What is pepe crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to pepe crypto

Pepe (PEPE) is a notable player in the vibrant and often whimsical world of cryptocurrency, specifically categorized as a memecoin. Launched in 2023, it pays homage to the popular Pepe the Frog internet meme, which has been a significant part of online culture since the early 2000s. Despite its humorous origins, Pepe has quickly gained traction among investors and the crypto community, establishing itself as one of the leading memecoins on the Ethereum blockchain. Its rise in popularity is emblematic of the broader trend where meme-based cryptocurrencies have captured the imagination of both seasoned traders and newcomers alike.

One of the defining characteristics of Pepe is its deflationary model, designed to reward long-term holders through a redistribution system. This system not only incentivizes users to hold onto their tokens but also features a burning mechanism that reduces the circulating supply over time, fostering scarcity. With its current market capitalization exceeding $4 billion and a trading volume that fluctuates in the hundreds of millions, Pepe stands as a testament to the potential of meme coins to generate significant interest and investment.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Pepe. It will delve into various aspects of the cryptocurrency, including its underlying technology, tokenomics, investment potential, and associated risks. Understanding these elements is crucial for anyone considering adding Pepe to their digital asset portfolio.

Purpose of This Guide

-

Technology Overview: We will explore how Pepe operates on the Ethereum blockchain as an ERC-20 token, utilizing the Proof-of-Stake (PoS) consensus mechanism to ensure network security and transaction processing.

-

Tokenomics: An in-depth look at the supply dynamics of Pepe, including its total supply of 420 trillion tokens, its burning mechanism, and the impact of its redistribution system on long-term value.

-

Investment Potential: We will analyze Pepe’s market performance, historical price movements, and factors that could influence its future growth, helping investors assess whether it aligns with their investment strategies.

-

Risks: The volatility of memecoins and the speculative nature of their investments will be discussed to provide a balanced view of the potential downsides associated with investing in Pepe.

-

How to Buy: Finally, we will guide readers through the process of acquiring Pepe, including the exchanges where it is traded and the necessary steps to make a purchase.

By the end of this guide, readers will have a solid understanding of Pepe and be equipped to make informed decisions about their involvement with this intriguing cryptocurrency.

What is pepe crypto? A Deep Dive into its Purpose

Introduction to Pepe Crypto

Pepe (PEPE) is a cryptocurrency that operates on the Ethereum blockchain and is classified as a memecoin. It was launched in 2023 as a tribute to the Pepe the Frog internet meme, which has been a significant part of internet culture since its inception in the early 2000s. The project aims to capitalize on the popularity of meme coins, drawing inspiration from successful predecessors like Dogecoin and Shiba Inu.

Pepe is designed to be a fun and engaging digital asset that appeals to a broad audience, particularly those familiar with internet memes. The project emphasizes a no-tax policy and openly acknowledges its lack of utility beyond being a memecoin, making it an attractive option for those looking to participate in the meme coin phenomenon without the complexities often associated with other cryptocurrencies.

The Core Problem It Solves

The primary problem that Pepe aims to address is the demand for accessible and entertaining digital assets within the cryptocurrency space. While many cryptocurrencies focus on providing utility through smart contracts or financial services, memecoins like Pepe serve a different purpose: they create a sense of community and engagement among investors and enthusiasts.

By leveraging the popularity of a well-known meme, Pepe provides a platform for users to engage with the cryptocurrency market in a lighthearted manner. This is particularly appealing to newcomers who may be intimidated by the technical aspects of investing in more traditional cryptocurrencies. The simplicity and fun associated with Pepe help lower the barrier to entry, inviting a broader audience into the world of digital assets.

Additionally, Pepe incorporates a redistribution system that rewards long-term holders, addressing the issue of volatility that often plagues cryptocurrencies. By incentivizing users to hold onto their tokens rather than sell them quickly, Pepe aims to create a more stable and committed community. This approach not only encourages investment but also enhances the overall market perception of the token.

Its Unique Selling Proposition

Pepe’s unique selling proposition lies in its combination of a well-recognized meme, a straightforward investment model, and community engagement. Here are several key aspects that set it apart:

-

Memetic Appeal: The Pepe the Frog character is iconic and has a long history in meme culture. This cultural resonance allows Pepe to attract a dedicated following, as many investors are drawn to projects that resonate with their interests and identities.

-

No-Tax Policy: The project’s commitment to a no-tax policy simplifies transactions for users, making it easier to buy, sell, and trade PEPE without the worry of additional fees. This transparency is appealing to investors who prefer straightforward investment opportunities.

-

Deflationary Mechanism: Pepe employs a burning mechanism, where a portion of coins is permanently removed from circulation on a regular basis. This approach aims to maintain scarcity, potentially increasing the value of the remaining tokens over time. Coupled with its redistribution system, this encourages long-term holding and reduces selling pressure.

-

Community Focus: By fostering an active community through social media engagement and meme-based marketing, Pepe emphasizes the importance of community involvement. This creates a sense of belonging among holders, which is essential for the success of any memecoin.

