Should You Invest in mantra crypto? A Full Analysis (2025)

An Investor’s Introduction to mantra crypto

MANTRA (OM) is an innovative Layer 1 blockchain platform that stands out in the rapidly evolving cryptocurrency landscape for its emphasis on security and regulatory compliance. Designed to facilitate the tokenization and trading of real-world assets (RWAs), MANTRA aims to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi). Built using the Cosmos SDK, MANTRA boasts compatibility with the Inter-Blockchain Communication (IBC) protocol, allowing for seamless interactions with other blockchain networks. This makes it particularly appealing to institutions and developers looking for a robust solution that meets stringent regulatory requirements while also harnessing the benefits of decentralization.

In today’s crypto market, where security concerns and regulatory scrutiny are at an all-time high, MANTRA’s approach to integrating real-world asset transactions with blockchain technology positions it as a pioneering force. The platform’s ability to process up to 10,000 transactions per second (TPS) ensures that it can handle high volumes, making it suitable for both individual users and large institutions. Furthermore, its focus on user experience and accessibility aims to onboard non-native users into the Web3 space, simplifying the transition for those unfamiliar with blockchain technology.

This guide serves as a comprehensive resource for both beginners and intermediate investors who are interested in understanding MANTRA crypto. It will cover essential aspects of the MANTRA ecosystem, including:

Technology

An exploration of the underlying technology that powers MANTRA, detailing its architecture, security mechanisms, and scalability features.

Tokenomics

A deep dive into the economic model of the MANTRA token (OM), including its supply dynamics, use cases, and overall market performance.

Investment Potential

An analysis of the investment landscape surrounding MANTRA, including historical price movements, market trends, and potential future growth.

Risks

A candid discussion of the risks associated with investing in MANTRA, including market volatility, regulatory changes, and technological challenges.

How to Buy

Step-by-step instructions on how to purchase MANTRA tokens, including the platforms where they can be traded and tips for new investors.

By the end of this guide, readers will have a well-rounded understanding of MANTRA, enabling them to make informed investment decisions and navigate the complexities of this promising blockchain technology.

What is mantra crypto? A Deep Dive into its Purpose

Understanding MANTRA Crypto

MANTRA (OM) is a decentralized finance platform and Layer 1 blockchain that aims to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi). It is specifically designed to facilitate the tokenization and trading of real-world assets (RWAs) while ensuring adherence to regulatory requirements. By leveraging advanced blockchain technology, MANTRA offers a secure and scalable solution for both institutions and developers.

The Core Problem It Solves

The primary issue that MANTRA addresses is the integration of real-world assets into the blockchain ecosystem while ensuring compliance with legal and regulatory frameworks. Traditional finance operates within a heavily regulated environment, and many institutions are hesitant to adopt blockchain technology due to concerns about security, compliance, and the complexity of navigating regulatory landscapes. MANTRA’s design focuses on providing a permissionless blockchain environment that supports permissioned applications, allowing institutions to develop and deploy applications that meet specific regulatory requirements.

Additionally, the lack of user-friendly platforms in the crypto space often deters non-native users and institutions from engaging with blockchain technology. MANTRA seeks to simplify the onboarding process through enhanced user experiences, making it more accessible for those unfamiliar with the intricacies of DeFi.

Its Unique Selling Proposition

MANTRA’s unique selling proposition lies in its commitment to security, regulatory compliance, and user experience. Built using the Cosmos SDK, MANTRA is compatible with the Inter-Blockchain Communication (IBC) protocol, allowing for seamless interoperability with other blockchain networks. This compatibility is crucial for creating a decentralized ecosystem where assets and information can flow freely across different platforms.

One of the standout features of MANTRA is its sovereign Proof-of-Stake (PoS) validator set. This mechanism ensures the security of the network by incentivizing validators to act honestly through the staking of their tokens. The scalability of the platform is another significant advantage, with the capability to handle up to 10,000 transactions per second (TPS). This high throughput is essential for supporting a wide range of applications, from simple transactions to complex financial instruments.

Moreover, MANTRA incorporates advanced authentication and verification technologies to enhance security. Features such as biometric fingerprint scanners and IRIS sensors provide an additional layer of protection, ensuring that only authorized users can access sensitive information or perform critical actions. This focus on security is particularly vital for applications involving RWAs, as it helps to mitigate the risks of fraud and unauthorized access.

The platform also includes built-in modules, software development kits (SDKs), and application programming interfaces (APIs) that facilitate the creation, trading, and management of regulatory-compliant RWAs. By streamlining these processes, MANTRA enables developers and institutions to focus on innovation without being bogged down by regulatory complexities.

