What is libra crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to libra crypto

Libra crypto, often simply referred to as LIBRA, has emerged as a noteworthy player in the ever-evolving landscape of cryptocurrencies. Launched with the ambition to stimulate economic growth in Argentina, LIBRA is designed to support small businesses and startups within the country. This unique approach positions LIBRA not just as a digital asset, but as a potential catalyst for local economic development, attracting attention from both investors and economic analysts alike.

The Significance of Libra Crypto

In a market flooded with various cryptocurrencies, LIBRA stands out due to its direct ties to the Argentine economy and its backing by political figures, notably President Javier Milei. This association has fueled interest and speculation, leading to significant volatility in its price. At its peak, LIBRA reached a staggering $4.50, although it has since experienced sharp declines, illustrating the inherent risks associated with investing in newly launched tokens, particularly those linked to political initiatives.

Purpose of This Guide

This comprehensive guide aims to equip both beginners and intermediate investors with a thorough understanding of LIBRA crypto. We will delve into various aspects of the asset, including its underlying technology, tokenomics, and investment potential. Additionally, we will highlight the risks associated with investing in LIBRA, particularly in light of its recent controversies and the broader implications of political backing.

What You Can Expect

-

Technology: We will explore the blockchain technology that powers LIBRA, examining how it facilitates transactions and supports the ecosystem of businesses it aims to help.

-

Tokenomics: Understanding the economics of LIBRA is crucial for any investor. We will break down its supply, market capitalization, and distribution mechanisms to provide clarity on its financial structure.

-

Investment Potential: In this section, we will assess LIBRA’s potential as an investment. This includes analyzing market trends, historical performance, and future projections based on current economic conditions.

-

Risks: As with any investment, there are risks involved. We will discuss the volatility associated with LIBRA, the impact of political influence, and the liquidity challenges that may arise.

-

How to Buy: Finally, we will guide you through the process of purchasing LIBRA, detailing the exchanges where it is available and the steps needed to securely acquire and store your tokens.

By the end of this guide, you will have a well-rounded perspective on LIBRA crypto, enabling you to make informed investment decisions. Whether you are looking to invest in this unique asset or simply wish to expand your cryptocurrency knowledge, this guide serves as your go-to resource.

What is libra crypto? A Deep Dive into its Purpose

Understanding Libra Crypto

Libra, a cryptocurrency that emerged from the political and economic landscape of Argentina, is gaining attention as a digital asset with a unique narrative and purpose. Unlike many cryptocurrencies that are purely speculative, Libra aims to address specific economic challenges in Argentina, particularly in fostering growth for small businesses and startups.

The Core Problem It Solves

Argentina’s economy has faced significant challenges, including inflation, currency devaluation, and a lack of access to traditional financial services for many citizens. These issues have created a pressing need for alternative financial solutions that can empower individuals and businesses alike. Libra seeks to address these challenges by providing a decentralized digital currency that can facilitate transactions and investments in a more stable and efficient manner.

The primary problems that Libra aims to solve include:

-

Access to Financial Services: Many Argentinians lack access to traditional banking services, which limits their ability to save, invest, and transact. Libra offers a digital alternative that can be accessed via smartphones, potentially bridging the gap for unbanked populations.

-

Inflation and Currency Instability: With the Argentine peso experiencing significant inflation, a stable digital currency like Libra can offer a hedge against the declining value of the national currency. By allowing transactions in a cryptocurrency that can be pegged to more stable assets, users may protect their purchasing power.

-

Support for Local Businesses: By facilitating easier transactions, Libra aims to support small businesses and startups in Argentina, providing them with the necessary funding and financial tools to thrive in a challenging economic environment.

Its Unique Selling Proposition

What sets Libra apart from other cryptocurrencies is its focus on the Argentine market and its backing by a prominent political figure, President Javier Milei. The project is designed not only as a cryptocurrency but as a tool for economic revitalization in Argentina. Key aspects of its unique selling proposition include:

-

Local Focus: While many cryptocurrencies aim for global reach, Libra’s primary target is the Argentine economy. This localized approach allows it to tailor its features and marketing to meet the specific needs of its user base.

-

Political Endorsement: The backing of President Javier Milei lends significant credibility and visibility to Libra. His promotion of the cryptocurrency has the potential to attract a wider audience and encourage adoption among citizens who may be skeptical of digital assets.

-

Community Engagement: Libra aims to foster a community around the token, encouraging users to participate in its growth and development. This community-driven approach can enhance user loyalty and create a sense of ownership among its holders.

