Should You Invest in sei crypto? A Full Analysis (2025)

An Investor’s Introduction to sei crypto

Sei is a cutting-edge Layer 1 blockchain specifically designed to enhance the functionality and performance of decentralized exchanges (DEXes). As the first sector-specific blockchain in this domain, Sei addresses the unique challenges faced by DEXes, which are critical to the cryptocurrency ecosystem. With a focus on reliability, speed, and scalability, Sei aims to provide a competitive advantage to exchanges, facilitating seamless trading experiences for users. Its architecture is built to handle high-frequency transactions efficiently, making it an attractive option for developers and financial institutions alike.

Significance in the Crypto Market

Sei’s emergence comes at a time when the demand for decentralized trading platforms is rapidly increasing. Traditional centralized exchanges often face issues related to security, downtime, and regulatory challenges. In contrast, Sei is engineered to mitigate these risks by offering unparalleled transaction speeds and low fees, essential for DEXes operating in a fast-paced market. The platform’s commitment to sustainability further aligns with the growing focus on environmental responsibility within the cryptocurrency space, appealing to a broader audience concerned with the ecological impact of blockchain technology.

Purpose of this Guide

This guide serves as a comprehensive resource for both beginners and intermediate investors looking to understand Sei crypto. It will cover various aspects of the Sei ecosystem, including:

-

Technology: A detailed overview of Sei’s underlying architecture, emphasizing its parallelized execution model and upcoming upgrades that promise to enhance transaction throughput significantly.

-

Tokenomics: Insight into the SEI token, its utility within the network, and how it supports governance, transaction fees, and staking mechanisms.

-

Investment Potential: Analysis of Sei’s market performance, historical price trends, and factors that could influence its future value.

-

Risks: An exploration of the potential risks associated with investing in Sei, including market volatility, competition from other blockchain platforms, and the regulatory landscape.

-

How to Buy: Practical guidance on acquiring SEI tokens, including a rundown of popular exchanges and wallet options.

By the end of this guide, readers will be equipped with a solid understanding of Sei crypto, enabling them to make informed decisions regarding their investment strategies in this promising blockchain project. Whether you are looking to invest or simply expand your knowledge of the cryptocurrency landscape, this guide aims to be your go-to resource for all things Sei.

What is sei crypto? A Deep Dive into its Purpose

Overview of Sei Crypto

Sei is a high-performance Layer 1 blockchain specifically designed to cater to the unique demands of decentralized exchanges (DEXes). As the first sector-specific Layer 1 blockchain, Sei aims to enhance the efficiency and reliability of trading processes within the cryptocurrency ecosystem. By leveraging innovative technology, Sei addresses the scalability, speed, and reliability issues that have historically plagued DEXes, providing a robust infrastructure for a variety of financial applications.

The Core Problem It Solves

Decentralized exchanges have become integral to the cryptocurrency landscape, enabling users to trade assets without intermediaries. However, these platforms often face significant challenges due to the limitations of existing blockchain infrastructures. Key issues include:

-

Scalability: Traditional blockchains struggle to handle high transaction volumes, leading to congestion and delays. This is particularly problematic for DEXes, which require swift transaction processing to facilitate real-time trading.

-

Reliability: DEXes operate in a highly competitive environment where even brief downtimes can result in substantial financial losses. The need for a reliable infrastructure is paramount, as traders demand uninterrupted access to trading platforms.

-

Transaction Speed: In the fast-paced world of trading, transaction speeds can make or break a trading opportunity. Existing solutions often fall short in delivering the rapid execution needed for high-frequency trading.

Sei addresses these challenges by utilizing a parallelized execution model, which allows for faster transaction processing and reduced latency. This architecture not only enhances scalability but also ensures that DEXes can operate efficiently without the risk of catastrophic downtimes.

Its Unique Selling Proposition

Sei’s unique selling proposition lies in its commitment to providing a tailored solution for DEXes and other trading applications. Key features that set Sei apart include:

-

Sector-Specific Layer 1 Blockchain: Sei is designed specifically for trading, making it the first blockchain to focus exclusively on the requirements of DEXes. This specialization allows it to offer performance optimizations that general-purpose blockchains cannot match.

-

Parallelized Execution: By employing parallelized execution, Sei can process thousands of transactions simultaneously, significantly increasing throughput and reducing transaction times. This feature is particularly beneficial for high-frequency trading applications, where speed is crucial.

