What is balance coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to balance coin

Balance Coin (BLC) is an innovative decentralized algorithmic stablecoin designed to maintain a stable peg to the U.S. dollar, playing a significant role in the growing landscape of decentralized finance (DeFi). As a part of the Balance Protocol, Balance Coin aims to facilitate seamless transactions within various DeFi applications, enabling users to leverage its stability in an otherwise volatile market. Its algorithmic stability mechanism dynamically adjusts the coin’s supply in response to market fluctuations, ensuring its value remains consistent and reducing risks associated with traditional cryptocurrencies.

In the context of the broader cryptocurrency market, Balance Coin stands out as a reliable option for investors seeking stability. Unlike many other digital assets, which can experience significant price swings, BLC offers a more predictable value due to its peg to fiat currency. This characteristic makes it particularly appealing for both seasoned investors and newcomers looking to hedge against market volatility.

This guide aims to serve as a comprehensive resource for understanding Balance Coin, covering various essential aspects that potential investors should consider. We will delve into the technology that underpins BLC, exploring its algorithmic mechanisms and how they contribute to its stability and usability. Additionally, we will analyze the tokenomics of Balance Coin, including its supply dynamics and distribution methods, to provide insights into its long-term investment potential.

Investing in cryptocurrencies inherently involves risks, and Balance Coin is no exception. This guide will outline the potential risks associated with investing in BLC, including market risks, regulatory challenges, and the implications of algorithmic stability mechanisms. Understanding these risks is crucial for making informed investment decisions.

Finally, we will provide practical information on how to purchase Balance Coin, including the exchanges where it is listed and the steps involved in acquiring it. By the end of this guide, readers will have a thorough understanding of Balance Coin’s significance in the crypto market, its technological foundations, its investment potential, and the practical steps needed to invest in this digital asset. Whether you are a beginner or an intermediate investor, this guide aims to equip you with the knowledge necessary to navigate the world of Balance Coin confidently.

What is balance coin? A Deep Dive into its Purpose

Overview of Balance Coin

Balance Coin (BLC) is a decentralized algorithmic stablecoin operating within the Balance Protocol, designed to maintain a stable value pegged to the U.S. dollar. It aims to facilitate transactions in various decentralized finance (DeFi) applications while providing users with a reliable medium of exchange. The BLC token leverages an advanced algorithmic stability mechanism to dynamically adjust its supply, ensuring that its value remains consistent amidst the volatile fluctuations typical of the cryptocurrency market.

The Core Problem It Solves

In the rapidly evolving landscape of cryptocurrencies, one of the most significant challenges is maintaining a stable value. Traditional cryptocurrencies like Bitcoin and Ethereum often experience high volatility, making them less practical for everyday transactions. This volatility can deter individuals and businesses from using cryptocurrencies for regular purchases or as a store of value.

Balance Coin addresses this issue by functioning as a stablecoin. Stablecoins are designed to maintain a stable value, often pegged to fiat currencies such as the U.S. dollar. By using Balance Coin, users can mitigate the risks associated with price fluctuations, making it a suitable option for transactions, savings, and as collateral in DeFi platforms. Additionally, the ability to mint BLC by collateralizing assets such as Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH) helps to back its value, further reducing risk and promoting stability.

Its Unique Selling Proposition

Balance Coin distinguishes itself from other stablecoins through its algorithmic mechanism, which adjusts supply based on market demand. This flexibility is crucial in maintaining its peg to the U.S. dollar. Unlike traditional stablecoins that rely on reserves of fiat currency or other assets, BLC’s supply can be increased or decreased algorithmically. This self-regulating system allows for quicker responses to market fluctuations, ensuring that BLC remains stable even during turbulent market conditions.

Moreover, Balance Coin integrates seamlessly with the broader Balance Protocol ecosystem, which includes B-Stablecoins pegged to various fiat currencies. This feature enhances transactional options, making it easier for users to conduct cross-border transactions without the need for currency conversion, thus reducing fees and increasing efficiency.

The Team and Backers

The development of Balance Coin is backed by a team of experienced professionals in the blockchain and finance sectors. The project is governed by the 42DAO community, which decentralizes decision-making and ensures that BLC remains aligned with the needs of its users. The 42DAO enables FTD token holders to participate in governance, influencing key decisions regarding the protocol’s development and direction.

