What is axie infinity coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to axie infinity coin

Axie Infinity Coin (AXS) is a pivotal player in the realm of blockchain gaming and decentralized finance (DeFi). As the native token of the Axie Infinity platform, AXS has gained significant attention and traction since its inception in 2018. With the rise of play-to-earn (P2E) models, Axie Infinity has positioned itself at the forefront of this innovative gaming trend, allowing players to earn cryptocurrency through gameplay while also engaging in the breeding and trading of unique digital creatures known as Axies.

Significance in the Crypto Market

Axie Infinity has emerged as a leader in the blockchain gaming sector, not only for its engaging gameplay but also for its robust economic framework. It has successfully integrated non-fungible tokens (NFTs) into its ecosystem, enabling users to buy, sell, and trade their Axies and in-game assets on various marketplaces. The platform’s unique blend of gaming and financial incentives has attracted millions of players and investors globally, particularly in regions like Southeast Asia, where players have turned gaming into a viable source of income.

Purpose of This Guide

This guide aims to be a comprehensive resource for both beginners and intermediate investors who are interested in Axie Infinity Coin. It will cover various aspects of the AXS token, including:

-

Technology: An overview of the underlying blockchain technology that powers Axie Infinity, including its use of the Ethereum blockchain and the Ronin sidechain for enhanced scalability and lower transaction fees.

-

Tokenomics: A detailed analysis of AXS’s economic model, including its total supply, distribution, and utility within the Axie Infinity ecosystem.

-

Investment Potential: Insights into the current market performance of AXS, its historical price trends, and factors that may influence its future value.

-

Risks: An examination of the potential risks associated with investing in AXS, including market volatility, regulatory challenges, and competition within the blockchain gaming space.

-

How to Buy: A step-by-step guide on how to purchase AXS tokens, covering various exchanges, wallets, and trading pairs.

By providing a well-rounded understanding of Axie Infinity Coin, this guide will empower readers to make informed decisions regarding their investments in this dynamic digital asset. Whether you’re looking to dive into the world of blockchain gaming or considering adding AXS to your portfolio, this resource is designed to equip you with the knowledge you need to navigate the landscape effectively.

What is axie infinity coin? A Deep Dive into its Purpose

Introduction to Axie Infinity Coin (AXS)

Axie Infinity Coin, also known as Axie Infinity Shard (AXS), is the native utility token of the Axie Infinity ecosystem, which is a blockchain-based game that allows players to collect, breed, battle, and trade virtual creatures called Axies. Launched in 2020 by Sky Mavis, AXS serves multiple purposes within the game, including governance, staking, and rewards. The game’s mechanics and economic model have positioned Axie Infinity as a significant player in the realm of play-to-earn gaming, enabling users to earn cryptocurrency while engaging in gameplay.

The Core Problem It Solves

One of the central issues that Axie Infinity addresses is the lack of ownership and monetization opportunities in traditional gaming. In conventional games, players invest time and money into acquiring in-game assets, such as characters, skins, and items, which ultimately belong to the game developers. Once a player stops playing, they have no means to recover their investment.

Axie Infinity changes this paradigm by utilizing blockchain technology to grant players true ownership of their in-game assets. Each Axie is represented as a non-fungible token (NFT) on the Ethereum blockchain, allowing players to buy, sell, and trade their Axies freely on the marketplace. This system not only empowers players with ownership rights but also creates a vibrant secondary market where players can monetize their gaming experience. This play-to-earn model has been especially appealing in regions with economic challenges, offering an alternative income source for many.

Its Unique Selling Proposition

Axie Infinity’s unique selling proposition lies in its combination of engaging gameplay mechanics and the economic opportunities provided by blockchain technology. Here are some key aspects that set it apart:

-

Play-to-Earn Model: Axie Infinity is one of the pioneers of the play-to-earn concept, allowing players to earn AXS and Small Love Potion (SLP) tokens through various in-game activities. Players can earn rewards by battling other players, completing quests, and participating in tournaments.

-

Diverse Gameplay: The game offers multiple modes, including Player vs. Environment (PvE) and Player vs. Player (PvP), catering to different play styles. Players can engage in battles, breed Axies to create new ones, and explore the land of Lunacia, which adds depth and variety to the gaming experience.

