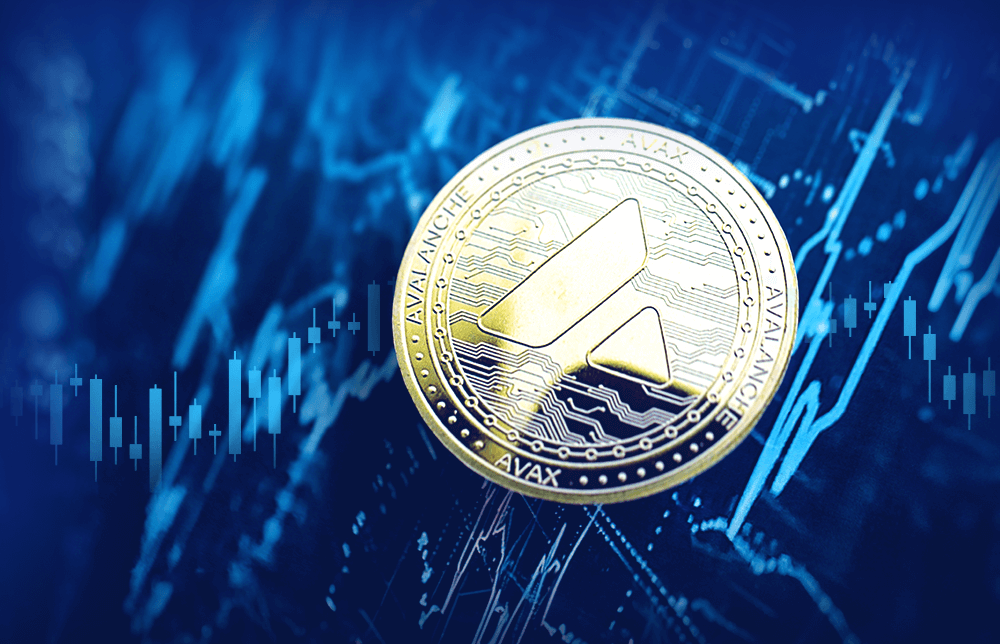

What is avalanche coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to avalanche coin

Avalanche Coin, commonly known as AVAX, is a significant player in the cryptocurrency market, recognized as one of the leading smart contract platforms. Launched by Ava Labs in 2020, Avalanche aims to provide a scalable and efficient alternative to Ethereum, addressing the limitations of existing blockchain networks. With its innovative architecture, which consists of three interoperable blockchains, Avalanche can process up to 6,500 transactions per second while maintaining low fees and robust security features. This capability has made it a popular choice among developers and investors looking for a reliable platform for decentralized applications (DApps) and decentralized finance (DeFi) projects.

The purpose of this guide is to serve as a comprehensive resource for both novice and intermediate investors interested in Avalanche Coin. We will delve into the underlying technology that powers AVAX, explaining its unique consensus mechanisms and the role of its three distinct blockchains: the Exchange Chain (X-Chain), the Contract Chain (C-Chain), and the Platform Chain (P-Chain). Understanding these components is crucial for grasping how Avalanche achieves high throughput and scalability.

In addition to the technical aspects, this guide will cover the tokenomics of AVAX. We will explore the total supply, distribution, and utility of the coin within the Avalanche ecosystem, including staking rewards and governance features. This information is vital for assessing the investment potential of AVAX as it provides insights into how the token is utilized and its economic model.

Moreover, we will discuss the investment risks associated with AVAX. As with any cryptocurrency, potential investors should be aware of market volatility, regulatory challenges, and competition within the blockchain space. By understanding these risks, investors can make more informed decisions regarding their investments in Avalanche Coin.

Finally, this guide will provide practical information on how to buy AVAX, including a step-by-step process for acquiring the coin on various exchanges. We will also highlight the importance of securing your investment through proper wallet management and best practices.

In summary, this guide aims to equip readers with a thorough understanding of Avalanche Coin, its technology, tokenomics, investment potential, risks, and practical purchasing steps, enabling them to navigate the evolving landscape of cryptocurrency with confidence.

What is avalanche coin? A Deep Dive into its Purpose

Introduction to Avalanche Coin (AVAX)

Avalanche Coin, commonly referred to as AVAX, is the native cryptocurrency of the Avalanche blockchain platform, a leading layer-one blockchain designed for decentralized applications (DApps) and custom blockchain networks. Launched by Ava Labs in 2020, Avalanche has quickly gained traction in the competitive landscape of blockchain technology, positioning itself as a viable alternative to Ethereum. Its architecture and consensus mechanisms address some of the critical challenges that blockchain technology faces today.

The Core Problem It Solves

The primary issue that Avalanche aims to tackle is the blockchain trilemma, which posits that a blockchain can only excel at two out of three desirable attributes: decentralization, scalability, and security. Many existing blockchains, like Ethereum, have struggled with scalability, leading to high transaction fees and slower processing times during peak demand periods.

