What is berachain crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to berachain crypto

Berachain crypto has emerged as a notable player in the blockchain landscape, particularly recognized for its innovative approach as a Layer 1 blockchain. Designed to be fully compatible with the Ethereum Virtual Machine (EVM), Berachain aims to provide a robust framework for developers to build decentralized applications (dApps) while addressing some of the significant challenges in the crypto market, such as liquidity fragmentation and scalability. Its unique Proof of Liquidity (PoL) consensus mechanism aligns network security with liquidity provision, making it a pioneer in enhancing the efficiency of blockchain operations.

The significance of Berachain lies in its dual-token model, which includes BERA as the gas and staking token, and BGT as the governance token. This structure not only incentivizes validators and users but also facilitates a dynamic governance framework that allows the community to play an active role in protocol decisions. By focusing on both security and liquidity, Berachain offers a compelling solution for developers and investors looking to participate in the rapidly evolving decentralized finance (DeFi) sector.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Berachain crypto. We will explore various aspects of the platform, including its underlying technology, tokenomics, and investment potential. Understanding the mechanics of Berachain will provide insights into how it operates, its unique features, and the potential benefits it offers to users.

In addition to the technical framework, this guide will also address the risks associated with investing in Berachain. The cryptocurrency market is known for its volatility, and potential investors should be aware of the inherent risks involved. By analyzing market trends, historical performance, and future projections, we aim to equip readers with the necessary knowledge to make informed investment decisions.

Finally, we will provide practical information on how to buy Berachain tokens, covering various platforms and strategies for acquiring BERA and BGT. Whether you are looking to invest in Berachain for its technological innovations or as part of a broader cryptocurrency portfolio, this guide will offer valuable insights to help you navigate the world of Berachain crypto with confidence.

What is berachain crypto? A Deep Dive into its Purpose

Overview of Berachain Crypto

Berachain is an innovative Layer 1 blockchain that aims to address some of the most pressing challenges in the cryptocurrency ecosystem. Built on a robust infrastructure that is fully compatible with the Ethereum Virtual Machine (EVM), Berachain is designed to facilitate the development and deployment of decentralized applications (dApps) while ensuring high levels of security, scalability, and interoperability. Its unique consensus mechanism, Proof of Liquidity (PoL), and tri-token model set it apart from other blockchain platforms, making it a compelling option for developers and users alike.

The Core Problem It Solves

One of the primary issues that Berachain addresses is liquidity fragmentation across different blockchain platforms. In the current landscape, assets often struggle to move seamlessly between various blockchains, leading to inefficiencies and missed opportunities for users and developers. By introducing a modular design, Berachain allows for the creation of Layer 1 blockchains tailored to specific needs without sacrificing interoperability or performance.

Additionally, traditional consensus mechanisms can lead to inefficiencies in resource allocation and network security. Berachain’s PoL mechanism fundamentally changes how Layer 1 economics are structured by creating a more efficient marketplace between validators, users, and applications. This mechanism not only secures the network but also incentivizes liquidity provision, thereby enhancing the overall functionality of dApps built on the platform.

Moreover, Berachain’s compatibility with Ethereum’s ERC standards and opcodes simplifies the migration process for developers looking to transition their applications from Ethereum to Berachain. This ease of migration is crucial for developers who wish to leverage the benefits of Berachain without extensive code modifications.

Its Unique Selling Proposition

Berachain’s unique selling propositions (USPs) stem from its innovative features and approach:

-

Proof of Liquidity (PoL): This consensus mechanism aligns network security with liquidity provision, ensuring that validators are incentivized to maintain a healthy liquidity pool. This not only enhances network security but also allows for scalability as demand for liquidity grows.

-

Tri-Token Model: Berachain utilizes a tri-token model consisting of BERA, BGT, and a third unspecified token. BERA serves as the gas and staking token for transaction fees and validator security, while BGT enables governance participation and can be earned through staking or providing liquidity. This tokenomics structure optimizes the network’s economic incentives and ensures that all participants have a stake in the platform’s success.

-

EVM Compatibility: By being fully EVM-compatible, Berachain allows developers to easily migrate existing Ethereum-based dApps and services. This compatibility also opens up the platform to a vast ecosystem of tools and services already built around Ethereum, further simplifying the development process.

-

Focus on Decentralized Finance (DeFi): Berachain’s architecture is particularly well-suited for DeFi applications, enabling seamless liquidity provision, protocol synergies, and composability with other chains. This focus positions Berachain as a strong contender in the rapidly evolving DeFi space.

