What is alephium coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to alephium coin

Alephium Coin (ALPH) is an emerging player in the cryptocurrency market, recognized for its innovative approach to blockchain technology and decentralized applications. As a sharded Layer 1 blockchain, Alephium integrates a unique Proof-of-Less-Work (PoLW) consensus mechanism, designed to enhance scalability while significantly reducing energy consumption. This makes it a compelling option for developers and investors alike, especially in a landscape increasingly concerned with sustainability. By combining the security features of the Unspent Transaction Output (UTXO) model with the efficiency of parallel processing, Alephium aims to provide a robust environment for decentralized finance (DeFi) and smart contract applications.

The significance of Alephium Coin lies in its ability to address the common challenges faced by existing blockchain platforms, such as high transaction costs and slow processing times. With its sharding architecture, Alephium can handle over 20,000 transactions per second, making it one of the most scalable options available. This capability is particularly valuable as the demand for DeFi solutions and decentralized applications continues to grow. Alephium’s custom virtual machine, Alphred, further enhances its appeal by offering developers a secure and efficient environment to create complex smart contracts.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Alephium Coin. It will delve into several key areas:

Technology Overview

Understanding the underlying technology of Alephium is crucial for grasping its potential. This section will explore the mechanics of its sharding architecture, the PoLW consensus mechanism, and the role of the Alphred virtual machine.

Tokenomics

Investors need to be aware of the economic model driving Alephium Coin. This section will cover the total supply, distribution, and factors influencing the token’s value, providing insights into its long-term viability.

Investment Potential

Alephium’s unique attributes make it an attractive investment option. This segment will analyze market trends, historical performance, and future growth prospects, helping investors make informed decisions.

Risks

Like any investment, Alephium Coin carries inherent risks. This section will outline potential challenges, such as market volatility, regulatory scrutiny, and technological hurdles that could impact its adoption and value.

How to Buy Alephium Coin

Finally, this guide will provide practical steps for purchasing Alephium Coin, including recommended exchanges and wallets, ensuring that investors have the necessary tools to enter the market.

By the end of this guide, readers will have a well-rounded understanding of Alephium Coin, empowering them to navigate their investment journey with confidence.

What is alephium coin? A Deep Dive into its Purpose

Understanding Alephium Coin

Alephium (ALPH) is a cryptocurrency that operates on a sharded Layer 1 blockchain designed to enhance scalability, security, and energy efficiency. By integrating advanced technologies such as sharding, a stateful Unspent Transaction Output (UTXO) model, and a unique consensus mechanism known as Proof of Less Work (PoLW), Alephium aims to address many of the challenges faced by existing blockchain networks, particularly in the realm of decentralized applications (dApps) and decentralized finance (DeFi).

The Core Problem It Solves

The primary issue Alephium seeks to address is the scalability dilemma inherent in many blockchain systems, particularly those using traditional Proof of Work (PoW) consensus mechanisms. As the number of users and transactions increases, networks like Bitcoin and Ethereum often face congestion, leading to slower transaction times and higher fees. This scalability challenge limits the ability of these networks to support a wide array of applications and services.

Alephium’s innovative sharding approach allows the blockchain to be divided into smaller segments (shards), enabling parallel processing of transactions. Each shard can process transactions independently, thereby increasing the overall throughput of the network. Alephium claims to support over 20,000 transactions per second (tps), significantly outpacing many existing blockchains and making it suitable for high-demand applications.

Another challenge Alephium addresses is energy consumption. Traditional PoW systems like Bitcoin require substantial computational power, resulting in high energy usage and environmental concerns. Alephium’s PoLW mechanism reduces energy consumption by up to 87% compared to Bitcoin, making it a more sustainable option while still maintaining a high level of security.

Its Unique Selling Proposition

Alephium’s unique selling proposition lies in its combination of cutting-edge technology and a focus on usability for developers and end-users alike. Some of the standout features include:

-

Sharded Layer 1 Architecture: By implementing sharding, Alephium enhances scalability and speeds up transaction processing. This design allows the network to handle more transactions concurrently, addressing the bottleneck issues faced by many blockchains.

-

Proof of Less Work (PoLW): This consensus mechanism not only reduces energy consumption but also dynamically adjusts mining difficulty based on network conditions. It combines aspects of physical work and coin economics, making it less resource-intensive while still securing the network effectively.

-

Custom Virtual Machine (Alphred): Alephium introduces a tailored virtual machine that enhances the development experience for smart contracts and dApps. This VM is designed to mitigate common security vulnerabilities and improve transaction efficiency, making it easier for developers to build and deploy applications on the platform.

