What is base coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to base coin

Introduction to Base Coin

Base Coin (BASE) is an emerging digital asset that has carved a niche for itself within the cryptocurrency ecosystem. As a foundational token, BASE serves as a critical component of the Base blockchain, which is designed to facilitate decentralized finance (DeFi) applications and automated liquidity protocols. Its significance lies in its ability to enhance the efficiency and scalability of blockchain transactions, catering to both seasoned investors and newcomers to the crypto market. With a market cap of approximately $2 million and a dedicated user base, BASE is gaining traction as a viable option in the competitive landscape of digital currencies.

The Base blockchain, on which BASE operates, supports non-upgradeable smart contracts, ensuring the security and integrity of transactions. This technology underpins various applications, from decentralized exchanges to innovative financial services, making BASE a versatile player in the DeFi space. Furthermore, the project aims to bridge the gap between Web2 and Web3, promoting accessibility for users unfamiliar with blockchain technology. By lowering barriers to entry, BASE seeks to attract a broader audience and enhance user experience in navigating the complexities of the crypto landscape.

This guide aims to provide a comprehensive resource for understanding Base Coin, covering essential aspects such as its underlying technology, tokenomics, investment potential, risks, and practical steps on how to acquire it. Whether you are a beginner looking to dip your toes into the world of cryptocurrencies or an intermediate investor seeking to deepen your knowledge, this guide will equip you with the necessary insights to make informed decisions regarding BASE.

In exploring the technology behind BASE, we will delve into its smart contract functionality and the automated liquidity protocols that facilitate seamless transactions. Additionally, we will analyze the tokenomics of BASE, examining its supply dynamics, market performance, and potential for growth. Understanding the risks associated with investing in BASE is equally important, as the cryptocurrency market is known for its volatility and regulatory challenges.

Finally, we will provide a step-by-step guide on how to buy BASE, ensuring that you are well-prepared to engage with this digital asset. By the end of this guide, you will have a clearer understanding of Base Coin and its place within the broader cryptocurrency ecosystem, empowering you to navigate your investment journey with confidence.

What is base coin? A Deep Dive into its Purpose

Understanding Base Coin: An Overview

Base Coin is a digital asset that operates within the broader cryptocurrency ecosystem, often associated with various protocols, platforms, and initiatives. Its significance stems from its role in addressing specific challenges faced by users and developers in the blockchain space, particularly in terms of scalability, accessibility, and decentralized finance (DeFi) applications.

The Core Problem It Solves

Scalability and Efficiency

One of the primary issues that Base Coin aims to tackle is the scalability problem prevalent in many blockchain networks, particularly Ethereum. As more users and applications join the network, the capacity to process transactions efficiently can become strained, leading to slower transaction times and increased fees. Base Coin, often integrated within Layer-2 solutions or as part of liquidity protocols, seeks to enhance transaction speeds and reduce costs, enabling a smoother user experience.

Accessibility for New Users

Another critical challenge in the cryptocurrency landscape is the steep learning curve associated with blockchain technology. Many potential users are deterred by the complexity of navigating wallets, exchanges, and decentralized applications (dApps). Base Coin is designed with user-friendliness in mind, bridging the gap between traditional finance (Web2) and decentralized finance (Web3). By simplifying the onboarding process, Base Coin encourages broader participation from individuals who may not have prior experience with cryptocurrencies.

Decentralized Finance (DeFi) Adoption

DeFi has emerged as a revolutionary aspect of the blockchain ecosystem, enabling users to trade, lend, and borrow without intermediaries. However, many DeFi protocols face liquidity challenges and rely heavily on traditional market-making strategies. Base Coin functions as an automated liquidity protocol, facilitating the seamless exchange of assets while reducing reliance on centralized entities. This fosters a more decentralized financial ecosystem, ultimately increasing user autonomy and financial inclusivity.

Its Unique Selling Proposition

Automated Liquidity Protocol

Base Coin is often associated with SwapBased, an automated liquidity protocol that operates on the Base blockchain. This protocol allows users to trade assets without the need for traditional market makers, significantly improving the efficiency and accessibility of decentralized exchanges (DEXs). By utilizing non-upgradeable smart contracts, Base Coin ensures that transactions are secure and transparent, a fundamental requirement in the DeFi space.

