What is ankr crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to ankr crypto

Ankr is a decentralized blockchain infrastructure provider that plays a crucial role in the development and operation of Web3 applications. With a global network of nodes that spans across more than 70 blockchains, Ankr is designed to enhance the accessibility and efficiency of blockchain technology, making it a significant player in the rapidly evolving cryptocurrency market. The platform offers various services, including RPC (Remote Procedure Call) connections, staking solutions, and custom blockchain creation, all aimed at fostering the growth of the crypto economy.

Significance in the Crypto Market

In an era where decentralized applications (dApps) are gaining traction, Ankr stands out by providing essential infrastructure that supports these applications’ performance and reliability. Its services are trusted by major industry players, including Microsoft, Binance, and Polygon, indicating its critical role in the ecosystem. Ankr’s unique proposition lies in its ability to deliver high-speed access to on-chain data, essential for developers and users to interact with smart contracts seamlessly. The ANKR token serves as the utility token within this ecosystem, facilitating transactions, staking rewards, and governance.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Ankr (ANKR). It will cover various aspects of the cryptocurrency, including:

- Technology: An overview of Ankr’s infrastructure, how it operates, and the services it provides to developers and users.

- Tokenomics: A detailed look at the ANKR token, including its supply, distribution, and utility within the Ankr ecosystem.

- Investment Potential: An analysis of the current market position of Ankr, historical price performance, and future growth prospects.

- Risks: An exploration of potential risks associated with investing in Ankr, including market volatility and regulatory challenges.

- How to Buy: Step-by-step instructions on acquiring ANKR tokens through various exchanges and platforms.

By the end of this guide, readers will have a solid understanding of Ankr crypto, empowering them to make informed investment decisions. Whether you are looking to explore the technical aspects of the platform or seeking insights into its market dynamics, this guide will provide the necessary information to navigate the Ankr ecosystem effectively.

What is ankr crypto? A Deep Dive into its Purpose

Understanding Ankr Crypto: A Comprehensive Overview

Ankr is a decentralized blockchain infrastructure provider that aims to facilitate the growth of the Web3 ecosystem. It operates a global network of nodes across more than 70 blockchains, offering a suite of services designed to support developers, decentralized applications (dApps), and users in the rapidly evolving cryptocurrency landscape. The native utility token of Ankr, known as ANKR, plays a crucial role in its ecosystem, enabling various functionalities such as transaction fees, staking rewards, and governance mechanisms.

The Core Problem It Solves

The primary challenge that Ankr addresses is the need for reliable and efficient infrastructure to support decentralized applications and blockchain operations. As the demand for Web3 services grows, developers face significant hurdles in accessing the underlying data and resources required to build and scale their projects. Traditional cloud service providers often present issues such as centralization, high costs, and susceptibility to outages and censorship.

Ankr’s decentralized approach seeks to eliminate these concerns by providing a robust, distributed network of nodes. This network not only enhances reliability and performance but also ensures that users and developers can access blockchain data with low latency and high availability. Ankr’s infrastructure enables developers to connect their applications to multiple blockchains easily, streamlining the development process and allowing for greater innovation within the space.

Its Unique Selling Proposition

Ankr’s unique selling proposition lies in its decentralized physical infrastructure network (DePIN), which comprises bare-metal nodes distributed globally. This design allows Ankr to offer several key advantages:

-

Scalability and Performance: Ankr’s infrastructure can support high volumes of requests, with over 8 billion daily remote procedure call (RPC) requests being processed across its network. This capability ensures that dApps can scale efficiently as user demand increases.

-

Diverse Services: Ankr provides a comprehensive suite of services, including Web3 API access, staking solutions, and custom blockchain creation. This range of services caters to a wide array of use cases, from developers seeking efficient node access to enterprises looking for tailored infrastructure solutions.

-

Interoperability: By supporting multiple blockchains, Ankr enhances interoperability within the crypto ecosystem. Developers can build applications that interact with various blockchains seamlessly, thus fostering a more integrated Web3 environment.

-

Cost-Effectiveness: Ankr offers competitive pricing for its services, making it an attractive option for developers and enterprises looking to minimize operational costs while maximizing performance.

-

Community and Ecosystem Support: Ankr has established partnerships with leading companies in the blockchain space, such as Microsoft, Binance, and Polygon. These collaborations enhance the platform’s credibility and expand its reach within the industry.