While specific details about the individual team members and their backgrounds may not be publicly available, the emphasis on decentralized governance suggests a commitment to community involvement and transparency. This community-driven approach is becoming increasingly important in the cryptocurrency space, as it fosters trust and encourages user engagement.

Fundamental Purpose in the Crypto Ecosystem

The primary purpose of Balance Coin within the crypto ecosystem is to serve as a stable medium of exchange that facilitates transactions in the DeFi space. By providing a stablecoin that users can rely on, BLC contributes to the overall usability of cryptocurrencies, making them more accessible to a broader audience. Its algorithmic stability mechanism allows it to adapt to market conditions, setting it apart from traditional stablecoins and enhancing its utility.

In addition to its use as a medium of exchange, Balance Coin plays a crucial role in the growing DeFi landscape. It can be utilized as collateral for lending and borrowing on various platforms, allowing users to leverage their crypto holdings without selling them. This functionality is essential for users looking to maximize their investment potential while minimizing risk.

Furthermore, BLC’s integration with B-Stablecoins provides additional options for users, allowing them to transact in different currencies without the complexities usually associated with currency conversion. This flexibility can be particularly beneficial for businesses operating in multiple regions or for individuals who frequently engage in cross-border transactions.

Conclusion

In summary, Balance Coin is an innovative solution to the challenges posed by volatility in the cryptocurrency market. Its algorithmic approach to stability, combined with the backing of a decentralized governance model, positions it as a valuable asset in the DeFi ecosystem. By providing users with a reliable medium of exchange and facilitating seamless transactions across various currencies, BLC enhances the overall functionality of cryptocurrencies and contributes to their adoption in everyday use. As the DeFi landscape continues to evolve, Balance Coin’s unique features and community-driven governance model make it a noteworthy player worth considering for both new and experienced investors.

The Technology Behind the Coin: How It Works

Introduction to Balance Coin Technology

Balance Coin (BLC) is an innovative digital asset designed to provide stability in the volatile world of cryptocurrencies. Built on the BNB Chain ecosystem, Balance Coin is categorized as an algorithmic stablecoin, meaning its value is pegged to the U.S. dollar. This section will delve into the various technological components that underpin Balance Coin, explaining its architecture, consensus mechanisms, and key innovations in a manner that is accessible to both beginners and intermediate investors.

Blockchain Architecture

Balance Coin operates on the BNB Chain, a blockchain designed for fast and low-cost transactions. The BNB Chain is known for its high throughput, allowing it to handle a large number of transactions per second, which is crucial for decentralized finance (DeFi) applications.

Layered Structure

The architecture of the BNB Chain is layered, which includes the following components:

-

Core Layer: This is where the blockchain’s consensus mechanism operates. It is responsible for validating transactions and maintaining the overall integrity of the blockchain.

-

Network Layer: This layer facilitates communication between nodes (computers that participate in the blockchain network). It ensures that all nodes have access to the same data and can synchronize effectively.

-

Application Layer: This is where various decentralized applications (dApps), including those that utilize Balance Coin, are built. The application layer allows developers to create and deploy smart contracts, which automate transactions based on predefined conditions.

-

User Interface Layer: This layer provides users with access to the blockchain through wallets and other interfaces. It allows users to interact with Balance Coin and other assets on the BNB Chain.

The combination of these layers allows Balance Coin to maintain a stable peg to the U.S. dollar while ensuring efficient transactions and robust security.

Consensus Mechanism

Balance Coin leverages the consensus mechanism of the BNB Chain, which is based on a combination of Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS). Understanding these mechanisms is essential to grasp how Balance Coin achieves stability and security.

Proof-of-Stake (PoS)

In a PoS system, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This approach has several advantages:

-

Energy Efficiency: Unlike Proof-of-Work (PoW), which requires significant computational power and energy, PoS consumes far less energy, making it a more environmentally friendly option.

-

Security: Validators have a vested interest in the network’s success, as their staked coins are at risk. This incentivizes them to act honestly and maintain the network’s integrity.

Delegated Proof-of-Stake (DPoS)

DPoS takes the PoS model a step further by allowing coin holders to vote for a small number of delegates (or validators) who will validate transactions on their behalf. This system enhances the speed and efficiency of transaction validation. Key benefits of DPoS include:

-

Scalability: DPoS can handle more transactions per second compared to traditional PoS, making it suitable for high-demand applications like those found in DeFi.