Avalanche addresses these concerns through its unique architecture, consisting of three interoperable blockchains: the X-Chain, C-Chain, and P-Chain. Each of these chains serves a distinct purpose and employs different consensus mechanisms tailored to their specific use cases.

-

X-Chain (Exchange Chain): This chain is primarily responsible for the creation and transfer of AVAX tokens and other assets. It employs a Directed Acyclic Graph (DAG) protocol, allowing for high throughput and fast transaction finalization. Transaction fees are fixed at a minimal 0.001 AVAX.

-

C-Chain (Contract Chain): This chain is where smart contracts are executed, and DApps are hosted. It is compatible with the Ethereum Virtual Machine (EVM), enabling Ethereum developers to easily migrate their DApps to Avalanche. The C-Chain uses the Snowman consensus mechanism, which enhances the efficiency of smart contract execution.

-

P-Chain (Platform Chain): This chain coordinates validators and manages the network’s subnets, which are custom sets of validators that can validate various blockchains. It also plays a crucial role in staking AVAX tokens to secure the network.

By dividing tasks among specialized chains, Avalanche can achieve higher transaction throughput—up to 6,500 transactions per second—without sacrificing decentralization or security.

Its Unique Selling Proposition

Avalanche’s unique selling proposition lies in its speed, scalability, and flexibility.

-

Speed: The Avalanche consensus mechanism allows for near-instant transaction finalization. Unlike traditional proof-of-work or proof-of-stake mechanisms, where one leader validates transactions, Avalanche employs a random polling method among validators, ensuring rapid and statistically secure transaction confirmations.

-

Scalability: By supporting multiple chains and subnets, Avalanche can easily scale to accommodate a growing number of DApps and users. Developers can create custom blockchains tailored to specific application needs, enhancing the overall flexibility of the ecosystem.

-

Interoperability: Avalanche is designed to be natively interconnected, allowing for seamless communication between its various chains and other blockchains, including Ethereum. This is particularly beneficial for projects that aim to leverage the strengths of different blockchain ecosystems.

-

Community and Ecosystem: Avalanche has built a robust ecosystem of decentralized finance (DeFi) applications and DApps. Many Ethereum-based projects, such as SushiSwap and TrueUSD, have migrated to or integrated with the Avalanche network, showcasing its growing popularity and utility.

-

Staking Rewards: AVAX holders can stake their tokens to become validators or delegate their tokens to existing validators, earning rewards in the process. The current staking reward is approximately 11.57% annually, attracting investors interested in passive income opportunities.

The Team and Backers Behind the Project

Avalanche was developed by Ava Labs, a company founded by a team of experts in blockchain technology and computer science. The core team includes:

-

Emin Gün Sirer: A professor at Cornell University, Sirer has been a prominent figure in the blockchain space for over a decade. He has conducted extensive research in cryptography and peer-to-peer networks, contributing significantly to the foundational principles of blockchain technology.

-

Kevin Sekniqi and Maofan “Ted” Yin: Both are PhD graduates from Cornell University and have been instrumental in the development of Avalanche’s architecture and consensus mechanisms. Their academic background and experience in computer science have helped shape Avalanche into a cutting-edge platform.

Ava Labs has attracted significant investment from notable firms such as Andreessen Horowitz and Polychain Capital, raising $42 million in a highly successful initial coin offering (ICO) in 2020. This financial backing has allowed Avalanche to scale its operations and invest in the development of its ecosystem.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Avalanche Coin and the Avalanche platform is to create a highly efficient, scalable, and flexible blockchain ecosystem that can support a wide range of decentralized applications and custom blockchain networks. By addressing the limitations of existing blockchains, Avalanche aims to enable real-world use cases in areas such as finance, supply chain management, gaming, and more.

With its innovative architecture and commitment to interoperability, Avalanche seeks to foster a vibrant community of developers and users. It empowers them to build applications that are not only fast and cost-effective but also capable of meeting the demands of a rapidly evolving digital economy.

In summary, Avalanche Coin (AVAX) represents a significant advancement in blockchain technology, combining speed, scalability, and security in a way that addresses the challenges faced by many existing platforms. Its unique structure and dedicated team position it as a formidable player in the cryptocurrency landscape, attracting both developers and investors alike.

The Technology Behind the Coin: How It Works

Overview of Avalanche Technology

Avalanche is a layer-1 blockchain platform designed to facilitate decentralized applications (DApps) and custom blockchain networks. Its architecture allows for high transaction throughput and low latency, making it a strong competitor to Ethereum and other blockchain platforms. This guide will break down the core technologies that underpin Avalanche, making it easier for both beginners and intermediate investors to understand how it works.

Blockchain Architecture

Avalanche’s architecture is unique in that it consists of three distinct blockchains, each optimized for different tasks:

-

Exchange Chain (X-Chain):

– Purpose: The X-Chain is responsible for the creation and transfer of AVAX tokens and other assets.

