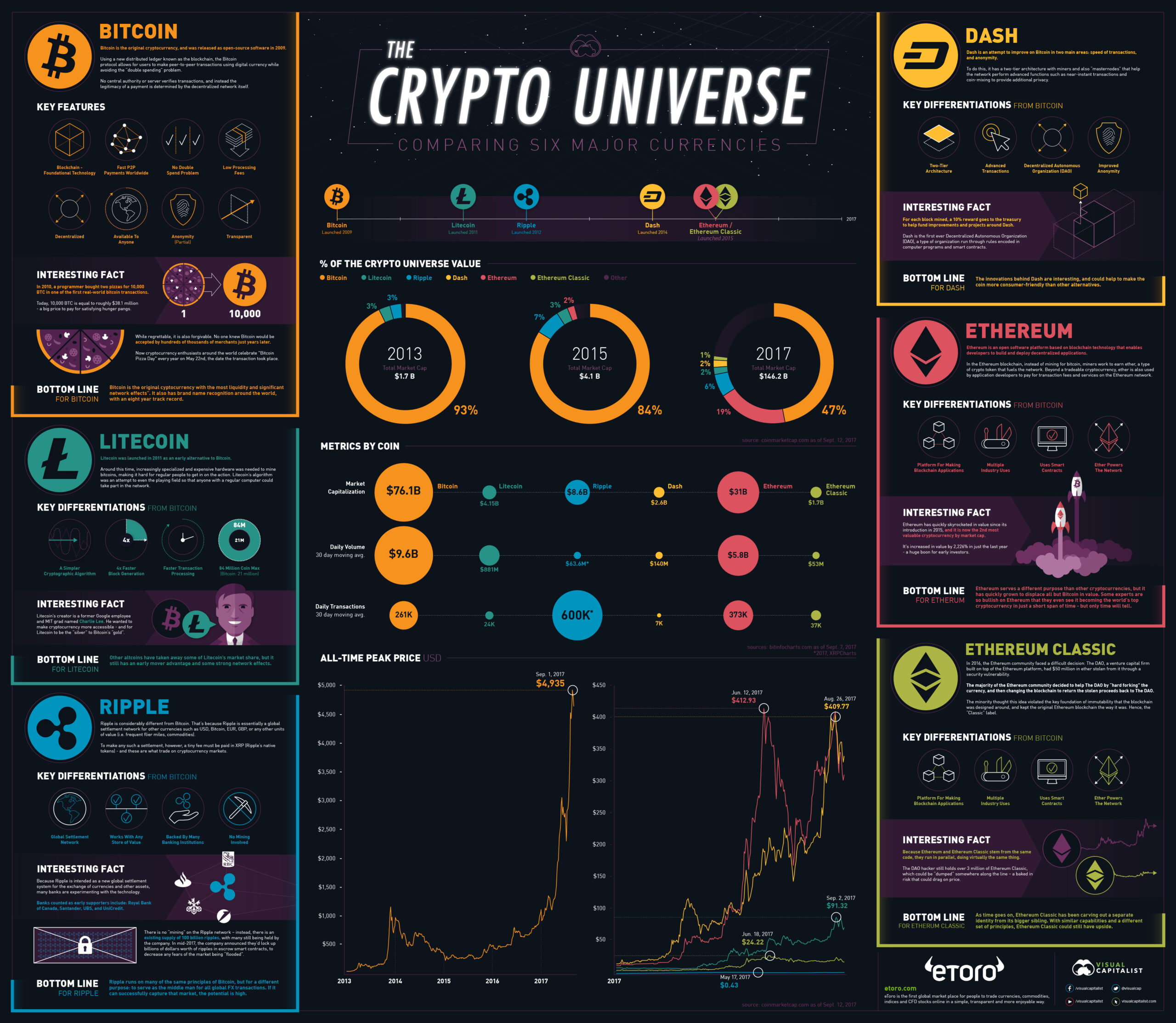

3. What makes CYBRO crypto different from Bitcoin?

While Bitcoin is primarily a decentralized digital currency aimed at being a store of value and medium of exchange, CYBRO focuses on providing an investment platform that incorporates AI and multi-chain capabilities. CYBRO offers various investment strategies and yield farming opportunities, enabling users to earn returns on their investments. Its focus on Web3 and AI distinguishes it from Bitcoin’s more straightforward utility as a cryptocurrency.