-

Stateful UTXO Model: By utilizing a stateful UTXO model, Alephium combines the benefits of the UTXO model (used by Bitcoin) with the programmability of Ethereum’s account model. This hybrid approach allows developers to create complex smart contracts while maintaining high security and efficiency.

-

Developer-Friendly Ecosystem: Alephium’s programming language, RALPH, is designed to be more accessible and secure than traditional languages like Solidity, fostering a broader range of developers to contribute to the ecosystem.

These features collectively position Alephium as a compelling alternative for developers and users looking for a more efficient, secure, and sustainable blockchain platform.

The Team and Backers

The Alephium project was founded by a team of experienced professionals in the fields of blockchain technology, software development, and cryptography. The core team includes individuals with backgrounds in computer science, engineering, and finance, bringing a wealth of knowledge and expertise to the project. Their diverse skill set enables them to tackle the complex challenges associated with blockchain technology and its real-world applications.

The project has also garnered support from various investors and backers who recognize the potential of Alephium’s innovative approach. While specific names of backers may not always be publicly disclosed, the project has participated in several funding rounds and community initiatives aimed at fostering growth and development within the blockchain ecosystem.

Alephium’s commitment to transparency and community engagement is evident through its active participation in industry conferences, hackathons, and collaborative efforts with other blockchain projects. This collaborative spirit not only enhances the project’s credibility but also helps to build a robust ecosystem around Alephium.

Fundamental Purpose in the Crypto Ecosystem

Alephium’s fundamental purpose is to provide a scalable, secure, and energy-efficient blockchain solution that meets the growing demands of decentralized applications and services. Its architecture is designed to support a wide range of use cases, particularly in the DeFi sector, where the need for high transaction throughput and low latency is paramount.

By addressing the limitations of existing blockchain technologies, Alephium aims to enable developers to create innovative dApps that can operate seamlessly and securely. Whether it’s through decentralized exchanges, lending platforms, or digital asset management systems, Alephium provides the infrastructure necessary to support the next generation of blockchain applications.

Furthermore, Alephium’s emphasis on sustainability and energy efficiency aligns with the increasing global focus on environmental issues. As blockchain technology faces scrutiny for its energy consumption, Alephium offers a solution that not only reduces its carbon footprint but also promotes a more sustainable approach to decentralized finance.

In summary, Alephium (ALPH) represents a significant advancement in the cryptocurrency landscape, combining innovative technology with a clear vision for the future of decentralized applications. Its focus on scalability, security, and energy efficiency positions it as a promising player in the evolving world of blockchain, catering to the needs of developers and users alike.

The Technology Behind the Coin: How It Works

Overview of Alephium

Alephium (ALPH) is a sharded Layer 1 blockchain that aims to address the common issues of scalability, security, and energy efficiency faced by many existing blockchain platforms. By integrating advanced technologies such as sharding, a stateful UTXO model, and a unique Proof-of-Less-Work (PoLW) consensus mechanism, Alephium offers a robust environment for decentralized applications (dApps), particularly in the realm of decentralized finance (DeFi).

Blockchain Architecture

At its core, Alephium utilizes a sharded architecture, which divides the blockchain into smaller segments known as shards. Each shard operates independently, allowing the network to process multiple transactions simultaneously. This parallel processing significantly enhances scalability, enabling Alephium to handle over 20,000 transactions per second (TPS) while maintaining a single-chain experience for users.

Sharding Explained

Sharding is a method that allows a blockchain to scale by breaking it into smaller, manageable parts. Each shard can process its own transactions and smart contracts, which helps in reducing congestion and improving overall performance. This method contrasts with traditional blockchains, where all nodes must process every transaction, leading to bottlenecks as network activity increases.

In Alephium, each shard produces blocks every 8 seconds, and the network achieves an average throughput of 2 blocks per second. This structure not only boosts transaction speed but also ensures that the network remains decentralized and resistant to censorship.

UTXO Model

Alephium employs the Unspent Transaction Output (UTXO) model, similar to Bitcoin. This model ensures that every transaction output can only be spent once, preventing double-spending and enhancing security. Unlike account-based models, where balances are tracked in accounts, the UTXO model treats each transaction output as a discrete entity.

The combination of the UTXO model with Alephium’s sharded architecture allows for greater scalability and security. Each shard can manage its own set of UTXOs, streamlining transaction verification and execution.