-

Community Governance: With a phased governance approach through the BGT Foundation, Berachain encourages community involvement in protocol decisions and economic incentives. This democratic structure ensures that the interests of users and developers are represented in the platform’s evolution.

The Team and Backers Behind the Project

The success of any blockchain project often hinges on the strength and expertise of its team. Berachain is backed by a team of experienced developers and blockchain enthusiasts who have a proven track record in the cryptocurrency space. While specific names and details may vary, the team has a diverse background in software development, blockchain technology, and financial services, which equips them with the necessary skills to navigate the challenges of building a robust and scalable blockchain ecosystem.

Additionally, Berachain has attracted interest from venture capitalists and institutional investors who recognize the potential of the platform to address critical issues in the blockchain space. This backing not only provides financial support for development and marketing but also lends credibility to the project, fostering trust among potential users and investors.

Fundamental Purpose in the Crypto Ecosystem

At its core, Berachain aims to serve as a foundational layer in the evolving blockchain ecosystem. Its primary purpose is to enhance the development and deployment of decentralized applications while ensuring a high level of security, scalability, and interoperability. By focusing on liquidity, Berachain seeks to create a more interconnected and efficient ecosystem where assets and data can flow freely between different blockchain networks.

Moreover, Berachain’s emphasis on education and community development, as seen through initiatives like Beracademy, highlights its commitment to increasing blockchain literacy and attracting more users and developers to the platform. This focus on community engagement is vital for the long-term success of any blockchain project, as it fosters a loyal user base and encourages active participation in the network’s development.

In summary, Berachain is positioned to make a significant impact on the blockchain landscape. Its innovative consensus mechanism, tri-token model, and EVM compatibility, combined with a strong team and community focus, make it a promising solution for the next generation of blockchain applications. As the project continues to evolve, it will be essential for potential users and investors to conduct thorough research to understand the platform’s capabilities and implications fully.

The Technology Behind the Coin: How It Works

Overview of Berachain Technology

Berachain is an innovative Layer 1 blockchain designed to enhance the functionality and scalability of decentralized applications (dApps). It utilizes a unique architecture and consensus mechanism to address common issues in the blockchain space, such as liquidity fragmentation and transaction efficiency. In this section, we will explore the core components that make up Berachain’s technology, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

EVM-Identical Layer 1 Blockchain

At its core, Berachain is an EVM-identical Layer 1 blockchain. This means it is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to deploy existing Ethereum applications or create new ones without major modifications. The EVM is crucial because it enables smart contracts and decentralized applications to run seamlessly across the Ethereum network.

This compatibility has several advantages:

- Ease of Development: Developers familiar with Ethereum can quickly adapt their skills to work on Berachain, lowering the barrier to entry for building on this blockchain.

- Interoperability: Berachain can interact with other Ethereum-compatible networks, facilitating the transfer of assets and data across different platforms.

- Access to Existing Tools: Developers can leverage the vast ecosystem of Ethereum-based tools and services, streamlining the development process.

Modular Design

Berachain’s architecture emphasizes modularity, allowing for tailored Layer 1 solutions that meet specific needs. This modular approach addresses liquidity fragmentation, a significant challenge in the blockchain space where assets are often stuck on one platform and cannot be easily transferred to another. By designing a flexible architecture, Berachain aims to create a more interconnected and efficient ecosystem.

Consensus Mechanism

Proof of Liquidity (PoL)

One of the standout features of Berachain is its unique consensus mechanism known as Proof of Liquidity (PoL). Unlike traditional consensus models, such as Proof of Work (PoW) or Proof of Stake (PoS), PoL aligns network security with liquidity provision.

Here’s how it works:

- Liquidity Incentives: Validators stake BERA tokens, which range from 250,000 to 10 million, to secure the network. In return, they earn BGT rewards, which they can allocate to various application reward vaults. This incentivizes validators to maintain liquidity in the network, contributing to its overall security and efficiency.

- Market Dynamics: PoL creates a marketplace where validators, users, and applications can interact. This system allows chain rewards to scale with the actual demand for economic security and liquidity, ensuring that the network remains responsive to user needs.

- Enhanced Security: By linking security to liquidity, Berachain mitigates risks associated with low liquidity, which can often lead to network vulnerabilities.

