libra coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to libra coin

Libra Coin has emerged as a notable player in the ever-evolving landscape of cryptocurrencies, particularly within the Solana ecosystem. Often associated with the broader category of meme coins, Libra Coin distinguishes itself by leveraging cultural trends and social narratives, making it a unique investment opportunity. The coin is designed not only for trading but also for community engagement, funding small businesses, and stimulating economic growth, especially in regions like Argentina.

Significance in the Crypto Market

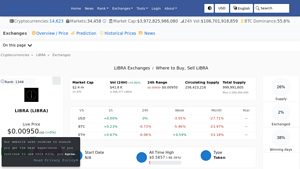

As a digital asset, Libra Coin holds a market capitalization of approximately $2.45 million, positioning it at around #1754 in terms of market ranking. Its current price is approximately $0.009561, reflecting a modest increase of 0.41% in the last 24 hours. However, its historical performance shows significant volatility, having reached an all-time high of $3.28 in February 2025, showcasing both the potential for substantial gains and the inherent risks associated with meme coins.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginner and intermediate investors interested in Libra Coin. It will cover the following key areas:

-

Technology: An overview of the underlying blockchain technology that supports Libra Coin, including its smart contract capabilities and integration within the Solana ecosystem.

-

Tokenomics: A breakdown of Libra Coin’s supply dynamics, including its total supply of 1 billion tokens, circulating supply, and market cap. We will also discuss the implications of its tokenomics on price movement and investor sentiment.

-

Investment Potential: An analysis of the current market trends and potential use cases for Libra Coin, including its role in supporting local businesses and community initiatives. We will explore its historical price performance and possible future trends.

-

Risks: A candid discussion of the risks associated with investing in meme coins like Libra, including market volatility, regulatory scrutiny, and the speculative nature of such assets.

-

How to Buy: Step-by-step instructions on acquiring Libra Coin, including the exchanges where it is available and tips for securely managing your investment.

By the end of this guide, you will have a thorough understanding of Libra Coin, enabling you to make informed decisions about investing in this unique digital asset. Whether you are looking to diversify your portfolio or simply learn more about this intriguing coin, our aim is to equip you with the knowledge necessary to navigate the crypto market effectively.

What is libra coin? A Deep Dive into its Purpose

Overview of Libra Coin

Libra Coin, often referred to simply as LIBRA, is a cryptocurrency that operates within the Solana ecosystem. It is designed with a focus on supporting economic growth in Argentina by funding small businesses and startups. The coin embodies a unique blend of cultural relevance, community engagement, and financial technology, making it an intriguing asset in the cryptocurrency landscape.

The Core Problem It Solves

One of the primary challenges faced by emerging economies, particularly in Argentina, is access to funding and resources for small and medium-sized enterprises (SMEs). Traditional financial systems often overlook these businesses, leaving them without the necessary capital to grow, innovate, and create jobs. Libra Coin aims to bridge this gap by providing a decentralized financial solution that enables easier access to funding.

The core problem LIBRA addresses can be summarized as follows:

-

Access to Capital: Many SMEs struggle to obtain loans from banks due to stringent requirements and lack of collateral. By leveraging blockchain technology, Libra Coin offers an alternative funding mechanism that bypasses traditional financial barriers.

-

Encouraging Local Investments: With its unique positioning, Libra Coin seeks to attract both local and international investors interested in supporting the Argentine economy. This is particularly relevant in a time when traditional investment avenues may seem risky or inaccessible.

-

Community Empowerment: By funding local businesses, Libra Coin not only contributes to economic development but also fosters a sense of community and social responsibility among its users and investors.

Its Unique Selling Proposition

Libra Coin stands out in the crowded cryptocurrency market due to several unique features:

-

Community-Centric Approach: Unlike many cryptocurrencies that focus solely on speculative trading, Libra Coin emphasizes community engagement and local economic support. This makes it appealing to those who wish to make a positive impact while investing.

-

Cultural Relevance: The project taps into cultural narratives, often using memes and popular social themes to engage users. This approach resonates particularly well with younger investors who are more inclined to participate in initiatives that reflect their values and interests.

-

Integration with Solana: Operating on the Solana blockchain, Libra Coin benefits from the high transaction speeds and low fees associated with this platform. This enhances the usability of the coin for both investors and businesses, making transactions more efficient and cost-effective.

