What is coti crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to coti crypto

COTI, short for Currency of the Internet, is an innovative cryptocurrency that aims to revolutionize the digital payment landscape. As a leading enterprise-grade fintech platform, COTI stands out in the crypto market by providing organizations with the tools to create their own payment solutions and digitize currencies without relying on traditional intermediaries. Built on a unique architecture known as Trustchain, COTI offers a fast, scalable, and secure environment for processing transactions, making it a significant player in the blockchain ecosystem.

The COTI network is designed to facilitate a range of applications, from payment processing and stablecoin creation to loyalty programs and remittance services. Its robust infrastructure enables businesses to streamline their operations and reduce costs, thereby enhancing overall efficiency. As the demand for digital payment solutions continues to grow, COTI’s approach positions it favorably among other cryptocurrencies, particularly in the DeFi and enterprise sectors.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in COTI crypto. It will cover various aspects of the COTI ecosystem, including:

Technology Overview

An exploration of COTI’s underlying technology, including its Trustchain protocol and the unique cryptographic frameworks that enhance transaction confidentiality and security. Understanding the technical foundation will help investors grasp the potential use cases and advantages of COTI over other digital assets.

Tokenomics

A detailed analysis of COTI’s tokenomics, including its supply dynamics, distribution, and economic incentives. This section will provide insights into how COTI’s token structure supports the network’s growth and sustainability.

Investment Potential

An evaluation of COTI’s market performance, historical price trends, and future growth prospects. This will include an examination of factors that may influence its value and position in the market.

Risks and Challenges

An objective discussion of the potential risks associated with investing in COTI. This section will cover market volatility, regulatory concerns, and technological challenges that could impact the network’s success.

How to Buy COTI

A step-by-step guide on how to purchase COTI tokens, including information on the exchanges where it is listed and tips for secure trading.

By the end of this guide, readers will have a well-rounded understanding of COTI crypto, empowering them to make informed decisions about their investments in this promising digital asset.

What is coti crypto? A Deep Dive into its Purpose

Understanding COTI Crypto

COTI (Currency of the Internet) is a blockchain-based platform designed to facilitate the creation of payment solutions and financial applications. It aims to provide businesses with the tools they need to build their own payment systems, allowing for the digitization of currencies and the creation of private payment networks. By leveraging a unique protocol known as Trustchain, COTI seeks to offer a fast, scalable, and secure alternative to traditional payment systems.

The Core Problem It Solves

In today’s digital economy, businesses face numerous challenges when it comes to payment processing. Traditional financial systems are often plagued by high transaction fees, slow processing times, and a lack of transparency. Additionally, many businesses struggle with the complexities of integrating payment solutions that are both efficient and secure. COTI addresses these issues by providing a comprehensive platform that allows businesses to create tailored payment solutions without the need for intermediaries.

One of the primary problems COTI solves is the inefficiency of existing payment systems. By utilizing its Trustchain protocol, COTI enables near-instantaneous transactions, significantly reducing the time it takes to process payments. This is particularly beneficial for businesses that rely on quick transactions, such as e-commerce platforms and service providers. Moreover, COTI’s approach minimizes transaction costs, making it an attractive option for businesses looking to optimize their payment processes.

Another critical issue COTI addresses is the need for privacy and security in digital transactions. With increasing concerns about data breaches and privacy violations, businesses require solutions that safeguard their customers’ information. COTI employs advanced cryptographic techniques to ensure that transactions are secure and confidential, allowing businesses to protect their customers’ data while fostering trust.

Its Unique Selling Proposition

COTI’s unique selling proposition lies in its combination of scalability, security, and ease of use. The platform is designed to support a wide range of applications, from payment processing to the creation of stablecoins and loyalty programs. This versatility allows businesses to leverage COTI’s infrastructure to meet their specific needs.

One of the standout features of COTI is its Trustchain protocol, which enables fast and secure transactions while eliminating the need for intermediaries. Unlike traditional payment processors that rely on a centralized system, COTI’s decentralized approach distributes transaction validation across the network, enhancing security and reducing the risk of fraud. This model not only improves transaction speed but also lowers costs, making it a compelling alternative for businesses.

Additionally, COTI offers a user-friendly interface that simplifies the process of creating and managing payment solutions. Businesses can easily design their own rules and parameters, giving them complete control over their payment systems. This level of customization is particularly appealing to enterprises that require specific functionalities to cater to their unique customer base.

COTI also stands out in its approach to scalability. As the demand for digital payment solutions continues to grow, COTI’s infrastructure is built to handle high transaction volumes without compromising performance. This scalability is crucial for businesses looking to expand their operations without facing bottlenecks in their payment processing systems.