Multilayer Security Measures

Security is paramount in the cryptocurrency world, where users are often vulnerable to hacks and fraud. Base Coin employs several security measures, including hardware wallet support, Multi-Factor Authentication (MFA), and Two-Factor Authentication (2FA). These layers of protection safeguard users’ assets and personal information, instilling confidence in the platform. The use of non-upgradeable smart contracts further enhances security, as it prevents unauthorized modifications after deployment.

Versatile Use Cases

Base Coin’s utility extends beyond mere transactions. It serves as a foundational element within various sectors, including education (through smart student IDs), logistics, and even decentralized social media applications. This versatility positions Base Coin as a multifaceted asset capable of driving innovation across multiple industries, thereby increasing its overall value and adoption potential.

The Team and Backers Behind the Project

Understanding the team and backers behind Base Coin is crucial to assessing its credibility and future potential. Base Coin is supported by a team of experienced blockchain developers and industry veterans who have a proven track record in building scalable solutions and navigating the regulatory landscape.

Founders and Development Team

The development team behind Base Coin is often comprised of individuals with backgrounds in computer science, finance, and cryptography. Their collective experience equips them to tackle the challenges associated with creating a robust cryptocurrency that meets user needs while adhering to regulatory standards. The team’s commitment to transparency and community engagement is evident through regular updates and open channels for feedback.

Partnerships and Collaborations

Base Coin has also established partnerships with various blockchain projects and organizations, enhancing its ecosystem and expanding its reach. Collaborations with established DeFi platforms and liquidity providers bolster its utility and user base, creating a network effect that benefits all participants. Additionally, these partnerships can facilitate the integration of Base Coin into existing financial systems, further driving its adoption.

Community Engagement

A strong community is vital for the success of any cryptocurrency. Base Coin actively engages its user base through educational initiatives, AMAs (Ask Me Anything sessions), and community events. This engagement fosters a sense of ownership among users and encourages them to contribute to the project’s growth and development. By prioritizing community feedback, Base Coin demonstrates its commitment to creating a user-centric platform.

Conclusion: Fundamental Purpose in the Crypto Ecosystem

Base Coin serves a critical role in the cryptocurrency ecosystem by addressing key challenges related to scalability, accessibility, and liquidity in decentralized finance. Its unique selling propositions, including automated liquidity protocols and robust security measures, position it as a valuable asset for both novice and experienced investors.

As the cryptocurrency landscape continues to evolve, Base Coin’s adaptability and commitment to user experience will be essential in driving its long-term success. By facilitating seamless interactions within the DeFi space and lowering barriers to entry for new users, Base Coin is poised to make a lasting impact on the future of finance.

The Technology Behind the Coin: How It Works

Understanding the Base Coin Technology

In the evolving landscape of cryptocurrency, understanding the technology behind a digital asset like Base Coin (BASE) is crucial for both novice and experienced investors. This guide will explore the fundamental components of Base Coin’s technology, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Base Coin operates on the Base blockchain, which is designed to support a wide array of decentralized applications (dApps) and automated liquidity protocols. The architecture of the Base blockchain is built on several key principles:

-

Layer-1 and Layer-2 Solutions: Base Coin may incorporate both layer-1 and layer-2 solutions to enhance scalability and efficiency. Layer-1 refers to the base blockchain itself, while layer-2 solutions operate on top of it to improve transaction speeds and reduce costs. This dual approach allows Base Coin to handle a higher volume of transactions without congestion.

-

Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. The Base blockchain supports non-upgradeable smart contracts, meaning once they are deployed, they cannot be altered. This immutability adds a layer of security, as it prevents malicious actors from modifying contract terms after deployment.

-

Decentralization: The Base blockchain is designed to be decentralized, meaning no single entity has control over the entire network. This decentralization is essential for ensuring that transactions are transparent and that no single point of failure exists.

-

Automated Liquidity Protocols: One of the standout features of the Base blockchain is its focus on automated liquidity protocols. These protocols allow for the decentralized exchange of assets without the need for traditional market makers, enabling users to trade directly with one another. This is a key innovation in the decentralized finance (DeFi) space, enhancing liquidity and reducing trading costs.

Consensus Mechanism

The consensus mechanism is a critical component of any blockchain, as it determines how transactions are validated and added to the blockchain. Base Coin utilizes a consensus mechanism that may include:

-

Proof-of-Work (PoW): Although not explicitly stated, some cryptocurrencies use PoW, which requires participants (miners) to solve complex mathematical problems to validate transactions. This method is energy-intensive and can lead to slower transaction speeds.

