Should You Invest in caldera crypto? A Full Analysis (2025)

An Investor’s Introduction to caldera crypto

Caldera Crypto, represented by its native token $ERA, is emerging as a significant player in the rapidly evolving landscape of blockchain technology, particularly within the Ethereum ecosystem. As a rollup platform designed for horizontal scaling and interoperability, Caldera addresses a critical issue in the blockchain space: fragmentation among various rollup solutions. By introducing the Metalayer, Caldera enables seamless communication and coordination between different rollups, enhancing the overall efficiency and usability of decentralized applications. This innovation positions Caldera as a pioneer in creating a more interconnected and scalable Ethereum environment.

The significance of Caldera in the crypto market stems from its potential to transform how projects deploy and interact with rollups. Instead of requiring extensive engineering resources, Caldera allows developers to launch customizable rollups easily, thereby democratizing access to advanced blockchain capabilities. With over 60 rollups enabled and more than 400 million transactions processed since its launch in 2023, Caldera has quickly gained traction, showcasing its robust infrastructure and attracting a diverse range of projects, including notable names like Manta Pacific and ApeChain.

This guide aims to serve as a comprehensive resource for both beginner and intermediate investors interested in Caldera Crypto. We will delve into various aspects of the platform, including:

Technology Overview

Understanding the underlying technology of Caldera is crucial for grasping its potential impact on the blockchain ecosystem. We will explore how the Metalayer operates, the role of the $ERA token, and the unique features that differentiate Caldera from other scaling solutions.

Tokenomics

An analysis of the tokenomics will provide insights into the distribution and utility of the $ERA token, including its applications in transaction fees, governance, and staking. Understanding the economic model is essential for evaluating the investment potential of Caldera.

Investment Potential

Investors will benefit from an examination of Caldera’s market performance, including its price history, market capitalization, and trading volume. We will also discuss factors that could influence future price movements and the overall demand for the $ERA token.

Risks and Considerations

Like any investment, Caldera Crypto comes with its own set of risks. This section will highlight potential challenges, including regulatory considerations, market volatility, and technological hurdles that could affect the platform’s growth.

How to Buy Caldera Crypto

For those looking to invest, we will provide a step-by-step guide on how to purchase $ERA, including the platforms where it is available and tips for secure trading.

By the end of this guide, you will have a well-rounded understanding of Caldera Crypto and the factors that may influence your investment decisions.

What is caldera crypto? A Deep Dive into its Purpose

Understanding Caldera Crypto

Caldera is an innovative cryptocurrency project that aims to address some of the most pressing challenges in the Ethereum ecosystem, specifically focusing on scalability and interoperability. As a rollup platform, Caldera introduces a unique infrastructure that enables projects to launch customizable rollups while ensuring the security and decentralization of the Ethereum network. Its native utility and governance token, $ERA, plays a crucial role in facilitating transactions, staking, and governance within the ecosystem.

The Core Problem It Solves

In the current landscape of blockchain technology, fragmentation has emerged as a significant barrier to scalability and usability. As various projects utilize different rollup technologies, the inability to communicate and interact seamlessly across these platforms results in inefficiencies and limits user experience. This fragmentation hampers the potential for mass adoption of decentralized applications (dApps) and services.

Caldera’s primary purpose is to solve this problem through its innovative Metalayer, a unifying layer designed to connect multiple rollups across different frameworks, including Optimistic and Zero-Knowledge (ZK) solutions. By facilitating coordination, communication, and resource sharing among rollups, Caldera effectively enhances interoperability without compromising the unique features of individual rollups. This is particularly important for the Ethereum ecosystem, which has seen a rapid rise in the number of rollup solutions that each offer distinct advantages.

Its Unique Selling Proposition

What sets Caldera apart from other projects is its comprehensive approach to scaling Ethereum. Here are some key features that highlight its unique selling proposition:

-

Rollup Engine: Caldera allows projects to deploy rollups without needing extensive engineering expertise. This lowers the barrier to entry for developers, making it easier for them to create and launch their solutions.

-

Message Passing & Relaying: The platform facilitates efficient data and asset transfers between rollups, enabling seamless interactions and enhancing the overall user experience.

-

Fast Finality & Preconfirmations: By improving transaction speed and security, Caldera ensures that users can rely on prompt confirmations of their transactions, which is critical in a fast-paced digital economy.

-

Guardian Nodes: To bolster security and decentralization, Caldera employs Guardian Nodes, which provide additional layers of security for rollup operations.

-

Native Yield: The platform supports ecosystem incentives and economic sustainability through native yield mechanisms, promoting long-term engagement and investment from users.

-

Omnichain Gas Token: The $ERA token serves as a gas token for cross-chain transactions, governance participation, and network security through staking. This omnichain capability enhances the utility and value of the token within the broader crypto ecosystem.