-

Community Governance: By allowing users to vote for their preferred validators, DPoS promotes a decentralized governance structure. This ensures that the interests of the community are represented in network decisions.

Key Technological Innovations

Balance Coin’s architecture incorporates several technological innovations that enhance its functionality and user experience. These innovations are pivotal in maintaining the coin’s stability and usability in various financial applications.

Algorithmic Stability Mechanism

One of the standout features of Balance Coin is its algorithmic stability mechanism, which helps maintain its peg to the U.S. dollar. This mechanism works by dynamically adjusting the supply of BLC based on market conditions. Here’s how it functions:

-

Minting and Burning: Users can mint BLC by collateralizing assets like Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH). If the price of BLC falls below $1, the protocol incentivizes users to burn (destroy) their BLC tokens to decrease supply, thereby increasing the price. Conversely, if the price rises above $1, the protocol allows new BLC to be minted, increasing supply to stabilize the price.

-

Market Feedback Loop: This minting and burning process creates a feedback loop that allows the protocol to respond to market fluctuations in real-time. This ensures that BLC remains as close to $1 as possible, making it a reliable medium of exchange.

Integration with Decentralized Finance (DeFi)

Balance Coin is designed to be utilized across various DeFi applications. Its ability to maintain a stable value makes it particularly useful for:

-

Lending and Borrowing: Users can leverage BLC as collateral for loans, providing liquidity to the DeFi ecosystem while maintaining a stable asset value.

-

Trading Pairs: BLC can be traded against other cryptocurrencies or fiat currencies, enabling users to easily exchange value within the ecosystem.

-

Stablecoin Interoperability: Balance Coin also integrates with other stablecoins pegged to different fiat currencies, expanding its utility in global transactions.

Governance through Decentralized Autonomous Organization (DAO)

Balance Coin is governed by the 42DAO, a decentralized autonomous organization that allows BLC token holders to participate in decision-making processes. This governance model enables:

-

Community Involvement: Token holders can vote on important proposals, such as changes to the protocol or the allocation of funds, ensuring that the community’s voice is heard.

-

Transparency: All governance decisions are made publicly, which fosters trust among users and promotes a fair and transparent ecosystem.

Security Features

Security is paramount in the cryptocurrency space, and Balance Coin implements several features to protect its users and the network.

Smart Contract Audits

Balance Coin’s smart contracts undergo rigorous audits to identify and fix potential vulnerabilities. This helps ensure that the code operates as intended and reduces the risk of hacks or exploits.

Decentralization

By utilizing a decentralized network of validators, Balance Coin minimizes the risk of a single point of failure. This decentralization enhances the overall security of the system, making it more resilient to attacks.

User-Controlled Wallets

Users have the option to store their BLC in decentralized wallets, which provide greater control over their assets. This contrasts with centralized exchanges, where users may not have full ownership of their tokens.

Conclusion

Balance Coin represents a significant advancement in the cryptocurrency landscape, combining innovative technology with a focus on stability and usability. Its algorithmic stability mechanism, integration with DeFi applications, and community-driven governance model position it as a valuable asset for both investors and users. As the cryptocurrency market continues to evolve, Balance Coin’s technology will likely play an essential role in shaping the future of digital finance. By understanding the technology behind Balance Coin, investors can make more informed decisions and engage more effectively with this dynamic digital asset.

Understanding balance coin Tokenomics

Balance Coin (BLC) is an algorithmic stablecoin designed to maintain a stable peg to the U.S. dollar. Understanding its tokenomics is essential for both beginners and intermediate investors who want to grasp how BLC functions within the broader cryptocurrency ecosystem. The tokenomics of Balance Coin encompasses its supply dynamics, utility, and distribution mechanisms, which all play crucial roles in its stability and usability.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 3.51 million BLC |

| Max Supply | Not specified |

| Circulating Supply | 3.51 million BLC |

| Inflation/Deflation Model | Algorithmic adjustments to maintain peg |

Total Supply and Circulating Supply

Balance Coin has a total supply of approximately 3.51 million BLC. It is important to note that the entire supply is currently circulating, meaning that there are no locked or reserved coins held by the developers or other entities. This transparency in supply is critical for investors as it minimizes concerns about sudden inflation due to undisclosed token releases.

