Should You Invest in hedera coin? A Full Analysis (2025)

An Investor’s Introduction to hedera coin

Hedera coin, known by its native token HBAR, is a significant player in the cryptocurrency market, often recognized for its innovative approach to distributed ledger technology. Unlike traditional blockchains, Hedera operates on a unique consensus mechanism called hashgraph, which allows for significantly faster transaction speeds, lower fees, and enhanced security. This positions Hedera as a leading platform for enterprises looking to leverage decentralized applications (DApps) and smart contracts.

As of now, Hedera ranks among the top cryptocurrencies globally, with a market capitalization exceeding $9 billion, placing it firmly within the top 20 digital assets. Its architecture is designed to support a wide range of applications, from simple transactions to complex enterprise solutions, making it a versatile option for developers and businesses alike. The Hedera network has garnered attention for its efficiency, claiming the ability to handle over 10,000 transactions per second, which is a stark contrast to the slower processing times of many legacy blockchain systems.

The purpose of this guide is to provide a comprehensive resource for both beginners and intermediate investors interested in Hedera coin. We will delve into the underlying technology that powers the Hedera network, exploring its unique hashgraph consensus mechanism and how it differentiates itself from traditional blockchains. Additionally, we will examine the tokenomics of HBAR, including its supply dynamics, utility, and the role it plays within the Hedera ecosystem.

Investing in cryptocurrencies involves inherent risks, and Hedera is no exception. This guide will address potential risks associated with investing in HBAR, such as market volatility, regulatory challenges, and technological risks. Furthermore, we will discuss the investment potential of Hedera coin, including its historical performance, future outlook, and the factors that could influence its price trajectory.

Lastly, for those interested in acquiring HBAR, we will provide clear instructions on how to buy it, including the various exchanges where it is listed, trading pairs available, and tips for safe storage. By the end of this guide, readers will have a well-rounded understanding of Hedera coin, empowering them to make informed decisions about their investments in this innovative digital asset.

What is hedera coin? A Deep Dive into its Purpose

Understanding Hedera Coin (HBAR)

Hedera Coin, commonly referred to by its ticker symbol HBAR, is the native cryptocurrency of the Hedera Hashgraph platform. This platform stands out in the crowded landscape of blockchain technologies, offering an alternative approach to distributed ledger technology (DLT) with its unique consensus mechanism known as Hashgraph. The design and functionality of Hedera aim to address some of the key limitations seen in traditional blockchain systems, making it particularly appealing for both enterprises and developers.

The Core Problem It Solves

One of the fundamental issues that Hedera seeks to address is the scalability and efficiency of transactions within blockchain networks. Traditional blockchains, such as Bitcoin and Ethereum, often face significant challenges regarding transaction speed, high fees, and energy consumption, particularly when the network is under heavy load. For instance, Bitcoin can handle about 7 transactions per second (TPS), while Ethereum manages around 30 TPS. In contrast, Hedera Hashgraph claims to handle over 10,000 TPS, with finality achieved in under five seconds and transaction fees as low as $0.0001.

Hedera’s unique structure allows it to process transactions in a manner that mitigates the risks of network congestion and high costs. This capability is crucial for applications requiring high throughput, such as micropayments, supply chain management, and real-time data integrity verification. By providing a more efficient alternative, Hedera aims to enable businesses to adopt decentralized applications (DApps) without the drawbacks that have historically limited blockchain’s mainstream adoption.

Its Unique Selling Proposition

Hedera’s unique selling proposition lies in its innovative use of the Hashgraph consensus algorithm, which differentiates it from traditional blockchain technologies. While most blockchains rely on proof-of-work (PoW) or proof-of-stake (PoS) mechanisms, Hedera employs a directed acyclic graph (DAG) structure combined with a consensus algorithm that uses a process called “Gossip about Gossip.” This method allows nodes to communicate efficiently, ensuring that all participants in the network reach consensus quickly and securely.

Key features of Hedera that underscore its unique selling proposition include:

-

High Transaction Speed and Low Fees: As mentioned, Hedera can handle thousands of transactions per second with minimal fees, making it economically viable for a wide range of applications.

-

Security: Hedera offers asynchronous Byzantine Fault Tolerance (ABFT), meaning it can confirm transactions even in the presence of malicious actors, ensuring the integrity of the network.