-

Unique NFTs: Each Axie possesses distinct characteristics and attributes, making them unique collectibles. The breeding mechanism allows players to create new Axies with varying traits, further enhancing the game’s appeal to collectors and competitive players alike.

-

Governance and Staking: AXS holders have the ability to participate in governance decisions regarding the development of the game. This democratic approach fosters a sense of community and gives players a voice in the platform’s evolution. Additionally, staking AXS tokens allows players to earn rewards, aligning the interests of the community with the project’s success.

-

Scalability and Low Fees: To address the scalability issues often associated with Ethereum, Axie Infinity operates on the Ronin Network, a sidechain that enables fast transactions with lower fees. This innovation significantly improves the user experience, making it more accessible for players around the world.

The Team and Backers

Axie Infinity was co-founded by Trung Nguyen and Aleksander Larsen, who bring a wealth of experience in technology and gaming to the project. Trung Nguyen serves as the CEO and has a background in computer software engineering, having worked as a software engineer prior to launching Axie Infinity. Aleksander Larsen, the COO, has been involved in blockchain gaming since 2017 and has a history in competitive gaming, which informs the game’s design and mechanics.

The development team at Sky Mavis consists of around 25 full-time employees, many of whom have backgrounds in game development and blockchain technology. Their expertise has been instrumental in creating a robust and engaging gaming ecosystem.

Axie Infinity has also attracted significant investment from well-known venture capital firms, including a $152 million funding round led by Andreessen Horowitz in 2021. This backing not only provides the necessary capital for further development but also lends credibility to the project in the competitive landscape of blockchain gaming.

The Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Axie Infinity Coin (AXS) extends beyond mere gameplay; it represents a broader movement towards decentralized gaming and digital ownership. By integrating blockchain technology into gaming, Axie Infinity is redefining how players interact with virtual worlds and their assets.

AXS serves as a governance token, allowing holders to participate in key decisions that shape the future of the game. This aligns the interests of the community with the long-term success of the platform. Additionally, the play-to-earn model creates economic opportunities for players, particularly in regions where traditional employment options may be limited.

In summary, Axie Infinity Coin plays a pivotal role in the evolving landscape of blockchain gaming. It embodies the principles of ownership, community governance, and economic empowerment, making it a significant player in the cryptocurrency ecosystem. As the gaming industry continues to evolve, Axie Infinity and its AXS token are well-positioned to lead the way in creating a more inclusive and rewarding gaming experience.

The Technology Behind the Coin: How It Works

Introduction to Axie Infinity and Its Technology

Axie Infinity (AXS) is a blockchain-based game that allows players to collect, breed, and battle creatures known as Axies, which are represented as non-fungible tokens (NFTs). The game has gained immense popularity due to its play-to-earn model, where players can earn cryptocurrency through their gameplay. Understanding the technology behind Axie Infinity is crucial for both new and experienced investors, as it provides insight into how the game functions and the underlying blockchain mechanisms that support it.

Blockchain Architecture

At its core, Axie Infinity is built on blockchain technology, specifically the Ethereum network. The Ethereum blockchain is known for its smart contract functionality, which allows developers to create decentralized applications (dApps) like Axie Infinity. Here’s how the architecture works:

-

Ethereum Blockchain: Axie Infinity leverages Ethereum’s capabilities, particularly for its governance token (AXS) and the in-game assets (Axies, land, etc.). Ethereum is a decentralized platform that enables the creation of smart contracts and dApps, making it a suitable choice for gaming applications.

-

Ronin Network: To address scalability issues inherent in Ethereum, Axie Infinity has developed its own sidechain known as the Ronin Network. This sidechain is specifically designed to facilitate faster and cheaper transactions for Axie Infinity users. By using Ronin, players can enjoy near-instant transaction confirmations and significantly lower gas fees compared to transactions directly on the Ethereum mainnet.

-

Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In Axie Infinity, smart contracts govern various aspects of the game, including breeding mechanics, battles, and marketplace transactions. This ensures transparency and trust among players, as the rules are immutable and enforced by the blockchain.

Consensus Mechanism

The consensus mechanism is a fundamental aspect of any blockchain, as it determines how transactions are verified and added to the blockchain. Here’s how it works in the context of Axie Infinity:

-

Proof-of-Work (PoW): Initially, Axie Infinity relied on Ethereum’s PoW consensus mechanism, which requires miners to solve complex mathematical problems to validate transactions. However, this method can lead to slower transaction times and higher fees during periods of high network congestion.