-

Transparency: The team behind Pepe has been upfront about the project’s lack of utility, which is a refreshing approach in an industry often filled with overly ambitious promises. This transparency helps manage investor expectations and builds trust within the community.

The Team and Backers

One of the distinctive features of Pepe is the anonymity of its founders. While this is not uncommon in the cryptocurrency space, it has led to a mix of skepticism and intrigue among potential investors. The lack of identifiable team members raises questions about accountability and the long-term vision of the project.

Despite the anonymity, the project has successfully garnered attention and built a community around it. The founders have utilized social media platforms like Twitter to promote Pepe, engaging users through memes, contests, and community-driven initiatives. This grassroots marketing strategy has proven effective in attracting investors and keeping the community active.

The project does not have traditional backers or venture capital support, which can be both a risk and a benefit. On one hand, the absence of external funding can lead to greater independence and flexibility in decision-making. On the other hand, it raises concerns about the project’s sustainability and long-term viability. Investors should be aware of these factors and conduct thorough research before committing to any investment.

Fundamental Purpose in the Crypto Ecosystem

Pepe serves a unique purpose within the broader cryptocurrency ecosystem. As a memecoin, its primary function is not to solve complex problems or provide groundbreaking technology but rather to create a fun and engaging experience for users. It caters to a demographic that values entertainment and community over utility, which is a refreshing contrast to many other cryptocurrencies.

Moreover, Pepe contributes to the ongoing discourse around the value of memes and cultural phenomena in the digital economy. It reinforces the idea that cryptocurrencies can thrive on community support and cultural relevance, rather than solely on technological innovation or financial utility.

In conclusion, Pepe (PEPE) stands out in the crowded cryptocurrency market as a memecoin that emphasizes community, engagement, and cultural relevance. Its straightforward approach, coupled with its unique branding and marketing strategy, makes it an appealing option for both novice and experienced investors looking to explore the lighter side of cryptocurrency. As the market continues to evolve, Pepe’s role as a fun and interactive digital asset will likely resonate with a diverse audience, contributing to the ongoing growth of the memecoin sector.

The Technology Behind the Coin: How It Works

Introduction to Pepe Crypto

Pepe (PEPE) is a deflationary memecoin that operates on the Ethereum blockchain, designed as a tribute to the popular Pepe the Frog internet meme. With a significant market cap and a large community of supporters, PEPE aims to capitalize on the popularity of meme-based cryptocurrencies. This section will explore the technology behind Pepe, including its blockchain architecture, consensus mechanism, and key innovations that make it a unique player in the cryptocurrency space.

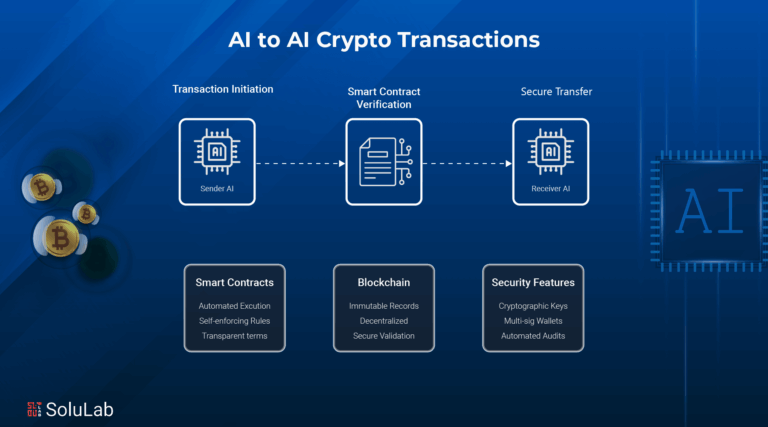

Blockchain Architecture

Pepe is built on the Ethereum blockchain, which is one of the most widely used blockchain platforms in the world. Ethereum is known for its smart contract functionality, allowing developers to create decentralized applications (dApps) and tokens. As an ERC-20 token, PEPE follows a standard protocol that ensures compatibility with other tokens and applications on the Ethereum network.

What is an ERC-20 Token?

ERC-20 is a technical standard used for smart contracts on the Ethereum blockchain. It defines a common set of rules that all tokens must follow, making it easier for developers to create and manage tokens. The ERC-20 standard includes functions that enable:

- Token Transfer: Sending tokens from one user to another.

- Balance Inquiry: Checking the balance of a specific address.

- Approval and Allowance: Allowing a third party to spend tokens on behalf of the token holder.

By adhering to the ERC-20 standard, PEPE can seamlessly interact with decentralized exchanges (DEXs), wallets, and other applications within the Ethereum ecosystem.

Consensus Mechanism

The Ethereum blockchain employs a Proof-of-Stake (PoS) consensus mechanism, which differs significantly from the traditional Proof-of-Work (PoW) model used by Bitcoin. In PoS, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral.

How Proof-of-Stake Works

-

Staking: To become a validator, a user must stake a minimum of 32 ETH. This stake acts as a security deposit that can be forfeited if the validator acts dishonestly or fails to validate transactions correctly.

