What is celsius crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to celsius crypto

Celsius is a notable player in the cryptocurrency landscape, primarily recognized for its innovative approach to decentralized finance (DeFi). Launched in June 2018, Celsius Network operates as a financial services platform that enables users to earn interest on their cryptocurrency deposits, secure loans, and engage in wallet-style transactions. Its native token, CEL, plays a pivotal role in enhancing user experience on the platform by offering various benefits, including higher interest rates and reduced borrowing costs.

The significance of Celsius in the crypto market lies in its mission to provide a more user-friendly alternative to traditional banking. Unlike conventional banks, which often impose hefty fees and low interest rates, Celsius aims to empower users with higher yields on their deposits—returning up to 80% of the interest generated from loans back to its users. This model not only attracts crypto investors seeking better financial returns but also creates a unique ecosystem where users can leverage their crypto holdings without needing to liquidate them.

However, the platform faced significant challenges, including filing for Chapter 11 bankruptcy in 2022. Despite emerging from bankruptcy in January 2024, the shutdown of its mobile and web apps in February 2024 marked a significant turning point in its operations. Nonetheless, the Celsius brand remains influential in the DeFi space, and its CEL token continues to be traded, albeit at a much lower market cap compared to its peak.

This guide serves as a comprehensive resource for both beginners and intermediate investors interested in Celsius crypto. It will delve into various aspects of the Celsius Network, including:

Technology

An exploration of the underlying technology that powers Celsius, including its modified proof-of-stake algorithm and the mechanics behind its lending and borrowing systems.

Tokenomics

A detailed analysis of the CEL token, its supply dynamics, and how it functions within the Celsius ecosystem to enhance user benefits.

Investment Potential

An evaluation of the investment landscape surrounding Celsius, including market trends, historical performance, and potential future growth.

Risks

An objective look at the inherent risks associated with investing in Celsius, especially in light of its recent bankruptcy proceedings and market volatility.

How to Buy

A straightforward guide on acquiring CEL tokens, including the various exchanges and methods available for potential investors.

By providing this structured overview, we aim to equip readers with the necessary knowledge to make informed decisions regarding their engagement with Celsius crypto.

What is celsius crypto? A Deep Dive into its Purpose

Understanding Celsius Crypto

Celsius is a cryptocurrency platform that offers a range of financial services, including earning interest on cryptocurrency deposits and providing loans against crypto holdings. The project was founded in 2017 by Alex Mashinsky and his team, and its native token, CEL, plays a central role in the ecosystem. This guide will explore the core problems Celsius aims to solve, its unique selling proposition, and the team and backers behind the project, providing a comprehensive understanding of its fundamental purpose in the crypto ecosystem.

The Core Problem It Solves

Celsius was created to address several challenges faced by cryptocurrency users and investors in the traditional banking system. One of the primary issues is the lack of viable options for earning interest on digital assets. Traditional banks often offer low interest rates on savings, which can discourage individuals from holding their funds in fiat currency. Conversely, Celsius allows users to earn significantly higher yields on their cryptocurrency deposits, making it an attractive alternative for savers in the crypto space.

Another critical problem is the difficulty many users face when trying to access liquidity without selling their crypto assets. Selling cryptocurrencies can trigger capital gains taxes and may result in missed opportunities for further appreciation. Celsius provides a solution by allowing users to borrow against their crypto holdings, enabling them to access cash without liquidating their assets. This feature is particularly beneficial for investors who wish to maintain their positions while still utilizing their assets for immediate financial needs.

Moreover, Celsius aims to simplify the lending and borrowing process, which can be complicated and fraught with high fees in traditional finance. By offering a user-friendly platform and eliminating many of the fees associated with traditional banking, Celsius makes it easier for users to engage with their digital assets.

Its Unique Selling Proposition

Celsius distinguishes itself from other platforms in several ways, primarily through its commitment to user-centric financial services. One of the standout features is its high yield on deposits. Celsius claims to return up to 80% of its revenue back to users in the form of interest, which is significantly higher than what traditional banks offer. This commitment to returning value to users fosters a community-oriented environment, where users feel valued and engaged.

Another unique aspect of Celsius is its CEL token, which serves multiple purposes within the ecosystem. Users can earn higher interest rates and lower loan rates by opting to receive their rewards in CEL. This token incentivizes users to hold and utilize CEL, creating a built-in demand for the asset. The loyalty program further enhances this by offering tiered rewards based on the amount of CEL held, allowing users to unlock additional benefits and discounts.