Delegated Proof of Stake (dPoS)

In addition to PoL, Berachain employs a Delegated Proof of Stake (dPoS) mechanism. In this model, BERA token holders can vote for validators who are responsible for confirming transactions and maintaining the integrity of the blockchain. The dPoS system enhances security and scalability by:

- Decentralization: By allowing token holders to select validators, the network remains decentralized, reducing the risk of central authority control.

- Efficiency: dPoS allows for faster transaction confirmations compared to traditional PoW systems, making the network more efficient and user-friendly.

Key Technological Innovations

Tri-Token Model

Berachain utilizes a tri-token model, which consists of three distinct tokens: BERA, BGT, and another token that is not specified in the reference material. Each token serves a unique purpose within the ecosystem:

- BERA: This is the gas and staking token used for transaction fees and securing the network. Users pay with BERA for executing smart contracts and processing transactions.

- BGT: This token is used for governance participation and can be earned through staking or providing liquidity. BGT holders can influence protocol decisions and economic incentives by voting on proposals.

- Third Token: While details on the third token are limited, such a model typically involves tokens that facilitate transactions or incentivize specific behaviors within the network.

This tri-token model optimizes Berachain’s economic structure, ensuring stability and promoting active participation among users.

Built-in Safeguards Against Centralization

Berachain incorporates several mechanisms to prevent centralization within its network:

- Stake Caps: By placing limits on the amount of tokens that can be staked by a single validator, Berachain ensures that no single entity can dominate the network.

- Concave Emission Scaling: This mechanism adjusts the rate at which rewards are distributed based on network activity, further promoting decentralization and fairness in reward distribution.

Security Framework

Multi-layered Security Approach

Berachain’s security framework employs a multi-layered approach to protect its network and transactions. Key components include:

- Proof of Liquidity: As mentioned earlier, this mechanism aligns liquidity provision with network security, creating a robust defense against various security threats.

- Hardware Wallets and Multi-Signers: By requiring multiple approvals for transactions, Berachain significantly reduces the risk of unauthorized access, ensuring that users’ assets are well-protected.

- Regular Protocol Updates: The network undergoes regular updates to address potential vulnerabilities and adapt to evolving security threats, maintaining a secure environment for users.

Conclusion

Berachain represents a significant advancement in blockchain technology, combining EVM compatibility, a unique consensus mechanism, and a modular design to create a robust platform for decentralized applications. Its innovative approaches to liquidity, governance, and security position it as a promising solution in the evolving blockchain landscape.

For beginners and intermediate investors, understanding these technological components is crucial to grasping the potential of Berachain as a foundational layer in the decentralized finance ecosystem. As with any emerging technology, it is essential to conduct thorough research and stay informed about developments within the Berachain ecosystem.

Understanding berachain crypto Tokenomics

Berachain operates on a unique tokenomics model that supports its innovative Proof of Liquidity (PoL) consensus mechanism. This two-token system consists of BERA and BGT, each serving distinct functions within the Berachain ecosystem. Understanding these tokens and their economic framework is crucial for both new and intermediate investors who wish to engage with this digital asset.

| Metric | Value |

|---|---|

| Total Supply | 508.08 million BERA |

| Max Supply | ∞ (Unlimited) |

| Circulating Supply | 125.56 million BERA |

| Inflation/Deflation Model | Dynamic inflation based on liquidity demand |

Token Utility (What is the coin used for?)

BERA Token:

The primary utility of the BERA token lies in its dual role as the gas and staking token within the Berachain network. Here’s a breakdown of its key uses:

-

Gas Fees: BERA is used to pay transaction fees on the network. Every transaction processed on Berachain requires a small amount of BERA, which incentivizes validators to maintain network integrity and security.

-

Staking: BERA holders can stake their tokens to participate in the network’s consensus mechanism. By staking BERA, users help secure the network and, in return, earn rewards in the form of BGT tokens. This staking mechanism aligns the interests of validators and users, promoting a healthy network environment.

-

Liquidity Provision: As a core aspect of the PoL mechanism, BERA can be utilized to provide liquidity to various decentralized applications (dApps) within the Berachain ecosystem. This feature enhances the usability of the token and facilitates the growth of the platform.

BGT Token:

BGT, on the other hand, serves primarily as a governance and rewards token. Its non-transferable nature highlights its focus on community engagement rather than speculative trading. Here are its main functions:

-

Governance Participation: BGT holders are granted the ability to participate in governance decisions regarding the protocol. This includes voting on proposals that can affect the network’s direction, features, and economic incentives.