The Team and Backers

COTI boasts a diverse and experienced team of professionals from various fields, including finance, technology, and blockchain development. The team’s collective expertise positions COTI as a formidable player in the fintech and cryptocurrency space. The founders and key team members have backgrounds in leading technology companies and financial institutions, which lends credibility to the project.

COTI has also garnered support from reputable backers and investors who recognize the potential of the platform. The involvement of established entities in the blockchain and fintech sectors helps validate COTI’s vision and enhances its prospects for growth and adoption. This backing not only provides financial resources but also strategic guidance as COTI navigates the complexities of the cryptocurrency market.

The Fundamental Purpose in the Crypto Ecosystem

COTI’s fundamental purpose in the cryptocurrency ecosystem is to bridge the gap between traditional finance and the emerging world of digital currencies. By providing a robust platform for payment processing and financial applications, COTI aims to empower businesses to transition to a more efficient and secure digital economy.

In a landscape increasingly dominated by cryptocurrencies, COTI’s focus on creating tailored payment solutions allows businesses to leverage the benefits of blockchain technology without the complexities often associated with it. This positions COTI as a vital player in the broader adoption of digital currencies, as it enables businesses to integrate cryptocurrency payments seamlessly.

Moreover, COTI’s commitment to enhancing privacy and security aligns with the growing demand for solutions that protect user data. As consumers become more aware of privacy issues, platforms that prioritize secure transactions will likely gain traction. COTI’s emphasis on confidentiality and data protection addresses this concern, making it an attractive option for businesses looking to build trust with their customers.

In conclusion, COTI is more than just a cryptocurrency; it is a comprehensive platform that empowers businesses to create innovative payment solutions tailored to their needs. By addressing the core challenges of traditional payment systems, offering unique features, and supported by a capable team, COTI is poised to play a significant role in the evolving landscape of digital finance.

The Technology Behind the Coin: How It Works

Introduction to COTI

COTI (Currency Of The Internet) is a unique cryptocurrency that aims to redefine the way we think about digital transactions. Built as a fast and scalable payment solution, COTI utilizes innovative technologies to offer enhanced privacy and efficiency. This guide will delve into the technology behind COTI, exploring its blockchain architecture, consensus mechanism, and key technological innovations that set it apart in the cryptocurrency landscape.

Blockchain Architecture

COTI operates on a decentralized, directed acyclic graph (DAG) architecture known as the Trustchain. Unlike traditional blockchains that use blocks of transactions, the DAG structure allows for a more scalable and efficient transaction process.

What is a DAG?

A Directed Acyclic Graph (DAG) is a data structure that consists of nodes and edges, where each node represents a transaction and edges indicate the flow of information between transactions. In a DAG, transactions are linked together in a way that does not form cycles, allowing for an unlimited number of transactions to be processed simultaneously. This means that as more transactions occur, the network becomes faster and more efficient.

Advantages of COTI’s Architecture

-

Scalability: COTI can handle a large volume of transactions without slowing down, making it suitable for high-frequency payments and microtransactions.

-

Low Fees: The transaction fees on the COTI network are significantly lower compared to traditional payment platforms, enabling cost-effective transactions.

-

Instant Transactions: With its DAG architecture, COTI allows for nearly instantaneous transaction confirmations, enhancing user experience.

-

Security: The Trustchain employs advanced cryptographic techniques to ensure the security and integrity of transactions, making it resilient against various types of cyber threats.

Consensus Mechanism

COTI employs a unique consensus mechanism called Proof of Trust (PoT). This system is designed to ensure that transactions are validated by trusted nodes within the network, promoting both security and efficiency.

Understanding Proof of Trust

Proof of Trust combines elements of traditional consensus mechanisms (like Proof of Work and Proof of Stake) while introducing a new paradigm based on trustworthiness. Here’s how it works:

-

Trust Scores: Each node in the COTI network is assigned a trust score based on its transaction history and behavior. Nodes that consistently validate transactions accurately and promptly earn higher trust scores.

-

Transaction Validation: When a transaction is initiated, it is validated by nodes with higher trust scores, ensuring that only reputable nodes participate in the consensus process.

-

Adaptive Scaling: The PoT mechanism adapts to network conditions, allowing for more efficient transaction processing during peak times while maintaining security and decentralization.

-

Reputation System: By incorporating a reputation system, COTI incentivizes good behavior among nodes. Nodes with higher trust scores can earn rewards, while those with lower scores may face penalties.

Key Technological Innovations

COTI introduces several groundbreaking technologies that enhance its functionality and user experience. These innovations include garbled circuits, multiparty computation (MPC), and a decentralized sequencer model.

Garbled Circuits and Multiparty Computation

COTI V2 employs garbled circuits and multiparty computation (MPC) to improve privacy and security.