-

Decentralized Governance: The Hedera Governing Council consists of up to 39 diverse organizations from various industries. This council is responsible for overseeing the network’s development, ensuring that no single entity has control over the platform. This governance model aims to provide stability and trust in the ecosystem.

-

Enterprise-Grade Solutions: Hedera targets enterprise use cases, offering features like the Hedera Token Service (HTS) for easy tokenization and the Hedera Consensus Service (HCS) for secure event logging. These tools allow businesses to build powerful applications on a reliable infrastructure.

-

Environmental Sustainability: Hedera is committed to sustainability, boasting a significantly lower energy consumption compared to traditional PoW blockchains. This makes it an attractive option for environmentally conscious businesses and developers.

The Team and Backers

The Hedera project was co-founded by Dr. Leemon Baird and Mance Harmon, both of whom bring extensive experience in technology and cybersecurity. Dr. Baird is credited with inventing the Hashgraph consensus algorithm and has a background in computer science and security, having worked in various roles in academia and industry. Mance Harmon serves as the CEO and has held executive positions in technology firms, focusing on IT security and enterprise solutions.

The Hedera Governing Council includes notable organizations such as Google, IBM, Boeing, and the University of South Florida, among others. This diverse backing not only lends credibility to the project but also allows for a wide range of expertise and resources to guide its development. The involvement of such established firms signals a strong belief in the potential of Hedera to transform industries through its technology.

Fundamental Purpose in the Crypto Ecosystem

Hedera’s fundamental purpose within the cryptocurrency ecosystem is to provide a robust platform for the development of decentralized applications that are both scalable and secure. By addressing the limitations of traditional blockchains, Hedera aims to enable widespread adoption of DApps across various sectors, including finance, supply chain, healthcare, and more.

Moreover, Hedera’s focus on enterprise solutions positions it as a key player in the evolution of blockchain technology, catering to businesses that require efficiency, security, and reliability. As industries increasingly look to integrate blockchain solutions, Hedera’s unique approach could play a crucial role in bridging the gap between traditional business practices and the decentralized economy.

In summary, Hedera Coin (HBAR) represents a significant innovation in the cryptocurrency space, combining speed, efficiency, and security in a way that addresses the core challenges faced by existing blockchain technologies. Its unique consensus mechanism, decentralized governance, and enterprise focus set it apart as a promising solution for both developers and businesses seeking to leverage the benefits of distributed ledger technology.

The Technology Behind the Coin: How It Works

Understanding Hedera Hashgraph

Hedera Hashgraph is a unique platform that operates as an alternative to traditional blockchain technologies. Instead of using a conventional blockchain architecture, Hedera leverages a distributed ledger technology (DLT) known as Hashgraph. This approach allows Hedera to offer significant advantages in speed, security, and scalability, making it an attractive option for both developers and enterprises looking to build decentralized applications (DApps).

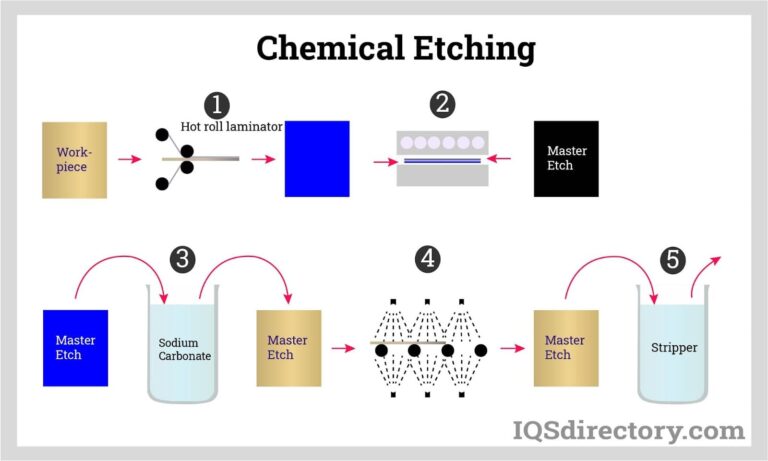

Blockchain Architecture

While most cryptocurrencies are built on top of blockchain architecture, Hedera operates on a different principle. The traditional blockchain consists of a series of blocks, each containing a list of transactions. These blocks are chained together in a linear fashion, and each block must be verified and added to the chain sequentially. This structure can lead to delays in transaction processing, especially during periods of high network activity.