-

Earning Rewards: Users can earn BGT by staking BERA or providing liquidity to the network. This incentivizes participation and fosters a robust community around Berachain.

-

Application Incentives: Developers can utilize BGT within their dApps to bootstrap liquidity or incentivize specific user actions. This flexibility enhances the functionality of applications built on Berachain.

Token Distribution

The distribution of BERA is pivotal to ensuring a balanced and sustainable growth model for the Berachain ecosystem. The genesis supply of 500 million BERA was allocated as follows:

-

Community Initiatives (48.9%): Almost half of the total supply is dedicated to community initiatives, emphasizing the importance of user engagement and participation in the ecosystem’s growth.

-

Validators and Network Security (25%): A significant portion of the token supply is reserved for validators, who play a crucial role in maintaining the network’s security and integrity. This allocation incentivizes them to stake and actively participate in the network.

-

Development and Ecosystem Growth (20%): Tokens are set aside for ongoing development efforts and to foster ecosystem growth. This includes funding for new projects, partnerships, and community development initiatives.

-

Team and Advisors (6.1%): A smaller percentage is allocated to the team and advisors who have contributed to the project’s inception and ongoing success. This allocation is typically subject to vesting periods to align their interests with the long-term success of Berachain.

Inflation and Economic Model

The inflation model of Berachain is designed to be dynamic and responsive to market demand for liquidity. Unlike traditional models that impose fixed supply caps, Berachain’s approach allows for the issuance of new tokens based on the level of economic activity and demand within the network. This feature aims to ensure that the token supply can adapt to changing market conditions, helping to stabilize the ecosystem.

Conclusion

In summary, Berachain’s tokenomics is structured to foster a thriving ecosystem that prioritizes community participation, governance, and network security. The distinct roles of BERA and BGT facilitate a robust economic model that aligns the interests of users, validators, and developers. As Berachain continues to evolve, understanding its tokenomics will be essential for anyone looking to engage with this innovative blockchain platform. Potential investors and users should keep abreast of ongoing developments and community initiatives to maximize their engagement with Berachain.

Price History and Market Performance

Key Historical Price Milestones

Berachain (BERA) has seen a dynamic price trajectory since its inception, reflecting various market conditions and events that have shaped its development. Understanding these price milestones can provide investors and enthusiasts with insights into the asset’s performance and the broader market context.

-

Initial Launch and Early Trading: Berachain was introduced to the market in early 2023, initially trading at modest levels as it garnered attention from early adopters. The price during this period was primarily influenced by the excitement surrounding the launch of new blockchain projects and the overall bullish sentiment in the cryptocurrency market.

-

First Major Surge: The cryptocurrency experienced its first significant price increase in mid-2023, reaching a peak of approximately $5.50. This surge was driven by heightened interest in decentralized finance (DeFi) applications and the growing adoption of blockchain technology, particularly in the context of Layer 1 solutions. The innovative Proof of Liquidity (PoL) consensus mechanism introduced by Berachain also contributed to its appeal, as investors sought out projects that offered unique technological advancements.

-

Market Correction: Following the peak, Berachain’s price underwent a correction, reflective of broader market trends that saw many cryptocurrencies experience declines. By early 2024, BERA’s price had adjusted to around $2.50. This correction was influenced by a combination of factors, including regulatory scrutiny in the cryptocurrency space and overall market volatility.

-

All-Time High: Berachain reached its all-time high of $14.99 in February 2025, just under two years after its launch. This remarkable achievement can be attributed to several factors, including successful community engagement initiatives, partnerships, and the launch of new features that enhanced the platform’s usability. The excitement surrounding the anticipated main launch in 2024 further fueled investor interest, leading to significant price appreciation.

-

Recent Performance: As of October 2023, Berachain’s price stands at approximately $2.26, reflecting a market capitalization of around $284.5 million. The price has experienced fluctuations, with a 24-hour trading volume of about $31.12 million. Over the past month, the price has shown resilience, with a low of $2.24 and a high of $2.33. Historically, these price movements illustrate the volatility that often characterizes cryptocurrency markets.

Factors Influencing the Price

Historically, the price of Berachain has been influenced by a variety of factors that reflect both internal developments within the project and external market conditions. Understanding these influences can help investors make informed decisions.