-

Transition to Proof-of-Stake (PoS): Ethereum is transitioning to a PoS mechanism through Ethereum 2.0, which will allow users to validate transactions based on the number of tokens they hold and are willing to “stake.” This shift is expected to improve transaction speeds and reduce energy consumption significantly.

-

Ronin Network’s Consensus: The Ronin Network utilizes a different consensus mechanism tailored for gaming, allowing for faster and more efficient transaction processing. This is crucial for real-time gameplay, where delays can affect the user experience.

Key Technological Innovations

Axie Infinity is not just another blockchain game; it incorporates several technological innovations that enhance gameplay and user engagement. Some of these innovations include:

-

Play-to-Earn Model: Axie Infinity is a pioneer of the play-to-earn model, allowing players to earn cryptocurrency through their in-game activities. Players can earn AXS and Smooth Love Potion (SLP) tokens by winning battles, completing quests, and breeding Axies. This model has made the game attractive to players, particularly in regions where traditional job opportunities may be limited.

-

Non-Fungible Tokens (NFTs): Each Axie is a unique NFT, meaning no two Axies are the same. This uniqueness is created through various body parts and traits, making some Axies rarer and more valuable than others. The NFT aspect allows players to truly own their in-game assets, as they can trade or sell Axies on the marketplace.

-

Marketplace and Land Ownership: Axie Infinity features an integrated marketplace where players can buy, sell, and trade Axies and land plots. Players can also own virtual land in the game, which can be developed and used for various purposes, adding another layer of strategy and investment potential.

-

Community Governance: AXS token holders can participate in governance votes, allowing them to have a say in the future development of the game. This community-driven approach fosters engagement and encourages players to invest not just in the game but in its ecosystem.

-

Breeding Mechanics: The breeding mechanism in Axie Infinity allows players to create new Axies by combining existing ones. Each Axie can be bred a limited number of times (up to seven), which helps control the Axie population and maintain the value of existing Axies. The breeding process requires the use of SLP tokens, which adds a layer of economic strategy to the game.

Security Features

Security is paramount in any blockchain application, especially in gaming where real assets are involved. Axie Infinity incorporates several security features:

-

Decentralization: By leveraging the Ethereum blockchain and the Ronin Network, Axie Infinity benefits from the security of a decentralized network. This reduces the risk of centralized attacks and fraud.

-

Smart Contract Audits: The smart contracts governing Axie Infinity have undergone audits to ensure they are secure and free from vulnerabilities. This is crucial for maintaining player trust and the integrity of the game.

-

Multi-Signature Wallets: The Ronin Network employs multi-signature wallets for the storage of assets, which requires multiple approvals for transactions. This adds an extra layer of security against unauthorized access.

Conclusion

Understanding the technology behind Axie Infinity provides valuable insights into how the game operates and what makes it unique in the blockchain gaming space. From its use of Ethereum and the Ronin Network to its innovative play-to-earn model and community governance, Axie Infinity represents a significant advancement in the intersection of gaming and blockchain technology. As the platform continues to evolve, it will likely introduce even more innovations, making it an exciting space for both gamers and investors alike.

Understanding axie infinity coin Tokenomics

Axie Infinity is a blockchain-based game that combines elements of trading, battling, and breeding digital creatures known as Axies. The ecosystem revolves around its native governance token, Axie Infinity Shard (AXS), which plays a pivotal role in the game’s economy and governance structure. Understanding the tokenomics of AXS is essential for both new and intermediate investors looking to navigate this unique digital asset.

| Metric | Value |

|---|---|

| Total Supply | 270,000,000 AXS |

| Max Supply | Not specified |

| Circulating Supply | 166,736,508 AXS |

| Inflation/Deflation Model | Controlled deflation |

Token Utility (What is the coin used for?)

The Axie Infinity Shard (AXS) token serves multiple purposes within the Axie Infinity ecosystem:

-

Governance: AXS holders can participate in governance votes that influence the future of the game, including gameplay changes, economic adjustments, and how funds in the Axie Community Treasury are spent. This decentralized governance model empowers players, giving them a voice in the evolution of the platform.