The Team and Backers

MANTRA is backed by a team of experienced professionals with a strong background in finance, technology, and blockchain. The project was co-founded by John Patrick Mullin, Will Corkin, and Rodrigo Quan Miranda. Mullin is recognized as a fintech researcher, while Corkin has a history as a blockchain entrepreneur. Together, they bring over six years of experience in the crypto and digital assets space, having worked with prestigious firms like PWC, BAML, Citigroup, Standard & Poors, and Credit Suisse.

This diverse expertise has been instrumental in building a robust foundation for MANTRA, as the team has successfully raised substantial funds for various ventures. Their deep understanding of both traditional and decentralized finance allows them to navigate the complexities of the blockchain landscape while ensuring that MANTRA remains aligned with regulatory standards.

The Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of MANTRA in the crypto ecosystem is to provide a secure and compliant platform for the tokenization and management of real-world assets. As blockchain technology continues to evolve, the need for solutions that bridge the gap between traditional finance and decentralized finance becomes increasingly important. MANTRA addresses this need by offering a robust infrastructure that supports regulatory compliance while facilitating innovation.

By focusing on user experience and security, MANTRA aims to onboard non-native users and institutions into the Web3 space. This initiative is essential for fostering greater adoption of decentralized technologies and ensuring that the benefits of blockchain are accessible to a broader audience. The platform’s emphasis on regulatory compliance also positions it as a trusted solution for institutions looking to explore the potential of blockchain without compromising their adherence to legal standards.

In summary, MANTRA (OM) is a pioneering platform that seeks to redefine the intersection of traditional finance and decentralized finance. By addressing key challenges such as regulatory compliance, user experience, and security, MANTRA establishes itself as a significant player in the cryptocurrency landscape. Its innovative approach to real-world asset tokenization not only enhances the utility of blockchain technology but also paves the way for a more integrated financial ecosystem.

The Technology Behind the Coin: How It Works

Introduction to MANTRA’s Technology

MANTRA (OM) is a Layer 1 blockchain that focuses on bridging the gap between traditional finance and decentralized finance (DeFi). It is designed to handle real-world regulatory requirements while maintaining the decentralized ethos of blockchain technology. The platform utilizes advanced technologies to ensure security, scalability, and user-friendliness, making it appealing to both institutions and developers. In this section, we will explore the underlying technology that powers MANTRA, breaking down its architecture, consensus mechanism, key innovations, and its approach to real-world asset integration.

Blockchain Architecture

MANTRA’s architecture is built using the Cosmos SDK, a robust framework that allows developers to create custom blockchains tailored to specific needs. Here are some key features of MANTRA’s blockchain architecture:

-

Modularity: The Cosmos SDK is known for its modular design, which allows developers to add or remove features as necessary. This flexibility is critical for MANTRA, as it aims to adapt to the evolving needs of both traditional finance and DeFi applications.

-

Inter-Blockchain Communication (IBC): MANTRA is IBC-compatible, which enables it to communicate seamlessly with other blockchains. This interoperability is essential for creating a decentralized ecosystem where assets and information can flow freely across different platforms.

-

CosmWasm Support: MANTRA supports CosmWasm, a smart contract platform that allows developers to write complex decentralized applications (dApps) using WebAssembly. This support enhances the capabilities of the blockchain, enabling the creation of versatile and secure applications.

-

User-Friendly Interface: The architecture prioritizes user experience, providing built-in modules and tools that simplify the process for developers. This focus on ease of use helps onboard non-native users and institutions into the Web3 space.

Consensus Mechanism

MANTRA employs a Proof-of-Stake (PoS) consensus mechanism, which differs significantly from traditional Proof-of-Work (PoW) systems used by cryptocurrencies like Bitcoin. Here’s how PoS works and why it’s beneficial for MANTRA:

-

Validator Selection: In a PoS system, validators are chosen based on the number of tokens they hold and are willing to “stake” as collateral. This means that the more tokens a validator stakes, the higher their chances of being selected to validate transactions and create new blocks.

-

Security Incentives: Validators have a strong incentive to act honestly because they risk losing their staked tokens if they attempt to compromise the network. This creates a more secure environment compared to PoW systems, where miners can potentially manipulate the network without significant financial repercussions.

-

Energy Efficiency: PoS is generally more energy-efficient than PoW since it does not require extensive computational power to solve complex mathematical problems. This efficiency aligns with MANTRA’s goal of being environmentally conscious while supporting high transaction throughput.

