What is aevo coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to aevo coin

Aevo coin (AEVO) has emerged as a notable player in the cryptocurrency landscape, particularly within the decentralized finance (DeFi) sector. As a decentralized derivatives exchange, Aevo focuses on offering options, perpetual contracts, and pre-launch trading opportunities, catering to both individual and institutional investors. The significance of Aevo coin lies in its innovative approach to trading, which combines the benefits of decentralized systems with the efficiency typically associated with centralized exchanges. Built on a custom Layer 2 (L2) solution utilizing Ethereum’s roll-up technology, Aevo is designed to handle high transaction volumes while ensuring security and transparency, making it a compelling option for traders looking for advanced financial instruments.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginner and intermediate investors interested in Aevo coin. It covers various aspects of the AEVO token, including its underlying technology, tokenomics, investment potential, associated risks, and practical guidance on how to purchase it. By providing in-depth information, this guide seeks to equip readers with the knowledge they need to make informed decisions regarding their investments in Aevo coin.

Understanding Aevo’s Technology

At the heart of Aevo coin’s appeal is its cutting-edge technology. The platform operates on Aevo L2, a custom Ethereum rollup that leverages the Optimism stack to achieve scalability and efficiency. With the capability to process over 5,000 transactions per second, Aevo ensures that users enjoy a seamless trading experience. The integration of a hybrid model, which combines off-chain trade matching with on-chain settlement, enhances performance while maintaining the decentralized ethos of blockchain technology.

Tokenomics and Investment Potential

Aevo coin’s tokenomics are structured to support its trading ecosystem, with a total supply of 1 billion AEVO tokens. The token serves multiple purposes within the platform, including governance, transaction fees, and incentivizing liquidity provision. Understanding these dynamics is crucial for investors looking to gauge the potential for growth and the impact of market trends on the token’s value.

Risks and Considerations

Like any investment in the cryptocurrency space, investing in Aevo coin comes with inherent risks. Market volatility, regulatory challenges, and technological risks are factors that potential investors should consider. This guide will address these risks, helping readers to evaluate their risk tolerance and investment strategy.

How to Buy Aevo Coin

Finally, this guide will provide step-by-step instructions on how to purchase Aevo coin, including where to find it on exchanges and the best practices for securing digital assets. Whether you’re a newcomer to cryptocurrency or an experienced trader, this guide aims to empower you with the knowledge to navigate the Aevo ecosystem effectively.

What is aevo coin? A Deep Dive into its Purpose

Introduction to Aevo Coin

Aevo Coin (AEVO) is the native cryptocurrency of the Aevo platform, a decentralized derivatives exchange that specializes in options, perpetuals, and pre-launch trading. Built on a custom Layer 2 (L2) solution using Ethereum’s roll-up technology, Aevo aims to provide users with a high-performance trading environment that combines the benefits of decentralized finance (DeFi) with the speed and efficiency often associated with centralized exchanges.

The Core Problem It Solves

The cryptocurrency trading landscape has been plagued by several critical issues, including high transaction fees, slow processing times, and the need for a secure and transparent trading environment. Traditional centralized exchanges, while offering speed and liquidity, often compromise on security and transparency, exposing users to risks such as hacks and unfair trading practices.

Aevo addresses these challenges by leveraging its unique hybrid trading model. This model integrates an off-chain central limit order book for efficient trade matching with on-chain settlement through Ethereum smart contracts. By processing trades off-chain, Aevo can achieve high transaction speeds—over 5,000 transactions per second—while the on-chain settlement ensures that all trades are recorded in a secure and transparent manner. This dual approach allows traders to enjoy the benefits of fast execution without sacrificing the security and transparency that decentralized systems provide.

Moreover, the emphasis on derivatives trading, particularly options and perpetual contracts, enables traders to hedge risks and speculate on market movements effectively. This sophisticated toolkit is especially valuable for institutional investors and experienced traders who require advanced financial instruments to navigate the complexities of the cryptocurrency market.

Its Unique Selling Proposition

Aevo’s unique selling proposition lies in its innovative use of Layer 2 roll-up technology, which is built on the Optimism stack. This technology allows for the aggregation of multiple transactions into a single batch, significantly enhancing transaction speed while reducing costs. By doing so, Aevo positions itself as a highly efficient platform that can handle substantial trading volumes—over $30 billion processed since its inception.

In addition to its technological advantages, Aevo’s focus on derivatives trading sets it apart from many other decentralized exchanges. By offering options and perpetual contracts, Aevo provides traders with the tools necessary to manage their portfolios proactively. This focus on derivatives is particularly timely, as the demand for sophisticated trading instruments continues to grow within the cryptocurrency ecosystem.

