Should You Invest in centrifuge crypto? A Full Analysis (2025)

An Investor’s Introduction to centrifuge crypto

Centrifuge crypto, represented by the native token CFG, is a pioneering decentralized asset financing protocol that bridges the gap between decentralized finance (DeFi) and real-world assets (RWA). Launched in 2017 by Lucas Vogelsang and Martin Quensel, Centrifuge aims to democratize access to liquidity for small and medium-sized enterprises (SMEs) while offering investors stable, income-generating opportunities that are less susceptible to the volatility typically associated with cryptocurrencies. The platform allows users to tokenize various types of real-world assets, such as invoices, real estate, and royalties, enabling these assets to be used as collateral for financing through its decentralized application (DApp) called Tinlake.

Centrifuge stands out in the crypto market due to its unique approach to asset tokenization. Unlike many blockchain projects that focus solely on cryptocurrencies, Centrifuge enables the integration of tangible assets into the DeFi ecosystem, thereby enhancing liquidity and providing a more stable investment avenue. By utilizing the Polkadot network for its blockchain infrastructure, Centrifuge benefits from lower transaction fees and faster processing times, making it a robust platform for both issuers and investors.

This guide aims to serve as a comprehensive resource for beginners and intermediate investors interested in understanding Centrifuge crypto. We will delve into several key areas:

Technology Overview

An exploration of the underlying technology that powers Centrifuge, including its use of smart contracts, the tokenization process, and the functionality of the Tinlake DApp.

Tokenomics

A breakdown of CFG’s tokenomics, covering aspects such as total supply, distribution, use cases, and the economic incentives for staking and governance participation.

Investment Potential

An analysis of the investment opportunities presented by Centrifuge, including its market performance, historical price trends, and potential for growth within the broader DeFi landscape.

Risks and Considerations

A discussion of the risks associated with investing in Centrifuge, including market volatility, regulatory challenges, and the inherent risks of DeFi protocols.

How to Buy Centrifuge

A practical guide on how to purchase CFG tokens, including the exchanges where they are available, and tips for securely managing your assets.

By the end of this guide, you will have a well-rounded understanding of Centrifuge crypto, empowering you to make informed investment decisions in this innovative sector of the cryptocurrency market.

What is centrifuge crypto? A Deep Dive into its Purpose

Introduction to Centrifuge

Centrifuge is a decentralized asset financing protocol that connects traditional finance with decentralized finance (DeFi) by enabling the tokenization of real-world assets (RWAs). Its primary mission is to lower the cost of capital for small and mid-sized enterprises (SMEs) while providing investors with stable and reliable income streams. By leveraging blockchain technology, Centrifuge aims to democratize access to financial resources and bridge the gap between real-world assets and the digital economy.

The Core Problem It Solves

In the traditional financial landscape, SMEs often face significant challenges when trying to access capital. These businesses may lack the necessary credit history or collateral to secure loans from banks, leading to a reliance on high-interest financing options. Additionally, the process of securing loans can be lengthy and cumbersome, further hindering business growth.

Centrifuge addresses these issues by allowing businesses to tokenize their assets, such as invoices, real estate, and royalties. Once tokenized, these assets can be used as collateral to access financing through Centrifuge’s decentralized application (DApp) called Tinlake. This process not only simplifies access to liquidity but also reduces reliance on traditional financial intermediaries, such as banks. By tapping into the liquidity available in DeFi, SMEs can secure funding more efficiently and at a lower cost.

Moreover, Centrifuge aims to provide investors with a stable source of income by enabling them to invest in tokenized real-world assets. This is especially important in a market where many cryptocurrencies experience significant volatility. By linking investments to tangible assets, Centrifuge offers a way for investors to diversify their portfolios and reduce risk.

Its Unique Selling Proposition

Centrifuge’s unique selling proposition lies in its ability to integrate real-world assets into the DeFi ecosystem seamlessly. The platform is built on the Polkadot blockchain, which allows for high-speed transactions and low fees. Its structure also enables the creation of non-fungible tokens (NFTs) that represent the tokenized assets. These NFTs can then be funded through Tinlake, which is designed to access liquidity on Ethereum.

Key features of Centrifuge include:

-

Asset-Agnostic Tokenization: Centrifuge allows users to tokenize a wide variety of asset classes without restrictions. This flexibility enables businesses from different sectors to access financing through the platform.