Consensus Mechanism: Proof-of-Less-Work (PoLW)

Alephium introduces a novel consensus mechanism known as Proof-of-Less-Work (PoLW). This approach combines elements of traditional Proof-of-Work (PoW) systems with economic incentives to create a more energy-efficient mining process.

How PoLW Works

In a standard PoW system, miners compete to solve complex mathematical problems, which requires substantial computational power and energy. Alephium’s PoLW reduces energy consumption by dynamically adjusting the difficulty of mining based on network conditions. This means that miners only need to perform a fraction of the work compared to traditional PoW systems, using approximately 1/8 of the energy required by Bitcoin.

By minimizing energy consumption while maintaining security, PoLW aligns with the growing emphasis on sustainability in the blockchain space. The economic incentives built into PoLW ensure that miners remain motivated to participate in securing the network without the excessive energy demands of traditional systems.

Key Technological Innovations

Alephium’s technology is characterized by several key innovations that enhance its functionality, security, and user experience.

BlockFlow Algorithm

The BlockFlow algorithm is integral to Alephium’s performance, ensuring that transactions are processed efficiently and in an orderly manner. This algorithm helps to manage the flow of transactions across shards, reducing the risk of congestion and delays. By optimizing transaction processing, BlockFlow enhances the overall user experience and supports the high throughput capabilities of the network.

Alphred Virtual Machine

Alephium features a custom virtual machine called Alphred, designed specifically for executing smart contracts and decentralized applications. Alphred addresses many of the security and usability challenges present in existing platforms. It offers a developer-friendly environment with built-in protections against common vulnerabilities, such as reentrancy attacks and flash loan exploits.

The Alphred VM is optimized for performance, allowing developers to create and deploy smart contracts efficiently. Its design makes it easier for developers to build complex financial applications while ensuring a high level of security.

Stateful UTXO Model

Alephium’s stateful UTXO model combines the benefits of both the UTXO and account models. This hybrid approach allows for the programmability of smart contracts while retaining the security and simplicity of the UTXO model. Developers can create complex smart contracts that maintain a high level of security, making Alephium an attractive platform for dApp development.

The stateful nature of the UTXO model means that it can track the state of transactions and contracts over time, enabling developers to create more dynamic and responsive applications.

Energy Efficiency and Sustainability

One of the standout features of Alephium is its commitment to energy efficiency. The PoLW consensus mechanism significantly reduces the environmental impact of blockchain technology, making Alephium a more sustainable option compared to traditional PoW blockchains.

In an era where the environmental footprint of technology is under scrutiny, Alephium’s energy-efficient design positions it as a forward-thinking solution in the blockchain space. By cutting energy consumption while maintaining robust security, Alephium aligns with the growing demand for sustainable blockchain solutions.

Security Features

Alephium employs multiple layers of security to protect its network and users. The PoLW mechanism inherently makes it economically unfeasible for malicious actors to gain control of the network. Additionally, the sharded architecture ensures that even if one shard is compromised, the integrity of the rest of the network remains intact.

The UTXO model further enhances security by making it difficult for attackers to manipulate transaction histories. This combination of innovative mechanisms ensures that Alephium provides a secure environment for users and developers alike.

Conclusion

Alephium represents a significant advancement in blockchain technology, integrating sharding, a stateful UTXO model, and an energy-efficient consensus mechanism to address the limitations of existing platforms. Its innovative architecture not only enhances scalability and security but also promotes sustainability in the blockchain ecosystem.

By providing a robust and developer-friendly environment, Alephium is well-positioned to support the growing demand for decentralized applications and financial services. As the blockchain landscape continues to evolve, Alephium’s unique technological innovations make it a noteworthy player in the space, paving the way for the next generation of decentralized finance and smart contract solutions.

Understanding alephium coin Tokenomics

Alephium Coin (ALPH) operates on a unique tokenomics model that supports its innovative blockchain technology, enhancing its scalability, security, and energy efficiency. Understanding the tokenomics of Alephium is crucial for both beginners and intermediate investors to grasp how this digital asset functions within its ecosystem. Below, we break down the key metrics and components of Alephium’s tokenomics.

| Metric | Value |

|---|---|

| Total Supply | 214.55 million ALPH |

| Max Supply | ∞ (Infinite) |

| Circulating Supply | 120.57 million ALPH |

| Inflation/Deflation Model | Inflationary |

Token Utility (What is the coin used for?)

Alephium Coin (ALPH) serves several critical functions within the Alephium ecosystem, making it an integral part of its operations. Here are the primary uses of ALPH:

-

Transaction Fees: ALPH is used to pay for transaction fees on the Alephium network. Every transaction processed on the blockchain incurs a fee, which is paid in ALPH. This fee mechanism helps to incentivize miners and validators to maintain the network’s integrity and security.

