What is aevo crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to aevo crypto

Aevo (AEVO) is emerging as a significant player in the cryptocurrency market, primarily recognized as a decentralized derivatives exchange. With a focus on options, perpetual contracts, and pre-launch trading, Aevo offers a unique platform that combines the benefits of decentralized finance (DeFi) with the performance typically associated with centralized exchanges. Built on a custom Layer 2 solution using the Optimism stack, Aevo can handle over 5,000 transactions per second, making it a robust option for traders seeking efficiency and speed.

The significance of Aevo lies in its innovative trading model, which integrates an off-chain central limit order book for rapid trade matching with on-chain settlement via smart contracts on the Ethereum blockchain. This hybrid approach not only enhances trading performance but also ensures the security and transparency that are hallmarks of decentralized systems. With a trading volume exceeding $30 billion, Aevo has established itself as a trustworthy platform in the DeFi landscape, appealing to both novice and experienced traders alike.

This guide aims to provide a comprehensive resource for understanding Aevo and its associated digital asset, AEVO. We will delve into several key aspects, including:

Technology

We will explore the underlying technology that powers Aevo, including its custom Layer 2 solution and how it leverages Ethereum’s robust infrastructure to deliver high-speed transactions while maintaining security.

Tokenomics

A detailed examination of AEVO’s tokenomics will help investors understand the supply dynamics, utility, and incentives associated with the token, including its role in governance and staking.

Investment Potential

We will assess the investment potential of AEVO, considering market trends, historical performance, and the factors that could influence its future valuation.

Risks

Investing in cryptocurrencies inherently carries risks. This guide will outline the potential pitfalls associated with trading Aevo, including market volatility, regulatory challenges, and technological vulnerabilities.

How to Buy AEVO

Finally, we will provide a step-by-step guide on how to purchase AEVO, detailing the platforms available for trading, the process of setting up a wallet, and tips for safe trading practices.

By the end of this guide, readers will have a well-rounded understanding of Aevo and be better equipped to make informed decisions regarding their investment in this promising digital asset. Whether you are a beginner looking to dip your toes into cryptocurrency or an experienced investor seeking to expand your portfolio, this guide aims to cater to your needs and enhance your understanding of Aevo.

What is aevo crypto? A Deep Dive into its Purpose

Understanding Aevo Crypto

Aevo (AEVO) is a decentralized derivatives exchange that primarily focuses on trading options, perpetual contracts, and facilitating pre-launch trading opportunities. Built on a custom Layer 2 (L2) solution using the Optimism stack, Aevo is designed to provide high throughput and low latency, making it an attractive platform for both novice and experienced traders. The exchange has processed over $30 billion in trading volume since its inception, highlighting its significance in the decentralized finance (DeFi) landscape.

The Core Problem It Solves

The cryptocurrency trading landscape is often plagued by issues such as high transaction fees, slow processing times, and a lack of reliable trading infrastructure. Traditional exchanges can be cumbersome, with challenges related to liquidity and security. Aevo addresses these issues by offering a decentralized platform that maintains the speed and performance of centralized exchanges while ensuring the security and transparency inherent in blockchain technology.

-

High Transaction Costs: By utilizing a custom L2 solution, Aevo significantly reduces transaction fees compared to on-chain trading on Ethereum. This is particularly beneficial for traders who engage in high-frequency trading or those who wish to execute smaller trades without incurring prohibitive costs.

-

Speed and Efficiency: Aevo’s architecture allows it to process over 5,000 transactions per second. This high throughput is vital in the fast-paced world of cryptocurrency trading, where market conditions can change rapidly. The platform’s off-chain central limit order book facilitates quick trade matching, ensuring that traders can react swiftly to market movements.

-

Security and Transparency: Aevo leverages the security features of the Ethereum blockchain, ensuring that all trades are settled on-chain through smart contracts. This not only enhances security but also provides transparency, as all transactions are recorded on the blockchain, allowing users to verify trade histories and execution.

Its Unique Selling Proposition

Aevo distinguishes itself in the crowded DeFi market through several key features:

-

Hybrid Trading Model: Aevo employs a unique hybrid model that combines an off-chain central limit order book for trade matching with on-chain settlement. This blend allows for rapid execution of trades while maintaining the benefits of decentralized finance. Traders enjoy the performance typically found on centralized exchanges without sacrificing security.

-

Focus on Derivatives: The platform’s specialization in derivatives—particularly options and perpetual contracts—provides traders with sophisticated tools for risk management and speculation. This focus is crucial for both individual traders seeking to hedge their positions and institutional investors looking for advanced financial instruments.