Celsius operates on a “no-fee” model, meaning that users do not face penalties for withdrawals or other transactions, which is a common pain point in traditional financial services. This transparency and lack of hidden fees resonate well with users who are wary of conventional banking practices.

The Team and Backers

Celsius was co-founded by Alex Mashinsky, a prominent figure in the tech and cryptocurrency industries. Mashinsky is known for his contributions to the development of Voice over Internet Protocol (VoIP) technology and has a long history of entrepreneurship. His vision for Celsius is rooted in providing accessible financial services that empower individuals to take control of their financial futures.

Alongside Mashinsky, co-founder Daniel Leon and Nuke Goldstein bring a wealth of experience in technology and finance to the project. Their combined expertise has been crucial in building a robust platform that meets the needs of a diverse user base. The founding team has also surrounded itself with a talented group of developers, advisors, and industry veterans, ensuring that Celsius remains at the forefront of innovation in the cryptocurrency space.

Celsius has garnered significant attention from both individual and institutional investors, which has helped to bolster its credibility and resources. Its funding rounds have attracted various backers, enabling the platform to expand its offerings and improve its services continually. The company’s commitment to compliance and regulatory standards has also positioned it as a trustworthy player in an often volatile market.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Celsius in the crypto ecosystem is to create a more accessible and rewarding financial system for users of digital assets. By offering competitive interest rates, easy access to loans, and a user-friendly interface, Celsius aims to bridge the gap between traditional finance and the burgeoning world of cryptocurrencies.

Celsius also plays a significant role in promoting the adoption of digital assets by providing a secure and transparent platform for users to manage their crypto portfolios. The integration of CEL as a utility token further enhances its ecosystem, encouraging users to engage actively with the platform and its offerings.

In summary, Celsius is more than just a cryptocurrency platform; it is a comprehensive financial service that aims to empower users by providing them with the tools and opportunities to maximize their digital assets’ potential. By focusing on high yields, user-centric services, and a robust team, Celsius is positioning itself as a key player in the evolving landscape of cryptocurrency finance.

The Technology Behind the Coin: How It Works

Introduction to Celsius Network Technology

Celsius Network is a platform designed to facilitate cryptocurrency lending and borrowing, enabling users to earn interest on their deposits while providing loans against their crypto holdings. Understanding the technology behind Celsius is essential for both beginners and intermediate investors who want to make informed decisions about using the platform. In this guide, we will explore the underlying technology of Celsius, including its blockchain architecture, consensus mechanism, and key innovations.

Blockchain Architecture

Celsius operates as a decentralized finance (DeFi) platform, primarily built on the Ethereum blockchain. Ethereum is known for its smart contract capabilities, which allow developers to create decentralized applications (dApps) that can automate complex processes without intermediaries.

Key Features of Celsius’s Blockchain Architecture

-

Smart Contracts: Celsius uses smart contracts to automate transactions between borrowers and lenders. When a user deposits cryptocurrency, a smart contract is created to manage the terms of the deposit, including interest rates and withdrawal conditions. This automation reduces the need for manual intervention, making the process faster and more secure.

-

ERC-20 Token Standard: The native token of Celsius, CEL, is an ERC-20 token. This means it adheres to a set of standards that allow it to be easily integrated with other Ethereum-based applications and wallets. This compatibility enables CEL to be traded on various exchanges and utilized within the Celsius ecosystem.

-

Decentralized Asset Management: Celsius manages user deposits through a system called the “Lending Stake Pool.” This pool aggregates funds from multiple users and lends them out to institutional borrowers and other platforms. This decentralization ensures that users can earn interest on their assets while minimizing the risks associated with individual lending.

Consensus Mechanism

Celsius employs a modified proof-of-stake (PoS) consensus mechanism for its operations. PoS is a popular alternative to proof-of-work (PoW), the method used by Bitcoin. Here’s a breakdown of how the modified PoS works within Celsius:

How Modified Proof-of-Stake Works

-

Staking: In a PoS system, participants can “stake” their tokens to help secure the network and validate transactions. In Celsius, users who hold CEL tokens can stake them to participate in the platform’s decision-making processes and earn rewards.

-

Rewards Structure: The rewards for staking are determined by a combination of the amount of CEL staked and the duration of the stake. This incentivizes users to hold their tokens longer, promoting stability within the ecosystem.

-

Risk Management: Celsius employs a risk management framework that assesses the creditworthiness of borrowers. By ensuring that loans are backed by more than 100% of the collateral in the same currency, Celsius minimizes the risk of default and protects lenders’ interests.

Key Technological Innovations

Celsius Network has introduced several technological innovations that enhance its functionality and user experience. These innovations set it apart from traditional banking systems and other cryptocurrency platforms.