-

Block Validation: Validators take turns proposing new blocks for the blockchain. When it’s their turn, they create a block containing a list of recent transactions.

-

Consensus: Other validators review the proposed block. If enough validators agree that the block is valid, it gets added to the blockchain.

-

Rewards: Validators earn rewards for their participation in the network. These rewards come from transaction fees and newly minted ETH, incentivizing them to act honestly and maintain network security.

The shift to PoS is designed to make Ethereum more energy-efficient and scalable, addressing some of the criticisms leveled at PoW systems, such as high energy consumption and slower transaction speeds.

Key Technological Innovations

Pepe incorporates several technological innovations that enhance its functionality and appeal to investors. These include its deflationary model, redistribution system, and burning mechanism.

Deflationary Model

The deflationary nature of PEPE means that the total supply of the token decreases over time. This is accomplished through a burning mechanism where a portion of the tokens is permanently removed from circulation. As fewer tokens are available, the value of the remaining tokens may increase, creating scarcity and potentially benefiting long-term holders.

Redistribution System

Pepe employs a redistribution system that rewards long-term stakers. This system is designed to encourage users to hold onto their tokens instead of selling them quickly. Here’s how it works:

-

Staking Rewards: Users who stake their PEPE tokens receive additional tokens as rewards. This incentivizes holding the token for a longer duration, promoting stability within the token’s price.

-

Community Engagement: By rewarding users for staking, the project fosters a sense of community and encourages users to become more involved in the ecosystem.

Tokenomics

The tokenomics of PEPE is designed to create an engaging and sustainable environment for its users. Here are some key aspects:

-

Total Supply: PEPE has a total supply of 420.69 trillion tokens, with 99.9999% currently in circulation. This high supply is typical for memecoins and aims to make the token accessible to a broad audience.

-

Liquidity Pool: A significant percentage of the tokens (93.1%) were allocated to a liquidity pool on Uniswap, a decentralized exchange. This facilitates trading and ensures that users can buy and sell PEPE tokens without significant price slippage.

-

Community Wallet: A small percentage (6.9%) of the tokens is held in a multi-signature wallet, which is intended for future centralized exchange (CEX) listings, liquidity pools, and bridging opportunities.

Security Features

Security is a crucial aspect of any cryptocurrency, and Pepe is no exception. Being an ERC-20 token on the Ethereum blockchain, PEPE benefits from the robust security features inherent in the Ethereum network.

Smart Contract Audits

Although the founders of PEPE remain anonymous, the project has undergone audits to ensure the security and reliability of its smart contracts. Auditing involves a third-party review of the code to identify and rectify any vulnerabilities. This process helps to build trust with the community and potential investors.

Community Governance

While PEPE does not have formal governance features like some other cryptocurrencies, the active community plays a significant role in decision-making. The team behind PEPE has utilized social media platforms to engage with the community, gathering feedback and suggestions for future developments.

Conclusion

Pepe (PEPE) stands out in the crowded memecoin market due to its unique combination of features, including its ERC-20 compliance, PoS consensus mechanism, and innovative tokenomics. By leveraging the popularity of the Pepe the Frog meme and adopting a transparent, community-focused approach, PEPE aims to carve out a niche in the cryptocurrency landscape.

Understanding the technology behind Pepe is essential for both new and experienced investors. By grasping concepts like blockchain architecture, consensus mechanisms, and tokenomics, investors can make informed decisions and participate effectively in the evolving world of digital assets. As the memecoin phenomenon continues to grow, keeping an eye on projects like PEPE will be crucial for anyone interested in this exciting space.

Understanding pepe crypto Tokenomics

Pepe (PEPE) is a memecoin that has captured the interest of the cryptocurrency community, primarily due to its cultural relevance as a tribute to the Pepe the Frog internet meme. As with many cryptocurrencies, understanding its tokenomics is crucial for potential investors and enthusiasts. Tokenomics refers to the economics of the token, including its supply, distribution, inflation or deflation model, and utility.

Here, we will delve into the key metrics and aspects of Pepe’s tokenomics to provide a comprehensive understanding of this digital asset.

| Metric | Value |

|---|---|

| Total Supply | 420.68 trillion PEPE |

| Max Supply | 420.69 trillion PEPE |

| Circulating Supply | 420.68 trillion PEPE |

| Inflation/Deflation Model | Deflationary |

Total Supply and Circulating Supply

Pepe has a total supply of approximately 420.68 trillion PEPE tokens, which is also its circulating supply. This means that all the tokens that have been minted are currently available in the market. The max supply is slightly higher at 420.69 trillion PEPE tokens, indicating that a small fraction of tokens may still be held in reserve for future purposes. This near-complete circulation of tokens can foster liquidity and trading activity.

Inflation/Deflation Model

Pepe employs a deflationary model, which is a common strategy among many cryptocurrencies. In a deflationary model, the supply of tokens can decrease over time, usually through mechanisms such as burning. This is done to create scarcity, potentially increasing the value of the remaining tokens as demand rises. In the case of Pepe, a portion of the tokens are regularly removed from circulation, thereby enhancing the long-term value proposition for holders.