-

Decentralized Finance (DeFi) Features: Libra Coin is positioned within the DeFi space, which allows for innovative financial products and services that can benefit users. This includes yield farming, lending, and other financial instruments that enhance the value proposition of holding LIBRA tokens.

The Team and Backers

Understanding the team behind any cryptocurrency project is crucial for assessing its potential success. Libra Coin’s development is driven by a group of passionate individuals with backgrounds in finance, technology, and social impact. While specific details about the team may not always be publicly available, the project has garnered attention for its commitment to fostering economic growth in Argentina.

-

Founders and Developers: The core team consists of individuals who have experience in blockchain technology, finance, and community development. Their collective expertise plays a significant role in guiding the project and ensuring its alignment with the needs of local businesses.

-

Advisory Board: The project benefits from an advisory board that includes professionals from various sectors, including finance, entrepreneurship, and technology. This diverse perspective aids in strategic planning and helps navigate the complexities of launching a cryptocurrency in a developing economy.

-

Community Involvement: Libra Coin actively encourages community participation, which is a fundamental aspect of its strategy. By involving local stakeholders, the project aims to create a robust ecosystem that supports sustainable economic growth.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Libra Coin extends beyond mere trading or speculation. It serves as a tool for economic empowerment, particularly in regions that face financial challenges. In a broader context, it highlights several key aspects of the cryptocurrency ecosystem:

-

Innovation in Funding: Libra Coin exemplifies how blockchain technology can be used to innovate traditional funding models. By decentralizing access to capital, it opens up new avenues for economic participation, particularly for underserved communities.

-

Promoting Financial Inclusion: The project aligns with the larger trend in the cryptocurrency space aimed at promoting financial inclusion. By providing a platform for local businesses to access funding, Libra Coin contributes to the global movement towards more inclusive financial systems.

-

Cultural Engagement: As cryptocurrencies increasingly intersect with cultural narratives, Libra Coin’s approach to community engagement through memes and social relevance sets it apart. This not only attracts attention but also fosters a sense of belonging among users.

-

Sustainable Economic Development: Ultimately, Libra Coin aims to create a sustainable economic model that empowers local businesses and stimulates growth. Its focus on funding SMEs aligns with global efforts to bolster local economies and promote entrepreneurship.

Conclusion

In summary, Libra Coin represents an innovative approach to solving real-world economic challenges through blockchain technology. By focusing on community engagement, cultural relevance, and decentralized finance, it seeks to empower local businesses in Argentina while offering investors a unique opportunity to contribute to meaningful economic development. As the cryptocurrency landscape continues to evolve, Libra Coin’s commitment to addressing fundamental economic issues positions it as a noteworthy player in the ecosystem.

The Technology Behind the Coin: How It Works

Introduction to Libra Coin Technology

Libra Coin, often referred to simply as LIBRA, is a digital asset designed to facilitate transactions and provide a stable form of value within the cryptocurrency ecosystem. Built on the Solana blockchain, LIBRA aims to harness the speed and efficiency of this platform while also incorporating unique features that set it apart from other cryptocurrencies. In this section, we will explore the underlying technology of Libra Coin, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

At its core, Libra Coin operates on the Solana blockchain, which is renowned for its high throughput and low transaction costs. Here are some key aspects of the blockchain architecture that support Libra Coin:

1. Layered Structure

The Solana blockchain employs a layered architecture that separates different functionalities. This design enhances scalability and allows for faster processing of transactions. The architecture consists of the following layers:

– Networking Layer: Responsible for communication between nodes.

– Consensus Layer: Handles the validation of transactions and blocks.

– Execution Layer: Executes smart contracts and processes transactions.

2. High Throughput

One of the standout features of the Solana blockchain is its capability to handle thousands of transactions per second (TPS). This high throughput is crucial for Libra Coin, as it enables quick transaction confirmations, making it suitable for real-time payments and transfers.

3. Low Transaction Fees

The architecture of Solana allows for minimal transaction fees, which is a significant advantage for users. This cost-effectiveness encourages more frequent transactions and increases user adoption.