1. Loyalty and Rewards Programs

Celsius has a unique loyalty program that rewards users based on their CEL holdings. The more CEL tokens a user holds, the higher their loyalty tier, which translates to better interest rates on deposits and lower rates on loans. This tiered system encourages users to engage more deeply with the platform and promotes long-term investment in CEL.

2. Automated Yield Generation

Celsius automates the process of yield generation for its users. When users deposit their cryptocurrencies, the platform automatically allocates these funds to various lending opportunities, maximizing the interest earned. This feature removes the complexity often associated with managing crypto assets and allows users to earn passive income effortlessly.

3. No Fees and Penalties

Unlike traditional banks, Celsius does not charge fees for transactions or early withdrawals. This fee-less structure is made possible by the platform’s business model, which takes a small cut from the interest earned on loans. This transparency and fairness in fees attract users who are disillusioned with conventional banking practices.

4. CelPay Feature

Celsius also includes a wallet feature known as CelPay, which allows users to send and receive cryptocurrency seamlessly. This functionality enhances the user experience, making it easier to transact without needing to rely on external wallets or exchanges.

Security Measures

Security is a crucial aspect of any cryptocurrency platform, and Celsius has implemented several measures to protect user assets:

-

Multi-Signature Wallets: Celsius uses multi-signature wallets, requiring multiple private keys to authorize transactions. This added layer of security helps prevent unauthorized access and protects user funds.

-

Cold Storage: A significant portion of user funds is stored in cold wallets, which are not connected to the internet. This practice minimizes the risk of hacks and cyberattacks, ensuring that most assets remain secure.

-

Regular Audits: To maintain transparency and trust, Celsius undergoes regular audits and security assessments. This proactive approach ensures that any vulnerabilities are identified and addressed promptly.

User Experience and Accessibility

Celsius Network is designed to be user-friendly, making it accessible to both beginners and experienced investors. The platform features a straightforward interface, allowing users to navigate easily and manage their assets without needing extensive technical knowledge.

Mobile and Web Applications

Celsius offers both mobile and web applications, enabling users to access their accounts anytime and anywhere. The apps provide real-time updates on asset performance, interest earned, and market conditions, empowering users to make informed decisions.

Conclusion

The technology behind Celsius Network is a blend of innovative features and robust security measures that create a unique financial ecosystem for cryptocurrency users. By leveraging the Ethereum blockchain, implementing a modified proof-of-stake consensus mechanism, and introducing various user-centric innovations, Celsius aims to revolutionize the way individuals interact with their crypto assets.

For those looking to earn passive income, take out loans, or simply manage their cryptocurrencies more effectively, understanding the technology behind Celsius is essential. As the platform continues to evolve, staying informed about its technological advancements will help users maximize their experience and investment potential.

Understanding celsius crypto Tokenomics

Tokenomics Overview

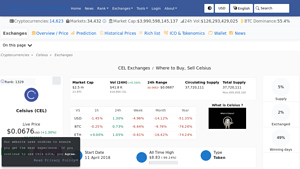

Celsius (CEL) is the native cryptocurrency of the Celsius Network, which provides a platform for users to earn interest on their cryptocurrency deposits and take out loans against their digital assets. The tokenomics of CEL includes various metrics that help in understanding its supply dynamics, utility, and distribution.

Here is a summary of key metrics associated with the CEL token:

| Metric | Value |

|---|---|

| Total Supply | 695,658,161 CEL |

| Max Supply | Not capped |

| Circulating Supply | 37,720,111 CEL |

| Inflation/Deflation Model | Deflationary mechanism through lock-up periods |

Token Utility (What is the coin used for?)

The CEL token serves multiple purposes within the Celsius Network ecosystem. Here are some key utilities:

-

Earning Interest: Users can earn higher interest on their cryptocurrency deposits if they choose to receive their rewards in CEL. This incentivizes users to hold and use the token actively.

-

Loan Discounts: CEL can be used to pay for interest on loans taken out against cryptocurrency collateral. Users who pay their loan interest in CEL benefit from lower rates, making it a practical choice for those utilizing Celsius’s lending services.

-

Loyalty Program: The Celsius Network has a tiered loyalty program that rewards users based on the amount of CEL they hold. As users accumulate CEL, they can reach higher loyalty levels, unlocking additional benefits such as better interest rates and exclusive features.

-

Transaction Fees: CEL can also be used to facilitate transactions within the Celsius Network, such as transferring assets or making payments.