Token Utility (What is the coin used for?)

The primary utility of the PEPE token is to serve as a digital asset that can be acquired, held, and exchanged. Unlike many other cryptocurrencies that aim to provide practical solutions or services, PEPE distinguishes itself by being a memecoin with a focus on community and culture. It does not have inherent utility beyond being a speculative asset.

-

Speculation and Trading: PEPE is often purchased and traded for speculative purposes. Investors buy the coin in hopes of capitalizing on price movements, similar to other popular memecoins like Dogecoin and Shiba Inu.

-

Community Engagement: The project aims to foster a strong community around the Pepe the Frog meme, leveraging social media platforms for promotion and engagement. The token serves as a way for community members to rally around a shared interest and participate in discussions or events.

-

Redistribution System: Pepe incorporates a redistribution system that rewards long-term stakers. By holding onto their tokens, users can receive additional PEPE tokens, thereby incentivizing stability and reducing volatility within the market.

-

Burning Mechanism: To maintain scarcity, PEPE utilizes a token burning mechanism. This means that a portion of the tokens is permanently removed from circulation on a regular basis, which can help support the price of the token over time.

Token Distribution

Understanding how the PEPE tokens are distributed is crucial for assessing the project’s long-term viability and community involvement. Here’s a breakdown of the token distribution:

-

Liquidity Pool: A significant majority, approximately 93.1% of the total supply, was sent to the liquidity pool on Uniswap. This approach helps ensure that there is sufficient liquidity for trading, allowing users to buy and sell PEPE tokens without significant price slippage.

-

Burned Tokens: The LP tokens associated with the liquidity pool were burned, which means they are permanently removed from circulation. Additionally, the deployer contract was sent to a null address, further enhancing the project’s deflationary aspect.

-

Multi-Sig Wallet: The remaining 6.9% of the total supply is held in a multi-signature wallet. This portion is reserved for future centralized exchange (CEX) listings, liquidity pools, and bridges. Holding a portion of the supply in a multi-sig wallet helps ensure that the tokens are managed securely and transparently.

-

Community Involvement: The anonymous nature of the founders and the project’s community-driven approach is a notable aspect of PEPE’s distribution. Engaging the community through social media and other platforms has allowed the project to grow organically, relying on the collective interest in the meme culture.

Conclusion

Pepe (PEPE) exemplifies the characteristics of a memecoin with its deflationary tokenomics and community-focused approach. While it lacks traditional utility, its appeal lies in its cultural significance and the potential for speculative gains. Understanding its tokenomics provides investors and enthusiasts with the foundational knowledge needed to navigate the dynamic landscape of cryptocurrency investments. As always, potential investors should conduct thorough research and consider market conditions before investing in any digital asset.