Another critical aspect of Aevo’s offering is its commitment to user experience. The platform is designed to cater to both seasoned traders and newcomers alike, providing a seamless trading environment that is both user-friendly and efficient. The integration of reliable data feeds, such as those from its partnership with Pyth, enhances the accuracy of market information available to traders, allowing for informed decision-making.

The Team and Backers

Aevo is developed by a skilled team with extensive experience in both finance and technology. The founding members—Julian Koh, Ken Chan, and Luís Felipe Carvalho—bring a wealth of knowledge from their backgrounds in software engineering, computer science, and business management. This diverse expertise is instrumental in driving Aevo’s development and ensuring that the platform remains at the forefront of innovation in the DeFi space.

The team is further bolstered by their connections to notable firms such as Coinbase and Goldman Sachs, which adds credibility to Aevo’s mission and operations. Their experience in both traditional finance and blockchain technology allows them to navigate the complexities of the cryptocurrency market effectively, ensuring that Aevo can adapt to the evolving needs of its users.

Moreover, Aevo has attracted significant backing from reputable investors, including prominent names in the cryptocurrency and venture capital spaces. This backing not only provides financial support but also enhances Aevo’s credibility and visibility in the competitive DeFi landscape. The involvement of high-profile investors signals confidence in Aevo’s potential and underlines its importance in the broader cryptocurrency ecosystem.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Aevo Coin and the Aevo platform is to create a secure, efficient, and transparent trading environment for derivatives in the cryptocurrency market. By combining the advantages of decentralized finance with the speed and performance typically associated with centralized exchanges, Aevo aims to bridge the gap between these two worlds.

As the cryptocurrency market continues to mature, the demand for sophisticated trading instruments and secure platforms will only increase. Aevo’s focus on options, perpetuals, and pre-launch trading positions it as a vital player in meeting these needs. Its innovative technology and commitment to user experience empower traders to engage in the market confidently, knowing that they are supported by a robust and secure platform.

In summary, Aevo Coin serves as a critical component of a decentralized derivatives exchange that is designed to address the key challenges facing cryptocurrency traders today. By offering a high-performance trading environment, advanced financial instruments, and a commitment to security and transparency, Aevo is poised to play a significant role in the evolution of the DeFi landscape.

The Technology Behind the Coin: How It Works

Overview of Aevo Coin’s Technology

Aevo Coin (AEVO) is an innovative digital asset that operates within a decentralized derivatives exchange, emphasizing options, perpetuals, and pre-launch trading. The technology behind Aevo is built on a robust framework that leverages the capabilities of Ethereum’s Layer 2 (L2) solutions. This guide will explore the key components of Aevo’s technology, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Aevo operates on a custom Layer 2 solution known as Aevo L2, which is built using the Optimism stack. This architecture is designed to enhance transaction throughput and reduce costs associated with trading on the Ethereum blockchain.

Layer 2 Solutions

Layer 2 solutions are secondary frameworks built on top of a primary blockchain (in this case, Ethereum) to improve scalability and efficiency. By processing transactions off the main Ethereum chain, Layer 2 solutions can significantly increase transaction speed and reduce fees. Aevo L2 utilizes roll-up technology, which aggregates multiple transactions into a single batch before submitting them to the Ethereum mainnet.

This process allows Aevo to support over 5,000 transactions per second, making it a highly efficient platform for traders. The roll-up technology not only speeds up transactions but also minimizes the overall load on the Ethereum network, contributing to a more scalable ecosystem.

On-Chain and Off-Chain Processes

Aevo employs a hybrid model that combines both off-chain and on-chain processes to create a seamless trading experience.

-

Off-Chain Central Limit Order Book: The matching of trades occurs off-chain using a central limit order book. This allows for rapid execution of trades, similar to centralized exchanges, which is crucial for traders who require speed and efficiency.

-

On-Chain Settlement: Once trades are matched, the actual settlement occurs on-chain via Ethereum smart contracts. This ensures that all transactions are secure, transparent, and verifiable, leveraging the inherent security features of the Ethereum blockchain.

This dual approach provides the best of both worlds: the speed of centralized exchanges and the security of decentralized systems.

Consensus Mechanism

Aevo utilizes Ethereum’s consensus mechanism, which is currently transitioning from Proof of Work (PoW) to Proof of Stake (PoS) as part of Ethereum 2.0. Understanding this mechanism is crucial for grasping how transactions are verified and secured on the platform.

Proof of Work (PoW)

In the traditional PoW model, miners solve complex mathematical problems to validate transactions and add them to the blockchain. This process requires significant computational power and energy consumption, which has raised concerns regarding sustainability.