-

Integration with DeFi Protocols: By facilitating the tokenization of real-world assets, Centrifuge creates a bridge between traditional finance and DeFi. This integration allows users to obtain liquidity without the slowdowns typically associated with traditional lending processes.

-

Transparency and Real-Time Data: The platform offers investors and asset managers access to real-time on-chain data, enabling them to monitor asset performance and make informed decisions. This level of transparency is crucial for building trust in the DeFi space.

-

Security and Low Costs: Centrifuge benefits from the security features of the Polkadot network, utilizing a Nominated Proof-of-Stake (NPoS) mechanism. This ensures that the network remains secure while keeping transaction costs low.

-

Decentralized Governance: The CFG token, the native cryptocurrency of Centrifuge, plays a vital role in the platform’s governance, staking, and transaction fee payment. This decentralized governance model empowers the community to participate in decision-making processes regarding the platform’s future.

The Team and Backers

Centrifuge was co-founded in 2017 by Lucas Vogelsang and Martin Quensel. Lucas Vogelsang serves as the CEO and is a seasoned entrepreneur with a background in e-commerce and technology. He co-founded the successful e-commerce startup DeinDeal and later worked with Taulia, a company focused on financial technology solutions. His experience has equipped him with the skills needed to lead Centrifuge’s mission of integrating real-world assets into the blockchain ecosystem.

Martin Quensel, the COO, also co-founded Taulia and has a strong background in software development and architecture. His technical expertise and experience in financial technology are invaluable to Centrifuge’s operations and development.

Centrifuge has garnered support from various notable investors and partners in the blockchain and finance sectors. The project has attracted attention from venture capital firms and industry leaders who recognize the potential of tokenizing real-world assets. Collaborations with established DeFi protocols, such as Aave and MakerDAO, further enhance Centrifuge’s credibility and market presence.

Conclusion: Centrifuge’s Fundamental Purpose in the Crypto Ecosystem

Centrifuge’s fundamental purpose within the crypto ecosystem is to create a bridge between traditional finance and decentralized finance, enabling the tokenization of real-world assets. By addressing the challenges faced by SMEs in accessing capital and providing investors with stable income opportunities, Centrifuge aims to democratize finance and foster innovation within the financial sector.

The platform’s unique features, combined with its commitment to transparency, security, and decentralization, position Centrifuge as a vital player in the growing landscape of tokenized finance. As the demand for innovative financial solutions continues to rise, Centrifuge is poised to make a significant impact, paving the way for a more inclusive and efficient financial system.

The Technology Behind the Coin: How It Works

Introduction to Centrifuge’s Technology

Centrifuge is a decentralized finance (DeFi) protocol that connects real-world assets (RWAs) with blockchain technology, enabling asset tokenization and efficient financing solutions. By leveraging the capabilities of blockchain, Centrifuge aims to lower capital costs for small and mid-sized enterprises (SMEs) while providing investors with stable income sources. This guide will delve into the core technological components that make Centrifuge a pioneering platform in the realm of tokenized finance.

Blockchain Architecture

Centrifuge operates on its own blockchain, which is built on the Polkadot ecosystem. This architecture enables it to benefit from the unique features of Polkadot while maintaining its independent functionality. The architecture consists of several key components:

-

Parachains: Centrifuge is one of the first projects to launch a parachain on the Polkadot network. Parachains are independent blockchains that run in parallel to the main Polkadot relay chain. This allows Centrifuge to achieve high throughput and low transaction costs, as it can process transactions more efficiently than a standalone blockchain.

-

Smart Contracts: Centrifuge utilizes smart contracts to automate various processes, including asset tokenization, lending, and liquidity provision. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This eliminates the need for intermediaries, reducing costs and increasing transaction speed.

-

Asset Tokenization: One of the standout features of Centrifuge is its ability to tokenize real-world assets. This process involves converting physical assets, such as invoices, real estate, and royalties, into digital tokens. These tokens can then be used as collateral in the Centrifuge ecosystem, allowing asset owners to access liquidity without relying on traditional financial institutions.

Consensus Mechanism

Centrifuge employs a Nominated Proof-of-Stake (NPoS) consensus mechanism to secure its network. This mechanism is designed to ensure the integrity and security of the blockchain while promoting decentralization. Here’s how it works:

-

Staking: In NPoS, users can stake their CFG tokens to participate in the network’s governance and validation processes. By locking up their tokens, they contribute to the security of the network and can earn rewards for their participation.