– Technology: It utilizes a Directed Acyclic Graph (DAG) structure, which allows for asynchronous processing of transactions. This means that multiple transactions can occur simultaneously, leading to faster processing times.

– Transaction Fees: Transactions on the X-Chain have a fixed fee of 0.001 AVAX, making it cost-effective for users. -

Contract Chain (C-Chain):

– Purpose: The C-Chain is where smart contracts and decentralized applications are hosted.

– Technology: It is compatible with Ethereum’s Virtual Machine (EVM), allowing developers to easily migrate their DApps from Ethereum to Avalanche. The C-Chain uses the Snowman consensus mechanism, designed for high throughput and fast finality.

– EVM Compatibility: This compatibility enables a broader range of developers to create applications on Avalanche, leveraging existing Ethereum-based tools and libraries. -

Platform Chain (P-Chain):

– Purpose: The P-Chain coordinates the network validators and manages the creation of subnets.

– Technology: It also uses the Snowman consensus mechanism, ensuring that the network remains efficient and secure. This chain is crucial for staking AVAX and earning rewards.

– Subnet Management: Subnets are customizable blockchains that can have specific rules and validators, allowing for tailored blockchain solutions depending on the needs of the application.

Consensus Mechanism

Avalanche employs a unique consensus mechanism that distinguishes it from traditional methods like Proof-of-Work (PoW) and Proof-of-Stake (PoS).

-

Avalanche Consensus:

– Overview: This consensus mechanism allows all nodes in the network to participate in the validation of transactions. Unlike PoW, which relies on mining, or PoS, which depends on staking, the Avalanche consensus uses a process called “random polling.”

– Directed Acyclic Graph (DAG): The use of a DAG structure means that there are no blocks in the traditional sense. Transactions are finalized almost instantly, providing immediate confirmation without the delays typical in other blockchains.

– Statistical Certainty: Validators randomly sample other validators to confirm the correctness of transactions. This method provides high assurance of transaction validity with minimal communication overhead. -

Snowman Consensus:

– Purpose: Specifically designed for the C-Chain, Snowman is optimized for sequential block production, which is ideal for smart contracts.

– Features: It maintains the speed and efficiency of the Avalanche consensus while ensuring that the order of transactions is preserved, which is crucial for executing smart contracts accurately.

Key Technological Innovations

Avalanche introduces several technological innovations that enhance its performance and usability:

-

Interoperability:

– Cross-Chain Communication: Avalanche’s architecture allows different blockchains within its ecosystem to communicate seamlessly. This feature enables the integration of various applications and assets, facilitating a more interconnected blockchain environment.

– Bridges to Other Blockchains: Avalanche is actively working on bridges to enhance interoperability with Ethereum and other networks, allowing users to transfer assets easily between chains. -

Subnets:

– Definition: Subnets are sets of validators that can validate multiple blockchains. Each subnet can have its own rules and governance, tailored to specific applications or user groups.

– Customizable Features: Subnets allow for application-specific networks, meaning developers can create customized blockchains with specific validators, governance models, and economic incentives.

– Private Blockchains: Subnets can also be used to create private blockchains where only predefined validators have access to the data, providing a layer of privacy for sensitive applications. -

Scalability:

– High Throughput: Avalanche is designed to handle thousands of transactions per second (up to 6,500), enabling it to scale effectively without sacrificing performance.

– Dynamic Resource Allocation: The network can allocate resources dynamically based on demand, ensuring that applications receive the necessary bandwidth and processing power when they need it. -

User-Friendly Developer Experience:

– Tools and SDKs: Avalanche provides a robust suite of developer tools, making it easier for programmers to create and deploy applications. This includes SDKs that simplify the process of building on the platform.

– Best Practices and Documentation: The platform offers extensive documentation and best practices, allowing developers to leverage existing knowledge from Ethereum while adapting to Avalanche’s unique features.

Security and Decentralization

Avalanche maintains a high level of security through its consensus mechanisms and validator system:

-

Validator Network:

– Participation: Anyone can become a validator by staking AVAX tokens, which helps ensure decentralization. The requirement to stake a minimum of 2,000 AVAX tokens helps to align the interests of validators with the health of the network.

– Incentives: Validators are incentivized to act honestly as they earn rewards in AVAX for participating in the validation process. Malicious behavior can lead to penalties, including losing staked tokens. -

Protection Against Attacks:

– Robust Consensus: The random polling mechanism of the Avalanche consensus makes it resistant to common attacks such as Sybil attacks, where a single entity creates multiple nodes to gain influence over the network.

– Finality Guarantees: Transactions are finalized with high confidence, reducing the risk of double-spending or transaction reversals.

Conclusion

Avalanche is a pioneering blockchain platform that leverages innovative technologies to offer a scalable, efficient, and user-friendly environment for decentralized applications. Its unique architecture, consensus mechanisms, and focus on interoperability set it apart from other blockchains, making it an attractive option for developers and investors alike. As the ecosystem continues to grow, Avalanche is well-positioned to play a significant role in the future of decentralized finance and Web3 applications.