The Team and Backers

Ankr was co-founded in 2017 by Chandler Song, Ryan Fang, and Stanley Wu, who were early participants in the Blockchain at Berkeley program. Their backgrounds in engineering and technology, combined with their vision for a decentralized infrastructure, have driven Ankr’s development. Chandler Song, in particular, brings experience from his time at Amazon Web Services, where he gained insights into cloud computing that have influenced Ankr’s architecture.

The team has garnered support from various investors and backers, which has enabled Ankr to grow and expand its services. The platform has attracted significant investment, facilitating the development of its infrastructure and technology. This backing not only provides financial stability but also enhances Ankr’s reputation in the competitive blockchain space.

Fundamental Purpose in the Crypto Ecosystem

Ankr’s fundamental purpose is to empower developers and users within the Web3 ecosystem by providing reliable, decentralized infrastructure. This goal is particularly important as the demand for blockchain services continues to rise. By offering high-performance node access, staking solutions, and a suite of developer tools, Ankr plays a critical role in fostering innovation and growth in the cryptocurrency space.

The platform’s infrastructure allows developers to focus on building their applications without the burden of managing complex backend systems. This simplification accelerates the development process and encourages more projects to enter the market, ultimately leading to greater adoption of blockchain technology.

Furthermore, Ankr contributes to the decentralization of the internet by providing an alternative to traditional cloud services. By leveraging a network of distributed nodes, Ankr reduces reliance on centralized entities, thus promoting a more resilient and censorship-resistant ecosystem.

In summary, Ankr is a vital player in the cryptocurrency landscape, addressing the infrastructure challenges faced by developers and users alike. Its unique approach combines performance, scalability, and decentralization, making it an essential component of the ongoing evolution of the Web3 ecosystem. As the demand for decentralized applications and services continues to grow, Ankr is well-positioned to meet the needs of the crypto community, driving further innovation and adoption.

The Technology Behind the Coin: How It Works

Overview of Ankr

Ankr is a decentralized blockchain infrastructure provider that operates a global network of nodes, supporting over 70 blockchains. Its goal is to enhance the accessibility and performance of Web3 applications by providing developers with reliable and efficient tools. The Ankr platform is designed to facilitate the growth of the crypto economy, offering services such as RPC (Remote Procedure Call) connections, staking services, and custom blockchain creation. The native utility token, ANKR, plays a crucial role in this ecosystem, enabling transactions, staking rewards, and service payments.

Blockchain Architecture

Ankr does not operate as a single blockchain; instead, it functions as a decentralized network that connects various blockchains and provides infrastructure services. Here are the key components of Ankr’s architecture:

-

Node Network: Ankr hosts a global network of nodes that serve as the backbone of its infrastructure. These nodes are strategically located in various regions to minimize latency and ensure fast access to blockchain data. The network supports multiple blockchains, including Ethereum, Binance Smart Chain, and Polygon, among others.

-

Decentralized Physical Infrastructure Network (DePIN): Ankr utilizes a unique concept called Decentralized Physical Infrastructure Network (DePIN). This involves a distributed network of physical nodes that provide reliable and high-performance access to blockchain data. By decentralizing its infrastructure, Ankr reduces reliance on traditional cloud services that can be vulnerable to outages and censorship.

-

RPC/API Services: Ankr offers a robust RPC/API platform that enables developers to interact with blockchains seamlessly. The average response time for RPC requests is approximately 56 milliseconds, with an impressive uptime of 99.99%. This ensures that developers can access on-chain data quickly and reliably, which is critical for building responsive decentralized applications (dApps).

Consensus Mechanism

While Ankr itself does not implement a consensus mechanism like Proof-of-Work (PoW) or Proof-of-Stake (PoS) directly, it interacts with various blockchains that utilize these mechanisms. Understanding these concepts is essential for grasping how Ankr operates within the broader blockchain ecosystem.

-

Proof-of-Stake (PoS): Many blockchains supported by Ankr, such as Ethereum 2.0, use PoS as their consensus mechanism. In a PoS system, validators are chosen to create new blocks and verify transactions based on the number of tokens they hold and are willing to “stake” as collateral. This method is more energy-efficient compared to PoW, as it does not require intensive computational power.

-

Delegated Proof-of-Stake (DPoS): Some blockchains employ a variation called Delegated Proof-of-Stake. In DPoS, token holders can delegate their voting power to a smaller group of validators, enhancing efficiency and speed in transaction processing. Ankr provides staking solutions that allow users to stake their ANKR tokens across multiple PoS networks, earning rewards while contributing to network security.