-

Potential for Growth: Given the economic challenges in Argentina, there is a pressing need for alternative solutions. If successfully adopted, Libra could experience significant growth and adoption, positioning itself as a key player in the local cryptocurrency landscape.

The Team and Backers

The success of any cryptocurrency project often hinges on the strength and vision of its team. Libra is backed by a group of developers and entrepreneurs who are committed to revitalizing the Argentine economy. Although specific details about the team may not be widely publicized, their connection to the local business community and understanding of the economic landscape are crucial.

Additionally, the political endorsement from President Milei plays a pivotal role in shaping the project’s direction. His involvement not only provides legitimacy but also aligns Libra with a broader economic vision for Argentina, which includes embracing digital innovation and enhancing financial inclusion.

Fundamental Purpose in the Crypto Ecosystem

Libra’s fundamental purpose extends beyond being a mere digital currency; it is envisioned as a vehicle for economic empowerment in a country grappling with financial instability. Its role in the cryptocurrency ecosystem can be understood through the following lenses:

-

Facilitating Transactions: By offering a low-fee digital currency, Libra aims to make everyday transactions more accessible and affordable for Argentinians. This could encourage the use of digital payments and reduce reliance on cash, which can be particularly beneficial in times of economic uncertainty.

-

Encouraging Investment: As a cryptocurrency that supports small businesses, Libra could attract investment from both local and international sources. This influx of capital could stimulate economic growth and innovation in Argentina, contributing to a more robust economy.

-

Promoting Financial Literacy: Through its community-driven approach, Libra has the potential to educate users about cryptocurrencies, blockchain technology, and financial management. This increased awareness can empower individuals to make informed financial decisions.

-

Contributing to the Global Crypto Narrative: While Libra is focused on Argentina, its success could serve as a case study for other countries facing similar economic challenges. If Libra successfully navigates the complexities of the Argentine economy, it could inspire similar projects in other regions, contributing to the global conversation about the role of cryptocurrencies in economic development.

Conclusion

In summary, Libra crypto represents a unique intersection of technology, politics, and economics within the Argentine context. By addressing specific financial challenges faced by the populace, it aims to create a more inclusive financial ecosystem. As the project develops, its success could have far-reaching implications, not only for Argentina but also for the broader cryptocurrency landscape. Understanding Libra’s purpose and potential will be crucial for investors and users alike as they navigate this evolving digital asset.

The Technology Behind the Coin: How It Works

Introduction to Libra Crypto Technology

Libra, a cryptocurrency originally introduced by Facebook and later rebranded as Diem, aimed to provide a simple, low-fee medium of exchange on a global scale. Although the project faced significant hurdles and eventually wound down in January 2022, understanding the technology behind Libra offers valuable insights into its design and intended functionality. This guide breaks down the essential components of Libra’s technology, including its blockchain architecture, consensus mechanism, and key innovations.

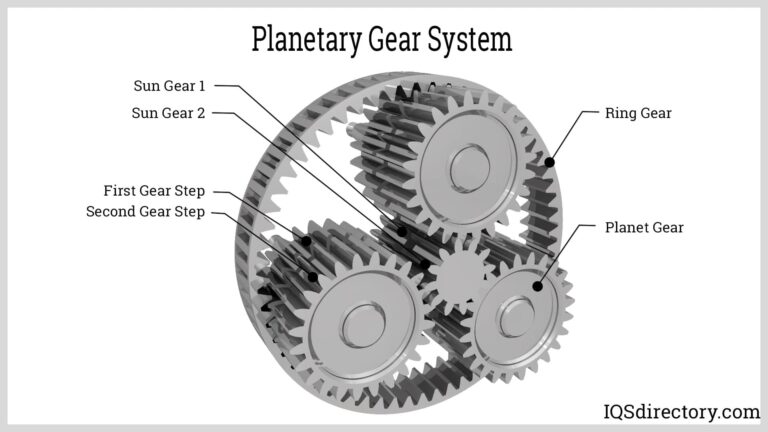

Blockchain Architecture

At its core, Libra was built on blockchain technology, which is a decentralized digital ledger that records transactions across many computers in a way that ensures the security and integrity of the data. Here are the critical aspects of Libra’s blockchain architecture:

1. Permissioned Blockchain

Unlike many cryptocurrencies, which operate on fully decentralized networks, Libra was designed as a permissioned blockchain. This means that only specific, pre-approved entities could participate in the network. The goal was to provide a balance between decentralization and regulatory compliance. The Libra Association (later the Diem Association) was responsible for overseeing the network’s operations, ensuring that only trusted members—like financial institutions and technology companies—could validate transactions and maintain the ledger.