-

Ethereum Compatibility: Sei maintains full compatibility with the Ethereum Virtual Machine (EVM), allowing developers to deploy existing Ethereum-based applications seamlessly on the Sei network. This compatibility not only facilitates easy migration but also opens up a broader ecosystem for developers.

-

Focus on Sustainability: Sei is committed to achieving carbon neutrality in its operations, reflecting a growing trend in the cryptocurrency industry towards environmental responsibility. This focus on sustainability may appeal to environmentally conscious investors and users.

-

Community-Driven Governance: Sei employs a governance model that allows token holders to participate in decision-making processes, ensuring that the platform remains responsive to the needs and concerns of its user base.

The Team and Backers

The founding team of Sei consists of Dan Edlebeck and Jayendra Jog, both of whom bring extensive experience in the cryptocurrency and technology sectors. Their vision for Sei stemmed from recognizing the critical gaps in the existing blockchain infrastructure, particularly regarding DEXes. By focusing on the unique requirements of trading platforms, they have aimed to create a solution that enhances the reliability and efficiency of decentralized trading.

Sei has garnered support from notable investors and institutions, including Coinbase Ventures and Multicoin Capital. These endorsements not only enhance the project’s credibility but also provide access to valuable resources and networks that can accelerate its growth and development.

Fundamental Purpose in the Crypto Ecosystem

Sei’s primary purpose is to serve as a foundational layer for a wide array of financial applications, particularly in the realm of decentralized finance (DeFi). By offering a specialized blockchain that prioritizes trading, Sei aims to empower DEXes and facilitate the development of innovative financial products, such as derivatives and complex financial instruments.

Sei’s architecture is designed to meet the high demands of trading platforms, addressing common challenges faced by DEXes on other Layer 1 blockchains. This specialization not only enhances the performance of trading applications but also creates a vibrant ecosystem for developers and financial institutions seeking a robust platform for trading, lending, and other financial activities.

Moreover, Sei’s commitment to community engagement and transparent governance fosters a collaborative environment that encourages innovation and growth. By supporting promising founders and projects within the crypto space, Sei aims to contribute to the broader development of the blockchain ecosystem.

In summary, Sei is poised to play a pivotal role in the evolution of decentralized exchanges and the broader DeFi landscape. By addressing the unique challenges faced by DEXes and providing a high-performance blockchain tailored for trading, Sei aims to enhance the efficiency, reliability, and accessibility of cryptocurrency trading, ultimately driving greater adoption and utility of digital assets.

The Technology Behind the Coin: How It Works

Overview of Sei Crypto

Sei is an innovative Layer 1 blockchain designed specifically for decentralized exchanges (DEXes). With a focus on scalability, speed, and efficiency, Sei aims to address the unique challenges faced by trading platforms in the cryptocurrency space. By leveraging advanced technology and a specialized architecture, Sei positions itself as a leader in the growing decentralized finance (DeFi) ecosystem. In this section, we will explore the foundational technologies that make Sei unique, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Sei’s blockchain architecture is a critical aspect of its performance and functionality. Unlike traditional blockchains that operate on a general-purpose framework, Sei is the first sector-specific Layer 1 blockchain tailored for trading applications. This specialization allows Sei to optimize its infrastructure for the high demands of DEXes, ensuring that transactions are processed quickly and reliably.

Parallelized Execution

One of the standout features of Sei’s architecture is its parallelized execution capability. In conventional blockchains, transactions are processed sequentially, which can create bottlenecks and slow down the network, especially during peak usage times. Sei addresses this limitation by allowing multiple transactions to be processed simultaneously. This parallel execution significantly enhances throughput, enabling Sei to handle thousands of transactions per second and achieve settlement times as low as 400 milliseconds.

Ethereum Compatibility

Sei maintains full compatibility with the Ethereum Virtual Machine (EVM), making it easier for developers to port existing Ethereum applications to the Sei blockchain. This compatibility is crucial because it allows a broader range of decentralized applications (dApps) to be built on Sei without needing extensive rewrites or modifications. As a result, developers can leverage Sei’s performance benefits while still utilizing familiar tools and programming languages.

Consensus Mechanism

The consensus mechanism is a fundamental component of any blockchain, determining how transactions are validated and added to the blockchain. Sei employs a unique consensus model designed to enhance both security and performance.

Proof of Stake (PoS)

Sei utilizes a Proof of Stake (PoS) consensus mechanism, where validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This approach contrasts with Proof of Work (PoW) systems, which require extensive computational resources and energy consumption. PoS is inherently more energy-efficient and allows for faster transaction confirmations.

