Should You Invest in celestia coin? A Full Analysis (2025)

An Investor’s Introduction to celestia coin

Celestia Coin, represented by the token TIA, is making waves in the cryptocurrency market as a pioneering modular blockchain network. Unlike traditional blockchains that bundle all core functionalities into a single layer, Celestia redefines blockchain architecture by separating execution from consensus. This unique approach enhances scalability and efficiency, allowing developers to deploy their own custom blockchains with minimal overhead. As a result, Celestia is positioned not just as a cryptocurrency but as a foundational layer for a new generation of decentralized applications.

The significance of Celestia Coin in the crypto space lies in its innovative technology, which utilizes data availability sampling—a method that ensures data is accessible to network participants without requiring each node to download the entire dataset. This capability is particularly beneficial for sectors that demand high scalability and customizability, such as decentralized finance (DeFi) and gaming. By lowering barriers to entry and fostering an environment of experimentation, Celestia opens up new possibilities for developers and entrepreneurs looking to leverage blockchain technology.

This guide aims to provide a comprehensive resource for both beginners and intermediate investors interested in Celestia Coin. We will cover various aspects, including:

Technology Overview

Understanding the modular architecture of Celestia, how it differs from traditional blockchains, and the implications of its innovative data availability sampling technique.

Tokenomics

An exploration of the economic model behind TIA, including its supply dynamics, distribution, and role within the Celestia ecosystem.

Investment Potential

Analysis of Celestia’s market performance, including historical price data, current market cap, and factors that could influence its future value.

Risks

A balanced examination of the potential risks associated with investing in Celestia Coin, including market volatility, regulatory challenges, and technological vulnerabilities.

How to Buy

A step-by-step guide on purchasing Celestia Coin, detailing the various exchanges where it is available and the procedures for acquiring TIA.

By delving into these topics, this guide will equip you with the knowledge necessary to make informed decisions regarding Celestia Coin. Whether you are a seasoned investor or just starting your journey in the cryptocurrency world, understanding Celestia’s unique position and potential can help you navigate the evolving landscape of digital assets.

What is celestia coin? A Deep Dive into its Purpose

Understanding Celestia Coin (TIA)

Celestia Coin, represented by the ticker symbol TIA, is the native cryptocurrency of the Celestia blockchain network, which is recognized as the first modular blockchain. This innovative platform redefines blockchain architecture by separating the execution of transactions from the consensus mechanism, allowing for greater scalability, flexibility, and efficiency. Celestia is designed to address the inherent limitations of traditional monolithic blockchains, providing a robust infrastructure for developers to build and deploy custom blockchains with minimal overhead.

The Core Problem It Solves

Traditional blockchains, known as monolithic blockchains, are designed to perform multiple core functions, including transaction processing, validation, and consensus within a single layer. This architecture often leads to significant scalability issues as the demand for transaction throughput increases. As more users join the network and transaction volumes rise, these blockchains struggle to maintain performance, resulting in slower transaction speeds and higher fees.

Celestia addresses these scalability challenges by introducing a modular approach. By decoupling the execution of transactions from the consensus mechanism, Celestia allows for independent scaling of each component. This means that developers can build their own execution environments while relying on Celestia’s consensus and data availability layer. The introduction of data availability sampling ensures that the necessary data for transaction validation is accessible without requiring every node to download the entire dataset. This method significantly reduces the computational burden on individual nodes, thereby enhancing overall network efficiency.

Moreover, Celestia facilitates the rapid deployment of new blockchains tailored to specific applications, such as decentralized finance (DeFi), gaming, and more. By lowering the barriers to entry for developers, Celestia fosters innovation and experimentation, enabling a diverse ecosystem of applications that can thrive without the limitations imposed by traditional blockchain architectures.

Its Unique Selling Proposition

Celestia’s unique selling proposition lies in its modular architecture, which offers several key advantages over traditional blockchains:

-

Scalability: By separating execution from consensus, Celestia can handle a higher volume of transactions without compromising security. This modular approach enables developers to create specialized blockchains that cater to specific use cases while leveraging Celestia’s shared security model.

-

Customizability: Developers have the freedom to define their own execution and settlement environments, allowing for tailored solutions that can adapt to the evolving needs of their applications. This level of customization is not feasible in monolithic blockchains, where changes often require extensive coordination and consensus among all participants.

