Should You Invest in celestia crypto? A Full Analysis (2025)

An Investor’s Introduction to celestia crypto

Celestia is a pioneering modular blockchain network that is revolutionizing how decentralized applications (dApps) are built and operated. By decoupling execution from consensus, Celestia offers a unique approach that enhances scalability and flexibility within the blockchain ecosystem. As a response to the challenges faced by traditional monolithic blockchains—such as limited scalability and high operational overhead—Celestia allows developers to deploy their own blockchains with minimal friction, making it a significant player in the cryptocurrency market.

With its innovative architecture, Celestia serves as a data availability layer for Layer 2 solutions and rollups, effectively optimizing the performance of these applications. This capability is particularly crucial in the evolving landscape of blockchain technology, where the demand for high-throughput and efficient systems continues to grow. By utilizing data availability sampling, Celestia ensures that data is readily accessible without imposing constraints on execution or settlement, thereby unlocking new possibilities for developers.

The Celestia network is backed by substantial financial support, having raised $155 million in funding, which underscores the confidence in its potential to drive significant innovation in the blockchain space. The native token, TIA, plays a vital role within the ecosystem, facilitating various functions and governance mechanisms that empower users and developers alike.

This guide aims to provide a comprehensive resource for both beginners and intermediate investors interested in understanding Celestia and its associated digital asset, TIA. We will delve into several key areas:

Technology Overview

We will explore the underlying technology that powers Celestia, including its modular design, data availability sampling, and how these innovations contribute to its scalability and security.

Tokenomics

An analysis of TIA’s economic model, including its supply dynamics, distribution, and the role it plays within the Celestia ecosystem.

Investment Potential

We will assess the potential for TIA as an investment, examining market trends, historical performance, and future growth prospects.

Risks

Investing in cryptocurrencies carries inherent risks. This section will cover the potential challenges and pitfalls associated with investing in Celestia and its token.

How to Buy TIA

Finally, we will provide a step-by-step guide on how to purchase TIA, including recommended exchanges and wallets for safe storage.

Through this guide, we aim to equip you with the knowledge necessary to make informed decisions regarding your investment in Celestia crypto. Whether you are looking to understand its technological innovations or evaluate its potential as an investment, this resource will serve as your comprehensive companion in navigating the world of Celestia.

What is celestia crypto? A Deep Dive into its Purpose

Understanding Celestia Crypto

Celestia is a groundbreaking project in the blockchain ecosystem, introducing a modular blockchain architecture designed to address some of the most pressing issues faced by traditional monolithic blockchains. As a modular blockchain network, Celestia seeks to redefine how blockchain applications are built and deployed, allowing developers to create more scalable and efficient solutions.

The Core Problem It Solves

One of the primary challenges in the blockchain space is scalability. Traditional blockchains, often referred to as monolithic blockchains, handle all core functions—transaction processing, validation, consensus, and data storage—within a single layer. This design results in significant limitations as the network grows, leading to congestion, slow transaction times, and high fees.

Celestia addresses this problem by decoupling these core functions. By introducing a modular architecture, it separates execution (the processing of transactions) from consensus (the agreement on the validity of those transactions). This separation allows Celestia to function as a data availability layer, providing the necessary data to rollups and layer 2 blockchains without imposing execution constraints. This architecture not only enhances scalability but also enables developers to create specialized blockchains tailored to specific applications, thereby overcoming the limitations imposed by monolithic systems.

Its Unique Selling Proposition

Celestia’s unique selling proposition lies in its innovative approach to blockchain architecture. Here are some key aspects that set it apart:

-

Modular Architecture: Celestia’s design allows for the independent scaling of various components of a blockchain. Developers can create their own execution environments while relying on Celestia for data availability and consensus. This flexibility encourages experimentation and innovation, as developers can easily deploy new blockchains without the overhead typically associated with blockchain development.

-

Data Availability Sampling: At the heart of Celestia’s technology is the concept of data availability sampling. This technique ensures that data required for validating transactions is accessible to all participants without the need for every node to download the entire dataset. This significantly reduces the computational burden on individual nodes while maintaining the network’s integrity and security.

-

Shared Security Model: New blockchains deployed on Celestia inherit security from its robust validator set. This shared security model allows developers to focus on building their applications without worrying about the underlying security of their blockchain. It creates a safe environment for experimentation and deployment, enabling new projects to flourish.