Consensus Mechanism

The consensus mechanism is a crucial component of any blockchain, as it determines how transactions are validated and added to the blockchain. Libra Coin utilizes a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS). Here’s how it works:

1. Proof of History (PoH)

- Time Stamping: PoH introduces a cryptographic timestamp that creates a historical record of events. This feature allows validators to agree on the order of transactions without needing to communicate extensively.

- Efficiency: By using PoH, the network can process transactions quickly, as validators can trust the recorded history without extensive verification.

2. Proof of Stake (PoS)

- Validator Selection: In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This method incentivizes participants to act honestly, as they stand to lose their staked coins for malicious behavior.

- Security: The combination of PoH and PoS enhances the security of the network, making it resistant to attacks and fraud.

Key Technological Innovations

Libra Coin incorporates several technological innovations that enhance its functionality and user experience. These include:

1. Smart Contracts

- Automated Transactions: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate processes, reducing the need for intermediaries and minimizing costs.

- Customization: Users can create customized smart contracts tailored to specific needs, allowing for versatile applications ranging from simple transactions to complex financial agreements.

2. Interoperability

- Cross-Chain Compatibility: Libra Coin is designed to be interoperable with other blockchain networks. This means that users can easily exchange LIBRA with other cryptocurrencies or utilize it across different platforms, enhancing its utility and adoption.

- Bridges to Other Blockchains: By developing bridges to other major blockchain networks, Libra Coin can facilitate seamless transfers and interactions, expanding its ecosystem.

3. Decentralized Finance (DeFi) Integration

- Access to DeFi Protocols: Libra Coin aims to integrate with various DeFi platforms, allowing users to lend, borrow, and earn interest on their holdings. This integration provides additional avenues for users to maximize their investment potential.

- Liquidity Pools: By participating in liquidity pools, users can contribute to the ecosystem while earning rewards, thus promoting community engagement and network stability.

Security Features

Security is paramount in the cryptocurrency space, and Libra Coin incorporates several features to protect users and their assets:

1. Cryptographic Techniques

- Public and Private Keys: Users hold a pair of cryptographic keys, ensuring that only they can access their funds. The public key is shared for transactions, while the private key remains confidential.

- Encryption: All transactions are encrypted, protecting sensitive information and ensuring the integrity of the blockchain.

2. Regular Audits

- Smart Contract Audits: To ensure the security of smart contracts, regular audits are conducted by third-party firms. This process helps identify vulnerabilities and ensures that contracts function as intended.

- Network Monitoring: Continuous monitoring of the network for unusual activities helps detect potential security threats in real-time.

Community and Governance

Libra Coin emphasizes community involvement and decentralized governance:

1. Community Governance

- Decentralized Decision-Making: Holders of LIBRA tokens can participate in governance decisions, such as protocol upgrades and changes to the ecosystem. This democratic approach fosters a sense of ownership among users.

- Voting Mechanisms: Various voting mechanisms are in place to ensure that community opinions are considered, allowing for collective decision-making.

2. Incentives for Participation

- Staking Rewards: Users can earn rewards by staking their LIBRA tokens, encouraging long-term investment and active participation in the network.

- Community Grants: The project allocates funds for community-driven initiatives, supporting developers and projects that contribute to the ecosystem’s growth.

Future Developments

As Libra Coin continues to evolve, several future developments are anticipated:

1. Enhanced Scalability

- Layer 2 Solutions: Future updates may include layer 2 solutions to further enhance scalability, allowing for even more transactions per second while maintaining low fees.

- Sharding: Implementing sharding could improve the network’s capacity by dividing the blockchain into smaller pieces, each capable of processing transactions independently.

2. Broader Adoption

- Partnerships: Collaborations with businesses and financial institutions will help integrate Libra Coin into everyday transactions, promoting wider acceptance.

- User Education: Initiatives aimed at educating users about the benefits and functionalities of Libra Coin will be crucial for driving adoption.

Conclusion

Libra Coin represents a significant advancement in the cryptocurrency landscape, leveraging the robust technology of the Solana blockchain. With its innovative consensus mechanism, smart contracts, and focus on security and community governance, LIBRA is poised to provide a valuable and efficient digital asset for users. As the project continues to develop and expand, it holds the potential to play a vital role in the future of decentralized finance and cryptocurrency adoption.