-

Data Availability Sampling: This innovative technique ensures that data required for validating transactions is accessible to all network participants. By allowing nodes to sample small portions of data, Celestia maintains the integrity of the blockchain while significantly reducing the load on individual nodes.

-

Sovereignty for Developers: Celestia empowers developers with sovereignty over their applications, enabling them to modify their blockchain’s tech stack without seeking permission from external entities. This autonomy fosters rapid innovation and iteration, allowing developers to respond quickly to market demands.

-

Shared Security: New blockchains deployed on Celestia inherit security from its validator set, ensuring robust protection while maintaining decentralization. This shared security model allows developers to focus on building their applications without worrying about the complexities of securing their own networks.

The Team and Backers

Celestia was co-founded by a team of experienced professionals in the blockchain and technology sectors. The key figures behind Celestia include Mustafa Al-Bassam, Ismail Khoffi, and Evan McMullen, who bring a wealth of knowledge and expertise to the project. Their collective experience spans various domains within the blockchain ecosystem, including cryptographic research, protocol development, and project management.

The project has received significant financial backing, raising approximately $155 million in funding from prominent investors and venture capital firms. This financial support underscores the confidence in Celestia’s potential to revolutionize blockchain technology and drive innovation in the space. Notable backers include firms like A16Z, Polychain Capital, and other strategic investors, which further solidify Celestia’s position as a key player in the blockchain landscape.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Celestia Coin (TIA) within the cryptocurrency ecosystem is to serve as the backbone of a modular blockchain network that enhances scalability, flexibility, and efficiency. By providing a platform where developers can easily deploy their own blockchains, Celestia aims to democratize access to blockchain technology and empower a new generation of applications.

Celestia’s architecture enables the creation of a diverse array of decentralized applications (dApps) that can operate independently while still benefiting from the shared security and consensus mechanisms of the Celestia network. This versatility positions Celestia as a critical infrastructure layer for the next wave of blockchain innovation, facilitating the growth of various sectors, including finance, gaming, and more.

In summary, Celestia Coin represents a significant advancement in blockchain technology, offering solutions to longstanding scalability issues and empowering developers to create customized blockchain environments. As the cryptocurrency ecosystem continues to evolve, Celestia’s modular approach may play a pivotal role in shaping the future of decentralized applications and services.

The Technology Behind the Coin: How It Works

Overview of Celestia

Celestia (TIA) is a revolutionary modular blockchain network that changes the way blockchains operate. Unlike traditional blockchains, which perform all core functions like transaction processing, validation, and consensus within a single layer, Celestia separates these functionalities to enhance scalability and flexibility. This modular approach allows developers to create custom blockchains tailored to their specific needs while maintaining security and decentralization.

Blockchain Architecture

Celestia’s architecture is fundamentally different from that of monolithic blockchains. In a monolithic structure, all the essential functions—transaction processing, data storage, and consensus—are handled in a single layer. This setup often leads to bottlenecks, making it difficult to scale effectively as the number of users and transactions grows.

Celestia’s modular architecture decouples these functions into separate layers:

-

Data Availability Layer: This layer is responsible for ensuring that all necessary data for validating transactions is accessible to network participants. It uses a technique called data availability sampling, which allows nodes to verify data availability without needing to download the entire dataset. This significantly reduces the computational burden on each node.

-

Execution Layer: This layer handles the actual execution of transactions. Developers can build their application-specific blockchains on top of Celestia, customizing the execution environment to meet their unique requirements.

-

Consensus Layer: This layer is responsible for achieving agreement among network participants regarding the state of the blockchain. It ensures that transactions are valid and that the order of transactions is consistent across the network.

By separating these layers, Celestia allows for greater scalability and flexibility. Developers can deploy new blockchains on the network without the heavy overhead typically associated with launching a new blockchain.

Consensus Mechanism

Celestia employs a unique consensus mechanism that enhances the network’s security and efficiency. Instead of relying on traditional methods like Proof-of-Work (PoW) or Proof-of-Stake (PoS), Celestia utilizes a hybrid approach that combines elements of both.

-

Validator Set: At the core of Celestia’s consensus mechanism is a robust validator set. Validators are responsible for confirming the validity and order of transactions. They maintain the network’s security and protect it from attacks.

-

Shared Security Model: One of the most significant advantages of Celestia’s architecture is its shared security model. New blockchains deployed on Celestia can inherit the security provided by its validator set. This means that developers do not have to establish their own security protocols from scratch, significantly lowering the barrier to entry for new projects.