Overall, Caldera’s Metalayer technology represents a significant advancement in the scalability and interoperability of blockchain solutions, setting it apart from traditional rollup solutions.

The Team and Backers

Caldera was developed by Constellation Labs, a blockchain research and development group with a focus on Ethereum scaling. The team comprises experienced engineers and protocol designers who have a deep understanding of Web3 infrastructure. Notable figures include Matthew Katz, the CEO and co-founder, and Parker Jou, the CTO and co-founder. Their combined expertise in blockchain technology and decentralized systems has been instrumental in shaping Caldera’s vision and execution.

Since its launch in 2023, Caldera has gained traction in the crypto space, enabling over 60 rollups and processing more than 400 million transactions. The project has also achieved significant milestones, such as securing $500 million in Total Value Locked (TVL) within its ecosystem. This growth has attracted various partnerships and collaborations with notable projects, including Manta Pacific, ApeChain, and others, further validating Caldera’s impact and potential in the market.

Fundamental Purpose in the Crypto Ecosystem

Caldera’s fundamental purpose is to create a robust and interconnected ecosystem for Ethereum-based applications. By addressing the challenges of scalability and interoperability, Caldera aims to facilitate the growth of decentralized finance (DeFi), gaming, and other sectors within the blockchain space. Its innovative approach not only enhances the user experience but also fosters a collaborative environment where developers can build and deploy their applications with ease.

Moreover, Caldera’s emphasis on security, decentralization, and economic sustainability ensures that its solutions are not only effective but also align with the core principles of blockchain technology. As the demand for scalable and interoperable solutions continues to rise, Caldera positions itself as a key player in shaping the future of decentralized applications and the broader crypto ecosystem.

In summary, Caldera is more than just a cryptocurrency; it is a comprehensive solution designed to tackle some of the most significant challenges facing the blockchain industry today. Through its innovative Metalayer, the project facilitates seamless interactions among rollups, enhances scalability, and promotes a more interconnected digital economy. With a strong team and a clear vision, Caldera is poised to make a lasting impact in the world of cryptocurrency and blockchain technology.

The Technology Behind the Coin: How It Works

Overview of Caldera Crypto Technology

Caldera is an innovative rollup platform built on Ethereum that aims to address scalability and interoperability issues in blockchain technology. By introducing a unique architecture and utilizing advanced consensus mechanisms, Caldera allows projects to deploy customizable rollups while ensuring security and decentralization. This section will delve into the core technological components that make Caldera a significant player in the blockchain ecosystem.

Blockchain Architecture

At its core, Caldera operates as a rollup platform, specifically designed to enhance Ethereum’s capabilities. A rollup is a layer-2 scaling solution that processes transactions off-chain while maintaining the security of the main Ethereum blockchain. This architecture allows for greater transaction throughput and reduced costs, making it an attractive option for developers and users alike.

The Metalayer

One of the standout features of Caldera is its Metalayer, which acts as a unifying layer connecting various rollup frameworks, including Optimistic and Zero-Knowledge (ZK) rollups. This layer facilitates seamless communication and resource sharing between different rollups, allowing projects to leverage the unique features of each framework without sacrificing performance or security.

- Interoperability: The Metalayer enables projects to interact with multiple rollups, enhancing the overall functionality of decentralized applications (dApps).

- Customization: Developers can launch their rollups tailored to specific needs without requiring extensive engineering resources, democratizing access to advanced blockchain technology.

Consensus Mechanism

Caldera employs a hybrid consensus mechanism that combines elements of both Proof-of-Stake (PoS) and traditional security measures to ensure the integrity and security of transactions.

Proof-of-Stake

In a PoS system, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This approach has several advantages:

- Energy Efficiency: Unlike Proof-of-Work (PoW), which requires extensive computational power and energy, PoS is more sustainable and environmentally friendly.

- Security: Validators have a vested interest in maintaining network integrity since their staked tokens can be slashed (i.e., lost) if they act maliciously.

In Caldera’s ecosystem, the native utility token, $ERA, is used for staking, allowing holders to participate in network validation and governance. This participation not only secures the network but also rewards stakers with transaction fees and potential governance powers.

Key Technological Innovations

Caldera’s architecture is underpinned by several technological innovations that enhance its functionality and usability within the blockchain space.

Rollup Engine

The Rollup Engine is a key component of Caldera’s infrastructure, allowing projects to deploy rollups without the need for a dedicated engineering team. This feature streamlines the process of building and launching new blockchain applications, making it more accessible for developers.

- One-Click Deployment: With a user-friendly interface, developers can launch their rollups in just a few clicks, significantly reducing the time and resources needed to bring their ideas to life.

- Scalability: By enabling multiple rollups to operate simultaneously, Caldera can accommodate a larger number of transactions, alleviating congestion on the Ethereum network.