Price History and Market Performance

Key Historical Price Milestones

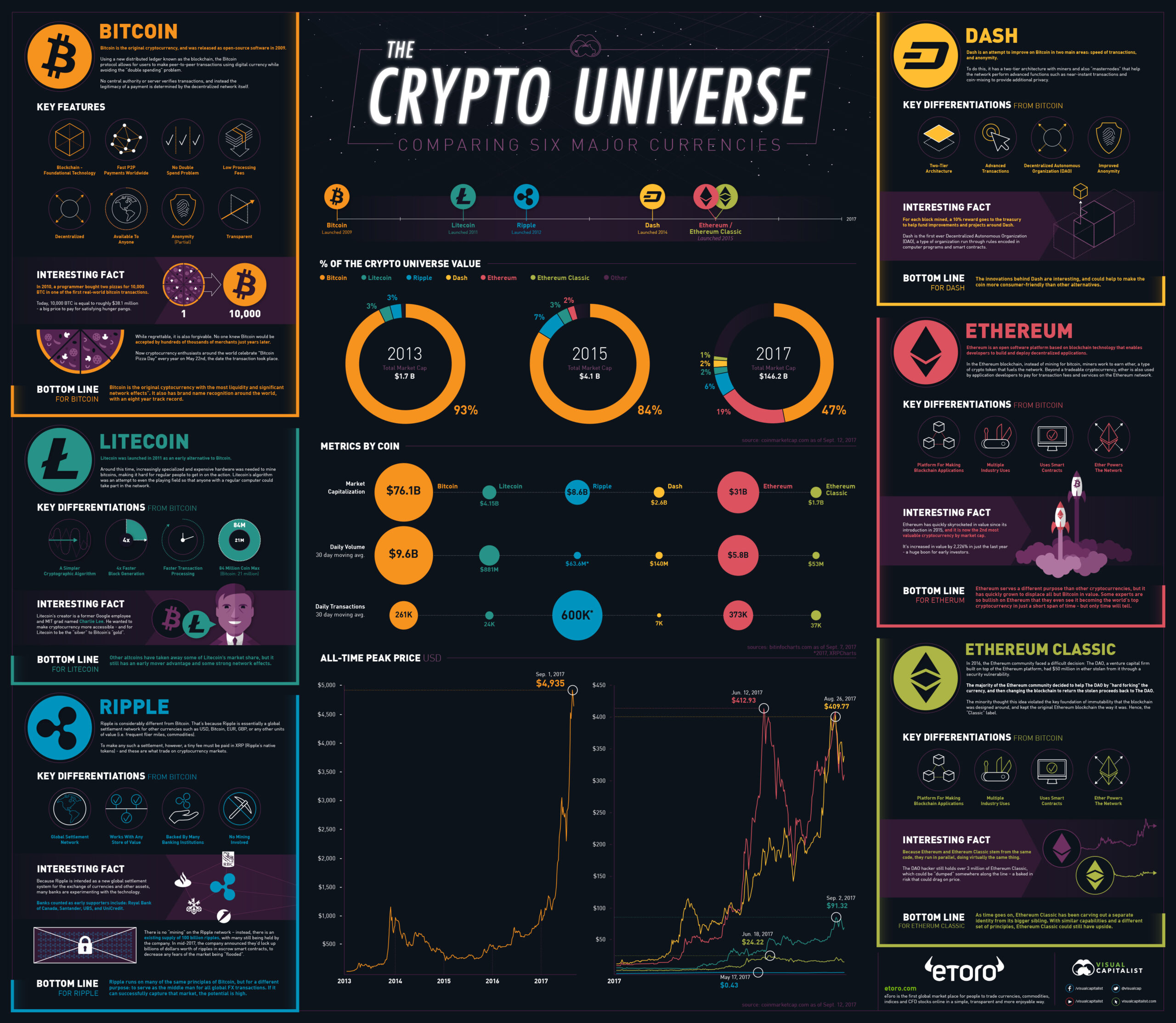

Pepe (PEPE) has experienced a remarkable price journey since its inception in April 2023. The cryptocurrency was launched as a meme coin, drawing inspiration from the popular internet meme, Pepe the Frog. The initial price of PEPE was extremely low, and it quickly garnered attention within the cryptocurrency community, leading to significant price movements shortly after its launch.

Launch and Initial Surge

In late April 2023, PEPE was introduced to the market, and within weeks, it began to rise sharply. By May 2023, the price had exploded, driving the market cap to an impressive $1.6 billion at its peak. This explosive growth made early holders millionaires and marked the onset of what some termed a “memecoin season,” where various meme coins experienced similar surges.

All-Time High

Pepe reached its all-time high (ATH) of approximately $0.00002825 on December 9, 2024. This milestone represented a staggering increase of over 92,000,000% from its all-time low. The surge to this ATH was fueled by a combination of social media hype, community engagement, and the broader trend of increasing interest in meme-based cryptocurrencies.

Recent Price Trends

As of October 2023, the price of PEPE has fluctuated significantly. The cryptocurrency is currently priced around $0.000010, reflecting a decline of approximately 65% from its all-time high. Throughout the past year, PEPE has shown a price change of about 39.67%, indicating a volatile yet active trading environment.

Historically, the price has been influenced by various factors, including market sentiment, regulatory developments, and the broader performance of the cryptocurrency market.

Factors Influencing the Price

The price of PEPE has been subject to various factors that have influenced its market performance over time. Understanding these factors can provide insight into the cryptocurrency’s historical price trends.

Market Sentiment and Social Media Influence

As a memecoin, PEPE’s price is heavily influenced by market sentiment and social media activity. The power of memes in the cryptocurrency community cannot be underestimated, and Pepe has leveraged this to its advantage. Social media platforms like Twitter and Reddit have played a crucial role in driving interest and engagement. Viral trends and endorsements from influential figures in the crypto space have often resulted in rapid price increases. Conversely, negative sentiment or unfavorable news can lead to swift sell-offs and price declines.

Speculative Trading and Volatility

The nature of memecoins often leads to speculative trading, where investors buy and sell based on short-term price movements rather than long-term fundamentals. This speculative nature contributes to high volatility, with PEPE experiencing significant price swings within short periods. For instance, the trading volume over a 24-hour period has varied widely, at times reaching over $300 million, further indicating the active trading environment surrounding the token.

Overall Market Conditions

The performance of PEPE is also tied to the broader cryptocurrency market dynamics. During bullish market conditions, when major cryptocurrencies like Bitcoin and Ethereum are rallying, memecoins like PEPE often see increased investor interest and capital inflow. Conversely, during bearish market trends, PEPE’s price may decline sharply, as seen in the recent 20% drop over the last 90 days. This correlation with the overall market underscores the importance of market conditions in influencing PEPE’s price.

Development and Community Engagement

The ongoing development of the PEPE project and community engagement initiatives have also impacted its price. The project has implemented a redistribution system aimed at rewarding long-term holders and incentivizing staking, which can create a more stable price environment. Community-driven events, contests, and promotions have further enhanced interest and participation, driving demand for PEPE.

Regulatory Environment

The evolving regulatory landscape surrounding cryptocurrencies can significantly affect PEPE’s market performance. Changes in regulations can lead to increased scrutiny or even restrictions on trading, which may adversely impact the price. Historical instances of regulatory announcements have resulted in immediate price reactions across the cryptocurrency market, including PEPE.