2. Multi-Currency Stablecoin Model

Libra was designed to be a stablecoin, meaning its value would be pegged to a basket of currencies and other assets. This backing aimed to reduce volatility, making it more suitable for everyday transactions. The stablecoin model was intended to provide users with a reliable medium of exchange, unlike many cryptocurrencies that experience significant price swings.

3. Wallet Integration

Users could access Libra through digital wallets, which would facilitate the buying, holding, and spending of Libra tokens. These wallets were designed to be user-friendly, allowing individuals to convert their local currencies into Libra tokens seamlessly. The integration of wallets was critical for fostering widespread adoption, as it simplified the transaction process for users unfamiliar with cryptocurrency.

Consensus Mechanism

The consensus mechanism is the method by which a blockchain network agrees on the validity of transactions. It ensures that all participants in the network have a consistent view of the ledger. Here’s how Libra’s consensus mechanism was structured:

1. Byzantine Fault Tolerance (BFT)

Libra employed a consensus algorithm based on Byzantine Fault Tolerance (BFT). This approach allows the network to reach consensus even if some nodes (participants) fail or act maliciously. In Libra’s case, the BFT mechanism meant that a two-thirds majority of the validating nodes had to agree on the state of the ledger for a transaction to be considered valid. This design aimed to enhance security while ensuring that the network could maintain efficiency and speed.

2. Validator Nodes

Validator nodes were central to Libra’s consensus mechanism. Only members of the Libra Association could operate these nodes, which were responsible for validating transactions and maintaining the integrity of the network. By limiting the number of validator nodes to trusted entities, Libra aimed to minimize the risks associated with decentralized networks, such as fraud and manipulation.

Key Technological Innovations

Libra’s design incorporated several technological innovations that set it apart from traditional cryptocurrencies. These innovations aimed to enhance usability, security, and regulatory compliance.

1. Asset-Backed Stability

One of the most significant innovations was the asset-backed model. Libra tokens were to be backed by a reserve of assets, including major currencies and government securities. This backing was intended to provide stability, making Libra more appealing for everyday transactions. By holding a diverse basket of assets, Libra aimed to maintain a stable value, which is crucial for a currency intended for global use.

2. Interoperability

Libra was designed with interoperability in mind, allowing it to integrate with existing financial systems and other cryptocurrencies. This feature aimed to facilitate cross-border transactions and enhance the overall utility of the token. By enabling interoperability, Libra sought to bridge the gap between traditional finance and the emerging world of digital currencies.

3. Privacy and Security Features

Security was a paramount concern for Libra, particularly given the scrutiny it faced from regulators. The project incorporated advanced cryptographic techniques to secure transactions and protect user data. Additionally, the permissioned nature of the blockchain allowed for greater control over who could access and validate transactions, thereby enhancing security.

4. Regulatory Compliance

Recognizing the regulatory challenges facing cryptocurrencies, Libra was designed with compliance in mind. The Libra Association intended to work closely with regulators to ensure that the project met legal requirements. This proactive approach aimed to build trust among users and financial institutions, which is critical for the widespread adoption of any currency.

Challenges and Criticisms

Despite its innovative design, Libra faced significant challenges that ultimately led to its decline. Regulatory scrutiny was one of the most pressing issues. Many governments expressed concerns about the potential for money laundering, fraud, and the impact on monetary policy. The association’s initial vision of a decentralized currency clashed with the need for regulatory oversight, leading to a lack of trust among stakeholders.

Additionally, the project’s association with Facebook raised concerns about privacy and data security, given the company’s history with user data. These challenges prompted many founding members to withdraw from the project, leading to its eventual winding down.

Conclusion

While the Libra project may have ultimately failed, its technological innovations and design principles have left a lasting impact on the cryptocurrency landscape. By exploring concepts such as permissioned blockchains, BFT consensus mechanisms, and asset-backed stability, Libra contributed to the ongoing dialogue about the future of digital currencies. Understanding these elements is essential for anyone looking to navigate the evolving world of cryptocurrencies, as they highlight both the potential and the challenges of creating a global digital currency.

Understanding libra crypto Tokenomics

The tokenomics of the Libra crypto token is an essential aspect to understand for both potential investors and users. Tokenomics refers to the economic model of a cryptocurrency, which includes its supply, distribution, and the utility of the token. In this section, we will delve into the key metrics that define the Libra token and explain its utility and distribution mechanisms.