-

Decoupled Consensus: By decoupling consensus from execution, Celestia allows for greater flexibility in how transactions are processed. Developers can define their own execution environments, making it easier to adapt to specific application requirements.

This innovative consensus mechanism not only enhances security but also ensures that the network can scale effectively as more users and transactions are added.

Key Technological Innovations

Celestia incorporates several key technological innovations that set it apart from traditional blockchain networks. Here are some of the most notable:

Data Availability Sampling

Data availability sampling is a groundbreaking technique that allows nodes to verify the availability of data without downloading the entire dataset. Instead of requiring each node to have a complete copy of the blockchain, nodes can sample small portions of the data to confirm that the necessary information is accessible. This significantly reduces the storage and computational requirements for nodes, making it easier for participants to join and maintain the network.

Modular Design

The modular design of Celestia enables developers to build specialized blockchains tailored to their specific needs. This flexibility allows for rapid experimentation and innovation, as developers can easily deploy new blockchains without the constraints imposed by traditional monolithic architectures. By allowing custom execution and settlement environments, Celestia empowers developers to create diverse applications across various sectors, from decentralized finance (DeFi) to gaming.

Sovereignty for Developers

Celestia promotes developer sovereignty by allowing them to modify their blockchain’s tech stack without requiring permission from other applications on the network. This autonomy fosters innovation, enabling developers to iterate quickly and adapt their solutions to evolving market demands. As a result, a dynamic and diverse ecosystem can flourish on the Celestia network.

Scalability and Performance

By separating execution from consensus, Celestia addresses the scalability challenges that plague traditional blockchains. This modular approach allows the network to handle a higher volume of transactions without sacrificing performance. Additionally, it enables the seamless integration of Layer 2 solutions, which can leverage Celestia’s infrastructure to enhance their scalability and performance.

Real-World Applications

Celestia’s innovative architecture and technological advancements have broad implications for real-world applications. The ability to deploy custom blockchains with minimal overhead opens up new opportunities in various sectors:

-

Decentralized Finance (DeFi): Developers can create tailored DeFi applications that meet specific requirements without the limitations of traditional blockchains. This flexibility allows for faster innovation and the ability to adapt to changing market conditions.

-

Gaming: Game developers can build immersive experiences that leverage Celestia’s capabilities. The modular design enables them to create specialized gaming blockchains that offer unique features and functionalities.

-

Interoperability: Celestia’s shared security model allows for seamless interoperability between different blockchains. Developers can create applications that interact with multiple blockchains, enhancing the overall utility of the ecosystem.

Conclusion

Celestia represents a significant advancement in blockchain technology, offering a modular approach that decouples execution from consensus. This innovative architecture enhances scalability, flexibility, and security, allowing developers to deploy custom blockchains tailored to their specific needs. Key technological innovations, such as data availability sampling and a shared security model, further strengthen Celestia’s position as a versatile platform for the next generation of blockchain applications.

As the blockchain landscape continues to evolve, Celestia’s unique approach is poised to drive innovation and experimentation, making it an exciting project for both developers and investors alike. Whether you’re a seasoned blockchain developer or a beginner exploring the world of cryptocurrencies, understanding the technology behind Celestia can provide valuable insights into the future of decentralized applications.

Understanding celestia coin Tokenomics

Celestia (TIA) operates within a unique modular blockchain ecosystem, and its tokenomics is structured to support both the network’s functionality and its growth. Understanding the tokenomics of Celestia is essential for anyone looking to invest or develop within this innovative platform.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 1.14 Billion TIA |

| Max Supply | N/A |

| Circulating Supply | 773.76 Million TIA |

| Inflation/Deflation Model | Controlled Inflation |

Token Utility (What is the coin used for?)

The TIA token serves multiple purposes within the Celestia ecosystem, making it a vital component of the network’s functionality. Here are the primary uses of the TIA token:

-

Transaction Fees: TIA is utilized to pay for transaction fees on the Celestia network. As users deploy their custom blockchains or interact with existing ones, they need to pay fees that are denominated in TIA. This creates a direct demand for the token, as every transaction requires its use.

-

Staking: TIA can be staked by validators who participate in the consensus mechanism. Validators are responsible for confirming transactions and maintaining the network’s security. By staking TIA, validators earn rewards, which incentivizes them to act honestly and keep the network secure.