-

Staking and Governance: With the introduction of Alephium’s Proof-of-Less-Work (PoLW) consensus mechanism, ALPH holders can participate in staking, allowing them to earn rewards for helping to secure the network. Additionally, stakers may have voting rights in governance decisions, influencing the direction of the project and protocol upgrades.

-

Smart Contracts and dApps: Developers use ALPH as a utility token to interact with smart contracts and decentralized applications (dApps) built on the Alephium platform. The unique programming language and virtual machine (Alphred) facilitate the creation of efficient smart contracts, making ALPH essential for developers looking to build on Alephium.

-

Incentives for Developers: Alephium also provides incentives for developers to create applications on its platform. These incentives can be distributed in ALPH, encouraging innovation and enhancing the overall utility of the token.

-

Ecosystem Growth: As Alephium expands its ecosystem, ALPH will play a role in enabling new features, partnerships, and integrations. The token can be utilized in various projects, including decentralized finance (DeFi) applications, digital gift cards, and decentralized exchanges (DEXs).

Token Distribution

Token distribution is a vital aspect of any cryptocurrency’s tokenomics, influencing its scarcity, value, and market dynamics. For Alephium, the distribution strategy is designed to promote a fair and sustainable ecosystem. Here’s an overview of how ALPH is distributed:

-

Initial Token Allocation: At the inception of the Alephium project, a specific percentage of the total supply was allocated for various purposes, including development, community incentives, and early investors. This allocation is essential for funding the project’s growth and ensuring a robust development ecosystem.

-

Team and Advisors: A portion of the tokens is reserved for the founding team and advisors. This allocation typically comes with a vesting schedule, ensuring that the team remains committed to the project’s long-term success and does not flood the market with tokens immediately.

-

Community Incentives: To foster community engagement, Alephium allocates tokens for community rewards, such as bounties for developers and incentives for users participating in network activities. This strategy aims to build a vibrant and active community that contributes to the platform’s growth.

-

Ecosystem Development: Tokens are also set aside for partnerships and ecosystem development, allowing Alephium to collaborate with other projects and platforms. This collaboration helps to expand the use cases for ALPH and integrates Alephium into broader blockchain initiatives.

-

Staking Rewards: A portion of the tokens is allocated for staking rewards, incentivizing ALPH holders to participate in the network’s security and governance. These rewards help maintain network integrity and encourage long-term holding of the token.

-

Token Burns and Reductions: Although Alephium has an infinite max supply, mechanisms may be introduced over time to reduce circulating supply and manage inflation. This may include token burns or buybacks, aiming to stabilize the token’s value and enhance its attractiveness to investors.

In summary, the tokenomics of Alephium Coin (ALPH) is structured to promote a sustainable and thriving ecosystem, balancing the needs of users, developers, and investors. By understanding the utility and distribution of ALPH, stakeholders can make more informed decisions regarding their investments and participation in the Alephium network.

Price History and Market Performance

Key Historical Price Milestones

Alephium (ALPH) has experienced notable fluctuations in its price since its inception, reflecting the dynamic nature of the cryptocurrency market. Understanding these key historical milestones can provide valuable insights into the asset’s performance over time.

-

Initial Launch and Early Trading (2021): Alephium officially launched its mainnet in November 2021, which marked a significant milestone for the project. Following the launch, ALPH began trading on various exchanges, and its price was initially influenced by the overall bullish sentiment in the cryptocurrency market, which was characterized by significant interest in new blockchain technologies and decentralized finance (DeFi) applications.

-

Price Surge and All-Time High (February 2024): The price of Alephium reached its all-time high of approximately $3.86 on February 27, 2024. This peak can be attributed to a combination of factors, including increased adoption of the platform, successful integration of its innovative features like sharding and the Proof of Less Work (PoLW) consensus mechanism, and a broader market rally in cryptocurrencies at that time.

-

Subsequent Price Correction: Following its all-time high, Alephium experienced a substantial price correction, which is common in the cryptocurrency space. By mid-2024, the price had dropped significantly, reflecting broader market trends and possibly profit-taking by early investors. Historically, such corrections often follow periods of rapid price increases, as traders react to market conditions.

-

Recent Performance (2023): As of October 2023, Alephium’s price was around $0.2172, with a market capitalization of approximately $26.19 million. The price has fluctuated in the range of $0.04655 (its all-time low recorded on January 10, 2023) to its recent figures, showcasing a growth of over 366% from its lowest point. This significant growth reflects the project’s ongoing development and the community’s increasing interest in its technology and applications.