-

Market Sentiment and Trends: The overall sentiment in the cryptocurrency market plays a significant role in influencing Berachain’s price. Bullish trends in the market, often triggered by positive news or developments in the blockchain space, tend to lead to price increases. Conversely, bearish sentiment can result in price declines, as seen during periods of market corrections.

-

Technological Developments: Berachain’s unique features, such as its Proof of Liquidity mechanism and EVM compatibility, have attracted attention from developers and investors alike. Announcements regarding new features, partnerships, or upgrades can lead to increased demand for BERA, driving its price higher. For instance, the introduction of the BeaconKit SDK provided developers with essential tools to build on the platform, enhancing its attractiveness and, subsequently, its price.

-

Community Engagement: The strength and activity of the Berachain community have also had a notable impact on its price. Initiatives such as the “Hot Bera Summer” event and the launch of Beracademy have fostered engagement and built a loyal user base. Increased community activity often correlates with price increases as more users become interested in participating in the ecosystem.

-

Regulatory Environment: The regulatory landscape surrounding cryptocurrencies has been a crucial factor influencing Berachain’s price. Regulatory scrutiny can lead to uncertainty and volatility in the market. For example, when governments announce new regulations or crackdowns on cryptocurrency exchanges, it often leads to market-wide sell-offs, impacting prices across the board, including Berachain.

-

Market Competitors: The performance of competing cryptocurrencies can also affect Berachain’s price. As new Layer 1 solutions and DeFi projects emerge, investors often compare these projects, which can lead to shifts in investment focus. Berachain’s ability to differentiate itself and maintain its competitive edge is critical for sustaining investor interest and price stability.

-

Liquidity and Trading Volume: The liquidity of Berachain and its trading volume are essential factors in price determination. Higher trading volumes generally indicate increased interest and can lead to more stable price movements. Conversely, low trading volumes can result in higher volatility and more pronounced price fluctuations.

In summary, the price history and market performance of Berachain reflect a complex interplay of various factors. From significant price milestones to the influences of market sentiment, technology, community engagement, regulatory developments, competition, and liquidity, each element plays a vital role in shaping the asset’s trajectory. For investors and enthusiasts, monitoring these factors can provide valuable insights into Berachain’s ongoing evolution within the cryptocurrency landscape.

Where to Buy berachain crypto: Top Exchanges Reviewed

1. Changelly – Lowest Fees for Berachain (BERA) Exchange!

Changelly stands out as a premier platform for exchanging Berachain (BERA) due to its exceptionally low fees and competitive rates, making it an attractive choice for both novice and seasoned traders. With a user-friendly website and app, Changelly supports over 700 cryptocurrencies and offers fast transactions. Additionally, the exchange is accessible around the clock, ensuring that users can trade whenever they wish, backed by a strong rating of 4.7 from over 5,000 reviews.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

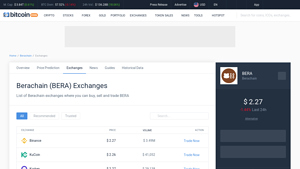

5. Berachain – Your Gateway to BERA Trading!

Berachain exchanges, including prominent platforms like HTX (Huobi), Binance, KuCoin, and Kraken, offer users a robust environment for buying, selling, and trading BERA. What sets these exchanges apart is their high liquidity, user-friendly interfaces, and strong security measures, making them ideal for both novice and experienced traders. Additionally, the diverse range of trading pairs and competitive fees further enhances the trading experience for BERA enthusiasts.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

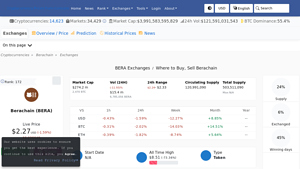

5. Berachain (BERA) – Your Gateway to Innovative Trading!

Berachain (BERA) is available on over 32 cryptocurrency exchanges, with Binance, MEXC Global, and Gate leading the way. What sets Berachain apart is its strong liquidity and diverse trading pairs, particularly with USDT on Binance, making it accessible for both novice and experienced traders. The variety of platforms enhances user choice and flexibility, ensuring that investors can easily buy, sell, and trade BERA in a competitive market environment.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

3 Reasons to Buy Berachain Instantly with Nexo!

Nexo stands out as a convenient platform for purchasing Berachain (BERA) with credit or debit cards, offering flexible payment options that cater to both beginners and experienced investors. Its user-friendly interface simplifies the buying process, making it accessible to a wider audience. With a focus on ease of use and a streamlined experience, Nexo positions itself as a go-to exchange for acquiring this emerging cryptocurrency.