-

Staking: AXS allows holders to stake their tokens, which can yield rewards. However, unlike many staking mechanisms, AXS holders must actively participate in gameplay to claim these rewards. This model encourages continuous engagement with the game and ensures that the rewards system aligns with player activity.

-

Earning Mechanism: Players can earn AXS tokens through various in-game activities, such as winning battles and completing quests. This play-to-earn model is a significant aspect of Axie Infinity, enabling players to monetize their gaming experience directly.

-

Marketplace Transactions: AXS can be used to buy, sell, and trade Axies and other in-game assets on the Axie marketplace. This marketplace supports a vibrant economy where players can engage in peer-to-peer trading.

-

Breeding Costs: Players need AXS to participate in breeding their Axies. This function adds a layer of strategy to the game, as players must manage their AXS holdings to breed unique and potentially valuable Axies.

Token Distribution

The distribution of AXS tokens is designed to incentivize various stakeholders and ensure a balanced growth of the ecosystem. Here’s a breakdown of the key allocations:

-

Binance Launchpad IEO Sale: 11% of the total supply was allocated to participants in the initial exchange offering (IEO) on Binance, where each token was priced at $0.10. This early investment helped kickstart the project.

-

Private Sale: 4% of the total supply was sold in a private sale, allowing early investors to support the project before its public launch.

-

Staking Rewards: A significant portion, 29% of the total supply, is earmarked for staking rewards. This allocation is designed to incentivize long-term holding and participation in the governance of the ecosystem.

-

Play-to-Earn Pool: 20% of AXS tokens are allocated to the play-to-earn pool, rewarding players for their engagement and success in the game. This mechanism is crucial for promoting active gameplay and attracting new users.

-

Team and Advisors: 21% of the total supply is reserved for the founding team, while 7% is allocated to advisors. This allocation ensures that the team has a vested interest in the project’s success and aligns their objectives with the community.

-

Ecosystem Fund: 8% of the total supply is dedicated to an ecosystem fund, which can be used to support initiatives that enhance the Axie Infinity community, including partnerships, marketing efforts, and further development of the game.

The total supply of AXS is capped at 270 million tokens, and the circulating supply as of now stands at approximately 166.7 million AXS. Based on the token release schedule, it is expected that 100% of AXS tokens will be in circulation by early 2026. This gradual release strategy aims to prevent market flooding and ensures a controlled deflationary environment, allowing the value of AXS to appreciate as demand grows.

Conclusion

In summary, Axie Infinity’s tokenomics is intricately designed to foster a thriving ecosystem that benefits players, investors, and developers alike. The utility of AXS as a governance token, its role in staking and earning mechanisms, and its strategic distribution all contribute to its potential value as an investment. For beginners and intermediate investors, understanding these facets of AXS can aid in making informed decisions regarding participation in the Axie Infinity ecosystem. As the game continues to evolve and attract a larger user base, the dynamics of AXS’s value and utility are likely to change, making it essential to stay informed about developments within the Axie Infinity community.

Price History and Market Performance

Key Historical Price Milestones

Axie Infinity (AXS) has had a notable journey since its launch, marked by significant price fluctuations that reflect both the game’s popularity and broader market trends.

-

Launch and Initial Growth (2020-2021)

The Axie Infinity Shard (AXS) token was launched in November 2020, with an initial price of approximately $0.10 during its IEO (Initial Exchange Offering) on Binance Launchpad. Following the launch, AXS experienced steady growth, reaching around $1.00 by early 2021. This initial uptick was largely fueled by increasing interest in blockchain gaming and the Play-to-Earn model that Axie Infinity introduced. -

All-Time High (November 2021)

The most significant milestone in AXS’s price history occurred on November 6, 2021, when the token reached its all-time high of $165.37. This surge was driven by a combination of factors, including a booming interest in NFTs and blockchain games, extensive media coverage, and the growth of the Axie Infinity player base. During this period, the game’s unique economic model, which allowed players to earn real money through gameplay, attracted a global audience, particularly from regions such as Southeast Asia. -

Post-Peak Decline (2022)

Following its all-time high, AXS entered a prolonged decline throughout 2022, mirroring the broader cryptocurrency market downturn. By the end of 2022, the price had dropped significantly, reflecting a decrease in player engagement and overall interest in blockchain games. The price fluctuated between $10 and $20 during this period, as the market grappled with regulatory concerns, macroeconomic factors, and a general decline in crypto prices. -