Factors Influencing the Price

Historically, the price of Alephium has been influenced by various factors that are common in the cryptocurrency market. Understanding these elements can help investors contextualize the price movements.

-

Market Sentiment and Speculation: Like many cryptocurrencies, Alephium’s price has been heavily influenced by market sentiment. Bullish trends in the broader cryptocurrency market often lead to increased interest and investment in emerging projects like Alephium. Conversely, negative news or market downturns can lead to rapid sell-offs, impacting the price significantly.

-

Technological Developments: Alephium’s unique technological features, such as its sharded architecture and energy-efficient consensus mechanism, have played a crucial role in shaping investor perception and demand. Announcements regarding upgrades, partnerships, or new integrations often lead to positive price movements as traders react to perceived improvements in the project’s viability.

-

Regulatory Environment: The regulatory landscape surrounding cryptocurrencies can have profound effects on prices. Changes in regulations, such as announcements of bans, restrictions, or favorable policies, can create volatility. For Alephium, any news regarding regulatory clarity or acceptance in major markets can influence its price, either positively or negatively.

-

Competition and Market Trends: The competitive landscape in the blockchain space is another critical factor. Alephium operates in a crowded market with several other blockchain projects focused on scalability and smart contracts. Developments in competing technologies or shifts in market preference towards certain platforms can impact Alephium’s market position and pricing.

-

Adoption and Use Cases: The extent to which Alephium is adopted for real-world applications, such as decentralized finance (DeFi) solutions, digital gift cards, and decentralized exchanges, directly affects its price. As more developers build on the Alephium platform and more users engage with its offerings, demand for ALPH may increase, positively influencing its price.

-

Liquidity and Trading Volume: Liquidity is a crucial factor in any asset’s price stability. Alephium’s trading volume has varied significantly, with periods of high activity leading to more stable price movements. Conversely, lower trading volumes can lead to more erratic price changes, as even small buy or sell orders can have a pronounced effect on the price.

-

Community Engagement and Ecosystem Development: The health of Alephium’s community and the ecosystem surrounding it also play vital roles in its market performance. Active community participation in events, hackathons, and discussions can foster innovation and development, which in turn can positively impact price by increasing interest and investment.

Conclusion

In summary, Alephium’s price history reflects a journey marked by significant milestones and influenced by various factors typical of the cryptocurrency market. From its initial launch and all-time highs to recent corrections and ongoing development, understanding these dynamics can assist investors in making informed decisions. As the Alephium ecosystem continues to evolve, its historical price performance serves as a foundation for analyzing potential future developments in this promising blockchain project.

Where to Buy alephium coin: Top Exchanges Reviewed

3. Alephium (ALPH) – Rising Star with Diverse Exchange Listings!

The article on ‘Exchange Listings of Alephium (ALPH)’ provides a comprehensive overview of available trading platforms for this cryptocurrency, highlighting key factors such as price comparisons, trading volumes, and available discounts. By offering detailed insights into each exchange, it empowers traders to make informed decisions, ensuring they select the best option for their next transaction. This focus on user-centric information sets the article apart as a valuable resource for both novice and experienced investors.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

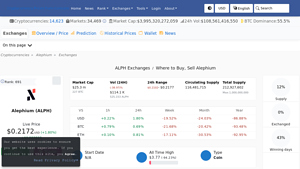

5. Alephium (ALPH) – Your Gateway to Next-Gen Blockchain Trading!

Alephium (ALPH) is available on over eight crypto exchanges, with Gate, Bitget, and Coinex leading the pack. These platforms stand out for their user-friendly interfaces, robust security measures, and competitive trading fees, making them ideal for both new and seasoned investors. Whether you’re looking to buy, sell, or trade ALPH, these exchanges provide a reliable and efficient environment for engaging with this innovative cryptocurrency.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy alephium coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Alephium (ALPH) is selecting a cryptocurrency exchange that supports trading of this coin. Popular exchanges where you can buy Alephium include:

- Binance: One of the largest and most reputable exchanges, offering a variety of cryptocurrencies.

- KuCoin: Known for listing a wide range of altcoins, including Alephium.

- Gate.io: Another exchange that often features lesser-known cryptocurrencies.

When choosing an exchange, consider factors such as:

- Security: Look for exchanges with strong security measures and a good track record.

- Fees: Different exchanges have varying fee structures, including trading fees, withdrawal fees, and deposit fees.

- User Experience: A user-friendly interface can simplify the buying process, especially for beginners.