-

Scalability: The PoS mechanism allows MANTRA to achieve scalability of up to 10,000 transactions per second (TPS). This high throughput ensures that the platform can accommodate a wide range of applications, from basic transactions to more complex financial instruments.

Key Technological Innovations

MANTRA incorporates several key technological innovations that distinguish it from other blockchain platforms. These innovations include:

-

Real-World Asset Integration: MANTRA is specifically designed to facilitate the tokenization and trading of real-world assets (RWAs). By adhering to legal standards, the platform allows institutions and developers to create compliant applications that bridge the gap between traditional and decentralized finance.

-

Advanced Security Features: Security is a top priority for MANTRA. The platform integrates advanced authentication technologies such as IRIS sensors and biometric fingerprint scanners. These features enhance security by ensuring that only authorized users can access sensitive information or perform critical actions, thus preventing fraud and unauthorized access.

-

Decentralized Exchange (DEX): MANTRA offers its own decentralized exchange, which provides users with a user-friendly interface to trade various cryptocurrencies. The DEX simplifies crypto investments, making it accessible to both seasoned investors and newcomers.

-

Built-in Modules and SDKs: The platform includes built-in modules, software development kits (SDKs), and application programming interfaces (APIs) that streamline the process for developers. These tools facilitate the creation, trading, and management of regulatory-compliant RWAs, making it easier for developers to build innovative applications.

-

User Experience Focus: MANTRA places a strong emphasis on improving user experience, particularly for those new to Web3. By providing intuitive interfaces and comprehensive support, the platform aims to lower the barriers to entry for non-native users and institutions, promoting broader adoption of decentralized technologies.

Real-World Applications of MANTRA

The technology behind MANTRA enables a wide range of real-world applications, particularly in the financial sector. Here are some examples of how MANTRA’s technology can be applied:

-

Regulatory Compliance: MANTRA’s architecture allows developers to create applications that adhere to legal standards, making it an attractive option for institutions looking to navigate complex regulatory environments.

-

Tokenization of Assets: The platform supports the tokenization of real-world assets, such as real estate, commodities, and financial instruments. This capability enhances liquidity and accessibility for investors.

-

Financial Services: With its high transaction throughput and robust security features, MANTRA can support various financial services, including lending, borrowing, and trading, all while ensuring compliance with regulatory requirements.

-

Supply Chain Management: The integration of RWAs and blockchain technology can improve transparency and traceability in supply chain management. MANTRA can facilitate the tracking of goods from origin to destination, ensuring that all parties involved have access to accurate information.

-

Decentralized Finance (DeFi) Applications: By providing a secure and scalable platform, MANTRA allows developers to build a wide range of DeFi applications that can operate efficiently and securely, catering to the needs of both individual users and large institutions.

Conclusion

MANTRA (OM) represents a significant advancement in blockchain technology, particularly in its focus on regulatory compliance and real-world asset integration. By leveraging the Cosmos SDK, employing a Proof-of-Stake consensus mechanism, and incorporating advanced security features, MANTRA creates a versatile and secure platform for developers and institutions alike. Its commitment to improving user experience and facilitating the transition to decentralized technologies positions it as a compelling choice for those looking to navigate the evolving landscape of finance. As the blockchain ecosystem continues to grow, MANTRA is poised to play a crucial role in bridging the gap between traditional finance and the decentralized future.

Understanding mantra crypto Tokenomics

Tokenomics refers to the economic model and structure of a cryptocurrency, including its supply, distribution, and utility. For Mantra (OM), understanding its tokenomics is crucial for both beginners and intermediate investors to gauge its potential value and functionality within the blockchain ecosystem. Below, we delve into the key metrics and factors that define Mantra’s tokenomics.

| Metric | Value |

|---|---|

| Total Supply | 1.69 Billion OM |

| Max Supply | Unlimited |

| Circulating Supply | 1.06 Billion OM |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

Mantra (OM) serves multiple purposes within its ecosystem, primarily revolving around the facilitation of transactions, governance, and staking. Here are the main utilities of the OM token:

-

Transaction Fees: OM tokens are used to pay for transaction fees on the Mantra network. This is essential for any blockchain-based application, as it ensures that validators and nodes are compensated for their services in maintaining the network’s integrity.

-

Staking: Users can stake their OM tokens to participate in the network’s security and consensus mechanism. By staking, users contribute to the Proof-of-Stake (PoS) system, which helps secure the blockchain. In return for staking, users earn rewards, which can be an attractive incentive for holding OM tokens.