-

Pre-launch Trading Opportunities: Aevo allows users to engage in pre-launch trading, giving them access to new projects before they become widely available on other exchanges. This feature can provide strategic advantages to traders who wish to capitalize on emerging opportunities in the crypto market.

-

User-Centric Design: Aevo emphasizes user experience by providing an intuitive interface and optimized mobile access. This accessibility is crucial for attracting a broader audience, particularly those new to cryptocurrency trading.

-

Community and Governance: Aevo fosters a sense of community through its governance model, allowing token holders to participate in decision-making processes. This inclusivity is essential for building trust and loyalty among users.

The Team and Backers Behind the Project

The Aevo project is backed by a team with a rich background in both traditional finance and blockchain technology. Many team members have previously worked at reputable firms such as Coinbase, Kraken, and Goldman Sachs, bringing a wealth of knowledge and expertise to the platform.

-

Experienced Team: The founders of Aevo also launched Ribbon Finance, a pioneering project in decentralized options vaults. Their experience in developing complex financial products equips them with the skills necessary to navigate the challenges of building a successful decentralized exchange.

-

Strong Investor Support: Aevo has garnered backing from notable investors in the cryptocurrency space, including Paradigm, Coinbase, and Dragonfly Capital. This support not only provides financial resources but also enhances credibility, as these investors bring their extensive networks and industry knowledge to the project.

-

Commitment to Innovation: The Aevo team is committed to continuous innovation, focusing on enhancing the platform’s features and capabilities. Their dedication to pushing the boundaries of what is possible in decentralized trading is evident in the platform’s technological advancements and user-centric approach.

Conclusion: Aevo’s Fundamental Purpose in the Crypto Ecosystem

Aevo serves a crucial role in the cryptocurrency ecosystem by addressing the challenges associated with traditional trading platforms. By combining the efficiency of centralized exchanges with the security and transparency of decentralized finance, Aevo provides a compelling solution for traders seeking advanced trading options.

The platform’s focus on derivatives and pre-launch trading opportunities caters to a diverse range of trading needs, making it an attractive option for both individual and institutional investors. With a strong team and solid backing, Aevo is well-positioned to continue evolving and shaping the future of decentralized trading.

In summary, Aevo represents a significant innovation in the DeFi space, offering a robust, secure, and efficient trading environment that meets the demands of modern cryptocurrency traders. Its unique approach to derivatives trading, combined with a commitment to user experience and community engagement, positions it as a leader in the decentralized exchange market.

The Technology Behind the Coin: How It Works

Introduction to Aevo Crypto

Aevo is a decentralized derivatives exchange designed primarily for trading options, perpetual contracts, and pre-launch assets. It operates on its own custom Layer 2 (L2) solution, built on the Optimism stack, which allows it to achieve high transaction speeds and maintain the security of the Ethereum blockchain. This guide will explore the underlying technology of Aevo, breaking down its architecture, consensus mechanism, and key innovations in a way that is accessible to both beginners and intermediate investors.

Blockchain Architecture

At the core of Aevo’s technology is its custom Layer 2 solution, referred to as Aevo L2. This architecture is crucial for enabling the platform to handle a large volume of transactions while ensuring low latency and cost-effectiveness.

Layer 2 Solutions Explained

Layer 2 solutions are secondary frameworks built on top of a primary blockchain (Layer 1). They aim to enhance the scalability and efficiency of the Layer 1 blockchain by processing transactions off-chain and only recording the final state on the main chain. In Aevo’s case, the Layer 1 is Ethereum, which is known for its smart contract capabilities but can face congestion and high fees during peak times.

Aevo L2 utilizes roll-up technology, which aggregates multiple transactions into a single batch. This batch is then processed on the Ethereum blockchain, significantly improving transaction speeds and reducing costs. By using this approach, Aevo can support over 5,000 transactions per second (TPS), making it competitive with centralized exchanges in terms of performance.

The Role of the Optimism Stack

The Optimism stack is a framework that allows developers to build Layer 2 solutions with enhanced scalability. It provides the necessary tools and protocols for creating a seamless integration between off-chain and on-chain processes. By leveraging the Optimism stack, Aevo can ensure that its trading environment is not only fast but also secure and efficient.

Consensus Mechanism

While Aevo itself does not introduce a new consensus mechanism, it operates on the Ethereum blockchain, which uses the Proof-of-Stake (PoS) model as of its transition from Proof-of-Work (PoW) in September 2022. Understanding this underlying consensus mechanism is essential for grasping how Aevo ensures the security and reliability of transactions.