Understanding libra coin Tokenomics

Tokenomics Overview

Tokenomics refers to the economic model of a cryptocurrency, detailing its supply, distribution, and utility within its ecosystem. Understanding the tokenomics of Libra Coin (LIBRA) is essential for investors and users to grasp the potential value and use cases of the asset. This section will break down key metrics and elements that define LIBRA’s tokenomics, including its supply structure, utility, and distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 999,999,999 LIBRA |

| Max Supply | 1,000,000,000 LIBRA |

| Circulating Supply | 256,422,274 LIBRA |

| Inflation/Deflation Model | Deflationary |

Total Supply and Circulating Supply

The total supply of Libra Coin is capped at 1 billion LIBRA tokens, a figure that is designed to ensure scarcity and value retention over time. As of now, the circulating supply stands at approximately 256.42 million tokens, which is about 25.64% of the total supply. This means that a significant portion of the total supply remains locked or not yet released into the market, suggesting potential inflationary pressure if not managed properly.

Inflation/Deflation Model

Libra Coin employs a deflationary model. This means that as the demand for LIBRA increases, the circulating supply may decrease due to mechanisms such as token burns or buybacks. A deflationary model can create upward pressure on the price, as the reduction in available tokens can lead to increased demand. Understanding this aspect is crucial for investors considering the long-term value of LIBRA.

Token Utility (What is the coin used for?)

Libra Coin serves multiple purposes within its ecosystem, which are critical to its adoption and use case:

-

Transaction Medium: LIBRA is designed to facilitate transactions within the platform, allowing users to send and receive payments quickly and efficiently. The low transaction fees associated with LIBRA make it an attractive option for microtransactions.

-

Funding Local Businesses: One of the primary goals of LIBRA is to stimulate the Argentine economy by funding small businesses and startups. Investors can use LIBRA to directly support local initiatives, thereby fostering economic growth and community development.

-

Staking and Yield Generation: Users can stake their LIBRA tokens to earn rewards, contributing to the network’s security and functionality. This staking mechanism not only rewards holders but also encourages long-term investment in the ecosystem.

-

Governance Participation: Token holders may have a say in the future direction of the project, including decisions on upgrades and changes to the protocol. This governance feature empowers the community and aligns the interests of token holders with the health of the ecosystem.

Token Distribution

Understanding how tokens are distributed is crucial for evaluating the project’s credibility and potential for growth. The distribution of LIBRA tokens is structured to promote decentralization and fair access:

-

Initial Distribution: A portion of the total supply is allocated for initial coin offerings (ICOs) and private sales, aimed at attracting early investors and stakeholders.

-

Team and Advisors: A specific percentage is reserved for the founding team and advisors, which typically comes with vesting periods to ensure that these individuals remain committed to the project long-term.

-

Community Incentives: A significant allocation is often earmarked for community engagement initiatives, including rewards for active participants, marketing campaigns, and liquidity mining programs. This approach fosters a vibrant community around the token.

-

Reserve Fund: A reserve fund may also be established to support future development and unforeseen circumstances. This fund is crucial for the project’s sustainability and long-term viability.

-

Burn Mechanisms: Some tokens may be burned periodically to reduce the total supply, further supporting the deflationary model. This strategy can be utilized to stabilize the token’s price and encourage holding among investors.

Conclusion

The tokenomics of Libra Coin provides a comprehensive framework for understanding its potential as a digital asset. With a clear supply structure, utility across various applications, and a thoughtful distribution model, LIBRA is positioned to play a significant role in the evolving cryptocurrency landscape. Investors should consider these elements when evaluating their strategies and potential involvement in the LIBRA ecosystem. Understanding tokenomics is essential for making informed decisions and maximizing potential returns in the cryptocurrency market.

Price History and Market Performance

Key Historical Price Milestones

The price history of Libra Coin (LIBRA) provides a fascinating glimpse into its market performance since its inception. Initially launched in the Solana ecosystem, LIBRA has experienced significant fluctuations that are emblematic of the broader cryptocurrency market.

-

Launch and Initial Trading: LIBRA began trading on various decentralized exchanges, with initial prices around the $0.001 mark. The early trading days were marked by volatility, as is common for new cryptocurrencies, with prices oscillating due to speculative trading and limited liquidity.