Understanding avalanche coin Tokenomics

Avalanche (AVAX) has garnered attention in the cryptocurrency space due to its unique architecture and high throughput capabilities. Understanding its tokenomics is essential for both new and experienced investors who wish to engage with this digital asset. This section will cover key metrics, the utility of the AVAX token, and its distribution model.

| Metric | Value |

|---|---|

| Total Supply | 720 million AVAX |

| Max Supply | 715.74 million AVAX |

| Circulating Supply | 422.27 million AVAX |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The AVAX token serves multiple purposes within the Avalanche ecosystem, making it a versatile asset for various stakeholders:

-

Transaction Fees: AVAX is used to pay transaction fees on the network. These fees are relatively low, fixed at 0.001 AVAX for transactions on the Exchange Chain (X-Chain). This affordability encourages frequent transactions, promoting network activity.

-

Staking: Users can stake AVAX tokens to participate in the network’s consensus mechanism. Staking rewards are a significant incentive for holders, currently offering an annual return of around 11.57%. To stake AVAX, users must lock a minimum of 2,000 AVAX for at least two weeks, which helps secure the network and validate transactions.

-

Governance: Holders of AVAX can participate in governance decisions regarding the Avalanche protocol. This includes voting on proposals for network upgrades, changes in protocol parameters, and allocation of resources within the ecosystem. This democratic approach allows the community to have a say in the platform’s future.

-

Collateral for Subnets: AVAX is also used as collateral for creating custom subnets. Subnets are specialized networks within the Avalanche ecosystem that can have their own rules and validator sets. By staking AVAX, users can validate transactions on these subnets, enhancing the overall scalability and flexibility of the network.

-

Incentives for Validators: Validators are essential for maintaining the network’s security and integrity. They earn AVAX rewards for their services, which helps to ensure that the validators are incentivized to act honestly and efficiently.

Token Distribution

The distribution model of AVAX is designed to ensure a balanced approach to allocation while fostering the growth of the ecosystem. Here’s a breakdown of how the total supply of AVAX is allocated:

-

Seed Sale (2.5%): This portion was allocated to early investors, with 10% released at the mainnet launch and the remaining amount distributed every three months.

-

Private Sale (3.5%): Similar to the seed sale, this allocation was for private investors, with a 10% release at the mainnet launch followed by quarterly distributions.

-

Public Sale (10%): The public sale allowed retail investors to participate, with 10% released at the mainnet launch and 15% released every three months over a period of 18 months.

-

Foundation (9.26%): This allocation is intended to support the development and growth of the Avalanche ecosystem, with funds released over a ten-year period.

-

Community Endowment (7%): Designed to foster community initiatives and projects, this allocation is released over twelve months.

-

Testnet Incentive Program (0.27%): This small allocation was used to incentivize participation in the testnet, with funds released over one year.

-

Strategic Partners (5%): This allocation is aimed at establishing partnerships that can enhance the Avalanche ecosystem, released over four years.

-

Airdrops (2.5%): A portion of AVAX was allocated for airdrops to promote the token and incentivize early users, released over four years.

-

Team (10%): The team behind Avalanche received a portion of AVAX, released over four years to ensure they remain committed to the project.

-

Staking Rewards (50%): The largest portion of AVAX is reserved for staking rewards. This incentivizes users to lock their tokens and support the network’s security and efficiency.

Conclusion

In summary, Avalanche’s tokenomics is structured to foster a vibrant ecosystem that supports transaction efficiency, governance, and community involvement. The utility of AVAX extends beyond mere transactions, serving as a cornerstone for staking, governance, and securing the network. The careful distribution of tokens also ensures that various stakeholders, from investors to developers, are incentivized to contribute positively to the network’s growth and sustainability. Understanding these elements is crucial for anyone looking to invest in or engage with Avalanche (AVAX).

Price History and Market Performance

Overview of Avalanche (AVAX)

Avalanche (AVAX) is a layer one blockchain platform designed for the development of decentralized applications (DApps) and custom blockchain networks. Launched in 2020 by Ava Labs, Avalanche has positioned itself as a robust competitor to Ethereum, aiming to provide high throughput and low latency in transaction processing. As a part of understanding Avalanche, analyzing its price history and market performance is crucial for both beginners and intermediate investors.

Key Historical Price Milestones

Avalanche’s price journey has been characterized by significant volatility since its inception.

-

Launch and Initial Trading: Avalanche’s mainnet went live in September 2020, and the AVAX token was initially priced at approximately $2.79. This price represented a starting point for investors who believed in the potential of the Avalanche ecosystem.

-

Rapid Growth: Following its launch, AVAX experienced a notable rally, reaching an all-time high of $146.22 on November 21, 2021. This price surge was fueled by a combination of factors, including increased interest in DeFi (Decentralized Finance) applications and the overall bullish sentiment in the cryptocurrency market.