Validator Selection

In Sei’s PoS system, validators are selected through a randomized process, ensuring that no single entity can dominate the network. This randomness helps maintain decentralization and security, as a diverse group of validators is responsible for transaction validation. Moreover, validators are incentivized to act honestly; if they attempt to manipulate the system, they risk losing their staked tokens.

Key Technological Innovations

Sei integrates several technological innovations that enhance its overall performance and user experience. These innovations are designed to overcome common challenges faced by traditional blockchains, especially in the context of DEXes.

Giga Upgrade

One of Sei’s most anticipated upgrades is the Giga upgrade, which promises to deliver a 50x improvement in EVM throughput. This upgrade focuses on optimizing three key areas: execution, consensus, and storage. By enhancing these components, Sei aims to push blockchain performance to levels comparable to Web 2.0 applications, making it capable of supporting high-frequency trading and other demanding financial applications.

Low Transaction Fees

Sei’s architecture is designed to minimize transaction costs, which is crucial for users engaged in frequent trading activities. By optimizing the execution of transactions, Sei can offer low fees, making it an attractive option for traders who wish to maximize their profits. Low fees also encourage greater participation in the network, fostering a vibrant ecosystem of users and developers.

Enhanced Security Protocols

Sei prioritizes security by incorporating advanced technology and stringent security protocols. The blockchain’s infrastructure is built on proven, battle-tested components that ensure a secure environment for transactions. Additionally, Sei’s governance model emphasizes transparency and community involvement, allowing users to participate in decision-making processes that shape the network’s future.

Utility and Applications

Sei’s technology is not just about speed and efficiency; it also facilitates a wide range of applications within the DeFi ecosystem. By providing a robust and scalable foundation, Sei supports the development of innovative financial products, including derivatives, asset management solutions, and complex trading instruments.

Decentralized Exchanges (DEXes)

As a sector-specific blockchain, Sei is particularly well-suited for DEXes, which require high reliability and speed for trading operations. By offering unparalleled transaction speeds and low fees, Sei empowers DEXes to operate efficiently, providing users with a seamless trading experience. This capability is essential in a market where even brief downtimes can lead to significant losses.

Native Governance Token

Sei has a native governance token that plays a critical role in the ecosystem. Token holders can participate in governance decisions, stake their tokens for rewards, and pay transaction fees. This governance aspect ensures that the community has a voice in the development and direction of the network, fostering a collaborative environment.

Conclusion

Sei is revolutionizing the blockchain landscape with its specialized architecture, innovative technology, and commitment to decentralization. By addressing the unique challenges faced by decentralized exchanges, Sei provides a robust and efficient platform for trading and financial applications. Its use of parallelized execution, a PoS consensus mechanism, and ongoing upgrades position Sei as a leader in the DeFi space. As the cryptocurrency ecosystem continues to evolve, Sei’s advancements will likely play a crucial role in shaping the future of decentralized finance.

For both beginners and experienced investors, understanding the technology behind Sei is essential to grasp its potential and the opportunities it presents within the rapidly changing world of cryptocurrencies.

Understanding sei crypto Tokenomics

Key Metrics of Sei Tokenomics

To understand the tokenomics of Sei (SEI), it’s essential to look at several key metrics that define its economic structure. Below is a summary of these metrics:

| Metric | Value |

|---|---|

| Total Supply | 10,000,000,000 SEI |

| Max Supply | Not Specified |

| Circulating Supply | 6,000,000,000 SEI |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The Sei token (SEI) serves multiple critical functions within the Sei ecosystem, primarily designed to enhance the performance of decentralized exchanges (DEXes) and other trading applications. Here’s a breakdown of the main utilities of the SEI token:

-

Transaction Fees: SEI tokens are used to pay for transaction fees on the Sei network. This is a common utility among cryptocurrencies, where the token is required to facilitate various operations on the blockchain. By using SEI for transaction fees, users contribute to the network’s maintenance and security.

-

Staking: Token holders can stake their SEI tokens to participate in the network’s proof-of-stake (PoS) mechanism. Staking not only helps secure the network but also allows participants to earn rewards. This creates an incentive for users to hold their tokens rather than sell them, potentially reducing the circulating supply and increasing demand.

-

Governance: SEI token holders have the power to participate in the governance of the Sei network. This means they can vote on important decisions, such as protocol upgrades or changes to the economic model. This democratic approach empowers the community and ensures that the platform evolves in a way that reflects the interests of its users.