4. Is CYBRO crypto a good investment?

As with any cryptocurrency, the potential for investment in CYBRO should be evaluated based on individual financial goals, risk tolerance, and market conditions. While CYBRO has shown growth potential and innovative features like AI-powered portfolio management and yield farming, its price history indicates volatility, with an all-time high of $0.6988 and a current price around $0.0061. It’s essential to conduct thorough research and consider market trends before investing.

5. How does CYBRO work?

CYBRO operates by utilizing blockchain technology to provide a secure marketplace for Web3 investments. Key functionalities include:

– AI-Powered Portfolio Management: Optimizes investment strategies based on user preferences.

– Multi-Chain Compatibility: Supports transactions across Ethereum, BNB Chain, and Blast.

– Yield Farming and Staking: Allows users to earn rewards by staking their CYBRO tokens.

– Decentralized Governance: Token holders can participate in platform decision-making.

– Smart Contract Integration: Automates transactions and enhances transparency.

6. What is the current price and market cap of CYBRO?

As of now, the price of CYBRO is approximately $0.0061, with a market cap around $806,924. The circulating supply is approximately 132.4 million CYBRO tokens, while the maximum supply is capped at 1 billion tokens. Market conditions can fluctuate, so it’s advisable to check live price updates from reliable cryptocurrency exchanges.

7. Where can I buy CYBRO crypto?

CYBRO can be purchased on various centralized and decentralized exchanges that support the token. It is essential to ensure that you are using reputable platforms for trading. Users can also swap or exchange CYBRO directly on its official marketplace, which is designed to facilitate easy transactions.

8. What security measures does CYBRO implement?

CYBRO has undergone multiple technical audits and KYC checks to ensure platform security and compliance. These audits are conducted by reputable organizations, ensuring that the project adheres to necessary security protocols. Additionally, the use of smart contracts enhances transaction transparency and reduces the risk of fraud.

Final Verdict on cybro crypto

Overview of CYBRO Crypto

CYBRO is a multichain AI-powered earn marketplace that aims to simplify and enhance the investment experience for both novice and experienced cryptocurrency investors. Launched in April 2024, CYBRO operates on multiple blockchains, including Ethereum, BNB Chain, and Blast, providing users with diverse investment options through its unique yield farming strategies. The platform employs artificial intelligence to recommend optimal investment opportunities based on individual user preferences, making it accessible and user-friendly.

Key Features and Technology

The core technology behind CYBRO includes its AI-driven portfolio management tools and smart contract integration, which ensure transparency and security in transactions. With over 25 investment vaults and various yield farming strategies, users can engage in staking and earn rewards while managing their portfolios effectively. Additionally, CYBRO has undergone multiple technical audits and KYC checks, underscoring its commitment to security and compliance.

Investment Potential and Risks

While CYBRO has shown potential for growth, with a recent price of approximately $0.0061 and a market cap of around $807K, it’s essential to recognize that investing in cryptocurrencies remains a high-risk, high-reward venture. The market is highly volatile, and CYBRO’s price has experienced significant fluctuations, including a notable all-time high of $0.6988. As a relatively new cryptocurrency, it may also face challenges as it competes with established players in the DeFi space.

Final Thoughts

In conclusion, CYBRO presents an intriguing opportunity for those looking to explore AI-driven investment platforms in the cryptocurrency space. However, given the inherent risks associated with digital assets, it is crucial for potential investors to conduct their own thorough research (DYOR) before committing any capital. Understanding the technology, market dynamics, and personal risk tolerance will be vital in navigating this evolving landscape. Always invest wisely!

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.