-

Garbled Circuits: This cryptographic technique allows for the execution of computations on encrypted data without revealing the data itself. This is particularly useful for confidential transactions, where privacy is paramount.

-

Multiparty Computation (MPC): MPC enables multiple parties to jointly compute a function over their inputs while keeping those inputs private. This means that sensitive information can be processed without exposing it to other parties, enhancing security.

-

Performance: Garbled circuits are approximately 1000 times faster and 250 times more efficient in terms of latency compared to traditional encryption methods. This efficiency helps to reduce the computational burden on the network.

Decentralized Sequencer Model

COTI’s decentralized sequencer model is another key innovation that enhances network security and scalability.

-

What is a Sequencer?: In blockchain networks, a sequencer is responsible for ordering transactions before they are finalized. Centralized sequencers can create single points of failure, which pose risks to the network’s security.

-

Decentralization: COTI’s model distributes the sequencing function across multiple participants, reducing the risks associated with centralization. This approach enhances redundancy and improves resistance to censorship.

-

Efficiency: By decentralizing the sequencing process, COTI can maintain high transaction throughput while ensuring that the network remains secure and resistant to attacks.

Security Measures

COTI prioritizes security through a combination of advanced cryptographic protocols and established encryption standards.

Encryption Protocols

-

Symmetric and Asymmetric Encryption: COTI employs standardized symmetric-key encryption schemes (like AES-CTR) for data protection and asymmetric-key schemes (like RSA) for secure key distribution. These methods are widely recognized and trusted across various industries, enhancing the overall security of the network.

-

Integration of Proven Technologies: COTI’s approach to security aligns with industry standards, utilizing encryption schemes that have been tested and adopted by governments and financial institutions. This reduces the need for unverified security assumptions, providing a robust security framework.

Use Cases and Applications

COTI’s technology enables a wide range of use cases that leverage its unique features:

-

Confidential Transactions: With its garbled circuits and MPC, COTI can facilitate transactions that keep sensitive information private, appealing to users who prioritize confidentiality.

-

Decentralized Finance (DeFi): COTI supports various DeFi applications, allowing users to engage in lending, borrowing, and trading while benefiting from low fees and fast transaction speeds.

-

Payment Solutions: Businesses can utilize COTI’s platform to create tailored payment solutions, including stablecoins and loyalty programs, empowering them to digitize their currencies and streamline payment processes.

Conclusion

COTI represents a significant advancement in the cryptocurrency space, combining cutting-edge technologies with a focus on scalability, security, and privacy. Its unique architecture, innovative consensus mechanism, and groundbreaking technological innovations position it as a formidable player in the digital asset landscape. By understanding the technology behind COTI, investors and users can better appreciate its potential and the impact it may have on the future of digital transactions.