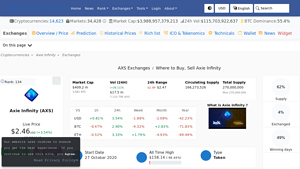

Current Price and Market Cap (2023)

As of October 2023, the price of AXS is approximately $2.45, with a market capitalization of around $409 million. The circulating supply stands at about 166.73 million AXS tokens, out of a total supply of 270 million. This represents a decline of approximately 98.52% from its all-time high, indicating a challenging period for the token amidst broader market conditions and evolving player dynamics.

Factors Influencing the Price

Historically, the price of Axie Infinity (AXS) has been influenced by various factors, both internal to the game’s ecosystem and external market conditions.

-

Player Engagement and Game Updates

The player base’s engagement level has a direct impact on AXS’s price. Key updates to the game, such as new features, characters, and gameplay mechanics, can lead to increased interest and investment in the token. For example, the introduction of new Axies or gameplay modes often results in a surge in players, which positively affects demand for AXS. Conversely, periods of stagnation or dissatisfaction among players can lead to price declines. -

Market Sentiment and Speculation

Like many cryptocurrencies, AXS’s price is also subject to market sentiment and speculation. Bullish trends in the broader cryptocurrency market can lead to increased investment in AXS, while bearish trends can result in significant sell-offs. Events such as regulatory news, macroeconomic shifts, and technological advancements in the blockchain space can influence investor sentiment and, consequently, the price of AXS. -

NFT Market Dynamics

The rise and fall of the NFT market have played a crucial role in AXS’s price movements. As a game that heavily integrates NFTs through its Axie creatures, fluctuations in the NFT market can directly affect the value of AXS. When the NFT market experiences a boom, interest in Axie Infinity often rises, leading to increased demand for AXS. Conversely, a downturn in the NFT market can lead to reduced player interest and lower AXS prices. -

Ecosystem Developments

Developments within the Axie Infinity ecosystem, such as the introduction of new tokens (like Smooth Love Potion – SLP) and staking mechanisms, can impact AXS’s price. The ability to stake AXS for rewards or participate in governance can incentivize holding the token, which may stabilize or increase its price. However, if these mechanisms are perceived as unfavorable or if they fail to attract users, it could lead to price declines. -

Competition and Market Position

The competitive landscape of blockchain games also influences AXS’s price. As new games emerge and capture player interest, AXS’s market position can be challenged. The ability of Axie Infinity to innovate and maintain its player base is critical for its long-term price stability. Failure to adapt to market trends or player preferences can lead to a decrease in demand for AXS.

In conclusion, the price history of Axie Infinity (AXS) is marked by significant milestones and influenced by a variety of factors ranging from player engagement to broader market trends. Understanding these elements is crucial for investors looking to navigate the complexities of this dynamic digital asset.

Where to Buy axie infinity coin: Top Exchanges Reviewed

5. Axie Infinity (AXS) – Your Gateway to Play-to-Earn Gaming!

Axie Infinity (AXS) exchanges offer a robust platform for buying, selling, and trading this popular cryptocurrency, with notable options including Binance, MEXC Global, and Gate. These exchanges stand out for their user-friendly interfaces, competitive trading fees, and comprehensive market data, making it easy for both novice and experienced investors to engage with AXS. Additionally, their high liquidity ensures efficient transactions, enhancing the overall trading experience.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Axie Infinity Shards (AXS) – Your Gateway to Play-to-Earn Gaming!

ChangeNOW stands out as a premier exchange for Axie Infinity Shards (AXS) due to its competitive fee structure and user-friendly interface. With a high rating of 4.8 from over 2,170 reviews, it offers users the flexibility to choose between two transaction fee options, enhancing the overall trading experience. Additionally, its commitment to zero hidden fees and a straightforward exchange process makes it an appealing choice for both novice and experienced crypto investors.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy axie infinity coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Axie Infinity Coin (AXS) is to select a reliable cryptocurrency exchange. There are several exchanges where AXS is available, including:

- Binance

- Coinbase

- Huobi Global

- Kraken

- KuCoin

- Bithumb

When choosing an exchange, consider factors such as security features, user interface, transaction fees, and the availability of your preferred payment methods. If you are a beginner, platforms like Coinbase or Binance are often recommended due to their user-friendly interfaces and extensive educational resources.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how to do that:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will be prompted to enter your email address and create a password.