-

Access to Financial Products: Sei aims to be a foundational layer for various financial applications, including derivatives and asset management solutions. Holding SEI tokens may provide users access to these innovative financial products, enhancing its utility within the DeFi (Decentralized Finance) ecosystem.

-

Incentives for Developers: The Sei platform encourages developers to build on its blockchain by offering incentives in SEI tokens. This strategy not only boosts the ecosystem’s growth but also leads to the creation of diverse applications that can leverage Sei’s high-performance capabilities.

-

Participation in Ecosystem Growth: By holding and using SEI tokens, participants can engage in various ecosystem initiatives, such as liquidity mining or yield farming, which further enhances their investment in the Sei platform.

Token Distribution

The distribution of SEI tokens is a crucial aspect of its tokenomics, affecting its market dynamics and community engagement. Here’s an overview of how SEI tokens are distributed:

-

Initial Distribution: SEI tokens were initially distributed through a combination of private sales, public sales, and community airdrops. These methods help ensure a broad distribution of tokens among various stakeholders, including early investors, developers, and users.

-

Airdrops: Airdrops have been an effective strategy for Sei to increase user engagement and adoption. By distributing tokens to potential users, Sei incentivizes participation in its ecosystem and encourages users to explore its functionalities.

-

Developer and Community Incentives: A portion of the total supply is allocated for developer incentives and community-building initiatives. This allocation aims to foster innovation and ensure that the platform attracts a vibrant community of builders and users.

-

Vesting Periods: To prevent market flooding and ensure long-term commitment, SEI tokens allocated to team members, advisors, and early investors typically have vesting periods. This means that these stakeholders cannot sell all their tokens immediately, which helps stabilize the token’s price in the early stages of the network’s life.

-

Ecosystem Growth Fund: Sei has established a fund dedicated to supporting projects and initiatives within its ecosystem. This fund is used to incentivize new projects, partnerships, and collaborations that can enhance the Sei platform’s capabilities and user experience.

-

Market Dynamics: The circulating supply of SEI is currently 6 billion tokens, with a total supply capped at 10 billion. The difference between circulating and total supply indicates that there are still tokens to be released into the market, which can impact the token’s price and availability. Additionally, a deflationary model is employed, which means that mechanisms may be in place to reduce the overall supply over time, potentially increasing the value of the remaining tokens.

Conclusion

Understanding the tokenomics of Sei is vital for anyone looking to invest in or utilize this cryptocurrency. With a clear utility model, a structured distribution plan, and a focus on community engagement, Sei aims to establish itself as a leading platform for decentralized trading. As always, potential investors should conduct their own research and consider the risks involved in engaging with any cryptocurrency.

Price History and Market Performance

Key Historical Price Milestones

Sei (SEI) has experienced significant price fluctuations since its inception, reflecting both the inherent volatility of the cryptocurrency market and the unique developments surrounding the Sei blockchain itself.

-

Launch and Early Days: Sei was launched in August 2023, with an initial price of approximately $0.007989. This price marked its all-time low, and the project began to gain traction as it attracted attention for its specialized capabilities in facilitating decentralized exchanges (DEXes).

-

Initial Growth Phase: As the Sei ecosystem expanded, the price began to rise, reaching $0.2953 by late 2023. This early phase of growth can be attributed to increased interest in Layer 1 blockchains that prioritize speed and efficiency, particularly for trading applications.

-

All-Time High: Sei reached its all-time high of $1.14 on March 16, 2024. This significant milestone reflected a broader market uptrend in cryptocurrencies and growing recognition of Sei’s potential as a sector-specific solution for DEXes. The surge in price was likely fueled by heightened trading volumes and strategic partnerships that bolstered the platform’s credibility.

-

Current Price Trends: As of now, Sei’s price is approximately $0.2953, representing a 74.13% decline from its all-time high. This decline highlights the typical volatility seen in the cryptocurrency market, where prices can fluctuate dramatically in response to market sentiment, regulatory news, and technological advancements.

Factors Influencing the Price

Historically, the price of Sei has been influenced by a variety of factors that encompass both market dynamics and project-specific developments.

-

Market Sentiment and Trends: Like many cryptocurrencies, Sei’s price has been significantly impacted by overall market sentiment. Periods of bullish sentiment across the broader cryptocurrency market have led to increased investment in Sei, while bearish trends have resulted in price declines. Events such as Bitcoin’s price movements often set the tone for the overall market, impacting altcoins like Sei.