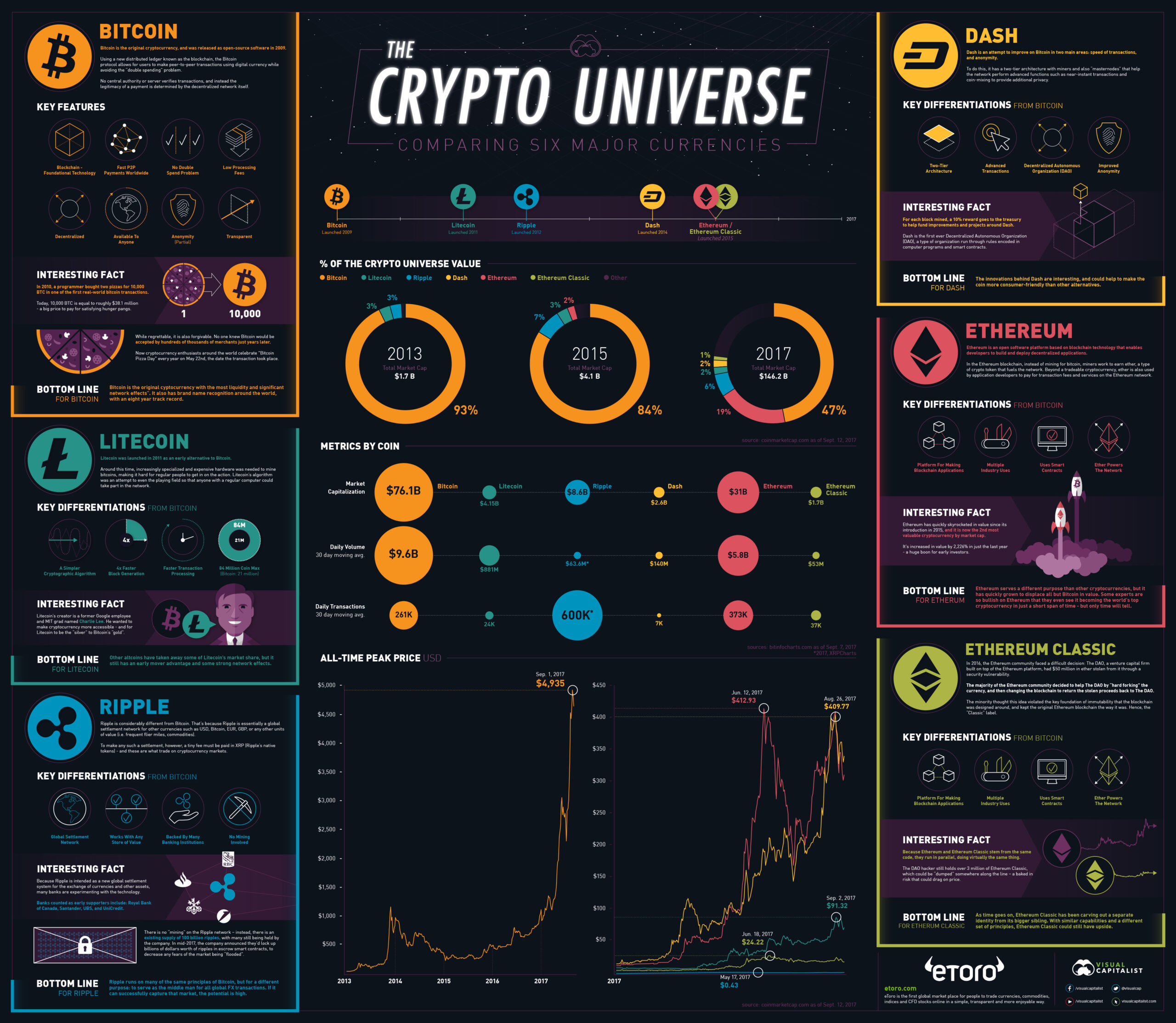

Understanding coti crypto Tokenomics

COTI (Currency of the Internet) is a blockchain-based platform designed to provide a comprehensive solution for payment processing and digital asset management. Its tokenomics play a crucial role in its functionality, utility, and overall market dynamics. Understanding these aspects is essential for both beginners and intermediate investors looking to engage with this digital asset.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 2.34 billion COTI |

| Max Supply | 4.91 billion COTI |

| Circulating Supply | 2.34 billion COTI |

| Inflation/Deflation Model | Controlled inflation |

Total Supply, Max Supply, and Circulating Supply

COTI has a total supply of approximately 4.91 billion tokens, with 2.34 billion currently in circulation. This means that half of the total supply remains to be released into the market. The circulating supply is vital as it represents the number of tokens that are actively available for trading and use, influencing the market cap and price dynamics of the asset.

The inflation model of COTI is controlled, which means that new tokens may be introduced gradually over time, rather than flooding the market all at once. This approach helps maintain price stability and incentivizes long-term holding among investors.

Token Utility (What is the coin used for?)

COTI serves multiple purposes within its ecosystem, making it a versatile digital asset:

-

Payment Processing: COTI enables fast and secure transactions, allowing businesses and individuals to send and receive payments seamlessly. The platform is designed to handle a high transaction volume, which is essential for real-world use cases.

-

Decentralized Finance (DeFi): COTI is integrated into various DeFi applications, allowing users to earn interest on their holdings, participate in liquidity pools, and engage in other financial activities without relying on traditional banking systems.

-

Loyalty Programs: Businesses can create their own loyalty programs using COTI, allowing customers to earn rewards in the form of COTI tokens. This increases customer engagement and retention.

-

Stablecoins: The platform supports the creation of stablecoins, enabling users to transact in a digital currency that maintains a stable value relative to traditional currencies. This is particularly useful in volatile markets.

-

Governance: COTI holders have voting rights in the ecosystem, allowing them to participate in decision-making processes regarding platform upgrades, changes in policies, or other significant developments.

-

Transaction Fees: Users pay transaction fees using COTI when conducting transactions on the network. This creates a demand for the token, contributing to its overall value.

Token Distribution

The distribution of COTI tokens is crucial for understanding its market dynamics and potential for price appreciation. Here’s a breakdown of how the tokens are allocated:

-

Founders and Team: A portion of the total supply is allocated to the founding team and early developers. This allocation incentivizes the team to work towards the long-term success of the project.

-

Advisors and Partners: Some tokens are reserved for advisors and strategic partners who contribute to the growth and development of the COTI ecosystem.

-

Ecosystem Development: A significant portion of tokens is set aside for ecosystem development, including partnerships, marketing, and community engagement efforts. This ensures that COTI continues to grow and attract new users.

-

Liquidity: Tokens are allocated for liquidity purposes, ensuring that there is enough supply available for trading on various exchanges. This helps maintain market stability and reduces price volatility.