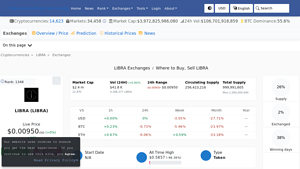

| Metric | Value |

|---|---|

| Total Supply | 999.99 million LIBRA |

| Max Supply | 1 billion LIBRA |

| Circulating Supply | 256.42 million LIBRA |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The primary purpose of the Libra token is to facilitate transactions within the ecosystem it serves. This token is designed to be a medium of exchange, allowing users to buy goods and services where Libra is accepted. The token aims to provide a low-fee alternative for both consumers and businesses, making it an attractive option in regions where traditional financial systems may be less accessible or more costly.

In addition to serving as a transactional currency, Libra is also intended to support various decentralized finance (DeFi) applications. This means that users may be able to lend, borrow, or earn interest on their holdings through various platforms built on the Libra network. The flexibility of the token also allows for its potential use in staking, where users can lock their tokens in a wallet to support network operations in exchange for rewards.

Furthermore, the token is designed to be integrated into various financial services, including remittances and microtransactions. Given its low transaction fees, Libra can make sending small amounts of money across borders more feasible, addressing a critical need in many developing economies.

Token Distribution

Understanding the distribution model of Libra is crucial for assessing its potential for growth and stability. The token distribution is typically planned to ensure a fair allocation among stakeholders, including early investors, project developers, and the community.

-

Initial Distribution: A portion of the total supply is allocated to early investors and contributors to the project. This initial distribution is often designed to incentivize those who contribute to the development and promotion of the token in its early stages.

-

Community Incentives: To foster a robust ecosystem, a significant amount of tokens is usually reserved for community incentives. This can include rewards for users who participate in governance, staking, or other community-driven activities. By engaging users in the governance of the token, the project aims to create a decentralized and self-sustaining ecosystem.

-

Liquidity Pool: Part of the token supply is set aside for liquidity pools, which are essential for facilitating trading on exchanges. A well-funded liquidity pool ensures that users can buy and sell the token without significant price slippage, thus attracting more traders to the platform.

-

Development Fund: A portion of the tokens may also be allocated to a development fund. This fund is crucial for ongoing project development, marketing, and partnerships. By having a dedicated source of funding, the project can adapt and grow in response to market demands and technological advancements.

-

Vesting Period: To prevent market flooding and ensure long-term stability, many projects implement a vesting period for team members and early investors. This means that their tokens are released gradually over time, which helps to align their interests with the long-term success of the project.

Conclusion

In summary, the tokenomics of Libra crypto plays a pivotal role in defining its utility, distribution, and overall economic model. With a total supply of approximately 999.99 million LIBRA tokens, a deflationary model, and a focus on community engagement and usability, Libra is positioned to serve as a viable medium of exchange within its intended ecosystem. Understanding these fundamentals is essential for anyone looking to invest in or utilize the Libra token effectively. As the cryptocurrency landscape continues to evolve, staying informed about the tokenomics of specific projects like Libra will help investors and users make informed decisions.

Price History and Market Performance

Key Historical Price Milestones

The price history of the Libra cryptocurrency, often referred to as LIBRA, has been marked by significant volatility since its inception. The token was launched with much fanfare, largely due to its association with political figures in Argentina and the promise of being a tool for economic development within the country.

-

Initial Launch and Price Surge: LIBRA experienced an initial surge in value shortly after its launch in early 2025. It reached an all-time high of approximately $4.50 on February 19, 2025, propelled by excitement and speculation surrounding its potential use cases and the backing of prominent political endorsements. This rapid increase in price drew considerable attention from both investors and the media.

-

Subsequent Decline: However, this peak was short-lived. Within hours of reaching its all-time high, LIBRA’s price began to plummet. Within days, it had dropped significantly, reflecting a common pattern seen in many newly launched cryptocurrencies, particularly those linked to political events or figures. The volatility was exacerbated by the withdrawal of substantial amounts of cryptocurrency from liquidity pools, reportedly linked to wallets associated with the token’s creators, which raised concerns about potential market manipulation.

-

Current Price Levels: As of October 2023, the price of LIBRA has stabilized around $0.009561, with a market capitalization of approximately $2.45 million. This represents a significant decline of about 99.71% from its all-time high. The circulating supply is currently 256.42 million LIBRA, out of a total supply of 1 billion LIBRA. The trading volume over the past 24 hours was approximately $41,790, indicating a relatively low level of trading activity compared to more established cryptocurrencies.