-

Technological Developments: The Sei blockchain’s unique technological features, including its parallelized execution and focus on DEX performance, have played a crucial role in shaping investor interest. Major upgrades, such as the anticipated Giga upgrade, which promises to enhance transaction speeds and throughput, have historically generated excitement and speculation, often leading to price increases.

-

Adoption and Use Cases: The practical use cases of Sei in the DeFi sector, especially its role in facilitating fast and reliable trades on DEXes, have influenced its market value. As more projects and applications choose to build on the Sei blockchain, the demand for SEI tokens has correspondingly increased, driving up its price.

-

Partnerships and Collaborations: Strategic partnerships have also been a significant factor in Sei’s market performance. Collaborations with established entities in the crypto space, such as Coinbase Ventures and Multicoin, have not only validated Sei’s potential but have also attracted additional investment and user interest. Each successful partnership has historically contributed to positive price movements.

-

Community Engagement: The establishment of the Sei Marines community and other initiatives aimed at fostering user engagement have played a role in building a loyal user base. Community-driven projects often lead to increased visibility and interest, positively impacting the token’s price.

-

Market Conditions and Economic Factors: Broader economic conditions, including regulatory developments and macroeconomic trends, have had a profound impact on Sei’s price. Regulatory news affecting the cryptocurrency market can lead to increased volatility, influencing investor confidence and trading activity.

-

Tokenomics and Supply Dynamics: Sei’s tokenomics, including its total supply of 10 billion SEI tokens and a circulating supply of around 6 billion, are important considerations for investors. The balance between supply and demand is critical, as any changes in circulating supply, such as token unlocks or airdrops, can lead to price fluctuations.

Conclusion

In summary, Sei’s price history reflects a complex interplay of market sentiment, technological advancements, strategic partnerships, and community engagement. The cryptocurrency’s journey from its all-time low to significant peaks underscores the volatility inherent in the digital asset space. Investors looking to understand Sei should consider these historical price milestones and the various factors that have influenced its market performance to make informed decisions. As the Sei ecosystem continues to evolve, its historical context will provide valuable insights into its future trajectory.

Where to Buy sei crypto: Top Exchanges Reviewed

1. ChangeNOW – Best for Seamless SEI Trading!

ChangeNOW stands out as a premier platform for exchanging SEI, offering competitive pricing and a user-friendly interface. With a commendable rating of 4.8 based on over 2,166 reviews, it provides real-time market data, including live charts and market cap insights, ensuring users are well-informed. The platform also features a free service model, making it an attractive option for both novice and experienced traders looking to buy or sell SEI efficiently.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

1. Sei Exchange – Top Choice for Low-Cost SEI Swaps!

Sei Exchange, powered by Changelly, offers a standout platform for trading Sei (SEI) with some of the lowest fees in the market. With a user-friendly interface available on both web and iOS, it allows for swift exchanges among over 700 cryptocurrencies. Users benefit from 24/7 live support and competitive rates, making it an attractive choice for both novice and experienced traders seeking efficiency and affordability in their transactions.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

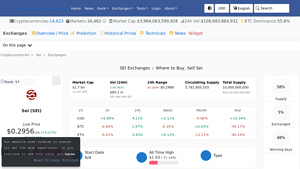

5. Sei (SEI) – Your Gateway to Next-Gen Trading!

Sei (SEI) stands out in the cryptocurrency market due to its availability on over 41 exchanges, with leading platforms like Binance, Gate, and Phemex facilitating trading. This extensive access allows users to buy, sell, and trade Sei with a variety of trading pairs, including popular options such as USDT, USDC, and BTC. The diverse exchange options enhance liquidity and provide flexibility for both novice and seasoned traders.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Coinbase – Easiest Way to Buy Sei (SEI) in the U.S.!

Coinbase stands out as a premier platform for purchasing Sei (SEI) in the United States due to its reputation for security and user-friendly interface. As a centralized exchange, it offers a reliable environment for both individuals and businesses to buy, sell, and manage their Sei assets. With robust regulatory compliance and a strong commitment to customer support, Coinbase ensures a seamless experience for users navigating the world of cryptocurrency.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

3. Sei Exchange – Unleash Your Trading Potential!

Sei Exchange, rated 4.7 based on 153 reviews, stands out for its fast and secure trading environment, allowing users to exchange SEI for other cryptocurrencies at competitive rates. Integrated with Swapzone, it offers a user-friendly interface and efficient transaction processes, making it an appealing choice for both novice and experienced traders looking to optimize their crypto portfolio with minimal hassle.