-

Community Incentives: COTI also allocates tokens for community initiatives, including rewards for users participating in governance, loyalty programs, and other engagement activities. This fosters a strong community and encourages user participation.

Conclusion

Understanding the tokenomics of COTI provides valuable insights into its utility, market behavior, and long-term potential. With a controlled inflation model and a clear distribution strategy, COTI is positioned to support a wide range of applications in the evolving landscape of digital finance. Whether you are a beginner or an intermediate investor, grasping these concepts is essential for making informed decisions regarding your investment in COTI.

Price History and Market Performance

Overview of COTI’s Price Journey

COTI (Currency of the Internet) is a cryptocurrency designed to facilitate fast and secure payments. It aims to provide an enterprise-grade fintech solution that allows businesses to create their own payment networks. Since its inception, COTI has experienced notable price fluctuations, influenced by various market dynamics and technological developments.

Key Historical Price Milestones

COTI’s price history is marked by several significant milestones that reflect its growth and the evolving cryptocurrency landscape:

-

Initial Launch and Early Trading: COTI was launched in late 2019. It initially traded at around $0.006226, marking its all-time low on November 9, 2019. This early phase was characterized by low market visibility and limited adoption.

-

Initial Growth Phase: Following its launch, COTI began to gain traction, and by the end of 2020, its price had increased significantly. This growth was attributed to rising interest in decentralized finance (DeFi) and the broader cryptocurrency market rally.

-

All-Time High: COTI reached its all-time high of approximately $0.6826 on October 31, 2021. This surge can be attributed to a combination of factors, including increased adoption of blockchain technology, partnerships with various enterprises, and growing demand for its unique payment solutions.

-

Market Correction: Following its peak, COTI, like many cryptocurrencies, experienced a significant market correction. By late 2022, the price had dropped sharply, reflecting broader market trends in the cryptocurrency ecosystem, where many digital assets faced downward pressure.

-

Recent Performance: As of October 2023, COTI is trading at around $0.04955, with a market capitalization of approximately $116 million. The price has shown some resilience, with a 24-hour trading volume of around $6.36 million, indicating active trading and interest in the asset despite past volatility.

Factors Influencing the Price

Historically, the price of COTI has been influenced by a variety of factors, both internal and external to the cryptocurrency market:

-

Market Sentiment: Like many cryptocurrencies, COTI’s price is heavily influenced by overall market sentiment. Bullish trends in the cryptocurrency market, driven by investor optimism and increased media coverage, tend to boost prices, while bearish sentiment can lead to significant declines.

-

Technological Developments: COTI has made strides in enhancing its platform, including the introduction of COTI V2, which brought advanced cryptographic protocols and improvements in transaction speed and privacy. Announcements of technological upgrades often lead to positive price movements as they enhance investor confidence.

-

Partnerships and Use Cases: Strategic partnerships and real-world applications of COTI’s technology have historically contributed to its price performance. Collaborations with businesses looking to integrate blockchain solutions for payments can drive demand for COTI tokens, positively impacting the price.

-

Regulatory Environment: The evolving regulatory landscape for cryptocurrencies can also influence COTI’s price. Clarity or uncertainty regarding regulations can affect investor confidence and market participation. For instance, recent regulatory developments in the U.S. that provide clearer frameworks for cryptocurrency operations may have positively influenced COTI’s market position.

-

Market Competition: COTI operates in a competitive environment alongside other payment-focused cryptocurrencies and blockchain solutions. The emergence of new technologies or competitors can impact COTI’s market share and, consequently, its price.

-

Supply Dynamics: COTI has a total supply of 4.91 billion tokens, with approximately 2.34 billion currently in circulation. Market dynamics related to token supply, such as new releases or buybacks, can also influence price movements.

-

Community Engagement: COTI has cultivated a strong community of followers and developers, which is crucial for its ongoing success. Community engagement in governance and development often leads to increased interest and investment in the token, positively impacting its price.

Conclusion

COTI’s price history reflects a journey marked by significant milestones and fluctuations driven by various market dynamics. Understanding these factors is essential for investors and enthusiasts looking to grasp the potential of COTI within the broader cryptocurrency ecosystem. As the digital asset space continues to evolve, so too will the factors influencing COTI’s market performance.

Where to Buy coti crypto: Top Exchanges Reviewed

5. COTI on Kraken – Simplified Buying for New Investors!

Kraken stands out as a user-friendly exchange for purchasing COTI, allowing users to start with as little as $10. The platform supports various payment methods, including credit/debit cards, ACH deposits, and mobile wallets like Apple and Google Pay, enhancing accessibility for both novice and experienced investors. With its robust security measures and comprehensive resources, Kraken provides a reliable environment for buying digital assets.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Coti Exchanges – Your Gateway to Seamless Crypto Trading!