In contrast, Hedera uses a directed acyclic graph (DAG) structure, specifically a Hashgraph. In this model, transactions are not grouped into blocks but rather represented as a graph where each transaction can connect to multiple others. This allows for parallel processing of transactions, meaning multiple transactions can be validated simultaneously, leading to a significant increase in throughput.

Consensus Mechanism

Hashgraph Consensus

Hedera employs a unique consensus mechanism called Hashgraph consensus, which is designed to enhance the efficiency and security of the network. Unlike traditional consensus models such as Proof-of-Work (PoW) or Proof-of-Stake (PoS), Hashgraph consensus uses a combination of a gossip protocol and virtual voting.

-

Gossip Protocol: Nodes in the Hedera network communicate with each other using a method known as the “Gossip-about-Gossip” protocol. In this system, each node randomly shares information about transactions it has processed with other nodes. This process ensures that all nodes in the network quickly become aware of new transactions and their order.

-

Virtual Voting: Once the nodes have shared information about transactions, they can effectively “vote” on the order of these transactions without requiring an actual voting process. This virtual voting mechanism enables the network to achieve consensus without the need for energy-intensive mining or staking, as seen in PoW and PoS systems.

The combination of these two methods allows Hedera to achieve asynchronous Byzantine Fault Tolerance (ABFT). This means that the network can continue to function effectively even if some nodes fail or provide incorrect data, ensuring the integrity and reliability of the overall system.

Key Technological Innovations

Hedera Hashgraph introduces several technological innovations that set it apart from traditional blockchain systems. Some of these key innovations include:

1. Speed and Scalability

Hedera Hashgraph is designed to handle a high volume of transactions efficiently. It can process over 10,000 transactions per second (TPS), significantly outperforming many popular blockchain networks, which typically manage between 5 to 20 TPS. This capability makes Hedera suitable for applications requiring high throughput, such as micropayments and real-time data processing.

2. Low Transaction Fees

One of the major advantages of Hedera is its low transaction fees. The average cost of a transaction on the Hedera network is approximately $0.0001. This affordability makes it an attractive option for developers and businesses looking to implement DApps without incurring high costs.

3. Decentralized Governance

Hedera operates under a unique decentralized governance model, which distinguishes it from many other cryptocurrency networks. The Hedera Governing Council, composed of up to 39 diverse organizations from various industries, oversees the network’s operations, including pricing policies and software updates. This governance structure aims to ensure that decisions are made transparently and collectively, enhancing trust among users and stakeholders.

4. Support for Smart Contracts and Tokenization

Hedera Hashgraph supports the creation and execution of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Developers can use the Solidity programming language, similar to Ethereum, to create DApps on the Hedera platform.

Additionally, Hedera offers a Token Service that allows users to create and manage both fungible and non-fungible tokens (NFTs) with ease. This built-in functionality simplifies the process of tokenization and expands the potential use cases for the Hedera network.

5. Enhanced Security

Hedera’s consensus mechanism and governance structure contribute to a high level of security. The asynchronous Byzantine Fault Tolerance ensures that the network can maintain its integrity even in the face of potential attacks or failures. Furthermore, Hedera’s architecture is designed to be resistant to common vulnerabilities associated with traditional blockchain systems, such as double-spending and Sybil attacks.

6. Built-in Compliance Features

Hedera Hashgraph incorporates compliance features such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. These tools help developers build applications that adhere to regulatory requirements, making it easier for enterprises to adopt the technology without facing legal challenges.

Conclusion

Hedera Hashgraph represents a significant advancement in distributed ledger technology, offering a range of benefits over traditional blockchain systems. With its unique architecture, efficient consensus mechanism, and focus on speed, scalability, and security, Hedera is well-positioned to support a new generation of decentralized applications. As the ecosystem continues to grow, it may provide valuable solutions for businesses and developers seeking to leverage the power of blockchain without the limitations often associated with conventional platforms. Understanding these technological foundations will equip beginners and intermediate investors with the knowledge needed to navigate the evolving landscape of cryptocurrency and decentralized technologies.