Conclusion

In summary, PEPE has experienced a rollercoaster journey since its launch, marked by significant price milestones and a variety of influencing factors. From its meteoric rise to an all-time high in late 2024 to the recent fluctuations in price, PEPE’s market performance illustrates the volatile nature of memecoins. Understanding the historical context and the factors influencing its price can provide valuable insights for both new and experienced investors looking to navigate the ever-changing landscape of cryptocurrency investments.

Where to Buy pepe crypto: Top Exchanges Reviewed

1. Kraken – Your Go-To Guide for Buying PEPE Today!

Kraken’s guide to purchasing Pepe stands out for its user-friendly approach, allowing investors to start with as little as $10. The exchange supports multiple payment methods, including credit/debit cards, ACH deposits, and mobile payment options like Apple and Google Pay, enhancing accessibility for both beginners and experienced traders. With a reputation for security and reliability, Kraken provides a seamless platform for acquiring the popular meme-inspired cryptocurrency.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Changelly – Your Go-To for Minimal Exchange Fees on Pepe (PEPE)!

Changelly stands out as a top choice for exchanging Pepe (PEPE) due to its competitive rates and low transaction fees, making it an economical option for traders. With a user-friendly platform available on both web and mobile, it supports over 700 cryptocurrencies and offers fast exchange services. Additionally, Changelly provides 24/7 live support, ensuring users receive assistance whenever needed, which enhances the overall trading experience.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. Coinbase – Easiest Way to Buy Pepe (PEPE) in the U.S.!

Coinbase stands out as a premier platform for purchasing Pepe (PEPE) in the United States, thanks to its reputation for security and user-friendly interface. As one of the most trusted exchanges, Coinbase offers a seamless experience for both beginners and seasoned investors, facilitating easy transactions and robust asset management tools. Its regulatory compliance and extensive support resources further enhance user confidence in navigating the cryptocurrency market.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

7. Coinbase – Ideal for Beginners in the USA!

The r/pepecoin Reddit community highlights a standout exchange for the USA market, emphasizing its user-friendly on-ramping feature that allows for quick purchases and direct deposits to wallets within minutes. This efficiency is particularly appealing for those not engaged in day trading, making it an ideal choice for casual investors who prioritize convenience and speed in their cryptocurrency transactions.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

How to Buy pepe crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying Pepe (PEPE) is selecting a cryptocurrency exchange where it is available for trading. PEPE can be purchased on both centralized exchanges (CEXs) and decentralized exchanges (DEXs). Some popular platforms include:

- Centralized Exchanges (CEXs): Binance, KuCoin, Huobi, Gate.io, and MEXC.

- Decentralized Exchanges (DEXs): Uniswap (V2 and V3).

When choosing an exchange, consider factors such as user interface, fees, security features, and customer support. If you are a beginner, a CEX may be easier to navigate, while DEXs provide more control over your funds.

2. Create and Verify Your Account

Once you’ve chosen an exchange, you’ll need to create an account. This process generally involves:

- Sign Up: Go to the exchange’s website and click on the sign-up button. You will need to provide your email address and create a password.

- Email Verification: After signing up, you will receive a verification email. Click the link in that email to verify your account.

- Identity Verification: Many exchanges require identity verification (KYC) to comply with regulations. This may involve uploading a government-issued ID and a selfie. Follow the instructions provided by the exchange to complete this process.

3. Deposit Funds

After your account is verified, you will need to deposit funds to buy PEPE. Most exchanges accept deposits in various forms, including:

- Bank Transfer: You can usually deposit fiat currency (like USD, EUR, etc.) through bank transfers. This method may take a few days to process.

- Credit/Debit Card: Some exchanges allow you to purchase cryptocurrency directly using a credit or debit card, offering instant access to funds.

- Cryptocurrency Transfer: If you already own cryptocurrencies, you can transfer them to your exchange wallet. Look for the deposit address for the specific cryptocurrency you plan to send.

Make sure to check the deposit fees and processing times associated with each method.

4. Place an Order to Buy PEPE Crypto

Now that you have funds in your exchange account, you can place an order to buy PEPE:

- Find PEPE: Use the exchange’s search function to locate the PEPE trading pair (e.g., PEPE/USD or PEPE/ETH).

- Choose Order Type: You can typically place different types of orders:

- Market Order: This order buys PEPE at the current market price. It is the quickest way to acquire the asset.

- Limit Order: This order allows you to set a specific price at which you want to buy PEPE. It will only execute when the market reaches your price.

- Enter Amount: Specify how much PEPE you wish to purchase and confirm the order. Review the transaction details, including fees, before finalizing your purchase.

5. Secure Your Coins in a Wallet

After successfully buying PEPE, it’s crucial to secure your investment:

- Leave on Exchange vs. Wallet: While you can leave your PEPE on the exchange, it’s generally safer to transfer it to a personal wallet. This reduces the risk of loss due to exchange hacks or shutdowns.

- Choose a Wallet Type: There are several types of wallets to choose from:

- Software Wallets: These are applications or software programs that can be installed on your computer or mobile device (e.g., MetaMask, Trust Wallet).