-

Proof-of-Stake (PoS): More likely, Base Coin employs a PoS mechanism, where validators are chosen to create new blocks and confirm transactions based on the number of coins they hold and are willing to “stake” as collateral. PoS is generally more energy-efficient and can process transactions faster than PoW.

-

Delegated Proof-of-Stake (DPoS): Another possibility is DPoS, where coin holders vote for a small number of delegates who then secure the network on their behalf. This can enhance transaction speeds and network efficiency while maintaining decentralization.

By utilizing these consensus mechanisms, Base Coin ensures that transactions are secure, fast, and reliable while minimizing the environmental impact compared to traditional PoW systems.

Key Technological Innovations

Base Coin stands out in the cryptocurrency space due to several key technological innovations:

-

Integration of Hardware Wallets: Security is paramount in the cryptocurrency world. Base Coin supports hardware wallets, particularly those from Ledger, to store private keys offline. This significantly reduces the risk of hacking and unauthorized access, providing a robust layer of protection for users’ assets.

-

Multi-Factor Authentication (MFA): To further enhance security, Base Coin implements MFA and Two-Factor Authentication (2FA). Users must provide two or more verification factors to access their accounts or execute transactions. This added layer of security ensures that even if a password is compromised, unauthorized access is still prevented.

-

User-Friendly Interface: Base Coin aims to bridge the gap between Web2 and Web3 users, making the blockchain experience more accessible. The user interface is designed to be intuitive, lowering the barriers for newcomers to engage with blockchain technology.

-

Decentralized Applications (dApps): The Base blockchain supports a variety of dApps, particularly in the DeFi sector. These applications can range from decentralized exchanges to automated yield farming platforms, enhancing the utility of Base Coin within the broader cryptocurrency ecosystem.

-

Interoperability: Base Coin is designed to be interoperable with other blockchains, allowing for seamless asset transfers and interactions across different platforms. This is crucial in a multi-chain world, where users may want to leverage the unique features of various blockchains.

Security Features

Security is a cornerstone of Base Coin’s technology. The following features are critical for ensuring the integrity and safety of the network:

-

Non-Upgradable Smart Contracts: As mentioned earlier, the use of non-upgradeable smart contracts prevents malicious modifications and ensures that the terms of agreements remain intact.

-

Regular Audits: The Base blockchain undergoes regular security audits to identify and mitigate potential vulnerabilities. These audits help maintain the integrity of the network and instill confidence in users.

-

Community Governance: Base Coin may incorporate community governance mechanisms, allowing holders to propose and vote on changes to the protocol. This democratic approach ensures that the network evolves in a way that reflects the interests of its users.

Conclusion

Understanding the technology behind Base Coin provides valuable insights into its potential as a digital asset. With its innovative blockchain architecture, efficient consensus mechanism, and robust security features, Base Coin is positioned to be a significant player in the cryptocurrency market. As the ecosystem continues to evolve, staying informed about technological advancements will empower users to make educated investment decisions and engage with the broader blockchain community effectively. Whether you are a beginner or an intermediate investor, grasping these concepts will enhance your understanding of Base Coin and its role in the ever-changing cryptocurrency landscape.

Understanding base coin Tokenomics

Tokenomics Overview

Tokenomics refers to the economic model of a cryptocurrency, encompassing aspects such as supply, distribution, and utility. Understanding the tokenomics of a digital asset like BASE is crucial for investors and enthusiasts who want to gauge its potential for growth, stability, and real-world application. Below is a detailed breakdown of BASE’s tokenomics.

| Metric | Value |

|---|---|

| Total Supply | 961.76 billion BASE |

| Max Supply | 961.76 billion BASE |

| Circulating Supply | 929.45 billion BASE |

| Inflation/Deflation Model | Deflationary |

Total Supply, Max Supply, and Circulating Supply

-

Total Supply: The total supply of BASE is 961.76 billion coins. This figure represents the maximum amount of BASE that can ever exist, creating a fixed limit that can help mitigate inflationary pressures over time.

-

Max Supply: The max supply is also set at 961.76 billion BASE. This means that no additional coins will be minted or created beyond this limit, ensuring scarcity.