Proof of Stake (PoS)

With the transition to PoS, Ethereum is moving towards a more energy-efficient model. In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This method reduces energy consumption and allows for faster transaction processing.

Aevo benefits from this transition by operating on Ethereum’s PoS, which enhances the security and efficiency of transactions on the platform. Since transactions are validated by stakeholders, it also aligns the interests of the network participants with the overall health of the ecosystem.

Key Technological Innovations

Aevo incorporates several key technological innovations that enhance its functionality and user experience. These innovations are crucial for addressing common challenges in the decentralized finance (DeFi) space.

High Throughput and Low Latency

Aevo’s custom Layer 2 solution enables high throughput of over 5,000 transactions per second. This capability is vital for traders who require rapid execution of their trades, especially in volatile markets. The low latency of the platform ensures that users can react quickly to market movements, which is essential for successful trading strategies.

Decentralized Derivatives Trading

Aevo focuses on providing a decentralized platform for derivatives trading, specifically options and perpetual contracts. This focus allows traders to engage in sophisticated financial strategies that are not typically available on traditional exchanges. The ability to trade derivatives enables users to hedge risks and speculate on market movements effectively.

Integration of Reliable Data Feeds

To enhance trading accuracy and reliability, Aevo has partnered with data providers like Pyth. This collaboration ensures that users have access to high-fidelity market data, which is crucial for making informed trading decisions. Accurate and timely information can significantly impact trading outcomes, making this integration a key feature of the platform.

User-Friendly Interface

Aevo’s platform is designed with user experience in mind, catering to both seasoned traders and newcomers. The interface is intuitive, allowing users to navigate the trading environment easily. This accessibility is important for attracting a wider audience and encouraging participation in the decentralized finance space.

Security Features

Security is a paramount concern in the blockchain space, and Aevo addresses this through its decentralized architecture. By leveraging Ethereum’s security features, Aevo ensures that all transactions are secure and transparent. The use of smart contracts for on-chain settlement further enhances security by automating and enforcing the terms of trades without the need for intermediaries.

Commitment to Innovation

The team behind Aevo, which includes experienced professionals from notable firms like Coinbase and Goldman Sachs, is dedicated to continuous innovation. Their commitment to pushing the boundaries of blockchain technology is evident in Aevo’s cutting-edge features and capabilities. This focus on development ensures that Aevo remains competitive in the rapidly evolving DeFi landscape.

Conclusion

Aevo Coin (AEVO) stands out as a sophisticated digital asset in the decentralized derivatives trading space. Its technological foundation, built on a custom Layer 2 solution and leveraging Ethereum’s roll-up technology, provides high transaction throughput and low latency. The hybrid model of off-chain trade matching and on-chain settlement ensures a seamless trading experience while maintaining security and transparency.

As the cryptocurrency landscape continues to evolve, Aevo’s commitment to innovation, user experience, and security positions it as a leader in the decentralized finance sector. For both beginners and experienced investors, understanding the technology behind Aevo is essential for appreciating its potential and the value it brings to the market.

Understanding aevo coin Tokenomics

Aevo Coin (AEVO) has a well-defined tokenomics structure that plays a crucial role in the functioning of the Aevo decentralized derivatives exchange. Understanding this tokenomics is essential for both beginners and intermediate investors who are looking to grasp how AEVO operates within its ecosystem. Below, we delve into the key metrics, utility, and distribution of the AEVO token.

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 AEVO |

| Max Supply | 1,000,000,000 AEVO |

| Circulating Supply | 912,970,000 AEVO |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The AEVO token serves multiple functions within the Aevo ecosystem, enhancing its utility and value proposition. Here are some of the primary uses of AEVO:

-

Transaction Fees: AEVO tokens can be used to pay for transaction fees on the Aevo platform. Users who utilize AEVO for this purpose may benefit from reduced fees compared to using other cryptocurrencies, which incentivizes holding and using the token.

-

Staking Rewards: Users can stake their AEVO tokens to earn rewards. Staking not only helps secure the network but also allows participants to earn passive income through staking rewards, further encouraging users to hold onto their tokens rather than sell them.

-

Governance Participation: AEVO holders may have the opportunity to participate in governance decisions regarding the platform’s future developments and protocol upgrades. This democratic aspect of governance empowers users to influence the direction of the Aevo platform.

-

Incentives for Liquidity Providers: AEVO tokens can be rewarded to liquidity providers who contribute to the depth of the market on the Aevo platform. This incentivizes users to provide liquidity, which is crucial for maintaining a stable and efficient trading environment.