Proof-of-Stake (PoS)

Proof-of-Stake is a consensus mechanism that requires validators to hold and stake a certain amount of cryptocurrency (in this case, Ether) to participate in the network’s operations. Unlike Proof-of-Work, which relies on computational power to solve complex puzzles, PoS is more energy-efficient and allows for faster transaction confirmations.

In a PoS system, validators are selected to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to “stake.” This mechanism incentivizes good behavior, as validators risk losing their staked assets if they act maliciously.

Benefits for Aevo

By relying on Ethereum’s PoS consensus, Aevo benefits from a secure and robust network. The decentralized nature of Ethereum, combined with its strong security protocols, ensures that transactions processed on Aevo L2 are reliable and protected from fraud or manipulation.

Key Technological Innovations

Aevo incorporates several innovative technologies that enhance its functionality and user experience. These innovations address common challenges in the cryptocurrency trading space, such as transaction speed, cost, and security.

Hybrid Trading Model

One of the standout features of Aevo is its hybrid trading model, which combines an off-chain central limit order book (CLOB) for trade matching with on-chain settlement via Ethereum L2 smart contracts.

- Off-Chain Central Limit Order Book: The CLOB allows trades to be matched quickly and efficiently without needing to process each transaction on-chain. This significantly reduces latency, enabling a trading experience similar to that of centralized exchanges.

- On-Chain Settlement: Once trades are matched, the actual transaction is settled on-chain using smart contracts. This dual approach ensures that while trades are executed rapidly, the integrity and security of the transactions are maintained through the transparency of blockchain technology.

Roll-Up Technology

As previously mentioned, Aevo’s use of roll-up technology is a significant innovation. By aggregating transactions into batches before submitting them to the Ethereum blockchain, Aevo reduces the burden on the main chain, allowing for:

- Higher Throughput: The ability to process thousands of transactions per second.

- Lower Fees: Reduced transaction costs for users, making it more economical to trade on the platform.

This technology not only improves user experience but also contributes to the overall scalability of the Ethereum network.

Security Features

Security is a critical aspect of any cryptocurrency exchange, and Aevo employs several measures to protect its users:

- Smart Contracts: All trades are executed through smart contracts on the Ethereum blockchain, ensuring that transactions are transparent, immutable, and secure.

- Decentralization: By operating on a decentralized network, Aevo minimizes the risk of single points of failure, making it more resilient to attacks.

- On-Chain Auditing: The transparent nature of blockchain allows for real-time auditing of transactions, enhancing trust among users.

User Experience and Accessibility

Aevo is designed to cater to both seasoned traders and newcomers, providing a user-friendly interface that simplifies the trading process. The platform emphasizes accessibility by offering:

- Mobile Optimized Trading: Users can trade anytime and anywhere using Aevo’s mobile Progressive Web App (PWA).

- Educational Resources: Aevo provides resources and tools to help users understand the intricacies of derivatives trading, ensuring that even beginners can participate confidently.

Conclusion

Aevo is a forward-thinking decentralized derivatives exchange that leverages advanced technologies to provide a high-performance trading environment. By utilizing a custom Layer 2 solution built on the Optimism stack, it addresses common challenges faced by traders, such as transaction speed and cost. The hybrid trading model, roll-up technology, and robust security features further enhance its appeal, making Aevo a significant player in the cryptocurrency landscape.

For both beginners and intermediate investors, understanding the technology behind Aevo is crucial for making informed decisions in the rapidly evolving world of cryptocurrency trading. As the platform continues to innovate and adapt, it promises to offer a seamless and secure trading experience for all users.

Understanding aevo crypto Tokenomics

Aevo (AEVO) operates within a unique tokenomics framework designed to enhance the utility of its native token while supporting the platform’s overall ecosystem. Understanding its tokenomics is crucial for both new and experienced investors looking to navigate the decentralized derivatives exchange landscape effectively.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 AEVO |

| Max Supply | 1,000,000,000 AEVO |

| Circulating Supply | 912,970,000 AEVO |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The AEVO token serves multiple purposes within the Aevo ecosystem, enhancing its functionality and value for users. Here are the primary uses of the AEVO token:

-

Governance: AEVO holders are granted governance rights, allowing them to participate in key decisions regarding the platform’s development and operational changes. This includes voting on proposals that can impact the direction of the Aevo exchange, such as new features, fee structures, or tokenomics adjustments. This democratic approach fosters community engagement and ensures that the interests of token holders are represented.

