apertum coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to apertum coin

Apertum Coin (APTM) is emerging as a significant player in the cryptocurrency landscape, particularly within the Avalanche ecosystem. Launched on February 19, 2025, APTM is the native token of the Apertum blockchain, which has been designed to deliver high performance, scalability, and sustainability. As a Layer-1 blockchain that is fully compatible with Ethereum’s Virtual Machine (EVM), Apertum enables developers to easily deploy smart contracts and build decentralized applications (dApps) with minimal friction. This capability positions it as a robust contender among other prominent blockchains such as Ethereum and Binance Smart Chain.

Significance in the Crypto Market

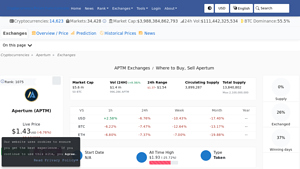

Apertum Coin has quickly gained traction since its inception, evidenced by its remarkable price performance and community growth. With a market cap of approximately $81 million and a trading volume exceeding $8 million in the past 24 hours, APTM is ranked among the top cryptocurrencies, reflecting strong investor interest. The project’s unique deflationary model, which involves burning up to 50% of transaction fees, aims to enhance token scarcity and encourage long-term value retention. Furthermore, Apertum operates under a decentralized autonomous organization (DAO) model, ensuring that its governance is driven by the community, thus emphasizing transparency and inclusivity.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginner and intermediate investors who are interested in understanding Apertum Coin. It will cover various essential aspects, including:

- Technology: An overview of the underlying technology that powers the Apertum blockchain, including its consensus mechanism and performance metrics.

- Tokenomics: A detailed analysis of the token’s supply, distribution, and economic model, including insights into the deflationary mechanics that govern APTM.

- Investment Potential: An examination of the factors that may influence APTM’s price trajectory, including market trends, community engagement, and future developments.

- Risks: An objective assessment of the potential risks associated with investing in APTM, including market volatility and regulatory challenges.

- How to Buy: Step-by-step guidance on where and how to purchase Apertum Coin, making it accessible for new investors.

By the end of this guide, readers will have a well-rounded understanding of Apertum Coin, enabling them to make informed decisions regarding their investments in this promising cryptocurrency.

What is apertum coin? A Deep Dive into its Purpose

Overview of Apertum Coin

Apertum Coin (APTM) is the native cryptocurrency of the Apertum blockchain, a high-performance Layer-1 blockchain built as a Subnet within the Avalanche ecosystem. Launched on January 30, 2025, the Apertum network is designed to facilitate the development and deployment of decentralized applications (dApps) while ensuring high transaction speeds, scalability, and long-term sustainability. The introduction of APTM aims to create a robust financial and operational framework that empowers developers, investors, and users alike.

The Core Problem It Solves

In the rapidly evolving landscape of blockchain technology, one of the primary challenges faced by developers and users is the scalability of existing platforms. Many traditional blockchain networks struggle with slow transaction speeds, high fees, and limited throughput, which can hinder the growth and functionality of dApps. Apertum addresses these issues by leveraging the Avalanche consensus mechanism, which allows for ultra-fast transaction processing—up to 4,500 transactions per second (TPS)—and quick finality times ranging from 0.15 to 1.50 seconds.

Moreover, the increasing demand for decentralized finance (DeFi) applications and smart contracts necessitates a platform that can support diverse use cases efficiently. Apertum provides a fully Ethereum Virtual Machine (EVM)-compatible environment, allowing developers to easily migrate existing Ethereum-based dApps to its network without extensive re-coding. This compatibility not only enhances the user experience but also encourages developers to take advantage of Apertum’s high-performance capabilities.

Additionally, the deflationary model of APTM, which burns up to 50% of transaction fees, contributes to its value retention by reducing the overall supply over time. This aspect aligns with the growing interest in cryptocurrencies that offer scarcity and sustainability, making Apertum an appealing option for long-term investors.

Its Unique Selling Proposition

Apertum’s unique selling proposition lies in its combination of high performance, community-driven governance, and a sustainable economic model. Key features that distinguish Apertum from other blockchain platforms include:

-

High Performance and Scalability: The network’s architecture supports over 4,500 TPS, ensuring that transactions are processed swiftly, which is crucial for the growing demands of dApps in various sectors, including finance, gaming, and social media.