-

Incentives for Borrowing: Borrowers can also receive incentives for using CEL in their transactions, making it a versatile token that encourages both lending and borrowing activities on the platform.

Token Distribution

The distribution of CEL tokens has been structured to ensure a balanced approach to both user engagement and business sustainability. The initial distribution occurred through an Initial Coin Offering (ICO) in May 2018, where approximately $50 million was raised. Here’s a breakdown of the initial distribution:

- ICO Participants: 50% of the total supply was allocated to presale and crowdsale participants.

- Treasury: 27% of the total supply was designated for the Celsius treasury, which is used for future development and operational costs.

- Team and Advisors: 19% was allocated to the founding team and advisors, ensuring that the core contributors have a vested interest in the long-term success of the project.

- Partners and Advertisers: 2% was reserved for partnerships and marketing efforts.

The CEL token operates on the Ethereum blockchain as an ERC-20 token, which means it benefits from the security and interoperability features of the Ethereum network.

Lock-up and Deflationary Model

A significant aspect of CEL’s tokenomics is its deflationary mechanism. A portion of CEL tokens is locked according to a predetermined schedule, which helps to manage the supply and maintain the token’s value over time. This locking mechanism is designed to reduce circulating supply gradually, potentially leading to price appreciation as demand for the token increases.

The Celsius Network also periodically reviews its economic model and adjusts the rewards and interest rates to ensure sustainability and user engagement. This flexibility allows Celsius to adapt to market conditions and user needs while maintaining a healthy ecosystem.

Conclusion

Understanding the tokenomics of Celsius (CEL) is crucial for both potential investors and users of the Celsius Network. With its structured supply, diverse utility, and strategic distribution, CEL is designed to foster a vibrant community and encourage active participation in the platform. As the Celsius Network continues to evolve post-bankruptcy and reorganization, the role of CEL in its ecosystem will likely adapt, offering new opportunities for users and investors alike.

Price History and Market Performance

Key Historical Price Milestones

Celsius (CEL) has experienced significant price fluctuations since its inception. Launched in June 2018, CEL was introduced through an Initial Coin Offering (ICO) that raised approximately $50 million, selling about 325 million CEL tokens. Following its ICO, the price of CEL was relatively stable, hovering around the $0.30 mark during its early months.

One of the key milestones in Celsius’ price history occurred on June 3, 2021, when CEL reached its all-time high of $8.02. This surge can be attributed to several factors, including increased adoption of the Celsius platform, the growing popularity of decentralized finance (DeFi), and a general bullish sentiment in the cryptocurrency market during that period. At its peak, Celsius was ranked among the top cryptocurrency projects, benefiting from its unique value proposition of providing high yields on crypto deposits and loans.

However, the price of CEL began to decline significantly after its all-time high. By the end of 2021 and into early 2022, the market experienced a downturn, which was exacerbated by regulatory scrutiny and broader economic factors affecting the cryptocurrency sector. By October 2022, CEL’s price had fallen to approximately $0.50, reflecting a substantial decrease from its peak.

The downward trend continued into 2023, primarily due to the impact of Celsius Network filing for Chapter 11 bankruptcy in July 2022, which raised concerns about the platform’s viability and the future of the CEL token. As a result, the price plummeted further, with CEL trading at around $0.02235 in October 2022, representing a staggering 99.72% decline from its all-time high.

As of October 2023, following its emergence from bankruptcy on January 31, 2024, CEL has shown signs of recovery, trading at around $0.06764. This represents a significant rebound from its all-time low, although it remains far below its historical highs.

Factors Influencing the Price

Historically, the price of CEL has been influenced by a combination of internal and external factors:

1. Market Sentiment and Trends

The broader cryptocurrency market sentiment has had a profound impact on CEL’s price. During periods of bullish sentiment, when investors are optimistic about cryptocurrency adoption and price increases, CEL has seen upward momentum. Conversely, bearish sentiment, often triggered by regulatory news, macroeconomic factors, or market corrections, has led to significant price declines.

2. Regulatory Developments

Celsius Network’s operations and the price of CEL have been closely tied to regulatory developments. The platform’s filing for Chapter 11 bankruptcy in July 2022 was a critical turning point, raising concerns among investors about the company’s future and the security of their assets. Regulatory scrutiny of cryptocurrency lending platforms has also influenced investor confidence, contributing to price volatility.

3. Adoption of the Celsius Platform

The growth of the Celsius Network itself has been a key driver of CEL’s price. In its early days, the platform gained traction due to its attractive yield offerings on crypto deposits and the ability to borrow against crypto holdings. As more users joined the platform, demand for CEL increased, positively impacting its price. However, as user confidence waned during financial difficulties, the demand for CEL diminished, leading to price declines.