Message Passing and Relaying

Caldera’s architecture includes robust message-passing capabilities that facilitate efficient data and asset transfers between rollups. This feature is critical for maintaining the integrity of cross-rollup interactions and ensuring that transactions are executed seamlessly.

- Efficient Data Transfer: The ability to relay messages between rollups minimizes latency and enhances user experience, particularly in dApps that require real-time interactions.

- Asset Interoperability: Users can move assets across different rollups without the need for complex exchanges, simplifying the process of interacting with various blockchain applications.

Fast Finality and Preconfirmations

To enhance transaction speed and security, Caldera incorporates mechanisms for fast finality and preconfirmations. These features ensure that transactions are confirmed quickly, reducing the likelihood of double-spending and other security threats.

- Fast Finality: Transactions are finalized almost instantaneously, allowing users to enjoy a seamless experience when interacting with dApps.

- Preconfirmations: This feature provides additional security by requiring a certain number of confirmations before a transaction is considered final, further mitigating risks associated with fraudulent activities.

Guardian Nodes

Caldera employs Guardian Nodes as an additional layer of security within its network. These nodes serve to monitor and validate transactions, ensuring that all operations adhere to the protocol’s rules and standards.

- Decentralization: By distributing the responsibility of monitoring transactions across multiple nodes, Caldera enhances the security and resilience of its network.

- Enhanced Security: Guardian Nodes act as a safeguard against potential threats, providing an extra layer of protection for users and their assets.

Native Yield and Ecosystem Incentives

Caldera’s economic model is designed to promote sustainability and reward participants within its ecosystem. The native yield feature supports various incentives, including staking rewards and governance participation.

- Staking Rewards: Users who stake $ERA tokens can earn rewards in the form of additional tokens, encouraging long-term participation in the network.

- Governance: Token holders have the power to influence protocol upgrades and treasury allocations, fostering a sense of community and shared ownership.

Real-World Applications

Caldera’s innovative technology has real-world applications across various sectors, including decentralized finance (DeFi), gaming, and enterprise solutions. By providing a scalable and interoperable platform, Caldera empowers developers to create diverse applications that can thrive in a competitive landscape.

- DeFi Protocols: Many projects utilizing Caldera’s rollup infrastructure aim to revolutionize financial services by offering decentralized lending, borrowing, and trading solutions.

- Gaming and Metaverse: The gaming industry can benefit from Caldera’s high throughput and low latency, enabling immersive experiences and seamless interactions within virtual environments.

- Enterprise Integration: Businesses can leverage Caldera’s technology for efficient data management and secure transactions, enhancing operational efficiency and reducing costs.

Conclusion

Caldera’s innovative approach to blockchain technology addresses critical challenges related to scalability and interoperability. With its unique Metalayer architecture, hybrid consensus mechanism, and advanced features like message passing and Guardian Nodes, Caldera provides a robust platform for developers and users alike. As the ecosystem continues to grow, its potential applications across various sectors highlight the transformative power of blockchain technology in shaping the future of decentralized solutions.

Understanding caldera crypto Tokenomics

Caldera Crypto, with its native token ERA, has a well-structured tokenomics model designed to support the platform’s functionality and growth within the Ethereum ecosystem. The tokenomics encompasses the total supply, distribution, utility, and the economic principles that govern the token’s behavior in the market. Below, we delve into the specific metrics and features that define Caldera’s tokenomics.

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 ERA |

| Max Supply | 1,000,000,000 ERA |

| Circulating Supply | 148,500,000 ERA |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The ERA token is integral to the Caldera ecosystem, serving multiple purposes that enhance its utility and demand. Here are the primary functions of the ERA token:

-

Transaction Fees: ERA is used to pay transaction fees within the Metalayer, which facilitates cross-rollup interactions. This ensures that users can perform operations across various rollups seamlessly and efficiently.

-

Staking: Token holders can stake their ERA tokens to participate in the network’s consensus mechanism. By staking, users help secure the network and are rewarded with additional ERA tokens. This creates an incentive for users to hold their tokens, contributing to price stability.

-

Governance: ERA token holders have the right to participate in governance decisions regarding protocol upgrades and treasury allocations. This decentralized governance model empowers the community to influence the development of the Caldera platform.

-

Cross-Chain Transactions: As an omnichain gas token, ERA facilitates transactions across different blockchain networks, enhancing interoperability. This feature is crucial in a fragmented ecosystem where various rollups operate independently.

-

Ecosystem Incentives: The tokenomics model supports various incentives designed to encourage participation in the Caldera ecosystem, including rewards for liquidity providers and users who engage with decentralized applications (dApps) built on Caldera.

Token Distribution

The distribution of the ERA token is carefully structured to ensure fair access and long-term sustainability of the project. The allocation of the total supply is as follows:

-

Foundation (35.94%): A significant portion of the tokens is allocated to the foundation, ensuring that there are sufficient resources for development, marketing, and community initiatives.