-

Deflationary Tokenomics: The burning of a portion of transaction fees creates a deflationary effect on the APTM token supply, helping to maintain or potentially increase its value over time. This model encourages holders to retain their tokens, fostering a long-term investment mindset.

-

Community-Driven Governance: Apertum is governed by a decentralized autonomous organization (DAO) model, allowing community members to participate in decision-making processes. This approach fosters innovation and responsiveness to user needs, ensuring that the network evolves according to the preferences of its stakeholders.

-

EVM Compatibility: The fully EVM-compatible environment enables seamless integration with existing Ethereum-based projects, facilitating easier migration and development of dApps. This compatibility opens up opportunities for developers to leverage the benefits of the Apertum network without the steep learning curve associated with new technologies.

-

Robust Ecosystem: Apertum’s ecosystem includes a decentralized exchange (DEX), smart contract deployment tools, and bridges for cross-chain interactions. This comprehensive suite of services empowers developers to launch projects quickly while benefiting from a liquid and engaged community.

The Team and Backers

Apertum is developed and managed by the Apertum Foundation, a team of experienced blockchain professionals and enthusiasts committed to building a sustainable and user-focused ecosystem. Notably, the project operates without venture capital or institutional backing, emphasizing organic growth driven by community involvement. This approach not only fosters trust among users but also ensures that the platform remains aligned with the interests of its community rather than external investors.

The team is dedicated to continuous improvement and expansion of the Apertum network. Their focus on transparency and accountability is reflected in the DAO governance model, which empowers users to influence the direction of the project and contribute to its evolution. By prioritizing community engagement, the Apertum team aims to create a platform that truly serves the needs of its users.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Apertum Coin and the Apertum blockchain is to provide a scalable, efficient, and user-friendly platform for developing and deploying decentralized applications. By addressing key challenges in the blockchain space—such as transaction speed, high fees, and interoperability—Apertum aims to enhance the overall user experience for both developers and end-users.

In the broader crypto ecosystem, Apertum positions itself as a viable alternative to existing platforms, particularly for projects that require high throughput and rapid finality. Its deflationary tokenomics and community-driven governance model further solidify its place as a sustainable and innovative solution within the cryptocurrency landscape.

As the demand for decentralized applications continues to grow, Apertum stands ready to support this evolution, making it an attractive option for developers, investors, and users alike. The combination of high performance, sustainability, and community governance positions Apertum Coin as a notable player in the future of blockchain technology.

The Technology Behind the Coin: How It Works

Blockchain Architecture

Apertum is built as a Layer-1 blockchain on the Avalanche platform, which means it operates independently but benefits from the robust infrastructure provided by Avalanche. The architecture is designed to support decentralized applications (dApps) with a focus on scalability, efficiency, and long-term sustainability.

The blockchain is structured to allow seamless deployment of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This feature is particularly beneficial for developers, as it enables them to create applications that can automatically execute transactions when certain conditions are met. The use of the Ethereum Virtual Machine (EVM)-compatible architecture allows developers familiar with Ethereum to easily migrate their dApps to Apertum without needing to learn a new programming language.

Consensus Mechanism

The consensus mechanism of a blockchain is crucial because it determines how transactions are validated and added to the blockchain. Apertum employs the Avalanche consensus protocol, which is known for its high throughput and low-latency transaction finality.

How Avalanche Consensus Works

-

Validator Nodes: In the Avalanche network, nodes participate as validators. These nodes are responsible for confirming transactions and maintaining the integrity of the blockchain. They do this by staking the native token, APTM, which incentivizes them to act honestly.

-

Gossip Protocol: The Avalanche consensus uses a unique “gossip” protocol, where nodes communicate with each other to share information about transaction validity. This process is very efficient, allowing nodes to quickly reach consensus on the state of the blockchain.

-

Finality: One of the standout features of the Avalanche consensus is its ability to achieve transaction finality in as little as 0.15 to 1.5 seconds. This means that once a transaction is confirmed, it cannot be reversed, providing a high level of security and reliability.