Understanding hedera coin Tokenomics

Hedera Hashgraph, through its native token HBAR, presents a unique approach to tokenomics that aligns with its innovative consensus algorithm and enterprise-grade goals. This section delves into the various aspects of HBAR’s tokenomics, including its supply metrics, utility, and distribution.

| Metric | Value |

|---|---|

| Total Supply | 50,000,000,000 HBAR |

| Max Supply | 50,000,000,000 HBAR |

| Circulating Supply | 42,392,927,395 HBAR |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

HBAR serves multiple essential functions within the Hedera ecosystem:

-

Transaction Fees: HBAR is utilized to pay for transaction fees on the Hedera network. Every action taken on the platform, whether it’s executing a smart contract or storing files, incurs a fee payable in HBAR. The average transaction fee is remarkably low, around $0.0001, making it accessible for both developers and users.

-

Staking: HBAR holders can stake their tokens to participate in the network’s consensus process. This staking not only helps secure the network but also allows users to earn rewards in the form of additional HBAR tokens. By staking, users contribute to maintaining the integrity and performance of the Hedera network.

-

Incentives for Network Nodes: HBAR is used to incentivize nodes operating on the network. This is crucial as it encourages more participants to run nodes, which in turn enhances the decentralization and security of the Hedera ecosystem.

-

Governance: HBAR holders may have a say in the governance of the Hedera network, especially as the platform moves towards a more decentralized governance model. Although currently controlled by the Governing Council, the vision includes increased participation from HBAR holders in decision-making processes.

-

Payment for Services: Developers and businesses utilizing Hedera’s services, such as the Hedera Token Service (HTS) or Hedera Consensus Service (HCS), need to pay in HBAR. This includes the creation and management of tokens and the use of consensus services for their applications.

Token Distribution

The distribution of HBAR tokens is structured to ensure a balanced allocation among stakeholders, including the development team, advisors, and the community. Here’s a breakdown of how HBAR tokens are distributed:

-

Initial Coin Offering (ICO): Hedera Hashgraph conducted an ICO in August 2018, which allowed early investors to purchase HBAR at a low price. This fundraising method was pivotal in securing initial capital for the project.

-

Founders and Team Allocations: The founders of Hedera, Dr. Leemon Baird and Mance Harmon, each received a grant of 2 billion HBAR, representing 4% of the total supply. These tokens are vested over a six-year period, ensuring that the founders remain committed to the project’s long-term success. Senior executives also received substantial grants, with amounts between 250 million and 300 million HBAR, which are similarly vested.

-

Community Incentives: A significant portion of the token supply is reserved for community incentives, including staking rewards and future ecosystem development. This helps engage the community and encourages participation in the network.

-

Governing Council: The Hedera Governing Council comprises up to 39 organizations from various industries that play a crucial role in managing the network. These members may also receive allocations of HBAR to incentivize their participation and ensure their commitment to the platform’s governance.

-

Gradual Unlocking: Hedera has a structured token unlocking mechanism, where tokens are gradually released into circulation over time. This helps manage inflation and ensures that the market is not flooded with HBAR, maintaining its value.

Conclusion

In conclusion, the tokenomics of Hedera Hashgraph and its native token HBAR is designed to support a sustainable and efficient ecosystem. With a fixed supply of 50 billion tokens, low transaction fees, and a dual role in utility and governance, HBAR is poised to facilitate a wide range of applications on the Hedera network. Its distribution model promotes long-term commitment from founders and incentivizes community participation, all while maintaining a focus on security and decentralization through staking and governance mechanisms. This thoughtful approach to tokenomics not only enhances the value of HBAR but also positions Hedera as a strong competitor in the evolving landscape of distributed ledger technologies.

Price History and Market Performance

Key Historical Price Milestones

Hedera (HBAR) has experienced significant price movements since its inception, reflecting various phases of market sentiment, technological developments, and broader economic factors.

-

Initial Coin Offering (ICO) and Launch: Hedera conducted its ICO in August 2018, during which investors could purchase HBAR tokens at a price of approximately $0.12. The project officially launched its mainnet in September 2019, marking the transition from development to operational status.

-

Early Price Movements: Following the ICO, HBAR’s price fluctuated as the market absorbed news about the project and its technology. By early 2020, HBAR was trading around $0.01001, marking its all-time low on January 2, 2020. This price represented a starting point for the asset, as it began gaining traction in the cryptocurrency community.