Inflation/Deflation Model

The inflation and deflation model of Balance Coin is algorithmic, which means that it uses smart contracts to dynamically adjust the supply of BLC in response to market conditions. When demand for BLC increases, the protocol can mint new coins to ensure that the price remains close to its target of $1. Conversely, if the demand decreases, the protocol can reduce the supply by burning existing tokens. This mechanism is fundamental to maintaining the stability of the coin and ensuring that it can function effectively as a stablecoin within decentralized finance (DeFi) applications.

Token Utility (What is the coin used for?)

Balance Coin serves multiple purposes within the Balance Protocol ecosystem and beyond:

-

Stable Transactions: As an algorithmic stablecoin, BLC is primarily used for transactions where price stability is essential. Users can leverage BLC for peer-to-peer transfers, payments for goods and services, and remittances without the volatility typically associated with cryptocurrencies.

-

Collateralization: Users can mint BLC by collateralizing other assets such as Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH). This collateralization process not only backs the value of BLC but also reduces the risk of price fluctuations, providing a more secure medium for transactions.

-

Integration with DeFi: BLC is designed to be compatible with various DeFi applications. It can be used in lending and borrowing protocols, liquidity pools, and decentralized exchanges, allowing users to earn interest or participate in yield farming.

-

Governance Participation: Holders of BLC can participate in governance decisions through the decentralized 42DAO community. This allows users to vote on key protocol changes and improvements, ensuring that the stablecoin evolves in a way that aligns with the community’s needs.

-

Seamless Currency Exchange: BLC facilitates easy exchanges between itself and other cryptocurrencies or fiat currencies. It also integrates with B-Stablecoins pegged to different fiat currencies, enhancing transactional options for users.

Token Distribution

The distribution of Balance Coin is crucial for understanding its market dynamics and potential for growth. The supply of BLC is governed by the Balance Protocol’s smart contracts, which determine how and when new tokens are minted or burned.

-

Minting Process: Users can mint new BLC by providing collateral. The protocol assesses the value of the collateral and issues BLC accordingly. This process ensures that every BLC in circulation is backed by a certain amount of collateral, which contributes to its stability.

-

Burning Mechanism: In times of decreased demand, the protocol has the ability to burn BLC tokens. This deflationary mechanism is essential for maintaining the peg to the U.S. dollar. By reducing the supply of BLC, the protocol can increase its value, thereby keeping it closer to the target price.

-

Decentralized Governance: The governance model is decentralized, allowing BLC holders to vote on important decisions. This distribution of power ensures that the community has a say in the future of the token, promoting a sense of ownership among its users.

-

Liquidity Provision: The protocol encourages liquidity provision by allowing users to stake their BLC in various DeFi applications. This not only enhances the usability of the token but also contributes to the overall liquidity of the Balance Protocol ecosystem.

In conclusion, understanding the tokenomics of Balance Coin provides valuable insights into its functioning and potential as a stablecoin. The algorithmic inflation/deflation model, combined with its utility and distribution mechanisms, positions BLC as a viable option for users looking for stability and reliability in the ever-volatile cryptocurrency market. Whether you are a beginner or an intermediate investor, grasping these concepts will enhance your ability to navigate the cryptocurrency landscape effectively.

Price History and Market Performance

Overview of Balance Coin (BLC) Price History

Balance Coin (BLC) is a decentralized algorithmic stablecoin designed to maintain a stable peg to the U.S. dollar, primarily for use in decentralized finance (DeFi) applications. As with many cryptocurrencies, BLC’s price history is marked by significant fluctuations driven by various market dynamics. Understanding these price movements can provide insight into the asset’s market performance and underlying mechanisms.

Key Historical Price Milestones

-

Initial Launch and Early Price Movements

Balance Coin was launched in early 2025, quickly gaining traction among DeFi enthusiasts. In its initial weeks, BLC traded close to its pegged value of $1. This period was characterized by a gradual increase in awareness and usage within the DeFi ecosystem, which helped stabilize its price around this target. -

All-Time High

The most notable milestone in BLC’s price history occurred on May 2, 2025, when it reached an all-time high of $1.42. This peak was attributed to a surge in demand for stablecoins during a broader market rally in the cryptocurrency sector. The growing interest in DeFi applications and the increasing need for stable assets in volatile markets contributed to this price increase. -

Subsequent Corrections

Following the all-time high, BLC experienced a correction, as is common in cryptocurrency markets. By mid-June 2025, the price had dropped to around $1.00, reflecting a broader trend of profit-taking among investors and a cooling-off period for the overall crypto market. -

All-Time Low

The price of BLC reached its all-time low of $0.7916 on March 14, 2025. This decline was largely influenced by market sentiment shifts and a general downturn in the cryptocurrency market, prompting a sell-off among many digital assets. The price rebounded afterward, showcasing the asset’s resilience. -

Recent Performance

As of October 2025, BLC is trading at approximately $0.9929, with a market cap of $3.48 million. Over the last 24 hours, it experienced a slight decrease of 0.14%, with a trading range between $0.9844 and $1.02. This recent performance indicates a stabilization around its peg, albeit with minor fluctuations typical of stablecoins.