-

Staking: Users can stake their AEVO tokens to earn rewards. Staking not only provides holders with passive income through accrued rewards but also helps secure the network by incentivizing users to lock their tokens rather than sell them. This reduces market volatility and supports the overall health of the ecosystem.

-

Trading Fee Discounts: Holding AEVO tokens may offer users discounts on trading fees when they execute trades on the platform. This utility encourages active trading and liquidity provision, benefiting both the traders and the platform’s overall transaction volume.

-

Participation in Incentive Programs: The Aevo platform frequently launches trading and staking incentive programs that reward users for their activity. By participating in these programs, AEVO holders can earn additional tokens, enhancing their overall returns.

-

Access to Advanced Trading Features: AEVO tokens may be required to unlock certain advanced trading features or products on the platform. This ensures that users who are more invested in the ecosystem have access to premium services, fostering a more engaged user base.

Token Distribution

The distribution of AEVO tokens is structured to ensure a balanced approach that rewards early supporters while maintaining incentives for long-term holders. Here’s an overview of how AEVO tokens are distributed:

-

Team and Advisors: A portion of the total supply is allocated to the founding team and advisors. This allocation is typically subject to a vesting schedule to align the interests of the team with the long-term success of the project. The vesting period ensures that the team remains committed and incentivized to contribute to the platform’s growth.

-

Community Incentives: A significant portion of AEVO tokens is reserved for community incentives, including staking rewards, liquidity mining, and trading competitions. This allocation is vital for fostering community engagement and incentivizing user participation in the ecosystem.

-

Investors and Partnerships: Early investors and strategic partners receive an allocation of AEVO tokens. This helps secure funding for the project’s development and provides an incentive for partners to promote and support the platform.

-

Ecosystem Development: A portion of the total supply is designated for future development and ecosystem expansion. This allocation ensures that Aevo can continuously innovate and improve its offerings, adapt to market demands, and expand its user base.

-

Reserve Fund: Aevo maintains a reserve fund to address unforeseen circumstances or opportunities that may arise. This fund can be utilized for future partnerships, strategic acquisitions, or to bolster liquidity during market downturns.

Inflation/Deflation Model

Aevo operates on a deflationary model, which is a crucial aspect of its tokenomics. The deflationary nature means that, over time, the total supply of AEVO tokens may decrease, which can potentially increase the value of the remaining tokens. Here are some key points regarding the deflationary model:

-

Burn Mechanisms: Aevo may implement token burn events where a portion of the tokens used for trading fees or other transactions is permanently removed from circulation. This reduces the total supply and can create upward pressure on the token’s price.

-

Limited Supply: With a total and max supply capped at 1 billion AEVO tokens, the scarcity of the token can drive demand, particularly as the platform grows and attracts more users.

-

Market Dynamics: As the Aevo platform gains traction and trading volumes increase, the demand for AEVO tokens is likely to rise. The deflationary model can enhance this effect, making AEVO a potentially attractive asset for long-term holders.

In conclusion, the tokenomics of Aevo is thoughtfully designed to create a sustainable and engaging ecosystem for users. By understanding the utility, distribution, and inflation/deflation model of the AEVO token, investors can make informed decisions about their participation in the Aevo platform and the broader cryptocurrency market.

Price History and Market Performance

Key Historical Price Milestones

Aevo (AEVO) has experienced a dynamic price journey since its inception in 2020, reflecting both the broader cryptocurrency market trends and specific developments within its ecosystem. The token’s price trajectory can be characterized by several significant milestones that highlight its volatility and growth potential.

-

Initial Launch and Early Trading (2020-2021)

When Aevo was first launched in 2020, it entered a rapidly growing market for decentralized finance (DeFi) solutions. During this period, AEVO’s price was relatively low, as it was still establishing its presence and utility. The initial trading activity saw AEVO fluctuate in a tight range as users began to explore the features of the platform, such as options and perpetual trading. -

Price Surge and All-Time High (2024)

AEVO reached its all-time high of approximately $3.86 on March 28, 2024. This surge can be attributed to several factors, including increased adoption of decentralized exchanges (DEXs) and a growing interest in derivatives trading. The high trading volume, which surpassed $30 billion at that time, significantly contributed to the price rally. The robust technological framework of the Aevo platform, including its ability to process over 5,000 transactions per second, also played a role in enhancing user confidence and interest. -

Post-Peak Correction (2024-Present)

Following its all-time high, AEVO experienced a notable correction, with prices declining significantly. As of October 2023, AEVO’s price hovered around $0.08836, representing a decrease of approximately 97.71% from its peak. This decline reflects broader market corrections typical within the cryptocurrency space, where prices often experience significant fluctuations in response to market sentiment, regulatory news, and macroeconomic factors. -

Recent Performance (2023)

In the current market environment, AEVO has shown signs of recovery, with the price fluctuating between $0.08702 and $0.08939 over the last 24 hours. The market capitalization of AEVO stands at approximately $80.67 million, with a circulating supply of around 912.97 million tokens. The volume of trading within a 24-hour period has been about $8.02 million, indicating active participation and interest from traders.