-

Price Fluctuations: The LIBRA token has shown a 24-hour price range between a low of $0.009515 and a high of $0.01408. Such fluctuations are indicative of the ongoing volatility characteristic of meme coins and newly launched tokens.

Factors Influencing the Price

Historically, the price of LIBRA has been influenced by several key factors:

-

Market Sentiment and Speculation: Like many cryptocurrencies, LIBRA’s price has been significantly affected by market sentiment. The initial excitement surrounding its launch, driven by political endorsements, created speculative trading behavior. As more investors became aware of the potential risks, including the implications of political involvement, market sentiment shifted, leading to increased selling pressure.

-

Liquidity Events: The withdrawal of nearly $99 million from LIBRA’s liquidity pools by wallets linked to the token’s creators played a pivotal role in the token’s price dynamics. Such liquidity events can lead to sharp price declines as they indicate a lack of confidence in the token’s future prospects. The market reacted negatively to these withdrawals, further driving down the price.

-

Regulatory Scrutiny: The involvement of political figures, specifically Argentine President Javier Milei, brought increased scrutiny and controversy. Following the rapid price increase and subsequent decline, legal investigations into the token’s launch and Milei’s potential conflicts of interest were initiated. Regulatory concerns often create uncertainty in the market, leading to reduced investor confidence and price declines.

-

Market Comparisons: LIBRA’s price movements also reflect broader trends in the cryptocurrency market. As a relatively new entrant, its performance is often compared to more established cryptocurrencies like Bitcoin and Ethereum. When these major cryptocurrencies experience significant price movements, it can affect investor sentiment towards altcoins, including LIBRA.

-

Meme Coin Dynamics: LIBRA is categorized as a meme coin, meaning its value is often driven by internet trends and social media hype rather than fundamental utility. This can lead to rapid price increases followed by sharp declines, as seen with LIBRA. The community’s engagement on platforms like Twitter and Reddit can heavily influence trading behavior and price fluctuations.

-

Economic Conditions in Argentina: Given LIBRA’s ties to the Argentine economy, macroeconomic factors such as inflation, currency devaluation, and political stability in Argentina can also impact its price. Investors often consider the economic environment when evaluating the potential success of a cryptocurrency tied to a specific region.

Conclusion

The price history of LIBRA illustrates the volatile nature of cryptocurrencies, particularly those influenced by political events and speculative trading. From its initial surge to its current levels, the token’s performance reflects a complex interplay of market sentiment, liquidity events, regulatory scrutiny, and broader economic conditions. Understanding these factors is essential for any investor looking to navigate the landscape of cryptocurrencies effectively.

Where to Buy libra crypto: Top Exchanges Reviewed

5. Top Exchanges for LIBRA (LIBRA) – Buy, Sell, and Trade with Ease!

The LIBRA (LIBRA) cryptocurrency is primarily available on three exchanges: Hibt, AscendEX (formerly BitMax), and Coinex. These platforms stand out for their user-friendly interfaces and robust trading features, making them accessible for both novice and experienced traders. Each exchange offers unique trading pairs and liquidity options, ensuring that users can effectively buy, sell, and trade LIBRA with ease.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

3. Libra Incentix – Your Gateway to Easy LIXX Trading!

Libra Incentix offers a unique trading experience for its native token, LIXX, with BitMart emerging as the premier exchange for purchasing this cryptocurrency. With a notable trading volume of $23,853 in the last 24 hours, BitMart stands out for its user-friendly interface and reliable liquidity, making it an attractive option for both novice and experienced traders looking to engage with Libra Incentix.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Easy Steps to Secure Your Libra Coin Today!

The article “How to Buy Libra Coin? – DailyCoin” highlights the flexibility of purchasing Libra Coins through various digital asset exchanges, rather than being limited to its proprietary applications and wallets. This accessibility enhances user experience by allowing investors to choose from multiple platforms, potentially increasing liquidity and convenience. The review emphasizes the importance of this feature, making Libra Coin more approachable for both new and experienced cryptocurrency enthusiasts.

- Website: dailycoin.com

- Platform Age: Approx. 20 years (domain registered in 2005)

How to Buy libra crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to purchasing Libra crypto is selecting a reliable cryptocurrency exchange. Various platforms allow you to buy, sell, and trade cryptocurrencies. Here are some popular exchanges where you can buy Libra:

- Binance: One of the largest exchanges globally, offering a wide range of cryptocurrencies, including Libra.

- Coinbase: A user-friendly platform ideal for beginners, although it may not have Libra available at all times.

- Kraken: Known for its security features and a variety of crypto offerings.