4. Economic Conditions

Broader economic conditions, including inflation rates, interest rates, and stock market performance, have historically influenced the cryptocurrency market as a whole, including CEL. For instance, economic uncertainty can lead investors to seek safe-haven assets, which may impact cryptocurrency investments negatively. Conversely, favorable economic conditions can lead to increased investment in riskier assets like cryptocurrencies.

5. Technological Developments and Partnerships

Technological advancements within the Celsius platform and strategic partnerships have also played a role in influencing CEL’s price. Features like enhanced security measures, improved user experience, and partnerships with other blockchain projects can attract new users and investors, subsequently driving up demand for CEL. Conversely, any technological issues or failures to deliver on promised features can lead to decreased confidence and lower prices.

6. Tokenomics and Supply Dynamics

The tokenomics of CEL, including its supply and distribution mechanisms, have historically influenced its price. CEL has a maximum supply of 695,658,161 tokens, with a significant portion allocated for various purposes, including rewards for users and operational costs. Changes in the circulating supply, such as token burns or lock-ups, can affect the price, as can the overall market dynamics of supply and demand.

Conclusion

In summary, the price history of Celsius (CEL) reflects a complex interplay of various factors, including market sentiment, regulatory developments, platform adoption, economic conditions, technological advancements, and tokenomics. Understanding these influences can help investors better navigate the fluctuating landscape of cryptocurrency investments. While CEL has faced significant challenges, including a substantial decline from its all-time high, recent developments indicate potential for recovery as the market stabilizes and the Celsius Network restructures its operations.

Where to Buy celsius crypto: Top Exchanges Reviewed

5 Top Exchanges to Buy, Sell, and Trade Celsius (CEL)!

Celsius (CEL) stands out in the cryptocurrency market by offering a variety of trading options across multiple platforms, including top exchanges like MEXC Global, Gate, and Coinex. These exchanges provide users with competitive trading fees, robust security features, and a user-friendly interface, making it easier for both beginners and experienced traders to buy, sell, and trade CEL effectively. Additionally, Celsius’s strong community and innovative financial services enhance its appeal in the crypto ecosystem.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Celsius Network (CEL) – Your Gateway to Earning Passive Income!

The “How to Buy Celsius Network (CEL) Guide 2025” by CoinCodex highlights the standout features of various exchanges like CoinEx, Gate, and MEXC for purchasing CEL. The guide emphasizes the importance of thorough research to assess fees, security protocols, and user experience, ensuring that investors can make informed decisions. By focusing on these critical factors, the article aids both novice and experienced traders in navigating the complexities of acquiring Celsius Network tokens.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Celsius (CEL) – Instant ETH Purchases with Your Card!

The platform for buying Celsius (CEL) ETH stands out for its user-friendly interface and instant transaction capabilities, allowing users to purchase with credit, debit, or prepaid cards securely. With a high rating of 4.8 from over 2,000 reviews, it offers competitive rates and a commitment to transparency, featuring no hidden fees. Transactions can be completed in as little as two minutes, making it an efficient choice for both novice and experienced investors.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

3. SimpleSwap – Best Rates for Celsius (CEL) Exchange!

SimpleSwap stands out as a user-friendly platform for exchanging Celsius (CEL) at competitive rates, offering an intuitive instant converter that allows users to seamlessly check live price charts. With the ability to swap CEL for various cryptocurrencies or fiat currencies like USD, SimpleSwap caters to both novice and experienced traders, ensuring a smooth and efficient trading experience without the need for extensive account setup or verification.

- Website: simpleswap.io

- Platform Age: Approx. 7 years (domain registered in 2018)

7. CEL Token Unveiled: Your Guide to Understanding and Acquiring CEL!

The CEL token, native to the Celsius Network, offers unique benefits to its holders, including access to higher annual percentage yield (APY) rewards, reduced annual percentage rate (APR) loans, and exclusive perks within the platform. This review delves into the mechanics of the CEL token, its utility in enhancing user experience, and provides guidance on where to purchase it, highlighting why Celsius stands out in the competitive cryptocurrency landscape.

- Website: celsius.network

How to Buy celsius crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

To buy Celsius (CEL) cryptocurrency, you first need to select a cryptocurrency exchange that supports CEL trading. Some popular exchanges where you can buy CEL include:

- Kraken: Known for its security and compliance, Kraken offers a user-friendly interface for buying and trading various cryptocurrencies.