Factors Influencing the Price

Historically, the price of AEVO has been influenced by a multitude of factors that reflect both internal developments within the Aevo platform and external market conditions.

-

Market Sentiment and Trends

The overall sentiment in the cryptocurrency market has had a profound impact on AEVO’s price. Bullish trends in the broader crypto market often lead to increased investment in DeFi projects, including Aevo. Conversely, during bearish phases or periods of negative news surrounding cryptocurrencies, AEVO’s price has typically mirrored these declines. The general market sentiment can be gauged through various indices and community discussions, which have historically correlated with AEVO’s price movements. -

Adoption and Utility

The growth of Aevo’s user base and trading volume directly influences the price of AEVO. As more traders utilize the platform for options and perpetual trading, demand for the token tends to rise, driving up its price. The introduction of new features, such as the AEVO Trading & Staking Incentives Program, aimed at rewarding users for trading and staking, has historically contributed to increased engagement and price stability. -

Technological Developments

Aevo’s technological advancements, particularly its custom Layer 2 solution based on the Optimism stack, have played a crucial role in its market performance. The ability to handle high transaction volumes with low latency has made the platform attractive to traders, thereby influencing the token’s demand and price positively. Innovations that enhance user experience or introduce new trading products can lead to price increases as traders flock to the platform for its competitive advantages. -

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies and DeFi has also impacted AEVO’s price. News of regulatory actions or guidance from governments can lead to swift market reactions, affecting investor confidence. For instance, any positive developments regarding regulatory clarity can boost prices, while negative news can lead to sharp declines. -

Competition in the DeFi Space

The presence of competing platforms in the DeFi sector can influence AEVO’s market performance. As more decentralized exchanges and derivative platforms emerge, AEVO must continuously innovate to maintain its market share. Competitive pressures can lead to price volatility as traders shift their focus to newer or more attractive platforms, impacting AEVO’s demand and price.

Conclusion

In summary, the price history and market performance of AEVO provide valuable insights into the dynamics of decentralized finance and cryptocurrency trading. The token’s journey reflects a combination of market sentiment, adoption rates, technological advancements, regulatory influences, and competitive pressures. Understanding these factors is essential for both new and experienced investors looking to navigate the evolving landscape of digital assets.

Where to Buy aevo crypto: Top Exchanges Reviewed

1. Changelly – Lowest Fees for Exchanging AEVO!

Changelly stands out as a premier exchange for AEVO (AEVO) due to its remarkably low fees and competitive exchange rates. With a user-friendly platform available on both web and iOS, it offers seamless exchanges among over 700 cryptocurrencies. Users benefit from fast transactions and round-the-clock live support, making Changelly a reliable choice for both novice and seasoned traders looking to optimize their trading experience.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. Kraken – Your Go-To for Seamless AEVO Purchases!

Kraken stands out as a user-friendly exchange for purchasing AEVO, offering flexible payment options such as credit/debit cards, ACH deposits, and mobile payment solutions like Apple and Google Pay. With a low entry point starting at just $10, Kraken caters to both novice and experienced investors, making it accessible for anyone looking to enter the AEVO market seamlessly. The platform’s robust security measures further enhance its appeal.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

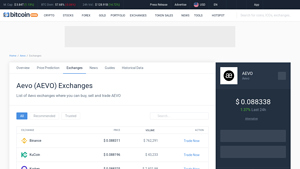

5. Aevo Exchanges – Your Go-To Hub for AEVO Trading!

Aevo exchanges, prominently featuring platforms like HTX (Huobi), Binance, KuCoin, and Kraken, offer a robust environment for buying, selling, and trading AEVO tokens. What sets these exchanges apart is their high liquidity, user-friendly interfaces, and extensive trading tools, which cater to both novice and experienced traders. Additionally, their strong security measures and reputation in the crypto community enhance user confidence, making them ideal choices for engaging with AEVO.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy aevo crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing aevo crypto (AEVO) is to select a reliable cryptocurrency exchange that lists the token. Popular exchanges that offer AEVO include:

- Binance: A leading global exchange known for its wide range of cryptocurrencies and trading pairs.