-

Investors (32.075%): This allocation is designated for early investors who supported the project, providing them with a stake in the network’s success.

-

Core Team (14.75%): A portion of the tokens is reserved for the core team, incentivizing them to continue developing and promoting the Caldera platform.

-

Research & Development (10.235%): Funds allocated for R&D are crucial for ongoing improvements and innovations within the Caldera ecosystem.

-

Community Airdrops (7%): Airdrops are a method to engage and grow the community, distributing tokens to users to increase awareness and participation in the platform.

This distribution model is designed to balance the interests of various stakeholders, from the development team to investors and the community. It aims to foster a sustainable ecosystem that encourages growth, innovation, and active participation.

Economic Model

Caldera’s economic model is primarily deflationary, which means that the total supply of ERA tokens is capped at 1 billion, with no additional tokens to be created in the future. This scarcity can potentially lead to increased demand over time, especially as the platform gains traction and more users engage with its features.

Furthermore, the staking mechanism allows users to lock their tokens, reducing the circulating supply and increasing scarcity. As more users stake their tokens, the available supply in the market diminishes, which can create upward pressure on the token’s price.

Conclusion

The tokenomics of Caldera Crypto is structured to promote a sustainable and thriving ecosystem. With a clear utility, strategic distribution, and a deflationary economic model, the ERA token is positioned to play a vital role in the future of Ethereum scaling solutions. As the platform continues to evolve and attract more projects, the utility and demand for the ERA token are likely to grow, benefiting all participants in the Caldera ecosystem.