Factors Influencing the Price

Historically, the price of Balance Coin has been influenced by a variety of factors:

-

Market Demand for Stablecoins

The primary objective of BLC is to maintain a stable value relative to the U.S. dollar. Consequently, fluctuations in demand for stablecoins can significantly affect BLC’s price. During periods of market volatility, the demand for stablecoins typically increases, leading to upward pressure on prices as users seek to hedge against market downturns. -

Algorithmic Stability Mechanism

The algorithmic stability mechanism employed by Balance Coin plays a crucial role in its price stability. By dynamically adjusting the supply of BLC based on market conditions, the protocol aims to maintain its peg to the dollar. This mechanism can create price fluctuations in response to changes in demand, but it generally works to keep the price close to $1. -

Market Sentiment and Broader Cryptocurrency Trends

Like many cryptocurrencies, BLC’s price is also sensitive to overall market sentiment. Positive news in the cryptocurrency sector, such as regulatory approvals or significant partnerships, can lead to increased interest and investment in stablecoins, including BLC. Conversely, negative news can result in declines. -

Regulatory Environment

The regulatory landscape for cryptocurrencies, particularly stablecoins, is continually evolving. Any changes in regulations can impact investor confidence and influence BLC’s price. For instance, increased scrutiny from regulators could lead to uncertainty and sell-offs, while favorable regulatory developments could enhance trust and adoption. -

Technological Developments

Innovations and updates in the Balance Protocol can also affect BLC’s market performance. Enhancements that improve the user experience or increase the efficiency of the stability mechanism may lead to greater adoption and positive price movements. -

Liquidity and Trading Volume

The liquidity of BLC on various exchanges influences its price stability. Higher trading volumes typically correlate with reduced volatility, allowing the price to remain close to its intended peg. Conversely, low liquidity can lead to more significant price swings.

Conclusion

Balance Coin has navigated a diverse landscape of price fluctuations since its inception. Key historical milestones, including its all-time high and low, reflect the asset’s response to market demand, algorithmic adjustments, and external influences. By understanding the factors that have historically influenced BLC’s price, investors can better appreciate the dynamics at play in this unique stablecoin ecosystem. As the cryptocurrency market continues to evolve, monitoring these elements will be crucial for those interested in investing in or utilizing Balance Coin.

Where to Buy balance coin: Top Exchanges Reviewed

5 Steps to Securely Buy Balance (EPT) in 2025!

The “How to Buy Balance (EPT) Guide 2025” on CoinCodex highlights key exchanges like KuCoin, CoinEx, and Kraken, emphasizing their competitive fees and robust security features. This guide stands out by providing a comprehensive comparison of platforms, enabling both beginners and seasoned investors to make informed decisions when purchasing Balance (EPT). The focus on thorough research ensures users can navigate the crypto landscape confidently.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Coinbase – Easiest for Beginners

In the current landscape of cryptocurrency trading, platforms like Binance, Kucoin, and Gate.io are favored for spot trading due to their robust features, user-friendly interfaces, and diverse asset offerings. For those interested in leverage trading, specialized exchanges that focus on futures are recommended for their advanced tools and enhanced trading experiences. Each platform’s unique strengths cater to different trading strategies, making them popular choices among both novice and experienced traders.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

5. Kraken – Powerhouse for Secure Trading

Kraken stands out in the cryptocurrency landscape as a reputable exchange known for its robust security measures, user-friendly interface, and a diverse selection of digital assets. Among the leading exchange-based tokens, such as BNB and UniSwap, Kraken offers a unique platform that supports a wide range of trading pairs and advanced features, catering to both novice and experienced investors while maintaining a strong commitment to regulatory compliance and customer service.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

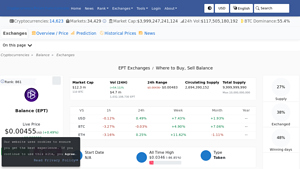

3. Balance (EPT) – Top Exchanges for Seamless Trading!

Balance (EPT) is available for trading on several prominent exchanges, including MEXC Global, Gate, and Bitget, which enhances its accessibility for investors. What sets these platforms apart is their robust trading infrastructure and user-friendly interfaces, catering to both novice and experienced traders. Additionally, the inclusion of liquidity depth metrics allows users to gauge market conditions effectively, making it easier to execute trades efficiently.

