beam crypto Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to beam crypto

Beam is a notable player in the cryptocurrency landscape, recognized for its unique combination of privacy features and a focus on the gaming sector. As a cryptocurrency that leverages the innovative Mimblewimble protocol, Beam stands out for its commitment to secure and confidential transactions. This protocol allows users to engage in transactions without revealing sensitive information, making Beam an appealing option for those prioritizing privacy in their digital interactions. Additionally, Beam has carved a niche for itself by integrating blockchain technology into the gaming industry, enabling developers to create immersive gaming experiences supported by secure in-game economies.

The significance of Beam in the crypto market extends beyond its privacy-centric approach. It operates within a decentralized autonomous organization (DAO) known as the Merit Circle DAO, which empowers $BEAM token holders to participate in governance and decision-making processes. This democratic structure fosters community engagement and allows for a collaborative development environment, driving innovation and adaptability in the rapidly evolving blockchain ecosystem.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in understanding Beam and its potential as an investment. We will delve into various aspects of Beam, including:

Technology

We will explore the underlying technology that powers Beam, focusing on the Mimblewimble protocol and its implications for transaction privacy and scalability. Additionally, we will discuss the tools available for developers, such as the Beam SDK, which facilitates the integration of blockchain technology into gaming applications.

Tokenomics

An understanding of Beam’s tokenomics is essential for evaluating its investment potential. We will examine the dynamics of the $BEAM token, its circulating supply, and the mechanisms in place for buybacks and burns, which influence its value.

Investment Potential

This section will analyze Beam’s market performance, historical price trends, and factors affecting its growth. We will also consider its competitive positioning within the crypto market, particularly in relation to other privacy-focused coins and gaming platforms.

Risks

Investing in cryptocurrencies carries inherent risks. We will highlight the specific risks associated with Beam, including market volatility, regulatory challenges, and technological hurdles.

How to Buy

Finally, we will provide practical information on acquiring $BEAM tokens, including the exchanges where they are listed and the steps for purchasing and storing them securely.

By the end of this guide, you will have a well-rounded understanding of Beam, enabling you to make informed decisions regarding your investment in this unique cryptocurrency.

What is beam crypto? A Deep Dive into its Purpose

Overview of Beam Crypto

Beam is a multifaceted cryptocurrency project that integrates privacy, gaming, and decentralized governance. Built on the MimbleWimble protocol, Beam emphasizes secure and confidential transactions, making it a unique player in the cryptocurrency landscape. The native asset of this network, known as $BEAM, serves multiple functions within the ecosystem, including facilitating transactions, interacting with smart contracts, and enabling governance participation through the Merit Circle DAO.

The Core Problem It Solves

In an era where data privacy is increasingly under threat, Beam addresses the pressing issue of transaction confidentiality in the cryptocurrency space. Traditional blockchain networks, like Bitcoin and Ethereum, while decentralized, expose transaction details on a public ledger, making it easy to trace the flow of funds. This transparency can be a double-edged sword, as it raises concerns about user privacy, especially in sensitive applications such as finance and healthcare.

Beam’s implementation of the MimbleWimble protocol allows for transactions that do not reveal any identifiable information about the parties involved. This feature not only enhances user privacy but also contributes to scalability, as it allows for more efficient data storage and processing. By employing techniques like Confidential Transactions and Cut-Through, Beam can verify transactions without disclosing amounts or sender/receiver identities, effectively addressing the core problem of privacy in cryptocurrency transactions.

In addition to privacy, Beam recognizes the growing significance of blockchain in the gaming industry. With the rise of play-to-earn models and decentralized gaming platforms, there is an increasing need for secure, transparent, and efficient methods of managing in-game assets. Beam’s gaming network offers developers the tools necessary to integrate blockchain technology into their games, thus enhancing user experiences and creating new economic opportunities.

Its Unique Selling Proposition

Beam’s unique selling proposition lies in its dual focus on privacy and gaming, which sets it apart from other cryptocurrencies. The project not only provides a secure environment for conducting transactions but also empowers game developers to leverage blockchain technology in innovative ways. Here are some key aspects that define Beam’s uniqueness:

-

Privacy by Design: Beam’s use of the MimbleWimble protocol ensures that transactions remain confidential and secure. This privacy-centric approach is particularly attractive to users who prioritize anonymity in their financial dealings.

-

Gaming Ecosystem: Beam provides a comprehensive ecosystem tailored for gaming, featuring a suite of tools such as APIs and SDKs that allow developers to create blockchain-integrated games. This opens up new avenues for in-game economies and player interactions, fostering a vibrant gaming community.

-

Decentralized Governance: The Merit Circle DAO governs the Beam network, allowing $BEAM holders to participate in decision-making processes. This decentralized governance model ensures that the community’s interests are represented, fostering a sense of ownership among token holders.

-

Dynamic Tokenomics: The circulating supply of $BEAM is influenced by various factors, including token migration, buybacks, and burns. This adaptability reflects the project’s commitment to evolving its tokenomics to meet the needs of its community and the broader ecosystem.