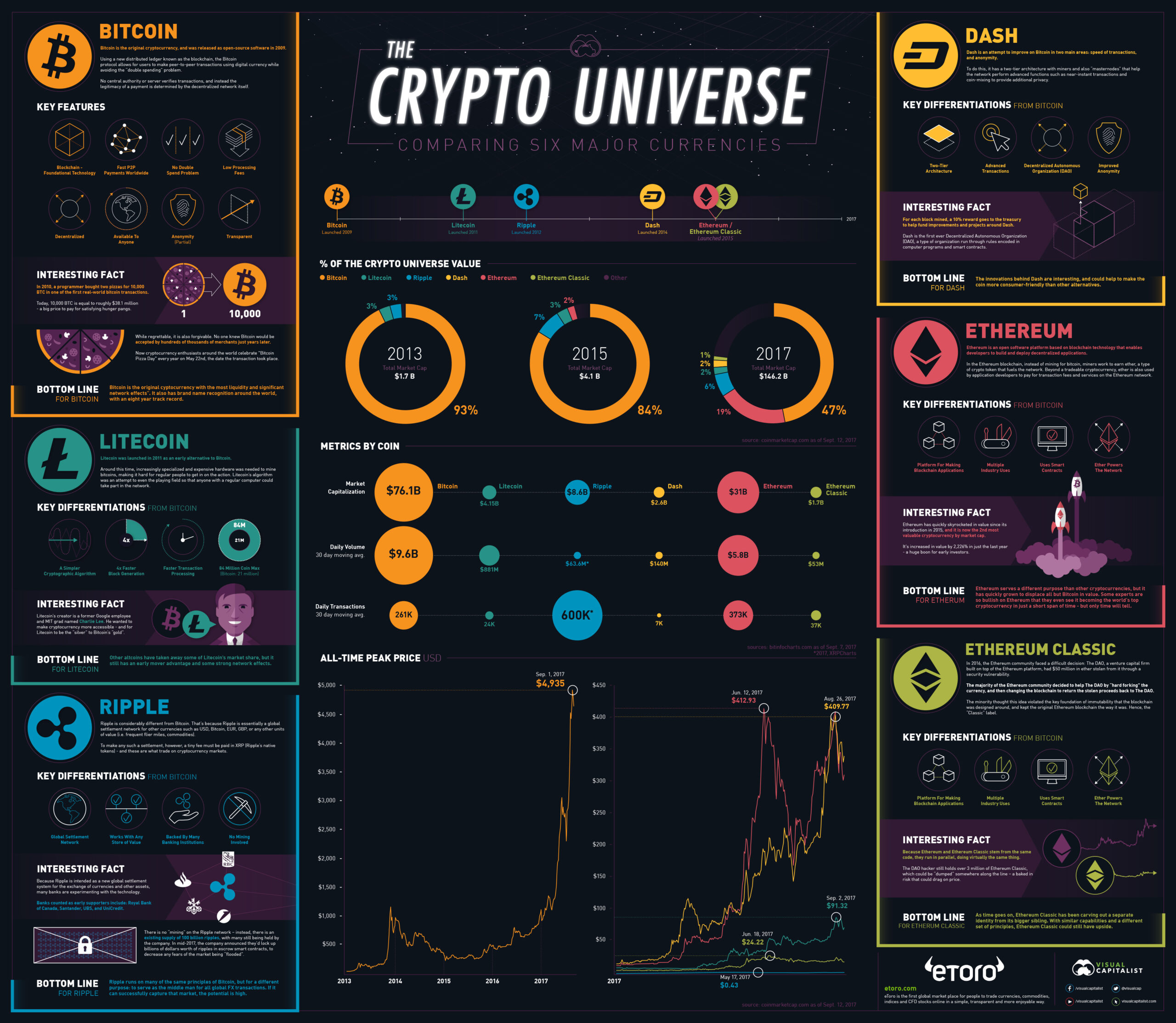

Price History and Market Performance

Overview of Caldera’s Market Performance

Caldera (ERA) has emerged as a notable player in the cryptocurrency market since its launch in 2023. As a rollup platform on Ethereum, Caldera addresses the critical issues of scalability and interoperability within blockchain ecosystems. This has not only attracted considerable attention but has also shaped its price trajectory and market performance.

Current Market Metrics

As of October 2023, Caldera’s price stands at approximately $0.72, with a market capitalization of about $106.9 million. The circulating supply is around 148.5 million ERA tokens, constituting roughly 14.85% of its total supply of 1 billion tokens. In the last 24 hours, the trading volume has reached approximately $15.83 million, indicating active trading and engagement from investors.

Key Historical Price Milestones

Caldera’s price history reflects significant volatility, characteristic of many cryptocurrencies.

-

Launch and Initial Trading: Following its launch in 2023, Caldera’s price initially fluctuated as it established itself in the market. Early adopters saw the price hover around $0.50 to $0.60 during the first few weeks of trading.

-

All-Time High: Caldera reached its all-time high of $2.00 on July 17, 2025. This surge was largely driven by heightened interest in Ethereum scaling solutions and the successful deployment of over 60 rollups on its platform. The increasing Total Value Locked (TVL), which surpassed $500 million, also contributed to this peak, showcasing the growing confidence in Caldera’s technology.

-

Subsequent Corrections: Following the all-time high, Caldera experienced a correction phase, with its price dropping to around $0.71 by October 2023. This decline of approximately 64.05% from its peak is not unusual in the cryptocurrency market, where rapid price fluctuations are common.

-

Recent Low: The price dipped to an all-time low of $0.6657 on September 1, 2025, before rebounding slightly. This volatility reflects broader market trends and investor sentiment during that period.

Factors Influencing the Price

Historically, the price of Caldera has been influenced by several key factors:

Market Sentiment and Trends

The cryptocurrency market is heavily influenced by investor sentiment, which can be swayed by broader economic indicators, market trends, and technological advancements. For instance, the rise of decentralized finance (DeFi) and the increasing demand for Ethereum scaling solutions have positively impacted Caldera’s perception and, consequently, its price. Conversely, market corrections and negative sentiment surrounding regulatory news can lead to sharp price declines.

Technological Developments

Caldera’s underlying technology plays a crucial role in its market performance. The introduction of the Metalayer, which facilitates interoperability among various rollup solutions, has been a significant selling point for the project. Successful implementation of new features and partnerships can lead to price surges as confidence in the project’s utility grows.

Adoption and Use Cases

The number of projects and platforms utilizing Caldera’s infrastructure significantly affects its price. The successful launch of rollups like Manta Pacific and ApeChain has showcased Caldera’s capabilities, increasing its visibility and potential user base. As more developers choose to leverage Caldera for their projects, the demand for the ERA token may increase, positively influencing its price.

Regulatory Environment

The evolving regulatory landscape for cryptocurrencies is another critical factor. Regulatory clarity can lead to increased institutional investment and wider adoption, positively impacting Caldera’s price. Conversely, stringent regulations or unfavorable news can lead to price drops as investors react to perceived risks.

Competition and Market Position

Caldera operates within a competitive environment filled with various Ethereum scaling solutions such as Optimism, Arbitrum, and ZKsync. The project’s ability to differentiate itself through unique features, such as its framework-agnostic design and one-click rollup deployment, can influence investor interest and market performance. The success of competing projects can also impact Caldera’s market share and price.

Conclusion

In summary, Caldera has demonstrated a dynamic price history influenced by various factors ranging from market sentiment to technological advancements and competitive positioning. Understanding these historical price movements and the underlying factors can provide valuable insights for both new and experienced investors looking to navigate the complexities of the cryptocurrency market. As Caldera continues to evolve and adapt, its historical performance will serve as a critical reference point for future developments.