- Website: coinlore.com

7. CEX.IO – Your Gateway to Effortless Crypto Trading!

CEX.IO distinguishes itself as a leading cryptocurrency exchange by offering a diverse range of trading options, including spot and margin trading, alongside a user-friendly interface suitable for both beginners and experienced traders. Its commitment to security is evident through robust protective measures, while 24/7 customer support ensures users receive assistance whenever needed. Additionally, stable deposit methods enhance user confidence, making CEX.IO a reliable choice for buying and selling cryptocurrencies.

- Website: cex.io

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy balance coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Balance Coin (BLC) is to select a cryptocurrency exchange that supports it. There are several exchanges where you can buy BLC, including centralized exchanges (CEX) and decentralized exchanges (DEX). Some popular options include:

- Binance: A leading global exchange known for its wide range of cryptocurrencies and trading pairs.

- PancakeSwap: A decentralized exchange operating on the Binance Smart Chain, ideal for swapping BLC directly from your wallet.

- Gate.io: Another well-known exchange that offers various trading pairs for BLC.

Before choosing an exchange, consider factors like transaction fees, security measures, and user interface. Make sure the exchange you select has a good reputation and positive user feedback.

2. Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide an email address and create a password.

- Email Verification: After registering, check your email for a verification link. Click on it to confirm your email address.

- Complete KYC: Most exchanges require you to complete a Know Your Customer (KYC) process for security and regulatory compliance. This typically involves submitting identification documents such as a government-issued ID and proof of address.

- Two-Factor Authentication: To enhance security, enable two-factor authentication (2FA) on your account. This adds an extra layer of protection against unauthorized access.

3. Deposit Funds

With your account set up and verified, you can now deposit funds:

- Select Deposit Method: Navigate to the “Funds” or “Wallet” section of the exchange and choose the deposit method that suits you best. Most exchanges accept bank transfers, credit/debit cards, and cryptocurrency deposits.

- Deposit Fiat Currency: If you are using fiat currency (like USD), follow the instructions to deposit funds. This may involve linking your bank account or using a payment service.

- Deposit Cryptocurrency: If you already hold cryptocurrencies, you can deposit them directly into your exchange wallet. Copy the deposit address provided by the exchange and send your coins from your existing wallet.

Make sure to check for any minimum deposit requirements and associated fees.

4. Place an Order to Buy Balance Coin

Now that your account is funded, you can purchase Balance Coin:

- Navigate to the Trading Page: Go to the trading section of the exchange. Look for the trading pair involving BLC, such as BLC/USDT or BLC/BTC.

- Choose Order Type: Select the type of order you want to place. Common options include:

– Market Order: Buy BLC at the current market price.

– Limit Order: Set a specific price at which you want to buy BLC. This order will execute when the market price reaches your specified price. - Enter the Amount: Specify how much BLC you wish to buy or the amount of fiat/crypto you want to spend.

- Review and Confirm: Double-check the details of your order, including the total cost and any fees. Once you are satisfied, confirm the order.

After the order is executed, the purchased BLC will be credited to your exchange wallet.

5. Secure Your Coins in a Wallet

After buying Balance Coin, it’s crucial to store your coins securely:

- Choose a Wallet: While you can keep your BLC on the exchange, it is safer to transfer them to a personal wallet. Options include:

– Hardware Wallets: Devices like Ledger or Trezor provide high security for storing your coins offline.

– Software Wallets: Applications like Trust Wallet or MetaMask allow you to store and manage your cryptocurrencies easily. - Transfer BLC to Your Wallet: Go to your wallet and find the option to receive coins. Copy your wallet address and then return to the exchange. Navigate to the withdrawal section, paste your wallet address, and specify the amount of BLC you want to transfer.

- Confirm the Transfer: Follow the instructions to confirm the withdrawal. Depending on network congestion, it may take some time for the transaction to be processed.