-

Nominators and Validators: Users can nominate validators to secure the network. Validators are responsible for producing new blocks and confirming transactions. This model incentivizes good behavior, as both validators and nominators can lose their staked tokens if a validator acts maliciously or fails to perform their duties.

-

Low Costs and High Security: The NPoS mechanism allows Centrifuge to maintain low transaction fees while ensuring a high level of security. The reliance on the Polkadot relay chain further enhances security by providing a robust layer of protection against attacks.

Key Technological Innovations

Centrifuge incorporates several innovative technologies that set it apart from traditional finance and other DeFi protocols. These innovations enhance its functionality and usability:

-

Tinlake DApp: Tinlake is the first decentralized application (DApp) built on the Centrifuge chain. It connects asset originators (those who provide real-world assets) with investors looking for stable returns. By using Tinlake, businesses can tokenize their assets and access liquidity from the Ethereum ecosystem, which broadens their funding options.

-

NFTs for Real-World Assets: Centrifuge has pioneered the use of non-fungible tokens (NFTs) for representing real-world assets. Unlike standard cryptocurrencies, which are interchangeable, NFTs are unique digital tokens that can represent ownership of specific assets. This innovation allows for precise ownership tracking and enhances the ability to leverage these assets in the DeFi space.

-

Interoperability with DeFi Protocols: Centrifuge is designed to work seamlessly with other DeFi protocols. This interoperability allows users to leverage various DeFi services, such as lending and borrowing, without facing the traditional barriers associated with accessing different platforms. By integrating with protocols like Aave and MakerDAO, Centrifuge enhances liquidity and creates new opportunities for users.

-

Real-Time Data Access: Centrifuge provides users with real-time access to on-chain data, enabling them to monitor asset performance and make informed decisions. This transparency is crucial for both investors and asset managers, as it enhances trust and accountability within the ecosystem.

-

Decentralized Governance: The Centrifuge network is governed by its community through a decentralized governance model. CFG token holders can propose and vote on changes to the protocol, ensuring that the platform evolves in a way that reflects the interests of its users. This democratic approach fosters a sense of ownership and engagement among participants.

Benefits of Centrifuge’s Technology

The technology behind Centrifuge offers several benefits to both asset originators and investors:

-

Access to Capital: By tokenizing real-world assets, Centrifuge allows SMEs to access capital without relying on traditional banks or financial intermediaries. This can significantly lower the cost of capital and provide businesses with more flexible financing options.

-

Stable Income for Investors: Investors can earn stable returns by financing real-world assets through the Centrifuge platform. The ability to diversify investments across various asset classes reduces risk and enhances income stability.

-

Increased Liquidity: Tokenization of assets increases liquidity in the market, as digital tokens can be traded or used as collateral more easily than their physical counterparts. This enhanced liquidity benefits both asset originators and investors.

-

Transparency and Security: The use of blockchain technology ensures that all transactions are recorded transparently and securely. This reduces the risk of fraud and enhances the credibility of the assets being tokenized.

-

Scalability: Centrifuge’s infrastructure is optimized for scalability, allowing it to handle an increasing number of transactions and assets as demand grows. This scalability is essential for accommodating the expanding DeFi landscape.

Conclusion

Centrifuge represents a significant advancement in the integration of real-world assets with decentralized finance. By leveraging innovative blockchain technology, it provides a platform that not only democratizes access to capital for SMEs but also offers investors a reliable and transparent way to earn stable returns. The combination of a robust architecture, an efficient consensus mechanism, and key technological innovations positions Centrifuge as a leader in the emerging field of tokenized finance. As the DeFi ecosystem continues to evolve, Centrifuge is well-positioned to play a crucial role in bridging the gap between traditional finance and blockchain technology.

Understanding centrifuge crypto Tokenomics

Centrifuge (CFG) is a unique cryptocurrency that plays a pivotal role in the decentralized finance (DeFi) ecosystem by bridging real-world assets (RWAs) with blockchain technology. The tokenomics of Centrifuge encompasses aspects such as supply, utility, and distribution, which are critical for understanding its functionality and investment potential.