-

Email Verification: After signing up, check your email for a verification link. Click on the link to verify your email address.

-

Complete Your Profile: Log in to your account and complete your profile. This may include providing personal information such as your name, address, and phone number.

-

Identity Verification: Most exchanges require you to verify your identity to comply with regulations. This typically involves uploading a government-issued ID and possibly a selfie. This process can take anywhere from a few minutes to several days, depending on the exchange.

3. Deposit Funds

After your account is verified, you can deposit funds to buy AXS. Here are the steps:

-

Choose Deposit Method: Navigate to the “Deposit” section of your account. Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency transfer. Choose the method that suits you best.

-

Enter Deposit Amount: Enter the amount you wish to deposit. Be mindful of any minimum deposit requirements set by the exchange.

-

Complete Deposit: Follow the on-screen instructions to complete your deposit. If you are using a bank transfer, it may take a few business days for the funds to appear in your account.

4. Place an Order to Buy Axie Infinity Coin

Once your funds are available, you can place an order to buy AXS:

-

Navigate to the Trading Section: Go to the trading or market section of the exchange.

-

Search for AXS: Use the search bar to find Axie Infinity Coin (AXS). You may see trading pairs such as AXS/USD, AXS/BTC, or AXS/USDT.

-

Choose Order Type: Decide on the type of order you want to place:

- Market Order: This order buys AXS at the current market price.

-

Limit Order: This order allows you to set a specific price at which you want to buy AXS. The order will only be executed when the market price reaches your set price.

-

Enter Amount: Specify how much AXS you want to buy.

-

Confirm Order: Review the details of your order and confirm the purchase. Your AXS tokens will be credited to your exchange wallet once the order is executed.

5. Secure Your Coins in a Wallet

After purchasing AXS, it’s important to secure your coins in a wallet for better security:

-

Choose a Wallet Type: You can choose between a hot wallet (connected to the internet) or a cold wallet (offline storage). Hot wallets are more convenient for trading, while cold wallets offer enhanced security.

-

Create Your Wallet: If you don’t already have a wallet, you can create one. Popular options include:

- Software Wallets: Trust Wallet, MetaMask, or the Ronin Wallet (specifically designed for Axie Infinity).

-

Hardware Wallets: Ledger Nano S/X or Trezor.

-

Transfer AXS to Your Wallet: Go to your exchange account, navigate to the withdrawal section, and enter your wallet address. Specify the amount of AXS you wish to transfer and complete the withdrawal process.

-

Verify Transfer: Check your wallet to ensure that the AXS tokens have been successfully transferred.

By following these steps, you can easily buy Axie Infinity Coin and begin your journey in the exciting world of blockchain gaming and play-to-earn opportunities. Remember to conduct thorough research and stay updated on market trends to make informed investment decisions.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Strong Market Position and Brand Recognition

Axie Infinity has established itself as one of the pioneering projects in the play-to-earn (P2E) gaming sector, gaining significant attention and a loyal user base. The game’s unique concept of allowing players to collect, breed, and battle digital creatures (Axies) has resonated well with gamers and NFT enthusiasts alike. Its recognition as a leading title in the blockchain gaming space contributes to a robust market position, attracting new players and investors continuously.

Expanding User Base and Community Engagement

The Axie Infinity community has shown remarkable growth, evidenced by its increasing number of active players and holders of the AXS token. Community engagement is vital for the success of any game, especially in the decentralized gaming space. Players not only participate in gameplay but also influence the game’s development through governance, fostering a sense of ownership and loyalty. This engagement is essential in creating a sustainable ecosystem that can adapt and thrive.

Innovative Economic Model

The Axie Infinity ecosystem is built on a unique economic model that allows players to earn tokens through gameplay. This P2E model has attracted a diverse audience, including players from regions where traditional gaming income is limited. Additionally, the integration of NFTs allows players to own unique in-game assets that can be traded or sold, enhancing the overall value proposition for participants. This model can potentially lead to increased demand for AXS as more players join the ecosystem.