By securing your Balance Coin in a personal wallet, you reduce the risk of loss due to exchange hacks or outages. Always remember to keep your wallet’s private keys and recovery phrases safe and never share them with anyone.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Stablecoin Characteristics

Balance Coin (BLC) is categorized as an algorithmic stablecoin, designed to maintain a stable peg to the U.S. dollar. This characteristic can make it an attractive option for investors looking for a less volatile asset within the cryptocurrency space. The stability offered by BLC can be particularly appealing during periods of high market volatility, as it allows users to hold their value without the drastic fluctuations often associated with other cryptocurrencies.

2. Decentralized Governance

Governance of the Balance Coin ecosystem is managed by a decentralized autonomous organization (DAO), known as 42DAO. This structure allows token holders to participate in decision-making processes, thereby fostering a sense of community and alignment of interests. Decentralized governance can enhance trust and transparency within the ecosystem, making it more appealing to potential users and investors.

3. Collateralization and Risk Mitigation

BLC is backed by various collateral assets, including well-established cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH). This collateralization mechanism can help mitigate risks associated with price volatility, as it provides a safety net that supports the coin’s value. By allowing users to mint BLC through collateralization, the protocol reduces the likelihood of significant price drops, enhancing its appeal as a stable investment.

4. Integration with DeFi Ecosystem

Balance Coin is designed to facilitate seamless exchanges between cryptocurrencies and fiat currencies, making it a useful asset in various decentralized finance (DeFi) applications. Its integration with B-Stablecoins, which are pegged to different fiat currencies, expands the transactional options available to users. This versatility can attract a broader user base and enhance liquidity, potentially driving demand for BLC.

5. Growth of Decentralized Finance

The growing interest in DeFi presents significant opportunities for Balance Coin. As more users seek decentralized financial solutions, stablecoins like BLC are likely to gain traction as mediums of exchange and stores of value. The increasing adoption of DeFi platforms could lead to greater utilization of BLC, boosting its market presence and value.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Despite being a stablecoin, Balance Coin is not entirely immune to market volatility. The cryptocurrency market is known for its unpredictable price swings, which can affect the trading of BLC. In situations where the collateral backing the coin experiences significant price fluctuations, the stability of BLC may be compromised. This risk is particularly pertinent in a market environment characterized by rapid changes in investor sentiment and macroeconomic factors.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and stablecoins is still evolving. Governments worldwide are increasingly scrutinizing digital assets, which can lead to regulatory changes that impact the viability of Balance Coin. Stricter regulations or unfavorable policies could hinder the adoption of BLC, limit its use cases, or even lead to its delisting from exchanges. Investors should remain aware of the potential for regulatory interventions that could affect the market dynamics of BLC.

3. Competition

The market for stablecoins is highly competitive, with established players like Tether (USDT), USD Coin (USDC), and DAI dominating the space. Balance Coin faces the challenge of differentiating itself from these well-known alternatives. The success of BLC will largely depend on its ability to attract users and liquidity in a crowded market. If it fails to offer compelling features or benefits that set it apart, it may struggle to gain significant market share.

4. Technological Risks

As with any blockchain-based project, Balance Coin is susceptible to technological risks, including vulnerabilities in its smart contracts and the underlying protocol. Bugs or exploits in the code could lead to loss of funds or undermine user confidence in the system. Moreover, the reliance on a decentralized governance model may introduce challenges in decision-making and consensus, potentially slowing down the protocol’s ability to adapt to changing market conditions or user needs.

5. Liquidity Challenges

Although BLC is designed for seamless exchanges, liquidity can be a significant concern for smaller cryptocurrencies. With a market cap of approximately $3.48 million and limited trading volume, BLC may experience liquidity issues, especially during periods of high volatility. Low liquidity can lead to increased slippage during trades, making it more challenging for investors to enter or exit positions without impacting the market price.

Conclusion

Investing in Balance Coin presents both potential rewards and inherent risks. Its algorithmic stability, decentralized governance, and integration within the growing DeFi ecosystem position it as a promising asset in the cryptocurrency landscape. However, investors must remain vigilant about the risks associated with market volatility, regulatory changes, competition, technological vulnerabilities, and liquidity challenges. As always, conducting thorough research and understanding the dynamics of the cryptocurrency market is essential for making informed investment decisions.