-

Comprehensive Ecosystem: Beyond gaming, Beam aims to provide a platform that supports a variety of blockchain-based applications and services. This ambition positions Beam as a versatile asset in the crypto ecosystem, with potential applications spanning finance, healthcare, and more.

The Team and Backers

Beam was launched in 2019 and has since grown into a robust project with a strong team behind it. The project is supported by the Merit Circle DAO, a decentralized autonomous organization focused on revolutionizing the gaming industry. The Merit Circle DAO comprises a diverse group of stakeholders, including gamers, token holders, and other organizations, all contributing to the project’s growth and development.

The team behind Beam is composed of experienced professionals from various fields, including blockchain technology, software development, and game design. Their collective expertise enables Beam to navigate the complexities of both the cryptocurrency and gaming landscapes effectively. The project also benefits from community engagement and feedback, fostering a collaborative environment where ideas and innovations can flourish.

Beam’s commitment to transparency is reflected in its open communication channels, where the team regularly shares updates, engages with the community, and solicits feedback on future developments. This community-driven approach not only enhances trust but also ensures that the project remains aligned with the needs and desires of its users.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Beam in the cryptocurrency ecosystem is to bridge the gap between privacy and usability, particularly within the gaming sector. By providing a platform that prioritizes user confidentiality while offering the tools necessary for developers to create engaging gaming experiences, Beam is well-positioned to capture a growing market of both gamers and developers.

Moreover, Beam’s focus on decentralized governance through the Merit Circle DAO empowers its community, allowing participants to shape the future of the project actively. This democratic approach to decision-making is crucial in an industry where user sentiment and community involvement can significantly impact a project’s success.

In conclusion, Beam stands out as a promising project that tackles critical issues in the cryptocurrency space, particularly privacy and the integration of blockchain in gaming. With its innovative features, strong community backing, and commitment to evolving its ecosystem, Beam is poised to make a lasting impact in the crypto landscape. As the digital asset space continues to grow, Beam’s unique approach to privacy and gaming positions it as a noteworthy player, appealing to both users seeking confidentiality and developers looking to innovate.

The Technology Behind the Coin: How It Works

Overview of Beam’s Technology

Beam is an innovative cryptocurrency project that combines privacy features with a focus on the gaming industry. Built on the Mimblewimble protocol, Beam emphasizes secure and confidential transactions while providing tools for developers to create engaging gaming experiences. This guide will break down the technology that powers Beam, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Beam’s blockchain is designed to facilitate private transactions while maintaining scalability. The core technology behind Beam is the Mimblewimble protocol, which enables a unique structure for its blockchain.

Mimblewimble Protocol

Mimblewimble is a privacy-centric blockchain design that allows users to conduct transactions without revealing sensitive information. The key features of this protocol include:

-

Confidential Transactions: In traditional blockchains, transaction details such as sender, receiver, and amount are visible to all participants. With Mimblewimble, this information is encrypted, ensuring that only the parties involved in the transaction can see the details. This is accomplished through cryptographic techniques that obscure the transaction data.

-

Cut-Through Mechanism: One of the standout features of Mimblewimble is its cut-through capability, which allows the blockchain to delete old transaction data. This means that only the most recent state of the blockchain is stored, making it lighter and more efficient. This reduces the amount of data that nodes need to process and store, contributing to better scalability.

-

No Addresses: Instead of using traditional addresses to identify participants in a transaction, Mimblewimble employs one-time keys. This means that each transaction generates a new key pair, enhancing privacy by ensuring that past transactions cannot be linked to a user’s identity.

Consensus Mechanism

Beam utilizes a Proof-of-Work (PoW) consensus mechanism, similar to Bitcoin, to secure its network. However, Beam has made some modifications to enhance efficiency and security.

Proof-of-Work Explained

Proof-of-Work is a system that requires participants (miners) to solve complex mathematical problems to validate transactions and create new blocks. Here’s how it works in the context of Beam:

-

Mining Process: Miners compete to solve cryptographic puzzles. The first miner to solve the puzzle gets to add a new block to the blockchain and is rewarded with newly minted BEAM tokens. This process ensures that transactions are validated and added to the blockchain in a decentralized manner.

-

Equihash Algorithm: Beam uses the Equihash algorithm, which is designed to be memory-intensive. This means that it requires a significant amount of memory to solve the puzzles, making it more resistant to ASIC mining (specialized hardware). This helps maintain decentralization by allowing more individuals to mine Beam using standard hardware.

-

Difficulty Adjustment: The Beam network dynamically adjusts the mining difficulty to ensure that blocks are added to the blockchain at a consistent rate. This prevents issues like block congestion and ensures smooth transaction processing.

Key Technological Innovations

Beam stands out not only for its privacy features but also for its technological innovations that cater to the gaming industry and decentralized applications (dApps).

Beam SDK

The Beam Software Development Kit (SDK) is a set of tools and libraries that developers can use to integrate blockchain technology into their games. Here are some key aspects:

-

Flexible Development Environment: The Beam SDK supports multiple programming languages, making it accessible to a wide range of developers. It allows for seamless integration of blockchain features into existing game architectures.