- Hardware Wallets: These are physical devices that store your cryptocurrencies offline (e.g., Ledger, Trezor), providing a higher level of security.

- Transfer PEPE: To transfer your PEPE from the exchange to your wallet, you will need to enter your wallet’s PEPE address. Double-check the address to ensure it is correct before confirming the transfer.

Final Thoughts

Buying PEPE crypto involves a straightforward process of selecting an exchange, creating an account, depositing funds, placing an order, and securing your coins. Always stay informed about the latest trends and market conditions, as the cryptocurrency market can be volatile. Remember to conduct thorough research and consider your risk tolerance before investing in any digital asset.

Investment Analysis: Potential and Risks

Overview of Pepe (PEPE)

Pepe (PEPE) is a memecoin launched on the Ethereum blockchain, inspired by the popular internet meme, Pepe the Frog. Since its inception, it has aimed to capture the essence of the meme culture that has permeated the cryptocurrency space, following in the footsteps of other successful meme coins like Dogecoin and Shiba Inu. With its recent rise in popularity, PEPE has attracted significant community interest and investment. However, as with any digital asset, potential investors should weigh the strengths and weaknesses before committing capital.

Potential Strengths (The Bull Case)

1. Strong Community and Cultural Relevance

One of the most significant advantages of Pepe is its robust community and cultural relevance. Memecoins often thrive on community engagement and social media presence. PEPE has successfully tapped into the meme culture, creating a dedicated following that actively promotes the token. This cultural resonance can lead to sustained interest and increased trading volumes, particularly during market upswings or meme-driven trends.

2. Historical Performance and Volatility

Since its launch, PEPE has experienced remarkable price increases, reaching an all-time high of $0.000028 in December 2024. Although this peak has been followed by volatility, the potential for significant returns has attracted many investors. The memecoin’s capacity for explosive growth during favorable market conditions could present opportunities for short- to medium-term gains.

3. Deflationary Mechanism

PEPE employs a deflationary model, which includes a burning mechanism that permanently removes a portion of the supply from circulation. This scarcity can enhance the token’s value proposition over time, particularly if demand remains constant or increases. Furthermore, the redistribution system rewards long-term holders, incentivizing investors to maintain their positions rather than quickly selling.

4. No-Tax Policy and Transparency

The project’s no-tax policy simplifies trading for users, potentially making it more appealing compared to other cryptocurrencies with transaction fees. Additionally, the team’s transparency regarding the lack of utility helps set realistic expectations for investors. This straightforward approach may resonate with those who appreciate a no-frills investment.

5. Market Positioning

As of October 2023, PEPE ranks within the top 50 cryptocurrencies by market capitalization, with a market cap of approximately $4.12 billion. This positioning suggests a level of stability and recognition within the broader crypto market. The continued push for listings on major exchanges could further enhance its visibility and accessibility to new investors.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies, particularly memecoins, are known for their extreme price volatility. PEPE has experienced significant price fluctuations, including a decline of over 65% from its all-time high. Such volatility can lead to substantial financial losses for investors, especially those who may not have a clear exit strategy or risk management plan. Price swings can be exacerbated by market sentiment, social media trends, and broader economic factors.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and varies significantly across jurisdictions. Governments are increasingly scrutinizing digital assets, which could lead to restrictions or regulations that impact PEPE and other memecoins. For example, if regulatory bodies classify PEPE as a security, it could face compliance challenges that might hinder its growth or lead to legal issues. Investors should remain vigilant about potential regulatory changes that could affect the token’s viability.

3. Competition from Other Memecoins

The memecoin market is highly competitive, with numerous alternatives vying for investor attention and capital. PEPE faces competition from established players like Dogecoin and Shiba Inu, as well as new entrants that may capitalize on current trends. This competitive environment can dilute market share and investor interest, impacting PEPE’s growth potential. The emergence of new memecoins could also lead to rapid shifts in community engagement and investment patterns.

4. Lack of Utility

While PEPE’s lack of utility is acknowledged as part of its charm, it also represents a significant risk. Unlike many cryptocurrencies that offer tangible use cases or technological innovations, PEPE is primarily a speculative asset. This reliance on meme culture and community sentiment means that its long-term value is uncertain. If interest wanes or market sentiment shifts, PEPE could struggle to maintain its current price levels.

5. Technological Risks

As an ERC-20 token on the Ethereum blockchain, PEPE is subject to the technological vulnerabilities associated with Ethereum. Issues such as network congestion, high transaction fees, or potential security flaws could adversely impact PEPE’s trading experience. Additionally, the Ethereum network is transitioning to a Proof-of-Stake (PoS) model, which, while potentially beneficial for scalability and energy efficiency, introduces its own set of risks and uncertainties during the transition period.

Conclusion

Investing in Pepe (PEPE) presents a unique opportunity shaped by the dynamics of the memecoin market. Its strong community backing, historical performance, and deflationary mechanisms contribute to its appeal. However, investors should remain cognizant of the inherent risks, including market volatility, regulatory uncertainty, competition, lack of utility, and technological vulnerabilities. As always, potential investors should conduct thorough research and consider their risk tolerance before engaging with this or any other cryptocurrency.