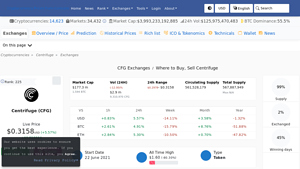

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 680,000,000 CFG |

| Max Supply | Not specified |

| Circulating Supply | 564,810,000 CFG |

| Inflation/Deflation Model | 3% annual inflation |

Token Utility (What is the coin used for?)

The CFG token serves multiple purposes within the Centrifuge ecosystem, enhancing its utility for both users and investors:

-

Staking: Users can stake CFG tokens to participate in the network’s security and governance. By staking, users help secure the network and are rewarded with additional tokens, incentivizing long-term holding and commitment to the platform.

-

Transaction Fees: CFG is used to pay transaction fees within the Centrifuge network. This fee structure not only helps maintain network operations but also creates a demand for the token, as users must hold CFG to engage in various activities on the platform.

-

Governance Participation: Token holders are granted voting rights, allowing them to influence decisions regarding network upgrades, changes in protocol, and other governance matters. This decentralized approach ensures that the community has a say in the direction of the project.

-

Liquidity Rewards: Investors who provide liquidity to the Tinlake protocol, Centrifuge’s decentralized application for asset financing, are rewarded with CFG tokens. This mechanism encourages liquidity provision, which is vital for the health of the DeFi ecosystem.

-

Collateralization: CFG tokens can be used as collateral within the Centrifuge ecosystem, allowing users to access loans by tokenizing their real-world assets. This feature connects traditional finance with DeFi, enabling companies to leverage their assets for liquidity without relying on banks or intermediaries.

Token Distribution

The distribution of CFG tokens is crucial for understanding the incentives and governance structure of the Centrifuge network. The total supply of CFG is allocated as follows:

-

Core Contributors (27%): This portion is allocated to the team behind Centrifuge, rewarding their efforts and ensuring they have a vested interest in the project’s success.

-

Backers (17.1%): This allocation goes to investors and supporters who contributed during the initial funding rounds, reflecting their role in the project’s early development.

-

Rewards and Grants (7.3%): These tokens are reserved for incentivizing community engagement and rewarding users who contribute to the network’s growth.

-

Community Sale (9.5%): A portion of tokens was made available for public sale, allowing a broader audience to participate in the project.

-

Foundation Endowment (11.8%): This allocation supports the long-term sustainability of the project, providing funds for future development and community initiatives.

-

Community Grants (7.1%): Tokens set aside for community-driven projects and initiatives that align with Centrifuge’s goals.

-

Development Grants (10.8%): These funds support developers working on projects that enhance the Centrifuge ecosystem.

-

Early Ecosystem (8.3%): This allocation is aimed at fostering early partnerships and collaborations that can help expand Centrifuge’s reach and capabilities.

Conclusion

The tokenomics of Centrifuge (CFG) is designed to create a sustainable and efficient ecosystem that connects real-world assets with decentralized finance. With a total supply of 680 million tokens, CFG serves various functions, including staking, transaction fee payment, governance, and liquidity rewards. The strategic distribution of tokens ensures that core contributors, investors, and the community are aligned in their interests, promoting long-term growth and stability within the network.

Understanding these elements is crucial for both new and experienced investors looking to navigate the evolving landscape of DeFi and real-world asset tokenization. As Centrifuge continues to develop its platform and expand its partnerships, the CFG token’s utility and demand are likely to grow, making it an asset worth considering in a diversified investment portfolio.

Price History and Market Performance

Key Historical Price Milestones

Centrifuge (CFG) has experienced a dynamic price trajectory since its inception, reflecting the broader trends within the cryptocurrency market and the specific developments surrounding the Centrifuge platform.

-

Initial Launch and Early Trading: Centrifuge launched its token, CFG, in May 2021. During its initial trading phase, the price fluctuated around $0.30 to $0.50 as investors began to explore its potential in the decentralized finance (DeFi) space.

-

All-Time High: The token reached its all-time high of approximately $2.58 on October 14, 2021. This peak occurred during a broader cryptocurrency market rally, fueled by heightened interest in DeFi projects and the growing trend of tokenizing real-world assets.

-

Market Correction: Following its all-time high, CFG, like many cryptocurrencies, faced a significant market correction. By early 2022, the price began to decline, reflecting a bearish sentiment in the overall market, which was exacerbated by macroeconomic factors such as rising inflation and tightening monetary policies.

-

Subsequent Price Fluctuations: The price continued to experience volatility throughout 2022 and into 2023. By the end of 2022, CFG had dropped to approximately $0.50, showcasing the impact of ongoing market trends and investor sentiment.