-

In-Game Economies: With the Beam SDK, developers can create unique in-game economies that utilize BEAM tokens. This enables players to trade, buy, and sell in-game assets securely and privately.

-

User Profiles and Assets: The SDK allows developers to manage user profiles and in-game assets on the blockchain. This ensures that player data is secure and that ownership of digital items is verifiable and protected.

Decentralized Autonomous Organization (DAO)

Beam’s governance model is facilitated through the Merit Circle DAO, which allows BEAM token holders to participate in decision-making processes. This decentralized governance structure is pivotal for the project’s development:

-

Community Involvement: BEAM holders can vote on proposals related to the development and direction of the Beam network. This empowers the community and ensures that decisions reflect the interests of users.

-

Funding and Resource Allocation: The DAO can allocate funds for various initiatives, such as development projects, marketing campaigns, and partnerships, ensuring that resources are used effectively to promote the Beam ecosystem.

-

Transparency and Trust: By utilizing a DAO, Beam enhances transparency in its governance processes. All proposals and voting results are recorded on the blockchain, allowing anyone to verify the decision-making process.

Security Features

Beam incorporates several security features to protect its users and ensure the integrity of the network.

Advanced Cryptographic Techniques

Beam employs state-of-the-art cryptographic methods to secure transactions and protect user privacy:

-

Zero-Knowledge Proofs: This technology enables one party to prove to another that a statement is true without revealing any additional information. In Beam, zero-knowledge proofs are used to validate transactions without disclosing transaction details.

-

Adaptive Parameters: Beam’s network parameters can be adjusted based on real-time conditions, which helps to mitigate potential attacks and maintain network stability.

-

Smart Contracts: Beam supports smart contracts, which are self-executing contracts with the terms directly written into code. This allows for automated and secure interactions between parties without the need for intermediaries.

Future Developments and Challenges

While Beam has made significant strides in the cryptocurrency and gaming sectors, it faces challenges that need to be addressed for continued growth.

-

User Adoption: Expanding the user base and fostering community engagement are crucial for Beam’s success. Educational initiatives and partnerships with gaming platforms can help drive adoption.

-

Scalability: As the network grows, maintaining scalability without compromising on privacy and security will be a critical focus. Continuous improvements to the blockchain infrastructure will be necessary.

-

Regulatory Landscape: Navigating the evolving regulatory environment around cryptocurrencies and gaming will be essential for Beam to thrive in different markets.

Conclusion

Beam represents a significant advancement in the cryptocurrency space, merging privacy, gaming, and decentralized governance through innovative technology. Its use of the Mimblewimble protocol, Proof-of-Work consensus mechanism, and developer-friendly tools position it as a versatile asset for both gamers and developers. As Beam continues to evolve, its commitment to security, community governance, and technological innovation will be key to its long-term success.

Understanding beam crypto Tokenomics

Key Metrics of Beam ($BEAM) Tokenomics

To understand the tokenomics of Beam, it is essential to start with the key metrics that define the $BEAM token’s economic model. Below is a summary of these metrics:

| Metric | Value |

|---|---|

| Total Supply | 62.43 billion BEAM |

| Max Supply | Not specified |

| Circulating Supply | 49.46 billion BEAM |

| Inflation/Deflation Model | Dynamic (Buybacks and Burns) |

Token Utility (What is the coin used for?)

The $BEAM token serves several critical functions within the Beam ecosystem, primarily focused on gaming and decentralized governance. Here are the key utilities of the $BEAM token:

-

Transaction Fees: $BEAM is used to pay for transaction fees on the Beam network. This includes transfers of assets as well as interactions with smart contracts. The token acts as the native currency, ensuring that all operations within the ecosystem are facilitated smoothly.

-

Governance Participation: One of the most significant features of $BEAM is its role in the governance of the Merit Circle DAO. Token holders can vote on proposals that shape the future of the Beam network. This participatory model empowers the community and ensures that decisions reflect the interests of those who are invested in the ecosystem.

-

In-Game Economy: In the context of gaming, $BEAM enables the creation and management of in-game assets. Developers can leverage the Beam SDK to integrate blockchain technology into their games, allowing for secure and transparent transactions. Players can use $BEAM for purchasing in-game items, accessing premium features, or engaging in player-to-player transactions.

-

Staking and Rewards: As Beam evolves, mechanisms for staking and rewards may be introduced, allowing token holders to earn passive income through their holdings. This feature would not only incentivize long-term holding but also contribute to network security and stability.

-

Access to Ecosystem Features: The $BEAM token may also be required to access certain features or services within the Beam ecosystem, such as premium tools for developers or exclusive in-game content.

Token Distribution

The distribution of $BEAM tokens plays a crucial role in the overall health and sustainability of the Beam ecosystem. Understanding how tokens are allocated can provide insights into the project’s long-term viability and community engagement. Here’s a breakdown of the distribution model:

-

Initial Token Migration: The Beam token was launched following a migration from the $MC token on October 26, 2023. This transition was essential in establishing the new tokenomics framework and aligning the interests of the community.