-

Governance: OM token holders have the right to participate in the governance of the Mantra platform. This means they can vote on key decisions regarding upgrades, protocol changes, and other significant aspects of the ecosystem. This decentralized governance model empowers users and aligns their interests with the platform’s success.

-

Access to Features: Holding OM tokens may provide users with access to exclusive features or services within the Mantra ecosystem. For instance, certain products or applications may only be available to those who possess a specific amount of OM tokens.

-

Incentives for Participation: Mantra also incorporates reward mechanisms that encourage users to engage with the platform actively. This could include rewards for liquidity provision, participation in community initiatives, or engaging in educational programs aimed at onboarding new users.

Token Distribution

Understanding how OM tokens are distributed is essential for assessing the token’s long-term value and potential for appreciation. The distribution model is typically designed to ensure that tokens are allocated in a way that fosters a healthy and sustainable ecosystem.

-

Initial Token Allocation: The initial distribution of OM tokens was likely allocated to various stakeholders, including the development team, advisors, early investors, and the community. This allocation is crucial for incentivizing early adoption and rewarding those who contribute to the project’s growth.

-

Team and Advisors: A portion of the tokens is reserved for the founding team and advisors. This allocation serves to compensate them for their time and expertise in building the platform and ensures they have a vested interest in its success. However, to prevent market manipulation, these tokens are usually subject to vesting periods.

-

Community Incentives: Tokens are often allocated for community incentives, including rewards for early adopters, liquidity mining, and other promotional activities. This encourages user engagement and helps to build a robust community around the project.

-

Ecosystem Development: A significant portion of the tokens may also be reserved for ecosystem development. This includes funding partnerships, collaborations, and development of decentralized applications (dApps) on the platform. By investing in the ecosystem, Mantra aims to create a thriving environment that attracts developers and users alike.

-

Burn Mechanisms: In some cases, tokenomics may include mechanisms for burning tokens, which effectively removes them from circulation. This can create a deflationary effect, potentially increasing the value of the remaining tokens over time. While specific details about a burn mechanism for OM are not explicitly mentioned, it is a common practice in many cryptocurrencies.

-

Liquidity Provision: To ensure that there is sufficient liquidity for trading OM tokens on exchanges, a portion of the supply is often allocated for liquidity provision. This helps maintain a healthy trading environment and reduces price volatility, making it easier for users to buy and sell tokens.

Conclusion

The tokenomics of Mantra (OM) provide a comprehensive framework that supports its vision of integrating real-world assets into the blockchain ecosystem. With a total supply of 1.69 billion OM tokens and a deflationary model, the design encourages both utility and sustainability. By understanding the utility and distribution of the OM token, investors can better assess its potential as a valuable asset in their portfolios. As the platform continues to evolve, these tokenomics will play a crucial role in its success and adoption in the decentralized finance landscape.

Price History and Market Performance

Key Historical Price Milestones

MANTRA (OM) has experienced a notable price trajectory since its inception, reflecting the overall volatility common within the cryptocurrency market. Launched in late 2020, OM initially traded at relatively low prices, typical for many new digital assets. Over the following months, the price began to gain traction as interest in decentralized finance (DeFi) surged, particularly during the 2021 bull market.

One of the most significant milestones in MANTRA’s price history occurred in February 2021, when the token reached an all-time high of $9.04. This peak was driven by a broader rally in the cryptocurrency market, where many assets experienced exponential growth. The enthusiasm around DeFi protocols and the growing acceptance of blockchain technology contributed to this price surge. However, following this high, the price of OM began a substantial correction, a trend observed across the cryptocurrency space as profit-taking set in.

By October 2023, MANTRA’s price had dropped significantly, reaching an all-time low of $0.01728. This decline of approximately 97.7% from its all-time high showcases the inherent volatility and risk associated with investing in cryptocurrencies. The fluctuations in price can be attributed to various factors, including market sentiment, regulatory news, and the overall performance of the cryptocurrency market.

As of now, the price of MANTRA stands at approximately $0.2079, reflecting a gradual recovery and stabilization phase after the significant dips experienced in the preceding years. The current market capitalization is around $220.48 million, with a trading volume of approximately $28.81 million over the last 24 hours. The circulating supply of OM tokens is about 1.06 billion, with a total supply of 1.69 billion tokens.

Factors Influencing the Price

Historically, the price of MANTRA has been influenced by a variety of factors, both internal and external to the cryptocurrency ecosystem. Understanding these influences can provide valuable insights for investors and enthusiasts alike.