- Coinbase: A user-friendly platform that is great for beginners and offers AEVO trading.

- KuCoin: Known for its extensive selection of altcoins, including AEVO.

- Uniswap: A decentralized exchange (DEX) where you can swap Ethereum-based tokens like AEVO directly.

Before choosing an exchange, consider factors such as trading fees, security features, and user reviews. Make sure the exchange you select supports your region and offers a straightforward trading experience.

2. Create and Verify Your Account

Once you have chosen an exchange, you will need to create an account. Here’s how to do it:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. Fill in the required information, such as your email address and password.

-

Verify Your Email: After signing up, you will receive a verification email. Click the link in the email to verify your account.

-

Complete KYC Verification: Most exchanges require you to complete Know Your Customer (KYC) verification. This process typically involves submitting identification documents (like a passport or driver’s license) and proof of address (like a utility bill). Follow the exchange’s instructions to complete this process.

-

Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This often involves linking your account to an authenticator app on your smartphone.

3. Deposit Funds

After your account is verified, you will need to deposit funds to purchase aevo crypto. Here’s how to deposit:

-

Select Deposit Option: Log into your account and navigate to the “Funds” or “Wallet” section. Look for an option to deposit funds.

-

Choose Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or other cryptocurrencies. Select your preferred method.

-

Follow Instructions: If you are depositing fiat (like USD), follow the instructions to link your bank account or enter your card details. If you are depositing another cryptocurrency, you will receive a wallet address to send your funds.

-

Confirm Deposit: After initiating the deposit, wait for the transaction to be confirmed. This can take anywhere from a few minutes to several hours, depending on the method used.

4. Place an Order to Buy aevo crypto

Once your account is funded, you can proceed to buy aevo crypto. Here’s how:

-

Find AEVO: In the exchange’s trading section, use the search bar to find aevo (AEVO). You may need to enter its trading pair, such as AEVO/USD or AEVO/ETH.

-

Select Order Type: Choose the type of order you want to place. Common options include:

– Market Order: Buy AEVO at the current market price.

– Limit Order: Set a specific price at which you want to buy AEVO. -

Enter Amount: Specify how much AEVO you want to purchase. The exchange will show you the total cost based on the current market price.

-

Confirm Order: Review your order details and click on the “Buy” button. You will receive a confirmation once your order is executed.

5. Secure Your Coins in a Wallet

After purchasing aevo crypto, it’s essential to secure your tokens in a wallet. Here’s how to do it:

-

Choose a Wallet: You can store AEVO in different types of wallets, including:

– Software Wallets: Apps or software that can be installed on your computer or mobile device (e.g., MetaMask, Trust Wallet).

– Hardware Wallets: Physical devices that store your cryptocurrency offline, providing enhanced security (e.g., Ledger, Trezor).

– Exchange Wallets: Most exchanges provide a wallet for your tokens, but this is less secure than using a personal wallet. -

Transfer AEVO to Your Wallet: If you choose a personal wallet, you’ll need to transfer your AEVO from the exchange. Go to your wallet, find the “Receive” option, and copy your AEVO wallet address. Then, on the exchange, go to the “Withdraw” section, enter the amount of AEVO you want to send, and paste your wallet address.

-

Confirm the Transaction: Review the transaction details and confirm the transfer. Allow some time for the transaction to be processed.

-

Backup Your Wallet: If you are using a software or hardware wallet, ensure you backup your wallet recovery phrase securely. This will allow you to recover your funds in case you lose access to your wallet.

By following these steps, you can safely and effectively purchase aevo crypto and secure your investment. Always remember to do your own research and stay updated on market trends and security practices.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Investing in Aevo (AEVO) presents several potential strengths that may appeal to both beginners and intermediate investors. Understanding these strengths can help in assessing the asset’s long-term viability and market position.

Innovative Trading Platform

Aevo operates as a decentralized derivatives exchange that focuses on options and perpetual contracts. Utilizing a hybrid model that integrates an off-chain central limit order book with on-chain settlement on Ethereum’s Layer 2 (L2) infrastructure, Aevo achieves high throughput and low latency. This means users can experience a trading environment akin to centralized exchanges while benefiting from the security and transparency of decentralized finance (DeFi). The platform’s capacity to process over 5,000 transactions per second positions it as a competitive player in the rapidly evolving DeFi landscape.