Key Technological Innovations

Apertum incorporates several innovative technologies that enhance its functionality and user experience. Here are some of the key innovations:

1. High Throughput and Scalability

Apertum is designed to handle over 4,500 transactions per second (TPS), significantly outperforming many existing blockchains like Bitcoin and Ethereum. This high throughput allows for a greater volume of transactions to be processed simultaneously, making the platform suitable for applications that require fast and reliable transaction processing, such as decentralized finance (DeFi) and gaming.

2. Deflationary Tokenomics

Apertum employs a deflationary token model, which is an essential aspect of its economic design. Up to 50% of transaction fees are burned, reducing the total supply of APTM over time. This mechanism not only helps maintain the value of the token but also incentivizes holding rather than selling.

In the first half of 2025, over 1,053,436 APTM tokens (approximately $1.2 million) were burned, contributing to the scarcity of the token and enhancing its long-term value retention.

3. DAO Governance

Apertum operates under a Decentralized Autonomous Organization (DAO) model, which empowers the community to participate in the decision-making process. This governance structure allows token holders to propose and vote on changes to the protocol, ensuring that the network evolves in a way that aligns with the interests of its users.

The DAO governance model fosters a sense of ownership among community members, encouraging active participation in the ecosystem’s growth and development.

4. Developer-Friendly Tools

Apertum provides a suite of tools that facilitate the development and deployment of dApps. This includes:

- Contracts Wizard: A user-friendly interface that simplifies the process of creating and deploying smart contracts.

- Apertum DEX: The native decentralized exchange allows users to trade tokens directly on the platform without relying on third-party exchanges.

- Bridge: This feature enables interoperability with other blockchains, allowing assets to move seamlessly between different networks.

These tools are designed to lower the barriers to entry for developers, making it easier for them to launch innovative projects within the Apertum ecosystem.

Security Features

Security is paramount in any blockchain network, and Apertum leverages several features to ensure the integrity and safety of its platform:

-

Validator-Based Consensus: As previously mentioned, the network relies on validators who stake APTM tokens to secure the network. This system ensures that only trustworthy participants can validate transactions, reducing the risk of malicious behavior.

-

Continuous Monitoring: The DAO governance structure enables ongoing monitoring and assessment of the network’s health. Community members can raise concerns or propose improvements, ensuring that security measures evolve as needed.

-

Energy Efficiency: The Avalanche consensus mechanism is designed to be energy-efficient compared to traditional Proof-of-Work systems. This not only reduces the environmental impact of the network but also makes it more sustainable in the long run.

Use Cases of Apertum

The Apertum blockchain is designed to support a wide array of applications and use cases, including:

- Decentralized Finance (DeFi): With its high throughput and low transaction costs, Apertum is an ideal platform for building DeFi applications that require fast and reliable transaction processing.

- Gaming: The ability to handle numerous transactions quickly makes Apertum suitable for gaming applications that involve real-time interactions and microtransactions.

- Social Platforms: The flexibility of smart contracts allows developers to create social applications that can integrate various functionalities, such as token-based rewards and governance.

Future Developments

Looking ahead, Apertum aims to enhance its ecosystem further by:

- Improving Interoperability: Future updates will focus on strengthening cross-chain capabilities, allowing for seamless interactions with other blockchain networks.

- Expanding the DAO Governance Model: Continued development of the DAO framework will empower community members to take an even more active role in shaping the platform’s future.

- Enhancing Transaction Throughput: Ongoing optimizations will aim to increase transaction speeds and efficiency, ensuring that Apertum remains competitive in the rapidly evolving blockchain landscape.

Conclusion

Apertum represents a significant step forward in blockchain technology, combining high performance, security, and a community-driven approach. With its innovative features and robust architecture, it is well-positioned to support the next generation of decentralized applications and digital assets. Whether you are a developer looking to build on a scalable platform or an investor interested in the future of blockchain technology, Apertum offers a promising ecosystem to explore.

Understanding apertum coin Tokenomics

Apertum coin (APTM) is the native cryptocurrency of the Apertum blockchain, a Layer-1 solution built on the Avalanche ecosystem. Understanding its tokenomics is crucial for both new and experienced investors to appreciate the potential value and utility of APTM. In this section, we will cover key metrics, token utility, and token distribution, providing a comprehensive overview of how APTM operates within its ecosystem.

| Metric | Value |

|---|---|

| Total Supply | 2,100,000,000 APTM |

| Max Supply | 2,100,000,000 APTM |

| Circulating Supply | 55,574,952 APTM |

| Inflation/Deflation Model | Deflationary (up to 50% of transaction fees burned) |

Token Utility (What is the coin used for?)