Frequently Asked Questions (FAQs)

1. What is Pepe crypto?

Pepe (PEPE) is a deflationary memecoin that operates on the Ethereum blockchain. It was developed as a tribute to the Pepe the Frog internet meme, which gained popularity in the early 2000s. The project aims to capitalize on the popularity of meme coins and strives to establish itself as one of the top meme-based cryptocurrencies. PEPE distinguishes itself by instituting a no-tax policy and being transparent about its lack of utility, making it appealing to the cryptocurrency community.

2. Who created Pepe crypto?

The founders of Pepe remain anonymous, which is a common practice in the cryptocurrency space. While there is limited information available about the team behind the project, they have effectively utilized social media platforms to promote the memecoin and build a community around it. The anonymity of the creators does not necessarily detract from the project’s appeal but does raise considerations regarding transparency and accountability.

3. How does Pepe crypto work?

PEPE operates as an ERC-20 token on the Ethereum blockchain. It employs a redistribution system that rewards long-term stakers, incentivizing them to hold onto their tokens rather than sell them quickly. This mechanism aims to promote coin stability. Additionally, PEPE has a burning mechanism, where a portion of the coins is permanently removed from circulation on a regular basis, helping to maintain scarcity despite its large maximum supply.

4. Is Pepe crypto a good investment?

The potential for investment in Pepe crypto, like many memecoins, is highly speculative. While it has experienced significant price surges and a strong community following, it also carries risks associated with high volatility and lack of intrinsic utility. Investors should conduct thorough research, assess their risk tolerance, and consider market conditions before investing in PEPE or any other cryptocurrency.

5. What makes Pepe crypto different from Bitcoin?

Pepe and Bitcoin serve different purposes within the cryptocurrency ecosystem. Bitcoin is a decentralized digital currency designed to function as a store of value and a medium of exchange, with a capped supply and strong security features. In contrast, Pepe is primarily a memecoin that lacks intrinsic utility and is mainly driven by community interest and market speculation. Additionally, Pepe operates on the Ethereum blockchain as an ERC-20 token, while Bitcoin has its own independent blockchain.

6. Where can I buy Pepe crypto?

PEPE can be traded on various platforms, including decentralized exchanges like Uniswap (V2 and V3) and centralized exchanges such as Binance, KuCoin, Huobi, and Gate.io. Before purchasing PEPE, it’s advisable to set up a compatible cryptocurrency wallet and ensure you have Ethereum (ETH) for transactions on the Ethereum network.

7. What is the current price and market cap of Pepe crypto?

As of now, the price of Pepe (PEPE) is approximately $0.000010, with a market cap of around $4.12 billion. The price can fluctuate significantly due to market dynamics, so it’s important to check real-time data on reputable cryptocurrency platforms for the latest updates.

8. What are the risks associated with investing in Pepe crypto?

Investing in Pepe crypto comes with several risks, including high volatility typical of memecoins, lack of intrinsic utility, and potential regulatory scrutiny. Additionally, the anonymity of the founders may raise concerns about transparency and governance. Investors should be cautious, conduct thorough research, and consider diversifying their portfolios to mitigate risks associated with investing in speculative assets like PEPE.

Final Verdict on pepe crypto

Overview of Pepe Crypto

Pepe (PEPE) is a deflationary memecoin launched on the Ethereum blockchain, inspired by the popular Pepe the Frog internet meme. Designed to capitalize on the trend of meme coins, PEPE aims to establish itself as a leading player in this niche market. Its appeal lies in its community-driven approach and a no-tax policy, which keeps the experience straightforward and focused on the meme culture.

Technology and Mechanics

As an ERC-20 token, PEPE employs the Proof-of-Stake (PoS) consensus mechanism, which enhances its security and transaction efficiency. The tokenomics of PEPE include a redistribution system that rewards long-term holders, promoting stability and encouraging users to stake their tokens. Additionally, a burning mechanism is in place, where a portion of the total supply is periodically removed from circulation, thereby maintaining scarcity and potentially increasing value over time.

Potential and Risks

While PEPE has seen significant price fluctuations and community engagement, it is essential to recognize that it operates within the highly volatile realm of cryptocurrencies, particularly in the memecoin sector. Its market cap has reached impressive heights, and its performance has been influenced by broader market trends, including the recent “memecoin season.” However, the lack of inherent utility and the anonymity of its founders introduce considerable risks for potential investors.

Conclusion

Investing in Pepe crypto presents an opportunity for high rewards, but it also comes with high risks typical of memecoins. Given its speculative nature and the volatility that characterizes this asset class, it is crucial for investors—especially beginners and intermediate traders—to conduct thorough research before making any investment decisions. Understanding the dynamics of the cryptocurrency market and assessing one’s risk tolerance are fundamental steps toward successful investing in digital assets like PEPE. Always remember the principle of “Do Your Own Research” (DYOR) to make informed choices.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.