-

Circulating Supply: As of now, approximately 929.45 billion BASE coins are in circulation. This figure is important because it helps investors understand how much of the total supply is actively traded in the market.

-

Inflation/Deflation Model: BASE operates on a deflationary model. This means that over time, the availability of BASE coins may decrease, potentially increasing their value as demand outstrips supply. This deflationary nature can result from various factors, including token burns or halving events, although specific mechanisms for BASE have yet to be fully detailed.

Token Utility (What is the coin used for?)

The BASE token serves multiple purposes within its ecosystem, primarily focusing on enhancing user experience and promoting decentralized finance (DeFi) applications. Here are some key utilities of the BASE token:

-

Transaction Fees: Users can utilize BASE tokens to pay for transaction fees within the BASE ecosystem. This utility is common across many blockchain platforms and helps to maintain the network’s operations.

-

Liquidity Provision: BASE is part of an automated liquidity protocol on the Base blockchain. Users can stake their BASE tokens to provide liquidity for decentralized exchanges (DEXs), earning rewards in return. This incentivizes participation and enhances the overall liquidity of the platform.

-

Governance: As the ecosystem matures, there may be plans to incorporate governance features where BASE token holders can vote on protocol changes or upgrades. This democratic approach empowers the community and aligns the interests of users with the network’s development.

-

Access to Services: BASE may also be used to access various services within the Base ecosystem, such as decentralized applications (dApps), smart contracts, and other offerings that leverage blockchain technology. This broadens the utility of the token and encourages its adoption.

-

Bridging Web2 and Web3: One of the objectives of BASE is to lower barriers for users transitioning from traditional web platforms (Web2) to decentralized applications (Web3). By providing an accessible interface and user-friendly experience, BASE aims to attract a broader audience.

Token Distribution

Understanding how tokens are distributed is vital for assessing the potential for price manipulation and the overall health of the ecosystem. The distribution of BASE tokens can typically be broken down into several categories, although specific percentages can vary based on the project’s roadmap and governance decisions.

-

Initial Distribution: BASE tokens are often distributed during initial coin offerings (ICOs) or through airdrops to early adopters. This incentivizes early participation and can help build a community around the project.

-

Team and Advisors: A portion of the total supply is usually allocated to the founding team and advisors as a reward for their contributions. This allocation is typically vested over a period to align their interests with the long-term success of the project.

-

Development Fund: Some tokens are set aside for ongoing development and operational costs. This fund is essential for maintaining the project, funding future upgrades, and incentivizing developers to contribute to the ecosystem.

-

Community Incentives: Tokens may also be allocated for community rewards, such as staking rewards, liquidity mining, and other incentive programs that encourage user engagement and participation.

-

Reserve: A reserve allocation may be held for unforeseen circumstances or future partnerships. This reserve can provide flexibility for the project to adapt to market changes and opportunities.

Conclusion

Understanding the tokenomics of BASE is crucial for potential investors and users within the cryptocurrency space. The fixed supply of BASE, its utility across various applications, and the structured distribution model contribute to its potential as a viable digital asset. By offering features that cater to both individual users and the broader DeFi ecosystem, BASE aims to enhance accessibility and engagement, paving the way for its growth and adoption in the ever-evolving blockchain landscape.

Price History and Market Performance

Key Historical Price Milestones

The price history of BASE coin is marked by several significant milestones that highlight its volatility and the impact of market dynamics. Initially launched in 2009, BASE coin’s price trajectory has been influenced by a variety of factors, from technological developments to broader market trends.

One of the most notable price points occurred on July 31, 2023, when BASE coin reached an all-time high of $26.25. This peak was driven by a combination of factors, including increased adoption of decentralized finance (DeFi) protocols and heightened investor interest in the BASE ecosystem. The surge in price during this period reflected a broader bullish trend in the cryptocurrency market, where many digital assets experienced significant gains.

Following this peak, BASE coin experienced a sharp decline, which is common in the cryptocurrency market due to its inherent volatility. The price fell to an all-time low of approximately $0.0000061257 on February 10, 2024. This drastic drop of over 99% from its all-time high exemplifies the extreme fluctuations that can occur in the crypto market, often influenced by market corrections and shifts in investor sentiment.

As of the most recent data, the current price of BASE coin is around $0.000002, with a market capitalization of approximately $2.02 million. The circulating supply stands at around 929.45 billion BASE coins, with a total supply capped at approximately 961.76 billion. The trading volume over the last 24 hours has been relatively low, indicating limited market activity, which can also contribute to price volatility.