-

Sovereignty for Developers: Celestia promotes developer sovereignty, allowing them to modify their blockchain’s tech stack without needing permission from other applications on the network. This autonomy fosters innovation and encourages a diverse range of blockchain ecosystems tailored to various use cases.

-

Accessibility: By minimizing the overhead required to launch a new blockchain, Celestia lowers the barrier to entry for developers and organizations interested in leveraging blockchain technology. This ease of deployment makes Celestia a versatile platform for the next generation of blockchain applications.

The Team and Backers

Celestia is supported by a talented team of experts in blockchain technology and has garnered significant backing from various entities within the industry. The project was co-founded by Mustafa Al-Bassam, who previously worked at Google and was a key contributor to the Tendermint consensus algorithm. His experience and vision have been instrumental in shaping Celestia’s architecture and goals.

In addition to its core team, Celestia has attracted attention from prominent investors and backers. The project raised $155 million in funding from notable entities, reflecting confidence in its potential to revolutionize the blockchain landscape. Among its backers are venture capital firms and technology organizations that recognize the transformative capabilities of a modular blockchain network.

Fundamental Purpose in the Crypto Ecosystem

Celestia’s fundamental purpose is to enhance the scalability and flexibility of blockchain applications, making it easier for developers to create and deploy new solutions. By providing a modular architecture that decouples execution from consensus, Celestia enables a more efficient and adaptable blockchain ecosystem.

This innovation is particularly relevant as the demand for blockchain technology continues to grow across various industries, including finance, supply chain, and digital identity. Celestia empowers developers to build applications that can handle increased transaction volumes and complex functionalities without being constrained by the limitations of traditional blockchains.

Moreover, Celestia’s emphasis on shared security and developer sovereignty aligns with the broader vision of decentralization in the crypto space. It promotes an ecosystem where innovation can thrive, and diverse blockchain applications can coexist and interoperate seamlessly.

In summary, Celestia represents a significant advancement in blockchain technology, addressing the critical challenges of scalability and flexibility. Its modular architecture, innovative data availability techniques, and robust support from a dedicated team and investors position it as a key player in the future of decentralized applications. As the blockchain landscape evolves, Celestia is poised to play a pivotal role in shaping how applications are built and deployed, fostering a new era of blockchain innovation.

The Technology Behind the Coin: How It Works

Introduction to Celestia

Celestia is a pioneering modular blockchain network that redefines how blockchain technology operates. Unlike traditional blockchains that combine various functions into a single layer, Celestia separates these functions to improve scalability, flexibility, and security. This innovative approach allows developers to create custom blockchains tailored to specific needs without the overhead typically associated with blockchain development.

Blockchain Architecture

Modular vs. Monolithic Blockchains

Traditional blockchains, often referred to as monolithic blockchains, handle multiple core functions—such as transaction processing, validation, and consensus—within a single layer. This architecture can lead to significant scalability issues as the network grows. For instance, as more users join and transactions increase, the network can become congested, slowing down processing times and increasing fees.

In contrast, Celestia adopts a modular architecture, decoupling these essential functions. This means that different layers of the blockchain can specialize in specific tasks. By separating execution from consensus, Celestia allows for greater scalability without compromising security or decentralization. Developers can build their own blockchains while leveraging Celestia’s robust consensus mechanism and validator set, which helps maintain the integrity of the network.

Data Availability Layer

At the core of Celestia’s architecture is the concept of a data availability layer. This layer ensures that all data required for transaction validation is accessible to network participants without the need for each node to download the entire dataset. This is achieved through a method known as data availability sampling.

Data availability sampling allows nodes to sample small portions of data to verify that the complete dataset is available. This not only maintains the integrity and security of the blockchain but also significantly reduces the computational load on individual nodes. As a result, the network can support a larger number of transactions without becoming overwhelmed.

Consensus Mechanism

How Consensus Works in Celestia

Consensus is a fundamental aspect of any blockchain network. It refers to the process by which network participants agree on the validity and order of transactions. In Celestia, consensus is achieved through a robust validator set, which is responsible for confirming transactions and maintaining the security of the network.

Celestia employs a Proof-of-Stake (PoS) consensus mechanism. In PoS, validators are selected to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This method encourages validators to act honestly, as they risk losing their staked tokens if they engage in malicious behavior.