-

2021 Surge: The year 2021 was pivotal for Hedera, as it reached its all-time high of $0.5701 on September 16, 2021. This surge was driven by increased interest in decentralized applications (DApps) and the unique capabilities of the Hedera Hashgraph technology, which positioned itself as a more efficient alternative to traditional blockchain systems. The price rise was also influenced by the overall bullish sentiment in the cryptocurrency market during this period, with many altcoins reaching new heights.

-

Market Corrections: Following its peak, HBAR, like many cryptocurrencies, experienced a significant correction. By mid-2022, the price had fallen to around $0.10, illustrating the volatility that characterizes the crypto market. This decline was part of a broader market downturn affecting many digital assets.

-

Recent Performance: As of October 2023, HBAR’s price is approximately $0.2193, with a market capitalization of around $9.3 billion. The asset has shown resilience, rebounding from its lows and demonstrating a recovery trend. The 24-hour trading volume currently stands at about $137.76 million, reflecting ongoing interest in the token. Historical data shows that HBAR has gained over 2091.26% from its all-time low, highlighting its potential for long-term growth.

Factors Influencing the Price

Historically, the price of HBAR has been influenced by a variety of factors that can be categorized into market sentiment, technological advancements, regulatory developments, and macroeconomic trends.

-

Market Sentiment: The cryptocurrency market is highly susceptible to investor sentiment, which can lead to rapid price fluctuations. Positive news regarding partnerships, technological advancements, or adoption can significantly boost HBAR’s price. Conversely, negative news or broader market downturns can lead to sharp declines.

-

Technological Developments: Hedera’s unique consensus mechanism, known as Hashgraph, plays a critical role in its value proposition. The network’s ability to process thousands of transactions per second at a low cost has made it attractive to developers and enterprises. Each major upgrade or announcement regarding new capabilities or partnerships tends to influence HBAR’s price positively.

-

Regulatory Environment: The regulatory landscape surrounding cryptocurrencies has evolved significantly. Regulatory announcements can impact investor confidence and trading volumes. For example, favorable regulations or endorsements from government entities can lead to increased adoption and higher prices, while stringent regulations can have the opposite effect.

-

Market Competition: Hedera operates in a competitive environment filled with other blockchain platforms and DApp ecosystems. The performance of competitors can influence HBAR’s market position. If competitors introduce compelling features or gain market share, HBAR’s price may be negatively impacted. Conversely, any differentiation that Hedera can establish can strengthen its market position and positively affect its price.

-

Broader Economic Trends: The performance of cryptocurrencies is often correlated with broader economic trends, including inflation rates, interest rates, and the performance of traditional financial markets. Economic uncertainty or inflation can drive investors toward cryptocurrencies as alternative assets, potentially increasing demand for HBAR.

-

Community Engagement and Governance: The structure of Hedera’s governance, which includes a council of diverse organizations, can influence investor confidence. Active engagement from the community and transparent decision-making processes can foster trust, leading to greater adoption and price stability.

In conclusion, the price history of Hedera (HBAR) demonstrates a pattern of volatility influenced by a variety of internal and external factors. Understanding these dynamics can help investors make informed decisions and better navigate the complexities of the cryptocurrency market.

Where to Buy hedera coin: Top Exchanges Reviewed

5. Hedera Wallets – Secure Your Digital Assets with Ease!

Hedera stands out in the cryptocurrency landscape by offering a unique blend of centralized and decentralized wallet options, catering to a diverse range of user needs. Its focus on high throughput and low transaction fees makes it an attractive choice for both novice and experienced investors. Additionally, Hedera’s commitment to security and scalability ensures that users can manage their digital assets with confidence, making it a notable player in the evolving crypto ecosystem.

- Website: hedera.com

- Platform Age: Approx. 27 years (domain registered in 1998)

5. Easy Steps to Buy Hedera (HBAR) Today!

In the guide “How to Buy Hedera (HBAR): Steps & Exchanges,” readers will discover the diverse range of platforms available for purchasing HBAR, including prominent exchanges like Binance, MEXC, OKX, and BingX. Each exchange offers unique features, such as competitive fees, user-friendly interfaces, and various payment options like bank transfers and credit cards, making it easier for both beginners and experienced investors to acquire Hedera’s cryptocurrency efficiently.