The APTM token serves several critical functions within the Apertum ecosystem:

-

Transaction Fees: APTM is used to pay for transaction fees on the network. Users must hold APTM to interact with the blockchain, whether they are making transactions, deploying smart contracts, or engaging with decentralized applications (dApps).

-

Staking and Rewards: APTM holders can stake their tokens to participate in the network’s consensus mechanism. Validators are rewarded with APTM for securing the network and processing transactions, promoting a decentralized and secure environment.

-

Governance: Apertum employs a Decentralized Autonomous Organization (DAO) model, allowing APTM holders to participate in governance decisions. This includes voting on protocol upgrades, changes to transaction fees, and other essential aspects of the ecosystem, ensuring that the community has a say in the network’s future.

-

Ecosystem Incentives: The token plays a vital role in incentivizing users and developers within the Apertum ecosystem. Various programs reward users for participating in network activities, such as providing liquidity or engaging with dApps, creating a vibrant community.

-

Deflationary Mechanism: A key aspect of APTM’s utility is its deflationary model. Up to 50% of transaction fees are burned, reducing the overall supply of APTM over time. This not only helps in maintaining scarcity but also supports the long-term value of the token.

Token Distribution

The distribution of APTM tokens is designed to foster a healthy and sustainable ecosystem. The key points regarding token distribution are as follows:

-

Initial Distribution: Upon its launch, Apertum aimed for a fair distribution of APTM tokens without any venture capital or institutional backing. This approach has helped create a community-driven project that prioritizes organic growth.

-

Mining and Rewards: APTM tokens are mined through a controlled emission schedule. In Q1 and Q2 of 2025, approximately 9,545,369 APTM were mined for ecosystem rewards. The mining rewards are essential for incentivizing validators and participants in the network.

-

Burning Mechanism: The burning of transaction fees plays a significant role in token distribution. By reducing the total supply, this mechanism creates a deflationary environment that can increase the value of remaining tokens over time.

-

Community Engagement: Apertum’s DAO governance model means that the community actively participates in the decision-making process, influencing future token allocations and ecosystem developments. This engagement fosters a sense of ownership and responsibility among APTM holders.

-

Liquidity and Exchange Listings: APTM is listed on various centralized exchanges (CEXs) and decentralized exchanges (DEXs), facilitating trading and liquidity. The presence of APTM in multiple markets allows for broader access and participation from investors around the globe.

Conclusion

Understanding the tokenomics of Apertum coin (APTM) is essential for anyone looking to invest in or utilize this digital asset. With its deflationary model, diverse utility, and community-driven approach, APTM is positioned to become a significant player in the blockchain ecosystem. The combination of its robust token distribution strategy and governance model ensures that the interests of the community are prioritized, paving the way for sustainable growth and innovation. By grasping these fundamentals, investors can better assess the potential of APTM as a valuable addition to their cryptocurrency portfolios.

Price History and Market Performance

Key Historical Price Milestones

Apertum (APTM) has experienced significant price movements since its launch, reflecting both investor interest and market dynamics within the broader cryptocurrency landscape. The coin was officially launched on February 19, 2025, starting at a modest price of approximately $0.025. This early trading price provided an entry point for early adopters, who would later witness remarkable price increases.

Shortly after its launch, APTM saw explosive growth. By March 17, 2025, the token had its first listing on centralized exchanges (CEXs) and reached a peak price of $2.50, marking a staggering ROI of 10,000% for those who had invested during its initial phase. This price surge was indicative of strong market confidence and substantial trading volume, which helped establish Apertum as a notable player within the cryptocurrency ecosystem.

The all-time high for Apertum was recorded on April 11, 2025, when the price peaked at $1.97. This milestone represented a significant achievement for the token, solidifying its place in the market and demonstrating its growing adoption. However, like many cryptocurrencies, APTM’s price was not immune to volatility. Following this peak, the price experienced fluctuations, and by April 24, 2025, it fell to an all-time low of $0.7208, representing a decline of about 63.4% from its previous high. This dip highlighted the inherent volatility in cryptocurrency markets, often influenced by broader market trends and investor sentiment.