-

Post-Peak Correction: After reaching its all-time high, AVAX faced a significant correction, typical of the cryptocurrency market. By early 2022, the price began to decline, with the token experiencing a drop of over 80% from its peak by mid-2022.

-

Recent Performance: As of October 2023, Avalanche’s price has stabilized around $24.63, indicating a recovery from the previous lows but still significantly below its all-time high. The market capitalization currently stands at approximately $10.4 billion, positioning AVAX as the 17th largest cryptocurrency by market cap.

Factors Influencing the Price

Historically, the price of Avalanche has been influenced by a variety of factors, both internal to the ecosystem and external market conditions.

1. Market Sentiment and Trends

Avalanche’s price has been closely tied to broader market trends in the cryptocurrency space. Bullish trends typically lead to increased interest and investment in AVAX, while bearish trends tend to result in price declines. For example, the surge in AVAX’s price to its all-time high in late 2021 coincided with a general market rally driven by the rise of DeFi and NFTs (Non-Fungible Tokens), which saw heightened interest from investors.

2. Technological Developments

The ongoing development of the Avalanche platform has also played a critical role in influencing its price. Innovations such as the introduction of subnets, which allow for customizable blockchains, have attracted developers and projects to the Avalanche ecosystem. Partnerships, such as the collaboration with Visa to integrate Avalanche into its stablecoin settlement network, have further enhanced the platform’s credibility and utility, positively impacting the token’s price.

3. Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has historically affected Avalanche’s market performance. News of regulatory changes or crackdowns in major markets can lead to increased volatility. For instance, announcements regarding regulatory scrutiny of DeFi platforms have occasionally resulted in market-wide sell-offs, impacting AVAX alongside other cryptocurrencies.

4. Competition within the Blockchain Space

Avalanche operates in a highly competitive environment, particularly against other layer one blockchains like Ethereum, Solana, and Cardano. Changes in the competitive landscape, such as technological advancements or significant partnerships by competitors, can influence investor sentiment towards Avalanche. If a competing platform gains traction, it may divert attention and investment away from Avalanche, leading to price fluctuations.

5. Market Liquidity and Trading Volume

Avalanche’s price has also been affected by market liquidity and trading volume. With a 24-hour trading volume of approximately $361 million, fluctuations in trading activity can lead to price volatility. Higher trading volumes can indicate greater investor interest, which can positively influence the price, while lower volumes may reflect declining interest and lead to price decreases.

6. Staking and Incentives

The staking mechanism within the Avalanche ecosystem has also had an impact on its price. With an annual staking reward of about 11.57%, many investors choose to stake their AVAX tokens, reducing the circulating supply in the market. This scarcity can drive prices upward, particularly during periods of increased demand for AVAX.

Conclusion

Avalanche (AVAX) has demonstrated a dynamic price history characterized by significant highs and lows, influenced by a myriad of factors ranging from market sentiment and technological advancements to regulatory changes and competitive pressures. Understanding these historical price milestones and the factors that have influenced them can provide valuable insights for investors considering AVAX as part of their cryptocurrency portfolio. As the blockchain ecosystem continues to evolve, monitoring these dynamics will be essential for making informed investment decisions.

Where to Buy avalanche coin: Top Exchanges Reviewed

1. Avax.Network – Your Gateway to Effortless Crypto Trading!

Avax.network distinguishes itself as a user-friendly platform for buying, selling, and trading cryptocurrencies, particularly appealing to novices. Unlike major exchanges like Coinbase and Binance, Avax.network offers a streamlined interface and educational resources tailored for beginners. This focus on accessibility, combined with competitive fees and a diverse range of supported digital assets, makes it an attractive alternative for users looking to navigate the crypto landscape with confidence.

- Website: avax.network

5. Coinbase – User-Friendly Interface for Easy AVAX Purchases

In the review article “Buy Avalanche (AVAX): Best 5 Places to Buy AVAX in 2025,” we explore top exchanges like eToro and Coinbase, which facilitate seamless AVAX purchases for US residents. These platforms stand out for their user-friendly interfaces, robust security measures, and varied payment options, including credit cards and bank transfers. Additionally, the potential for integration with services like PayPal enhances accessibility, making it easier for both beginners and seasoned investors to engage with AVAX.

- Website: milkroad.com

- Platform Age: Approx. 12 years (domain registered in 2013)

15. Kraken – Top Choice for Security and User Experience

In this comprehensive review article, we explore the top 15 exchanges for purchasing Avalanche, providing a detailed comparison of real-time prices, transaction fees, and available payment methods. With insights from 215 user reviews, this guide highlights the unique features and advantages of each platform, helping both novice and experienced investors make informed decisions. Whether you’re seeking the lowest fees or the most convenient payment options, you’ll find the ideal exchange for your Avalanche transactions.