Future Growth Potential

Axie Infinity’s development team, Sky Mavis, has demonstrated a commitment to innovation and expansion. Future updates and features, such as new game modes, enhancements to the breeding system, and improvements to the user interface, can drive further interest and investment in the game. The upcoming staking mechanism for AXS holders may also increase demand for the token, as it provides an additional incentive for players and investors to hold onto their assets.

Robust Technological Infrastructure

The game operates on the Ronin Network, a sidechain specifically designed for Axie Infinity, which allows for faster transactions and lower fees compared to the Ethereum mainnet. This infrastructure is critical for maintaining a smooth user experience and can support the growing demands of the player base. The technological foundation of Axie Infinity, backed by a capable development team, positions the project well for scalability and performance improvements.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Cryptocurrency markets are notoriously volatile, and the price of Axie Infinity’s native token, AXS, is no exception. The value of AXS has experienced significant fluctuations, with its all-time high reaching $165.37 in November 2021 and its current price hovering around $2.45. Such volatility can deter potential investors and players who may be hesitant to engage with a digital asset that can experience drastic price changes in a short period. This inherent market risk can impact both player participation and investor confidence.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and blockchain-based games is still evolving. Governments worldwide are increasingly scrutinizing digital assets, which could lead to potential restrictions or regulations that may impact the operation of Axie Infinity. For instance, changes in how NFTs are classified or taxed could alter the economic dynamics of the game, affecting player incentives and the overall ecosystem. Investors and players should be aware of the potential for regulatory developments that could impact Axie Infinity’s operations.

Competition from Other Projects

The blockchain gaming sector is becoming increasingly competitive, with numerous projects emerging that offer similar play-to-earn mechanics and NFT integrations. As new games enter the market, they may attract players away from Axie Infinity, potentially reducing its user base and market share. Additionally, established gaming companies are beginning to explore blockchain technology, which could pose a significant challenge to Axie Infinity’s dominance in the space. The ability of Axie Infinity to innovate and retain its player base amidst this competition will be crucial for its long-term success.

Technological Risks

While the Ronin Network provides benefits in terms of speed and cost, it also introduces potential technological risks. Any vulnerabilities in the network, such as hacks or exploits, could jeopardize player assets and trust in the platform. Furthermore, the reliance on a sidechain means that any issues with Ethereum or the broader blockchain ecosystem could also impact Axie Infinity’s operations. Players and investors should remain cautious about the technological underpinnings of the game and be aware of the risks associated with digital asset security.

Economic Sustainability

The sustainability of Axie Infinity’s economic model is another area of concern. The game’s reliance on continuous new player onboarding to maintain the economic balance can create pressure. If player growth slows, it may lead to a decrease in demand for Axies and associated tokens, affecting the overall ecosystem. Additionally, if the incentives for earning tokens diminish or if players find it challenging to generate income, interest in the game may wane. The developers must continually adapt the game’s economic mechanics to ensure long-term viability.

Conclusion

Investing in Axie Infinity (AXS) presents a mix of opportunities and challenges. Its strong market position, innovative economic model, and community engagement create a compelling case for potential growth. However, investors must also consider the inherent risks, including market volatility, regulatory uncertainty, competition, technological vulnerabilities, and economic sustainability. As with any investment in the cryptocurrency space, thorough research and a clear understanding of both the potential and risks are essential.

Frequently Asked Questions (FAQs)

1. What is Axie Infinity Coin (AXS)?

Axie Infinity Coin, also known as AXS, is the native governance token of the Axie Infinity ecosystem, which is a blockchain-based game that allows players to collect, breed, and battle creatures known as Axies. AXS is utilized for governance purposes, enabling holders to vote on key decisions affecting the game’s ecosystem, as well as for staking to earn rewards. The token was launched in November 2020 and is an ERC-20 token on the Ethereum blockchain.

2. Who created Axie Infinity Coin?

Axie Infinity was co-founded in 2018 by Trung Nguyen and Aleksander Larsen, along with a team from Sky Mavis, a technology-focused game development company based in Vietnam. Trung Nguyen serves as the CEO, while Aleksander Larsen has a background in competitive gaming and blockchain gaming. The team consists of about 25 full-time employees with experience in game development.