Strong Market Adoption and Trading Volume

Since its inception, Aevo has processed over $30 billion in trading volume, indicating significant market adoption and a growing user base. The Total Value Locked (TVL) currently stands at approximately $33.6 million, reflecting investor confidence in its ecosystem. Such metrics often serve as indicators of a platform’s reliability and user engagement, which are critical for long-term sustainability.

Backing by Experienced Teams and Investors

Aevo is developed by a team with a proven track record in the cryptocurrency and finance sectors, including members from Coinbase, Kraken, and Goldman Sachs. This background lends credibility to the project, as the team is well-versed in both traditional finance and blockchain technology. Additionally, Aevo has garnered support from notable investors, which could provide the necessary resources for continued development and marketing efforts.

Diverse Financial Instruments

The platform’s focus on a variety of financial products—including options, perpetual futures, and structured products—allows traders to utilize advanced strategies for risk management and speculation. This diversity can attract a wide range of investors, from individual traders to institutional players, broadening its appeal and potential market share.

Staking and Yield Opportunities

Aevo offers trading and staking incentives, allowing users to stake their AEVO or RBN tokens to earn additional AEVO rewards. This feature not only encourages user engagement but also provides a mechanism for passive income generation, which can enhance the attractiveness of holding AEVO tokens.

Potential Risks and Challenges (The Bear Case)

While Aevo presents several potential strengths, it is essential to consider the risks associated with investing in this cryptocurrency. Understanding these challenges can provide a more balanced view of the asset’s investment potential.

Market Volatility

The cryptocurrency market is notoriously volatile, with prices subject to rapid fluctuations influenced by a variety of factors, including market sentiment, economic data, and broader financial trends. AEVO, like many digital assets, may experience significant price swings, which can lead to substantial gains or losses for investors. This inherent volatility can be particularly daunting for new investors who may not be prepared for the dramatic price changes characteristic of the crypto space.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and varies significantly by jurisdiction. Governments around the world are still formulating their approaches to digital assets, and regulatory changes can have profound impacts on how platforms like Aevo operate. Increased scrutiny or unfavorable regulations could affect Aevo’s business model, user base, and ultimately its token value. Investors must remain vigilant and informed about potential regulatory developments that could impact the cryptocurrency market.

Competitive Landscape

The DeFi space is crowded with numerous platforms offering similar services, including trading options and perpetual contracts. Competition from established exchanges and emerging projects can pose a significant risk to Aevo’s market share. If competitors provide better features, lower fees, or superior user experiences, Aevo could struggle to maintain its position. The ability to innovate and adapt to market demands will be crucial for Aevo to stay relevant in a rapidly evolving ecosystem.

Technological Risks

While Aevo leverages advanced technology to enhance its trading platform, it is not without risks. The reliance on a custom Layer 2 solution introduces potential vulnerabilities, including bugs or exploits that could compromise user funds or the integrity of the trading platform. Furthermore, the integration of off-chain and on-chain processes necessitates robust security measures. Any technological failures or breaches could have dire consequences for both the platform and its users.

Market Sentiment and Perception

Investor sentiment can significantly impact the value of cryptocurrencies, including AEVO. Negative media coverage, social media trends, or loss of user confidence can lead to rapid sell-offs and price declines. The perception of Aevo within the broader cryptocurrency community will play a vital role in its market performance. A lack of enthusiasm or negative sentiment can hinder user adoption and impact trading volumes, ultimately affecting AEVO’s price and market position.

Conclusion

Investing in Aevo (AEVO) presents both potential strengths and risks that are crucial for prospective investors to consider. The platform’s innovative technology, strong market adoption, and backing from experienced teams offer promising prospects. However, challenges such as market volatility, regulatory uncertainty, and competition must also be taken into account.

As with any investment in the cryptocurrency space, thorough research and a clear understanding of both the potential rewards and risks are essential. By weighing these factors, investors can make more informed decisions about their involvement with AEVO and the broader cryptocurrency market.

Frequently Asked Questions (FAQs)

1. What is Aevo crypto?

Aevo is a decentralized derivatives exchange that primarily focuses on options, perpetual contracts, and pre-launch trading. It operates on a custom Layer 2 solution built using the Optimism stack, allowing it to handle over 5,000 transactions per second. The platform combines an off-chain central limit order book for trade matching with on-chain settlement via Ethereum smart contracts, providing users with a high-performance trading experience while maintaining the security and transparency associated with decentralized systems.