Coti exchanges, including prominent platforms like HTX (Huobi), Binance, KuCoin, and Kraken, offer users a robust environment for buying, selling, and trading COTI. What sets these exchanges apart is their high liquidity, user-friendly interfaces, and advanced trading features, making it easier for both novice and experienced investors to engage with COTI. Additionally, their strong security measures and diverse trading pairs enhance the overall trading experience.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. COTI Exchange – Best Prices for Buying & Selling!

This exchange stands out for its competitive pricing and user-friendly interface, making it an ideal platform for buying and selling COTI (ERC20). With a high rating of 4.8 from over 2,165 users, it offers comprehensive market data, including live charts and detailed insights on price, market cap, and circulating supply. Additionally, the exchange provides a free service, enhancing its appeal to both novice and experienced traders.

- Website: changenow.io

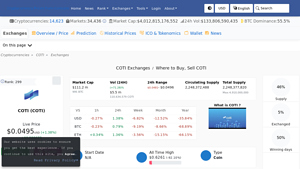

5. COTI – Your Gateway to Seamless Transactions!

COTI (COTI) is available on over 33 cryptocurrency exchanges, with Binance, Gate, and HTX leading the pack. These platforms offer a variety of trading pairs, including USDT, BUSD, TRY, and BTC on Binance, providing users with flexible options for buying, selling, and trading COTI. The strong presence on major exchanges enhances liquidity and accessibility, making it easier for investors to engage with this innovative digital asset.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

7. Gate.com – Your Gateway to Coti (COTI) Investing!

Gate.com distinguishes itself as a user-friendly cryptocurrency exchange by providing a straightforward 4-step guide to purchasing Coti (COTI). With an emphasis on low transaction fees and robust security measures, Gate.com ensures that both novice and experienced investors can navigate the buying process with ease. Its diverse range of available cryptocurrencies further enhances its appeal, making it a compelling choice for those looking to invest in digital assets.

- Website: gate.com

How to Buy coti crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying COTI (COTI crypto) is selecting a cryptocurrency exchange that lists COTI for trading. Some of the most popular exchanges where you can buy COTI include:

- Binance

- Coinbase

- KuCoin

- Kraken

- Toobit

When choosing an exchange, consider factors such as:

- User Experience: Look for a platform that is easy to navigate, especially if you are a beginner.

- Fees: Review the trading fees and withdrawal fees, as these can vary significantly between exchanges.

- Security: Ensure the exchange has robust security measures in place, such as two-factor authentication (2FA) and cold storage for funds.

- Payment Options: Check what payment methods are accepted (bank transfer, credit card, etc.).

Once you’ve selected an exchange, you can proceed to the next step.

2. Create and Verify Your Account

After choosing an exchange, you will need to create an account:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide your email address and create a password.

-

Verify Your Identity: Most exchanges require identity verification to comply with regulations. This may involve:

– Providing personal information (name, address, date of birth).

– Uploading identification documents (passport, driver’s license).

– Completing a facial verification process (if required). -

Enable Two-Factor Authentication (2FA): For added security, enable 2FA. This usually involves linking your account to an app like Google Authenticator or receiving codes via SMS.

3. Deposit Funds

With your account set up and verified, the next step is to deposit funds:

-

Choose Your Deposit Method: Most exchanges allow deposits through various methods such as bank transfers, credit/debit cards, or even other cryptocurrencies.

-

Select the Currency: If you are depositing fiat currency (like USD, EUR, etc.), select the currency you wish to deposit.

-

Initiate the Deposit: Follow the instructions provided by the exchange to complete your deposit. This may involve entering your bank details or card information.

-

Confirm the Deposit: After initiating the deposit, you may need to wait for the transaction to process. This can take anywhere from a few minutes to a couple of days, depending on the method used.

4. Place an Order to Buy COTI Crypto

Once your account is funded, you can place an order to buy COTI:

-

Navigate to the COTI Trading Pair: On the exchange, find the trading section and search for COTI. Look for the trading pair that corresponds with the currency you deposited (e.g., COTI/USD, COTI/USDT).

-

Select Order Type: You can usually choose between different order types:

– Market Order: This buys COTI at the current market price. It is the quickest way to purchase.

– Limit Order: This allows you to specify a price at which you want to buy COTI. Your order will only execute if the market reaches your specified price. -

Enter the Amount: Specify how much COTI you want to buy.

-

Review and Submit the Order: Double-check the details of your order, including fees, and click the “Buy” button to execute the transaction.