Benefits of Proof-of-Stake

The PoS consensus mechanism offers several advantages over traditional Proof-of-Work (PoW) systems, such as Bitcoin. In PoW, miners compete to solve complex mathematical problems to validate transactions, which requires significant computational power and energy consumption. PoS, on the other hand, reduces energy costs and allows for faster transaction processing, making it more environmentally friendly and efficient.

Additionally, PoS promotes decentralization by enabling more participants to become validators without the need for expensive mining equipment. This inclusivity helps secure the network while maintaining a diverse set of validators.

Key Technological Innovations

Data Availability Sampling

Data availability sampling is one of Celestia’s most significant innovations. By allowing nodes to validate data availability without downloading the entire dataset, this technology reduces the computational burden on individual nodes. This capability is crucial for scaling the network, as it enables the addition of more users and transactions without compromising performance.

Sovereignty and Customization

Celestia’s modular architecture empowers developers with sovereignty over their applications. Unlike traditional blockchains, where developers often have limited control over the underlying technology, Celestia allows for significant customization. Developers can define their own execution and settlement environments, enabling them to create tailored solutions that meet specific use cases.

This flexibility opens the door for a wide variety of applications, from decentralized finance (DeFi) platforms to gaming and beyond. Developers can experiment and innovate without the constraints imposed by monolithic blockchains, fostering a rich ecosystem of diverse applications.

Shared Security Model

One of the challenges faced by new blockchains is ensuring security without a large validator set. Celestia addresses this issue through its shared security model. New blockchains deployed on the Celestia network can immediately benefit from the security provided by Celestia’s validators. This arrangement allows developers to launch new applications quickly while maintaining robust protection against attacks.

By sharing security resources, Celestia encourages rapid experimentation and deployment of new blockchain applications without compromising safety. This model is particularly beneficial for startups and smaller projects that may not have the resources to establish their own security infrastructure.

Scalability and Performance

Achieving High Throughput

Celestia is designed to scale beyond traditional blockchain limits. The modular architecture allows for high data throughput, with the network aiming to achieve over 1 GB/s. This capability removes the scaling bottlenecks that often hinder monolithic blockchains, enabling the processing of a larger number of transactions in a shorter time.

The separation of execution from consensus also contributes to this scalability. As developers build application-specific blockchains, they can optimize their environments for performance, leading to faster transaction processing and reduced latency.

Real-World Applications

Celestia’s technology has the potential to unlock new possibilities across various industries. For example, in the world of decentralized finance (DeFi), developers can create custom solutions that are tailored to specific financial products, enhancing user experience and functionality. In gaming, developers can leverage Celestia to create fully on-chain experiences, ensuring that gameplay remains decentralized and verifiable.

Furthermore, Celestia’s focus on data availability and modularity allows for the integration of real-world assets (RWAs) into the blockchain ecosystem, paving the way for tokenization and broader adoption of blockchain technology in traditional industries.

Conclusion

Celestia represents a significant advancement in blockchain technology, offering a modular architecture that enhances scalability, flexibility, and security. By decoupling execution from consensus, employing data availability sampling, and providing developers with sovereignty over their applications, Celestia opens the door to a new era of blockchain innovation.

As the demand for scalable and efficient blockchain solutions continues to grow, Celestia’s unique approach positions it as a leader in the space. With its potential to transform various industries and enable the next generation of decentralized applications, Celestia is well on its way to becoming a foundational platform for the future of blockchain technology.

Understanding celestia crypto Tokenomics

Celestia’s tokenomics is an essential aspect of its ecosystem, providing insights into how the native token, TIA, functions within the modular blockchain network. Understanding the tokenomics involves examining key metrics, the utility of the token, and its distribution model.

| Metric | Value |

|---|---|

| Total Supply | 1.14 billion TIA |

| Max Supply | Not specified |

| Circulating Supply | 773.76 million TIA |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The TIA token serves multiple purposes within the Celestia ecosystem, enhancing its functionality and providing incentives for various stakeholders. Here are the primary uses of TIA:

-

Transaction Fees: TIA is used to pay for transaction fees on the Celestia network. When users execute transactions or deploy new blockchains, they need to use TIA to cover the costs associated with these operations. This fee model ensures that the network remains sustainable, as it compensates validators for their services.

-

Data Availability Payments: Given that Celestia operates as a data availability layer, TIA is used to pay for blobspace, which is the data storage required for transactions and operations on the network. This payment mechanism incentivizes the efficient use of the network’s resources and ensures that data remains available for processing by various applications.