- Website: nexo.com

- Platform Age: Approx. 27 years (domain registered in 1998)

3. Berachain – Your Quick Guide to Smart Investing!

Revolut stands out as a user-friendly platform for purchasing Berachain (BERA), offering a straightforward three-step process to acquire this cryptocurrency. With a high rating of 4.6 from over 253,000 users, Revolut allows customers to create a free account and access a diverse portfolio of more than 280 cryptocurrencies. Its intuitive interface and seamless integration of banking and crypto services make it an attractive choice for both beginners and seasoned investors.

- Website: revolut.com

- Platform Age: Approx. 19 years (domain registered in 2006)

How to Buy berachain crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Berachain (BERA) is selecting a cryptocurrency exchange that supports the trading of BERA. Here are some popular options:

-

Centralized Exchanges (CEX): These are traditional exchanges where you can buy, sell, and trade cryptocurrencies. Some well-known exchanges that may list BERA include Binance, Coinbase, and Kraken. Always check the specific exchange to confirm if BERA is available for trading.

-

Decentralized Exchanges (DEX): If you prefer a non-custodial approach, you can use DEX platforms like Uniswap or PancakeSwap. These allow you to trade directly from your wallet without needing to create an account.

When choosing an exchange, consider factors such as security, user interface, fees, and liquidity.

2. Create and Verify Your Account

Once you’ve selected an exchange, you will need to create an account. Here’s how:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide basic information such as your email address, password, and possibly your phone number.

-

Email Verification: After signing up, you will receive an email with a verification link. Click on this link to verify your email address.

-

Account Verification: Depending on the exchange, you may need to complete Know Your Customer (KYC) verification. This process typically involves providing identification documents, such as a government-issued ID and proof of address. Follow the instructions provided by the exchange to complete this process.

3. Deposit Funds

After your account is verified, you will need to deposit funds to purchase Berachain. Here’s how:

-

Choose a Deposit Method: Most exchanges allow you to deposit funds using various methods, including bank transfers, credit/debit cards, or other cryptocurrencies. Select the method that suits you best.

-

Deposit Process: Follow the exchange’s instructions for depositing funds. If you choose a bank transfer, you may need to provide your bank details. For credit/debit card deposits, you will need to enter your card information.

-

Confirm Deposit: After initiating the deposit, it may take some time for the funds to reflect in your exchange account, depending on the method used. Keep an eye on your account balance to ensure the funds have been credited.

4. Place an Order to Buy Berachain Crypto

With funds in your account, you can now purchase Berachain. Here’s how to place an order:

-

Navigate to the Trading Section: Find the trading or market section of the exchange. Look for the trading pair that includes BERA, typically shown as BERA/USD, BERA/BTC, or similar.

-

Select Order Type: You will usually have the option to place different types of orders, such as a market order (buy at the current market price) or a limit order (set a specific price at which you want to buy). For beginners, a market order is often the simplest option.

-

Enter the Amount: Specify how much BERA you want to buy. Review the total cost, including any transaction fees the exchange may charge.

-

Confirm the Purchase: Once you’re ready, click on the “Buy” or “Place Order” button. You should receive a confirmation once your order has been executed.

5. Secure Your Coins in a Wallet

After purchasing Berachain, it’s crucial to keep your coins secure. Here’s how to do that:

- Choose a Wallet: There are several types of wallets where you can store your BERA:

- Software Wallets: These are applications or software installed on your computer or mobile device. Examples include Trust Wallet or MetaMask.

- Hardware Wallets: These are physical devices that store your cryptocurrency offline, providing enhanced security. Examples include Ledger and Trezor.

-

Paper Wallets: A less common method, a paper wallet involves printing your public and private keys on paper.

-

Transfer BERA to Your Wallet: If you choose a wallet, you will need to transfer your BERA from the exchange. Go to your wallet, find the option to receive funds, and copy the wallet address. Then, go back to the exchange, navigate to your BERA holdings, and select the option to withdraw. Paste your wallet address, specify the amount, and confirm the transaction.

-

Backup Your Wallet: If you’re using a software or hardware wallet, ensure you back up your recovery phrases and private keys. This step is crucial in case you lose access to your wallet.