5. Secure Your Coins in a Wallet

After successfully purchasing COTI, it’s crucial to secure your coins:

-

Choose a Wallet: While you can store your COTI on the exchange, it’s safer to transfer it to a personal wallet. Options include:

– Software Wallets: Applications you can install on your computer or mobile device (e.g., Trust Wallet, Exodus).

– Hardware Wallets: Physical devices that store your crypto offline (e.g., Ledger, Trezor). These are generally considered the most secure option. -

Transfer COTI to Your Wallet: If you choose to use a wallet, you will need to transfer your COTI from the exchange:

– Go to your wallet and find your COTI receiving address.

– In the exchange, navigate to the withdrawal section, enter your wallet address, and confirm the withdrawal. -

Verify the Transfer: Check your wallet to ensure the COTI has arrived. Always double-check the wallet address before sending any funds to avoid loss.

By following these steps, you will have successfully purchased and secured your COTI crypto. Remember to stay informed about market trends and keep your wallet secure!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Technology

COTI (Currency of the Internet) positions itself as an enterprise-grade digital fintech platform that allows organizations to create their own payment solutions. Utilizing a proprietary protocol known as Trustchain, COTI offers a unique blend of scalability and security, crucial for businesses looking to digitize their financial operations. This technology allows for the creation of payment networks, stablecoins, and loyalty programs, making COTI attractive to enterprises seeking to innovate in the digital payment space.

Strong Market Position

COTI has established a solid market presence, boasting a market capitalization of approximately $116 million as of now. It is ranked #332 among cryptocurrencies, indicating a level of stability and recognition within the crypto ecosystem. The platform’s focus on enterprise solutions positions it well in the burgeoning fintech sector, which is increasingly adopting blockchain technology for its advantages in transparency, efficiency, and cost-effectiveness.

Growing Ecosystem and Use Cases

COTI’s V2 introduces advanced functionalities including confidential transactions and enhanced data protection through garbled circuits and multiparty computation (MPC). This development not only enhances the scalability and security of the Ethereum ecosystem but also enables a myriad of decentralized applications (dApps). The potential use cases range from DeFi applications to decentralized identity solutions, thereby broadening its appeal.

Community and Partnerships

COTI has garnered a strong community with over 300,000 followers across various social channels. This community support is vital for any cryptocurrency as it can foster adoption and engagement. Additionally, COTI’s collaborations with diverse business partners and its developer funding schemes suggest that the project is well-positioned for future growth and innovation.

Regulatory Compliance

COTI aims to align its encryption and security measures with industry standards from the outset, utilizing widely adopted schemes like AES-CTR and RSA. This focus on compliance and standardization may enhance its acceptance among businesses wary of regulatory scrutiny, potentially making COTI an attractive option for enterprises looking to navigate the complex landscape of digital finance.

Potential Risks and Challenges (The Bear Case)

Market Volatility

One of the most significant risks associated with investing in COTI, like any cryptocurrency, is market volatility. The price of COTI has experienced substantial fluctuations, with an all-time high of approximately $0.6826 in October 2021, followed by a significant decline of over 92% as of now. Such volatility can lead to dramatic changes in investment value, making it a high-risk asset for investors who may be unprepared for sharp price swings.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, with governments around the world grappling with how to manage and regulate digital assets. COTI’s focus on compliance may mitigate some risks, but regulatory uncertainty remains a significant concern. Changes in regulations could impact COTI’s operations, partnerships, and overall market viability, leading to potential legal challenges or restrictions that could hinder growth.

Competitive Landscape

COTI operates in a highly competitive market, facing challenges from other cryptocurrencies and blockchain solutions that offer similar functionalities. Established players like PayPal and emerging blockchain-based payment solutions pose significant competition. Additionally, new entrants in the blockchain space could quickly gain traction, thereby diluting COTI’s market share and limiting its growth potential.

Technological Risks

While COTI’s use of innovative technologies like garbled circuits and multiparty computation offers numerous advantages, it also introduces technological risks. The complexity of these systems could lead to vulnerabilities that may not be immediately apparent. Moreover, the reliance on Ethereum’s network for security means that any issues within the Ethereum ecosystem could directly affect COTI’s performance and reliability.

Adoption Challenges

Despite its potential, COTI faces hurdles in achieving widespread adoption. Businesses may be hesitant to transition to a new payment solution due to the costs and complexities involved in integrating new technologies. Additionally, the existing payment infrastructure is deeply entrenched, and persuading enterprises to switch to a blockchain-based solution like COTI may require substantial effort and time.

Conclusion

In conclusion, COTI presents a compelling investment opportunity characterized by innovative technology, a robust market position, and a growing ecosystem. However, potential investors must also weigh the risks associated with market volatility, regulatory uncertainty, competition, technological challenges, and adoption hurdles. As with any investment in the cryptocurrency space, thorough research and understanding of both the potential strengths and risks are essential before making any financial commitments.