In the months following its launch, the price of APTM fluctuated between $1.35 and $1.55, indicating a period of relative stability after the initial volatility. As of the latest data, APTM is trading around $1.46, with a market capitalization of approximately $81.26 million. The trading volume over the last 24 hours has been around $8.24 million, which reflects a healthy level of market activity.

Factors Influencing the Price

Historically, the price of Apertum has been influenced by several factors, both internal and external to the cryptocurrency ecosystem. Understanding these factors can provide insights into the price dynamics of APTM.

Market Sentiment and Investor Interest

The sentiment within the cryptocurrency community plays a pivotal role in influencing the price of digital assets, and Apertum is no exception. Positive news about the project, such as successful upgrades or partnerships, often leads to increased investor interest and buying pressure, which can drive prices higher. Conversely, negative news or market downturns can lead to panic selling, causing prices to drop.

For instance, the initial launch and subsequent CEX listings generated excitement around APTM, resulting in rapid price appreciation. The community-driven nature of Apertum, with no venture capital backing, has also fostered a strong sense of belonging among investors, which can amplify price movements based on collective sentiment.

Market Trends and Broader Economic Factors

The cryptocurrency market is heavily influenced by broader market trends and economic conditions. For example, during periods of bullish sentiment in the overall crypto market, APTM has typically seen upward price movement alongside other cryptocurrencies. Market cycles, such as the transition from bear to bull markets, have historically led to significant price increases for many tokens, including Apertum.

Moreover, macroeconomic factors, such as regulatory developments and changes in monetary policy, can also affect investor behavior and market dynamics. For instance, positive regulatory news can enhance market confidence, while negative news can create uncertainty, impacting the price of APTM.

Technological Developments and Upgrades

Apertum’s underlying technology and its roadmap for future developments are crucial in shaping investor perceptions and, subsequently, the price of APTM. The platform’s focus on high performance, scalability, and EVM compatibility has attracted developers and projects looking for robust blockchain solutions. Successful implementation of technological upgrades or new features can lead to increased adoption and utility for the APTM token, positively influencing its price.

The deflationary model employed by Apertum, which involves burning a portion of transaction fees, is another key factor contributing to its price dynamics. By reducing the overall supply of APTM tokens over time, this model is designed to create scarcity, which can drive demand and support long-term value retention.

Trading Volume and Liquidity

The trading volume and liquidity of APTM across various exchanges also play a significant role in price determination. Higher trading volumes often indicate greater market interest and can lead to increased price stability. Conversely, low trading volume can result in higher volatility, making the token more susceptible to significant price swings.

As of now, APTM has established a presence on multiple exchanges, including MEXC, Bitmart, and LBank, which contributes to its liquidity and overall market performance. The existence of a decentralized exchange (DEX) within the Apertum ecosystem further enhances trading opportunities for investors.

Conclusion

In summary, the price history and market performance of Apertum reflect a complex interplay of factors ranging from investor sentiment and technological advancements to market trends and trading volume. As the project continues to develop and expand its ecosystem, ongoing analysis of these elements will be crucial for understanding the future trajectory of APTM within the ever-evolving cryptocurrency landscape.

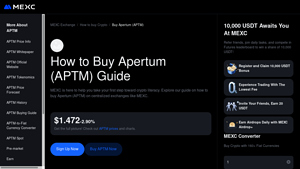

Where to Buy apertum coin: Top Exchanges Reviewed

5. Apertum (APTM) – Your Gateway to Seamless Trading!

Apertum (APTM) is currently available for trading on three prominent exchanges: Bitmart, Lbank, and MEXC Global. What sets these platforms apart is their user-friendly interfaces and a variety of supported trading pairs, catering to both novice and experienced traders. Each exchange offers unique features, such as competitive fees and robust security measures, making them reliable options for buying, selling, and trading Apertum effectively.

- Website: coinlore.com

5. MEXC Exchange – Your Gateway to Buying Apertum (APTM) Easily!

MEXC Exchange stands out as a premier platform for purchasing Apertum (APTM) due to its robust reliability, deep liquidity, and an extensive selection of over 2,800 cryptocurrencies. This diverse offering not only enhances trading opportunities but also ensures users can easily access and invest in a wide range of digital assets. MEXC’s user-friendly interface further simplifies the buying process, making it an ideal choice for both novice and experienced traders.