- Website: swapzone.io

- Platform Age: Approx. 6 years (domain registered in 2019)

How to Buy sei crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Sei (SEI) is selecting a cryptocurrency exchange that supports SEI trading. Popular exchanges where you can buy Sei include:

- Binance: One of the largest cryptocurrency exchanges globally, Binance offers a wide range of trading pairs and features.

- Coinbase: Known for its user-friendly interface, Coinbase is a great option for beginners.

- Bybit: This exchange has gained popularity for its derivatives trading and supports SEI.

- KuCoin: KuCoin is another well-known exchange that lists a variety of altcoins, including SEI.

When choosing an exchange, consider factors such as:

- Fees: Look for exchanges with competitive trading fees.

- Security: Ensure the exchange has a good reputation and robust security measures.

- Liquidity: Higher liquidity can lead to better prices and faster transactions.

- User Experience: A user-friendly interface can make the buying process smoother.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how to do it:

- Visit the Exchange Website: Go to the homepage of the chosen exchange.

- Sign Up: Click on the “Sign Up” or “Register” button. You will be prompted to enter your email address and create a password.

- Email Verification: After signing up, check your email for a verification link. Click on it to verify your email address.

- Identity Verification: Most exchanges require identity verification to comply with regulations. You may need to provide personal information such as your name, address, and date of birth, as well as upload identification documents (like a passport or driver’s license).

- Two-Factor Authentication (2FA): Enable 2FA for added security. This typically involves linking your account to an authentication app on your smartphone.

3. Deposit Funds

After your account is verified, the next step is to deposit funds:

- Log into Your Account: Use your credentials to access your account.

- Go to the Deposit Section: Look for an option labeled “Deposit” or “Funds.”

- Choose Your Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency. Choose the method that suits you best.

- Follow Instructions: Each deposit method will have specific instructions. For bank transfers, you may need to provide your bank details, while card payments will require card information.

- Confirm the Deposit: Once you enter the required information, confirm the deposit. Depending on the method, it may take some time for funds to appear in your account.

4. Place an Order to Buy Sei Crypto

With funds in your account, you can now purchase Sei:

- Navigate to the Trading Section: Look for a “Markets” or “Trade” tab on the exchange.

- Find SEI: Search for Sei (SEI) in the trading pairs. You might see it listed as SEI/USD, SEI/BTC, or similar.

- Select Order Type: Choose between different order types:

– Market Order: Buys SEI at the current market price.

– Limit Order: Sets a specific price at which you want to buy SEI. The order will only execute if the price reaches your specified limit. - Enter the Amount: Specify how much SEI you want to buy.

- Review and Confirm: Double-check the order details and confirm the purchase. The SEI will be added to your exchange wallet upon completion of the transaction.

5. Secure Your Coins in a Wallet

After purchasing Sei, it’s crucial to keep your coins safe:

- Choose a Wallet: There are several types of wallets available:

– Software Wallets: Applications or software that store your cryptocurrency. Examples include Exodus and Atomic Wallet.

– Hardware Wallets: Physical devices that store your cryptocurrency offline, such as Ledger or Trezor. They provide enhanced security.

– Paper Wallets: Physical printouts of your private keys and QR codes. While secure, they require careful handling. - Transfer SEI to Your Wallet: If using a software or hardware wallet, you need to transfer your SEI from the exchange:

– Go to your wallet and select the option to receive SEI.

– Copy the wallet address.

– Go back to the exchange, navigate to your SEI holdings, and select the option to withdraw.

– Paste your wallet address and confirm the transfer. - Confirm the Transfer: After a short period, check your wallet to ensure that the SEI coins have been successfully transferred.

By following these steps, you can safely buy and store Sei cryptocurrency, allowing you to participate in its growing ecosystem. Always remember to conduct thorough research and only invest what you can afford to lose.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Technology and Performance

Sei distinguishes itself as a high-performance Layer 1 blockchain specifically designed to cater to decentralized exchanges (DEXes). Its unique architecture employs parallelized execution, allowing for faster transaction processing times, lower fees, and seamless smart contract deployment. This technological edge addresses some of the most pressing challenges faced by DEXes, such as reliability and speed. With the upcoming Giga upgrade promising to enhance EVM throughput by 50x, Sei aims to push blockchain performance to levels comparable to traditional web applications, potentially attracting a wider array of users and developers.