- Payment Methods: Check if the exchange allows your preferred payment method (e.g., credit card, bank transfer).

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account. Follow these steps:

- Sign Up: Visit the exchange’s website and click on the ‘Sign Up’ or ‘Register’ button.

- Provide Information: Fill out the registration form with your email address, password, and any other required information.

- Email Verification: Most exchanges will send a verification email. Click on the link provided in the email to verify your account.

- Complete KYC: Many exchanges require users to complete a Know Your Customer (KYC) process. This typically involves providing personal identification information (like a driver’s license or passport) and proof of address. This step is crucial for security and compliance with financial regulations.

3. Deposit Funds

After verifying your account, the next step is to deposit funds into it. Here’s how to do it:

- Navigate to the Deposit Section: Log in to your exchange account and go to the ‘Wallet’ or ‘Funds’ section.

- Select Deposit: Choose the cryptocurrency or fiat currency you wish to deposit.

- Choose Payment Method: Depending on the exchange, you may be able to deposit funds via bank transfer, credit card, or other methods.

- Follow Instructions: If you’re depositing cryptocurrency, the exchange will provide you with a wallet address. If you’re depositing fiat, follow the instructions for your selected payment method. Ensure to double-check that you are sending funds to the correct address.

4. Place an Order to Buy Alephium Coin

With funds in your exchange account, you are ready to buy Alephium. Follow these steps:

- Go to the Trading Section: Look for the ‘Markets’ or ‘Trading’ section of the exchange.

- Search for Alephium: Use the search bar to find Alephium (ALPH) in the list of available cryptocurrencies.

- Choose a Trading Pair: Select the trading pair that corresponds with the currency you deposited (e.g., ALPH/USD, ALPH/BTC).

- Select Order Type: You can typically choose between different types of orders, such as:

– Market Order: Buy Alephium at the current market price.

– Limit Order: Set a specific price at which you want to buy Alephium. - Enter Amount: Specify how much Alephium you wish to purchase.

- Review and Confirm: Double-check your order details, including the amount and total cost, then confirm the transaction.

5. Secure Your Coins in a Wallet

After successfully purchasing Alephium, it’s crucial to secure your coins. While you can leave them on the exchange, it’s safer to move them to a personal wallet. Here’s how:

-

Choose a Wallet: There are several types of wallets:

– Hardware Wallets: Devices like Ledger or Trezor that store your coins offline for enhanced security.

– Software Wallets: Applications that can be installed on your computer or mobile device (e.g., Exodus, Trust Wallet).

– Web Wallets: Online wallets that are accessible from any device but may be less secure. -

Create Your Wallet: Follow the instructions to set up your chosen wallet. Ensure you back up your recovery phrases or keys securely.

- Transfer Your ALPH: Go to your exchange account, navigate to the withdrawal section, and enter your wallet address to transfer your Alephium coins.

- Confirm the Transaction: Check the transaction details and confirm the withdrawal. It may take some time for the transfer to process.

Conclusion

Buying Alephium is a straightforward process that involves choosing a reliable exchange, creating an account, depositing funds, placing an order, and securing your coins in a wallet. By following these steps, you can successfully invest in Alephium and participate in its growing ecosystem. Always remember to do thorough research and stay informed about market trends to make educated investment decisions.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Technology

Alephium’s unique technological framework is one of its standout features. By employing a sharded Layer 1 blockchain, Alephium can process transactions simultaneously across different shards, significantly enhancing scalability. This design allows the network to achieve impressive transaction throughput—over 20,000 transactions per second—while maintaining a single-chain experience. The integration of the stateful UTXO model with a Directed Acyclic Graph (DAG) structure further optimizes transaction processing and reduces congestion, making it an attractive option for developers building decentralized applications (dApps).

Energy Efficiency

The Proof-of-Less-Work (PoLW) consensus mechanism used by Alephium is designed to be more energy-efficient than traditional Proof-of-Work systems. By requiring only 1/8 of the energy consumed by Bitcoin, Alephium addresses growing concerns about the environmental impact of blockchain technologies. This sustainability aspect may appeal to environmentally-conscious investors and users, positioning Alephium favorably in a market increasingly focused on eco-friendly solutions.

Developer-Friendly Environment

Alephium provides a robust ecosystem for developers, featuring a custom virtual machine (Alphred) and a programming language designed for high performance and security. This ease of development can foster innovation and attract a diverse range of projects to the Alephium platform. By simplifying the creation of smart contracts and decentralized applications, Alephium may encourage a growing developer community, contributing to the overall health and sustainability of the ecosystem.