-

Governance: The TIA token also plays a crucial role in governance. Token holders have the power to participate in decision-making processes regarding the future of the Celestia network. This includes voting on protocol upgrades, changes to network parameters, and other important governance issues. The decentralized governance model ensures that the community has a say in the project’s direction.

-

Access to Features: Developers and users may need TIA to access specific features or functionalities within the Celestia ecosystem. This could include deploying new blockchains, utilizing various tools provided by the network, or engaging with decentralized applications (dApps) built on Celestia.

-

Incentives for Developers: As a modular blockchain, Celestia aims to attract developers to build on its platform. TIA may be used as an incentive for developers who contribute to the ecosystem by creating applications or services that enhance the network’s usability and attractiveness.

The combination of these utilities creates a robust demand for TIA, as each function reinforces the token’s necessity within the Celestia ecosystem.

Token Distribution

The distribution of TIA tokens is crucial for ensuring a fair and sustainable growth model for the Celestia network. Here’s a breakdown of the key aspects of TIA’s distribution:

-

Initial Distribution: TIA was distributed through a combination of private and public sales, allowing early investors and the community to acquire the token. This initial distribution strategy helped raise significant funding for the project, enabling further development and marketing efforts.

-

Team and Advisors: A portion of the TIA supply is allocated to the founding team and advisors. This allocation is typically subject to vesting schedules, ensuring that team members remain committed to the project long-term and align their interests with those of the community.

-

Ecosystem Development: A certain percentage of TIA tokens is reserved for ecosystem development. This may include grants, bounties, and incentives for developers to build applications on the Celestia platform. By fostering a vibrant ecosystem, Celestia aims to encourage innovation and attract more users.

-

Community Incentives: Tokens are also allocated for community initiatives, including marketing campaigns, user acquisition strategies, and rewards for early adopters. This approach helps to build a strong community around the project and ensures that users are incentivized to participate actively.

-

Validator Rewards: A portion of the TIA supply is designated for validator rewards. This is crucial for maintaining network security, as it incentivizes validators to stake their tokens and participate in the consensus process. The rewards are typically distributed based on the amount of TIA staked and the validator’s performance.

-

Controlled Inflation: Celestia employs a controlled inflation model to manage the supply of TIA tokens over time. This model allows for new tokens to be minted as needed, primarily to reward validators and fund ecosystem initiatives. However, the inflation rate is designed to be sustainable, ensuring that the token’s value is not excessively diluted.

-

Burn Mechanisms: To counteract inflation, Celestia may implement burn mechanisms where a portion of transaction fees is burned. This reduces the overall supply of TIA over time, potentially increasing scarcity and value.

In summary, the tokenomics of Celestia (TIA) is designed to create a sustainable, secure, and engaging ecosystem. By understanding its key metrics, utility, and distribution strategy, investors and developers can better appreciate the value proposition that Celestia offers within the rapidly evolving blockchain landscape.

Price History and Market Performance

Key Historical Price Milestones

Celestia (TIA) has experienced a dynamic price trajectory since its inception, reflecting the broader trends within the cryptocurrency market as well as the unique developments surrounding the project itself.

-

Initial Trading and Early Adoption: Celestia’s market debut was marked by cautious optimism. Initially, TIA traded at modest levels, around $1.00, as investors began to understand the implications of its modular blockchain approach. As the project gained traction and awareness, the price started to rise steadily.

-

All-Time High: The most significant milestone in Celestia’s price history occurred on February 10, 2024, when TIA reached an all-time high of $20.91. This spike can be attributed to a combination of factors, including increased adoption of modular blockchain solutions, significant partnerships, and a surge in investor interest in innovative blockchain technologies. This price peak represented a staggering appreciation from its initial trading values and highlighted the market’s enthusiasm for Celestia’s potential.

-

Subsequent Corrections: Following its all-time high, Celestia experienced a correction phase, common in cryptocurrency markets. By mid-2024, the price had dropped significantly, illustrating the volatile nature of digital assets. The price fluctuated between $10 and $15 for several months as the market adjusted to the rapid influx of capital and speculative trading.

-

All-Time Low: The lowest recorded price for Celestia occurred on June 22, 2025, when it fell to $1.32. This downturn was influenced by broader market trends, including a downturn in the overall cryptocurrency market and concerns over regulatory scrutiny affecting blockchain technologies. However, the price rebounded after this low, indicating resilience among its community and investors.