- Website: mexc.com

- Platform Age: Approx. 25 years (domain registered in 2000)

How to Buy apertum coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Apertum Coin (APTM) is to select a cryptocurrency exchange that supports this digital asset. A few popular exchanges where you can buy APTM include:

- Centralized Exchanges (CEXs): These are traditional exchanges that require you to create an account. Some well-known CEXs that list APTM are MEXC, Bitmart, and LBank.

- Decentralized Exchanges (DEXs): If you prefer to trade directly from your wallet without an intermediary, you can use the Apertum DEX, which is the native exchange for the Apertum ecosystem.

When selecting an exchange, consider factors such as user reviews, trading fees, security features, and the availability of customer support.

2. Create and Verify Your Account

Once you have chosen an exchange, you will need to create an account. Here’s how:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will be required to provide your email address, create a password, and possibly enter your phone number.

- Email Verification: After signing up, you will receive a verification email. Click on the link provided in the email to verify your account.

- Identity Verification: Most exchanges require you to complete KYC (Know Your Customer) verification for security purposes. This usually involves uploading a government-issued ID and possibly a proof of address. Follow the instructions provided by the exchange to complete this step.

3. Deposit Funds

After your account is verified, the next step is to deposit funds into your exchange account. Here’s how to do it:

- Choose Deposit Method: Most exchanges offer several methods for depositing funds, including bank transfers, credit/debit cards, or cryptocurrency deposits. Choose the method that is most convenient for you.

- Deposit Fiat or Crypto: If you are using fiat currency (like USD, EUR, etc.), select the corresponding option and follow the prompts to deposit funds. If you already own cryptocurrency, you can deposit it directly into your exchange wallet.

- Confirm Deposit: After initiating the deposit, wait for the transaction to be confirmed. This may take a few minutes to several hours, depending on the method used.

4. Place an Order to Buy Apertum Coin

With funds in your exchange account, you are now ready to buy APTM. Here’s how to place an order:

- Navigate to the Market: Find the trading section of the exchange and search for the APTM trading pair (e.g., APTM/USD, APTM/BTC).

- Select Order Type: You will typically have options for different order types:

- Market Order: This order buys APTM at the current market price.

- Limit Order: This order allows you to set a specific price at which you want to buy APTM. Your order will only execute if the market reaches your specified price.

- Enter Amount: Specify how much APTM you wish to buy. The exchange will automatically calculate the total cost based on the current market price.

- Review and Confirm: Double-check your order details and confirm the transaction. Once completed, APTM will be credited to your exchange wallet.

5. Secure Your Coins in a Wallet

Once you have purchased APTM, it’s essential to keep your coins secure. Here’s how to do it:

- Choose a Wallet: You can store your APTM in several types of wallets:

- Exchange Wallet: While convenient, this is not the most secure option. If you plan to trade frequently, keeping a small amount here is acceptable, but avoid holding large amounts.

- Software Wallet: These are apps or software that you can install on your computer or smartphone. They offer a balance of security and convenience.

- Hardware Wallet: For maximum security, consider a hardware wallet. These are physical devices that store your cryptocurrency offline, making them less susceptible to hacking.

- Transfer APTM: If you choose a non-exchange wallet, you will need to transfer your APTM from the exchange to your wallet. Go to your wallet, generate a receiving address, and initiate the transfer from the exchange.

Conclusion

Purchasing Apertum Coin (APTM) is a straightforward process if you follow these steps. Always ensure you do your own research before investing, and consider the security of your assets as a top priority. Happy investing!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Apertum Coin (APTM) operates within a unique and rapidly evolving segment of the cryptocurrency market, leveraging several key strengths that could position it favorably for future growth. Below are some of the potential strengths that could bolster investor confidence.

1. High Performance and Scalability

Apertum is built on the Avalanche ecosystem, known for its impressive transaction throughput and low latency. The network can process over 4,500 transactions per second (TPS) with finality times ranging from 0.15 to 1.50 seconds. This performance is significantly higher than many other established blockchains like Bitcoin and Ethereum, making it an attractive option for developers seeking to build decentralized applications (dApps).