3. How does Axie Infinity differ from traditional cryptocurrencies like Bitcoin?

Axie Infinity Coin is fundamentally different from Bitcoin in that it is not merely a store of value or a medium of exchange. AXS is tied to a gaming ecosystem where it serves multiple functions, including governance, staking, and rewarding players for their participation in the game. While Bitcoin operates on a peer-to-peer network as a decentralized currency, AXS is specifically designed for use within the Axie Infinity platform, which incorporates elements of gaming, non-fungible tokens (NFTs), and community governance.

4. Is Axie Infinity Coin a good investment?

Whether AXS is a good investment depends on various factors, including market conditions, the success of the Axie Infinity game, and individual investment goals. As with any cryptocurrency, AXS has experienced significant price fluctuations, having reached an all-time high of $165.37 in November 2021. Potential investors should conduct thorough research and consider their risk tolerance before investing, as the gaming and NFT markets can be highly volatile.

5. How can I buy Axie Infinity Coin?

AXS can be purchased on numerous cryptocurrency exchanges, including Binance, Coinbase, Huobi Global, and Kraken. To buy AXS, you typically need to create an account on one of these platforms, complete any necessary identity verification, deposit funds (usually in fiat or another cryptocurrency), and then place an order to buy AXS. It is advisable to use a secure wallet to store your AXS tokens after purchase.

6. What are the use cases for Axie Infinity Coin?

Axie Infinity Coin serves several purposes within its ecosystem:

– Governance: AXS holders can participate in governance votes to influence game development and community initiatives.

– Staking: Users can stake their AXS tokens to earn rewards, which encourages long-term holding.

– In-game purchases: AXS can be used to buy Axies, land, and other in-game assets.

– Rewards: Players can earn AXS by performing well in the game or participating in community events.

7. How does the Axie Infinity ecosystem work?

The Axie Infinity ecosystem revolves around gameplay that includes collecting, breeding, and battling Axies. Players must first acquire Axies to participate in battles, either in Player vs. Environment (PvE) or Player vs. Player (PvP) modes. Axies can be bred to create new offspring, and the game incorporates a marketplace where players can buy and sell their Axies and other in-game assets. The game operates on the Ronin Network, a sidechain of Ethereum, which facilitates faster transactions and lower fees.

8. What is the total supply of Axie Infinity Coin?

The total supply of Axie Infinity Coin (AXS) is capped at 270 million tokens. As of now, approximately 166.73 million AXS tokens are in circulation. The distribution of AXS tokens includes allocations for staking rewards, gameplay rewards, team compensation, and ecosystem development. The release schedule indicates that all AXS tokens will be circulating by early 2026, which may influence the token’s scarcity and value over time.

Final Verdict on axie infinity coin

Overview of Axie Infinity Coin (AXS)

Axie Infinity Coin (AXS) serves as the governance and utility token for the Axie Infinity ecosystem, a popular blockchain-based game where players can collect, breed, and battle creatures known as Axies. Launched by Sky Mavis in 2018, this platform has pioneered the Play-to-Earn (P2E) model, enabling users to earn cryptocurrency and NFTs through gameplay. AXS is integral to this ecosystem, allowing holders to participate in governance decisions and earn rewards through staking.

Technological Foundation

The Axie Infinity ecosystem operates primarily on the Ronin Network, a custom sidechain built to enhance scalability and reduce transaction costs compared to the Ethereum blockchain. This technology allows for quick transactions and a seamless gaming experience, which is crucial for maintaining player engagement in a competitive market. The game incorporates unique mechanics like breeding limits and community governance, creating a sustainable and engaged player base.

Investment Potential and Risks

As of now, AXS is trading at approximately $2.45, with a market capitalization of around $409 million. Despite its significant growth since its all-time high of $165.37 in November 2021, AXS has experienced a considerable decline, showcasing the volatility typical of cryptocurrencies. This asset class is characterized by high risk and the potential for substantial rewards, making it appealing to both gamers and investors.

Final Thoughts

Investing in Axie Infinity Coin can be a compelling opportunity for those intrigued by blockchain gaming and the emerging play-to-earn landscape. However, potential investors must be aware of the inherent risks associated with cryptocurrencies, including market volatility and regulatory uncertainties. It is crucial to conduct thorough research (DYOR) and assess your risk tolerance before making any investment decisions. The Axie Infinity ecosystem continues to evolve, and understanding its dynamics will be key to navigating its future.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.