-

Recent Performance: As of October 2023, the price of CFG is around $0.3149, with a market capitalization of approximately $177.86 million. The token has shown resilience, recovering from its lows, and has been trading within a range of $0.2962 to $0.3158 over the past 24 hours.

Factors Influencing the Price

Historically, the price of Centrifuge has been influenced by a variety of factors, both internal to the project and external market conditions.

1. Market Trends

The cryptocurrency market is notorious for its volatility, and Centrifuge is no exception. The price of CFG has often mirrored the movements of major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). For instance, the surge in CFG’s price to its all-time high in late 2021 coincided with a significant bull run in the cryptocurrency market, where many altcoins experienced substantial gains.

2. Adoption and Use Cases

Centrifuge’s unique value proposition lies in its ability to tokenize real-world assets, connecting decentralized finance with traditional finance. The adoption of the Centrifuge platform by businesses seeking to tokenize their assets has played a crucial role in influencing the price of CFG. Increased usage of its Tinlake application, which allows users to lend and borrow against tokenized assets, has historically led to price rallies as more investors recognize the utility of the platform.

3. Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has also impacted CFG’s price. Announcements of regulatory scrutiny or favorable legislation can lead to price fluctuations. For example, news about regulatory clarity for DeFi projects has historically resulted in positive sentiment and price increases, while concerns over potential crackdowns have led to declines.

4. Technological Developments

Technological advancements and upgrades to the Centrifuge platform can influence investor sentiment and thus the price of CFG. Major updates, partnerships, or integrations with other DeFi protocols are often met with positive reactions from the market. For instance, collaborations with other blockchain projects or enhancements to the platform’s features have historically led to increased trading volume and price appreciation.

5. Overall Economic Conditions

Broader economic factors, such as inflation rates, interest rates, and global financial stability, have also played a role in CFG’s price movements. During periods of economic uncertainty, investors may turn to cryptocurrencies as an alternative asset class, which can drive up prices. Conversely, during periods of economic stability, traditional investments may be favored, potentially leading to declines in cryptocurrency prices, including CFG.

6. Market Sentiment

Investor sentiment, driven by social media trends, news articles, and market analyses, significantly impacts the price of CFG. Positive news coverage, community engagement, and endorsements from influential figures in the crypto space can lead to increased demand and price surges. On the other hand, negative sentiment or fear can trigger sell-offs, leading to price declines.

Conclusion

In summary, the price history and market performance of Centrifuge (CFG) illustrate the complexities of investing in cryptocurrencies. As a project focused on bridging traditional finance with decentralized finance through the tokenization of real-world assets, its price has been influenced by a multitude of factors, including market trends, adoption rates, regulatory changes, technological advancements, economic conditions, and investor sentiment. Understanding these influences can provide valuable insights for both new and experienced investors looking to navigate the evolving landscape of digital assets.

Where to Buy centrifuge crypto: Top Exchanges Reviewed

5. Centrifuge – Your Ultimate Guide to Buying CFG Today!

Kraken offers a user-friendly platform for purchasing Centrifuge (CFG), allowing users to start with as little as $10. The exchange stands out for its diverse payment options, including credit/debit cards, ACH deposits, and mobile payment solutions like Apple and Google Pay, enhancing accessibility for both novice and experienced investors. Kraken’s robust security measures and comprehensive trading tools further solidify its reputation as a trusted choice in the cryptocurrency market.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. ChangeNOW – Top Choice for Instant CFG Exchanges!

ChangeNOW stands out as a premier platform for trading Centrifuge (CFG) due to its competitive pricing and user-friendly interface. With a high rating of 4.8 from over 2,161 users, it offers instant exchanges without hidden fees, making it an attractive option for both novice and experienced traders. Additionally, ChangeNOW provides real-time price charts and educational resources, enhancing the overall trading experience while ensuring users get the best rates for their CFG transactions.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

5 Steps to Seamless Centrifuge (CFG) Purchases!

The “How to Buy Centrifuge (CFG) Guide 2025” on CoinCodex highlights the top exchanges for purchasing CFG, emphasizing their reliability and user-friendly interfaces. Notably, platforms like KuCoin, Kraken, and OKX stand out for their robust security features, extensive trading options, and competitive fees, making them ideal choices for both novice and experienced investors looking to acquire Centrifuge tokens with ease and confidence.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Centrifuge (CFG) – Your Gateway to Decentralized Finance!