Factors Influencing the Price

Historically, the price of BASE coin has been influenced by various factors that are common in the cryptocurrency market. Understanding these influences can provide insight into the dynamics that shape the asset’s valuation.

Market Sentiment and Speculation

Market sentiment plays a crucial role in the price movements of BASE coin. Like many cryptocurrencies, BASE is subject to speculative trading, where investors buy and sell based on their perceptions of future price movements rather than underlying fundamentals. During periods of positive sentiment, such as when the broader cryptocurrency market is experiencing a rally, BASE coin has seen significant price increases. Conversely, during market downturns, investor fear can lead to rapid sell-offs, contributing to steep declines in price.

Technological Developments

Technological advancements within the BASE ecosystem have also been pivotal in influencing its price. The launch and enhancement of decentralized applications (dApps) and automated liquidity protocols on the Base blockchain have attracted attention from developers and investors alike. Positive developments, such as successful upgrades or partnerships, can lead to increased usage and demand for BASE coin, thereby driving up its price. Conversely, delays or technical issues can result in diminished confidence and lower prices.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has been another significant factor affecting BASE coin’s price. Changes in regulations can create uncertainty in the market, impacting investor confidence. For instance, announcements of regulatory scrutiny or unfavorable legislation can lead to price drops, while positive regulatory developments, such as clearer guidelines or acceptance of cryptocurrencies by mainstream financial institutions, can bolster prices.

Market Liquidity

The liquidity of BASE coin in various trading markets is also a critical factor in its price dynamics. Low liquidity can lead to higher volatility, as even small trades can result in significant price changes. The presence of BASE coin on various centralized and decentralized exchanges affects its accessibility and the volume of transactions, which in turn impacts its price stability.

Broader Economic Conditions

Macroeconomic factors, including inflation rates, interest rates, and economic stability, can indirectly influence BASE coin’s price. In times of economic uncertainty, investors may seek alternative assets, including cryptocurrencies, which can lead to increased demand and higher prices. Conversely, in a stable economic environment with low inflation, traditional investment vehicles may be favored over cryptocurrencies, potentially leading to decreased demand for BASE coin.

Conclusion

The price history of BASE coin illustrates the complexities and volatility inherent in the cryptocurrency market. Key historical price milestones, such as its all-time high and subsequent low, reflect the asset’s journey through market cycles. Various factors, including market sentiment, technological developments, regulatory changes, liquidity, and broader economic conditions, have shaped its price trajectory. For investors and enthusiasts, understanding these dynamics is essential for navigating the landscape of BASE coin and the broader cryptocurrency ecosystem.

Where to Buy base coin: Top Exchanges Reviewed

3. Coinbase – Affordable & User-Friendly for BASE Swaps!

In the discussion titled “What’s the best, cheapest way to buy (or swap for) base?” on r/CoinBase, users compare various decentralized exchanges like Uniswap, Jupiter, and PancakeSwap, highlighting concerns over high gas fees and transaction inefficiencies. The consensus suggests that CoinBase stands out for its user-friendly interface and competitive fees, making it a preferred option for both novice and experienced traders looking to acquire or swap base tokens efficiently.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

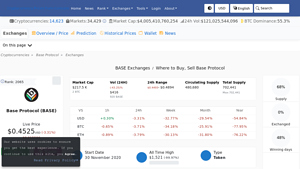

5. Base Protocol (BASE) – Your Gateway to Seamless Trading!

Base Protocol (BASE) is gaining traction in the cryptocurrency market, offering users diverse trading options across multiple platforms like Gate, Uniswap V2, and Sushiswap. What sets these exchanges apart is their combination of liquidity, user-friendly interfaces, and robust security features, making it easier for both novice and experienced traders to buy, sell, and trade BASE effectively. This accessibility, along with innovative trading tools, enhances the overall trading experience for investors.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

7. Coinbase – Ideal for Beginners with High Trust Score

In the competitive landscape of cryptocurrency exchanges, Binance, Bitget, and Bybit have emerged as frontrunners, distinguished by their high trust scores and robust trading activity. Binance is renowned for its extensive selection of cryptocurrencies and advanced trading features, while Bitget excels in derivatives trading with innovative products. Bybit stands out for its user-friendly interface and strong customer support, making these exchanges top choices for both novice and experienced traders seeking reliability and performance.