- Website: 99bitcoins.com

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy hedera coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to purchasing Hedera (HBAR) is selecting a cryptocurrency exchange where you can buy it. Some of the most popular exchanges that support HBAR include:

- Binance

- Coinbase

- Huobi Global

- Bittrex

When choosing an exchange, consider factors such as:

- Security: Look for exchanges with a strong reputation for security and user protection.

- Fees: Check the trading fees and withdrawal fees, as these can vary significantly between exchanges.

- User Experience: An intuitive interface can make your trading experience smoother, especially if you are a beginner.

- Supported Payment Methods: Ensure the exchange supports your preferred payment method, such as bank transfer, credit card, or other cryptocurrencies.

2. Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will be asked to provide your email address and create a password.

- Email Verification: Check your email for a verification link. Click the link to confirm your email address.

- Complete Profile: Fill in your profile details, including your name, date of birth, and address.

- Identity Verification: Most exchanges require you to verify your identity to comply with regulations. You may need to upload a government-issued ID (like a passport or driver’s license) and a proof of address (like a utility bill). This process can take anywhere from a few minutes to a couple of days, depending on the exchange.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy HBAR:

- Navigate to Deposit Section: Log in to your account and find the “Deposit” or “Funds” section.

- Choose Deposit Method: Select your preferred deposit method. Common options include bank transfer, credit/debit card, or depositing another cryptocurrency.

- Follow Instructions: Follow the instructions provided by the exchange to complete the deposit. If using a bank transfer, ensure you include any reference numbers required by the exchange to link your deposit to your account.

- Wait for Confirmation: Deposits may take some time to process, especially bank transfers. Check the exchange for updates on your deposit status.

4. Place an Order to Buy Hedera Coin

Once your funds are available in your account, you can proceed to purchase HBAR:

- Go to the Trading Section: Navigate to the trading or market section of the exchange.

- Select HBAR: Search for Hedera (HBAR) in the list of available cryptocurrencies. Select the HBAR trading pair that corresponds with the currency you deposited (e.g., HBAR/USD or HBAR/USDT).

- Choose Order Type: Decide on the type of order you want to place:

– Market Order: Buy HBAR at the current market price. This is the quickest option.

– Limit Order: Set a specific price at which you want to buy HBAR. The order will only execute if the market reaches your specified price. - Enter Amount: Specify the amount of HBAR you wish to buy.

- Confirm Order: Review your order details and confirm the transaction. You should receive a confirmation once the order is executed.

5. Secure Your Coins in a Wallet

After purchasing HBAR, it is crucial to store your coins securely:

- Choose a Wallet: While you can leave your HBAR on the exchange, it’s safer to transfer them to a personal wallet. Options include:

– Software Wallets: These are applications you can install on your computer or mobile device (e.g., Atomic Wallet, Exodus).

– Hardware Wallets: These are physical devices that store your cryptocurrencies offline (e.g., Ledger, Trezor). They are considered the most secure option. - Transfer HBAR: Go to your exchange account, find the option to withdraw HBAR, and enter your wallet address. Double-check the address to avoid errors.

- Confirm the Transfer: Follow any additional steps required by the exchange to confirm the withdrawal. Once completed, check your wallet to ensure the HBAR has arrived.

Conclusion

Buying Hedera (HBAR) is a straightforward process, but it is essential to take the necessary precautions to secure your investment. By following these steps, you can confidently enter the world of cryptocurrency and participate in the Hedera ecosystem. Always stay informed about market trends and developments in the crypto space to make informed decisions.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Technology and Performance

Hedera Hashgraph introduces a distinct consensus algorithm known as Hashgraph, which differentiates it from traditional blockchain technologies. This innovation allows Hedera to achieve high transaction speeds, processing over 10,000 transactions per second (TPS) with finality in under five seconds. In comparison, many popular blockchains, particularly those using Proof-of-Work (PoW), often struggle to match these performance metrics, with typical TPS rates ranging from 5 to 20. This speed and efficiency make Hedera an attractive option for enterprises looking to deploy decentralized applications (DApps) that require quick and reliable transaction processing.

2. Low Transaction Costs

Another compelling aspect of Hedera is its low transaction fees, averaging around $0.0001 per transaction. This cost-effectiveness is particularly appealing for applications involving micropayments or high-volume transactions, positioning Hedera as a potential leader in sectors where transaction fees can significantly impact user experience and profitability.