Key Technological Innovations

Ankr introduces several technological innovations that enhance its capabilities and provide value to users. Here are some of the standout features:

1. Multi-Chain Infrastructure

Ankr’s ability to support over 70 blockchains sets it apart from many infrastructure providers. This multi-chain approach allows developers to deploy dApps across different networks without needing to build separate infrastructures. Ankr’s flexible architecture facilitates cross-chain interactions, promoting interoperability within the blockchain ecosystem.

2. Staking Solutions

Ankr offers seamless staking experiences that allow users to stake their ANKR tokens across various chains. The platform provides integrated staking services, making it easy for users to participate in network security while earning rewards. This feature is particularly beneficial in the growing DeFi space, where staking has become a popular way to generate passive income.

3. High Performance and Scalability

Ankr has designed its infrastructure to deliver high performance and scalability. With an average response time of 56 milliseconds and 8 billion daily RPC requests, the platform is capable of handling significant traffic and providing fast access to on-chain data. This performance is essential for developers looking to create responsive dApps that can scale with user demand.

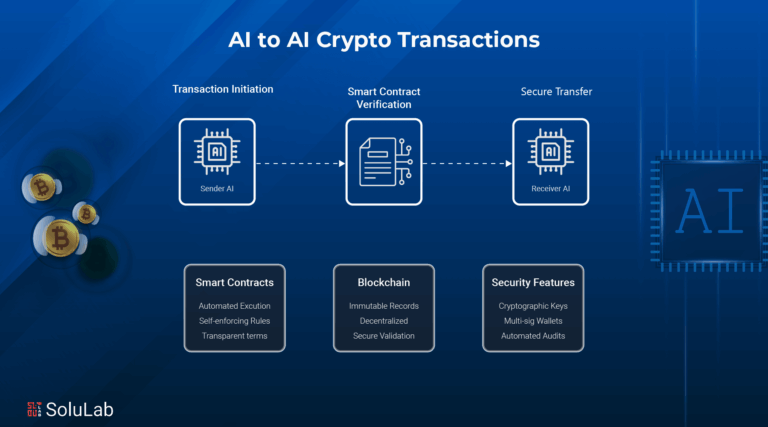

4. Native Oracle System (NOS)

Ankr employs a Native Oracle System (NOS) that facilitates secure and authenticated data transfer between on-chain smart contracts and off-chain data. Oracles are crucial for enabling smart contracts to interact with real-world data, which is essential for many decentralized applications. By integrating this feature, Ankr enhances the functionality and usability of the dApps built on its infrastructure.

5. Developer-Friendly Tools

Ankr provides a suite of developer-friendly tools that simplify the process of building and deploying dApps. This includes comprehensive documentation, SDKs (Software Development Kits), and easy-to-use APIs. By lowering the barriers to entry for developers, Ankr fosters innovation and encourages more projects to launch on its platform.

Conclusion

Ankr represents a significant advancement in blockchain infrastructure, providing a decentralized, high-performance network that supports a wide range of blockchains and services. Its architecture, which includes a global network of nodes and a Decentralized Physical Infrastructure Network, ensures reliable access to blockchain data. By leveraging consensus mechanisms like Proof-of-Stake and offering innovative features such as staking solutions and a Native Oracle System, Ankr empowers developers to create and scale decentralized applications effectively.

For beginners and intermediate investors, understanding the technology behind Ankr is crucial for evaluating its potential in the rapidly evolving crypto landscape. With its focus on performance, decentralization, and developer accessibility, Ankr is well-positioned to play a pivotal role in the growth of the Web3 ecosystem.

Understanding ankr crypto Tokenomics

Ankr Crypto Tokenomics

Ankr (ANKR) is a decentralized blockchain infrastructure provider that has positioned itself as a vital player in the Web3 ecosystem. Understanding the tokenomics of Ankr is essential for both new and intermediate investors who want to grasp how the ANKR token functions within its ecosystem, including its supply mechanics, utility, and distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 10 billion ANKR |

| Max Supply | 10 billion ANKR |

| Circulating Supply | 10 billion ANKR |

| Inflation/Deflation Model | Deflationary (fixed supply) |

Token Utility (What is the coin used for?)

The ANKR token serves multiple purposes within the Ankr ecosystem, making it a versatile utility token. Here are the primary uses of ANKR:

-

Gas Fees: ANKR is used to pay for transaction fees on the Ankr network. This is similar to how Ethereum uses ETH to cover gas fees for transactions and smart contract executions. Users must hold ANKR tokens to interact with decentralized applications (dApps) and services offered on the Ankr platform.