-

Governance: TIA holders have the power to participate in the governance of the Celestia network. This means that they can vote on proposals affecting the network’s development, upgrades, and policies. By allowing token holders to have a say in governance, Celestia fosters a decentralized decision-making process that aligns with the interests of its community.

-

Incentives for Validators: Validators play a crucial role in maintaining the security and integrity of the Celestia network. They are responsible for confirming transactions and ensuring that data is available. TIA tokens are awarded to validators as incentives for their contributions, aligning their interests with the network’s health and stability.

-

Staking: While specific staking mechanisms may evolve, TIA tokens may be staked to help secure the network. By locking up their tokens, holders can contribute to the network’s security and, in return, potentially earn rewards.

Token Distribution

The distribution of TIA tokens is a critical factor in understanding the overall health and decentralization of the Celestia network. The distribution model can significantly impact market dynamics, governance, and the project’s long-term sustainability. Here are key points regarding the token distribution:

-

Initial Distribution: Celestia’s initial token distribution occurred during its fundraising rounds, where the project raised $155 million. This funding was essential for its development and operations. The exact breakdown of tokens allocated to various stakeholders, including the team, investors, and reserves, can influence how the tokens are perceived in the market.

-

Team and Development Allocations: A portion of TIA tokens is typically allocated to the development team and early contributors. This allocation is crucial for incentivizing the team to continue building and improving the network. However, it’s essential for such allocations to have vesting periods to prevent sudden sell-offs that could negatively impact the token’s market price.

-

Community Incentives: Celestia may allocate a portion of TIA tokens for community incentives, such as rewards for early adopters, developers, and users contributing to the ecosystem. This strategy helps to foster a strong community around the project, encouraging engagement and participation.

-

Liquidity Provisioning: To ensure that TIA tokens have sufficient liquidity in the market, some tokens may be allocated to liquidity pools on decentralized exchanges. This liquidity is vital for users looking to buy or sell TIA without facing significant slippage.

-

Deflationary Mechanisms: While Celestia’s inflation or deflation model is currently categorized as deflationary, it is essential to monitor how future developments may affect this aspect. Deflationary mechanisms can include token burns or buybacks, which help reduce the overall supply of TIA tokens in circulation, potentially increasing their value over time.

-

Community Governance and Future Distribution: As Celestia evolves, its governance model may lead to adjustments in token distribution. For instance, the community might propose changes to how tokens are allocated for development, incentives, or other purposes. This adaptability ensures that the tokenomics remain relevant and aligned with the community’s needs.

In summary, the tokenomics of Celestia is designed to ensure that TIA serves multiple critical functions within the ecosystem, from facilitating transactions to incentivizing validators and enabling governance. The distribution model is structured to support the project’s long-term sustainability while fostering a decentralized community. As Celestia continues to develop, monitoring these aspects will be essential for investors and users looking to engage with this innovative modular blockchain network.

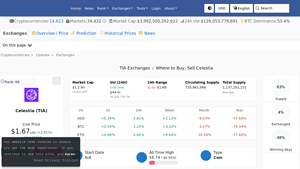

Price History and Market Performance

Overview of Celestia’s Price History

Celestia (TIA) is a modular blockchain network that has gained significant attention since its inception, largely due to its innovative approach to blockchain architecture. As a relatively new player in the cryptocurrency market, Celestia’s price history reflects the broader trends within the cryptocurrency space as well as the unique developments surrounding the project itself.

Key Historical Price Milestones

Celestia’s price journey began shortly after its launch, with the token making its debut in early 2024. The initial trading price of TIA was approximately $20.91, marking a significant entry into the market. However, this peak was short-lived, as the cryptocurrency market experienced a notable correction.

Over the next several months, TIA’s price fluctuated dramatically, influenced by both market conditions and project developments. By mid-2024, the price had dropped to around $1.32, representing a decline of over 92% from its all-time high. This decline was indicative of broader market trends affecting many cryptocurrencies, particularly during periods of high volatility and investor uncertainty.

As of October 2023, Celestia’s price is approximately $1.66, having shown signs of recovery from its all-time low. The market capitalization has also been notable, peaking at around $1.29 billion, with a circulating supply of approximately 773.76 million TIA tokens. The trading volume within a 24-hour period has varied, reaching highs of around $77.65 million, reflecting active trading interest.