- Website: cointelegraph.com

- Platform Age: Approx. 12 years (domain registered in 2013)

7. KuCoin – Your Gateway to Base Protocol!

In this review of “How to Buy Base Protocol – KuCoin,” we explore the unique features of KuCoin as a cryptocurrency exchange, highlighting its user-friendly interface and extensive range of supported assets. Despite the current lack of direct support for Base Protocol (BASE), the article provides a comprehensive, step-by-step guide to acquiring this digital asset, showcasing KuCoin’s commitment to helping users navigate the evolving crypto landscape.

- Website: kucoin.com

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy base coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing base coin is to select a cryptocurrency exchange that lists it. Popular exchanges where base coin may be available include Coinbase, Binance, and Kraken. When choosing an exchange, consider the following factors:

- Reputation and Security: Look for exchanges with a strong track record of security and customer service.

- Fees: Review the trading fees, withdrawal fees, and deposit fees associated with the exchange.

- Ease of Use: Choose an exchange that has a user-friendly interface, especially if you are a beginner.

- Payment Methods: Ensure the exchange supports your preferred payment method (credit card, bank transfer, etc.).

After selecting an exchange, navigate to its website to start the registration process.

2. Create and Verify Your Account

Once you have chosen an exchange, you need to create an account. Follow these steps:

- Sign Up: Click on the “Sign Up” or “Register” button on the exchange’s homepage. You will typically need to provide your email address and create a password.

- Email Verification: After signing up, check your email for a verification link. Click the link to verify your email address.

- Identity Verification: Most exchanges require identity verification to comply with regulations. You may need to provide personal information, such as your name, address, and date of birth, along with a government-issued ID (like a passport or driver’s license). Some exchanges may also ask for a utility bill or bank statement for address verification.

- Two-Factor Authentication (2FA): For added security, enable 2FA. This typically involves linking your account to an authentication app (like Google Authenticator) or receiving SMS codes.

3. Deposit Funds

After your account is verified, you will need to deposit funds to buy base coin. Here’s how to do it:

- Navigate to the Deposit Section: Log into your exchange account and find the “Deposit” section, usually located in your account settings or wallet area.

- Choose Your Deposit Method: Select your preferred deposit method (bank transfer, credit/debit card, etc.). Each method will have different processing times and fees.

- Follow the Instructions: Enter the amount you wish to deposit and follow the instructions provided by the exchange. For bank transfers, you may need to complete a wire transfer or use an ACH transfer.

- Confirm the Deposit: Once you have completed the deposit, confirm that the funds have been credited to your account. This may take some time, especially for bank transfers.

4. Place an Order to Buy base coin

Now that your account is funded, you can purchase base coin. Follow these steps:

- Find the Trading Pair: Go to the trading section of the exchange and search for the base coin trading pair (e.g., BASE/USD or BASE/BTC).

- Select the Order Type: Choose between a market order (buy at the current price) or a limit order (set a specific price to buy). A market order is usually the simplest for beginners.

- Enter the Amount: Specify how much base coin you want to purchase. The exchange will display the total cost based on the current market price.

- Review Your Order: Double-check the details of your order, including the amount of base coin and the total cost, before confirming the purchase.

- Place the Order: Click on the “Buy” button to execute your order. You should receive a confirmation once the transaction is completed.

5. Secure Your Coins in a Wallet

After purchasing base coin, it’s crucial to store your coins securely. Here’s how to do it:

- Choose a Wallet Type: You can store your base coin in several types of wallets:

- Hardware Wallets: These are physical devices that store your private keys offline, providing strong security against hacks (e.g., Ledger or Trezor).

- Software Wallets: These are applications (mobile or desktop) that allow you to manage your coins. They are more convenient but less secure than hardware wallets.

-

Exchange Wallets: While you can leave your coins on the exchange, it’s generally safer to transfer them to a personal wallet.

-

Transfer Your Coins: If you choose to use a personal wallet, locate your wallet address. Go to your exchange account, find the withdrawal section, and enter your wallet address and the amount of base coin you wish to transfer.

- Confirm the Transfer: After initiating the transfer, wait for the transaction to be confirmed on the blockchain. Check your wallet to ensure that the coins have arrived.