-

Staking Rewards: One of the primary features of Ankr is its staking service. ANKR tokens can be staked to support various Proof-of-Stake (PoS) networks. Stakers receive rewards in return for locking up their tokens, which helps secure the network. This encourages a decentralized governance model, as those who stake their tokens often have a say in network decisions.

-

Ecosystem Incentives: ANKR also plays a critical role in incentivizing developers and users within the Ankr ecosystem. Developers can receive discounts on services or rewards for using ANKR when deploying applications. This creates a self-sustaining economy where the utility of the token drives further development and adoption.

-

Payments for Services: ANKR is utilized for payments related to various services provided by Ankr, such as node hosting, custom blockchain creation, and API access. By using ANKR as a payment method, the ecosystem maintains a cohesive economic model that benefits all participants.

-

Governance: As Ankr continues to evolve, ANKR holders may have the opportunity to participate in governance decisions regarding network upgrades and protocol changes. This decentralization of control ensures that the community has a voice in the future direction of the Ankr ecosystem.

Token Distribution

The distribution of ANKR tokens is designed to ensure a fair allocation while promoting long-term growth and stability. Here’s a breakdown of how ANKR tokens are typically distributed:

-

Initial Token Allocation: When Ankr launched, a portion of the total supply was allocated for various purposes, including team, advisors, and early investors. This allocation is often locked for a specific period to prevent market flooding.

-

Community Incentives: A significant portion of the token supply is allocated for community incentives. This includes rewards for staking, liquidity mining, and other community-driven initiatives aimed at fostering engagement and participation.

-

Ecosystem Development: A portion of ANKR is dedicated to ecosystem development, which includes partnerships, integrations, and marketing efforts. This ensures that the Ankr ecosystem continues to grow and attract new users and developers.

-

Team and Advisors: Tokens allocated to the founding team and advisors typically have vesting periods to align their interests with the long-term success of the project. This helps to prevent any sudden sell-offs that could negatively impact the token price.

-

Reserves: Ankr may also maintain a reserve of tokens for future use, which can be deployed as needed for strategic initiatives or unforeseen challenges.

Conclusion

Understanding the tokenomics of Ankr is crucial for investors looking to engage with this innovative platform. The ANKR token’s utility spans gas fees, staking rewards, and ecosystem incentives, while its distribution model supports community growth and ensures fair allocation. With a fixed supply of 10 billion tokens, ANKR adopts a deflationary model that enhances its value proposition over time. As the Web3 landscape continues to evolve, Ankr’s infrastructure and the ANKR token are likely to play a pivotal role in shaping the future of decentralized applications and services.

Price History and Market Performance

Key Historical Price Milestones

Ankr (ANKR) has experienced a range of price movements since its inception in 2017. Understanding these historical milestones is crucial for investors looking to gauge the asset’s performance over time.

-

Initial Launch and Early Trading: Ankr was launched in 2017, and it began trading on various exchanges shortly after its Initial Coin Offering (ICO). In the early days, the price was relatively low, with ANKR trading at fractions of a cent. The first recorded price on major exchanges was around $0.0007111 on March 13, 2020, marking its all-time low.

-

First Significant Price Surge: The cryptocurrency market saw a massive boom in early 2021, and Ankr was no exception. The price began to rise significantly, and by March 28, 2021, ANKR reached its all-time high of $0.2252. This represented an increase of over 31,000% from its all-time low. The surge was largely attributed to the overall bullish sentiment in the cryptocurrency market, driven by increased institutional interest and retail investment.

-

Post-Peak Correction: After hitting its all-time high, ANKR underwent a significant correction, a common trend in the crypto space. By mid-2021, the price began to decline, reflecting broader market trends. This drop continued throughout 2022, with ANKR fluctuating between $0.04 and $0.10 for much of the year.

-

2023 Performance: In 2023, ANKR has seen continued volatility. As of October 2023, the price is approximately $0.01467, which represents a decrease of around 93% from its all-time high. Throughout the year, ANKR’s price has fluctuated, with a 24-hour trading volume averaging around $6.27 million and a market cap of approximately $146.76 million.

-

Total Supply and Circulation: ANKR has a total supply of 10 billion tokens, all of which are currently in circulation. This fixed supply can influence price dynamics, particularly in relation to demand for staking and usage within the Ankr ecosystem.