-

Community and Developer Incentives: A portion of the total supply is allocated for community incentives, including rewards for developers who contribute to the Beam ecosystem. This encourages innovation and helps in building a robust network of games and applications.

-

Buyback and Burn Mechanism: Beam has implemented a dynamic approach to manage its circulating supply. The DAO engages in buybacks and burns using profits generated from the ecosystem. This strategy aims to reduce the total supply over time, potentially increasing the value of the remaining tokens. It also aligns with deflationary principles, countering inflationary pressures that can arise from excessive token issuance.

-

Vesting Periods: Some tokens may be subject to vesting periods, which restrict their circulation until a specified time has passed. This approach helps to prevent market flooding and ensures that stakeholders remain committed to the project over the long term.

-

Governance and Community Engagement: The distribution model emphasizes community involvement, with significant portions of tokens reserved for governance purposes. This structure not only empowers token holders but also fosters a sense of ownership and responsibility towards the ecosystem.

Conclusion

The tokenomics of Beam ($BEAM) is designed to create a sustainable and engaged community within the gaming and blockchain space. Through its dual role as a utility and governance token, $BEAM enables seamless transactions, fosters community participation, and facilitates the development of innovative gaming solutions. The dynamic supply model, coupled with community-driven governance, reflects Beam’s commitment to evolving in response to its users’ needs while ensuring long-term viability and growth. Understanding these elements is crucial for both new and experienced investors looking to engage with the Beam ecosystem effectively.