Real-World Applications

The versatility of Alephium extends to various real-world applications, particularly in decentralized finance (DeFi) and digital gift cards. Its capabilities in enabling secure and efficient transactions can lead to widespread adoption in these sectors. As more businesses and developers recognize the potential of Alephium’s technology, the demand for the ALPH token could increase, positively impacting its market value.

Community Engagement and Ecosystem Growth

Alephium has demonstrated a commitment to fostering a vibrant developer community through initiatives such as hackathons and active participation in blockchain events. This community-driven approach not only enhances the platform’s development but also encourages collaboration and innovation. A strong community can lead to increased interest and investment in the project, potentially driving the value of the ALPH token upward.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Like most cryptocurrencies, Alephium is susceptible to significant market volatility. The price of ALPH can fluctuate dramatically based on market sentiment, regulatory news, technological advancements, and macroeconomic factors. For investors, this volatility poses risks, as sudden price drops can lead to substantial financial losses. While volatility can also create opportunities for profit, it requires careful consideration and risk management strategies.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continually evolving. Governments worldwide are grappling with how to regulate digital assets, and changes in regulation can have immediate effects on the market. For Alephium, any unfavorable regulatory developments could hinder its adoption and use case, impacting the value of the ALPH token. Investors should be aware of the potential for increased scrutiny and regulation, which could affect the project’s operations and user engagement.

Competition

Alephium operates in a highly competitive environment, facing challenges from other blockchain platforms that offer similar functionalities. Established platforms like Ethereum, Binance Smart Chain, and newer entrants with advanced technologies pose direct competition. The ability of Alephium to differentiate itself and capture market share will be crucial for its long-term success. If Alephium fails to attract sufficient developer interest or user adoption compared to its competitors, its growth prospects may be limited.

Technological Risks

While Alephium’s innovative technology presents numerous advantages, it also carries inherent risks. The complexity of sharding, the UTXO model, and the PoLW consensus mechanism may introduce unforeseen vulnerabilities or bugs, which could impact the network’s performance and security. If critical vulnerabilities are discovered, they could undermine user trust and lead to decreased adoption. Additionally, technological advancements in the blockchain space occur rapidly, and Alephium must continually innovate to stay relevant.

Adoption and Network Effects

The success of Alephium hinges on its ability to gain traction within the blockchain ecosystem. Network effects play a crucial role in the adoption of any cryptocurrency; the more users and developers a platform attracts, the more valuable it becomes. If Alephium struggles to build a significant user base or developer community, it may face challenges in achieving the critical mass necessary for sustainable growth. The potential for slow adoption could limit the market value of the ALPH token and hinder its overall success.

Conclusion

Investing in Alephium (ALPH) presents a mixed bag of opportunities and challenges. On the one hand, its innovative technology, energy efficiency, developer-friendly environment, and real-world applications provide a strong foundation for potential growth. On the other hand, market volatility, regulatory uncertainty, competition, and technological risks pose significant challenges that investors should carefully consider.

As with any investment in the cryptocurrency space, it is essential for potential investors to conduct thorough research, stay informed about market trends, and assess their risk tolerance before making investment decisions. Alephium’s unique features and potential applications make it an intriguing option for those looking to explore the evolving landscape of blockchain technology, but it is crucial to remain aware of the risks that accompany such investments.

Frequently Asked Questions (FAQs)

1. What is Alephium Coin (ALPH)?

Alephium Coin (ALPH) is the native cryptocurrency of the Alephium blockchain, which is a sharded Layer 1 blockchain designed to enhance scalability, security, and energy efficiency. Alephium utilizes a unique consensus mechanism called Proof of Less Work (PoLW), which significantly reduces energy consumption while maintaining a secure network. The platform is built for decentralized finance (DeFi) applications and supports smart contracts through its custom virtual machine, Alphred.

2. How does Alephium differ from Bitcoin?

Alephium differs from Bitcoin in several key ways:

- Consensus Mechanism: While Bitcoin uses traditional Proof of Work (PoW), Alephium employs Proof of Less Work (PoLW), which is designed to be more energy-efficient, requiring only 1/8 of the energy used by Bitcoin.

- Scalability: Alephium uses sharding technology to process transactions in parallel, allowing it to achieve over 20,000 transactions per second (TPS), significantly higher than Bitcoin’s throughput.

- Smart Contracts: Alephium supports advanced smart contracts through its custom virtual machine, Alphred, while Bitcoin’s scripting capabilities are limited.