-

All-Time High: LIBRA reached its all-time high of approximately $3.28 on February 14, 2025. This peak was driven by a surge in interest in meme-based cryptocurrencies, which coincided with broader market trends favoring social media-driven assets. The all-time high illustrated the potential for rapid price appreciation, which often characterizes emerging tokens in the cryptocurrency space.

-

Subsequent Decline: Following its peak, LIBRA faced a substantial decline, dropping over 99% from its all-time high within a few months. This decline can be attributed to a combination of profit-taking by early investors, market corrections, and a general decline in the enthusiasm for meme coins as the market shifted focus to more established assets.

-

Recent Price Movements: As of the latest data, LIBRA’s price is approximately $0.009561, reflecting a 0.41% increase in the last 24 hours. The trading volume over the past day was around $41,780, highlighting ongoing interest in the token despite its previous price declines. Historical lows were recorded at around $0.006954 on August 19, 2025, marking a significant recovery phase following the sharp decline from its all-time high.

Factors Influencing the Price

Historically, the price of LIBRA has been influenced by a variety of factors, both intrinsic to the cryptocurrency itself and extrinsic from the broader market environment.

-

Market Sentiment: The overall sentiment in the cryptocurrency market has played a crucial role in determining the price of LIBRA. Positive news surrounding the cryptocurrency sector, such as regulatory advancements or increased institutional adoption, often leads to price surges across the board, including for LIBRA. Conversely, negative sentiment, such as market corrections or regulatory crackdowns, tends to result in price declines.

-

Memetic Value and Community Engagement: As a meme-inspired cryptocurrency, LIBRA’s value is significantly influenced by its community and cultural relevance. Social media trends and community engagement can lead to spikes in interest and trading volume. For instance, during periods when meme coins gain traction on platforms like Twitter and Reddit, LIBRA has seen increases in both price and trading activity. The intrinsic value derived from its meme status is a double-edged sword, leading to both rapid gains and swift losses.

-

Market Liquidity and Trading Volume: The liquidity of LIBRA, which refers to how easily it can be bought or sold without affecting its price, has a substantial impact on its market performance. During times of low trading volume, even minor buy or sell orders can lead to significant price fluctuations. The 24-hour trading volume has varied widely, with periods of high activity correlating with price increases and vice versa.

-

Technological Developments and Ecosystem Integration: As LIBRA operates within the Solana ecosystem, developments related to Solana’s technology, updates, or partnerships can directly impact LIBRA’s price. For example, improvements in transaction speed or scalability within the Solana network may enhance the overall perception and usability of LIBRA, driving demand and, consequently, its price.

-

Broader Economic Factors: Macro-economic factors, including inflation rates, changes in monetary policy, and global economic stability, also influence the price of cryptocurrencies. As investors seek alternative assets during economic uncertainty, cryptocurrencies like LIBRA may experience price increases. However, economic recovery or stabilization can lead to decreased interest in speculative assets, resulting in price declines.

-

Regulatory Environment: The evolving regulatory landscape surrounding cryptocurrencies can significantly impact LIBRA’s price. Positive regulatory developments can enhance investor confidence, while stringent regulations may lead to price volatility. As governments around the world continue to refine their approach to digital assets, LIBRA’s performance will likely respond to these external pressures.

Conclusion

In summary, the price history and market performance of Libra Coin reflect a complex interplay of market sentiment, community engagement, technological developments, and broader economic factors. As with many cryptocurrencies, LIBRA’s journey has been characterized by remarkable highs and significant lows, underscoring the inherent volatility of the digital asset space. Understanding these historical trends and influences can provide valuable insights for both new and experienced investors navigating the ever-evolving cryptocurrency landscape.

Where to Buy libra coin: Top Exchanges Reviewed

5. Libra Exchange – Your Gateway to Seamless Trading!

The review article on LIBRA (LIBRA) exchanges highlights key platforms like Coinex, Hibt, and AscendEX (formerly BitMax) where users can buy, sell, and trade LIBRA tokens. What sets these exchanges apart is their user-friendly interfaces, competitive trading fees, and robust security measures, making them accessible for both novice and experienced traders. The article provides a comprehensive overview of trading options and liquidity, ensuring readers can make informed decisions.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Binance – Your Gateway to LIBRA (LIBRA) with Ease!