Price History and Market Performance

Key Historical Price Milestones

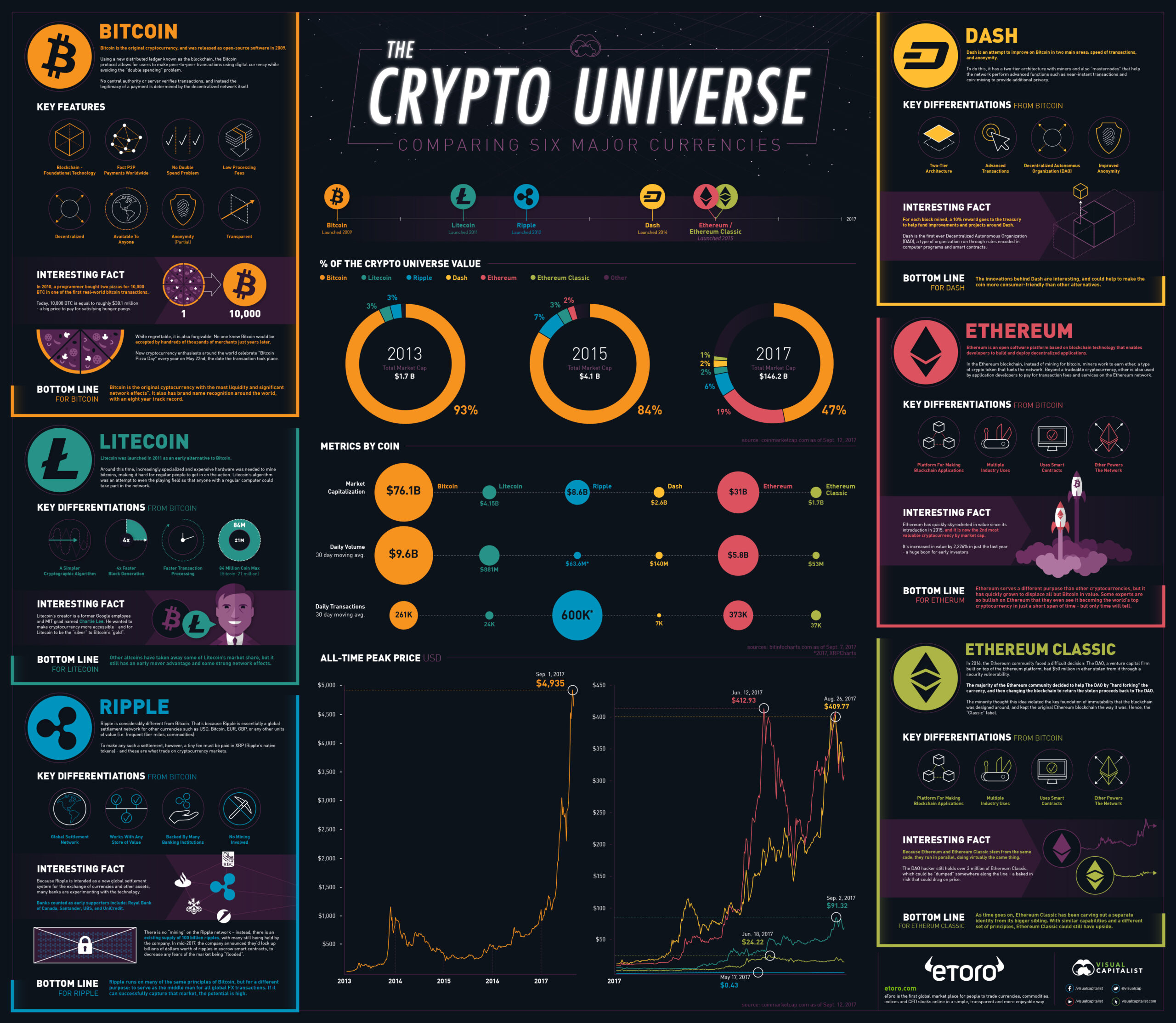

Beam ($BEAM) has experienced notable price fluctuations since its inception, reflecting the broader trends in the cryptocurrency market as well as specific developments within the Beam ecosystem. Launched in 2019, Beam focused on providing a privacy-centric platform built on the MimbleWimble protocol. This foundation set the stage for its initial price movements.

In its early days, Beam’s price was relatively modest, often trading under $0.01. However, as awareness of privacy coins grew, Beam began to gain traction. One of the significant milestones occurred on March 10, 2024, when Beam reached its all-time high of approximately $0.04434. This peak represented a surge of interest and investment in the token, driven by the broader acceptance of privacy-focused cryptocurrencies and the increasing demand for decentralized gaming solutions.

Conversely, Beam has also faced substantial price corrections. Following its all-time high, the price plummeted, reflecting the volatility that is characteristic of the cryptocurrency market. As of today, Beam is trading around $0.007172, indicating a decline of approximately 83.82% from its all-time high. This decline can be attributed to various market factors, including shifts in investor sentiment and the overall performance of the cryptocurrency market.

Moreover, Beam’s price history includes a notable low of $0.003814 recorded on October 26, 2023. This period marked a significant downturn for Beam, coinciding with broader market challenges and a decline in interest towards privacy-centric projects. However, since hitting this low, Beam has shown resilience, achieving an increase of about 88.07% from its all-time low.

Factors Influencing the Price

Historically, the price of Beam has been influenced by a multitude of factors, both internal to the project and external market dynamics.

Market Sentiment

Market sentiment plays a crucial role in the price movements of Beam. Like many cryptocurrencies, Beam is susceptible to shifts in investor sentiment, which can be driven by news events, regulatory changes, and broader economic conditions. Positive developments, such as partnerships or technological upgrades, often lead to increased buying interest, driving up the price. Conversely, negative news or market downturns can result in panic selling, causing significant price drops.

Technological Developments

Technological advancements within the Beam ecosystem have also significantly impacted its price. The introduction of new features or enhancements, particularly those that improve user experience or expand functionality, can lead to increased demand for the $BEAM token. For instance, the launch of the Beam SDK for game developers has positioned Beam as an attractive option for integrating blockchain technology into gaming, which can drive up demand and subsequently influence the price.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies is another critical factor affecting Beam’s price. As governments around the world continue to grapple with how to regulate digital assets, any announcements or changes in regulation can lead to market volatility. For example, favorable regulatory news can boost investor confidence and lead to price increases, while negative regulatory news can have the opposite effect.

Competition

Beam operates in a competitive environment, particularly within the privacy coin sector. The presence of other privacy-focused cryptocurrencies, such as Monero and Zcash, can influence Beam’s market position and price. If competitors introduce innovative features or gain significant market share, it can affect Beam’s attractiveness to investors and users, thereby impacting its price.

Community Engagement

Community engagement and development efforts are vital for the long-term success of any cryptocurrency, including Beam. The active participation of the Beam community in governance through the Merit Circle DAO allows token holders to influence decisions that shape the project’s future. Community-driven initiatives, such as hackathons and educational campaigns, can foster a sense of belonging and encourage investment, positively impacting the price.

Market Trends

Beam’s performance is also tied to broader cryptocurrency market trends. During bullish market cycles, when investor enthusiasm is high, Beam has historically experienced upward price movements. Conversely, during bearish trends, Beam’s price has often followed suit, reflecting the overall market downturn. This correlation underscores the importance of understanding the larger market dynamics when analyzing Beam’s price history.

In summary, Beam’s price history is marked by significant milestones and influenced by a variety of factors, including market sentiment, technological developments, regulatory changes, competition, community engagement, and broader market trends. Understanding these dynamics is essential for investors looking to navigate the complexities of Beam and its potential within the cryptocurrency landscape.

Where to Buy beam crypto: Top Exchanges Reviewed

3. Kraken – Your Go-To for Effortless BEAM Purchases!

Kraken stands out as a user-friendly exchange for purchasing BEAM, offering a low entry point of just $10. With multiple payment options, including credit/debit cards, ACH deposits, and mobile payment methods like Apple and Google Pay, it caters to both beginners and experienced investors. The platform’s robust security features and comprehensive educational resources further enhance its appeal, making it an excellent choice for those looking to invest in BEAM.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

1. Changelly – Lowest Fees for Exchanging Beam (BEAM)!

Changelly stands out as an exceptional platform for exchanging Beam (BEAM) due to its competitive rates and low fees, making it an attractive choice for both novice and experienced traders. With a user-friendly interface accessible via its website and app, Changelly supports over 700 cryptocurrencies and offers fast transaction speeds. Additionally, its 24/7 live support ensures users receive assistance whenever needed, enhancing the overall trading experience.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. ChangeNOW – Top Choice for BEAM Trading!