By following these steps, you can successfully buy and store base coin. Always remember to do thorough research and consider your investment strategy before engaging in cryptocurrency trading.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Innovative Use Cases

BASE is integrated within the Base blockchain ecosystem, which supports various decentralized applications (dApps). Its role in facilitating automated liquidity through the SwapBased protocol positions it as a crucial component in the decentralized finance (DeFi) landscape. As DeFi continues to expand, BASE could benefit significantly from increased adoption and use of its services.

2. Market Accessibility

The design of BASE aims to lower barriers to entry for users unfamiliar with blockchain technology. By bridging the gap between Web3 and Web2, BASE seeks to attract a wider audience, including those new to the cryptocurrency space. This accessibility could drive user engagement and adoption, potentially leading to a broader market share.

3. Strong Community Support

With a significant number of holders (over 85,000), BASE has established a robust community. Community engagement is critical in the cryptocurrency space, as it often drives awareness, education, and adoption. A strong community can also provide support during market fluctuations, encouraging long-term holding and stability.

4. Diverse Applications

BASE is not limited to financial services; it is designed to be versatile, with applications extending into sectors such as education, logistics, and autonomous driving. This adaptability could enhance its relevance and utility, making it an appealing investment for those looking for long-term growth potential.

5. Scalability and Efficiency

As a Layer-2 scaling solution, BASE aims to improve transaction speeds and reduce costs on the Ethereum network. Scalability is a significant concern for many blockchain networks, and solutions like BASE could address these issues, making it more attractive for users and developers alike.

6. Security Features

BASE implements advanced security measures, including hardware wallet support and multi-factor authentication. These features can enhance user confidence, as security is a major concern in the cryptocurrency space. A secure platform is more likely to attract and retain users, driving growth and adoption.

7. Potential for Growth

With a current market cap of approximately $2.02 million and a circulating supply of around 929.45 billion BASE coins, there is potential for price appreciation, especially if the project gains traction. The all-time high of $26.25 suggests that significant value has been recognized in the past, indicating potential for future growth if the project can regain momentum.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is notoriously volatile, with prices subject to rapid fluctuations. BASE has already experienced a significant decline from its all-time high, which may deter potential investors concerned about the risks associated with price instability. Such volatility can lead to quick losses, making it a high-risk investment, especially for those with a low tolerance for risk.

2. Regulatory Uncertainty

Regulatory environments surrounding cryptocurrencies are continually evolving, and BASE is not immune to these changes. Regulatory scrutiny can impact operations, lead to project discontinuations, or create compliance challenges. Investors must be aware that changes in laws or regulations can significantly affect the value and viability of BASE.

3. Intense Competition

The cryptocurrency and blockchain space is highly competitive, with numerous projects vying for attention and market share. BASE faces competition from established cryptocurrencies and emerging projects, particularly in the DeFi space. This competition can limit its growth potential and market adoption, particularly if competitors offer superior technology or user experience.

4. Technological Risks

As a blockchain project, BASE is subject to various technological risks. These include vulnerabilities in smart contracts, potential bugs in the code, and challenges related to scalability and network congestion. Any security breaches or technical failures could undermine user trust and lead to a decline in adoption and value.

5. Limited Historical Data

With a market cap of around $2 million and relatively low trading volume, BASE’s performance may not be well-established in the market. Limited historical data can make it challenging for investors to assess the long-term viability and stability of the asset. Investors may find it difficult to gauge future performance based on past trends.

6. Dependency on Ethereum

As BASE operates on the Ethereum blockchain, it is inherently tied to the performance and scalability of Ethereum. Any issues affecting Ethereum, such as network congestion or high gas fees, can also impact BASE’s usability and attractiveness. This dependency can introduce additional risks, particularly in times of high network demand.

7. Market Sentiment and Speculation

The cryptocurrency market is heavily influenced by public sentiment and speculation. As a lesser-known asset, BASE may be more susceptible to market rumors, hype, or negative publicity, which can affect its price and adoption. Investors should be cautious of the speculative nature of the market and the potential impact on their investment.

Conclusion

Investing in BASE presents both potential opportunities and risks. Its innovative applications, community support, and role in enhancing blockchain scalability are compelling strengths that could drive future growth. However, investors must remain aware of the inherent volatility, regulatory challenges, and competitive landscape that could impact its performance. As with any investment, thorough research and careful consideration of personal risk tolerance are essential before making decisions in the cryptocurrency space.