- Website: cryptoradar.com

- Platform Age: Approx. 10 years (domain registered in 2015)

5. Coinbase – Easiest Way to Buy Avalanche (AVAX) in the U.S.

Coinbase stands out as a premier platform for purchasing Avalanche (AVAX) in the United States due to its reputation for security and user-friendliness. As one of the most trusted centralized exchanges, Coinbase offers a streamlined process for buying, selling, and managing AVAX, making it accessible for both beginners and experienced investors. Its robust features, including a secure wallet and comprehensive educational resources, enhance the overall trading experience.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

7. ChangeNOW – Top Choice for AVAX Exchanges!

ChangeNOW stands out as a premier platform for exchanging Avalanche (AVAX) due to its competitive pricing and user-friendly interface. With an impressive rating of 4.8 from over 2,170 users, it offers instant transactions without hidden fees, making it accessible for both beginners and experienced traders. Users can easily track AVAX prices in USD, view comprehensive charts, and access educational resources for buying and selling, ensuring a seamless trading experience.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy avalanche coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Avalanche (AVAX) is selecting a cryptocurrency exchange. A cryptocurrency exchange is a platform that allows you to buy, sell, and trade digital currencies. Here are some popular exchanges that support AVAX:

- Binance: One of the largest exchanges globally, offering a wide variety of cryptocurrencies.

- Bitfinex: Known for its advanced trading features and liquidity.

- Gate.io: Offers a range of cryptocurrencies and has a user-friendly interface.

- KuCoin: Provides a wide selection of altcoins and various trading options.

When choosing an exchange, consider factors like security, user interface, trading fees, and available payment methods. It’s also advisable to check if the exchange is compliant with regulations in your region.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. Fill in the required information, which usually includes your email address and a secure password.

-

Email Verification: After signing up, you will receive a verification email. Click on the link provided in the email to verify your account.

-

KYC Process: Most exchanges require you to complete a Know Your Customer (KYC) verification process. This typically involves submitting identification documents (such as a passport or driver’s license) and possibly a proof of address. This step is essential for compliance and helps secure your account.

3. Deposit Funds

After your account is verified, you need to deposit funds to purchase AVAX:

-

Select Deposit Method: Log into your exchange account and navigate to the “Deposit” section. Most exchanges accept various payment methods, including bank transfers, credit/debit cards, and sometimes cryptocurrencies.

-

Choose Currency: Select the currency you wish to deposit (e.g., USD, EUR, etc.).

-

Deposit Funds: Follow the instructions to complete the deposit. If you are using a bank transfer, it may take a few days for the funds to clear. Credit or debit card deposits are usually instant.

-

Check Deposit Status: Ensure that your funds have been credited to your exchange account before proceeding to buy AVAX.

4. Place an Order to Buy Avalanche Coin

With your account funded, you can now place an order to buy AVAX:

-

Navigate to the Trading Section: Go to the exchange’s trading platform. This might be labeled as “Markets” or “Trade.”

-

Select AVAX: Search for the AVAX trading pair that matches your deposited currency (for example, AVAX/USD or AVAX/EUR).

-

Choose Order Type: You can typically select between different order types:

- Market Order: Buy AVAX at the current market price. This is the simplest option for beginners.

-

Limit Order: Set a specific price at which you want to buy AVAX. This order will only execute if the market reaches your desired price.

-

Enter Amount: Specify how much AVAX you want to buy. The exchange will show you the total cost based on the current price.

-

Confirm Order: Review the details and click “Buy” to execute your order. You should receive a confirmation once your order is successfully placed.

5. Secure Your Coins in a Wallet

After purchasing AVAX, it’s essential to store your coins securely:

- Choose a Wallet: While you can keep your AVAX on the exchange, it’s safer to transfer it to a personal wallet. There are different types of wallets:

- Software Wallets: Applications or desktop programs that store your AVAX. Examples include Exodus and Atomic Wallet.

-

Hardware Wallets: Physical devices that offer the highest security. Examples include Ledger and Trezor.

-

Transfer AVAX: If you choose to use a wallet, you will need to transfer your AVAX from the exchange. Go to your wallet, find your AVAX address, and copy it.

-

Withdraw from Exchange: On the exchange, navigate to the withdrawal section, select AVAX, and paste your wallet address. Confirm the transaction. Ensure to double-check the address, as transactions cannot be reversed.

-

Secure Your Wallet: If using a software wallet, ensure you enable two-factor authentication (2FA) and back up your wallet recovery phrase securely.

By following these steps, you can successfully purchase and store Avalanche (AVAX) coins. Always remember to do your own research and consider the risks involved in cryptocurrency investments.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Avalanche (AVAX) has emerged as a significant player in the cryptocurrency space, offering a variety of features and benefits that make it an attractive investment opportunity. Below are some key strengths that investors may find compelling.

1. High Throughput and Scalability

Avalanche is designed to handle a high volume of transactions without sacrificing speed or decentralization. The network can process up to 6,500 transactions per second (TPS), which is significantly higher than many other blockchains, including Ethereum. This capability is essential for supporting decentralized applications (DApps) and decentralized finance (DeFi) protocols, making Avalanche a desirable platform for developers.