-

Access to Exclusive Features: Holding AEVO tokens may grant users access to certain premium features or trading tools within the Aevo ecosystem. This adds an additional layer of value for token holders.

-

Participation in Pre-Launch Trading: AEVO holders may have exclusive access to certain pre-launch trading opportunities, allowing them to invest in new projects before they become widely available. This can provide strategic advantages in the rapidly evolving cryptocurrency market.

Token Distribution

The distribution of AEVO tokens is designed to foster a balanced and sustainable ecosystem while ensuring that key stakeholders are incentivized to support the platform’s growth. Here’s a breakdown of the distribution model:

-

Team Allocation: A portion of the total supply is allocated to the founding team and developers. This allocation typically comes with a vesting schedule to ensure that team members are committed to the project’s long-term success.

-

Advisors and Partnerships: Tokens are allocated to advisors and partners who bring expertise and resources to the Aevo platform. This helps to establish strong relationships within the industry, which can be beneficial for the platform’s growth.

-

Ecosystem Development: A significant portion of the tokens is reserved for ecosystem development, which includes marketing, partnerships, and community engagement efforts. This allocation is crucial for driving adoption and usage of the platform.

-

Liquidity Provision: A percentage of AEVO tokens is allocated for liquidity provision on various exchanges. This ensures that there is enough liquidity for users to trade AEVO without significant slippage, enhancing the overall trading experience.

-

Community Incentives: Tokens are also set aside for community incentives, such as airdrops, rewards for active participants, and other promotional activities that encourage user engagement and growth.

-

Reserve Fund: A reserve fund may be established to address unforeseen circumstances or to fund future developments. This fund provides a safety net for the project, ensuring it can adapt to changing market conditions.

Conclusion

The tokenomics of Aevo Coin (AEVO) is a well-structured framework that not only supports the operational needs of the Aevo decentralized derivatives exchange but also incentivizes various stakeholders to participate actively in the ecosystem. With a total supply capped at 1 billion tokens and a focus on utility through transaction fees, staking, governance, and liquidity incentives, AEVO is positioned to enhance user engagement while fostering a sustainable growth trajectory.

Understanding the tokenomics behind AEVO is crucial for investors looking to capitalize on its potential, as it offers insight into how the token is designed to function within the broader ecosystem. As the platform continues to evolve, the demand and utility of AEVO are likely to play a significant role in its future success.

Price History and Market Performance

Key Historical Price Milestones

Aevo coin (AEVO) has experienced significant price fluctuations since its inception, reflecting both the inherent volatility of the cryptocurrency market and the unique dynamics surrounding decentralized finance (DeFi) platforms.

-

Launch and Initial Pricing: AEVO was launched on March 28, 2024, with an initial price of approximately $3.86. This price point marked the all-time high for AEVO, coinciding with a surge in interest in decentralized derivatives trading and the overall growth of the DeFi sector. Many new investors were eager to capitalize on the latest innovations in this space, leading to a rapid increase in trading volume and market capitalization.

-

Subsequent Decline: Following its initial surge, AEVO faced significant price corrections, common in the cryptocurrency market. The price began to decline and reached an all-time low of approximately $0.0673 on June 22, 2025. This drop of around 97.71% from its all-time high underscored the volatility that often characterizes digital assets, particularly those tied to emerging technologies and trading platforms.

-

Current Price Status: As of October 2023, AEVO is trading at approximately $0.08836. This current price reflects a recovery of about 31.3% from its all-time low, indicating some stabilization in the market. The market capitalization of AEVO at this time is approximately $80.67 million, with a trading volume of $8.02 million over the past 24 hours.

-

Trading Activity: The trading activity around AEVO has been noteworthy, with a volume-to-market cap ratio of approximately 9.94%. This ratio signifies that AEVO has maintained a healthy trading volume relative to its market cap, suggesting ongoing interest from traders and investors alike.

Factors Influencing the Price

Historically, the price of AEVO has been influenced by a variety of factors that are crucial to understanding its market performance.

-

Market Sentiment: Like many cryptocurrencies, AEVO’s price has been significantly affected by overall market sentiment. Positive news regarding the DeFi space, advancements in blockchain technology, or endorsements from influential figures or firms can lead to increased demand and higher prices. Conversely, negative news, regulatory concerns, or market downturns can result in decreased interest and price drops.

-

Technological Developments: The underlying technology of Aevo, particularly its custom Layer 2 solution built on the Optimism stack, plays a crucial role in its market performance. Enhancements to the platform’s capabilities, such as increased transaction speeds and improved user experience, can positively influence investor confidence and subsequently the price. For instance, the launch of new features or partnerships, like Aevo’s collaboration with Pyth for reliable data feeds, can enhance the platform’s appeal and drive user engagement.