- Coinbase: A widely-used exchange, particularly among beginners, Coinbase provides a simple buying process and a secure platform.

- Binance: One of the largest exchanges by trading volume, Binance offers a wide range of cryptocurrencies, including CEL.

When choosing an exchange, consider factors such as fees, available trading pairs (e.g., CEL/BTC, CEL/USDT), security features, and user reviews. It’s essential to ensure that the exchange you choose is reputable and has a good track record.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how to do that:

- Sign Up: Visit the exchange’s website and click on the sign-up or register button. You’ll be prompted to enter your email address and create a password.

- Email Verification: After registering, you’ll receive a verification email. Click the link in that email to verify your account.

- Complete KYC: Most exchanges require you to complete a Know Your Customer (KYC) process to comply with regulations. This typically involves providing personal information such as your full name, address, date of birth, and identification documents (e.g., a driver’s license or passport).

- Two-Factor Authentication (2FA): For added security, enable two-factor authentication on your account. This usually involves linking your account to an authenticator app or receiving a code via SMS.

3. Deposit Funds

After your account has been verified, you need to deposit funds to buy CEL. Here’s how to do it:

- Select Deposit Method: Log in to your account, go to the “Funds” or “Wallet” section, and select the option to deposit. Choose your preferred deposit method, which can include bank transfers, credit/debit cards, or cryptocurrency deposits.

- Follow Instructions: If you’re using a bank transfer, follow the provided instructions to transfer funds to your exchange account. Make sure to check for any deposit fees or limits.

- Confirm Deposit: Once you have initiated the deposit, wait for the funds to appear in your account. This can take anywhere from a few minutes to several days, depending on the method used.

4. Place an Order to Buy Celsius Crypto

With funds in your exchange account, you can now buy CEL. Here’s how to place your order:

- Navigate to the Trading Section: Go to the trading or market section of the exchange where you can buy CEL.

- Choose Trading Pair: Select the appropriate trading pair for CEL. For example, if you deposited Bitcoin, look for the CEL/BTC pair.

- Select Order Type: Decide whether you want to place a market order (buying CEL at the current market price) or a limit order (setting a specific price at which you want to buy).

- Enter Amount: Specify how much CEL you want to buy. The exchange will show you the equivalent amount in your deposited currency.

- Review and Confirm: Double-check your order details and click the “Buy” button to confirm your order. Your CEL will be credited to your account once the order is filled.

5. Secure Your Coins in a Wallet

After purchasing CEL, it’s crucial to secure your cryptocurrency. Here’s how to do it:

- Choose a Wallet: Decide on a storage solution for your CEL. You can use a hot wallet (online, convenient but less secure) or a cold wallet (offline, more secure). Popular wallets for storing CEL include:

- Hardware Wallets: Devices like Ledger or Trezor provide offline storage for your cryptocurrencies.

- Software Wallets: Wallets like Exodus or Atomic Wallet offer user-friendly interfaces and are suitable for beginners.

- Transfer CEL to Your Wallet: If you choose to use a wallet, you will need to transfer your CEL from the exchange to your wallet. Go to your wallet, find the option to receive CEL, and copy the wallet address.

-

Initiate Transfer: In your exchange account, go to the withdrawal section, enter your wallet address, specify the amount of CEL you wish to transfer, and confirm the transaction.

-

Verify Transfer: After the transaction is complete, check your wallet to ensure that the CEL has been received. Always keep a backup of your wallet’s recovery phrase or private keys in a secure location.

By following these steps, you can safely purchase and store Celsius cryptocurrency, setting a strong foundation for your crypto investment journey.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Celsius Network, through its native token CEL, presents several compelling advantages that may attract investors and users alike. Understanding these potential strengths can help one gauge the viability of investing in Celsius.

1. Innovative Financial Model

Celsius operates on a unique financial model that allows users to earn interest on their cryptocurrency deposits, a service not typically offered by traditional banks. By leveraging a lending pool system, Celsius distributes the interest earned from loans taken out by borrowers among its depositors. This model not only incentivizes users to deposit their cryptocurrencies but also creates an ecosystem where both lenders and borrowers can benefit.

2. High Yield Potential

One of the primary appeals of Celsius is the potential for high yields on crypto deposits. The platform has historically offered competitive interest rates compared to traditional financial institutions. For many crypto investors, the ability to earn passive income on holdings can be a significant attraction, especially in a landscape where traditional savings accounts yield minimal returns.