Frequently Asked Questions (FAQs)

1. What is COTI crypto?

COTI (Currency Of The Internet) is a blockchain-based platform designed to facilitate fast and secure digital payments. It operates as a Layer 2 solution on Ethereum, utilizing advanced cryptographic protocols like Garbled Circuits and Multi-Party Computation (MPC) to enhance transaction privacy and efficiency. COTI aims to provide a robust infrastructure for enterprises to create their own payment solutions, stablecoins, and loyalty programs while eliminating intermediaries.

2. Who created COTI crypto?

COTI was founded by a team of fintech and blockchain experts, including David Assia, who serves as the CEO. The team has a strong background in technology, finance, and business development, aiming to revolutionize digital payments through innovative solutions that leverage blockchain technology.

3. What makes COTI crypto different from Bitcoin?

COTI differs from Bitcoin in several key ways:

– Purpose: While Bitcoin is primarily a decentralized digital currency and a store of value, COTI is designed specifically for payment processing and financial applications.

– Scalability: COTI employs a unique consensus algorithm and Layer 2 technology, enabling faster transactions and lower fees compared to Bitcoin’s proof-of-work mechanism.

– Privacy: COTI utilizes advanced cryptographic techniques like Garbled Circuits to offer confidential transactions, a feature that Bitcoin lacks.

4. Is COTI crypto a good investment?

Investing in COTI can be considered based on various factors, including its market potential, technological advancements, and overall market conditions. As of now, COTI has shown significant growth potential, evidenced by its increasing adoption for various fintech applications. However, like all cryptocurrencies, it carries risks, and potential investors should conduct thorough research and consider their risk tolerance before investing.

5. Where can you buy COTI crypto?

COTI can be purchased on several centralized exchanges, including Binance, Coinbase, KuCoin, and Kraken. It is advisable to compare trading fees and supported trading pairs on these platforms before making a purchase. Additionally, COTI can also be tracked in real-time using cryptocurrency market tracking apps like CoinMarketCap and CoinGecko.

6. What is the current market performance of COTI?

As of the latest data, COTI is trading at approximately $0.04955 with a market capitalization of around $116 million. The circulating supply is about 2.34 billion COTI tokens, with a maximum supply capped at 4.91 billion tokens. The price has experienced fluctuations, with an all-time high of $0.6826 reached in October 2021.

7. How does COTI ensure transaction security?

COTI employs a combination of advanced cryptographic techniques and established encryption standards to secure transactions. This includes using widely adopted symmetric-key and asymmetric-key schemes, ensuring that security measures are in line with those used by major financial institutions. Furthermore, the decentralized sequencer model enhances network security by distributing transaction ordering responsibilities among multiple participants.

8. What are the future prospects for COTI crypto?

COTI’s future prospects appear promising due to its focus on enterprise-grade digital payment solutions and the growing demand for scalable and secure blockchain applications. The platform’s unique features, including its privacy capabilities and decentralized architecture, position it well in the rapidly evolving fintech landscape. However, the cryptocurrency market is inherently volatile, and potential investors should monitor market trends and project developments closely.

Final Verdict on coti crypto

Overview of COTI

COTI is a unique cryptocurrency and blockchain platform designed to facilitate fast, secure, and private transactions. Positioned as an enterprise-grade digital fintech solution, COTI allows businesses to create tailored payment systems while eliminating intermediaries. Its proprietary Trustchain protocol underpins the network, enabling efficient processing of transactions and the digitization of various currencies.

Technology and Innovations

At the core of COTI’s technology is its innovative use of garbled circuits and multiparty computation (MPC), which significantly enhances privacy and scalability on the Ethereum blockchain. This advanced cryptographic framework offers a competitive edge by being approximately 1000 times faster and 250 times better in terms of latency compared to traditional methods. The introduction of a decentralized sequencer model further strengthens network security by distributing transaction ordering responsibilities, thus mitigating risks associated with centralized systems.

Market Position and Potential

As of now, COTI is ranked #332 in market capitalization with a value of around $0.04955 and a market cap of approximately $116 million. Despite experiencing a significant drop from its all-time high of $0.6826, COTI has shown resilience and potential for growth, especially as the demand for privacy-focused and scalable blockchain solutions continues to rise. Its strong community and active development efforts are promising indicators for its future.

Investment Considerations

However, it is essential to acknowledge that investing in cryptocurrencies, including COTI, carries inherent risks. The digital asset space is known for its volatility, and while the potential for high rewards exists, so do the possibilities of substantial losses. Therefore, it is crucial for investors—both beginners and experienced ones—to conduct thorough research (DYOR) before making any investment decisions. Understanding the technology, market dynamics, and personal financial goals will be pivotal in navigating this complex landscape.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.