-

Trading Volume and Liquidity: The trading volume of AEVO has been another significant factor influencing its price. A robust trading volume indicates a high level of market activity, which can attract more investors and traders. The liquidity of the AEVO token is critical for its price stability; low liquidity can lead to increased volatility and price swings.

-

Investor Behavior: The behavior of investors, particularly during periods of high volatility, has also shaped AEVO’s price movements. Speculative trading, where investors buy and sell based on short-term price movements rather than long-term fundamentals, has contributed to price fluctuations. In contrast, institutional interest and participation can provide a more stable price foundation, as institutional investors typically adopt a longer-term perspective.

-

Regulatory Environment: The regulatory landscape surrounding cryptocurrencies and DeFi platforms can significantly impact AEVO’s price. Regulatory developments, such as the introduction of new laws or guidelines governing the use of digital assets, can either bolster investor confidence or create uncertainty, leading to price volatility. For example, favorable regulations might encourage more widespread adoption and investment, while restrictive measures could deter participation.

-

Competition: The competitive landscape within the DeFi sector also influences AEVO’s market performance. The emergence of new decentralized exchanges and derivative platforms can create competitive pressure, impacting AEVO’s market share and pricing. Investors often compare AEVO with its peers, and shifts in competitive dynamics can lead to changes in demand for AEVO tokens.

Conclusion

In summary, AEVO’s price history reflects a journey marked by both significant highs and challenging lows. Understanding the factors that influence its price is crucial for both new and experienced investors. Historical price milestones, market sentiment, technological advancements, trading volume, investor behavior, regulatory developments, and competition all play integral roles in shaping the market performance of Aevo coin. As the cryptocurrency landscape continues to evolve, these factors will remain critical in determining AEVO’s future trajectory.

Where to Buy aevo coin: Top Exchanges Reviewed

1. Changelly – Lowest Fees for AEVO Exchange!

Changelly stands out as a premier exchange for trading AEVO (AEVO) due to its exceptionally low fees and competitive rates. With a user-friendly platform available on both web and iOS, it offers seamless exchanges among over 700 cryptocurrencies. Additionally, Changelly provides 24/7 live support, ensuring that users receive prompt assistance whenever needed, making it a reliable choice for both novice and experienced traders.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

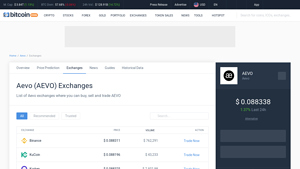

5. Aevo Exchanges – Your Go-To Hub for AEVO Trading!

Aevo exchanges, including prominent platforms like HTX (Huobi), Binance, KuCoin, and Kraken, offer a robust environment for buying, selling, and trading AEVO tokens. What sets these exchanges apart is their high liquidity, diverse trading pairs, and user-friendly interfaces, making them accessible for both novice and seasoned traders. Additionally, their strong security measures and competitive fees enhance the overall trading experience for AEVO enthusiasts.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Kraken – Your Ultimate Guide to Buying AEVO Today!

Kraken stands out as a premier cryptocurrency exchange for purchasing AEVO, offering a user-friendly experience that allows investors to start with as little as $10. The platform supports various payment methods, including credit/debit cards, ACH deposits, and mobile payment options like Apple and Google Pay, making it accessible for both beginners and seasoned traders. With its robust security measures and comprehensive resources, Kraken is an excellent choice for acquiring AEVO efficiently.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

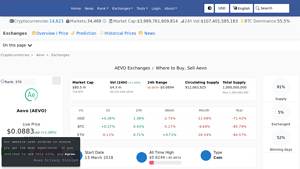

3. Aevo (AEVO) – Your Gateway to Seamless Trading!

Aevo (AEVO) stands out in the crowded cryptocurrency market by being available on over 40 exchanges, including prominent platforms like Binance, MEXC Global, and Gate. This wide accessibility ensures that investors have ample opportunities to buy, sell, and trade AEVO, making it a versatile option for both new and experienced traders. The presence on major exchanges also enhances liquidity and trust in the asset, contributing to its growing popularity.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy aevo coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing aevo coin (AEVO) is selecting a cryptocurrency exchange where it is listed. As of now, AEVO is available on several exchanges, including Gate.io and other prominent platforms. When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with a solid reputation in the cryptocurrency community. Reviews and user experiences can provide insights into an exchange’s reliability.

- Security Features: Ensure the exchange has robust security measures in place, such as two-factor authentication (2FA) and cold storage for funds.