2. EVM Compatibility

The Ethereum Virtual Machine (EVM) compatibility of Apertum allows for seamless integration with existing Ethereum-based dApps and projects. This feature not only facilitates easier migration for developers but also enhances the potential for interoperability with a vast array of blockchain projects. As more developers seek to leverage the benefits of Apertum, the ecosystem may see accelerated growth.

3. Deflationary Tokenomics

Apertum employs a deflationary model where up to 50% of transaction fees are burned, contributing to a decrease in the overall supply of APTM tokens. The scarcity created by this mechanism may enhance the long-term value of the token, appealing to investors looking for assets with built-in value retention strategies. In just the first two quarters of 2025, over 1 million APTM tokens were burned, indicating a commitment to maintaining this deflationary structure.

4. Strong Community and Governance

Apertum operates under a Decentralized Autonomous Organization (DAO) model, emphasizing community-driven decision-making. This governance structure allows token holders to have a say in protocol upgrades and ecosystem developments, fostering a sense of ownership and engagement among users. The absence of venture capital or institutional backing also signifies a focus on organic growth, which can be appealing to investors wary of centralized influences.

5. Growing Adoption and Market Interest

Since its launch, Apertum has experienced rapid adoption, surpassing 50,000 active on-chain members and processing over 1.5 million transactions within the first two quarters of 2025. The initial token launch saw significant price appreciation, reflecting strong investor interest and market confidence. Furthermore, the platform’s DEX and various development tools are attracting a growing number of projects, enhancing liquidity and market participation.

Potential Risks and Challenges (The Bear Case)

While Apertum offers numerous strengths, potential investors should also consider several risks and challenges that may impact its long-term viability and price performance.

1. Market Volatility

The cryptocurrency market is characterized by extreme volatility, which can lead to significant price fluctuations in short periods. APTM, like many altcoins, may be subject to rapid price changes due to speculative trading, market sentiment, or external macroeconomic factors. Investors should be prepared for potential losses and should approach investments in cryptocurrencies with caution.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continually evolving. Governments worldwide are increasingly scrutinizing digital assets, which can lead to changes in legislation that affect the operations of blockchain projects like Apertum. New regulations could impose restrictions on trading, limit the use of tokens, or introduce compliance requirements that may hinder growth. Regulatory uncertainty poses a risk that could affect investor confidence and market participation.

3. Competition

The blockchain space is highly competitive, with numerous projects vying for market share. Apertum faces competition from other Layer-1 blockchains such as Ethereum, Solana, and Binance Smart Chain, which also offer high-performance capabilities and developer-friendly environments. As established platforms continue to innovate and expand, Apertum must differentiate itself and prove its value proposition to attract and retain users.

4. Technological Risks

As a relatively new blockchain, Apertum may encounter technological challenges that could affect its performance and reliability. Issues such as network congestion, security vulnerabilities, or bugs in smart contracts can undermine user trust and deter developers from building on the platform. Furthermore, the rapid pace of technological advancements in the blockchain space means that Apertum must continuously evolve to stay relevant.

5. Token Supply and Price Pressure

While the deflationary model of APTM is designed to enhance scarcity, the total supply of 2.1 billion tokens could lead to downward pressure on prices if demand does not keep pace with the available supply. As more tokens are mined and circulated, the risk of oversupply increases, potentially diluting the value of existing holdings. Investors should consider the long-term dynamics of supply and demand when evaluating APTM as a potential investment.

Conclusion

In summary, Apertum Coin (APTM) presents a compelling case for investment, backed by strong performance metrics, a deflationary token model, and a vibrant community. However, investors must remain vigilant regarding the inherent risks associated with market volatility, regulatory uncertainty, and competition. A balanced approach that considers both the potential strengths and challenges will be essential for making informed investment decisions in the dynamic world of cryptocurrencies.

Frequently Asked Questions (FAQs)

1. What is Apertum Coin (APTM)?

Apertum Coin (APTM) is the native cryptocurrency of the Apertum blockchain, which is a high-performance, Ethereum Virtual Machine (EVM)-compatible Layer-1 network built on the Avalanche ecosystem. APTM is used for various purposes within the Apertum ecosystem, including paying gas fees, rewarding validators, and participating in decentralized governance through a DAO model. The token operates under a deflationary model, where a portion of transaction fees is burned to reduce supply and enhance long-term value.