- Meteora: The exchange that launched the Libra token; check if it supports trading for this specific asset.

Before making a choice, ensure the exchange supports Libra, has good security features, and provides a seamless user experience.

2. Create and Verify Your Account

Once you’ve chosen an exchange, the next step is to create an account. Here’s how to do it:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide your email address and create a password.

- Verification: Most exchanges require identity verification to comply with regulations. You may need to submit:

- A government-issued ID (like a passport or driver’s license).

- A selfie for identity verification.

- Proof of address (like a utility bill or bank statement).

This verification process can take anywhere from a few minutes to a few days, depending on the exchange.

3. Deposit Funds

After your account is verified, you need to deposit funds to purchase Libra. Here’s how:

- Choose Deposit Method: Most exchanges offer multiple deposit methods, including:

- Bank transfer (ACH for U.S. users).

- Credit or debit card.

-

Cryptocurrency transfer (if you already own other cryptocurrencies).

-

Deposit Funds: Follow the on-screen instructions to deposit funds into your account. Be aware of any fees associated with your chosen deposit method.

-

Wait for Confirmation: Depending on the method, it might take a few minutes to a few days for the funds to reflect in your exchange account.

4. Place an Order to Buy Libra Crypto

With funds in your account, you can now place an order to buy Libra. Here’s how:

-

Navigate to the Trading Section: Find the trading or market section on your chosen exchange.

-

Select Libra: Search for the Libra trading pair (for example, LIBRA/USD or LIBRA/BTC) and click on it.

-

Choose Order Type: You can typically place different types of orders:

- Market Order: This buys Libra at the current market price.

-

Limit Order: This allows you to set a specific price at which you want to buy Libra. Your order will only execute if the market reaches that price.

-

Enter Amount: Specify how much Libra you want to buy. The exchange will show you the equivalent amount in your deposited currency.

-

Confirm Order: Review the details and confirm your order. Once completed, you will see the Libra in your exchange wallet.

5. Secure Your Coins in a Wallet

After purchasing Libra, it’s crucial to secure your investment. Keeping your coins in an exchange wallet can be risky due to potential hacks. Here’s how to secure your coins:

- Choose a Wallet: There are various types of wallets available:

- Software Wallets: Apps like Exodus or Trust Wallet, which are easy to use for beginners.

- Hardware Wallets: Physical devices like Ledger or Trezor that store your coins offline, providing enhanced security.

-

Paper Wallets: A printed document containing your public and private keys, though this method requires careful handling to avoid loss or damage.

-

Transfer Libra: If you choose a wallet, initiate a transfer from the exchange to your wallet’s address. Make sure to double-check the address to avoid sending your coins to the wrong place.

-

Backup Your Wallet: If using a software or hardware wallet, ensure you back it up and keep your recovery phrase safe. This step is crucial for recovering your assets in case of loss or theft.

Conclusion

Buying Libra crypto can be an exciting venture into the world of digital assets. By following these steps—choosing a reputable exchange, verifying your account, depositing funds, placing an order, and securing your coins—you can confidently navigate the process. Always do your own research and consider the risks associated with investing in cryptocurrencies.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Community Support and Market Awareness

The LIBRA cryptocurrency has gained significant attention in the crypto community, particularly due to its association with political figures in Argentina, such as President Javier Milei. This visibility can lead to increased interest and adoption, which is crucial for any cryptocurrency’s success. A strong community can support the growth of the token, potentially driving demand and usage.

2. Low Transaction Fees

One of the key selling points of LIBRA is its potential for low transaction fees, making it an attractive option for users looking to send money or make purchases. This could appeal to users in regions with high remittance costs or limited access to traditional banking services. Lower fees may facilitate greater adoption among individuals and small businesses, further boosting its usage.

3. Potential for Economic Growth in Argentina

Given that LIBRA is positioned as a means to support the Argentine economy, it could attract investments from those looking to capitalize on local business growth. By funding small businesses and startups in Argentina, LIBRA may create a positive feedback loop where economic development fosters increased usage of the cryptocurrency. This could enhance its value proposition as a local currency alternative, especially in a country facing economic challenges.

4. Speculative Trading Opportunities

With its recent price fluctuations, LIBRA has presented opportunities for traders looking to capitalize on short-term market movements. The high volatility often associated with new cryptocurrencies can lead to substantial profits for those who engage in speculative trading. While this carries risks, the potential for significant returns can attract traders and investors looking for high-risk, high-reward opportunities.