ChangeNOW stands out as a premier platform for exchanging BEAM, boasting a high user rating of 4.8 based on over 2,100 reviews. The exchange offers competitive pricing with no hidden fees, making it an attractive option for both buying and selling BEAM. Additionally, users can access real-time market data, including live charts and market cap information, enhancing their trading experience and decision-making.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

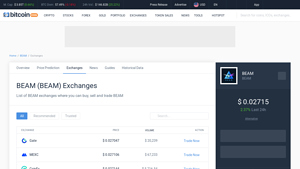

5. BEAM Exchanges – Your Gateway to Seamless Trading!

The review article highlights the unique features of various exchanges where BEAM can be bought, sold, and traded, including Caladex SRO, CoinEx, Gate, MEXC, and NonKyc.io. Notably, the availability of BEAM on both centralized and decentralized platforms caters to diverse trading preferences, while the inclusion of NonKyc.io appeals to users seeking privacy-focused options. This variety ensures that traders can find suitable platforms that align with their specific needs and regulatory considerations.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

7. BEAM – Pioneering Confidentiality in DeFi!

BEAM distinguishes itself in the cryptocurrency landscape by prioritizing confidentiality and privacy in decentralized finance (DeFi) transactions. Users can mine or purchase BEAM using various fiat and crypto options, making it accessible for a wide range of investors. Its emphasis on secure, private payments empowers users to engage in DeFi activities without sacrificing their anonymity, setting BEAM apart as a unique player in the growing field of confidential cryptocurrencies.

- Website: beam.mw

How to Buy beam crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Beam (BEAM) cryptocurrency is selecting a cryptocurrency exchange where it is listed. Beam is available on various platforms, including both centralized exchanges (CEX) and decentralized exchanges (DEX). Some of the most popular exchanges for buying BEAM include:

- Binance: One of the largest exchanges in terms of trading volume, offering a user-friendly interface and a variety of trading pairs, including BEAM/USDT.

- Uniswap V2: A decentralized exchange that allows users to trade BEAM directly from their wallets.

- Bybit: Another centralized exchange known for its derivatives trading but also supports spot trading for BEAM.

Before choosing an exchange, consider factors such as security, fees, available trading pairs, and user reviews to find one that best suits your needs.

2. Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account. Here’s how to do it:

-

Sign Up: Visit the exchange’s website and look for the “Sign Up” or “Register” button. You will need to provide some basic information, such as your email address and a password. Ensure that your password is strong and secure.

-

Email Verification: After registration, you will typically receive an email to verify your account. Click on the link provided in the email to confirm your registration.

-

Identity Verification: Many exchanges require identity verification to comply with regulatory standards (KYC – Know Your Customer). You may need to upload identification documents (like a passport or driver’s license) and possibly a selfie. Follow the instructions provided by the exchange to complete this process.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy BEAM. Most exchanges accept deposits in fiat currency (like USD, EUR) or other cryptocurrencies. Here’s how to deposit funds:

-

Choose a Deposit Method: Navigate to the “Funds” or “Wallet” section of the exchange. Select “Deposit” and choose your preferred method (e.g., bank transfer, credit/debit card, or cryptocurrency transfer).

-

Follow Instructions: If depositing fiat, follow the instructions for linking your bank account or card. If depositing cryptocurrency, you will be given a wallet address to send your funds. Make sure to double-check the address and the cryptocurrency you are sending.

-

Confirm Deposit: Wait for your deposit to be confirmed. This can take anywhere from a few minutes to several hours, depending on the method used and the exchange’s processing times.

4. Place an Order to Buy Beam Crypto

With funds in your exchange account, you can now purchase BEAM. Here’s how to place an order:

-

Navigate to the Trading Section: Look for the “Markets” or “Trade” section on the exchange. Search for the BEAM trading pair you wish to use (e.g., BEAM/USDT).

-

Choose Order Type: You can typically place different types of orders:

- Market Order: Buys BEAM at the current market price. This is the simplest option for beginners.

-

Limit Order: Sets a specific price at which you want to buy BEAM. This order will only execute if the price reaches your specified level.

-

Enter the Amount: Specify how much BEAM you want to buy or how much of your deposited currency you wish to spend.

-

Confirm the Order: Review your order details and confirm the transaction. Once executed, your BEAM tokens will be credited to your exchange wallet.

5. Secure Your Coins in a Wallet

After purchasing BEAM, it is advisable to transfer your coins to a secure wallet rather than leaving them on the exchange. Here’s how to do that:

- Choose a Wallet: There are several types of wallets to consider:

- Hardware Wallet: A physical device that stores your cryptocurrency offline (e.g., Ledger, Trezor).

- Software Wallet: A digital wallet that can be downloaded on your computer or mobile device (e.g., Exodus, Atomic Wallet).