-

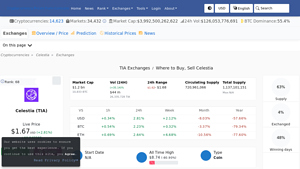

Recent Performance: As of the latest data, Celestia is trading around $1.67, reflecting a 2.77% increase over the past 24 hours. The market capitalization stands at approximately $1.29 billion, with a 24-hour trading volume of $77.46 million. This activity indicates ongoing interest and trading in TIA, suggesting that while the price has seen significant volatility, there remains a robust market presence.

Factors Influencing the Price

Historically, the price of Celestia has been influenced by a myriad of factors, each contributing to its market performance in different ways:

-

Market Sentiment and Speculation: Like many cryptocurrencies, Celestia’s price is heavily influenced by market sentiment. Positive news, such as successful partnerships or technological advancements, tends to drive prices up as investors become more optimistic. Conversely, negative news or market corrections can lead to swift price declines. For instance, the surge to its all-time high coincided with a period of heightened interest in blockchain technology, particularly modular solutions.

-

Technological Developments: Celestia’s unique architecture as a modular blockchain has been a significant factor in its pricing. Key milestones, such as the launch of its mainnet and the introduction of the TIA token, have historically led to increased investor interest and speculation. The ability to deploy custom blockchains with minimal overhead is a compelling proposition that has attracted developers and investors alike, influencing price movements.

-

Broader Cryptocurrency Market Trends: Celestia does not operate in a vacuum; its price is also subject to the overall trends in the cryptocurrency market. Bull markets can lift the prices of most digital assets, while bear markets can lead to declines across the board. For example, during major bullish runs, Celestia’s price surged alongside other cryptocurrencies, while downturns in the market have resulted in its price dropping significantly.

-

Regulatory Environment: The regulatory landscape surrounding cryptocurrencies can have a profound effect on market performance. Announcements regarding new regulations, particularly those concerning blockchain technology and digital assets, can lead to increased volatility. Investors often react swiftly to news of regulatory changes, which can either bolster confidence in a project like Celestia or lead to fear and selling pressure.

-

Community and Ecosystem Growth: The strength and activity of the Celestia community also play a crucial role in its price performance. Community engagement, development activity on its GitHub repository, and the number of active projects using the Celestia infrastructure can enhance investor confidence. As more developers build on Celestia, this could lead to increased demand for TIA, positively affecting its price.

-

Market Liquidity and Trading Volume: The liquidity of TIA, indicated by its trading volume, is another crucial factor influencing its price. Higher trading volumes generally signify greater interest and can lead to more stable prices. Conversely, low trading volumes can result in increased volatility, making the price more susceptible to sharp movements based on fewer trades.

In summary, Celestia’s price history and market performance reflect a complex interplay of various factors, including technological advancements, market sentiment, regulatory developments, and broader market trends. Understanding these elements can provide valuable insights for investors looking to navigate the evolving landscape of cryptocurrency investments.

Where to Buy celestia coin: Top Exchanges Reviewed

1. Changelly – Top Choice for Low-Cost Celestia (TIA) Exchanges!

Changelly stands out as an exceptional platform for exchanging Celestia (TIA) due to its low fees and competitive rates, boasting a high rating of 4.7 from over 5,000 users. The exchange facilitates quick transactions and offers access to more than 700 cryptocurrencies, making it a versatile choice for both novice and experienced traders. Additionally, Changelly provides 24/7 live support, enhancing the user experience and ensuring seamless exchanges.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. Celestia (TIA) – Your Gateway to Scalable Blockchain Solutions!

Celestia (TIA) stands out in the cryptocurrency landscape due to its innovative modular blockchain architecture, which enables efficient data availability and scalability. This unique approach allows users to trade, buy, and sell TIA seamlessly across major exchanges like Binance, MEXC Global, and Gate. By leveraging these platforms, investors can access a robust ecosystem that enhances transaction speed and reduces costs, making Celestia an attractive option for both new and experienced traders.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

3. ChangeNOW – Top Choice for TIA Trading!

ChangeNOW stands out as a premier platform for exchanging Celestia tokens (TIA), offering competitive rates and a user-friendly interface. With a high rating of 4.8 based on over 2,170 reviews, it provides instant transactions without any fees, making it an attractive choice for both novice and experienced investors. Additionally, users can access real-time price charts and educational resources, enhancing their trading experience.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy celestia coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Celestia Coin (TIA) is to select a cryptocurrency exchange that supports it. Popular exchanges that typically offer a wide range of cryptocurrencies include:

- Binance

- Coinbase

- Kraken

- KuCoin

- Gemini

Before choosing an exchange, consider factors such as:

- User Interface: Is it beginner-friendly?