Growing Demand for Decentralized Finance

The rise of decentralized finance (DeFi) has created a robust market for platforms that facilitate trading, lending, and asset management without intermediaries. Sei’s specialized focus on DEXes positions it well to capitalize on this trend. As more users seek efficient, cost-effective trading solutions, Sei’s ability to provide a dedicated infrastructure for DEXes could enhance its market adoption and overall value. The increasing integration of cryptocurrencies into mainstream finance further supports the potential for Sei to grow as a key player in the DeFi space.

Strong Community and Ecosystem Support

Sei’s commitment to community engagement is evidenced by initiatives like the Sei Marines community and active participation in blockchain events. Such efforts foster a loyal user base and encourage collaboration among developers, enhancing the overall ecosystem. Partnerships with established entities within the cryptocurrency space, such as Coinbase Ventures and Multicoin, also lend credibility to Sei’s vision and can attract further investment and innovation.

Governance and Utility of SEI Token

The SEI token plays a crucial role in the Sei ecosystem, enabling users to participate in governance, pay transaction fees, and engage in staking. This multifaceted utility can drive demand for the token as the network grows and matures. A governance model that involves the community not only empowers users but also aligns their interests with the platform’s success, potentially leading to increased user retention and engagement.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Cryptocurrencies are notoriously volatile, and Sei is no exception. Price fluctuations can be extreme, driven by market sentiment, regulatory news, and macroeconomic factors. For investors, this volatility poses a risk to capital, as the value of SEI tokens can rise or fall dramatically within short time frames. Such price movements can deter potential investors, especially those with a low-risk appetite, and may lead to speculative trading rather than long-term investment.

Regulatory Uncertainty

The regulatory environment for cryptocurrencies remains fluid and uncertain across many jurisdictions. Changes in regulations can have profound impacts on the operations of blockchain projects, including Sei. For instance, stricter regulations on DEXes could limit their functionality or impose additional compliance requirements, potentially hampering Sei’s growth and adoption. Furthermore, regulatory scrutiny can also affect investor confidence, leading to increased market volatility.

Intense Competition

The blockchain space is highly competitive, with numerous Layer 1 blockchains vying for market share. Established platforms like Ethereum, Binance Smart Chain, and newer entrants like Solana and Avalanche pose significant competition to Sei. These platforms also have robust ecosystems and developer communities, which can be challenging for Sei to compete against. If Sei cannot differentiate itself sufficiently or capture a significant user base, it risks falling behind in an increasingly crowded market.

Technological Risks

While Sei’s innovative technology presents potential advantages, it also comes with inherent risks. The complexity of its architecture and the reliance on advanced features like parallelized execution may introduce vulnerabilities that could be exploited. Additionally, any technical glitches or security breaches could undermine user trust and lead to significant financial losses. As Sei continues to evolve, the need for rigorous testing, audits, and updates will be critical to maintaining its integrity and performance.

Adoption and Network Effects

The success of any blockchain project is often tied to its adoption rates and the network effects that come with a growing user base. Sei needs to attract not only individual traders but also developers and financial institutions to build on its platform. Without a critical mass of users, the value proposition of Sei could diminish, as liquidity and trading volume are vital for DEXes to function effectively. Additionally, if competing platforms succeed in attracting developers and users, Sei may struggle to establish itself as a go-to solution for trading.

Conclusion

Investing in Sei presents both intriguing opportunities and significant risks. Its focus on high-performance solutions for DEXes, combined with a supportive community and innovative technology, positions it as a noteworthy contender in the blockchain landscape. However, investors must also consider the volatility of the cryptocurrency market, regulatory uncertainties, intense competition, and potential technological challenges.

As always, conducting thorough research and understanding the dynamics of the cryptocurrency market is essential before making any investment decisions. Whether Sei ultimately fulfills its potential will depend on its ability to navigate these challenges while capitalizing on the growing demand for decentralized financial solutions.

Frequently Asked Questions (FAQs)

1. What is Sei Crypto (SEI)?

Sei Crypto (SEI) is a high-performance Layer 1 blockchain specifically designed to enhance the functionality and efficiency of decentralized exchanges (DEXes). It aims to solve common issues faced by DEXes, such as scalability, transaction speed, and reliability, by utilizing a parallelized execution model that allows for faster transactions and lower fees. Sei is notable for being the first sector-specific Layer 1 blockchain tailored for trading applications, which includes not only cryptocurrency exchanges but also platforms for NFTs and in-game items.

2. Who created Sei Crypto?

Sei Crypto was co-founded by Dan Edlebeck and Jayendra Jog. Both founders recognized the unique challenges that decentralized exchanges face in terms of reliability and scalability. They aimed to create a specialized blockchain infrastructure that caters to the high demands of trading platforms, ensuring that DEXes can operate smoothly and efficiently without the risk of catastrophic downtimes.