Centrifuge (CFG) is available on more than 12 cryptocurrency exchanges, with MEXC Global, Gate, and OKEX leading the pack. These platforms stand out for their robust trading features, user-friendly interfaces, and high liquidity, making it easy for users to buy, sell, and trade CFG. Additionally, their commitment to security and customer support enhances the overall trading experience, appealing to both novice and experienced investors.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy centrifuge crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Centrifuge (CFG) is to choose a reliable cryptocurrency exchange where you can purchase the tokens. Popular exchanges that list Centrifuge include:

- Coinbase

- Binance

- Kraken

- KuCoin

- BitZ

When selecting an exchange, consider factors such as security features, fees, user experience, and the availability of trading pairs with your preferred fiat currency (e.g., USD, EUR). It’s important to choose an exchange that is accessible in your country and complies with local regulations.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how to do it:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button.

- Provide Information: Fill in the required information, including your email address, password, and any other necessary details.

- Verification: Most exchanges require identity verification to comply with regulations. You will need to provide a government-issued ID (like a passport or driver’s license) and possibly a utility bill or bank statement to confirm your address.

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA using an authenticator app or SMS verification.

3. Deposit Funds

After your account is set up and verified, the next step is to deposit funds. Here’s how to do it:

- Choose a Deposit Method: Exchanges typically offer several methods for depositing funds, including bank transfers, credit/debit cards, and sometimes PayPal or other payment services.

- Select Your Currency: Choose the fiat currency you wish to deposit (e.g., USD, EUR).

- Follow the Instructions: Follow the on-screen instructions to complete the deposit. If you are using a bank transfer, ensure you provide the correct details to avoid delays.

- Wait for Confirmation: Depending on the deposit method, it may take some time for your funds to appear in your exchange account. Bank transfers can take longer than card deposits.

4. Place an Order to Buy Centrifuge Crypto

With your account funded, you are ready to buy Centrifuge (CFG). Here’s how to place an order:

- Navigate to the Trading Section: Find the trading or markets section on the exchange’s platform.

- Select CFG: Search for Centrifuge (CFG) in the list of available cryptocurrencies. You may need to select a trading pair (e.g., CFG/USD, CFG/EUR).

- Choose Order Type: Decide whether you want to place a market order (buy at the current price) or a limit order (set a specific price at which you want to buy).

- Enter the Amount: Specify how much CFG you want to purchase.

- Review and Confirm: Double-check the details of your order, including fees, and then click the “Buy” or “Place Order” button.

5. Secure Your Coins in a Wallet

After successfully purchasing Centrifuge, it’s important to secure your tokens. Here are the steps to store your CFG safely:

- Choose a Wallet: You can store your CFG in a hot wallet (online) or a cold wallet (offline). Popular wallet options include:

– Hot Wallets: MetaMask, Trust Wallet, or the wallet provided by the exchange.

– Cold Wallets: Ledger, Trezor, or any hardware wallet that supports CFG. - Transfer Your Tokens: If you bought CFG on an exchange, it is recommended to transfer them to your personal wallet for better security. To do this, go to your wallet, find the option to receive tokens, and copy your wallet address.

- Withdraw from the Exchange: Go back to the exchange, navigate to your CFG holdings, and select the option to withdraw. Paste your wallet address and confirm the transaction.

- Verify the Transfer: Once the transfer is complete, check your wallet to ensure that the CFG tokens have arrived safely.

Conclusion

Buying Centrifuge (CFG) can be a straightforward process if you follow these steps. Always remember to conduct thorough research on any platform you use and prioritize the security of your investments. With the right approach, you can effectively add CFG to your cryptocurrency portfolio.

Investment Analysis: Potential and Risks

Overview of Centrifuge Crypto (CFG)

Centrifuge (CFG) is a decentralized asset financing protocol that connects decentralized finance (DeFi) with real-world assets (RWA). It aims to lower the cost of capital for small and mid-sized enterprises (SMEs) while providing investors with a stable source of income. The platform allows companies to tokenize real assets and use these tokens as collateral to access financing through its decentralized application, Tinlake. This unique positioning offers several potential benefits, but it also comes with inherent risks.