-

Paper Wallet: A physical printout of your public and private keys.

-

Transfer BEAM to Your Wallet: Go to the “Withdraw” section of your exchange. Enter your wallet address (ensure it is the correct address for BEAM) and the amount you want to transfer.

-

Confirm the Transaction: Review the details and confirm the withdrawal. Wait for the transaction to be processed. You can check the transaction status on a blockchain explorer using your wallet address.

By following these steps, you will have successfully purchased and secured your Beam (BEAM) cryptocurrency. Always remember to keep your wallet information safe and be cautious of phishing attempts or scams in the cryptocurrency space.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Use of Technology

Beam leverages the Mimblewimble protocol, which is designed to enhance privacy and scalability in transactions. This technology allows for confidential transactions that do not reveal user identities or transaction amounts, setting Beam apart from many cryptocurrencies that are more transparent by design. The focus on privacy can appeal to users who prioritize confidentiality in their financial dealings.

Expanding Ecosystem

Beam is not just a cryptocurrency; it is evolving into a comprehensive ecosystem that integrates gaming and decentralized finance (DeFi). The introduction of tools like the Beam SDK enables game developers to create blockchain-based games, which can include unique in-game economies and asset management features. This diversification can attract a wider range of users and developers, potentially increasing demand for the $BEAM token as the ecosystem grows.

Active Governance through the Merit Circle DAO

The governance model of Beam, facilitated by the Merit Circle DAO, allows $BEAM token holders to participate in decision-making processes. This decentralized governance structure fosters community engagement and ensures that the project evolves in a manner that reflects the interests of its users. Such community-driven initiatives can enhance user loyalty and promote further adoption of the token.

Strong Market Position

As of October 2023, Beam’s market capitalization is approximately $354.8 million, with a circulating supply of around 49.46 billion $BEAM tokens. The token’s presence on major exchanges like Binance and Uniswap V2 enhances its accessibility to investors and users alike. The relatively high trading volume indicates active interest and engagement from the community, which can be a positive sign for potential investors.

Historical Performance

Beam has shown the ability to recover from market lows, with a notable price increase of approximately 88% since its all-time low of $0.003814 in October 2023. This resilience may suggest that the project has a solid foundation and a dedicated community, factors that can positively influence its future price trajectory.

Potential Risks and Challenges (The Bear Case)

Market Volatility

The cryptocurrency market is notoriously volatile, and Beam is no exception. Price fluctuations can be dramatic, influenced by broader market trends, investor sentiment, and external factors such as macroeconomic conditions. For instance, the price of Beam has experienced significant drops from its all-time high of $0.04434 in March 2024, showing a decline of over 83% at one point. Such volatility can pose a risk to investors, particularly those who are risk-averse or new to cryptocurrency investing.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, with governments worldwide grappling with how to approach digital assets. Beam, with its focus on privacy, could face heightened scrutiny from regulators concerned about the potential for misuse in illicit activities. Changes in regulations or unfavorable policies could adversely impact Beam’s adoption, trading volume, and overall market sentiment. Investors should remain vigilant about the regulatory environment and how it may affect their holdings.

Competition

The cryptocurrency space is highly competitive, with numerous projects vying for market share. Beam competes not only with other privacy-focused coins but also with established gaming platforms and emerging blockchain projects. Projects like Monero and Zcash have a strong foothold in the privacy sector, while platforms like Ethereum and Binance Smart Chain dominate the gaming and DeFi spaces. Beam must continuously innovate and provide unique value propositions to maintain and grow its user base in this crowded market.

Technological Risks

As a project that relies heavily on advanced blockchain technology, Beam faces inherent technological risks. Issues such as bugs in the code, vulnerabilities to hacking, or failures in the underlying Mimblewimble protocol could undermine user confidence and disrupt operations. Additionally, the project’s reliance on decentralized governance means that any misalignment in community interests could lead to challenges in development and decision-making.

Moreover, as Beam integrates into the gaming sector, it must ensure that its technology can seamlessly support the complex interactions required in gaming environments. Any significant technological hiccup could deter developers from adopting the Beam SDK or utilizing the platform for their games.

User Adoption Challenges

While Beam offers innovative features, it must overcome hurdles related to user adoption. Many potential users may not fully understand the benefits of Beam’s privacy features or how to interact with the Beam ecosystem. Education and outreach will be critical in helping new users navigate the platform and realize its potential. If Beam fails to effectively communicate its value proposition, it may struggle to attract and retain users in a competitive landscape.

Economic Considerations

The economic environment can also impact Beam’s performance. Factors such as inflation, interest rates, and global economic stability can influence investor behavior in the cryptocurrency market. In times of economic uncertainty, investors may be more risk-averse and less inclined to invest in volatile assets like Beam. The overall health of the cryptocurrency market can also affect Beam’s price, as downturns in major cryptocurrencies like Bitcoin often lead to broader sell-offs across the market.

Conclusion

Investing in Beam presents a blend of potential strengths and significant risks. The project’s innovative technology, expanding ecosystem, and community governance model offer a compelling case for its future viability. However, investors must also contend with the inherent volatility of the cryptocurrency market, regulatory uncertainties, and competitive pressures.