Market Sentiment and Investor Behavior

One of the primary drivers of price fluctuations in MANTRA has been the overall sentiment in the cryptocurrency market. During periods of bullish sentiment, where optimism about future price increases prevails, MANTRA and similar tokens often see a rise in demand, leading to price increases. Conversely, during bearish markets, negative sentiment can lead to significant sell-offs, causing prices to drop sharply.

Investor behavior, particularly the actions of large holders or “whales,” has also played a critical role. Large-scale buy or sell orders can significantly impact market prices, especially in a market with lower liquidity. When large holders decide to liquidate their assets, it can trigger panic selling among smaller investors, leading to rapid declines in price.

Regulatory Developments

As a blockchain platform designed to comply with real-world regulatory requirements, MANTRA has been particularly sensitive to regulatory news. Any announcements regarding cryptocurrency regulations can lead to immediate reactions in the market. For instance, positive regulatory developments, such as approvals for cryptocurrency use or clarity on compliance measures, can boost investor confidence and drive prices higher. Conversely, negative news, such as crackdowns on crypto exchanges or adverse regulatory frameworks, can lead to price declines.

Technological Developments and Partnerships

Technological advancements within the MANTRA ecosystem have also influenced its price. The introduction of new features, partnerships with reputable brands, and integrations with other blockchain platforms can enhance the utility and appeal of the token, potentially driving demand and price up. For example, MANTRA’s integration with the Cosmos ecosystem and its compatibility with the Inter-Blockchain Communication (IBC) protocol have broadened its potential user base and increased its attractiveness to developers and institutions.

Furthermore, the launch of new decentralized applications (dApps) and enhancements to the existing infrastructure can create positive momentum in the market. As MANTRA continues to innovate and expand its offerings, these developments can significantly impact the price trajectory.

Market Dynamics and Competition

The broader cryptocurrency market dynamics also play a crucial role in MANTRA’s price performance. The cryptocurrency market is highly competitive, with numerous projects vying for investor attention and capital. As new projects emerge and existing ones evolve, shifts in market share can occur, impacting the performance of tokens like OM. Additionally, the overall market capitalization of cryptocurrencies, trends in Bitcoin’s price, and the performance of leading altcoins can influence investor behavior and sentiment towards MANTRA.

Historical Price Corrections

Price corrections are a common phenomenon in the cryptocurrency market. Following the initial surge in 2021, MANTRA experienced a significant correction, which is typical for many digital assets. These corrections often follow periods of rapid price increases and can be attributed to profit-taking by investors, shifts in market sentiment, and the natural ebb and flow of market dynamics.

In summary, the price history of MANTRA (OM) illustrates the volatility and complexity of the cryptocurrency market. Various factors, including market sentiment, regulatory developments, technological advancements, and broader market dynamics, have all played a role in shaping its price trajectory. Understanding these influences can aid investors in making informed decisions as they navigate the evolving landscape of digital assets.

Where to Buy mantra crypto: Top Exchanges Reviewed

1. Changelly – Top Choice for Lowest Exchange Fees!

Changelly stands out as a premier platform for exchanging Exchange Mantra (OM) due to its exceptionally low fees and user-friendly interface. With a stellar rating of 4.7 from over 5,000 users, it offers fast transactions across more than 700 cryptocurrencies. Additionally, Changelly provides 24/7 live support, ensuring a seamless experience for both novice and experienced traders alike.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5 Reasons to Love MANTRA DAO: Innovative Exchange for OM Trading!

MANTRA DAO Exchange stands out for its user-friendly interface and competitive rates, making it an appealing choice for trading the OM token and other cryptocurrencies. With a commendable rating of 4.7 from 153 users, it emphasizes fast and secure transactions, ensuring a seamless experience for both beginners and experienced traders. The integration with Swapzone enhances its functionality, allowing users to easily swap OM for various digital assets at optimal rates.

- Website: swapzone.io

- Platform Age: Approx. 6 years (domain registered in 2019)

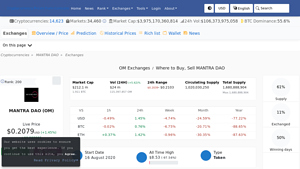

5. MANTRA DAO (OM) – Your Gateway to Decentralized Finance!

MANTRA DAO (OM) stands out in the cryptocurrency market by being accessible on over 36 exchanges, with top platforms like Binance, Gate, and Bitget offering a variety of trading pairs, including USDT and TRY. This extensive availability enhances liquidity and trading opportunities for users, making it easier for both newcomers and seasoned investors to buy, sell, and trade OM tokens efficiently.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Your Ultimate Guide to Buying MANTRA DAO (OM) in 2025!