Factors Influencing the Price

Historically, the price of Celestia has been influenced by a variety of factors, both internal to the project and external within the broader cryptocurrency market.

Market Sentiment and Speculation

As with many cryptocurrencies, market sentiment plays a crucial role in influencing the price of Celestia. Positive news, such as partnerships or technological advancements, often leads to bullish sentiment, driving prices upward. Conversely, negative news or broader market downturns can result in rapid price declines. For instance, the initial surge to $20.91 was fueled by optimism surrounding the project’s innovative modular architecture and its potential to solve scaling issues faced by traditional blockchains.

Technological Developments

Celestia’s unique selling proposition lies in its modular blockchain architecture, which allows for greater scalability and flexibility compared to traditional monolithic blockchains. The introduction of features like data availability sampling has garnered significant interest from developers and investors alike. Announcements regarding new partnerships or integrations, such as with Arbitrum and various decentralized applications, have historically contributed to price increases.

Regulatory Environment

The cryptocurrency market is heavily influenced by regulatory developments. Changes in legislation, government policies, or regulatory scrutiny can impact investor confidence and, consequently, prices. For example, during periods of regulatory uncertainty, many cryptocurrencies—including Celestia—experienced price declines as investors became cautious.

Overall Market Trends

Celestia’s price is also subject to the broader trends in the cryptocurrency market. Historical price movements often correlate with Bitcoin’s performance, as Bitcoin remains the leading cryptocurrency and often sets the tone for the market. During bull markets, altcoins like Celestia often see increased investment, while in bear markets, they may suffer greater losses relative to Bitcoin.

Community and Ecosystem Growth

The growth of Celestia’s ecosystem has been a significant factor in its price performance. As more developers and projects adopt the Celestia framework, the demand for TIA tokens increases, which can positively influence the price. Initiatives like the launch of new applications and platforms built on Celestia have historically attracted attention and investment, contributing to price stability and growth.

Conclusion

In summary, Celestia’s price history reflects a combination of market dynamics, technological advancements, and external influences. From its peak of $20.91 to its current price of approximately $1.66, the journey has been marked by volatility common in the cryptocurrency space. Understanding these historical price movements and the factors that influence them can provide valuable insights for both new and experienced investors looking to navigate the complexities of investing in Celestia and similar digital assets.

Where to Buy celestia crypto: Top Exchanges Reviewed

1. Changelly – Lowest Fees for Celestia (TIA) Exchange!

Changelly stands out as a premier exchange for trading Celestia (TIA) due to its competitive rates and minimal fees, making it an attractive option for both novice and seasoned investors. With a user-friendly platform available on both web and iOS, it offers fast exchanges among over 700 cryptocurrencies. Additionally, Changelly’s commitment to 24/7 customer support ensures a seamless trading experience, earning it a commendable rating of 4.7 from over 5,000 users.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. ChangeNOW – Top Choice for TIA Trading!

ChangeNOW stands out as a premier exchange for trading the Celestia token (TIA), offering users the best rates and a seamless experience. With a high customer rating of 4.8 based on over 2,170 reviews, it provides a free platform for instant exchanges. Users can access real-time TIA pricing in USD, comprehensive charts, and educational resources to enhance their trading strategies, making it an ideal choice for both novice and experienced investors.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Celestia – Your Gateway to Scalable Blockchain Solutions!

Kraken stands out as a user-friendly exchange for purchasing Celestia (TIA), offering flexible payment options starting from just $10. Users can easily buy TIA using credit/debit cards, ACH deposits, or mobile payment methods like Apple and Google Pay, where available. This accessibility, combined with Kraken’s robust security features and reputation in the cryptocurrency space, makes it an ideal platform for both beginners and seasoned investors looking to acquire Celestia.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

3. Celestia (TIA) – Your Gateway to Scalable Blockchain Solutions!

Gate.com stands out as a user-friendly exchange for purchasing Celestia (TIA), offering a streamlined four-step guide that simplifies the buying process for both beginners and experienced traders. With competitive fees and a diverse selection of cryptocurrencies, Gate.com ensures an efficient trading experience, making it an attractive option for those looking to invest in TIA and expand their digital asset portfolio.