3. CEL Token Utility

The CEL token serves multiple functions within the Celsius ecosystem. Users can receive higher payouts and lower loan rates when they choose to earn rewards in CEL. This tokenomics model creates a demand for CEL as users engage more with the platform, potentially increasing its value over time. Additionally, CEL is an ERC-20 token on the Ethereum blockchain, allowing it to be traded on various exchanges, which can enhance liquidity.

4. Strong Community and User Engagement

Celsius has fostered a robust community, often referred to as “Celsians.” The platform claims to have over 220,000 users, showcasing a solid base of active participants. This community engagement can lead to increased trust and loyalty, which is critical in the volatile cryptocurrency market. A strong user base may also provide a network effect, attracting more users to the platform as it gains popularity.

5. Experienced Leadership

Celsius was founded by Alex Mashinsky and Daniel Leon, both of whom have extensive backgrounds in technology and entrepreneurship. Mashinsky, in particular, has a proven track record in building tech companies and has played a significant role in developing VOIP technology. A knowledgeable and experienced leadership team can be a critical factor in navigating the challenges of the cryptocurrency landscape.

6. Asset-Backed Loans

The Celsius platform emphasizes the importance of security by requiring borrowers to collateralize their loans with more than 100% of the loan amount in cryptocurrency. This practice significantly reduces the risk of defaults and enhances the overall stability of the platform. For investors, this may provide a sense of security when considering the risk of lending their assets on the platform.

Potential Risks and Challenges (The Bear Case)

While Celsius offers many potential strengths, investors should also be aware of the risks and challenges associated with investing in CEL and using the Celsius platform. Understanding these risks can help investors make informed decisions.

1. Market Volatility

Cryptocurrency markets are notoriously volatile, with prices subject to rapid fluctuations. The CEL token itself has experienced significant price declines since its all-time high of approximately $8 in June 2021, trading at around $0.067 as of October 2023. Such volatility can lead to substantial financial losses for investors. Furthermore, market downturns can affect user engagement and deposit levels on the platform, potentially impacting Celsius’s ability to offer competitive yields.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions. Celsius, like other crypto platforms, could face regulatory scrutiny or changes in laws that may impact its operations. For example, the U.S. Securities and Exchange Commission (SEC) has been increasingly active in regulating cryptocurrency lending platforms, which could lead to compliance challenges for Celsius. Investors should be cautious about the potential for regulatory changes that could affect the platform’s services and the value of the CEL token.

3. Competition

The cryptocurrency lending space is becoming increasingly competitive, with numerous platforms offering similar services. Companies like BlockFi, Nexo, and others are vying for market share by providing attractive interest rates and innovative features. This competition could pressure Celsius to maintain high yields, which may not be sustainable in the long term. If Celsius cannot differentiate itself effectively, it risks losing users to competitors.

4. Technological Risks

As a blockchain-based platform, Celsius is inherently exposed to various technological risks. These include potential vulnerabilities in its smart contracts, which could be exploited by malicious actors. Additionally, the platform’s reliance on the Ethereum network means it could be affected by any issues within that ecosystem, such as network congestion or high gas fees. Furthermore, if Celsius fails to implement adequate security measures, users’ funds could be at risk from hacking attempts.

5. Bankruptcy and Financial Health

Celsius Network emerged from Chapter 11 bankruptcy in January 2024, which raises concerns about its financial stability and operational viability. While the company has stated that it is implementing a Plan of Reorganization, the long-term impacts of its bankruptcy filing on user confidence and platform functionality remain to be seen. Investors should be wary of any lingering financial issues and consider how these may affect their investments in CEL.

6. Dependence on User Adoption

The success of Celsius is heavily reliant on user adoption and engagement. If user interest wanes, it could lead to decreased deposits and reduced liquidity, adversely affecting the platform’s ability to offer competitive rates. Additionally, a decline in the number of active users could diminish the perceived value of the CEL token, further impacting its price.

Conclusion

Investing in Celsius and its native CEL token presents a mix of potential rewards and significant risks. While the platform offers innovative financial services, high yield opportunities, and is backed by experienced leadership, it is essential to remain cognizant of market volatility, regulatory uncertainties, and competition. For beginners and intermediate investors, conducting thorough research and understanding the landscape surrounding Celsius is crucial before making investment decisions. Always remember that cryptocurrency investments carry inherent risks, and it’s vital to only invest what one can afford to lose.

Frequently Asked Questions (FAQs)

1. What is Celsius crypto (CEL)?

Celsius crypto, represented by the token CEL, is the native cryptocurrency of the Celsius Network, a platform that provides financial services for cryptocurrency users. Founded in 2017, Celsius allows users to earn interest on their crypto deposits and access loans using their crypto assets as collateral. The platform aims to offer higher yields than traditional banks while maintaining low fees and providing a user-friendly experience.