The “How to Buy MANTRA DAO (OM) Guide 2025” from CoinCodex highlights the advantages of purchasing OM on top-tier exchanges like KuCoin, Binance, and Kraken. These platforms stand out for their user-friendly interfaces, robust security measures, and a wide range of trading options. The guide emphasizes the importance of selecting a reputable exchange to ensure a smooth buying experience for both beginners and experienced investors looking to enter the MANTRA DAO ecosystem.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Mantra – Unlocking Potential with Live Price Trends!

Kraken distinguishes itself as a leading cryptocurrency exchange by offering a user-friendly platform that includes a recurring buy feature for various digital assets, such as Mantra (OM). This functionality allows investors to automate their purchasing strategy, making it easier to build a position over time. Coupled with comprehensive price charts and live trends, Kraken provides essential tools for both novice and experienced traders to navigate the cryptocurrency market effectively.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

How to Buy mantra crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying MANTRA (OM) is selecting a suitable cryptocurrency exchange. There are several exchanges where you can trade MANTRA, including both centralized exchanges (CEX) and decentralized exchanges (DEX). Here are a few popular options:

- Binance: Known for a wide range of cryptocurrencies and high liquidity.

- KuCoin: Offers a user-friendly interface and a variety of trading pairs.

- Uniswap: A DEX that allows you to trade directly from your wallet without the need for an account.

When choosing an exchange, consider factors such as security, fees, available trading pairs, and user reviews. It’s also advisable to check whether the exchange is available in your region.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account. Follow these steps:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide an email address and create a password.

- Verify Your Identity: Most exchanges require identity verification to comply with regulatory standards. This typically involves uploading a government-issued ID and possibly a selfie. Follow the instructions provided by the exchange to complete this process.

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA. This can usually be done using an authenticator app or SMS verification.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy MANTRA. You can deposit either fiat currency (like USD or EUR) or cryptocurrencies (like Bitcoin or Ethereum) depending on the exchange:

- Fiat Deposit: If you’re depositing fiat, navigate to the “Deposit” section of the exchange. Choose your preferred payment method (bank transfer, credit card, etc.) and follow the instructions.

- Crypto Deposit: For cryptocurrency deposits, locate your wallet address on the exchange for the specific cryptocurrency you are depositing. Transfer the funds from your external wallet to this address.

Keep in mind that deposits may take some time to process, especially bank transfers, so be patient.

4. Place an Order to Buy MANTRA Crypto

Once your funds are available in your exchange account, you can proceed to buy MANTRA (OM):

- Navigate to the Trading Section: Go to the trading interface of the exchange. Look for the trading pair that matches your deposited funds (e.g., OM/USD, OM/BTC).

- Choose Your Order Type: You can place different types of orders:

- Market Order: Buy MANTRA at the current market price. This is the quickest option.

- Limit Order: Set a specific price at which you want to buy MANTRA. The order will only be executed if the market reaches your specified price.

- Enter the Amount: Specify how much MANTRA you want to buy. The exchange will display the total cost.

- Confirm the Purchase: Review your order details and confirm the transaction. You should receive a confirmation once the order is executed.

5. Secure Your Coins in a Wallet

After purchasing MANTRA, it’s crucial to transfer your coins to a secure wallet. While exchanges provide wallets, they are more susceptible to hacks and theft. Here are your options for storing your MANTRA:

- Software Wallets: These are applications or software that you can download on your computer or mobile device. Examples include Trust Wallet and Atomic Wallet. They offer a balance of convenience and security.

- Hardware Wallets: For the highest level of security, consider using a hardware wallet like Ledger or Trezor. These devices store your private keys offline, making them less vulnerable to online threats.

- Paper Wallets: This is a physical printout of your private keys and public addresses. While secure, paper wallets require careful handling and storage.

To transfer your MANTRA to a wallet, locate your wallet address, and initiate a withdrawal from the exchange to your wallet. Always double-check the address before confirming the transaction.

Conclusion

Buying MANTRA (OM) is a straightforward process that involves selecting a reputable exchange, creating an account, depositing funds, placing an order, and securing your tokens in a wallet. By following these steps, you can successfully enter the world of MANTRA and participate in its growing ecosystem. Always remember to conduct thorough research and keep your investments secure.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Strong Technological Foundation

MANTRA is built on the Cosmos SDK, which offers a modular and adaptable framework for blockchain development. This foundation enhances MANTRA’s scalability and security, allowing it to process up to 10,000 transactions per second (TPS). The platform’s compatibility with the Inter-Blockchain Communication (IBC) protocol and support for CosmWasm further bolster its capabilities, enabling seamless interaction with other blockchains and the development of complex decentralized applications (dApps).