- Website: gate.com

- Platform Age: Approx. 29 years (domain registered in 1996)

7. Celestia (TIA) – Your Gateway to Scalable Blockchain Solutions!

Celestia (TIA) stands out in the cryptocurrency market due to its availability on over 40 exchanges, ensuring broad accessibility for traders. Notably, top platforms like Binance, MEXC Global, and Gate offer robust trading options, including popular pairs such as USDT. This wide range of exchange options, combined with strong liquidity, makes Celestia an attractive choice for both new and experienced investors looking to buy, sell, or trade this innovative digital asset.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy celestia crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to purchasing Celestia (TIA) is selecting a cryptocurrency exchange where you can buy it. Several exchanges support TIA, including both centralized exchanges (CEX) and decentralized exchanges (DEX). Here are some popular options:

- Centralized Exchanges (CEX): These platforms offer a user-friendly interface and typically have a higher trading volume, which can lead to better prices. Examples include Binance, Coinbase, and Kraken.

- Decentralized Exchanges (DEX): DEXs allow users to trade directly with one another without an intermediary. Uniswap and SushiSwap are examples where you can potentially find TIA, but ensure the liquidity is sufficient.

Before making a choice, consider factors such as trading fees, user experience, and the availability of fiat-to-crypto options (if you plan to use traditional currency).

2. Create and Verify Your Account

Once you’ve chosen an exchange, you’ll need to create an account:

- Sign Up: Visit the exchange’s website and click on the sign-up button. You’ll be prompted to enter your email address and create a secure password.

- Email Verification: After signing up, check your email for a verification link. Click on it to verify your email address.

- Identity Verification: Most exchanges will require you to complete Know Your Customer (KYC) procedures. This typically involves providing personal information and uploading identification documents (e.g., passport, driver’s license). Follow the instructions to complete this process. It may take anywhere from a few minutes to several days for your account to be verified.

3. Deposit Funds

Once your account is verified, you can deposit funds to buy Celestia:

- Choose Deposit Method: Most exchanges offer multiple deposit methods, such as bank transfer, credit/debit card, or even other cryptocurrencies. Choose the method that best suits your needs.

- Deposit Funds: Follow the instructions on the exchange to deposit funds. If using a bank transfer, make sure to account for any processing times, as it may take a few days for the funds to appear in your account. If using a credit card, the transaction is usually instant.

- Check Your Balance: After the deposit is processed, check your account balance to ensure the funds are available for trading.

4. Place an Order to Buy celestia crypto

With funds in your account, you can now buy Celestia:

- Navigate to the Trading Section: Find the trading or market section of the exchange. Look for the TIA trading pair, which is typically presented as TIA/USD, TIA/BTC, or similar.

- Choose Order Type: Decide whether you want to place a market order or a limit order.

- Market Order: This order buys TIA at the current market price. It’s straightforward and ensures you get the tokens quickly.

- Limit Order: This order allows you to specify the price at which you want to buy TIA. Your order will only execute when the market reaches your specified price.

- Enter Amount: Input the amount of TIA you wish to purchase. The exchange will display the total cost based on your chosen order type.

- Confirm Purchase: Review the details of your order, including fees, and confirm the purchase. After the transaction is completed, the TIA will be credited to your exchange wallet.

5. Secure Your Coins in a Wallet

After purchasing Celestia, it’s crucial to secure your tokens:

- Choose a Wallet: While you can leave your TIA on the exchange, it’s safer to transfer them to a personal wallet. There are different types of wallets:

- Software Wallets: These are applications or software programs (like Exodus or Atomic Wallet) that can be installed on your computer or mobile device.

- Hardware Wallets: These are physical devices (like Ledger or Trezor) that store your cryptocurrency offline, providing enhanced security against hacks.

- Transfer TIA: If you choose to use a software or hardware wallet, you’ll need to transfer your TIA from the exchange. Go to your wallet, find the option to receive funds, and copy your wallet address. Then, on the exchange, go to the withdrawal section, paste your wallet address, and specify the amount to transfer.

- Confirm Transfer: Ensure the transaction details are correct and confirm the transfer. It may take some time for the transaction to be processed on the blockchain.

By following these steps, you can successfully purchase and secure Celestia (TIA) cryptocurrency. Always remember to do your own research and consider the risks involved in trading digital assets.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Modular Architecture

Celestia (TIA) is positioned as a pioneering force in the blockchain landscape due to its modular architecture. Unlike traditional monolithic blockchains that perform all core functions—transaction processing, validation, and consensus—within a single layer, Celestia separates these functions. This decoupling allows for significant improvements in scalability and flexibility. Developers can create custom execution and settlement environments tailored to their specific needs, which can lead to innovative applications and solutions that were previously difficult to implement.