- Security Features: Does it have two-factor authentication (2FA) and insurance for user funds?

- Fees: What are the deposit, trading, and withdrawal fees?

- Supported Payment Methods: Does it accept credit/debit cards, bank transfers, or other methods?

Once you’ve selected an exchange, you can proceed to create an account.

2. Create and Verify Your Account

To buy Celestia Coin, you will need to create an account on your chosen exchange. Follow these steps:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You’ll be asked to provide an email address and create a password.

-

Email Verification: After signing up, check your email for a verification link. Click on it to verify your email address.

-

Identity Verification: Most exchanges require you to complete Know Your Customer (KYC) verification. This process may involve submitting personal information such as your name, address, and date of birth. You may also need to upload a government-issued ID (like a passport or driver’s license) and a selfie.

-

Enable Two-Factor Authentication (2FA): For added security, set up 2FA using an authentication app like Google Authenticator or Authy.

3. Deposit Funds

Now that your account is verified, you need to deposit funds to buy Celestia Coin. Follow these steps:

-

Choose Deposit Method: Navigate to the “Deposit” section of the exchange. You can typically deposit funds using a bank transfer, credit/debit card, or even other cryptocurrencies.

-

Select Currency: If you are depositing fiat currency (like USD), select the currency and amount you wish to deposit.

-

Follow Instructions: Follow the on-screen instructions to complete the deposit. This may involve entering your bank details or card information.

-

Wait for Confirmation: Depending on the method, deposits may take anywhere from a few minutes to several days to process. Make sure to check your account balance to confirm that the funds have been credited.

4. Place an Order to Buy Celestia Coin

With funds in your account, you can now buy Celestia Coin. Here’s how:

-

Navigate to the Trading Section: Go to the trading or market section of the exchange.

-

Search for TIA: Use the search bar to find the Celestia Coin trading pair (e.g., TIA/USD or TIA/BTC).

-

Choose Order Type: You can typically place different types of orders:

- Market Order: Buy TIA at the current market price.

-

Limit Order: Set a specific price at which you want to buy TIA.

-

Enter Amount: Specify how much TIA you want to purchase.

-

Review and Confirm: Double-check the details of your order, including fees, and then click “Buy” or “Place Order.” You will receive a confirmation once your order is executed.

5. Secure Your Coins in a Wallet

After purchasing Celestia Coin, it’s crucial to secure your investment. Here’s how:

- Choose a Wallet: You can store TIA in various types of wallets:

- Software Wallets: Apps like Exodus or Atomic Wallet allow you to store your coins on your computer or mobile device.

- Hardware Wallets: Devices like Ledger or Trezor offer enhanced security by storing your coins offline.

-

Exchange Wallets: While convenient, keeping your coins on an exchange is less secure. It’s recommended to transfer them to a personal wallet.

-

Transfer Your Coins: If you choose a software or hardware wallet, go to your exchange account, find the “Withdraw” option, and enter your wallet address. Confirm the transaction.

-

Backup Your Wallet: Make sure to back up your wallet recovery phrases and private keys in a secure location. This ensures you can recover your funds in case you lose access to your wallet.

By following these steps, you can successfully buy and secure your Celestia Coin, entering the world of cryptocurrency with confidence. Always remember to do your own research and stay updated on market conditions!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Celestia (TIA) represents a novel approach in the blockchain ecosystem, particularly with its modular architecture that separates consensus from execution. This unique structure offers several potential strengths that may appeal to investors and developers alike.

Scalability and Efficiency

One of the most compelling advantages of Celestia is its scalability. Traditional blockchains often face limitations due to their monolithic design, which requires them to handle all functions — transaction processing, validation, and consensus — within a single layer. Celestia’s modular architecture allows for the decoupling of these functions, thereby enabling greater scalability and efficiency. This design can facilitate higher transaction throughput and lower latency, making it a suitable platform for a wide array of applications, including decentralized finance (DeFi) and gaming.