Factors Influencing the Price

Historically, the price of Ankr has been influenced by a combination of market trends, technological developments, and broader economic factors.

-

Market Sentiment: Like many cryptocurrencies, Ankr’s price is significantly impacted by overall market sentiment. Bullish trends in the cryptocurrency space tend to lift the prices of many assets, including ANKR. Conversely, bearish trends can lead to sharp declines in price. Events such as Bitcoin’s price movements or regulatory news often have a ripple effect on altcoins.

-

Technological Developments: Ankr’s position as a blockchain infrastructure provider means that technological advancements or partnerships can significantly impact its price. Collaborations with major blockchain platforms like Polygon, Binance, and Solana have helped enhance its visibility and adoption. Each announcement or upgrade can lead to increased investor interest and, consequently, price movements.

-

Adoption Rates: The level of adoption of Ankr’s services also plays a crucial role in determining its price. The more developers and projects utilize Ankr’s infrastructure for Web3 applications, the higher the demand for ANKR tokens, which can drive prices up. For instance, the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) has led to increased demand for infrastructure services, benefiting Ankr.

-

Staking and Yield Opportunities: Ankr offers various staking solutions, allowing users to earn rewards by locking up their ANKR tokens. The total value locked (TVL) in Ankr’s staking platform, which currently stands at approximately $67.83 million, can be a significant indicator of demand. Higher TVL indicates more tokens are being staked, which can reduce circulating supply and potentially increase price.

-

Market Competition: The competitive landscape of blockchain infrastructure providers also influences Ankr’s market performance. The emergence of new protocols and platforms can divert attention and investment away from Ankr. Keeping up with technological trends and maintaining a competitive edge is vital for Ankr’s long-term price sustainability.

-

Regulatory Environment: The evolving regulatory landscape surrounding cryptocurrencies can impact investor confidence. Regulatory news can lead to price volatility, as seen in various instances where announcements from regulatory bodies have caused significant price swings across the entire market, including Ankr.

-

Global Economic Factors: Broader economic conditions, such as inflation rates, interest rates, and global market trends, can also affect cryptocurrency prices. Economic uncertainty can lead to increased interest in cryptocurrencies as alternative investments, while economic stability may lead to reduced speculative trading.

In conclusion, the price history and market performance of Ankr reflect a complex interplay of various factors, including market sentiment, technological developments, and economic conditions. Understanding these elements can provide valuable insights for investors and enthusiasts alike.

Where to Buy ankr crypto: Top Exchanges Reviewed

3. Kraken – Your Go-To for Buying ANKR Today!

Kraken stands out as a user-friendly cryptocurrency exchange for purchasing Ankr, allowing users to start with as little as $10. The platform offers multiple payment options, including credit/debit cards, ACH deposits, and mobile payments through Apple and Google Pay, enhancing accessibility for both beginners and experienced investors. With its robust security features and intuitive interface, Kraken is a reliable choice for buying ANKR and other digital assets.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Ankr Exchange – Unlocking Value with Competitive Rates!

ChangeNOW stands out as a premier platform for trading Ankr (ANKR) by offering competitive prices and real-time market data, including live charts and market cap insights. Users can easily buy and sell ANKR with a seamless interface that prioritizes efficiency and user experience. With comprehensive information on circulating supply and market trends, ChangeNOW empowers both novice and experienced investors to make informed trading decisions.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

7. Ankr – Your Gateway to Decentralized Infrastructure!

Coinbase stands out as a premier platform for trading Ankr (ANKR), offering users access to live price charts and real-time market capitalization data. Its user-friendly interface and comprehensive guides, such as the “how to buy Ankr” resource, make it an ideal choice for both beginners and experienced investors looking to navigate the cryptocurrency market efficiently. The platform’s robust security measures further enhance its appeal for trading digital assets like Ankr.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

3. Ankr Network – Your Gateway to Easy ANKR Trading!

Ankr Network distinguishes itself by being available on a wide array of 58 cryptocurrency exchanges, including prominent platforms like Binance, Binance US, and Bibox. This extensive accessibility allows users to easily buy, sell, and trade ANKR tokens across various markets, enhancing liquidity and trading options. The presence of Ankr on major exchanges also underscores its credibility and growing adoption within the crypto ecosystem.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy ankr crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Ankr (ANKR) is to select a cryptocurrency exchange where it is listed. Ankr can be found on several well-known exchanges, including:

-

Centralized Exchanges (CEX): Coinbase, Binance, Kraken, Crypto.com, and Bitget are some of the popular platforms where you can buy ANKR. These exchanges offer user-friendly interfaces and a wide range of trading pairs.