- Fees: Compare trading fees, deposit fees, and withdrawal fees among different exchanges. Lower fees can save you money in the long run.

- User Interface: A user-friendly interface can simplify the buying process, especially for beginners.

- Supported Payment Methods: Check which payment methods the exchange accepts, such as bank transfers, credit/debit cards, or other cryptocurrencies.

2. Create and Verify Your Account

Once you’ve selected an exchange, the next step is to create an account. Follow these general steps:

- Sign Up: Visit the exchange’s website and look for the “Sign Up” or “Register” button. You’ll need to provide an email address and create a password.

- Email Verification: After signing up, you’ll typically receive a verification email. Click on the link in the email to verify your account.

- Identity Verification: Most exchanges require identity verification (KYC) for compliance and security purposes. You may need to upload a government-issued ID (like a passport or driver’s license) and possibly a selfie.

- Complete Profile: Fill out any additional required information, such as your address and phone number.

3. Deposit Funds

With your account verified, you can deposit funds to purchase aevo coin. Here’s how to do it:

- Navigate to the Deposit Section: Find the “Deposit” option on the exchange’s dashboard.

- Choose Your Deposit Method: Select your preferred payment method. This could be through a bank transfer, credit/debit card, or another cryptocurrency.

- Enter Deposit Amount: Specify how much you wish to deposit. Be aware of any minimum deposit requirements.

- Complete the Transaction: Follow the instructions provided by the exchange to complete your deposit. If you’re using a bank transfer, it may take some time for the funds to appear in your account.

4. Place an Order to Buy aevo coin

Now that your account is funded, you can buy aevo coin. Follow these steps:

- Find AEVO: Use the exchange’s search feature to locate aevo coin (AEVO).

- Select the Trading Pair: Choose the trading pair that matches your deposited currency (e.g., AEVO/USD or AEVO/USDT).

- Choose Order Type: Decide between a market order (buying at the current price) or a limit order (setting a specific price at which you want to buy). Market orders are generally executed immediately, while limit orders may take longer.

- Enter Order Details: If you are placing a limit order, input the price and amount of AEVO you wish to purchase.

- Review and Confirm: Double-check the order details before confirming the transaction.

5. Secure Your Coins in a Wallet

After purchasing aevo coin, it’s crucial to secure your assets. While you can leave your coins on the exchange, this poses risks, such as hacking. Instead, consider transferring your AEVO to a personal wallet. Here’s how:

- Choose a Wallet: Select a cryptocurrency wallet that supports aevo coin. Options include hardware wallets (like Ledger or Trezor), software wallets (like MetaMask), or mobile wallets (like Trust Wallet).

- Create Your Wallet: If you don’t already have a wallet, follow the instructions to create one. Ensure you securely save your recovery phrase.

- Transfer AEVO: Go to your exchange account, navigate to the withdrawal section, and enter your wallet address. Specify the amount of AEVO you wish to transfer.

- Confirm the Transfer: Review the details and confirm the withdrawal. Depending on network congestion, it may take some time for the transfer to complete.

Conclusion

Buying aevo coin involves a straightforward process: selecting an exchange, creating and verifying your account, depositing funds, placing an order, and securing your coins in a wallet. By following these steps, you can confidently enter the world of aevo coin and participate in its decentralized trading ecosystem. Always stay informed about market trends and security practices to protect your investments.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Investing in Aevo Coin (AEVO) presents several potential strengths that could enhance its appeal to both beginner and intermediate investors. Here are some key factors to consider:

Innovative Trading Platform

Aevo operates as a decentralized derivatives exchange that focuses on options, perpetual contracts, and pre-launch trading. By utilizing a hybrid model that combines an off-chain central limit order book with on-chain settlement through smart contracts, Aevo provides a trading experience that merges the speed of centralized exchanges with the security and transparency of decentralized systems. This innovative approach could attract a wide range of traders, from novices to seasoned professionals, enhancing the platform’s user base and overall trading volume.

High Transaction Throughput

Built on a custom Ethereum Layer 2 (L2) solution utilizing the Optimism stack, Aevo is capable of processing over 5,000 transactions per second. This high transaction throughput is crucial for traders who require immediate execution of trades, especially in the volatile cryptocurrency market. The ability to handle substantial trading volumes—over $30 billion processed to date—positions Aevo as a competitive player in the decentralized finance (DeFi) ecosystem.

Backing by Experienced Founders and Investors

Aevo’s development team includes individuals with backgrounds from prominent firms such as Coinbase and Goldman Sachs, providing a wealth of expertise in both finance and technology. Additionally, Aevo has received backing from notable investors, including Paradigm and Coinbase. This level of support not only lends credibility to the project but also suggests a strong belief in its potential for growth and innovation in the DeFi space.