Enhanced Scalability

Celestia aims to address one of the most pressing challenges in blockchain technology: scalability. By leveraging data availability sampling, the network ensures that data required for transaction validation is accessible without burdening each node to download the entire dataset. This architectural choice not only enhances throughput but also reduces the computational load on individual nodes, making it easier for more users to participate in the network.

Strong Financial Backing

The project has garnered considerable financial support, raising approximately $155 million in funding. This financial backing reflects a strong level of confidence in Celestia’s potential to drive innovation within the blockchain space. With the backing of reputable entities such as CelestiaOrg and megaeth_labs, the project is well-positioned to attract further investment and development, fostering a robust ecosystem around its technology.

Sovereignty and Customization for Developers

Celestia’s modular approach offers developers unprecedented control over their applications. They can modify their blockchain’s tech stack without needing permission from other applications, promoting innovation and enabling a diverse range of use cases. This autonomy can lead to the development of specialized blockchains that cater to specific industries or applications, further enhancing the overall utility of the Celestia network.

Community and Ecosystem Growth

The Celestia network is rapidly expanding, with a growing ecosystem of projects being built on its infrastructure. Initiatives like Converge, Hibachi, and Abstract are examples of the diverse applications being developed, showcasing the potential for real-world use cases. As more developers and organizations adopt the platform, the network effect could enhance the value of Celestia’s native token, TIA, further solidifying its position in the market.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Like many cryptocurrencies, TIA is subject to extreme market volatility. Price fluctuations can be driven by various factors, including investor sentiment, macroeconomic conditions, and developments in the broader cryptocurrency market. Such volatility can make it challenging for investors to make informed decisions and can lead to significant losses, especially for those who may not have a long-term investment strategy in place.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and can vary significantly by jurisdiction. Governments around the world are still in the process of developing frameworks for how digital assets should be classified and regulated. This uncertainty can pose risks for Celestia, as changes in regulations could impact its operations, user adoption, and overall market perception. For example, stricter regulations could hinder the ability to raise funds or limit the use of the platform in certain regions.

Competition in the Blockchain Space

Celestia operates in a highly competitive environment. Many other blockchain projects are also exploring modular designs or offering similar features, such as enhanced scalability and customization for developers. Competitors may have established user bases, greater brand recognition, or more extensive ecosystems, making it challenging for Celestia to differentiate itself and capture market share. Projects like Ethereum, Polkadot, and Cosmos could potentially overshadow Celestia if they successfully implement similar or superior technologies.

Technological Risks

While Celestia’s innovative approach holds great promise, it also carries inherent technological risks. The complexities of developing and maintaining a modular blockchain architecture can lead to unforeseen technical challenges. Issues such as network security vulnerabilities, bugs in the code, or difficulties in achieving consensus among validators could undermine the platform’s reliability. Additionally, as the network grows and scales, maintaining performance and security will be critical, and any failure to address these challenges could negatively impact user trust and adoption.

Adoption and Network Effects

The success of any blockchain project is heavily reliant on adoption. Celestia needs to attract a sufficient number of developers and users to its platform to create a vibrant ecosystem. If adoption fails to materialize, the network could struggle to gain traction, leading to diminished interest from investors and potential challenges in maintaining its operational viability. Without a strong user base, the value of TIA may not appreciate as expected, posing risks for those looking to invest in the token.

Conclusion

In summary, Celestia presents a compelling investment opportunity with its innovative modular architecture, strong scalability, and community-driven growth potential. However, potential investors should carefully consider the associated risks, including market volatility, regulatory uncertainty, competition, technological challenges, and the need for broad adoption. As with any investment in the cryptocurrency space, it is crucial to conduct thorough research and maintain an informed perspective on both the potential rewards and the inherent risks.

Frequently Asked Questions (FAQs)

1. What is Celestia crypto?

Celestia is a modular blockchain network designed to improve scalability and flexibility in the blockchain space. Unlike traditional monolithic blockchains, which handle all functions (transaction processing, validation, and consensus) in a single layer, Celestia decouples these functions. It serves primarily as a data availability layer, allowing developers to deploy their own blockchains with custom execution and settlement environments. This modular architecture enhances performance and promotes innovation in blockchain applications.