Frequently Asked Questions (FAQs)

1. What is BASE coin?

BASE coin is a cryptocurrency associated with the SwapBased automated liquidity protocol on the Base blockchain. It facilitates decentralized finance (DeFi) applications by enabling efficient asset exchanges without traditional market makers. The BASE token is integral to this ecosystem, supporting transactions and interactions within the Base blockchain.

2. Who created BASE coin?

BASE coin was developed as part of the SwapBased protocol, which is implemented on the Base blockchain. While the specific individuals behind the creation of BASE coin are not widely publicized, the project is aligned with initiatives aimed at enhancing the functionality and scalability of decentralized applications.

3. What makes BASE coin different from Bitcoin?

BASE coin differs from Bitcoin primarily in its use case and underlying technology. Bitcoin serves as a decentralized digital currency primarily for peer-to-peer transactions and value storage. In contrast, BASE coin is designed to support DeFi applications through automated liquidity protocols, focusing on facilitating decentralized exchanges rather than serving solely as a currency.

4. Is BASE coin a good investment?

The potential of BASE coin as an investment depends on various factors, including market trends, its utility within the Base ecosystem, and overall cryptocurrency market conditions. Investors should conduct thorough research, consider their risk tolerance, and evaluate BASE coin’s market performance, such as its price history, volatility, and adoption rate before making investment decisions.

5. How is BASE coin secured?

BASE coin’s security is bolstered by several measures. It utilizes non-upgradeable smart contracts, which cannot be altered post-deployment, thereby preventing malicious changes. Additionally, it supports hardware wallets for private key management, Multi-Factor Authentication (MFA), and Two-Factor Authentication (2FA) to enhance user account security.

6. What is the current market performance of BASE coin?

As of the latest data, BASE coin has a market cap of approximately $2.02 million and a circulating supply of around 929.45 billion BASE tokens. Its price has experienced fluctuations, recently trading at approximately $0.000002, reflecting a 5.26% decrease over the last 24 hours. Investors should keep an eye on its trading volume and market trends for a comprehensive understanding of its performance.

7. What are the use cases for BASE coin?

BASE coin serves multiple purposes within its ecosystem. It is used for transactions on the Base blockchain, supporting DeFi applications, decentralized exchanges, and automated liquidity protocols. Furthermore, BASE aims to facilitate integration across various sectors, such as education and logistics, thereby broadening its utility beyond financial transactions.

8. How can I buy BASE coin?

To purchase BASE coin, investors can utilize cryptocurrency exchanges that list the token. Steps typically include creating an account on an exchange, completing identity verification if required, depositing funds (fiat or other cryptocurrencies), and then placing an order to buy BASE coin. Ensure to conduct due diligence on the exchange’s reputation and security measures before proceeding.

Final Verdict on base coin

Summary of BASE Coin

BASE Coin operates within the innovative landscape of the Base blockchain, primarily functioning as an automated liquidity protocol through non-upgradeable smart contracts. This unique structure enables efficient and secure transactions, positioning BASE as a critical component in the growing decentralized finance (DeFi) ecosystem. The coin’s utility extends beyond traditional financial applications, aiming to enhance accessibility for both Web2 and Web3 users. By bridging these two realms, BASE seeks to democratize the benefits of blockchain technology, making it easier for newcomers to engage with decentralized applications.

Technology and Potential

The technological foundation of BASE Coin includes robust security measures such as hardware wallet support and multi-factor authentication, ensuring the safety of users’ assets. Furthermore, its role in facilitating various sectors, from education to logistics, showcases the versatility and potential impact of BASE in real-world applications. The coin’s historical performance indicates a significant volatility, with an all-time high of $26.25 in July 2023, underscoring the high-risk, high-reward nature of investing in such digital assets.

Investment Considerations

Investing in BASE Coin, like many cryptocurrencies, carries inherent risks. The volatility in price and market dynamics can lead to substantial gains or losses. Therefore, it is crucial for potential investors to approach BASE with caution and an informed perspective.

Final Advice

Before making any investment decisions, we strongly recommend conducting thorough research (DYOR). Understanding the fundamentals, technology, and market conditions surrounding BASE Coin is essential for navigating the complexities of the cryptocurrency space. As the landscape continues to evolve, staying informed will empower you to make better investment choices.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.