3. Strong Governance Model

Hedera is governed by a council of up to 39 diverse organizations across various industries. This decentralized governance structure not only enhances the credibility of the network but also ensures that decisions regarding the platform’s future are made by reputable entities. The council’s role in managing the network and its codebase can inspire confidence among potential investors and users, as it mitigates the risks associated with centralized control.

4. Growing Ecosystem

The Hedera ecosystem is expanding, with a variety of applications being developed across sectors such as finance, supply chain, gaming, and more. The Hedera Token Service (HTS) enables easy token creation and management, which can foster innovation and encourage developers to build on the platform. As more DApps and services launch on Hedera, demand for the HBAR token is likely to increase, potentially driving up its value.

5. Institutional Interest and Adoption

Hedera has garnered attention from notable organizations that are exploring or have already integrated its technology. This interest from established enterprises can be seen as a validation of Hedera’s technology and its potential for real-world applications. As institutional adoption increases, it could lead to greater market confidence and stability in the HBAR token’s value.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Like most cryptocurrencies, HBAR is subject to significant market volatility. Prices can fluctuate dramatically within short periods due to various factors such as market sentiment, regulatory news, and macroeconomic trends. For investors, this volatility can lead to substantial gains, but it also poses the risk of considerable losses. The high degree of speculation in the cryptocurrency market may also result in price manipulations, further complicating the investment landscape for HBAR.

2. Regulatory Uncertainty

The regulatory environment for cryptocurrencies remains uncertain and varies significantly across jurisdictions. Governments worldwide are still formulating their approaches to digital assets, and changes in regulations can have profound impacts on the market. For example, stricter regulations could limit the use of HBAR or impose additional compliance costs on developers and businesses utilizing the Hedera network. Furthermore, any negative regulatory developments could lead to a decline in investor confidence and negatively affect HBAR’s price.

3. Competition

Hedera operates in a highly competitive space, with numerous other blockchain and distributed ledger technologies vying for market share. Established players like Ethereum, as well as emerging projects like Solana and Polkadot, present formidable competition. These alternatives may offer similar or superior functionalities, which could dilute Hedera’s market position and hinder its growth. The success of Hedera will depend not only on its own technological advancements but also on its ability to differentiate itself from competitors and capture a significant user base.

4. Technological Risks

While Hedera’s Hashgraph technology presents many advantages, it also carries inherent risks. Any technical vulnerabilities or flaws in the consensus mechanism could lead to security breaches, which could undermine trust in the network. Additionally, the complexity of the technology may pose challenges for developers unfamiliar with Hashgraph, potentially limiting the number of applications being built on the platform. If Hedera fails to maintain robust security and functionality, it risks losing users and developers to other platforms.

5. Centralization Concerns

Despite its claims of decentralization, Hedera’s governance structure has faced scrutiny. While the governing council includes various organizations, the fact that these entities operate the nodes can raise questions about true decentralization. Critics argue that this centralized control could lead to decision-making that favors the interests of council members over the broader community. If users perceive Hedera as being too centralized, it may hinder adoption and investment, as decentralization is often a key selling point for blockchain technologies.

Conclusion

Investing in Hedera (HBAR) presents both potential strengths and risks that investors should carefully consider. The platform’s unique technology, low transaction costs, strong governance, growing ecosystem, and institutional interest contribute to a compelling investment case. However, market volatility, regulatory uncertainty, competition, technological risks, and centralization concerns are significant challenges that could impact HBAR’s future performance.

As with any investment, conducting thorough research and considering both sides of the argument is essential for making informed decisions in the cryptocurrency space. While Hedera shows promise, potential investors should remain vigilant and prepared for the inherent risks associated with digital asset investments.

Frequently Asked Questions (FAQs)

1. What is Hedera Coin (HBAR)?

Hedera Coin, or HBAR, is the native cryptocurrency of the Hedera Hashgraph platform, which is designed as a decentralized public network that facilitates the development and operation of decentralized applications (DApps). Unlike traditional blockchains, Hedera utilizes a unique consensus algorithm known as Hashgraph, which aims to provide faster transaction speeds, lower costs, and enhanced security.