Binance stands out as a premier exchange for purchasing LIBRA (LIBRA) due to its user-friendly interface, extensive trading options, and robust security features. It offers a seamless buying experience, making it accessible for both beginners and experienced traders. Additionally, Binance provides comprehensive market data and analytical tools, empowering users to make informed investment decisions while navigating the dynamic cryptocurrency landscape.

- Website: binance.com

- Platform Age: Approx. 8 years (domain registered in 2017)

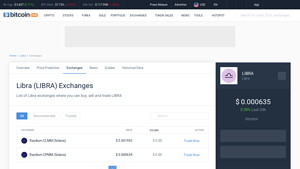

5. CoinCodex – Your Go-To Hub for Libra Trading!

Libra exchanges, specifically Raydium CLMM and Raydium CPMM on the Solana blockchain, offer a unique trading experience for LIBRA enthusiasts. These platforms stand out due to their efficient automated market-making mechanisms, which enhance liquidity and reduce trading costs. With only two exchanges currently supporting LIBRA, traders can benefit from a focused environment that caters specifically to this asset, making it easier to buy, sell, and trade effectively.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy libra coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Libra Coin (LIBRA) is selecting a cryptocurrency exchange. Libra Coin is primarily traded on decentralized exchanges (DEX), with Raydium being one of the most popular platforms for this token. Here’s how to make your choice:

- Research Exchanges: Look for exchanges that list Libra Coin. Raydium is a good option, but you can also check other DEX platforms or centralized exchanges (CEX) that may list LIBRA.

- Check Fees and Features: Review the trading fees, withdrawal fees, and additional features offered by the exchange. Some exchanges may have lower fees but offer fewer features.

- Review Security Measures: Ensure that the exchange you choose has strong security protocols to protect your funds.

2. Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account. Follow these steps to set up your account securely:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide an email address and create a strong password.

- Email Verification: After signing up, check your email for a verification link. Click on it to verify your email address.

- Complete KYC (Know Your Customer): Many exchanges require users to complete KYC verification. This process typically involves submitting identification documents such as a passport or driver’s license and proof of residence.

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This adds an extra layer of protection, requiring you to enter a code sent to your mobile device whenever you log in.

3. Deposit Funds

With your account set up and verified, you can now deposit funds to buy Libra Coin. Follow these steps:

- Choose Your Deposit Method: Most exchanges allow deposits via bank transfers, credit/debit cards, or cryptocurrencies. Choose the method that suits you best.

- Initiate the Deposit: Follow the instructions provided by the exchange to deposit funds. If you are depositing fiat currency (like USD), ensure you understand any fees associated with the deposit method.

- Wait for Confirmation: Depending on the deposit method, it may take some time for your funds to appear in your exchange account. Bank transfers can take a few days, while cryptocurrency deposits are usually faster.

4. Place an Order to Buy Libra Coin

Now that you have funds in your account, you can place an order to buy Libra Coin. Here’s how to do it:

- Navigate to the Trading Section: Go to the exchange’s trading platform and find the trading pair for Libra Coin (e.g., LIBRA/SOL or LIBRA/USDT).

- Select Order Type: You can choose different types of orders, such as market orders (buying at the current market price) or limit orders (setting a specific price at which you want to buy). Beginners often start with market orders for simplicity.

- Enter the Amount: Specify how much Libra Coin you want to buy. The exchange will show you how much it will cost based on the current market price.

- Review and Confirm: Before finalizing the purchase, review the order details, including fees. Once everything looks correct, confirm the order.

5. Secure Your Coins in a Wallet

After purchasing Libra Coin, it’s essential to store your coins securely. While you can leave them on the exchange, this is not recommended due to security risks. Here’s how to secure your coins:

- Choose a Wallet: There are different types of wallets available:

- Software Wallets: Applications that can be installed on your computer or smartphone (e.g., Exodus, Atomic Wallet).

- Hardware Wallets: Physical devices that store your cryptocurrencies offline (e.g., Ledger, Trezor). These are considered the most secure option.