5. Use of Blockchain Technology

As a cryptocurrency built on blockchain technology, LIBRA benefits from the inherent advantages of blockchain, including transparency, security, and decentralization (to an extent). These features can instill confidence in users regarding the safety of their transactions and holdings. Moreover, the use of blockchain can facilitate faster and more efficient transactions compared to traditional financial systems.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

One of the most significant risks associated with LIBRA is its market volatility. Cryptocurrencies are known for their price fluctuations, and LIBRA is no exception. Investors may experience substantial gains, but they can also face severe losses. The price of LIBRA has already shown dramatic swings, peaking at over $4.50 before dropping significantly. This volatility can deter cautious investors and make LIBRA a risky asset for those with low-risk tolerance.

2. Regulatory Uncertainty

The regulatory environment for cryptocurrencies remains fluid and uncertain globally. LIBRA, especially with its association with political figures, could attract regulatory scrutiny. Any adverse regulatory actions or changes in legislation could impact the token’s legality, usage, and overall market perception. For instance, if the Argentine government were to impose restrictions on LIBRA or cryptocurrencies in general, it could severely hinder its adoption and value.

3. Competition from Other Cryptocurrencies

LIBRA faces stiff competition from established cryptocurrencies like Bitcoin, Ethereum, and various stablecoins. Many of these competitors have significant market share, user bases, and established infrastructure, making it challenging for LIBRA to gain traction. Additionally, the rise of new projects and innovations in the crypto space could further dilute LIBRA’s market position and appeal.

4. Technological Risks

As a cryptocurrency, LIBRA is subject to various technological risks, including security vulnerabilities, hacking incidents, and software bugs. While blockchain technology is generally secure, vulnerabilities can exist within the ecosystem, particularly if the infrastructure is not adequately maintained or updated. A significant security breach could undermine user confidence and lead to a rapid decline in the token’s value.

5. Potential for Market Manipulation

Given the relatively low market capitalization of LIBRA, it could be susceptible to market manipulation. Large holders or “whales” can influence the price by executing large trades, which can lead to sudden price swings. Such manipulation can create an environment of distrust among smaller investors, further exacerbating market volatility.

6. Dependence on Key Individuals

The LIBRA cryptocurrency’s visibility and credibility are closely tied to individuals like President Milei. Should these figures face scandals, regulatory issues, or loss of public support, it could negatively impact LIBRA’s reputation and adoption. The perception of LIBRA as a “political” cryptocurrency may deter some investors and users who prefer to engage with decentralized and apolitical projects.

Conclusion

In summary, LIBRA presents a unique investment opportunity that carries both potential strengths and significant risks. While its low transaction fees, community support, and local economic initiatives may bolster its prospects, the inherent market volatility, regulatory uncertainties, and competitive landscape present substantial challenges. Investors should approach LIBRA with caution, conducting thorough research and considering their risk tolerance before engaging with this cryptocurrency. The dynamic nature of the crypto market necessitates a careful assessment of both the potential rewards and pitfalls associated with investing in LIBRA.

Frequently Asked Questions (FAQs)

1. What is Libra Crypto?

Libra is a cryptocurrency that emerged from Argentina and is primarily focused on supporting the growth of the Argentine economy. It aims to fund small businesses and startups in the region. Unlike many cryptocurrencies, Libra has a distinct political aspect, having been promoted by Argentine President Javier Milei. The coin is part of the Solana ecosystem and is categorized as a meme coin, which often references internet trends or jokes.

2. Who created Libra Crypto?

Libra was created as part of a private initiative that has garnered support from various political figures, particularly Argentine President Javier Milei. The project aims to stimulate investment in Argentina and improve economic conditions through the funding of local enterprises. However, the exact identities of all the creators and team members involved in the project are not widely publicized.

3. How does Libra Crypto work?

Libra operates on the Solana blockchain, utilizing its infrastructure for transactions and smart contracts. Users can buy, hold, and trade Libra tokens, which are intended to be used as a medium of exchange for businesses that accept them. The total supply of Libra is capped at 1 billion tokens, with a circulating supply of around 256 million tokens as of now.

4. Is Libra Crypto a good investment?

The investment potential of Libra is uncertain and highly speculative. While it has seen significant price fluctuations, including a rise to $4.50 before a notable drop, potential investors should consider the inherent risks associated with meme coins and cryptocurrencies linked to political figures. Thorough research and analysis, as well as a consideration of personal risk tolerance, are crucial before investing.