2. Who created Celsius crypto?

Celsius was co-founded by Alex Mashinsky, S. Daniel Leon, and Nuke Goldstein. Alex Mashinsky is known for his contributions to Voice Over Internet Protocol (VoIP) technology and has a background in entrepreneurship, having founded several successful startups. The Celsius team brings together expertise in technology and finance to build a platform that aims to disrupt traditional banking services.

3. What makes Celsius crypto different from Bitcoin?

While Bitcoin is primarily a decentralized digital currency and a store of value, Celsius operates as a financial platform that offers services like earning interest on deposits and taking out loans. Celsius utilizes its native token, CEL, to enhance user rewards, facilitate transactions, and provide discounts on loan interest. In contrast, Bitcoin does not have an associated financial service platform and mainly serves as a digital asset for trading and investment.

4. Is Celsius crypto a good investment?

As with any investment, the potential for profit or loss with Celsius crypto depends on various factors, including market conditions, the performance of the Celsius Network, and individual investment goals. Since Celsius emerged from Chapter 11 bankruptcy in January 2024, it’s essential to conduct thorough research and consider the associated risks before investing. Consulting with a financial advisor can also provide personalized insights.

5. How does the Celsius Network work?

Celsius operates by allowing users to deposit cryptocurrencies into their accounts, which are then pooled and lent out to borrowers. Users earn interest on their deposits based on a modified proof-of-stake algorithm. The interest earned from loans is distributed among depositors, with Celsius taking a small cut. The platform also offers collateralized loans, allowing users to borrow against their crypto holdings.

6. What are the benefits of using Celsius crypto?

Celsius offers several benefits, including:

– Higher Interest Rates: Users can earn competitive yields on their crypto deposits compared to traditional banks.

– Low or No Fees: The platform aims to provide fee-less transactions, enhancing user experience.

– Loyalty Program: Users can increase their CEL holdings and receive additional rewards or discounts on loan interest based on their CEL token holdings.

– User-Friendly Interface: Celsius provides a straightforward platform for both beginners and experienced investors.

7. What happened to Celsius after its bankruptcy filing?

Celsius filed for Chapter 11 bankruptcy in July 2022 and emerged from it on January 31, 2024. Following its reorganization, the Celsius mobile and web apps were shut down on February 29, 2024, as part of the winding down of its business operations. However, distributions to eligible creditors began on February 1, 2024, in the form of cryptocurrency and US dollars, as outlined in the Plan of Reorganization.

8. Where can I buy Celsius (CEL) tokens?

Celsius (CEL) tokens can be purchased on various cryptocurrency exchanges. Before buying, users should ensure they are using a reputable exchange that lists CEL. As of the latest information, CEL is available for trading against popular cryptocurrencies and stablecoins. Always conduct due diligence and consider security measures when selecting an exchange for your transactions.

Final Verdict on celsius crypto

Overview of Celsius Crypto

Celsius (CEL) was designed as a comprehensive platform for cryptocurrency users, allowing them to earn interest on their deposits while offering loan services against their crypto holdings. The Celsius Network aimed to disrupt traditional banking by providing higher interest rates on deposits and more favorable loan terms, eliminating many of the fees commonly associated with conventional financial institutions. The platform utilized a modified proof-of-stake mechanism, rewarding users based on their participation and holdings within the ecosystem.

Technology and Features

The Celsius Network’s core technology revolves around its native token, CEL, which serves multiple purposes, including enhancing user rewards and facilitating transactions. Users can earn yield on a variety of cryptocurrencies, including Bitcoin and stablecoins, while also having the option to take loans backed by their crypto assets. The platform’s loyalty program incentivizes users to hold CEL tokens, unlocking higher rewards and lower loan rates as they progress through different tiers.

Risks and Considerations

Despite its innovative approach, investing in Celsius crypto remains a high-risk, high-reward proposition. The platform faced significant challenges, including a Chapter 11 bankruptcy filing in 2022, which has raised concerns about its future viability and the security of user funds. As of early 2024, while Celsius has restructured and resumed some operations, the long-term implications for the CEL token and the platform’s overall health remain uncertain.

Final Thoughts

Given the volatility and complexity of the cryptocurrency market, it is crucial for potential investors to conduct thorough research before committing to Celsius or any digital asset. Understanding the risks involved, alongside the potential for rewards, will help you make informed decisions in this rapidly evolving space. Always remember to practice due diligence (DYOR) and consider your financial situation and risk tolerance before investing in high-risk assets like Celsius crypto.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.