- Transfer Your Libra Coin: Once you have set up your wallet, transfer your Libra Coin from the exchange to your wallet. This usually involves entering your wallet address in the withdrawal section of the exchange.

- Backup Your Wallet: If you are using a software or hardware wallet, make sure to back up your wallet’s recovery phrase and store it in a safe place. This will allow you to recover your funds if you lose access to your wallet.

By following these steps, you can confidently purchase and secure your Libra Coin, setting a solid foundation for your cryptocurrency investment journey.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Market Position

Libra Coin operates within the Solana ecosystem, which is known for its high throughput and low transaction costs. This positioning allows Libra to potentially benefit from the growing interest in Solana-based projects. With a focus on community engagement and meme culture, Libra Coin taps into a niche market that could attract investors looking for novel and engaging projects.

2. Community and Cultural Relevance

Libra Coin is designed to resonate with cultural trends, particularly in the realm of memes and social narratives. This approach can create a strong community of supporters and investors who are not just interested in financial returns but are also engaged in the cultural significance of the coin. A vibrant community can lead to increased adoption and liquidity, which are essential for any cryptocurrency’s success.

3. Growth Potential in Emerging Markets

The project’s focus on funding small businesses and startups in Argentina indicates a commitment to supporting local economies. As digital assets become more integrated into everyday transactions, Libra Coin could see increased usage and acceptance in regions where traditional financial systems are less accessible. This could lead to significant growth opportunities, particularly in emerging markets.

4. Low Market Capitalization

With a current market cap of approximately $2.45 million, Libra Coin is relatively small compared to more established cryptocurrencies. This low market capitalization can present a higher risk but also offers the potential for substantial returns if the project gains traction. Investors often look for low-cap coins that have the potential to grow significantly, making Libra an attractive option for speculative investors.

5. Technological Innovation

Being part of the Solana blockchain, Libra Coin benefits from the underlying technology that supports high-speed transactions and scalability. Solana’s infrastructure is designed to handle a large number of transactions per second, which can be a significant advantage in a rapidly evolving market where speed and efficiency are crucial.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is notoriously volatile, with prices capable of fluctuating dramatically in short periods. Libra Coin’s price has seen significant drops from its all-time high of $3.28, showcasing the potential for drastic declines. New investors should be cautious, as the volatility can lead to substantial financial losses, especially in the short term.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continuously evolving, and Libra Coin is not immune to potential regulatory scrutiny. Governments around the world are increasingly looking to regulate cryptocurrencies, which can impact their usability and adoption. If Libra Coin were to face regulatory challenges, it could significantly hinder its growth and market acceptance.

3. Competition

The cryptocurrency space is crowded with thousands of competing projects, many of which have larger market caps, established communities, and more robust technological infrastructures. Libra Coin must differentiate itself from other tokens in the Solana ecosystem and beyond. The presence of larger, well-funded competitors could make it challenging for Libra to capture significant market share.

4. Technological Risks

While being built on the Solana blockchain provides Libra Coin with advantages, it also exposes it to the risks associated with the underlying technology. Issues such as network congestion, security vulnerabilities, and potential bugs in the codebase can adversely affect the performance of Libra Coin. Additionally, if the Solana blockchain were to face significant operational challenges, it could impact all projects built on that platform.

5. Lack of Adoption and Use Cases

For any cryptocurrency to succeed, it requires a strong use case and widespread adoption. While Libra Coin aims to support small businesses in Argentina, the real-world application and acceptance of the coin are still in early stages. Without a clear path to widespread use, Libra Coin may struggle to maintain value and attract investors.

Conclusion

Investing in Libra Coin presents a unique opportunity for those interested in the intersection of cryptocurrency, culture, and community-driven projects. Its potential strengths, including a unique market position, cultural relevance, and the backing of a robust blockchain, suggest that it could be a worthwhile consideration for speculative investors. However, the risks associated with market volatility, regulatory uncertainty, competition, technological challenges, and the need for broader adoption cannot be overlooked.

As with any investment in the cryptocurrency space, potential investors should conduct thorough research, assess their risk tolerance, and consider their investment goals before engaging with Libra Coin. The landscape is dynamic, and staying informed about developments is crucial for making educated decisions in this rapidly evolving market.