2. Regulatory Compliance Focus

One of MANTRA’s key differentiators is its emphasis on regulatory compliance. The platform is designed to cater to institutions and developers who require adherence to legal standards when dealing with real-world assets (RWAs). By facilitating the tokenization and trading of RWAs, MANTRA positions itself as a bridge between traditional finance and decentralized finance (DeFi), attracting institutional interest and fostering trust among users.

3. User Experience and Accessibility

MANTRA prioritizes user experience, making it easier for non-native users and institutions to transition into the Web3 space. The platform provides built-in modules, software development kits (SDKs), and application programming interfaces (APIs) that simplify the process of creating and managing regulatory-compliant RWAs. This focus on accessibility can drive greater adoption and engagement within the ecosystem, attracting a wider audience.

4. Growing Ecosystem and Partnerships

The MANTRA ecosystem is enriched by partnerships with well-known brands and on/off-ramp solution providers, enhancing its utility and reach. The integration of pre-built, compliant dApps within the platform can foster innovation and collaboration, creating a vibrant ecosystem that supports a wide range of applications. As the platform continues to grow and evolve, it may attract more developers and users, further solidifying its position in the market.

5. Market Potential

The increasing interest in decentralized finance and the tokenization of real-world assets presents significant growth opportunities for MANTRA. As more institutions look to integrate blockchain technology into their operations, MANTRA’s focus on compliance and security could position it as a preferred platform for developers and enterprises seeking to navigate the complexities of regulatory environments.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Like most cryptocurrencies, the price of MANTRA (OM) is subject to significant market volatility. Investors may experience dramatic price swings in response to market sentiment, regulatory news, or broader economic conditions. This volatility can deter potential investors, particularly those who are risk-averse or new to the cryptocurrency space. Additionally, the historical price performance of MANTRA, including a substantial drop from its all-time high, may raise concerns about its long-term value proposition.

2. Regulatory Uncertainty

While MANTRA’s focus on regulatory compliance is a strength, it also exposes the platform to risks associated with changing regulatory landscapes. Governments worldwide are still determining how to regulate cryptocurrencies and blockchain technology, which could impact MANTRA’s operations and user base. Unfavorable regulations or increased scrutiny could hinder the platform’s growth and adoption, particularly if it restricts the ability to tokenize or trade certain assets.

3. Competitive Landscape

The cryptocurrency and blockchain space is highly competitive, with numerous projects vying for market share. MANTRA faces competition from other platforms that offer similar services, particularly those focused on RWAs and regulatory compliance. As new technologies and solutions emerge, MANTRA must continuously innovate and differentiate itself to maintain its relevance and attract users. Failure to do so could result in a loss of market share and diminished investor confidence.

4. Technological Risks

While MANTRA’s technological foundation is robust, it is not without risks. The platform’s reliance on the Cosmos SDK and its associated technologies means that vulnerabilities or bugs in the underlying code could expose the network to potential attacks or disruptions. Additionally, as the platform evolves and incorporates new features, the complexity of its technology stack may increase, potentially leading to unforeseen challenges in maintaining security and performance.

5. Dependence on Developer Engagement

The success of MANTRA largely depends on the engagement of developers and the creation of innovative applications within its ecosystem. If developers are not incentivized to build on the platform or if they encounter significant barriers to entry, MANTRA’s growth could stagnate. Furthermore, a lack of compelling dApps may lead to reduced user interest and engagement, undermining the platform’s overall value proposition.

Conclusion

Investing in MANTRA presents both potential strengths and risks that should be carefully considered by investors. Its strong technological foundation, focus on regulatory compliance, and commitment to improving user experience position it well within the evolving landscape of decentralized finance. However, investors must also be aware of the market volatility, regulatory uncertainties, competition, and technological risks that could impact the platform’s success.

As with any investment, thorough research and a clear understanding of both the potential and the risks are crucial for making informed decisions. Investors should consider their risk tolerance and investment goals before engaging with MANTRA or any other cryptocurrency.

Frequently Asked Questions (FAQs)

1. What is MANTRA crypto?

MANTRA (OM) is a decentralized finance (DeFi) platform and Layer 1 blockchain designed to facilitate the tokenization and trading of real-world assets (RWAs). It prioritizes security and regulatory compliance, making it suitable for institutional use. Built using the Cosmos SDK, MANTRA is Inter-Blockchain Communication (IBC) compatible and supports CosmWasm for smart contract development. Its focus on improving user experience aims to onboard both non-native users and institutions into the Web3 space.