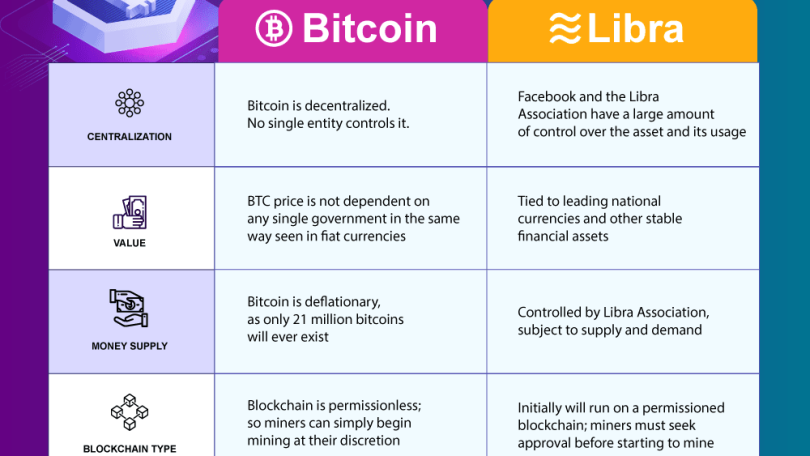

5. What makes Libra Crypto different from Bitcoin?

Libra differs from Bitcoin in several ways:

- Purpose: While Bitcoin is primarily seen as a digital store of value or “digital gold,” Libra aims to support local economic growth by funding businesses in Argentina.

- Market Position: Bitcoin is a widely recognized and established cryptocurrency with significant market capitalization, whereas Libra is relatively new and less known.

- Underlying Technology: Libra operates on the Solana blockchain, while Bitcoin has its own blockchain designed for secure, decentralized transactions.

6. What are the risks associated with investing in Libra Crypto?

Investing in Libra carries several risks, including:

- Volatility: Like many cryptocurrencies, Libra’s price can fluctuate dramatically in a short period, which can lead to substantial financial losses.

- Regulatory Scrutiny: Given its political connections, Libra may face regulatory challenges that could impact its viability and market acceptance.

- Market Sentiment: Being categorized as a meme coin, Libra’s value may be heavily influenced by social media trends and public sentiment rather than fundamental economic factors.

7. What is the current price of Libra Crypto?

As of the latest data, the price of Libra is approximately $0.009561 USD. The market capitalization stands at around $2.45 million, with a 24-hour trading volume of about $41,790. It’s important to note that cryptocurrency prices are highly volatile and can change rapidly.

8. Where can I buy Libra Crypto?

Libra can be purchased on various cryptocurrency exchanges that support its trading. It is advisable to research and choose a reputable exchange that offers Libra, ensuring that it adheres to security standards and provides a user-friendly interface for transactions. Always consider the fees and trading pairs available before making a purchase.

Final Verdict on libra crypto

Overview of Libra Crypto

Libra, originally conceptualized by Facebook and later rebranded to Diem, aimed to create a stablecoin that would facilitate low-fee, global transactions. The intent was to provide a user-friendly digital currency for everyday purchases, leveraging blockchain technology to ensure secure and efficient transactions. Unlike traditional cryptocurrencies, Libra was designed to be backed by a basket of assets, including major currencies and government securities, providing it with a level of stability uncommon in the volatile crypto market.

Technological Framework

Libra’s underlying technology was built on a blockchain framework that was not entirely decentralized, as it restricted access to the transaction ledger to members of the Libra Association (later the Diem Association). This organization included multiple notable partners like Mastercard and Visa, ensuring that governance was not solely in the hands of Facebook. This structure aimed to foster trust and regulatory compliance, a significant consideration given the scrutiny faced by cryptocurrencies.

Market Performance and Risks

Despite its ambitious goals, Libra’s journey has been tumultuous. The token witnessed dramatic price fluctuations, including a rise to over $4.50 before experiencing significant declines. Such volatility exemplifies the high-risk nature of investing in cryptocurrencies, particularly those backed by political figures or subject to regulatory investigations. Reports of substantial withdrawals from liquidity pools further underscore the speculative nature of this asset class.

Conclusion: Do Your Own Research

In conclusion, Libra crypto represents a high-risk, high-reward investment opportunity. Its innovative approach to digital transactions and backing by a diversified asset pool may appeal to some investors, but the associated risks cannot be overstated. The potential for significant price swings and the ongoing scrutiny from regulatory bodies make it essential for prospective investors to thoroughly research the market dynamics, underlying technology, and the political context surrounding Libra. Always remember to conduct your own thorough research (DYOR) before making any investment decisions in the cryptocurrency space.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.