-

Decentralized Exchanges (DEX): Uniswap and other DEX platforms allow you to trade directly from your cryptocurrency wallet without the need for an intermediary. This option may provide more privacy and control over your assets.

When choosing an exchange, consider factors such as fees, security features, user interface, and the availability of your preferred payment method.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will be prompted to provide your email address and create a password.

-

Verification: Most exchanges require identity verification to comply with regulations. You may need to provide personal information, such as your name, address, and a form of identification (e.g., passport or driver’s license). This step is crucial for security and prevents fraudulent activities.

-

Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This usually involves linking your account to an authentication app (like Google Authenticator) that generates a time-sensitive code.

3. Deposit Funds

Before you can buy Ankr, you need to deposit funds into your exchange account. Here’s how to do it:

-

Select Deposit Method: Go to the “Funds” or “Wallet” section of the exchange. Choose your preferred deposit method, which may include bank transfer, credit/debit card, or cryptocurrency transfer.

-

Deposit Currency: If you’re depositing fiat currency (like USD, EUR, etc.), follow the instructions to link your bank account or card. If you’re transferring cryptocurrency, locate your wallet address on the exchange and send the desired amount from your external wallet.

-

Confirm Deposit: Make sure to check for any deposit fees and confirm the transaction. It may take some time for the funds to appear in your exchange account, depending on the method used.

4. Place an Order to Buy ankr crypto

With funds available in your account, you can now purchase Ankr:

-

Navigate to the ANKR Market: Use the search function to find the ANKR trading pair (e.g., ANKR/USD, ANKR/USDT). Click on it to access the trading interface.

-

Choose Order Type: There are typically two types of orders:

– Market Order: This order buys ANKR at the current market price. It is executed immediately.

– Limit Order: This order lets you set a specific price at which you want to buy ANKR. The order will only be executed when the market price reaches your set price. -

Enter Amount: Specify how much ANKR you want to buy. You can also choose to buy a percentage of your available funds.

-

Confirm the Order: Review the details of your order, including the total cost and fees, then click “Buy” or “Confirm” to complete the purchase.

5. Secure Your Coins in a Wallet

After successfully buying Ankr, it’s essential to secure your investment:

-

Choose a Wallet: While you can keep your ANKR on the exchange, it’s safer to transfer your coins to a personal wallet. Options include:

– Software Wallets: Apps like Exodus or Trust Wallet provide convenience and ease of use.

– Hardware Wallets: Devices like Ledger or Trezor offer enhanced security by storing your private keys offline. -

Transfer ANKR to Your Wallet: Go to the “Withdraw” or “Send” section on the exchange. Enter your wallet address and specify the amount of ANKR you wish to transfer. Double-check the address to avoid errors.

-

Confirm the Transfer: After confirming the transaction, wait for it to process. This may take some time, depending on network congestion.

-

Backup Your Wallet: If using a software wallet, ensure you back up your recovery phrase securely. This step is critical to recover your funds if you lose access to your wallet.

By following these steps, you can confidently purchase and secure Ankr (ANKR) while minimizing risks associated with cryptocurrency trading.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Comprehensive Infrastructure Services

Ankr positions itself as a leading provider of blockchain infrastructure, which is crucial for the growth and development of the Web3 ecosystem. By offering a suite of services such as RPC/API connections, staking solutions, and custom blockchain creation, Ankr caters to a wide range of developers and businesses. This versatility can attract a diverse client base, from startups to established enterprises, leading to potential revenue growth.

2. Strong Market Demand

As the demand for decentralized applications (dApps) and blockchain services continues to rise, Ankr stands to benefit significantly. Its infrastructure is designed to support over 70 blockchains, which positions it well to capture market share in the expanding Web3 landscape. The increasing adoption of blockchain technology across various sectors, including finance, gaming, and supply chain, provides a favorable environment for Ankr’s growth.

3. Decentralization and Reliability

Ankr’s unique approach to decentralization through its Decentralized Physical Infrastructure Network (DePIN) ensures that it is not reliant on centralized cloud services, which are often susceptible to outages and censorship. By operating a global network of nodes, Ankr can offer reliable and efficient service with minimal downtime, which is a critical factor for developers and businesses that rely on consistent access to blockchain data.