Focus on Derivatives Trading

The platform’s emphasis on derivatives trading, particularly options and perpetual contracts, provides sophisticated tools for managing risk and speculation. This focus aligns with the growing interest in derivatives within the cryptocurrency market, offering opportunities for traders to hedge their positions or capitalize on market movements. The availability of pre-launch trading also allows early engagement with new projects, providing strategic advantages for investors.

Commitment to Security

Aevo’s architecture is designed with security in mind. By utilizing Ethereum’s robust security features and processing transactions off-chain before submitting them to the Ethereum blockchain, Aevo minimizes the risk of fraud and enhances overall network security. This commitment to security is essential in building trust among users, which can further drive adoption and usage of the platform.

Potential Risks and Challenges (The Bear Case)

While Aevo Coin presents various strengths, potential investors should also be aware of the risks and challenges associated with investing in AEVO. Understanding these factors is crucial for making informed investment decisions.

Market Volatility

The cryptocurrency market is notorious for its volatility. Prices can fluctuate dramatically within short periods, influenced by various factors such as market sentiment, macroeconomic events, and technological developments. For AEVO, this volatility could lead to significant price swings, impacting investor confidence and the overall market capitalization. Investors should be prepared for the possibility of losing a substantial portion of their investment if market conditions turn unfavorable.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is still evolving, with different jurisdictions taking varied approaches to regulation. Regulatory changes can significantly impact the operations of decentralized exchanges like Aevo. For instance, increased scrutiny or unfavorable regulations could limit Aevo’s ability to offer certain services or operate in specific regions, potentially affecting its user base and trading volume. Investors must stay informed about regulatory developments that could impact Aevo and the broader cryptocurrency market.

Competition

Aevo operates in a competitive environment, with numerous other decentralized exchanges and trading platforms vying for market share. Established players in the DeFi space, such as Uniswap and Sushiswap, have already built substantial user bases and liquidity. New entrants, as well as traditional finance platforms entering the crypto space, could also pose significant competition. Aevo must continually innovate and enhance its offerings to differentiate itself and attract users, which may require significant resources and development.

Technological Risks

As with any blockchain-based project, Aevo is susceptible to technological risks, including potential bugs in the smart contracts, vulnerabilities in the Layer 2 infrastructure, or issues related to network congestion. While Aevo’s use of roll-up technology offers advantages in terms of speed and cost, any technical failures could disrupt trading activities and undermine user confidence. Moreover, the reliance on Ethereum’s underlying network means that any significant issues with Ethereum itself could also impact Aevo’s operations.

Dependence on Market Sentiment

The success of AEVO is closely tied to overall market sentiment towards cryptocurrencies and decentralized finance. Factors such as negative news coverage, security breaches in the industry, or changes in investor sentiment can significantly influence the price and adoption of AEVO. An adverse shift in market perception could lead to decreased trading volumes and reduced interest in the platform, ultimately affecting its growth trajectory.

Conclusion

Investing in Aevo Coin (AEVO) presents a mix of potential strengths and risks that investors should carefully consider. The innovative trading platform, high transaction throughput, experienced backing, and focus on derivatives trading position Aevo favorably within the DeFi landscape. However, market volatility, regulatory uncertainty, competition, technological risks, and dependence on market sentiment pose significant challenges that could impact AEVO’s future performance.

As with any investment, thorough research and a clear understanding of both the potential and the risks involved are essential. Investors should assess their risk tolerance and consider their investment goals before engaging with AEVO or any other cryptocurrency asset.

Frequently Asked Questions (FAQs)

1. What is Aevo Coin (AEVO)?

Aevo Coin (AEVO) is the native token of the Aevo decentralized derivatives exchange. The platform focuses on options, perpetual contracts, and pre-launch trading, operating on a custom Layer 2 (L2) solution built on Ethereum’s roll-up technology, specifically utilizing the Optimism stack. This infrastructure enables Aevo to process over 5,000 transactions per second and handle substantial trading volumes, enhancing the overall trading experience for users.

2. Who created Aevo Coin?

Aevo Coin was created by a team of experienced professionals in the finance and technology sectors. The founders are Julian Koh, Ken Chan, and Luís Felipe Carvalho, who collectively bring expertise in software engineering, computer science, and business management. Their background includes significant experience from well-known firms, including Coinbase and Goldman Sachs, which contributes to Aevo’s credibility and innovative capabilities in the decentralized finance (DeFi) space.