2. Who created Celestia crypto?

Celestia was developed by a team of experts in blockchain technology, including notable figures like Mustafa Al-Bassam, John Adler, and Evan Schwartz. They aimed to address the scalability challenges faced by existing blockchain systems and provide a more flexible framework for developers to build decentralized applications.

3. What makes Celestia different from Bitcoin?

The key difference between Celestia and Bitcoin lies in their architectural design and purpose. Bitcoin is a monolithic blockchain that performs all core functions—transaction processing, validation, and consensus—within a single layer, which can lead to scalability issues as the network grows. In contrast, Celestia utilizes a modular architecture that separates these functions, allowing for greater scalability and flexibility. Celestia serves as a data availability layer for other blockchains, enabling developers to create specialized chains without the limitations imposed by monolithic designs.

4. Is Celestia crypto a good investment?

As with any investment in cryptocurrency, the potential of Celestia as a good investment depends on various factors, including market conditions, technological advancements, and adoption rates. Celestia’s innovative approach to modular blockchain technology and its ability to address scalability issues may appeal to investors looking for long-term growth. However, potential investors should conduct thorough research and consider their risk tolerance before investing.

5. How does Celestia ensure security?

Celestia ensures security through a robust validator set responsible for confirming the validity and order of transactions. This shared security model allows new blockchains deployed on Celestia to inherit the security provided by its validators. Additionally, the network utilizes data availability sampling, which ensures that data required for validating transactions is accessible without requiring each node to download the entire dataset, maintaining the integrity and security of the blockchain.

6. What is the native token of Celestia?

The native token of Celestia is TIA. It plays a crucial role in the ecosystem by facilitating various functions, including governance, transaction fees, and securing the network. TIA tokens can be used to pay for blobspace, participate in governance decisions, and contribute to the overall functionality of the Celestia network.

7. What are the main use cases for Celestia?

Celestia’s modular architecture allows for a wide range of use cases, including but not limited to:

– Deploying specialized blockchains for specific applications, such as decentralized finance (DeFi) and gaming.

– Serving as a data availability layer for layer 2 solutions and rollups, enhancing their performance.

– Enabling developers to experiment and innovate with minimal overhead, fostering the creation of diverse blockchain ecosystems.

– Supporting on-chain communication and tokenization, as seen in various projects built on Celestia.

8. How can I get started with Celestia?

To get started with Celestia, you can visit the official website and explore the developer portal, which provides comprehensive documentation and resources. You can learn about running a light node, deploying your own blockchain, and participating in the Celestia ecosystem. Engaging with the community through forums and events can also provide valuable insights and support as you navigate the development process.

Final Verdict on celestia crypto

Overview of Celestia Crypto

Celestia (TIA) stands at the forefront of blockchain innovation, introducing a modular architecture that decouples execution from consensus. This unique approach allows for unprecedented scalability and flexibility, addressing the limitations of traditional monolithic blockchains. By leveraging data availability sampling, Celestia ensures that data is accessible and can support multiple applications without imposing execution constraints. This flexibility empowers developers to create custom execution and settlement environments, unlocking new potential for blockchain applications.

Key Features and Potential

One of the standout features of Celestia is its ability to serve as a data availability layer for rollups and layer 2 solutions, significantly enhancing their performance. The platform has garnered substantial attention and financial backing, raising $155 million, indicating strong confidence in its potential to revolutionize blockchain technology. Moreover, Celestia promotes developer sovereignty, allowing for modifications to the tech stack without external permission, fostering a diverse ecosystem of applications.

Investment Considerations

However, it’s important to recognize that investing in Celestia, like any cryptocurrency, comes with inherent risks. The cryptocurrency market is highly volatile, and while Celestia presents a promising opportunity for growth, it is classified as a high-risk, high-reward asset class. Potential investors should be aware of the market’s unpredictability and the evolving nature of blockchain technology.

Final Thoughts

In conclusion, Celestia represents a transformative leap in blockchain architecture, poised to facilitate the development of innovative applications while ensuring security and scalability. As you consider investing in this promising project, it’s crucial to conduct thorough research and stay informed about the developments in the cryptocurrency space. Remember the mantra: Do Your Own Research (DYOR). This diligence will help you make informed decisions tailored to your investment strategy and risk tolerance.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.