Developer Empowerment and Customizability

Celestia provides developers with the ability to create their own blockchains with minimal overhead. This flexibility allows for the development of application-specific or general-purpose blockchains that can inherit security from Celestia’s validator set. The sovereignty over execution and settlement environments means that developers can innovate and iterate rapidly without being constrained by the limitations of existing monolithic blockchains. This could foster a vibrant ecosystem of diverse applications and services, attracting more developers to the platform.

Strong Financial Backing and Community Support

Celestia has successfully raised $155 million in funding, indicating strong investor confidence in its potential to disrupt the blockchain landscape. This financial backing can facilitate ongoing development, marketing, and community building, which are essential for the long-term success of any blockchain project. Additionally, an engaged and active community can contribute to the platform’s growth, as developers and users collaborate to build new applications and services.

Technological Innovation

The introduction of data availability sampling is a significant technological advancement that can enhance the performance and security of blockchain applications. By ensuring that data is accessible without requiring each node to download the entire dataset, Celestia reduces the computational load on individual nodes. This innovative approach not only enhances scalability but also maintains the integrity and security of the blockchain, making it an attractive option for developers looking to build scalable applications.

Market Position and Future Growth

Celestia’s position as a modular blockchain network may offer it a competitive edge as the demand for blockchain solutions continues to grow. With increasing interest in DeFi, NFTs, and other blockchain applications, Celestia’s ability to provide a flexible, scalable, and secure platform could position it well for future growth. If the project can successfully capture market share, it may lead to increased demand for its native token, TIA, potentially driving its value higher.

Potential Risks and Challenges (The Bear Case)

While Celestia presents several opportunities, potential investors should also be aware of the risks and challenges associated with investing in this cryptocurrency.

Market Volatility

Cryptocurrencies are known for their price volatility, and Celestia is no exception. The value of TIA can fluctuate significantly over short periods, influenced by market sentiment, investor behavior, and macroeconomic factors. This volatility can result in substantial gains, but it can also lead to significant losses. Investors should be prepared for the possibility of price swings and should consider their risk tolerance before investing.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, with many jurisdictions yet to establish clear guidelines. Regulatory uncertainty poses a risk to the long-term viability of blockchain projects, including Celestia. Changes in regulations or governmental attitudes towards cryptocurrencies can affect market dynamics, potentially leading to restrictions that could impact Celestia’s operations or its token’s value. Investors should keep an eye on regulatory developments that could affect the cryptocurrency market as a whole.

Competition

Celestia operates in a highly competitive environment, with numerous blockchain platforms vying for market share. Other modular blockchains, layer 1 solutions, and established monolithic blockchains also aim to offer scalability, security, and flexibility. If competitors develop more effective or innovative solutions, Celestia could struggle to attract developers and users, which may adversely affect its market position and TIA’s value. Continuous innovation and differentiation will be crucial for Celestia to maintain its competitive edge.

Technological Risks

While Celestia’s modular architecture and data availability sampling are innovative, they also introduce technological risks. As with any new technology, there may be unforeseen challenges or vulnerabilities that could arise during implementation. Bugs, security vulnerabilities, or performance issues could affect the network’s reliability and security. Additionally, as new applications and blockchains are built on Celestia, there may be challenges in ensuring interoperability and maintaining security across diverse ecosystems.

Adoption and Network Effects

The success of Celestia largely depends on its adoption by developers and users. If developers do not find the platform compelling or if they choose to build on competing platforms, Celestia may struggle to gain traction. Network effects are crucial in the blockchain space; as more applications are built on a platform, it becomes increasingly valuable. If Celestia fails to attract a critical mass of developers and users, its potential for growth may be limited.

Overall Market Sentiment

The broader cryptocurrency market sentiment can significantly impact Celestia’s performance. Market downturns or negative news related to cryptocurrencies can lead to decreased interest and investment in all digital assets, including TIA. Investors should consider the overall market conditions and sentiment before making investment decisions.

Conclusion

Celestia presents a compelling opportunity for those interested in the innovative aspects of blockchain technology. Its modular architecture, focus on scalability, and developer empowerment are significant strengths that could drive adoption and growth. However, potential investors must remain vigilant about the inherent risks, including market volatility, regulatory uncertainty, and competition. As with any investment, a thorough understanding of both the potential rewards and risks is essential for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Celestia Coin (TIA)?