3. What makes Aevo Coin different from Bitcoin?

Aevo Coin differs from Bitcoin in several key aspects:

- Purpose: Bitcoin is primarily a digital currency aimed at being a decentralized store of value, while Aevo Coin is a utility token designed for use within a decentralized derivatives exchange, facilitating trading in options and perpetual contracts.

- Technology: Aevo operates on a Layer 2 solution using Ethereum’s roll-up technology, allowing for faster and cheaper transactions, whereas Bitcoin operates on its own blockchain with its own set of protocols.

- Functionality: Aevo enables advanced trading features such as options and derivatives, catering to traders looking for sophisticated financial instruments, while Bitcoin’s primary function is as a currency.

4. Is Aevo Coin a good investment?

As with any cryptocurrency investment, the decision to invest in Aevo Coin should be based on thorough research and an understanding of the market dynamics. Aevo has shown significant trading volume and infrastructure capabilities, but potential investors should consider factors such as market trends, the project’s development roadmap, team expertise, and their own risk tolerance. Always consult with a financial advisor before making investment decisions.

5. What are the real-world applications of Aevo Coin?

Aevo Coin’s primary application lies within the Aevo platform as a utility token for trading derivatives. Users can utilize AEVO to participate in various trading activities, including options and perpetual contracts, allowing them to hedge risks or speculate on market movements. The platform’s emphasis on pre-launch trading also offers users early access to new projects, which can be advantageous in the rapidly evolving crypto landscape.

6. What is the market performance of Aevo Coin?

As of now, Aevo Coin (AEVO) has a market capitalization of approximately $80.67 million, with a circulating supply of about 912.97 million AEVO tokens out of a total supply of 1 billion. The price of AEVO is currently around $0.08836, having experienced significant fluctuations since its all-time high of $3.86. Investors should keep an eye on market trends and trading volume, as these factors can influence the price and market dynamics of AEVO.

7. How does Aevo ensure security and transparency?

Aevo prioritizes security and transparency through its decentralized architecture built on Ethereum. By utilizing a hybrid model that combines an off-chain central limit order book with on-chain settlement via smart contracts, Aevo maintains a high level of security. This model minimizes risks associated with centralized exchanges while ensuring that all transactions are recorded on the blockchain, providing transparency and traceability.

8. What are the key features of Aevo’s trading platform?

Aevo’s trading platform boasts several key features:

- Hybrid Trading Model: Combines off-chain trade matching with on-chain settlement, ensuring low latency and high performance.

- High Transaction Throughput: Capable of processing over 5,000 transactions per second due to its Layer 2 solution.

- Focus on Derivatives: Specializes in options, perpetual contracts, and pre-launch trading, catering to both individual and institutional investors.

- Robust Infrastructure: Supports substantial trading volumes, having processed over $30 billion in transactions, indicating a strong user trust and engagement.

These features collectively create a seamless trading environment for users looking to engage in decentralized finance.

Final Verdict on aevo coin

Overview of Aevo Coin

Aevo Coin (AEVO) serves as the native token for Aevo, a decentralized derivatives exchange that specializes in options, perpetual contracts, and pre-launch trading. Built on a custom Layer 2 solution using Ethereum’s roll-up technology, Aevo is designed to handle high transaction volumes efficiently, boasting a capacity of over 5,000 transactions per second. This scalability positions Aevo favorably in the rapidly evolving decentralized finance (DeFi) landscape, catering to both retail and institutional investors seeking advanced trading tools.

Technological Edge

The innovative architecture of Aevo combines an off-chain central limit order book with on-chain settlement through Ethereum smart contracts. This hybrid model not only enhances trading speed and performance but also ensures the security and transparency that decentralized platforms are known for. Furthermore, Aevo’s backing by experienced developers from the successful Ribbon Finance project adds credibility and a wealth of expertise to its operations.

Investment Potential and Risks

While Aevo Coin has demonstrated significant trading volume and has the potential for substantial growth, it is essential to recognize that investing in cryptocurrencies, particularly in the DeFi sector, comes with inherent risks. The price of AEVO has experienced volatility, with an all-time high of $3.86 dropping significantly to its current trading price of approximately $0.08836. This fluctuation indicates the high-risk, high-reward nature of this asset class, making it critical for investors to approach with caution.

Final Thoughts

In conclusion, Aevo Coin represents a compelling opportunity for those interested in decentralized trading solutions. However, its potential for high returns is accompanied by considerable risks typical of the cryptocurrency market. Therefore, it is vital for potential investors to conduct thorough research (DYOR) and consider their risk tolerance before committing to any investments in Aevo or similar digital assets.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.