2. Who created Aevo crypto?

Aevo was developed by a team known for launching Ribbon Finance, a prominent project in the decentralized finance (DeFi) space. The team comprises professionals with experience from notable companies such as Coinbase, Kraken, and Goldman Sachs, as well as prestigious institutions like Stanford, MIT, and Cornell. This blend of expertise in finance and technology has contributed significantly to Aevo’s design and functionality.

3. What makes Aevo crypto different from Bitcoin?

While Bitcoin is primarily a digital currency designed for peer-to-peer transactions and a store of value, Aevo functions as a decentralized derivatives exchange. Aevo focuses on offering advanced financial instruments such as options and perpetual contracts, allowing traders to hedge risks or speculate on market movements. Additionally, Aevo operates on a Layer 2 solution that enhances transaction speeds and reduces costs, making it more suitable for high-frequency trading compared to Bitcoin’s main blockchain.

4. Is Aevo crypto a good investment?

As with any investment, the potential for profit with Aevo crypto depends on various factors, including market conditions, user adoption, and the overall performance of the platform. Aevo has shown strong trading volumes and a reputable team backing it, which can be positive indicators. However, it is essential for investors to conduct thorough research, assess their risk tolerance, and consider market trends before investing in any cryptocurrency, including Aevo.

5. How does Aevo ensure security for its users?

Aevo prioritizes security through its decentralized architecture, leveraging Ethereum’s robust security features. By utilizing a hybrid model that combines off-chain trade matching with on-chain settlement, the platform minimizes risks associated with fraudulent activities. Additionally, the use of smart contracts for executing trades ensures transparency and reliability in transaction processing.

6. What trading options are available on Aevo?

Aevo supports a variety of trading options, including options trading, perpetual futures, and structured products. This diverse range of financial instruments allows traders to implement different strategies, whether for hedging, speculation, or yield generation. The platform’s single margin account structure simplifies the trading process by allowing users to manage multiple products in one place.

7. What are the benefits of using Aevo’s Layer 2 solution?

Aevo’s custom Layer 2 solution, built on the Optimism stack, offers several advantages:

– High Throughput: Capable of processing over 5,000 transactions per second, enhancing the user experience for high-frequency traders.

– Low Latency: Provides a trading experience similar to centralized exchanges, with reduced delays in order execution.

– Cost Efficiency: The roll-up technology allows for lower transaction fees, making trading more accessible to a broader audience.

– Security: Inherits the security features of the Ethereum blockchain while maintaining decentralization.

8. How can I participate in Aevo’s trading and staking programs?

To participate in Aevo’s trading and staking programs, users need to create an account on the Aevo platform. After completing the registration process, users can start trading by depositing supported cryptocurrencies. Aevo also offers staking opportunities where users can stake their $AEVO or $RBN tokens to earn additional $AEVO rewards. It is advisable to review the platform’s guidelines and terms to understand the requirements and potential risks associated with staking and trading activities.

Final Verdict on aevo crypto

Summary of Aevo Crypto

Aevo (AEVO) is a decentralized derivatives exchange that primarily focuses on options, perpetual contracts, and pre-launch trading. Built on a custom Layer 2 solution leveraging the Optimism stack, Aevo provides a robust trading environment capable of processing over 5,000 transactions per second. This advanced infrastructure not only facilitates high trading volumes but also ensures low-latency performance akin to centralized exchanges while upholding the security and transparency of decentralized systems.

The platform employs a hybrid trading model, integrating an off-chain central limit order book for trade matching with on-chain settlement via Ethereum smart contracts. This structure offers users a seamless trading experience while allowing for the complexity required by sophisticated financial instruments. Aevo’s development is backed by a team with extensive experience in finance and technology from reputable firms such as Coinbase and Goldman Sachs, further solidifying its credibility in the market.

Potential and Risks

As a relatively new player in the cryptocurrency landscape, Aevo presents both potential and risks. Its focus on derivatives trading and innovative technology positions it as a significant contender in the DeFi space. However, like all cryptocurrencies, AEVO is classified as a high-risk, high-reward asset. Investors should be aware of the volatile nature of digital assets and the possibility of substantial price fluctuations.

Conduct Your Own Research (DYOR)

Before making any investment decisions regarding Aevo or any other cryptocurrency, it is imperative to conduct thorough research. Understanding the underlying technology, market trends, and potential risks will empower investors to make informed choices. Remember, the cryptocurrency market can be unpredictable, and due diligence is key to navigating this complex landscape successfully.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.