Potential Strengths (The Bull Case)

1. Innovative Tokenization of Real-World Assets

Centrifuge’s core innovation lies in its ability to tokenize real-world assets, such as invoices, real estate, and royalties. By converting these assets into non-fungible tokens (NFTs), Centrifuge facilitates their integration into the DeFi ecosystem. This not only broadens the scope of assets available for investment but also introduces a new layer of liquidity to traditionally illiquid markets.

2. Access to Diverse Investment Opportunities

Investors using Centrifuge can access a diverse spectrum of tokenized assets across the credit yield curve. The ability to invest in real-world assets provides opportunities for portfolio diversification, which can be appealing to those seeking to mitigate risks associated with more volatile cryptocurrencies.

3. Potential for Stable Returns

One of the significant attractions of investing in real-world assets through Centrifuge is the potential for stable returns. Since these assets are typically less volatile than cryptocurrencies, they can provide a more predictable income stream. This could be particularly attractive to conservative investors or those looking to balance their portfolios with less risk-prone investments.

4. Robust Infrastructure and Ecosystem

Centrifuge offers a comprehensive platform that includes features like real-time data access, advanced reporting, and operational efficiency. The platform is designed to support any issuer or asset type, providing flexibility and scalability. Additionally, being built on Polkadot enhances its performance and lowers transaction costs, making it a compelling choice for asset managers and investors alike.

5. Growing Institutional Interest

Centrifuge has been able to attract significant institutional interest, which is crucial for its long-term viability. Partnerships with established financial entities, such as Aave and BlockTower Capital, indicate a growing acceptance of tokenized real-world assets in the broader financial ecosystem. This could lead to increased liquidity and higher demand for CFG tokens.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Despite the relative stability of real-world assets compared to cryptocurrencies, the broader crypto market is known for its volatility. This could impact the value of CFG tokens and the overall sentiment towards Centrifuge. A downturn in the crypto market could lead to reduced investor confidence, which may adversely affect the platform’s performance and adoption.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and tokenized assets is still evolving. Governments worldwide are grappling with how to regulate these new financial instruments, and changes in regulations could pose significant risks. For instance, if stricter regulations are imposed on tokenization or DeFi platforms, it could limit Centrifuge’s operational capabilities or increase compliance costs, potentially affecting its growth and profitability.

3. Competition from Other Platforms

Centrifuge operates in a rapidly growing sector of the blockchain space, which has attracted numerous competitors. Other projects are also exploring the tokenization of real-world assets, and some may offer more advanced features or better user experiences. This competitive landscape could pose challenges for Centrifuge in terms of market share and user acquisition.

4. Technological Risks

While blockchain technology offers numerous advantages, it is not without its risks. Issues such as smart contract vulnerabilities, network congestion, or even bugs in the Centrifuge codebase could lead to significant problems, including loss of funds or operational failures. Investors should be aware that while the technology is innovative, it also requires ongoing maintenance and vigilance against potential exploits.

5. Dependence on Ethereum and Polkadot

Centrifuge’s functionality is heavily reliant on the Ethereum and Polkadot ecosystems. Any issues affecting these networks, such as congestion or security vulnerabilities, could impact Centrifuge’s operations. Additionally, changes in the underlying protocols or governance structures of these blockchains could have unforeseen effects on Centrifuge’s performance and token utility.

Conclusion

Investing in Centrifuge (CFG) presents a unique opportunity to gain exposure to the burgeoning field of tokenized real-world assets, which could offer both diversification and stable returns. However, it is essential for potential investors to understand the inherent risks associated with market volatility, regulatory uncertainty, competition, and technological challenges.

As with any investment, conducting thorough research and considering one’s risk tolerance is crucial before making any decisions. The landscape of cryptocurrency and DeFi is continuously evolving, and staying informed will be key to navigating this dynamic environment successfully.

Frequently Asked Questions (FAQs)

1. What is Centrifuge Crypto (CFG)?

Centrifuge (CFG) is a decentralized asset financing protocol that bridges decentralized finance (DeFi) with real-world assets (RWA). The primary aim of Centrifuge is to lower the cost of capital for small and medium-sized enterprises (SMEs) while providing investors with stable income opportunities. It enables businesses to tokenize their real assets, such as invoices and real estate, and use these tokens as collateral for financing through its lending platform called Tinlake.