4. Established Partnerships

Ankr has formed strategic partnerships with industry giants such as Microsoft, Binance, and Polygon. These collaborations not only enhance Ankr’s credibility but also provide access to a broader market. Partnering with established names can lead to increased visibility and potential business opportunities, further solidifying Ankr’s position in the market.

5. Utility of ANKR Token

The ANKR token serves multiple purposes within the Ankr ecosystem, including payment for services, staking rewards, and governance. This multi-faceted utility can create a steady demand for the token as users engage with the platform. Additionally, the ability to stake ANKR across various networks adds an incentive for holders to retain their tokens, potentially stabilizing its price.

6. Strong Community Engagement

Ankr has cultivated a robust community of users and developers, with significant engagement on platforms like Discord and Telegram. A strong community can drive user adoption and loyalty, as community members often act as advocates for the platform. This engagement can lead to organic growth and help Ankr stay competitive in the rapidly evolving crypto landscape.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrency markets are notorious for their volatility, and the price of ANKR is no exception. The token’s price has experienced significant fluctuations, including a dramatic decline from its all-time high of $0.2252 in March 2021 to its current levels. Such volatility can deter potential investors and users who may be hesitant to engage with an asset that can lose substantial value in a short period. Moreover, the overall crypto market is influenced by external factors, including macroeconomic conditions, regulatory news, and market sentiment, which can further exacerbate price swings.

2. Regulatory Uncertainty

The cryptocurrency sector faces ongoing scrutiny from regulators worldwide. Changes in regulations can significantly impact Ankr’s operations and the broader market. For instance, if new laws impose stricter requirements on blockchain infrastructure providers or impose heavy taxes on crypto transactions, it could lead to increased operational costs for Ankr and potentially diminish its competitive edge. Additionally, regulatory actions could affect user adoption and the overall market environment, leading to reduced demand for Ankr’s services.

3. Competition in the Infrastructure Space

Ankr operates in a competitive landscape with several other blockchain infrastructure providers, including established players like Infura and Alchemy, as well as emerging projects. The rapid innovation and development in this space mean that Ankr must continuously enhance its offerings to remain relevant. Failure to keep pace with competitors in terms of technology, pricing, and service quality could result in a loss of market share and revenue.

4. Technological Risks

As a tech-driven company, Ankr faces inherent technological risks, including software bugs, security vulnerabilities, and network outages. The reliability of its services is critical for user trust and adoption. Any significant technical failure could lead to disruptions in service, loss of user data, or even exploitation by malicious actors, which could damage Ankr’s reputation and user confidence. Additionally, the complexity of blockchain technology means that Ankr must invest continuously in research and development to address these risks.

5. Dependence on the Broader Crypto Market

Ankr’s success is closely tied to the overall performance of the cryptocurrency market. If the market experiences a downturn or prolonged bearish conditions, demand for blockchain infrastructure services could diminish. Many projects may reduce their spending on infrastructure or delay development, leading to decreased revenues for Ankr. The cyclical nature of the crypto market poses a significant risk to Ankr’s growth and sustainability.

6. Tokenomics and Supply Concerns

With a total supply of 10 billion ANKR tokens, the management of tokenomics is crucial for maintaining value. If a large number of tokens are released into the market, it could lead to oversupply and downward pressure on the price. Additionally, the market cap to total value locked (TVL) ratio currently stands at 2.16, which suggests that the market may be undervaluing Ankr’s services relative to the total assets being staked. Should this perception persist, it could hinder ANKR’s price recovery potential.

Conclusion

In summary, Ankr presents a compelling case for potential investors with its comprehensive infrastructure services, strong market demand, and established partnerships. However, the risks associated with market volatility, regulatory uncertainty, competition, technological challenges, and broader market dependence cannot be overlooked. As with any investment in the cryptocurrency space, it is essential for individuals to conduct thorough research and consider both the potential rewards and risks before making investment decisions.

Frequently Asked Questions (FAQs)

1. What is Ankr (ANKR)?

Ankr (ANKR) is a decentralized blockchain infrastructure provider that operates a global network of nodes across more than 75 Proof-of-Stake networks. It offers a range of services designed to support the growth of the crypto economy, including blockchain developer solutions, staking services, and access to Web3 through its RPC (Remote Procedure Call) platform. The ANKR token is the native utility token of the Ankr network, used for transactions, payments for services, and governance within the platform.