Where to Buy caldera crypto: Top Exchanges Reviewed

5 Reasons to Trade CDA on Caldera Exchanges!

Caldera Exchanges distinguishes itself by offering a comprehensive platform for trading Caldera (CDA) with real-time price comparisons across various exchanges. This feature enables users to make informed decisions when buying, selling, or trading CDA for other cryptocurrencies and fiat currencies. With its user-friendly interface and commitment to transparency, Caldera Exchanges caters to both novice and experienced traders looking for efficient and competitive trading options.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Coinbase – Easiest Way to Buy Caldera (ERA) in the USA!

Coinbase stands out as a premier exchange for purchasing Caldera (ERA) in the United States due to its robust security measures, user-friendly interface, and regulatory compliance. As one of the most trusted platforms, it offers a seamless experience for both beginners and experienced investors, ensuring safe transactions and a wide range of cryptocurrencies. Additionally, Coinbase provides educational resources, making it an ideal choice for those looking to navigate the digital asset landscape confidently.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

3. ChangeNOW – Seamless Caldera Purchases with Barbadian Dollar!

ChangeNOW offers a standout platform for purchasing Caldera with Barbadian Dollars, allowing users to buy instantly starting from just BBD 1.00. The exchange prioritizes security and transparency, enabling payments through debit, credit, or prepaid cards without hidden fees. With competitive rates and a swift two-minute exchange process, ChangeNOW caters to both novice and experienced investors looking for a hassle-free way to enter the Caldera market.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy caldera crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Caldera crypto (ERA token) is selecting a cryptocurrency exchange that supports it. Popular exchanges that list ERA include:

- Binance

- MEXC

- Uniswap (for decentralized trading)

When choosing an exchange, consider the following factors:

– Reputation: Look for exchanges with a good track record and positive user reviews.

– Fees: Check the trading fees and deposit/withdrawal fees associated with the platform.

– Security: Ensure the exchange has robust security measures in place, such as two-factor authentication (2FA).

– User Interface: A user-friendly interface can make the buying process easier, especially for beginners.

2. Create and Verify Your Account

Once you’ve chosen an exchange, you need to create an account. Follow these steps:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button.

- Provide Information: Fill out the registration form with your email address, password, and any other required information.

- Verify Your Email: After registering, you’ll receive a verification email. Click the link in the email to verify your account.

- Complete KYC (Know Your Customer): Most exchanges require identity verification to comply with regulations. You’ll need to upload a government-issued ID (like a passport or driver’s license) and possibly a utility bill to confirm your address. This process can take anywhere from a few minutes to a couple of days.

3. Deposit Funds

After your account is verified, the next step is to deposit funds. Here’s how to do it:

- Log In: Access your account on the exchange.

- Go to the Deposit Section: Find the deposit option in your account dashboard.

- Choose a Payment Method: Most exchanges accept various payment methods, including bank transfers, credit/debit cards, and sometimes PayPal or other e-wallets.

- Follow Instructions: Enter the amount you want to deposit and follow the instructions provided by the exchange. Make sure to double-check any details, especially if you’re using a bank transfer.

- Confirm Deposit: Depending on your payment method, the funds may be available instantly or take a few hours/days to reflect in your account.

4. Place an Order to Buy Caldera Crypto

Now that your account is funded, you can buy Caldera crypto (ERA). Follow these steps:

- Find the Trading Pair: In the exchange’s trading section, search for the ERA token. It may be listed as ERA/USD or ERA/ETH, depending on the pair you want to trade.

- Select the Order Type: Most exchanges offer different types of orders:

- Market Order: Buy at the current market price.

- Limit Order: Set a specific price at which you want to buy ERA. The order will execute when the price reaches your target.

- Enter the Amount: Specify how much ERA you want to buy. If you’re using a market order, the exchange will automatically calculate how much of your deposited currency will be used to purchase the ERA tokens.

- Review and Confirm: Double-check the details of your order before clicking the “Buy” button. Make sure everything is correct, including the amount and the total cost.

- Execute the Order: Click “Buy” to complete your purchase. You should see a confirmation message once your order is executed.

5. Secure Your Coins in a Wallet

After purchasing Caldera crypto, it’s crucial to store your tokens securely. Here’s how to do it:

- Choose a Wallet: There are different types of wallets available:

- Software Wallets: Applications like MetaMask or Trust Wallet that store your tokens on your device.

- Hardware Wallets: Physical devices like Ledger or Trezor that provide enhanced security by storing your tokens offline.

-

Exchange Wallets: While convenient, it’s generally safer to move your coins to a personal wallet.

-

Transfer Your Tokens: If you’re using a software or hardware wallet, you’ll need to transfer your ERA tokens from the exchange:

- Go to your wallet and generate a receiving address for ERA.

- Log into your exchange account, navigate to the withdrawal section, and enter the receiving address.

-

Specify the amount of ERA you want to transfer and confirm the transaction.