2. Who created Centrifuge Crypto?

Centrifuge was co-founded in 2017 by Lucas Vogelsang and Martin Quensel. Lucas Vogelsang serves as the CEO, while Martin Quensel is the COO. Both founders have backgrounds in technology and finance, with previous experience in startups and established companies, which they leverage to drive the growth and innovation of Centrifuge.

3. What makes Centrifuge Crypto different from Bitcoin?

While Bitcoin is primarily a digital currency designed for peer-to-peer transactions and a store of value, Centrifuge focuses on the tokenization of real-world assets and connecting them with the DeFi ecosystem. Centrifuge allows for the creation of asset-backed tokens that can be used for financing, thereby enabling access to liquidity for businesses. This asset-centric approach contrasts with Bitcoin’s role as a decentralized currency.

4. Is Centrifuge Crypto a good investment?

As with any investment, whether Centrifuge (CFG) is a good investment depends on individual risk tolerance, market conditions, and investment goals. CFG has demonstrated significant growth potential, particularly in the burgeoning field of real-world asset tokenization. However, potential investors should conduct thorough research, consider market trends, and possibly consult financial advisors before investing.

5. How does Centrifuge’s tokenization process work?

Centrifuge’s tokenization process involves converting real-world assets into non-fungible tokens (NFTs), which are then financed through the Tinlake DApp. This allows asset owners to leverage their assets for liquidity without relying on traditional banks or intermediaries. The tokens represent ownership of the underlying asset and can be used as collateral in the DeFi space.

6. What are the main use cases for Centrifuge (CFG) tokens?

The CFG token has several key use cases within the Centrifuge ecosystem:

– Staking: Users can stake CFG tokens to earn rewards and support network security.

– Transaction Fees: CFG tokens are used to pay transaction fees on the Centrifuge network.

– Governance Participation: Token holders can participate in governance decisions, influencing the future direction of the platform.

– Liquidity Rewards: CFG is also used to reward liquidity providers on the Tinlake platform.

7. Where can I buy Centrifuge (CFG) tokens?

Centrifuge (CFG) tokens can be purchased on various cryptocurrency exchanges. As of the latest data, CFG is available on platforms like BitZ and other decentralized exchanges. It’s advisable to check the most current listings and trading volumes on exchanges to find the best option for purchasing CFG tokens.

8. How is the Centrifuge network secured?

The Centrifuge network is secured through a combination of mechanisms. It operates on the Polkadot blockchain, which provides a robust layer of security through its Nominated Proof-of-Stake (NPoS) consensus mechanism. Users pay transaction fees in CFG tokens, which incentivizes honest behavior among network participants. Additionally, the integration with Polkadot’s relay chain ensures high security at lower operational costs.

Final Verdict on centrifuge crypto

Overview of Centrifuge Crypto

Centrifuge is a decentralized asset financing protocol that aims to bridge the gap between traditional finance and decentralized finance (DeFi) by enabling the tokenization of real-world assets (RWAs). By utilizing blockchain technology, Centrifuge allows small and mid-sized enterprises (SMEs) to access liquidity through its platform, facilitating a new way for companies to finance their operations without relying on traditional banking systems. The native token, CFG, plays a crucial role in the network, enabling staking, governance, and transaction fee payments.

Technology and Functionality

Centrifuge operates on the Polkadot blockchain, which is known for its high speed and low transaction costs. Its key application, Tinlake, allows users to fund tokenized RWAs while providing liquidity through Ethereum. The protocol’s asset-agnostic nature means that it can tokenize a diverse range of assets, including invoices, real estate, and royalties, making it a versatile tool for asset managers and investors alike. Furthermore, Centrifuge emphasizes transparency and security, offering real-time on-chain data to monitor asset performance and transactions.

Investment Potential and Risks

While Centrifuge presents an innovative approach to integrating RWAs into the DeFi ecosystem, it is essential to recognize that investing in CFG carries inherent risks. The cryptocurrency market is known for its volatility, and Centrifuge is no exception. As of now, CFG has experienced significant fluctuations in value, with an all-time high of $2.58 in 2021, but has since seen a decline. Potential investors should carefully consider their risk tolerance and investment strategies.

Conclusion

In summary, Centrifuge offers a promising platform for tokenizing real-world assets, providing unique opportunities for both asset managers and investors. However, it remains a high-risk, high-reward asset class. Therefore, it is crucial for potential investors to conduct their own thorough research (DYOR) to understand the complexities and risks involved before making any investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.