Following these steps will help you successfully buy and securely store Berachain (BERA). Remember to always do your research and consider the risks associated with investing in cryptocurrencies.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Consensus Mechanism

One of the standout features of Berachain is its unique Proof of Liquidity (PoL) consensus mechanism. This innovation aligns network security with liquidity provision, potentially offering a more sustainable model for validators and users. By incentivizing liquidity, Berachain aims to create a more efficient marketplace that can adapt to real-time demand, which could enhance user experience and overall network performance.

EVM Compatibility

Berachain is fully compatible with the Ethereum Virtual Machine (EVM), making it easier for developers to migrate existing decentralized applications (dApps) from Ethereum to Berachain without significant code alterations. This compatibility broadens the appeal of Berachain, as developers can leverage the extensive Ethereum ecosystem, tools, and resources while building on a platform designed for scalability and efficiency.

Strong Community Engagement

The Berachain project has allocated a significant portion of its genesis supply—48.9% of the 500 million BERA tokens—to community initiatives. This focus on community building not only fosters a loyal user base but also encourages active participation in governance and decision-making processes. Such engagement can lead to a more resilient and adaptive ecosystem, as community members are likely to contribute to the platform’s growth and development.

Robust Tokenomics

Berachain employs a tri-token model, which is designed to optimize its economic structure. The two primary tokens, BERA and BGT, serve distinct purposes—BERA functions as the gas and staking token, while BGT enables governance participation and can be earned through staking or liquidity provision. This clear delineation of token functions can enhance user understanding and participation, potentially driving demand for both tokens.

Institutional Interest

The platform has garnered attention from institutional investors and venture capitalists, indicating a level of confidence in its technology and potential for future growth. Such backing can provide the necessary resources for development, marketing, and overall ecosystem expansion, which are crucial for long-term success.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Cryptocurrencies, including Berachain, are subject to extreme market volatility. Prices can fluctuate dramatically within short periods, influenced by various factors such as market sentiment, macroeconomic conditions, and technological developments. This volatility poses risks for investors, as sudden price drops can lead to significant losses. For those considering an investment in Berachain, it’s essential to be prepared for potential price swings and to understand the inherent risks associated with cryptocurrency markets.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and varies significantly across jurisdictions. Governments around the world are still formulating their approaches to blockchain technology and digital assets, which could impact Berachain’s operations. Regulatory changes, such as new compliance requirements or restrictions on cryptocurrency trading, could adversely affect the platform’s adoption and usability. Investors should stay informed about regulatory developments that may influence the project’s future.

Competition

The blockchain space is highly competitive, with numerous Layer 1 and Layer 2 solutions vying for market share. Established platforms like Ethereum, Binance Smart Chain, and newer entrants continuously innovate to attract developers and users. Berachain must differentiate itself in terms of technology, user experience, and ecosystem development to gain traction. If it fails to establish a unique value proposition, it may struggle to capture a significant user base in a crowded market.

Technological Risks

As with any emerging technology, Berachain is not immune to technological risks. The platform relies on complex code and systems that must function seamlessly to ensure security and performance. Bugs, vulnerabilities, or failures in the underlying technology could lead to significant issues, including loss of funds or compromised network integrity. Additionally, the evolving nature of blockchain technology means that Berachain must continually adapt to new advancements and challenges, which requires ongoing development and investment.

Adoption and Network Effects

For Berachain to succeed, it must achieve widespread adoption among developers and users. The network effects in the blockchain space mean that platforms with larger user bases tend to attract even more users, creating a self-reinforcing cycle. If Berachain struggles to build a robust ecosystem of applications and users, it may find it challenging to compete with more established platforms. This could limit its growth potential and impact the value of its tokens.

Security Vulnerabilities

While Berachain employs advanced security measures, including a Delegated Proof of Stake (dPoS) mechanism and hardware wallets, no system is entirely foolproof. The risk of hacks, smart contract exploits, or other security breaches remains a concern in the blockchain space. A significant security incident could undermine user trust and lead to a decline in the platform’s value and user base.

Conclusion

In summary, Berachain presents a compelling opportunity for investors and developers interested in the evolving blockchain landscape. Its innovative consensus mechanism, EVM compatibility, and strong community engagement offer several potential strengths. However, investors must also consider the various risks, including market volatility, regulatory uncertainty, competition, technological challenges, and security vulnerabilities. Thorough research and a balanced understanding of these factors are essential for anyone looking to engage with Berachain or the broader cryptocurrency market.