As with any investment, thorough research and an understanding of both the potential rewards and risks are essential. Beam could be an intriguing addition to a diversified portfolio, particularly for those interested in the intersection of privacy, gaming, and decentralized governance. However, prospective investors should proceed with caution and be prepared for the unpredictable nature of the crypto landscape.

Frequently Asked Questions (FAQs)

1. What is Beam crypto?

Beam is a cryptocurrency that operates on the MimbleWimble protocol, focusing on privacy and scalability for transactions. It serves as the native asset of the Beam network, which combines features of decentralized finance (DeFi) and gaming. Beam allows users to conduct confidential transactions while also providing developers with tools such as APIs and SDKs to integrate blockchain technology into gaming applications.

2. Who created Beam crypto?

Beam was developed by the Merit Circle DAO, a decentralized autonomous organization established in early 2021. The DAO aims to revolutionize the gaming industry by enabling collaboration between gamers and developers. The project includes a diverse group of contributors, from independent developers to corporations, all working towards enhancing the Beam ecosystem.

3. How does Beam differ from Bitcoin?

While both Beam and Bitcoin are cryptocurrencies, they differ significantly in their core functionalities and underlying technology. Beam utilizes the MimbleWimble protocol, which allows for confidential transactions where the details of the transaction are not publicly visible. In contrast, Bitcoin transactions are recorded on a public ledger, making them transparent. Additionally, Beam focuses on providing a gaming ecosystem and supports smart contracts, whereas Bitcoin primarily serves as a digital currency and store of value.

4. Is Beam crypto a good investment?

Determining whether Beam is a good investment depends on various factors, including market conditions, personal financial goals, and risk tolerance. As of October 2023, Beam has shown potential for growth within the gaming sector and has a dedicated community. However, like any cryptocurrency, it carries risks associated with volatility and market fluctuations. It is advisable to conduct thorough research and consider consulting a financial advisor before making investment decisions.

5. How can I buy Beam tokens?

Beam tokens ($BEAM) can be purchased on various centralized and decentralized exchanges. Some of the most popular platforms for trading Beam include Binance, Uniswap V2, and Bybit. Users should ensure they have a compatible wallet to store their tokens securely after purchase.

6. What is the total supply of Beam tokens?

As of now, the circulating supply of Beam tokens is approximately 49.46 billion BEAM, with a total supply reaching around 62.43 billion BEAM. The supply dynamics can change due to mechanisms like token migration, buybacks, and burns initiated by the Merit Circle DAO, reflecting the project’s commitment to managing its tokenomics effectively.

7. How is Beam secured?

Beam ensures security through its use of the MimbleWimble protocol, which encrypts transaction data to maintain privacy and scalability. Additionally, it employs a proof-of-work consensus mechanism that requires computational power from participants to validate transactions and create new blocks, thereby securing the network against fraud and ensuring decentralized token distribution.

8. What are the potential use cases for Beam?

Beam’s versatility allows it to cater to various sectors beyond gaming. Its focus on privacy makes it suitable for industries that require confidentiality, such as finance and healthcare. For instance, Beam can facilitate secure transactions in financial services and protect sensitive patient information in healthcare settings. Furthermore, its integration with gaming platforms enhances the user experience by enabling secure management of in-game assets and interactions.

Final Verdict on beam crypto

Overview of Beam Crypto

Beam is a cryptocurrency project that uniquely combines privacy, gaming, and decentralized governance. Built on the Mimblewimble protocol, Beam emphasizes secure and confidential transactions, making it a notable player in the cryptocurrency landscape. Its native token, $BEAM, serves multiple purposes within its ecosystem, including transaction fees, smart contract interactions, and governance within the Merit Circle DAO. This DAO enables token holders to participate in critical decisions affecting the platform’s future, fostering a community-driven environment.

Technological Foundations

At the heart of Beam’s technology is its focus on privacy and scalability. The Mimblewimble protocol allows for encrypted transaction data, ensuring that sensitive information remains confidential. Additionally, Beam provides developers with a robust suite of tools, including APIs and SDKs, to create and manage blockchain-based gaming applications. This innovation aims to enhance the gaming experience by integrating blockchain’s security and transparency features into in-game economies and interactions.

Potential and Risks

While Beam presents exciting opportunities, particularly in the gaming sector and privacy-focused applications, it is essential to recognize that investing in cryptocurrencies carries inherent risks. The digital asset space is volatile, and Beam’s performance can fluctuate significantly based on market trends and technological developments. As such, it is classified as a high-risk, high-reward investment.

Final Thoughts

In conclusion, Beam stands out as a multifaceted cryptocurrency with promising use cases in privacy and gaming. However, potential investors should approach it with caution, understanding the complexities and risks involved. We strongly encourage you to conduct your own thorough research (DYOR) before making any investment decisions. In the rapidly evolving world of cryptocurrencies, informed choices are crucial to navigating this exciting yet unpredictable landscape.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.