2. Who created Hedera Coin?

Hedera Coin was co-founded by Dr. Leemon Baird and Mance Harmon. Dr. Baird is recognized for his development of the Hashgraph consensus algorithm and serves as Hedera’s chief scientist. Mance Harmon acts as the CEO and has extensive experience in the technology sector, particularly in IT security.

3. What makes Hedera Coin different from Bitcoin?

Hedera Coin differs from Bitcoin primarily in its underlying technology and consensus mechanism. While Bitcoin operates on a proof-of-work (PoW) system, Hedera uses a proof-of-stake (PoS) model with Hashgraph consensus, allowing for faster transaction speeds (over 10,000 transactions per second) and significantly lower fees (around $0.0001 per transaction). Additionally, Hedera’s governance model includes a governing council of diverse organizations, which is distinct from Bitcoin’s decentralized and ungoverned structure.

4. Is Hedera Coin a good investment?

The potential of Hedera Coin as an investment depends on various factors, including market conditions, technological advancements, and overall demand for DApps and services on the Hedera network. As of now, HBAR has shown significant growth since its launch, but like all cryptocurrencies, it carries inherent risks and volatility. It’s advisable to conduct thorough research and consider your investment goals and risk tolerance before investing.

5. How can I buy Hedera Coin?

HBAR can be purchased on several cryptocurrency exchanges, including Binance, Bittrex, and Huobi Global. Users can trade HBAR against various fiat currencies (like USD and KRW) or other cryptocurrencies (such as BTC and ETH). To buy HBAR, you will typically need to create an account on a trading platform, complete any necessary verification steps, and then deposit funds to start trading.

6. How does Hedera ensure network security?

Hedera maintains network security through its unique Hashgraph consensus algorithm and a rotating governing council comprised of up to 39 diverse organizations. This council oversees platform decisions and operations, while HBAR holders can stake their tokens to help secure the network. The system achieves asynchronous Byzantine fault tolerance (ABFT), ensuring that the network can reliably process transactions even in the presence of faults or delays.

7. What are the main uses of Hedera Coin (HBAR)?

HBAR serves multiple purposes within the Hedera ecosystem. It is primarily used to pay for transaction fees on the network, including costs associated with smart contracts, file storage, and in-app payments. Additionally, HBAR can be used for staking to help secure the network and as a medium for micropayments, enabling a wide range of decentralized applications and services.

8. What are the future prospects of Hedera Coin?

The future prospects of Hedera Coin are tied to the ongoing development of its technology, partnerships, and the adoption of its platform for decentralized applications. As the demand for scalable and efficient blockchain alternatives continues to grow, Hedera’s unique offerings may position it favorably in the market. However, potential investors should remain aware of market volatility and conduct comprehensive research before making investment decisions.

Final Verdict on hedera coin

Summary of Hedera Coin (HBAR)

Hedera Hashgraph presents a unique approach to distributed ledger technology with its innovative hashgraph consensus algorithm. Unlike traditional blockchains, Hedera aims to enhance transaction speed, efficiency, and scalability, achieving up to 10,000 transactions per second with minimal fees—averaging just $0.0001 per transaction. The network’s dual utility token, HBAR, serves as both the fuel for transaction fees and a means for staking, contributing to the security and integrity of the platform.

The Hedera ecosystem is designed for enterprises, providing essential services like the Hedera Token Service (HTS) for token creation and the Hedera Consensus Service (HCS) for secure and verifiable event logging. This positions Hedera as a robust platform for decentralized applications (DApps), enabling developers to create applications with built-in compliance measures, such as KYC and AML checks.

Risk and Potential

Investing in Hedera Coin (HBAR) represents a high-risk, high-reward opportunity. As with any cryptocurrency, market volatility can significantly impact asset prices, and while Hedera’s technological advancements and partnerships position it favorably within the blockchain landscape, potential investors should remain cautious. The market is influenced by various factors, including regulatory developments, technological adoption, and competitive dynamics.

Final Thoughts

Before considering an investment in HBAR, it is crucial to conduct thorough research (DYOR). Understanding the underlying technology, market trends, and the broader implications of decentralized networks will equip you with the knowledge to make informed decisions. As the cryptocurrency landscape continues to evolve, being well-informed is your best strategy for navigating this exciting yet unpredictable asset class.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.