Frequently Asked Questions (FAQs)

1. What is Berachain crypto?

Berachain is a high-performance Layer 1 blockchain that is fully compatible with the Ethereum Virtual Machine (EVM). It aims to enhance the development and deployment of decentralized applications (dApps) by introducing a modular design and a unique consensus mechanism known as Proof of Liquidity (PoL). This structure allows for efficient liquidity allocation and supports various applications, particularly in the decentralized finance (DeFi) sector.

2. Who created Berachain crypto?

Berachain was developed by a team of blockchain enthusiasts and experts, although specific details about the founders are often not publicly disclosed. The project has also garnered support through strategic partnerships and community engagement initiatives, which have played a significant role in its development and expansion.

3. What makes Berachain crypto different from Bitcoin?

While Bitcoin is primarily a store of value and a medium of exchange utilizing a Proof of Work (PoW) consensus mechanism, Berachain operates as a Layer 1 blockchain with a focus on decentralized applications and DeFi. Berachain employs a unique Proof of Liquidity (PoL) mechanism, which aligns network security with liquidity provision, making it more suitable for complex applications and smart contracts.

4. Is Berachain crypto a good investment?

Investing in Berachain crypto, like any cryptocurrency, comes with risks and potential rewards. As of now, Berachain has shown promising features such as its novel consensus mechanism, EVM compatibility, and growing ecosystem. However, potential investors should conduct thorough research, consider market conditions, and assess their risk tolerance before making any investment decisions.

5. How does Berachain ensure security?

Berachain employs a multi-layered security framework that combines its Proof of Liquidity mechanism with a Delegated Proof of Stake (dPoS) consensus model. This system allows token holders to vote for validators who confirm transactions, enhancing security and scalability. Additionally, Berachain utilizes hardware wallets and multiple signers to protect assets and ensure transaction integrity.

6. What are the main tokens associated with Berachain?

Berachain operates using a tri-token model, which includes:

– BERA: The primary gas and staking token used for transaction fees and network security.

– BGT: A non-transferable governance and rewards token that enables holders to participate in governance decisions and earn rewards through staking or providing liquidity.

– Additional tokens may exist to support specific applications or initiatives within the Berachain ecosystem.

7. How can I participate in the Berachain ecosystem?

Individuals can participate in the Berachain ecosystem by acquiring BERA tokens, which can be used for transactions, staking, and governance. Developers can also contribute by building dApps or utilizing the BeaconKit SDK provided by Berachain. Engaging with the community through forums, social media, and events can also be beneficial for staying updated and involved.

8. What is the future outlook for Berachain?

Berachain is positioned for growth within the blockchain landscape, particularly with its focus on DeFi and interoperability. Upcoming initiatives, such as the anticipated main launch in 2024 and ongoing community engagement efforts, suggest that the platform aims to expand its user base and functionality. As with any technology, potential users and investors should monitor developments and assess the evolving market landscape.

Final Verdict on berachain crypto

Overview of Berachain Crypto

Berachain represents a promising addition to the blockchain landscape, designed as an EVM-identical Layer 1 blockchain that enhances the development and deployment of decentralized applications (dApps). Its innovative Proof of Liquidity (PoL) consensus mechanism aligns network security with liquidity provision, creating a more efficient economic model. The platform operates on a tri-token system, featuring BERA as the gas and staking token, and BGT for governance and rewards, which enhances the functionality and governance capabilities of the network.

Key Features and Potential

The modular design of Berachain allows it to cater to specific application needs without compromising interoperability or performance. This positions it as a vital player in the decentralized finance (DeFi) sector, addressing issues like liquidity fragmentation that have historically hindered seamless asset exchange. Moreover, Berachain’s compatibility with Ethereum’s ecosystem facilitates easy migration of dApps, making it an attractive option for developers.

Despite its potential, it is important to recognize that investing in Berachain, like many cryptocurrencies, carries significant risks. The market remains volatile, and while the technology behind Berachain is innovative, the success of the platform will depend on various factors including market adoption, competition, and regulatory developments.

Final Thoughts

In conclusion, Berachain crypto offers an intriguing opportunity for those looking to explore the evolving landscape of blockchain technology. Its unique features and strong community engagement indicate a forward-thinking approach that could lead to substantial growth. However, as with any high-risk, high-reward asset, it is essential for investors to conduct their own thorough research (DYOR). Understanding the intricacies of Berachain and the broader market context will be crucial in making informed investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.