2. Unique Architecture

Avalanche operates on three distinct blockchains: the Exchange Chain (X-Chain), Contract Chain (C-Chain), and Platform Chain (P-Chain). This modular architecture allows for specialized functions and consensus mechanisms tailored to each blockchain’s specific needs. Such a design not only enhances efficiency but also improves interoperability between different applications and chains, making it easier for developers to build on the Avalanche network.

3. Strong Ecosystem and Partnerships

Since its launch, Avalanche has cultivated a robust ecosystem with numerous DApps and partnerships. The integration of Ethereum-based projects like SushiSwap and TrueUSD showcases Avalanche’s ability to attract established projects. Additionally, the recent partnership with Visa for stablecoin settlement further validates Avalanche’s role in the real-world application of blockchain technology. Such collaborations can drive user adoption and increase the overall value of the AVAX token.

4. Staking Rewards

Investors can stake their AVAX tokens on the network, earning annual rewards of approximately 11.57%. This staking mechanism not only provides a passive income opportunity but also incentivizes long-term holding of the token, contributing to its overall demand and stability. The minimum requirement of 2,000 AVAX for staking may encourage larger holders to participate, reducing circulating supply and possibly driving up prices.

5. Active Development and Community Support

Avalanche is backed by Ava Labs, founded by Emin Gün Sirer, a well-respected figure in blockchain research. The continuous development of the network, including improvements in interoperability and scalability, positions Avalanche favorably in the competitive landscape. The active community of developers and users further enhances its potential for growth and innovation.

Potential Risks and Challenges (The Bear Case)

While Avalanche presents several promising opportunities, potential investors should also consider the risks associated with investing in AVAX. Below are some of the primary challenges and uncertainties.

1. Market Volatility

Cryptocurrencies are notoriously volatile, and AVAX is no exception. Price fluctuations can be extreme, influenced by various factors such as market sentiment, regulatory news, and macroeconomic conditions. For instance, AVAX reached an all-time high of $146.22 in November 2021 but has since experienced significant declines, highlighting the unpredictable nature of the market. This volatility can pose risks for investors, especially those who may not have a high tolerance for risk.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and Avalanche is not insulated from potential regulatory scrutiny. Governments worldwide are increasingly looking at ways to regulate digital assets, which could impact the operation and adoption of blockchain networks like Avalanche. Any unfavorable regulations could hinder the growth of the ecosystem or impose additional compliance costs on projects built on the Avalanche platform.

3. Competition

Avalanche faces stiff competition from other layer 1 blockchains such as Ethereum, Solana, and Cardano, which also aim to provide high throughput and smart contract capabilities. As these platforms continue to evolve and improve, they may capture a larger share of the market, potentially limiting Avalanche’s growth. The success of competing projects could divert developers and users away from Avalanche, impacting its ecosystem’s expansion and the value of AVAX.

4. Technological Risks

Despite its innovative architecture, Avalanche is not immune to technological risks. The complexity of managing multiple blockchains and consensus mechanisms introduces potential vulnerabilities. Any technical failures, security breaches, or bugs in the network could result in significant losses for investors and damage the reputation of the platform. Furthermore, the reliance on validator nodes for network security raises concerns about centralization, particularly if a small number of validators hold a significant portion of the staked AVAX.

5. Market Adoption and Use Cases

While Avalanche has established a growing ecosystem, the long-term success of the platform depends on widespread adoption and the development of compelling use cases. If developers and users do not find sufficient value in building on Avalanche compared to other networks, it could limit the growth potential of the AVAX token. The lack of real-world applications could lead to stagnation in network activity and investment interest.

Conclusion

Investing in Avalanche (AVAX) presents a range of opportunities and challenges. Its high throughput, unique architecture, strong ecosystem, and staking rewards are compelling factors that could drive growth. However, potential investors must also weigh the risks associated with market volatility, regulatory uncertainty, competition, technological vulnerabilities, and the need for continued adoption.

As with any investment, it is crucial to conduct thorough research and consider your risk tolerance before investing in AVAX or any other cryptocurrency. Understanding both the strengths and weaknesses of Avalanche will help you make informed decisions in this rapidly evolving market.

Frequently Asked Questions (FAQs)

1. What is Avalanche Coin (AVAX)?

Avalanche Coin, commonly referred to as AVAX, is the native cryptocurrency of the Avalanche blockchain platform. Avalanche is a Layer 1 blockchain that aims to provide a scalable solution for decentralized applications (DApps) and custom blockchain networks. It was designed to process up to 6,500 transactions per second without compromising on decentralization or security, making it a competitor to Ethereum in the realm of smart contracts.

2. Who created Avalanche Coin?

Avalanche was launched by Ava Labs, founded by Emin Gün Sirer, a professor at Cornell University, along with his colleagues Kevin Sekniqi and Maofan “Ted” Yin. Emin Gün Sirer has a long history in cryptographic research and was involved in early Bitcoin scaling solutions. The project was initiated in 2018 and raised $42 million through an Initial Coin Offering (ICO) in 2020.