-

Confirm the Transfer: Check your wallet to ensure the tokens have arrived. It may take a few minutes for the transfer to complete.

By following these steps, you can successfully buy and secure Caldera crypto (ERA) while enhancing your understanding of cryptocurrency transactions. Always remember to stay informed about the market and practice safe trading habits.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Caldera, through its innovative Metalayer architecture, positions itself as a significant player in the Ethereum ecosystem, especially in the realm of layer-2 solutions. This section will explore the strengths and potential upsides of investing in Caldera crypto (ERA token).

1. Unique Value Proposition

Caldera addresses a critical challenge in the Ethereum network: fragmentation among various layer-2 rollups. By providing a unified Metalayer, it facilitates interoperability across different rollup frameworks such as Optimism, Arbitrum, and ZKsync. This interoperability is essential for fostering a more cohesive ecosystem, enabling seamless transactions and interactions across decentralized applications (dApps) and protocols.

2. Robust Market Demand

The demand for scalable solutions is on the rise as Ethereum continues to face congestion and high gas fees. Caldera’s rollup infrastructure has already supported over 60 live rollups and processed more than 400 million transactions, indicating strong market acceptance. With $500 million in Total Value Locked (TVL), Caldera demonstrates its capacity to attract significant liquidity and user engagement, which is a positive indicator for potential growth.

3. Strong Token Utility

The native $ERA token serves multiple functions within the Caldera ecosystem. It is used for transaction fees within the Metalayer, staking for validator nodes, and governance participation. This multifaceted utility creates inherent demand for the token as the platform scales and attracts more projects. Moreover, the ability to stake $ERA may provide investors with additional income opportunities, enhancing its appeal.

4. Experienced Development Team

Founded by Constellation Labs, Caldera benefits from a team of experienced blockchain engineers and protocol designers. Their background in Web3 infrastructure is a significant asset, as it suggests a well-informed approach to tackling the complex challenges of blockchain scaling and interoperability. An experienced team can navigate technological hurdles and foster innovative solutions, which is crucial for long-term success.

5. Ecosystem Growth Potential

Caldera’s compatibility with various DeFi protocols, gaming applications, and enterprise integrations opens avenues for extensive ecosystem growth. As more projects seek to leverage its rollup capabilities, the overall demand for the $ERA token may increase. Additionally, the platform’s design allows for one-click rollup deployment, making it accessible for developers and startups looking to build on Ethereum.

Potential Risks and Challenges (The Bear Case)

While Caldera presents several promising opportunities, potential investors should also be aware of the risks and challenges that could impact the value of the $ERA token and the project’s overall success.

1. Market Volatility

The cryptocurrency market is notoriously volatile, with prices subject to rapid fluctuations influenced by a range of factors, including market sentiment, macroeconomic trends, and regulatory news. Caldera, like other digital assets, is vulnerable to these market dynamics. Significant price swings can result in substantial financial losses for investors, particularly those who may not be prepared for the inherent risks of crypto investing.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain across many jurisdictions. Governments worldwide are still formulating their approaches to digital assets, which can lead to sudden changes in how cryptocurrencies are treated legally. Regulatory crackdowns or unfavorable regulations could adversely impact Caldera’s operations, user adoption, and token value. Investors should stay informed about regulatory developments that could affect the broader market and Caldera specifically.

3. Intense Competition

Caldera operates in a highly competitive space, with numerous projects aiming to solve similar issues of scalability and interoperability within the Ethereum ecosystem. Competitors like Polygon, Arbitrum, and Optimism are already well-established and have significant user bases. If Caldera fails to differentiate itself effectively or capture market share, it may struggle to achieve the growth and adoption necessary for long-term success.

4. Technological Risks

As a relatively new platform, Caldera may face various technological challenges, including bugs, security vulnerabilities, and scalability issues. Any significant technical failures or breaches could undermine user confidence and negatively impact the token’s value. Furthermore, the rapid pace of technological advancement in the blockchain space means that Caldera must continually innovate to remain relevant and competitive.

5. Tokenomics and Supply Concerns

Caldera’s tokenomics play a crucial role in its long-term viability. With a total supply of 1 billion $ERA tokens, careful management of token distribution and inflation is essential. If a large portion of tokens is released into the market too quickly, it could lead to oversupply and price depreciation. Investors should consider how the tokenomics structure and the allocation of tokens might affect scarcity and value over time.

Conclusion

Investing in Caldera crypto offers both potential rewards and inherent risks. Its innovative approach to Ethereum scalability through the Metalayer, combined with a strong utility for the $ERA token, positions it favorably in the evolving blockchain landscape. However, investors must remain vigilant about market volatility, regulatory uncertainties, competition, technological challenges, and tokenomics.

As with any investment, thorough research and a clear understanding of both the potential strengths and risks are essential for making informed decisions. Always consider your risk tolerance and investment strategy when exploring opportunities in the cryptocurrency space.