3. Is Alephium Coin a good investment?

The potential of Alephium Coin as an investment depends on various factors, including market conditions, technological advancements, and adoption of the Alephium platform. As of now, Alephium has demonstrated promising features such as scalability and energy efficiency, which could appeal to investors looking for innovative blockchain solutions. However, like all cryptocurrencies, it carries inherent risks and volatility. It’s essential to conduct thorough research and consider your risk tolerance before investing.

4. Who created Alephium Coin?

Alephium Coin was developed by a team of blockchain experts and engineers. The project was founded by a group that recognized the limitations of existing blockchain solutions and sought to create a more scalable and energy-efficient alternative. The exact identities of the founders may not be publicly disclosed, but the team comprises individuals with significant experience in the fields of computer science, cryptography, and decentralized technologies.

5. What are the real-world applications of Alephium?

Alephium has several real-world applications, including:

- Decentralized Finance (DeFi): Alephium supports the development of scalable DeFi applications that can handle high transaction volumes efficiently.

- Digital Gift Cards: The platform enables secure and verifiable digital gift card solutions, enhancing transaction security.

- Decentralized Exchanges (DEXs): Alephium’s fast and energy-efficient consensus mechanism makes it suitable for building DEXs that require quick transaction processing.

6. What is the technology behind Alephium?

Alephium employs a sharded Layer 1 blockchain structure that enhances scalability by dividing the network into smaller segments called shards. This allows for parallel transaction processing, improving overall throughput. Additionally, Alephium utilizes a unique stateful UTXO model and the Alphred virtual machine, which enhances security and simplifies the development of smart contracts. The platform’s Proof of Less Work (PoLW) consensus mechanism ensures energy efficiency while maintaining robust security.

7. How can I buy Alephium Coin?

Alephium Coin (ALPH) can typically be purchased through various cryptocurrency exchanges that support it. To buy ALPH, you would generally need to follow these steps:

- Choose an Exchange: Select a reputable exchange that lists Alephium Coin.

- Create an Account: Sign up and complete any necessary identity verification processes.

- Deposit Funds: Deposit fiat currency or other cryptocurrencies into your exchange account.

- Buy ALPH: Navigate to the trading section of the exchange, choose ALPH, and execute your purchase.

8. What are the future prospects for Alephium?

The future prospects for Alephium depend on several factors, including technological advancements, community adoption, and market trends. Given its innovative approach to scalability and energy efficiency, Alephium may attract more developers and users looking for sustainable blockchain solutions. Continuous updates, partnerships, and real-world applications will also play a crucial role in determining the platform’s growth and relevance in the competitive blockchain landscape.

Final Verdict on alephium coin

Summary of Alephium Coin

Alephium (ALPH) is a promising cryptocurrency designed to address the scalability, security, and energy efficiency challenges faced by traditional blockchain networks. Its primary purpose is to facilitate decentralized finance (DeFi) applications through an innovative sharded Layer 1 blockchain architecture. This architecture allows for high transaction throughput, enabling Alephium to handle over 20,000 transactions per second, while ensuring robust security through its unique Proof of Less Work (PoLW) consensus mechanism. By utilizing a stateful Unspent Transaction Output (UTXO) model, Alephium offers both the scalability and programmability needed for complex smart contracts, making it an attractive option for developers.

Technology and Real-World Applications

The technology underpinning Alephium is designed for efficiency and sustainability. The PoLW mechanism significantly reduces energy consumption—using only 1/8 of the energy required by Bitcoin—thereby promoting a more environmentally friendly approach to blockchain technology. Alephium also supports a custom virtual machine, Alphred, which enhances the development experience for decentralized applications, making it easier for developers to create secure and efficient solutions.

Alephium’s real-world applications extend beyond DeFi, encompassing areas like digital gift cards and decentralized exchanges. Its growing ecosystem and developer community further enhance its potential, fostering innovation and continuous improvement.

Investment Considerations

While Alephium presents intriguing opportunities, it is essential to remember that investing in cryptocurrencies, including ALPH, is inherently risky. The market is volatile, and potential rewards are often accompanied by significant risks. As of now, Alephium’s market cap is relatively small, and its price has experienced considerable fluctuations, which can impact investor sentiment and market behavior.

Final Thoughts

In conclusion, Alephium is a high-risk, high-reward asset that could offer substantial benefits for those willing to explore its capabilities. However, it is crucial for prospective investors to conduct thorough research (DYOR) before making any investment decisions. Understanding the technology, market dynamics, and associated risks is vital to navigating the complex landscape of cryptocurrency investments effectively.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.