Celestia Coin (TIA) is the native cryptocurrency of the Celestia network, which is a modular blockchain platform. Unlike traditional blockchains that handle all functions in a single layer, Celestia decouples execution from consensus, allowing developers to deploy their own blockchains with minimal overhead. This innovative architecture enables enhanced scalability, flexibility, and customization for blockchain applications.

2. Who created Celestia Coin?

Celestia was founded by Mustafa Al-Bassam, Ismail Khoffi, and Evan Greebel in 2019. The team comprises experienced developers and researchers in the blockchain space who aimed to address the limitations of traditional monolithic blockchains by introducing a modular architecture.

3. What makes Celestia Coin different from Bitcoin?

Celestia Coin differs from Bitcoin primarily in its architecture and purpose. Bitcoin is a monolithic blockchain that processes transactions, validates them, and achieves consensus all in one layer. In contrast, Celestia uses a modular design that separates these functions. This allows for greater scalability and the ability for developers to create custom blockchains that can leverage Celestia’s data availability layer, enhancing performance without sacrificing security.

4. Is Celestia Coin a good investment?

The potential of Celestia Coin as an investment depends on various factors, including market trends, the project’s technology, and its adoption within the blockchain community. As of now, Celestia has garnered significant attention and funding, suggesting a strong belief in its potential. However, like all cryptocurrencies, it carries inherent risks, and investors should conduct thorough research and consider their risk tolerance before investing.

5. What are the real-world applications of Celestia Coin?

Celestia Coin has multiple real-world applications, particularly in sectors like decentralized finance (DeFi), gaming, and portfolio management. Its modular architecture enables developers to create specialized blockchains tailored to specific needs, allowing for high-throughput applications with full-stack customizability. Additionally, it serves as a foundation for Layer 2 solutions, enhancing scalability and performance.

6. How does Celestia Coin ensure security?

Celestia ensures security through a robust validator set that oversees the consensus process. Validators confirm the validity and ordering of transactions, maintaining the integrity of the network. The shared security model allows newly deployed blockchains on the Celestia network to inherit security from its validators, enabling safe experimentation and development without compromising decentralization.

7. What is data availability sampling in Celestia?

Data availability sampling is a key innovation in Celestia’s architecture that allows nodes to verify the availability of transaction data without needing to download the entire dataset. By sampling small portions of data, nodes can confirm that the complete dataset is accessible, which significantly reduces the computational burden on individual nodes while maintaining the security and integrity of the blockchain.

8. What is the current market status of Celestia Coin?

As of the latest data, Celestia Coin (TIA) has a market capitalization of approximately $1.29 billion, with a circulating supply of around 773.76 million TIA tokens. The price of Celestia Coin fluctuates based on market dynamics, with its all-time high recorded at $20.91. Investors should monitor market conditions and perform due diligence to understand the factors influencing its price and market behavior.

Final Verdict on celestia coin

Overview of Celestia Coin

Celestia (TIA) is a pioneering modular blockchain network that addresses the limitations of traditional monolithic blockchains. By decoupling execution from consensus, Celestia enables developers to deploy custom blockchains with remarkable scalability and efficiency. Its innovative architecture leverages data availability sampling, ensuring that necessary transaction data is accessible without burdening individual nodes with large datasets. This approach not only enhances performance but also fosters an environment where developers can create tailored execution and settlement environments.

Potential and Applications

The potential of Celestia is vast, particularly in sectors that require scalable and customizable blockchain solutions, such as decentralized finance (DeFi), gaming, and data management. The platform’s ability to support high-throughput applications while maintaining security through a shared validator set makes it an attractive option for developers. Furthermore, the recent financial backing, amounting to $155 million, demonstrates strong confidence in Celestia’s vision and future growth.

High-Risk, High-Reward Asset

Despite its promising technology and applications, investing in Celestia Coin remains a high-risk venture. The cryptocurrency market is notoriously volatile, and while Celestia has distinguished itself through innovative solutions, it is still subject to market fluctuations and regulatory uncertainties. As with any investment in digital assets, potential investors should be aware of the risks involved and consider their financial situation carefully.

Conduct Your Own Research

In conclusion, while Celestia Coin offers exciting opportunities for developers and investors alike, it is crucial to conduct thorough research before making any investment decisions. Understanding the technology, market dynamics, and potential risks associated with Celestia will empower you to make informed choices. Remember, the mantra in the cryptocurrency space is to “Do Your Own Research” (DYOR) to navigate this complex and rapidly evolving landscape effectively.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.