2. Who created Ankr crypto?

Ankr was co-founded by Chandler Song, Ryan Fang, and Stanley Wu in 2017. The founders are recognized for their contributions to the blockchain space, with backgrounds in engineering and technology. They initially participated in the Blockchain at Berkeley program, which provided them with insights into the needs of decentralized applications and infrastructure.

3. How does Ankr work?

Ankr operates by providing a decentralized network of public RPC nodes that developers can use to access blockchain data and execute smart contracts. Users can stake their ANKR tokens to validator nodes, which helps secure the network and allows them to earn rewards. Additionally, Ankr uses a reputation system to maintain the quality of its services and employs a Native Oracle System (NOS) for secure data transfer between on-chain and off-chain environments.

4. What makes Ankr different from Bitcoin?

Ankr and Bitcoin serve different purposes within the cryptocurrency ecosystem. Bitcoin is primarily a digital currency and a store of value, while Ankr focuses on providing infrastructure for Web3 applications. Ankr offers services such as node hosting, blockchain creation, and staking, which are not features of Bitcoin. Additionally, Ankr operates on a decentralized infrastructure aimed at enhancing the performance and accessibility of blockchain technology, whereas Bitcoin operates on its own blockchain primarily for peer-to-peer transactions.

5. Is Ankr crypto a good investment?

Determining whether Ankr is a good investment depends on various factors, including market conditions, individual financial goals, and risk tolerance. As with any cryptocurrency, it is crucial to conduct thorough research, analyze market trends, and consider the utility and adoption of Ankr’s services. Investors should also be aware of the inherent volatility in the cryptocurrency market.

6. Where can I buy Ankr (ANKR)?

Ankr (ANKR) is available on various centralized and decentralized exchanges. Some of the popular platforms where you can buy, sell, or trade ANKR include Coinbase, Binance, Kraken, and Uniswap. It is advisable to choose an exchange that meets your needs regarding security, fees, and ease of use.

7. What are the use cases of the ANKR token?

The ANKR token has multiple use cases within the Ankr ecosystem. It is used for paying transaction fees, staking rewards, and ecosystem incentives. Additionally, it facilitates payments for services like node access and developer discounts. The token’s utility extends across various blockchains, as it is compatible with ERC-20, BEP-2, and BEP-20 standards.

8. How can I stake ANKR tokens?

To stake ANKR tokens, users typically need to choose a staking platform that supports ANKR and create a wallet that holds their tokens. Once the tokens are in the wallet, users can delegate their ANKR to a validator node, which helps secure the network. In return, users earn staking rewards based on the amount of ANKR staked and the performance of the validator node. Always ensure you do due diligence on the staking provider to understand their terms and rewards structure.

Final Verdict on ankr crypto

Overview of Ankr Crypto

Ankr (ANKR) serves as a pivotal infrastructure provider in the rapidly evolving Web3 landscape, facilitating reliable access to blockchain technology. Its main purpose is to enable developers and users to build and interact with decentralized applications (dApps) efficiently. Ankr’s technology is built on a global network of nodes that spans over 80 blockchains, which allows it to provide essential services such as RPC/API connections, custom blockchain creation, and staking options. This decentralized infrastructure minimizes reliance on centralized services, fostering a more resilient and censorship-resistant environment for blockchain operations.

Potential and Market Position

As of October 2023, Ankr’s market capitalization stands at approximately $146.76 million, with a circulating supply of 10 billion ANKR tokens. The asset has demonstrated fluctuating price performance, with an all-time high of $0.2252 in March 2021, reflecting its potential for significant growth. However, the price has since decreased by over 90%, highlighting the inherent volatility associated with cryptocurrencies. Ankr’s various applications, including its Decentralized Physical Infrastructure Network (DePIN) and staking solutions, position it as a versatile player in the blockchain ecosystem, catering to both developers and enterprise clients.

High-Risk, High-Reward Asset

Investing in Ankr presents both opportunities and risks. While its strong technological foundation and partnerships with industry leaders like Microsoft and Binance lend credibility, the volatility and unpredictability of the cryptocurrency market can lead to substantial losses. Therefore, it is crucial for potential investors to assess their risk tolerance and investment strategy thoroughly.

Final Thoughts

In conclusion, Ankr crypto offers a compelling blend of innovative technology and significant market potential. However, as with any investment in cryptocurrencies, it is essential to recognize the high-risk, high-reward nature of this asset class. We strongly encourage readers to conduct their own thorough research (DYOR) to make informed decisions before considering any investments in Ankr or similar digital assets.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.