Frequently Asked Questions (FAQs)

1. What is Caldera Crypto?

Caldera is a blockchain infrastructure platform designed to enhance Ethereum’s scalability through a concept known as the “Metalayer.” This platform enables the creation of customizable rollups, which are layer-2 scaling solutions that help improve transaction speeds and reduce congestion on the Ethereum network. The native token of Caldera, $ERA, is utilized for transaction fees, staking for network security, and governance within the ecosystem.

2. Who created Caldera Crypto?

Caldera was developed by Constellation Labs, a team focused on research and development within the blockchain space, particularly aimed at scaling Ethereum. The project was co-founded by Matthew Katz, the CEO, and Parker Jou, the CTO. The team’s experience in Web3 infrastructure plays a crucial role in the development and success of Caldera.

3. What makes Caldera Crypto different from Bitcoin?

Caldera differs from Bitcoin in several key aspects. While Bitcoin is primarily a digital currency designed for peer-to-peer transactions, Caldera functions as a layer-2 solution aimed at improving scalability and interoperability on the Ethereum network. Caldera’s focus on rollups and the Metalayer allows for customizable and efficient transaction processing across multiple rollup frameworks, which is not a feature present in Bitcoin’s architecture.

4. Is Caldera Crypto a good investment?

Determining whether Caldera is a good investment depends on various factors, including market conditions, the project’s development progress, and individual investment goals. As of now, Caldera has shown promising metrics, such as over 60 deployed rollups and significant Total Value Locked (TVL). However, like any cryptocurrency investment, it is essential to conduct thorough research and consider market volatility before investing.

5. How does the $ERA token function within the Caldera ecosystem?

The $ERA token serves multiple purposes within the Caldera ecosystem. It is used to pay for transaction fees on the Metalayer, enables governance participation where holders can vote on protocol upgrades, and allows for staking to support validator nodes, thereby enhancing the network’s security and efficiency.

6. What are the advantages of using Caldera’s Metalayer?

Caldera’s Metalayer offers several advantages, including:

– Interoperability: It connects various rollup frameworks like Optimistic and ZK rollups, allowing seamless data and asset transfers.

– Customizability: Projects can deploy their rollups without needing extensive engineering resources.

– Enhanced Security: By utilizing Guardian Nodes, Caldera provides additional security and decentralization for rollups.

– Fast Finality: It ensures quicker transaction confirmations, improving the overall user experience.

7. What types of projects are using Caldera?

Caldera has enabled a diverse range of projects across various sectors, including decentralized finance (DeFi), gaming, and metaverse applications. Notable projects utilizing Caldera’s infrastructure include Manta Pacific, ApeChain, and Zero Network by Zerion, showcasing the platform’s flexibility and effectiveness in supporting innovative applications.

8. How can I purchase $ERA tokens?

$ERA tokens can be purchased on various cryptocurrency exchanges that list the token. Users should create an account on a reputable exchange, complete any necessary identity verification processes, and then deposit funds to buy $ERA. Always ensure to follow safe practices, including using secure wallets to store your tokens after purchase.

Final Verdict on caldera crypto

Summary of Caldera Crypto

Caldera is an innovative platform designed to enhance Ethereum’s scalability through its unique Metalayer technology. This solution addresses the growing challenge of rollup fragmentation by allowing projects to deploy customizable rollups while ensuring interoperability across various frameworks, such as Optimism and ZKsync. The native utility and governance token, $ERA, plays a crucial role in facilitating cross-rollup transactions, staking for network security, and governance participation. This infrastructure has already enabled over 60 rollups and processed more than 400 million transactions, showcasing its market traction and potential.

Technology and Use Cases

The technology underpinning Caldera focuses on simplifying the deployment of rollups, making it accessible for developers without extensive engineering teams. Key features such as fast finality, message passing, and guardian nodes enhance transaction speed and security, positioning Caldera as a significant player in the decentralized finance (DeFi) landscape. Its applications extend beyond DeFi, reaching into gaming, enterprise integration, and multi-rollup development, indicating a broad utility across various sectors.

Investment Considerations

As with any cryptocurrency, investing in Caldera Crypto comes with inherent risks. The digital asset market is known for its volatility, and while Caldera presents promising technology and real-world applications, potential investors should be aware of the market’s unpredictable nature. The current price of $ERA is around $0.72, with a market cap of approximately $106.9 million, suggesting that it is still in a relatively early stage of its development.

Final Thoughts

Before considering an investment in Caldera Crypto, it is imperative to conduct thorough research (DYOR). Understanding the project’s fundamentals, technology, market trends, and your own risk tolerance will be crucial in making informed investment decisions. The potential for high rewards exists, but it is accompanied by significant risks, making due diligence essential for any investor looking to navigate this dynamic space.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.