2. Who created Apertum Coin?

Apertum Coin was launched by the Apertum Foundation on January 30, 2025. The foundation focuses on community-driven innovation and development, with no venture capital or institutional funding. This grassroots approach aims to foster organic growth and ensure that the network remains aligned with its user base.

3. What makes Apertum Coin different from Bitcoin?

While both Apertum and Bitcoin are cryptocurrencies, they serve different purposes and operate on distinct technological frameworks. Apertum is built as a Layer-1 blockchain that supports smart contracts and decentralized applications (dApps) with high transaction speeds (up to 4,500 transactions per second) and fast finality (0.15–1.50 seconds). In contrast, Bitcoin primarily functions as a digital currency and store of value, with slower transaction times and limited programmability. Additionally, Apertum employs a deflationary token model by burning a portion of transaction fees, whereas Bitcoin has a fixed supply cap of 21 million coins.

4. Is Apertum Coin a good investment?

As with any investment, the potential for profit with Apertum Coin depends on various factors, including market conditions, technological advancements, and community support. Apertum has demonstrated significant growth since its launch, achieving high trading volumes and a strong market presence. However, investors should conduct thorough research and consider their risk tolerance before investing, as the cryptocurrency market can be highly volatile.

5. Where can I buy Apertum Coin?

Apertum Coin (APTM) can be purchased on multiple centralized exchanges (CEXs) such as MEXC, Bitmart, and LBank, as well as on the native decentralized exchange (DEX) within the Apertum ecosystem. These platforms provide liquidity and trading options for investors looking to acquire APTM.

6. How does the deflationary model of Apertum Coin work?

Apertum operates under a deflationary model where up to 50% of transaction fees are burned. This process reduces the overall supply of APTM tokens over time, potentially increasing scarcity and value. In Q1 and Q2 of 2025 alone, over 1 million APTM tokens were burned, contributing to the token’s deflationary nature and incentivizing long-term holding among investors.

7. How is the Apertum network secured?

The Apertum network operates as a Subnet on the Avalanche blockchain, utilizing its advanced consensus mechanism known for fast finality, strong security, and energy efficiency. The network is secured through validator-based consensus, where validators stake APTM tokens. Continuous monitoring and governance by the community through a DAO model further enhance the integrity and security of the network.

8. What are the future prospects for Apertum Coin?

The future of Apertum Coin looks promising, with plans for continued ecosystem expansion, enhanced interoperability with other blockchain networks, and improvements in transaction throughput. The community-driven governance model will also play a crucial role in shaping the platform’s evolution, ensuring that it meets the needs of its users. As the network grows, it aims to attract more developers and projects, potentially increasing demand for APTM and its utility within the ecosystem.

Final Verdict on apertum coin

Overview of Apertum Coin (APTM)

Apertum Coin (APTM) serves as the native cryptocurrency of the Apertum blockchain, a high-performance, Ethereum Virtual Machine (EVM)-compatible Layer-1 network built on the Avalanche ecosystem. Launched in early 2025, Apertum aims to provide a scalable and efficient platform for decentralized applications (dApps), with a strong emphasis on community governance and sustainability. Its innovative deflationary tokenomics, where a portion of transaction fees is burned, contributes to the long-term value retention of APTM.

Technology and Performance

Apertum boasts impressive technological capabilities, processing over 4,500 transactions per second with a finality time of just 0.15 to 1.50 seconds. This high throughput and rapid transaction speed set it apart from many other blockchain networks, making it an attractive option for developers looking to deploy dApps. Additionally, its governance model is structured as a Decentralized Autonomous Organization (DAO), empowering the community to shape the protocol’s evolution.

Investment Potential and Risks

As with any cryptocurrency, investing in Apertum carries inherent risks. The asset has demonstrated significant volatility since its launch, with rapid price fluctuations reflecting both investor enthusiasm and market sentiment. While the potential for high returns exists, particularly given its recent price movements and robust community growth, investors should be prepared for the possibility of losses.

Conclusion

In conclusion, Apertum Coin represents a compelling investment opportunity within the cryptocurrency space, backed by advanced technology and a vibrant ecosystem. However, it is essential to remember that this asset class is characterized by high risk and high reward. Therefore, potential investors are strongly encouraged to conduct thorough research (DYOR) and assess their risk tolerance before making any financial commitments in the cryptocurrency market.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.