3. What makes Sei Crypto different from Bitcoin?

Sei Crypto and Bitcoin serve different purposes within the cryptocurrency ecosystem. Bitcoin is primarily a digital currency designed for peer-to-peer transactions and as a store of value. In contrast, Sei is a specialized Layer 1 blockchain optimized for high-frequency trading and decentralized exchanges. Sei focuses on enhancing transaction speeds and reducing fees, which are critical for trading applications, whereas Bitcoin prioritizes security and decentralization as a medium of exchange.

4. Is Sei Crypto a good investment?

As with any investment, whether Sei Crypto is a good choice depends on various factors, including market conditions, technological advancements, and individual risk tolerance. Sei’s focus on decentralized exchanges and its unique technological architecture may provide growth opportunities, especially as the DeFi sector continues to expand. However, potential investors should conduct thorough research, analyze market trends, and consider the inherent risks associated with investing in cryptocurrencies before making decisions.

5. How is Sei secured?

Sei employs a multifaceted security approach, leveraging a specialized Layer 1 blockchain architecture that caters to the unique needs of DEXes. This design enhances transaction speeds and reliability, crucial for trading operations. Additionally, Sei implements proven security protocols and fosters community involvement in governance, ensuring transparency and responsiveness to user concerns. The platform’s infrastructure is built on battle-tested components, further solidifying its security profile.

6. What are the main use cases of Sei Crypto?

Sei Crypto is designed to facilitate a wide range of financial applications, particularly in the decentralized finance (DeFi) sector. Its primary use cases include the development of innovative financial products like derivatives, asset management solutions, and lending platforms. Moreover, Sei’s native governance token allows users to participate in transaction fee payments and influence network governance decisions, thereby fostering a community-driven ecosystem.

7. What recent developments have occurred with Sei Crypto?

Sei Crypto has seen several significant developments, including the establishment of the Sei Marines community, which promotes user engagement and collaboration. The platform also underwent a major technical upgrade with Sei v2, enhancing scalability, speed, and security. Additionally, Sei has formed strategic partnerships and received recognition from notable institutions, underscoring its potential within the cryptocurrency landscape. The upcoming Giga upgrade aims to further optimize its performance, pushing EVM throughput to new levels.

8. How can I buy Sei Crypto?

Sei Crypto can be purchased through various cryptocurrency exchanges that support SEI trading pairs. Users should create an account on a reputable exchange, complete any necessary verification processes, and deposit funds. Once the account is funded, users can trade their fiat currency or other cryptocurrencies for SEI. It’s crucial to conduct due diligence on the exchange’s security measures and fees before proceeding with any transactions.

Final Verdict on sei crypto

Overview of Sei Crypto

Sei is a pioneering Layer 1 blockchain specifically designed to enhance the functionality and performance of decentralized exchanges (DEXes). It employs a unique approach to parallelized execution that significantly boosts transaction speeds, reduces costs, and enables seamless smart contract deployment. The platform is built to cater to the high demands of trading applications, which are crucial for the broader cryptocurrency ecosystem. With a market capitalization of approximately $1.77 billion and a circulating supply of around 6 billion SEI tokens, Sei is positioned as a significant player in the crypto market.

Technological Advancements

The Sei blockchain leverages advanced technology to address the scalability and reliability challenges faced by traditional DEXes. Its upcoming Giga upgrade promises a remarkable 50x improvement in transaction throughput, pushing blockchain performance to levels comparable to Web 2.0 applications. This commitment to innovation not only enhances user experience but also strengthens Sei’s competitive edge in the market.

Investment Potential and Risks

While Sei presents a compelling case for investment due to its technological advancements and strategic focus on the high-frequency trading sector, it is essential to recognize the inherent risks associated with cryptocurrencies. The digital asset market is notoriously volatile, and Sei is no exception. Its price history, with significant fluctuations from an all-time low of $0.007989 to a recent high of $1.14, underscores the potential for both substantial gains and losses.

Final Thoughts

In conclusion, Sei represents an innovative and ambitious project within the cryptocurrency landscape, targeting the pressing needs of decentralized trading platforms. However, as with any investment in the digital asset space, potential investors should approach with caution. Conducting thorough research (DYOR) is crucial to understanding the complexities of the Sei ecosystem and evaluating whether it aligns with your investment strategy and risk tolerance.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.