Frequently Asked Questions (FAQs)

1. What is Balance Coin (BLC)?

Balance Coin (BLC) is a decentralized algorithmic stablecoin designed to maintain a stable peg to the U.S. dollar. It operates within the Balance Protocol, utilizing a sophisticated algorithmic stability mechanism that dynamically adjusts its supply to ensure price consistency amidst market fluctuations. BLC can be minted by collateralizing assets such as Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH), which helps back its value and reduce risk.

2. Who created Balance Coin?

Balance Coin was developed as part of the Balance Protocol, which aims to provide a stable and reliable currency for decentralized finance (DeFi) applications. The governance of Balance Coin is decentralized through the 42DAO community, allowing token holders to influence key decisions regarding the protocol’s development and functionality.

3. How does Balance Coin differ from Bitcoin?

While Bitcoin is primarily a digital gold and a store of value, Balance Coin serves as an algorithmic stablecoin designed to maintain a consistent value relative to the U.S. dollar. Bitcoin’s supply is capped and its price can be highly volatile, whereas Balance Coin aims for stability by adjusting its supply in response to market conditions. This makes BLC more suitable for everyday transactions and use in DeFi applications.

4. Is Balance Coin a good investment?

As with any investment, the suitability of Balance Coin depends on individual financial goals, risk tolerance, and market conditions. Since BLC is an algorithmic stablecoin, it is designed to maintain a stable value rather than appreciate significantly like more speculative cryptocurrencies. Potential investors should conduct thorough research and consider the broader market context before making investment decisions.

5. Where can I buy Balance Coin?

Balance Coin can be traded on various centralized and decentralized exchanges. The specific exchanges where BLC is available may vary, so it is advisable to check platforms like CoinMarketCap or CoinGecko for the most current trading options and volumes.

6. What is the current price of Balance Coin?

As of now, the price of Balance Coin (BLC) is approximately $0.9929. Prices can fluctuate frequently due to market conditions, so it is recommended to check real-time data on cryptocurrency tracking platforms for the most accurate information.

7. What are the risks associated with investing in Balance Coin?

Investing in Balance Coin, like any cryptocurrency, carries risks including market volatility, regulatory changes, and the potential for loss of capital. Additionally, as an algorithmic stablecoin, there are specific risks related to the mechanisms that maintain its peg to the U.S. dollar, such as the effectiveness of its supply adjustment algorithms during extreme market conditions.

8. How does the governance of Balance Coin work?

Balance Coin is governed by the 42DAO community, where token holders have the ability to propose and vote on key decisions that affect the protocol. This decentralized governance model is intended to ensure that the development and operational strategies align with the interests of the community, promoting a user-driven approach to the protocol’s evolution.

Final Verdict on balance coin

Overview of Balance Coin

Balance Coin (BLC) is a decentralized algorithmic stablecoin designed to maintain a stable peg to the U.S. dollar, primarily for use in decentralized finance (DeFi) applications. Utilizing a sophisticated algorithmic stability mechanism, BLC adjusts its supply dynamically to adapt to market fluctuations, ensuring consistency in value. The coin can be minted by collateralizing various assets, including Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH), which helps back its value and mitigate risks. Additionally, BLC integrates with other fiat-pegged stablecoins, expanding its utility for transactions across different currencies.

Technology and Governance

The technology behind Balance Coin is rooted in smart contracts and decentralized governance through the 42DAO community. This governance model empowers FTD token holders to influence significant decisions, aligning the project with the needs of its users. The decentralized nature of the protocol is designed to enhance transparency and security, making it a noteworthy option for investors interested in stablecoins and DeFi solutions.

Investment Potential and Risks

Investing in Balance Coin presents both opportunities and challenges. The current market cap of approximately $3.48 million indicates that it is a relatively small player in the cryptocurrency space, which can lead to significant price volatility. With a price hovering around $0.99, and an all-time high of $1.42 reached recently, potential investors should be aware that while there may be opportunities for gains, the inherent risks associated with algorithmic stablecoins and the broader crypto market are substantial.

Conclusion

In conclusion, Balance Coin represents a high-risk, high-reward asset class within the cryptocurrency ecosystem. Its unique technology and decentralized governance may offer interesting opportunities, but prospective investors must exercise caution. It is crucial to conduct thorough research (DYOR) to understand the nuances of Balance Coin, its market dynamics, and the potential risks involved before making any investment decisions. Always consider your financial situation and risk tolerance before venturing into this volatile market.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.