3. What makes Avalanche Coin different from Bitcoin?

The primary difference between Avalanche and Bitcoin lies in their purpose and technology. While Bitcoin is primarily a digital currency and a store of value, Avalanche is designed as a platform for building decentralized applications and custom blockchains. Avalanche utilizes a unique consensus mechanism that allows for higher transaction speeds and scalability, unlike Bitcoin’s Proof-of-Work system, which can be slower and more energy-intensive. Additionally, Avalanche consists of three interoperable blockchains (X-Chain, C-Chain, and P-Chain), each serving a different function, which enhances its overall efficiency and usability.

4. Is Avalanche Coin a good investment?

As with any cryptocurrency, the potential for investment in Avalanche Coin (AVAX) depends on various factors, including market conditions, technological developments, and adoption rates. While AVAX has shown significant price movements and has a robust ecosystem of DApps, it is essential for investors to conduct thorough research and consider their risk tolerance. Consulting financial advisors and evaluating market trends can help in making informed investment decisions.

5. How does the Avalanche consensus mechanism work?

Avalanche employs a novel consensus mechanism that differs from traditional Proof-of-Work and Proof-of-Stake systems. It uses a directed acyclic graph (DAG) protocol, where all nodes participate in processing and validating transactions simultaneously. This structure allows for rapid finalization of transactions and high throughput, significantly enhancing the speed and efficiency of the network. Unlike other blockchains, there are no traditional blocks, leading to immediate transaction confirmations.

6. How many Avalanche Coins (AVAX) are in circulation?

The total supply of AVAX is capped at 720 million coins. As of now, approximately 422 million AVAX are in circulation. The distribution includes various allocations for seed sales, private sales, public sales, community endowments, and staking rewards. The staking mechanism allows users to earn rewards by holding and locking their AVAX tokens, which currently offers an annual reward of around 11.57%.

7. Where can I buy Avalanche Coin?

Avalanche Coin (AVAX) can be purchased on several cryptocurrency exchanges, including Binance, Bitfinex, Gate.io, and Kucoin. To buy AVAX, users typically need to create an account on one of these platforms, complete any necessary identity verification, deposit funds, and then place an order to buy AVAX.

8. What are Avalanche’s built-in blockchains?

Avalanche comprises three primary built-in blockchains, each serving a specific function:

-

Exchange Chain (X-Chain): Used for creating and exchanging AVAX tokens and other assets. It employs a DAG technology for fast transactions.

-

Contract Chain (C-Chain): This chain hosts smart contracts and decentralized applications (DApps). It is compatible with Ethereum’s Virtual Machine, allowing developers to easily port their projects.

-

Platform Chain (P-Chain): This chain manages staking and validator activities within the network. It coordinates validators and tracks active subnets, which are essential for the network’s operation.

This modular approach allows Avalanche to optimize performance and scalability across its ecosystem.

Final Verdict on avalanche coin

Overview of Avalanche Coin (AVAX)

Avalanche (AVAX) is a cutting-edge layer one blockchain designed to facilitate decentralized applications (DApps) and custom blockchain networks. Its unique architecture, which includes three distinct blockchains—the X-Chain, C-Chain, and P-Chain—enables it to achieve high throughput and scalability. This design allows Avalanche to process up to 6,500 transactions per second, significantly outperforming many of its competitors in the space.

Technological Edge

The foundation of Avalanche’s performance lies in its innovative consensus mechanism, which utilizes a directed acyclic graph (DAG) structure. This approach allows for simultaneous transaction validation, resulting in near-instant finality and lower transaction costs. Furthermore, Avalanche’s interoperability with Ethereum enhances its appeal, enabling developers to migrate existing Ethereum-based applications seamlessly.

Market Potential

Avalanche has garnered attention not only for its technological advancements but also for its strategic partnerships, including collaborations with major players like Visa. This integration into real-world financial systems could bolster its adoption and market presence. As the blockchain ecosystem continues to evolve, Avalanche’s customizable Layer 1s and scalable solutions position it as a promising contender in the decentralized finance (DeFi) and Web3 landscapes.

Investment Considerations

However, it is crucial to recognize that investing in Avalanche (AVAX) comes with its own set of risks. The cryptocurrency market is notoriously volatile, and while AVAX has shown considerable growth since its inception, potential investors should be prepared for price fluctuations. As with any digital asset, it is classified as a high-risk, high-reward investment.

Conclusion

In conclusion, Avalanche presents an intriguing opportunity for those looking to invest in the future of blockchain technology. Its robust infrastructure, innovative consensus mechanism, and growing ecosystem make it a noteworthy candidate in the cryptocurrency space. However, potential investors are strongly encouraged to conduct their own thorough research (DYOR) to understand the risks and rewards associated with this dynamic asset class before making any investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.