Frequently Asked Questions (FAQs)

1. What is Libra Coin?

Libra Coin (LIBRA) is a digital asset created within the Solana ecosystem, designed primarily as a meme token. It aims to engage the community through cultural trends and popular narratives, allowing users to speculate on or invest based on astrological themes. Libra Coin operates on a decentralized platform, facilitating peer-to-peer transactions with minimal fees.

2. Who created Libra Coin?

Libra Coin was developed by a group of enthusiasts within the cryptocurrency community who sought to combine modern financial technology with cultural elements, particularly astrology and memes. The project is independent and not affiliated with any major corporations, giving it a grassroots appeal.

3. What makes Libra Coin different from Bitcoin?

While both Libra Coin and Bitcoin are cryptocurrencies, they serve different purposes. Bitcoin is primarily a store of value and a medium of exchange, designed to be a decentralized alternative to traditional currencies. In contrast, Libra Coin is a meme-based token that leverages cultural trends and astrological themes for community engagement and speculation, making it more niche-oriented.

4. Is Libra Coin a good investment?

Investing in Libra Coin, like any cryptocurrency, carries inherent risks and should be approached with caution. As of October 2023, Libra Coin has a market cap of approximately $2.45 million and a circulating supply of around 256 million LIBRA tokens. Its price has shown significant volatility, with an all-time high of approximately $3.28 and a current price around $0.009561. Potential investors should conduct thorough research and consider their risk tolerance before investing.

5. Where can I buy Libra Coin?

Libra Coin can be traded on decentralized exchanges, with Raydium being one of the most popular platforms for buying and selling LIBRA tokens. Users can trade LIBRA against other cryptocurrencies, particularly Solana (SOL), which is the primary trading pair.

6. What is the current market cap of Libra Coin?

As of now, Libra Coin has a market cap of approximately $2.45 million, ranking it around #1754 among cryptocurrencies. The market cap is calculated by multiplying the current price of LIBRA by its circulating supply, which is about 256 million tokens.

7. What are the risks associated with investing in Libra Coin?

Investing in Libra Coin comes with several risks, including high volatility, market speculation, and the potential for loss of capital. As a meme token, its value may be influenced by trends and community sentiment rather than fundamental utility. Additionally, the relatively low market cap could make it susceptible to significant price swings.

8. How does Libra Coin’s price performance compare to other cryptocurrencies?

Libra Coin has experienced notable price fluctuations, with a recent price increase of 0.41% in the last 24 hours but a decline of approximately 22.20% over the past week. Its performance can be compared to the broader cryptocurrency market, which has seen mixed results. Investors should keep an eye on market trends and community engagement, as these factors can significantly influence LIBRA’s price.

Final Verdict on libra coin

Overview of Libra Coin

Libra Coin (LIBRA) is a digital asset operating within the Solana ecosystem, primarily designed to tap into cultural trends and the burgeoning meme economy. Its unique approach combines astrological themes with cryptocurrency, appealing to both crypto enthusiasts and those interested in astrology. The primary goal of Libra Coin is to foster economic growth in Argentina by supporting small businesses and startups, thus integrating local economic empowerment with blockchain technology.

Technology and Market Position

Libra Coin leverages the Solana blockchain, known for its high throughput and low transaction costs, making it a suitable platform for a meme-based cryptocurrency. With a total supply capped at 1 billion tokens and a current circulating supply of approximately 256 million, the coin has a market capitalization of around $2.45 million. Despite its potential, the asset has experienced significant volatility, evidenced by an all-time high of $3.28 and a recent low of $0.006954. This volatility underscores the speculative nature of meme coins and their susceptibility to market trends and investor sentiment.

Investment Considerations

Investing in Libra Coin represents a high-risk, high-reward opportunity. Its niche positioning and community-driven focus may attract a specific demographic of investors, yet the overall market dynamics can lead to unpredictable price movements. As with any cryptocurrency investment, potential investors should be aware of the risks involved, including regulatory scrutiny, market competition, and technological challenges.

Final Thoughts

Before considering an investment in Libra Coin or any cryptocurrency, it is crucial to conduct thorough research (DYOR). Understand the underlying technology, the market environment, and your own risk tolerance. As the cryptocurrency landscape continues to evolve, informed decision-making is essential to navigate the complexities of this high-risk asset class.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.