2. What makes MANTRA crypto different from Bitcoin?

While Bitcoin is primarily a digital currency aimed at peer-to-peer transactions, MANTRA is a comprehensive blockchain platform that focuses on regulatory compliance and the integration of real-world assets. MANTRA is designed for institutional use and offers a permissionless blockchain environment for permissioned applications, enabling the creation and management of regulatory-compliant assets. Additionally, MANTRA supports a higher transaction throughput (up to 10,000 transactions per second) compared to Bitcoin’s lower capacity.

3. Is MANTRA crypto a good investment?

As with any investment, whether MANTRA crypto is a good choice depends on individual risk tolerance, investment goals, and market conditions. MANTRA has shown significant price movements in the past and is backed by a strong team with experience in fintech and blockchain. However, potential investors should conduct thorough research, assess market trends, and consider the inherent volatility of cryptocurrencies before making investment decisions.

4. Who created MANTRA crypto?

MANTRA was co-founded by John Patrick Mullin, Will Corkin, and Rodrigo Quan Miranda. The team brings a wealth of experience from prestigious firms in finance and technology, including PWC, Citigroup, and Credit Suisse. Their collective background in fintech and blockchain has been instrumental in shaping MANTRA’s vision and functionality.

5. What are the real-world applications of MANTRA crypto?

MANTRA focuses on bridging traditional finance with decentralized finance by providing a platform for developing applications that comply with regulatory standards. Its decentralized exchange (MANTRA DEX) allows users to trade various cryptocurrencies easily. Additionally, MANTRA’s architecture supports a wide range of applications, including financial services, asset management, and supply chain solutions, all designed to integrate seamlessly with real-world assets.

6. How does MANTRA ensure security?

MANTRA employs a sovereign Proof-of-Stake (PoS) validator set to secure its network, where validators are incentivized to act honestly by staking tokens as collateral. The platform also incorporates advanced authentication technologies, such as biometric fingerprint scanners, to enhance user security. These measures are particularly crucial for applications involving real-world assets, as they help prevent fraud and unauthorized access.

7. What is the current price of MANTRA crypto?

As of the latest data, the price of MANTRA (OM) is approximately $0.2079. The market capitalization stands at about $220.48 million, with a circulating supply of 1.06 billion OM tokens. However, cryptocurrency prices are highly volatile and can change rapidly; therefore, it is recommended to check real-time prices on reliable cryptocurrency market platforms.

8. What are the future developments planned for MANTRA?

Looking ahead, MANTRA has plans for significant upgrades and developments, including the anticipated Mainnet launch in October 2024. This launch aims to enhance the platform’s features and capabilities, further solidifying its position in the blockchain industry. Additionally, the team continues to engage in partnerships and community events to foster growth and innovation within the MANTRA ecosystem.

Final Verdict on mantra crypto

Summary of MANTRA Crypto

MANTRA (OM) is a distinctive Layer 1 blockchain platform that emphasizes security and regulatory compliance, specifically designed for the tokenization and trading of real-world assets (RWAs). Built on the Cosmos SDK, MANTRA benefits from its modular architecture, allowing for high scalability and interoperability with other blockchains through the Inter-Blockchain Communication (IBC) protocol. The platform is secured by a sovereign Proof-of-Stake (PoS) validator set, which ensures a robust and secure environment for both individual users and institutional applications.

The primary purpose of MANTRA is to bridge the gap between traditional finance and decentralized finance (DeFi). It offers a permissionless blockchain tailored for permissioned applications, making it particularly appealing to developers and institutions that require adherence to regulatory standards. With features like built-in modules, SDKs, and APIs, MANTRA provides a comprehensive solution for creating, trading, and managing regulatory-compliant assets, thereby streamlining the transition for users unfamiliar with Web3 technologies.

Potential and Risks

While MANTRA presents significant potential for growth, particularly as the demand for compliant blockchain solutions rises, it is essential to recognize that investing in cryptocurrencies carries inherent risks. The price volatility associated with MANTRA (OM) can lead to substantial fluctuations in value, making it a high-risk, high-reward asset class.

Final Thoughts

As with any investment in cryptocurrency, thorough research is crucial. Potential investors should take the time to understand the underlying technology, market dynamics, and the specific use cases of MANTRA. Conducting your own research (DYOR) will empower you to make informed decisions and navigate the complexities of the digital asset landscape effectively.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.